Bhimsen

Diunggah oleh

Abhishek Kujur0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan3 halamanHo

Hak Cipta

© © All Rights Reserved

Format Tersedia

XLSX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHo

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan3 halamanBhimsen

Diunggah oleh

Abhishek KujurHo

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

Bhimsen company is considering investing in a machine to produce bowling b

The building which is proposed to be used in the production process can be s

for immeidately an after tax amount of 150,000. If you go ahead with the

investment the building can be sold at the end 5th year at an after tax amoun

150,000. The cost of the machine is 100,000 and it is expected to last 5 years.

the end of 5 years, the machine will be sold at estimated value of 30000. The

machine can be depreciated on a straight line basis to value of 20000. The

production units during 5 year of machine life is expected to be 5000, 8000 ,

12000 , 10000 and 6000 units. The price of bowling balls will be Rs 20 per un

the first year`. And the price is expected to increase at 2% per year. The first y

production cost will be Rs 10. And it is expected to increase at 10% per year. T

project requires an immediate( year 0) investment in working capital of 10000

The net working capital every year is 10% of sales. The tax rate is 34%.

Discounting rate is 10%

o produce bowling balls.

on process can be sold

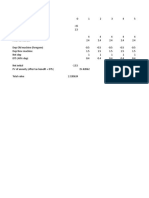

ahead with the time 0 1 2

t an after tax amount of OP Bal 100000 84000

ected to last 5 years. At Dep 16000 16000

value of 30000. The

ue of 20000. The Closing Bal 100000 84000 68000

to be 5000, 8000 ,

will be Rs 20 per unit in Dep Tax Shield 5440 5440

per year. The first year

se at 10% per year. The

king capital of 10000. Initial Inv -100000

x rate is 34%. Salvage Value

Capital Gain tax

Opp Cost -150000

Units 5000 8000

Price 20 20.4

Cost 10 11.0

Business Cashflows 50000 75200

After-tax cashflows 33000 49632

WC 10000 10000 16320

Change in WC -10000 0 -6320

Net Cashflows -260000 38440 48752

50032.9

3 4 5

68000 52000 36000

16000 16000 16000

52000 36000 20000

5440 5440 5440

30000

-3400

150000

12000 10000 6000

20.8 21.2 21.6

12.1 13.3 14.6

104496 79142 42046

68967 52233 27750

24970 21224

-8650 3745 21224

65758 61419 231014

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- How To Draw Faces Eyes Lips Ears and NosesDokumen7 halamanHow To Draw Faces Eyes Lips Ears and NosesAbhishek Kujur100% (1)

- QuestionnaireDokumen1 halamanQuestionnaireAbhishek KujurBelum ada peringkat

- SIIB Case StudyDokumen1 halamanSIIB Case StudyAbhishek KujurBelum ada peringkat

- Package Misctools': R Topics DocumentedDokumen19 halamanPackage Misctools': R Topics DocumentedAbhishek KujurBelum ada peringkat

- UyudfgDokumen1 halamanUyudfgAbhishek KujurBelum ada peringkat

- Week Milestones To Be CompletedDokumen1 halamanWeek Milestones To Be CompletedAbhishek KujurBelum ada peringkat

- Learn Intern 2.0: Participation GuidelinesDokumen11 halamanLearn Intern 2.0: Participation GuidelinesAjhay Krishna K SBelum ada peringkat

- Abhishek Kujur D WACI 1Dokumen6 halamanAbhishek Kujur D WACI 1Abhishek KujurBelum ada peringkat

- Downloaded From WWW - Ettv.tvDokumen1 halamanDownloaded From WWW - Ettv.tvcristibobilcaBelum ada peringkat

- Torrent Downloaded FromDokumen1 halamanTorrent Downloaded FromAbhishek KujurBelum ada peringkat

- Torrent by SeeHD - PLDokumen1 halamanTorrent by SeeHD - PLNaqash AliBelum ada peringkat

- Challenges That Airtel Need To Embrace in Order To Become Digital OrganizationDokumen3 halamanChallenges That Airtel Need To Embrace in Order To Become Digital OrganizationAbhishek KujurBelum ada peringkat

- 1111Dokumen3 halaman1111Abhishek KujurBelum ada peringkat

- Trump DiagramDokumen2 halamanTrump DiagramAbhishek KujurBelum ada peringkat

- Plot of Utilization of Station 1, Averaged Over Each DayDokumen9 halamanPlot of Utilization of Station 1, Averaged Over Each DayAbhishek KujurBelum ada peringkat

- L Z TableDokumen1 halamanL Z TableAbhishek KujurBelum ada peringkat

- VBA Individual AssignmentDokumen1 halamanVBA Individual AssignmentAbhishek KujurBelum ada peringkat

- BabyDokumen1 halamanBabyAbhishek KujurBelum ada peringkat

- Summer Internship 2019: Reculta Solutions, GurgaonDokumen6 halamanSummer Internship 2019: Reculta Solutions, GurgaonAbhishek KujurBelum ada peringkat

- Question 5Dokumen2 halamanQuestion 5Abhishek KujurBelum ada peringkat

- Lilac Flour Mills FinalDokumen1 halamanLilac Flour Mills FinalAbhishek KujurBelum ada peringkat

- Negative Interest Rate Section D D9Dokumen2 halamanNegative Interest Rate Section D D9Abhishek KujurBelum ada peringkat

- Lilac Flour Mills FinalDokumen7 halamanLilac Flour Mills FinalAbhishek KujurBelum ada peringkat

- Consumer BehaviourDokumen19 halamanConsumer BehaviourAbhishek KujurBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Credit Risk ManagementDokumen64 halamanCredit Risk Managementcherry_nu100% (12)

- BBO2020Dokumen41 halamanBBO2020qiuBelum ada peringkat

- Kamapehmilya: Fitness Through Traditional DancesDokumen21 halamanKamapehmilya: Fitness Through Traditional DancesValerieBelum ada peringkat

- Chemical Classification of HormonesDokumen65 halamanChemical Classification of HormonesetBelum ada peringkat

- 5070 s17 QP 22 PDFDokumen20 halaman5070 s17 QP 22 PDFMustafa WaqarBelum ada peringkat

- Sinamics g120 BrochureDokumen16 halamanSinamics g120 BrochuremihacraciunBelum ada peringkat

- Grammar Practice #2Dokumen6 halamanGrammar Practice #2Constantin OpreaBelum ada peringkat

- RELATION AND FUNCTION - ModuleDokumen5 halamanRELATION AND FUNCTION - ModuleAna Marie ValenzuelaBelum ada peringkat

- The Attachment To Woman's Virtue in Abdulrazak Gurnah's Desertion (2005)Dokumen7 halamanThe Attachment To Woman's Virtue in Abdulrazak Gurnah's Desertion (2005)IJELS Research JournalBelum ada peringkat

- Laporan Keuangan TRIN Per Juni 2023-FinalDokumen123 halamanLaporan Keuangan TRIN Per Juni 2023-FinalAdit RamdhaniBelum ada peringkat

- Research Paper On Marketing PlanDokumen4 halamanResearch Paper On Marketing Planfvhacvjd100% (1)

- Accounting System (Compatibility Mode) PDFDokumen10 halamanAccounting System (Compatibility Mode) PDFAftab AlamBelum ada peringkat

- T Rex PumpDokumen4 halamanT Rex PumpWong DaBelum ada peringkat

- Micronet TMRDokumen316 halamanMicronet TMRHaithem BrebishBelum ada peringkat

- New Compabloc IMCP0002GDokumen37 halamanNew Compabloc IMCP0002GAnie Ekpenyong0% (1)

- E9 Đề khảo sát Trưng Vương 2022 ex No 1Dokumen4 halamanE9 Đề khảo sát Trưng Vương 2022 ex No 1Minh TiếnBelum ada peringkat

- March 2023 (v2) INDokumen8 halamanMarch 2023 (v2) INmarwahamedabdallahBelum ada peringkat

- 2011 - Papanikolaou E. - Markatos N. - Int J Hydrogen EnergyDokumen9 halaman2011 - Papanikolaou E. - Markatos N. - Int J Hydrogen EnergyNMarkatosBelum ada peringkat

- Teacher'S Individual Plan For Professional Development SCHOOL YEAR 2020-2021Dokumen2 halamanTeacher'S Individual Plan For Professional Development SCHOOL YEAR 2020-2021Diether Mercado Padua100% (8)

- Online Shopping MallDokumen17 halamanOnline Shopping MallMerin LawranceBelum ada peringkat

- 3 A Sanitary Standards Quick Reference GuideDokumen98 halaman3 A Sanitary Standards Quick Reference GuideLorettaMayBelum ada peringkat

- Best of The Photo DetectiveDokumen55 halamanBest of The Photo DetectiveSazeed Hossain100% (3)

- Resolution: Owner/Operator, DocketedDokumen4 halamanResolution: Owner/Operator, DocketedDonna Grace Guyo100% (1)

- Catalogo HydronixDokumen68 halamanCatalogo HydronixNANCHO77Belum ada peringkat

- Andromeda: Druid 3 Warborn06Dokumen5 halamanAndromeda: Druid 3 Warborn06AlanBelum ada peringkat

- Financial Statement AnalysisDokumen18 halamanFinancial Statement AnalysisAbdul MajeedBelum ada peringkat

- Things You Can Do at Burnham ParkDokumen2 halamanThings You Can Do at Burnham ParkBcpo TeuBelum ada peringkat

- DescriptiveDokumen1 halamanDescriptiveRizqa Anisa FadhilahBelum ada peringkat

- Wordbank 15 Youtube Writeabout1Dokumen2 halamanWordbank 15 Youtube Writeabout1Olga VaizburgBelum ada peringkat

- B2B Marketing: Chapter-8Dokumen23 halamanB2B Marketing: Chapter-8Saurabh JainBelum ada peringkat