Respa Qualified Written Request

Diunggah oleh

Mark JacksonHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Respa Qualified Written Request

Diunggah oleh

Mark JacksonHak Cipta:

Format Tersedia

NAME

Name

Adress

City, STATE ZIPCODE

PHONE

CREDITOR NAME HERE

123 RIPOFF LANE

ANOTHER TOWN, TX 54321

ATTN: ACCOUNT MANAGER

Certified Mail #: XXXX XXXX XXXX XXXX XXXX

REF: Alleged Account #123456789

RESPA QUALIFIED WRITTEN REQUEST, TILA REQUEST,

DISPUTE OF DEBT AND DEBT VALIDATION LETTER

This letter is a ‘‘qualified written request’’ in compliance with and under the

Real Estate Settlement Procedures Act, 12 U.S.C. Section 2605(e) and

Regulation X at 24 C.F.R. 3500, and The Gramm Leach Bliley Act, A TILA

Request in compliance with the Truth in Lending Act and a Dispute of Debt and

Debt Validation Letter in compliance with the Fair Debt Collection Practices Act

and the Fair Credit Reporting Act

DATE,

Dear Madam or Sir:

I am writing to you to inquire about the accounting and servicing of this mortgage and my

need for understanding and clarification of various sale, transfer, funding source, legal and

beneficial ownership, charges, credits, debits, transactions, reversals, actions, payments, analyses

and records related to the servicing of this account from its origination to the present date.

To date, the documents and information I have, that you have sent, and the conversations

with your service representatives, have been unproductive and have left unanswered questions.

As a consumer, I am extremely concerned about predatory practices, specifically regarding this

mortgage company or anyone who has any interest this matter.

I am concerned about the possibility of potential fraudulent and deceptive practices by

unscrupulous mortgage brokers; sales and transfers of mortgage servicing rights; deceptive and

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 1 of 21

fraudulent servicing practices to enhance balance sheets; deceptive, abusive and fraudulent

accounting tricks and practices that may have negatively affected my credit rating, mortgage

account and/or the debt or payments that I am currently, or may be legally obligated to.

THEREFORE, I am legally and lawfully able to demand, and do demand, first hand

evidence and information from you, pertaining to the original, uncertified or certified, security,

regarding my account, #123456789. Failure to provide this security will be confirmation that

you had not created or owned one.

BE AWARE, that notice to the agent is notice to the principal and notice to the

principal is notice to the agent. Any notice or demand made in this correspondence applies to

anyone dealing any part of this account.

Also, I demand that you provide me with information related to the chain of custody of that

same security and its current location. Absent evidence of the security, I will dispute the validity

of your lawful ownership, funding, entitlement right, and the current debt you allege that I owe.

By debt, I am including but am not limited to the principal balance, the calculated monthly

payment, calculated escrow payment and any fees that you claim that I owe or any agent, trust or

entity you may service or subservice for.

To independently validate this debt, I need to conduct a complete exam, audit, review

and accounting of this mortgage account from its inception through the present date.

I request that you conduct your own investigation and audit of this account, since its

inception, to validate the debt that you currently claim I owe. I would like you to validate this

debt, so that it is accurate. Please, do not rely on previous servicers or originators records,

assurances or indemnity agreements and refuse to conduct a full audit and investigation of this

account.

I understand that potential abuses by you or previous servicers could have deceptively,

wrongfully, unlawfully, and/or illegally:

1. Increased the amounts of monthly payments,

2. Increased the principal balance that I owe,

3. Increased escrow payments,

4. Increased the amounts applied and attributed toward interest on this account,

5. Decreased the proper amounts applied and attributed toward the principal on this

account, and/or assessed, charged and/or collected fees, expenses and misc. charges

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 2 of 21

that I am not legally obligated to pay, under this mortgage, note and/or deed of trust.

To insure that I have not been the victim of such predatory servicing or lending practices. I

have authorized a thorough review, examination, accounting and audit of mortgage account

#123456789 by mortgage auditing and predatory servicing or lending experts. This exam and

audit will review this mortgage account file from the date of initial contact, application and the

origination of this account to the present date written above.

Again, this is a Qualified Written Request under the Real Estate Settlement Procedures

Act, codified as Title 12 § 2605 (e)(1)(B)(e) and Reg. X § 3500.21(f)2 of the United States Code

as well as a request under Truth In Lending Act [TILA] 15 U.S.C. § 1601, et seq. RESPA

provides for penalties and fines for non-compliance or failure to answer my questions provided

in this letter within sixty [60] days of its receipt.

ALLEGED DEBT

BE NOTICED THAT This is also a letter of dispute and debt validation. I recently pulled

my credit report and found CREDITOR NAME HERE reporting derogatory information in my

account. I dispute the validity of this debt. I would like to resolve this matter, at the earliest

possible time, however, due to the possibility of error or fraud in this matter, I must insist that

you prove that I owe you this purported debt and state the reasons why I owe this debt.

In order to prove the debt, I must have a signed and sworn statement before a notary

public, under penalty of perjury, by a person having firsthand knowledge of the indebtedness and

stating that the reported indebtedness was a legal indebtedness under all applicable state and

federal laws, was not subsequently disputed as a result of returned, faulty, or recalled consumer

products, and furthermore swearing that this purported debt is not now nor ever has been part of

any tax write off scheme nor insurance claim. Please be advised that I am requesting validation

and competent evidence that I had some contractual obligation sans consumer protection

encumbrance whereby I incurred the original claims associated with this purported debt.

Please be advised, that under the Fair Debt Collection Practices Act, I am authorized to

demand that you not contact me by telephone, nor at my place of employment by any means,

whatsoever. If you wish to communicate with me, you may do so only by U.S. mail and only at

my place of residence.

Your failure to provide such information, as I request in a timely manner, may constitute

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 3 of 21

prima facie evidence of intent to defraud, intimidate or coerce me and to deprive me of my civil

rights.

Also be advised, that any contact made by your firm with any 3rd party firm or entity

regarding this issue, absent compliance with each and every part of this demand for validation,

may constitute violation of the FDCPA and the FCRA and may constitute grounds for civil

action, criminal action or complaints being filed against you.

DOCUMENT REQUESTS

In order to conduct a full and complete examination and audit of this loan, I must have full

and immediate disclosure, including copies of all pertinent information, regarding this loan. The

documents requested and answers to my questions are needed to insure that this loan:

I. was originated in lawful compliance with all federal and state laws, regulations

including, but not limited to, Title 62 of the Revised Statutes, RESPA, TILA, Fair

Debt Collection Practices Act, Fair Credit Reporting Act, HOEPA, Regulation Z and

all other applicable laws;

II. That any sale or transfer of this account or monetary instrument, was conducted in

accordance with proper laws and was a lawful sale with complete disclosure to all

parties with an interest;

III. That the claimed holder in due course of the monetary instrument/deed of trust/asset

is holding such note in compliance with statutes, State and Federal laws and is

entitled to the benefits of payments;

IV. That all good faith and reasonable disclosures of transfers, sales, Power of Attorney,

monetary instrument ownerships, entitlements, full disclosure of actual funding

source, terms, costs, commissions, rebates, kickbacks, fees, etc. were and still are

properly disclosed to me;

V. That each of the servicers and/or sub-servicers, of this mortgage, have serviced this

mortgage in accordance with all statutes, laws and the terms of mortgage, monetary

instrument/deed of trust;

VI. That each servicers and sub-servicers of this mortgage have serviced this mortgage in

compliance with local, state and Federal statutes, laws and regulations;

VII.That this mortgage account has properly been credited, debited, adjusted, amortized

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 4 of 21

and charged correctly;

VIII. That interest and principal have been properly calculated and applied to this loan;

IX. That any principal balance has been properly calculated, amortized and accounted for;

X. that no charges, fees or expenses, not obligated by me in any agreement, have been

charged, assessed or collected from this account;

I need copies of pertinent documents to be provided to me. In order to maintain the

integrity of your response, I ask that the all documents be indexed, numbered and labeled

pursuant to this request, specifically, which element of the request that each document(s) or

answer fulfills. I, also, need answers, certified in writing, to various servicing questions. For

each record kept on computer or in any other electronic file or format, please provide a paper

copy of all information in each field or record in each computer system, program or database

used by you that contains any information on this account number or my name.

For clarity, all requests and questions, in this document, pertain to the property located at

129 North Lowell Road, Township of Windham, County of Rockingham, NH [03087] and

account #123456789, from the date of first contact, or loan inception, whichever is first in time,

until the present date.

As such, please send to me, at the address above, copies of the documents, requested

below. Please provide copies of:

1. Any certified or uncertified security, front and back, used for the funding of account

#123456789.

2. Any and all “Pool Agreement(s)”, including account #123456789 between

CREDITOR NAME HERE and any government sponsored entity, hereinafter

referred to as GSE.

3. Any and all “Deposit Agreement(s)” regarding account #123456789 or the “Pool

Agreement”, including account #123456789, between CREDITOR NAME HERE

and any GSE.

4. Any and all “Servicing Agreement(s)” between CREDITOR NAME HERE and any

GSE.

5. Any and all “Custodial Agreement(s)” between CREDITOR NAME HERE and any

GSE.

6. Any and all “Master Purchasing Agreement” between CREDITOR NAME HERE

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 5 of 21

and any GSE.

7. Any and all “Issuer Agreement(s)” between CREDITOR NAME HERE and any

GSE.

8. Any and all “Commitment to Guarantee” agreement(s) between CREDITOR NAME

HERE and any GSE.

9. Any and all “Release of Document agreements” between CREDITOR NAME HERE

and any GSE.

10. Any and all “Master Agreement for servicer’s Principle and Interest Custodial

Account” between CREDITOR NAME HERE and any GSE.

11. Any and all “Servicers Escrow Custodial Account” between CREDITOR NAME

HERE and any GSE.

12. Any and all “Release of Interest” agreements between CREDITOR NAME HERE

and any GSE.

13. Any Trustee agreement(s) between CREDITOR NAME HERE and CREDITOR

NAME HERE’s trustee regarding account #123456789 or pool accounts with any

GSE.

14. Any documentation or evidence of any trust relationship regarding the

Mortgage/Deed of Trust and any Note in this matter.

15. Any and all document(s) establishing a Trustee of record for the Mortgage/Deed of

Trust and any Note.

16. Any and all document(s) establishing the date of any appointment of Trustee

Mortgage/Deed of Trust and any Note. Please also include any and all assignments

or transfers or nominees of any substitute trustee(s).

17. Any and all document(s) establishing any Grantor for this Mortgage/Deed of Trust

and any Note.

18. Any and all document(s) establishing any Grantee for this Mortgage/Deed of Trust

and any Note.

19. Any and all document(s) establishing any Beneficiary for this Mortgage/Deed of

Trust and any Note.

20. Any documentation evidencing the Mortgage or Deed of trust is not a constructive

trust or any other form of trust.

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 6 of 21

21. All data, information, notations, text, figures and information contained in your

mortgage servicing and accounting computer systems including, but not limited to

Alltel or Fidelity CPI system, or any other similar mortgage servicing software used

by you, any servicers, or sub-servicers of this mortgage account from the date of

inception of this account to the date written above.

22. All descriptions and legends of all Codes used in your mortgage servicing and

accounting system so that the examiners, auditors and experts retained to audit and

review this mortgage account may properly conduct their work.

23. All assignments, transfers, allonge, or other document evidencing a transfer, sale or

assignment of this mortgage, deed of trust, monetary instrument or other document

that secures payment by me to this obligation in this account from the date of

inception of this account to the present date, including any such assignments on

MERS.

24. All records, electronic or otherwise, of assignments of this mortgage, monetary

instrument or servicing rights to this mortgage including any such assignments on

MERS.

25. All deeds in lieu, modifications to this mortgage, monetary instrument or deed of

trust;

26. The front and back of each and every canceled check, money order, draft, debit or

credit notice issued to any servicers of this account for payment of any monthly

payment, other payment, escrow charge, fee or expense on this account.

27. All escrow analyses conducted on this account.

28. 2The front and back of each and every canceled check, draft or debit notice issued for

payment of closing costs, fees and expenses listed on any and all disclosure

statement(s) including, but not limited to, appraisal fees, inspection fees, title

searches, title insurance fees, credit life insurance premiums, hazard insurance

premiums, commissions, attorney fees, points, etc.

29. Front and back copies of all payment receipts, checks, money orders, drafts,

automatic debits and written evidence of payments made by others or myself on this

account.

30. All letters, statements and documents sent by your company.

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 7 of 21

31. All letters, statements and documents sent by agents, attorneys or representatives of

your company.

32. All letters, statements and documents sent by previous servicers, sub-servicers or

others in your account file or in your control or possession or in the control or

possession of any affiliate, parent company, agent, sub-servicers, servicers, attorney

or other representative of your company.

33. All letters, statements and documents contained in this account file or imaged by you,

any servicers or sub-servicers of this mortgage.

34. All electronic transfers, assignments, sales of the note/asset, mortgage, deed of trust

or other security instrument.

35. All copies of property inspection reports, appraisals, BPOs and reports done on the

property.

36. All invoices for each charge such as inspection fees, BPOs, appraisal fees, attorney

fees, insurance, taxes, assessments or any expense, which has been charged to this

mortgage account.

37. All checks used to pay invoices for each charged such as inspection fees, BPOs,

appraisal fees, attorney fees, insurance, taxes, assessments or any expense which has

been charged to this mortgage account.

38. All agreements, contracts and understandings with vendors that have been paid for

any charge on this account.

39. All account servicing records, payment payoffs, payoff calculations, ARM audits,

interest rate adjustments, payment records, transaction histories, account histories,

accounting records, ledgers, and documents that relate to the accounting of this

account.

40. All account servicing transaction records, ledgers, registers and similar items

detailing how this account has been serviced.

In order to conduct an audit and review of this account and to determine the proper

amounts due, I need the following answers to issues and questions, concerning the servicing and

accounting of this mortgage from its inception to the present date. Accordingly, please provide

me, in writing, the answers to the requests and questions listed below:

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 8 of 21

ACCOUNTING & SERVICING SYSTEMS

41. Identify each account accounting and servicing system used by you and any sub-

servicers or previous servicers.

42. For each account, accounting and servicing system identified by you and any sub-

servicers or previous servicers, provide the name and address of the company or party

that designed and sold the system.

43. For each account, accounting and servicing system used by you and any sub-servicers

or previous servicers, provide the complete transaction code list for each system.

DEBITS & CREDITS

44. In a spreadsheet form or in letter form in a columnar format, detail each credit on this

account and the date that such credit was posted to this account, as well as the date

any credit was received.

45. In a spreadsheet form or in letter form in a columnar format, detail each debit on this

account and the date the debit was posted to this account, as well as the date any debit

was received.

a. For each debit or credit listed, please provide the definition for each

corresponding transaction code utilized.

i. For each transaction code, please provide the master transaction code list

used by you or previous servicers.

DEBT VALIDATION

46. Sworn validation, by a competent fact witness, that the systems are and have always

been in place to accurately report information to the credit reporting agencies to

prevent the reporting of inaccurate and erroneous information, by you or your agents.

MORTGAGE & ASSIGNMENTS

47. Has each sale, transfer or assignment of this mortgage, monetary instrument, deed of

trust or any other instrument that I executed, to secure this debt, been recorded in the

county property records, in the county and state, in which the property is located,

from the inception of this account to the present date, yes or no?

a. If the answer is no to question #47, then why?

48. Is your company the servicers of this mortgage account or the holder in due course

and beneficial owner of this mortgage, monetary instrument and/or deed of trust?

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 9 of 21

49. Have any sales, transfers or assignments of this mortgage, monetary instrument, deed

of trust or any other instrument that I executed to secure this debt been recorded in

any electronic fashion, such as MERS or other internal or external recording system

from the inception of this account to the present date, yes or no?

a. If the answer is yes to question #49, please detail for me the names of each

seller, purchaser, assignor, assignee or any holder, in due course, to any right or

obligation of any note, mortgage, deed or security instrument that I executed

securing the obligation on this account, that was not recorded in the county

records where my property is located, whether they be mortgage servicing

rights or the beneficial interest in the principal and interest payments.

ATTORNEY FEES

For purposes of my questions below, dealing with attorney fees, please consider the terms

“attorney fees” and “legal fees” to be the same.

50. Have attorney fees ever been assessed to this account?

a. If the answer is yes to question #50, please detail each separate assessment,

charge and collection of attorney fees to this account, from the inception of this

account to the present date and the date of such assessment to this account and

which corresponding payment period(s) and/or month(s) such fees were

assessed.

51. Have attorney fees ever been charged to this account?

b. If the answer is yes to question #51, please detail each separate charge of

attorney fees to this account and the date of such charge to this account and

which corresponding payment period(s) and/or month(s) such fees were

charged.

52. Have attorney fees ever been collected from this account?

a. If the answer is yes to questions #52, please detail each separate incident of the

collection of attorney fees from this account and the date of such collection

from this account and which corresponding payment period(s) and/or month(s)

such fees were collected.

b. Provide the name(s) and address of each attorney or law firm that have been

paid fees or expenses related to this account.

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 10 of 21

53. Identify any provisions, paragraphs, sections or sentences, of any note, mortgage,

deed of trust or any other agreement that I signed which authorized any such

assessment, charge or collection of attorney fees.

54. List and detail any adjustment(s) in attorney fees assessed, charged or collected and

on what date such adjustment(s) were made and the reasons for such adjustment(s).

55. List and detail any adjustments in attorney fees collected and on what date such

adjustment were made and the reasons for such adjustment.

56. Is interest allowed to be assessed or charged on attorney fees, assessed or charged, to

this account, yes or no?

a. Has there been any interest charged on attorney fee(s) assessed or charged to

this account, yes or no?

57. How much, in total attorney fees, have been assessed to this account from the date of

inception of this account until the present date?

58. How much, in total attorney fees, have been collected on this account from the date of

inception of this account until the present date?

59. How much, in total attorney fees, have been charged to this account from the date of

inception of this account until the present date?

60. Please include copies of all invoices and detailed billing statements from any law firm

or attorney that has billed such fees that been assessed or collected from this account.

SUSPENSE/UNAPPLIED ACCOUNTS

For purposes of this section, please treat the terms “suspense account” and “unapplied

account” as the same.

61. Has there been any suspense or unapplied account transactions on this account?

a. If the answer to Question #61 is yes, then explain the reason for each and every

suspense transaction that occurred on this account?

i. In a spreadsheet or in letter form in a columnar format, detail each

suspense or unapplied transaction, both debits and credits, that have

occurred on this account.

LATE FEES

For purposes of my questions below dealing with late fees, please consider the terms “late fees”

and “late charges” to be the same.

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 11 of 21

62. Have you reported the collection of late fees on this account, as interest, in any

statement(s) to me or to the IRS, yes or no?

63. Have any previous servicers or sub-servicers, of this mortgage, reported the collection

of late fees on this account as interest in any statement(s) to me or to the IRS, yes or

no?

64. Do you consider the payment of late fees as liquidated damages to you for not

receiving payment on time, yes or no?

65. Do you consider late fees considered interest, yes or no?

66. Detail expenses and damages which you or others incurred for any and all late

payments.

67. Were any of these expenses or damages charged or assessed to this account in any

other way, yes or no?

a. If the answer to question #67 is yes, then describe what expenses or charges

were charged or assessed to this account?

68. Identify the provisions, paragraphs, sections or sentences of any note, mortgage, deed

of trust or any agreement to authorize to the assessment or collection of late fees?

69. Have any late charges been assessed to this account, yes or no?

a. If the answer to questions #69 was yes, then list and detail each separate late fee

assessed to this account and the corresponding payment period and/or month

that late fee was assessed.

i. How much, in total late charges, have been assessed to this account?

70. Have any late charges been collected to this account, yes or no?

a. If the answer to questions #70 was yes, then list and detail each separate late fee

collected to this account and the corresponding payment period and/or month

that late fee was collected.

i. How much, in total late charges, have been collected on this account?

71. List and detail any adjustments in late fees assessed and the date the adjustment was

made and the reasons.

72. Has interest been charged on any late fee(s) assessed or charged to this account, yes

or no?

73. Is interest allowed to be assessed or charged on late fees charged or assessed to this

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 12 of 21

account, yes or no?

74. Provide the months and/or payment dates you or other previous servicers of this

account claim that there have been late payments.

PROPERTY INSPECTIONS

For purposes of this section, “property inspection” and “inspection fee” refer to any inspection

of property, by any source and any related fee or expense charged, assessed or collected for

such inspection.

75. Explain your policy on property inspections.

76. Do you consider the payment of inspection fees as a cost of collection, yes or no?

a. If the answer to question #76 is yes, then explain why.

77. Do you use property inspections to collect debts, yes or no?

78. Have any property inspections been conducted on the property that is the secured

interest for this mortgage, deed or note, by you, your agents or any previous servicer?

a. If the answer to questions #78 is yes, then list the date of each property

inspection and the corresponding payment period and/or month.

i. List the price charged for each inspection.

ii. List the company name and address and the person who performed each

inspection.

iii. List the reason for each inspection.

iv. List the assessment of each inspection.

v. List the amounts collected for each inspection.

vi. Have you used any portion of the property inspection process to collect or

inform me of a debt, payment or obligation that you allege that I owe?

1. If the answer to question #78(a)(iv) is yes, then list the date(s)

and explain the reason.

79. Identify the provisions, paragraphs, sections or sentences of any note, mortgage, deed

of trust or any agreement that authorized the assessment or collection of property

inspection fees.

80. Have you labeled, in any record or document, a property inspection on this property

as a misc. advance or as anything other than a “property inspection”, yes or no?

a. If the answer to question #80 is yes, then list what it was labeled and explain

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 13 of 21

why.

81. List and detail any adjustments in inspection fees assessed and on what date the

adjustment was made and the reasons for the adjustment.

82. List and detail any adjustments in inspection fees collected and on what date the

adjustment was made and the reasons for the adjustment.

83. Has interest been charged on any inspection fees assessed or charged to this account,

yes or no?

a. If the answer to question #83 is yes, the list when and how much was charged.

84. Is interest allowed to be assessed or charged on inspection fees charged or assessed to

this account, yes or no?

85. How much, in total inspection fees, have been assessed to this account?

86. How much, in total inspection fees, have been collected on this account?

87. Please provide copies of all property inspections made on my property in this

mortgage account file.

88. Have any fee(s) charged or assessed for property inspections been placed into escrow

account, yes or no?

BPO FEES

For this section, the term “BPO” will refer to Broker Price Opinions.

89. Please explain to me your policy on BPOs.

90. Have any BPOs, been conducted on the property that is the secured interest for this

mortgage, deed or note?

a. If the answer to question #90 is yes, then list the date of each BPO conducted

on the property.

b. List the price of each BPO.

c. Who conducted each BPO?

d. List the reason for each BPO.

91. Have any BPO fees been assessed to this account, yes or no?

a. If the answer to question #91 is yes, then how much in total BPO fees have

been assessed to this account?

92. Have any BPO fees been charged to this account, yes or no?

a. If the answer to question #92 is yes, then how much in total BPO fees have

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 14 of 21

been charged to this account?

93. Identify which clauses, paragraphs and/or sentences in the note, mortgage or deed of

trust or any agreement which allows you to assess, charge or collect a BPO fee.

94. Send copies of all BPO reports that have been done on the property.

95. Have any fee(s) charged or assessed for a BPO been placed into escrow, yes or no?

FORCED-PLACED INSURANCE

96. Detail your policies on forced-placed insurance policies.

97. Have you placed or ordered any forced-placed insurance polices on the property?

a. If the answer to question #97 is yes, then list the date of each policy ordered or

placed on the property.

b. List the price of each policy.

c. List the agent for each policy.

d. Explain the reason for each policy.

98. Have any forced-placed insurance fees been assessed to this mortgage or escrow

account, yes or no?

a. If the answer to question #98 is yes, then how much, in total forced-placed

policy fees, have been assessed to this account?

99. Have any forced-placed insurance fees been charged to this mortgage or escrow

account, yes or no?

a. If the answer to question #99 is yes, then how much, in total forced-placed

insurance fees, have been charged to this mortgage or escrow account?

100.Specifically, what clause(s), paragraph(s) and/or sentence(s) in the note, mortgage or

deed of trust or any agreement allow you to assess, charge or collect forced-placed

insurance fees?

101.Do you have any relationship with the agent(s) or agency(s) that placed any policies

on the property?

a. If the answer to question #101 is yes, then describe your relationship with the

agent(s) or agency(s).

i. List the agent(s) or agency(s) with addresses and contact information.

ii. List the date(s) that the policy(s) were placed on the property/

102.Do you have any relationship with any carrier(s) that issued any policies on the

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 15 of 21

property?

a. If the answer to question #102 is yes, then describe your relationship with the

carrier(s).

i. List the carrier(s) with addresses and contact information.

103.If the answer to questions #101 or #102 was yes, then have the agency(s), agent(s) or

carrier(s), that you used to place a forced-placed insurance policy on the property,

provided you any service, computer system, discount on policies, commissions,

rebates or any form of consideration(s)?

a. If the answer to question #103 is yes, then list and describe the service,

computer system, discount on policies, commissions, rebates or any other form

of consideration(s).

104.Do you maintain a blanket insurance policy or any other insurance policy to protect

your properties when customer policies have expired, yes or no?

a. If the answer to question #104 is yes, then list those policies and describe those

policies.

105.Include all copies of forced-placed insurance policies that have been ordered on the

property.

SERVICING RELATED QUESTIONS

106.Did the originator or previous servicers of this account have any financing

agreements or contracts with your company or an affiliate of your company, yes or

no?

a. If the answer to question #106 is yes, then explain those financing agreements

or contracts.

107.Did the originator of this account or previous servicers of this account have a

warehouse account agreement or contract with your company, yes or no?

108.Did the originator of this account or previous servicers of this account receive any

compensation, fee, commission, payment, rebate or other financial consideration from

your company or any affiliate of your company for handling, processing, originating

or administering this loan, yes or no?

a. If the answer to question #108 is yes, then describe and itemize each form of

compensation, fee, commission, payment, rebate or other financial

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 16 of 21

consideration paid to the originator of this account by your company or

affiliate.

109.Identify and explain where the originals of this entire account file are currently

located and how they are being stored, kept and protected?

110. Where is the original signed monetary instrument or mortgage located?

a. Who is holding this note as a custodian or trustee, if applicable?

111. Where is the original signed deed of trust or mortgage and note located?

a. Who is holding this note as a custodian or trustee, if applicable?

112.Has there ever been any assignment of the monetary instrument/asset to any other

party, yes or no?

a. If the answer to question #112 is yes, then identify the names and addresses of

each individual, party, bank, trust or entity that has received the assignment?

113.Has there ever been any assignment of the deed of trust or mortgage and note to any

other party?

a. If the answer to question #113 is yes, then identify the names and addresses of

each individual, party, bank, trust or entity that has received that assignment?

114.Has there been any sale or assignment of servicing rights to this mortgage account to

any other party?

a. If the answer to question #114 is yes, then identify the names and addresses of

each individual, party, bank, trust or entity that has received that assignment or

sale.

115. Have any sub-servicers serviced any portion of this mortgage loan?

a. If the answer to question #115 is yes, then identify the names and addresses of

each individual, party, bank, trust or entity that has sub-serviced this mortgage

loan.

116.Has this mortgage account been made a part of any mortgage pool since the inception

of this loan?

a. If the answer to question #116 is yes, then identify each account mortgage pool

that this mortgage has been a part of.

117.Has each and every assignment of the asset/monetary instrument been recorded in the

county land records where the property associated with this mortgage account is

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 17 of 21

located?

118.Has there been any electronic assignment of this mortgage with MERS [Mortgage

Electronic Registration System] or any other computer mortgage registry service or

computer program?

a. If the answer to question #118 is yes, then identify the name and address of

each individual, entity, party, bank, trust or organization or servicers that have

been assigned the mortgage servicing rights to this account as well as the

beneficial interest to the payments of principal and interest on this loan.

119. Have there been any investors, as defined in your industry, who have participated in

any mortgage-backed security, collateral mortgage obligation or other mortgage

security instrument that this mortgage account has ever been a part of?

a. If the answer to question #119 is yes, then identify the name and address of

each individual, entity, organization and/or trust.

120.Identify the parties and their addresses to all sales contracts, servicing agreements,

assignments, alonges, transfers, indemnification agreements, recourse agreements and

any agreement related to this account.

121. Provide all copies of sales contracts, servicing agreements, assignments, alonges,

transfers, indemnification agreements, recourse agreements and any agreement

related to this account.

122. How much did you pay for this individual mortgage account?

123. If this mortgage was part of a mortgage pool, then what was the principal balance

used, by you, to determine payment for this individual mortgage loan.

a. What was the percentage paid, by you, of the principal balance used to

determine purchase of this individual mortgage loan?

124. Who did you issue a check or payment to for this mortgage loan?

125. Provide front and back copies of the canceled check used to pay for this mortgage

loan.

126.Did any investor approve the foreclosure of my property?

127. Has HUD assigned or transferred foreclosure rights to you as required by 12 USC

3754?

128. Identify all persons or agencies who approved the foreclosure of the property.

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 18 of 21

Please provide me with the documents that I have requested and a detailed answer to each

of my questions and requests within the required lawful time frame. Upon receipt of the

documents and answers, an exam and audit will be conducted that may lead to a further

document request and answers to questions under an additional QWR letter.

Copies of this Qualified Written Request, Dispute of Debt, Validation of Debt, TILA and

request for accounting and legal records letter are being sent to FTC, HUD, Thrift Supervision,

all relevant state and federal regulators; and other consumer advocates; and my congressman. It

is my hope that you answer this request in accordance with law and the questions, documents

and validation of debt accurately and act to correct any abuse(s) or scheme(s) uncovered and

documented.

DEFAULT PROVISION(S) UNDER THIS QUALIFIED WRITTEN

REQUEST

CREDITOR NAME HERE’s or any agents, transfers, or assigns omissions of or acquiescence of

this RESPA REQUEST via certified answer or rebuttal of any and all points, herein this RESPA

REQUEST”, agrees and consents to, including but not limited by, any violations of law and/or

immediate terminate/remove any and all right, title, interests and liens, in John Henry Doe or any

property or collateral connected to John Henry Doe or account #123456789 and waives any and

all immunities or defenses, in claims and or violations, agreed to in this RESPA REQUEST,

including but not limited by any and all of the following:

1. The right, by breach of fiduciary responsibility, fraud and misrepresentation,

revocation and rescinding of any and all power of attorney or appointment

CREDITOR NAME HERE may have or may have had in connection with account

#123456789 and any property and/or real estate connected with account #123456789.

2. The right to have any certified or uncertified security re-registered in John Henry

Doe’s, and only John Henry Doe’s name.

3. The right of collection via CREDITOR NAME HERE’s liability insurance and/or

bond.

4. John Henry Doe’s entitlement in filing and executing any instruments, as power of

attorney for and by CREDITOR NAME HERE, including but not limited by a new

certified security or any security agreement perfected by filing a UCC Financing

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 19 of 21

Statement with the Secretary of State in the State where the CREDITOR NAME

HERE is located.

5. The right to damages because of CREDITOR NAME HERE’s wrongful registration,

breach of intermediary responsibility with regard to John Henry Doe’s asset by

CREDITOR NAME HERE issuing to John Henry Doe a certified check for the

original value of John Henry Doe’s monetary instrument.

6. The right to have account #123456789 completely set off because of CREDITOR

NAME HERE’s wrongful registration, breach of intermediary responsibility with

regard to John Henry Doe’s monetary instrument/asset by CREDITOR NAME HERE

sending confirmation of set off of wrongful liability of John Henry Doe and issuing a

certified check for the difference between the original value of John Henry Doe’s

monetary instrument/asset and what John Henry Doe mistakenly sent to CREDITOR

NAME HERE as payment for such wrongful liability.

CREDITOR NAME HERE or any transfers, agents or assigns offering a rebuttal of this

RESPA REQUEST must do so in the manner of this “RESPA REQUEST” in accordance of and

in compliance with current statutes and/or laws by signing in the capacity of a fully liable man

or woman being responsible and liable under the penalty of perjury while offering direct

testimony with the official capacity as an appointed agent for CREDITOR NAME HERE in

accordance with CREDITOR NAME HERE’s Articles of Incorporation, Article of Incorporation,

by Laws signed by a current and duly sworn director(s) of such corporation/Holding

Corporation/National Association. Any direct rebuttal with certified true and complete

accompanying proof must be posted with the address herein within sixty days. When no verified

response/rebuttal of this “RESPA REQUEST” is made in a timely manner, a “Certificate of

Non-Response” serves as CREDITOR NAME HERE’s acquiescence and consent/agreement by

means of silence with any and all claims and/or violations, herein-stated, in the default

provisions or any other law.

Sincerely,

________________________ ________________________

Name Name,

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 20 of 21

ADDRESS

CITY, STATE ZIPCODE

PHONE

CC:

Federal Trade Commission

Office of RESPA and Interstate Land Sales

600 Pennsylvania Avenue NW, Office of Housing, Room 9146

Washington, DC. 20580 Department of Housing and Urban Development

451 Seventh Street, SW

Office of Housing Enterprise Oversight (OFHEO )

1700 G Street, NW., Fourth Floor,

Washington, DC 20552.

RESPA QUALIFIED WRITTEN REQUEST, ET AL. Page 21 of 21

Anda mungkin juga menyukai

- Respa LetterDokumen17 halamanRespa LetterForeclosementor93% (27)

- RESPA Qualified Written Request (QWR), Complaint, Dispute and Validation of Debt, TILA RequestDokumen19 halamanRESPA Qualified Written Request (QWR), Complaint, Dispute and Validation of Debt, TILA RequestCasey Serin100% (7)

- Mortgage......... Debt Validation Letter - NoticeDokumen28 halamanMortgage......... Debt Validation Letter - Noticevsoskil80% (10)

- Response To Bank AttorneyDokumen5 halamanResponse To Bank Attorneyvaltec100% (6)

- QWR - Long VersionDokumen20 halamanQWR - Long Versionrifishman1100% (1)

- Qualified Written Request - 1st Step of Forensic Loan Audit - Predatory Lending ViolationsDokumen9 halamanQualified Written Request - 1st Step of Forensic Loan Audit - Predatory Lending ViolationsUnemployment Hotline100% (30)

- 6 QWR Master Respa QWRDokumen23 halaman6 QWR Master Respa QWRPete Santilli100% (1)

- Sample Qualified Written Request 1Dokumen8 halamanSample Qualified Written Request 1winstons2311Belum ada peringkat

- Killer QWR Qualified Written RequestDokumen20 halamanKiller QWR Qualified Written Requestwinstons2311100% (10)

- Proof of Claim 1Dokumen3 halamanProof of Claim 1Greg Wilder100% (2)

- Validation Proof of ClaimDokumen4 halamanValidation Proof of Claimroyalarch13100% (5)

- Qualified Written Respa Tila RequestDokumen17 halamanQualified Written Respa Tila RequestJulie Hatcher-Julie Munoz Jackson100% (5)

- 12 U S C 2605 (Qualified Written Requests)Dokumen15 halaman12 U S C 2605 (Qualified Written Requests)starhoney100% (3)

- QWR Short FormDokumen5 halamanQWR Short Formboytoy 9774Belum ada peringkat

- Sample Mortgage Violations LetterDokumen9 halamanSample Mortgage Violations Letteracademicone100% (1)

- QWRDokumen2 halamanQWRT Patrick Murray100% (2)

- New QWRDokumen4 halamanNew QWRjerry806100% (2)

- Sample QWRDokumen7 halamanSample QWRjp5170scBelum ada peringkat

- Mortgage VODDokumen6 halamanMortgage VODmanitobamktg67% (3)

- Greentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Dokumen4 halamanGreentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Andy Craemer100% (1)

- 001 Tila Rescission Case Adversary Proceeding Ruling in Favor of BorrowersDokumen31 halaman001 Tila Rescission Case Adversary Proceeding Ruling in Favor of BorrowersCarrieonic100% (1)

- Qualified Written Request SampleDokumen2 halamanQualified Written Request SampleSterlingjr50% (2)

- Qualified Written Request Template 4Dokumen4 halamanQualified Written Request Template 4douglas jones100% (2)

- US District Court Opinion and Order Denies Motions to Dismiss Mortgage LawsuitDokumen30 halamanUS District Court Opinion and Order Denies Motions to Dismiss Mortgage LawsuitHelpin Hand100% (2)

- Qualified Written Request (QWR) Basics, Presentation by Homeowner AdversaryDokumen16 halamanQualified Written Request (QWR) Basics, Presentation by Homeowner AdversaryForeclosureG8100% (1)

- QWR RequestDokumen5 halamanQWR RequestChris Doxzen100% (1)

- 2012-12-31 Eft As First Mortgage Offer To PayDokumen10 halaman2012-12-31 Eft As First Mortgage Offer To PayskunkyghostBelum ada peringkat

- QWR For 1 BorrowerDokumen6 halamanQWR For 1 BorrowerRick Albritton100% (1)

- Simple Qualified Written RequestDokumen2 halamanSimple Qualified Written Requestwinstons2311100% (1)

- PublishedDokumen21 halamanPublishedScribd Government DocsBelum ada peringkat

- 15fighting ForeclosureDokumen19 halaman15fighting ForeclosureKeith Muhammad: Bey83% (6)

- R-1 - Attorney - Notice of FraudDokumen4 halamanR-1 - Attorney - Notice of Fraudderrick100% (5)

- Mortgage KillerDokumen2 halamanMortgage KillerPamGraveBelum ada peringkat

- Lexington Dispute of DebtDokumen4 halamanLexington Dispute of DebtArmond Trakarian100% (3)

- Stop Foreclosures FastDokumen9 halamanStop Foreclosures Fastzeke11100% (4)

- Foreclosure Affidavit Cog1Dokumen15 halamanForeclosure Affidavit Cog1Guy Madison NeighborsBelum ada peringkat

- Case File California FDCPA RESPA UCL QUASI CONTRACT Decl Relief M-T-D DENIED Naranjo v. SBMC MortgageDokumen208 halamanCase File California FDCPA RESPA UCL QUASI CONTRACT Decl Relief M-T-D DENIED Naranjo v. SBMC MortgageDeontos100% (1)

- Sample Qualified Written Request 1Dokumen5 halamanSample Qualified Written Request 1derrick1958100% (2)

- Affidavit of FactDokumen3 halamanAffidavit of FactMortgage Compliance Investigators100% (8)

- RescissionNotice Fin Charge COMPLAINTDokumen23 halamanRescissionNotice Fin Charge COMPLAINTLoanClosingAuditors100% (1)

- QWR Template - GenericDokumen3 halamanQWR Template - GenericBob Ramers100% (2)

- Copies and The Affidavit TrapDokumen29 halamanCopies and The Affidavit TrapJeff Wilner93% (29)

- Homeowner Victory in Ca VS ChaseDokumen23 halamanHomeowner Victory in Ca VS ChaseMortgage Compliance Investigators100% (2)

- Mortgage KillerEXDokumen53 halamanMortgage KillerEXAndyJackson75% (4)

- How To Fight Assigment of MortgageDokumen3 halamanHow To Fight Assigment of Mortgagekcollman100% (1)

- Mortgage Creditors Proof of Claim and Objections by June - MannDokumen28 halamanMortgage Creditors Proof of Claim and Objections by June - Mannwicholacayo100% (1)

- Foreclosure Cancellation PackageDokumen58 halamanForeclosure Cancellation Packagealbtros100% (11)

- Judicial vs Non-Judicial Foreclosure ProcessDokumen4 halamanJudicial vs Non-Judicial Foreclosure ProcessTeodoro Cabo San LucasBelum ada peringkat

- QWR - 2 BorrownersDokumen6 halamanQWR - 2 BorrownersRick Albritton100% (1)

- Tim Bulloch Email On Object To Everything and Related From Neil Garfield 10132017Dokumen5 halamanTim Bulloch Email On Object To Everything and Related From Neil Garfield 10132017api-293779854Belum ada peringkat

- MERS - Show Me The Nomination !!!Dokumen14 halamanMERS - Show Me The Nomination !!!Tim Bryant100% (8)

- What Is Satisfaction of Mortgage?: Step 1 - Identify The PartiesDokumen3 halamanWhat Is Satisfaction of Mortgage?: Step 1 - Identify The PartiesMJ CaliaoBelum ada peringkat

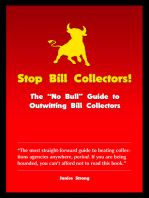

- Stop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsDari EverandStop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsPenilaian: 5 dari 5 bintang5/5 (1)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionDari EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionBelum ada peringkat

- American Foreclosure: Everything U Need to Know About Preventing and BuyingDari EverandAmerican Foreclosure: Everything U Need to Know About Preventing and BuyingBelum ada peringkat

- The Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationDari EverandThe Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationPenilaian: 5 dari 5 bintang5/5 (1)

- Candidates For Change (10!31!10)Dokumen3 halamanCandidates For Change (10!31!10)Mark JacksonBelum ada peringkat

- Amicus CuruiDokumen14 halamanAmicus CuruiMark JacksonBelum ada peringkat

- Sentence Dec 8, 2008 - 23852Dokumen13 halamanSentence Dec 8, 2008 - 23852JOEMAFLAGEBelum ada peringkat

- H.R. 279, 22nd Congress, 1st Session, January 17, 1832Dokumen4 halamanH.R. 279, 22nd Congress, 1st Session, January 17, 1832Mark JacksonBelum ada peringkat

- Plea Sep 25, 2008 - 23852Dokumen18 halamanPlea Sep 25, 2008 - 23852Mark Jackson100% (1)

- Application For Leave To Appeal SC 23852Dokumen35 halamanApplication For Leave To Appeal SC 23852JOEMAFLAGEBelum ada peringkat

- Pros Response To Application For Leave SC - 23852Dokumen70 halamanPros Response To Application For Leave SC - 23852JOEMAFLAGEBelum ada peringkat

- Amended Motion To Vacate (10!30!10)Dokumen64 halamanAmended Motion To Vacate (10!30!10)Mark JacksonBelum ada peringkat

- Quo Warranto Letter To Attorney General Regarding Judge Chylinski (10!15!2010)Dokumen2 halamanQuo Warranto Letter To Attorney General Regarding Judge Chylinski (10!15!2010)Mark Jackson100% (1)

- Motion For Relief and Stay of Any Collection of Fines or Penalties Pending AppealDokumen6 halamanMotion For Relief and Stay of Any Collection of Fines or Penalties Pending AppealMark JacksonBelum ada peringkat

- Request For Investigation - Department of JusticeDokumen2 halamanRequest For Investigation - Department of JusticeMark JacksonBelum ada peringkat

- Affidavit of Events of October 21, 2010Dokumen2 halamanAffidavit of Events of October 21, 2010Mark JacksonBelum ada peringkat

- Defendant's Motion To Disqualify Judge (10-14-2010)Dokumen9 halamanDefendant's Motion To Disqualify Judge (10-14-2010)Mark Jackson75% (4)

- Bill of Rights (Philippines)Dokumen2 halamanBill of Rights (Philippines)Jen100% (3)

- Defendant's Motion For Findings of Facts and Conclusions of Law (10-14-2010)Dokumen6 halamanDefendant's Motion For Findings of Facts and Conclusions of Law (10-14-2010)Mark Jackson100% (2)

- Prosecutorial Misconduct Series - USA TODAYDokumen2 halamanProsecutorial Misconduct Series - USA TODAYMark JacksonBelum ada peringkat

- Brief in Support of Complaint For Mandamus (10!26!10)Dokumen10 halamanBrief in Support of Complaint For Mandamus (10!26!10)Mark JacksonBelum ada peringkat

- Habeas Corpus (Generic)Dokumen69 halamanHabeas Corpus (Generic)Mark Jackson100% (3)

- Closer Look - Prosecutor Misconduct Takes Many Forms - USATODAYDokumen5 halamanCloser Look - Prosecutor Misconduct Takes Many Forms - USATODAYMark JacksonBelum ada peringkat

- HabeasDokumen45 halamanHabeasMark Jackson100% (1)

- Va. Bankers Scored A Rare Victory Against Federal Prosecutors - USATODAYDokumen4 halamanVa. Bankers Scored A Rare Victory Against Federal Prosecutors - USATODAYMark Jackson100% (1)

- Monograph 5 Prelim Exams April-2009Dokumen74 halamanMonograph 5 Prelim Exams April-2009Mark JacksonBelum ada peringkat

- Justice Dept. Ensures Prosecutors Brush Up On Duties - USATODAYDokumen3 halamanJustice Dept. Ensures Prosecutors Brush Up On Duties - USATODAYMark JacksonBelum ada peringkat

- Prosecutors' Conduct Can Tip Justice Scales - USATODAYDokumen8 halamanProsecutors' Conduct Can Tip Justice Scales - USATODAYMark JacksonBelum ada peringkat

- Prosecuting Offices' Immunity TestedDokumen7 halamanProsecuting Offices' Immunity TestedMark JacksonBelum ada peringkat

- Not Guilty, But Stuck With Big Bills, Damaged Career - USATODAYDokumen6 halamanNot Guilty, But Stuck With Big Bills, Damaged Career - USATODAYMark JacksonBelum ada peringkat

- Court Questions $14 Million Judgment in Unjust Prosecution - USATODAYDokumen3 halamanCourt Questions $14 Million Judgment in Unjust Prosecution - USATODAYMark JacksonBelum ada peringkat

- Monograph 8 Felony Sentencing Appendices April-2009Dokumen160 halamanMonograph 8 Felony Sentencing Appendices April-2009Mark JacksonBelum ada peringkat

- Case File California FDCPA RESPA UCL QUASI CONTRACT Decl Relief M-T-D DENIED Naranjo v. SBMC MortgageDokumen208 halamanCase File California FDCPA RESPA UCL QUASI CONTRACT Decl Relief M-T-D DENIED Naranjo v. SBMC MortgageDeontos100% (1)

- Church of The Gardens and Property OwnerDokumen23 halamanChurch of The Gardens and Property OwnerValerie LopezBelum ada peringkat

- Real Estate Finance InstrumentsDokumen84 halamanReal Estate Finance InstrumentsJackie Lang100% (7)

- Debentures: Investment Law 5 Year Semanti ChoudhuryDokumen16 halamanDebentures: Investment Law 5 Year Semanti ChoudhurylukeBelum ada peringkat

- Notice and Notice of Defective Chain of Title SlsDokumen3 halamanNotice and Notice of Defective Chain of Title SlsCindy BrownBelum ada peringkat

- Slander of Title V Wells FargoDokumen7 halamanSlander of Title V Wells FargoBleak Narratives100% (1)

- The Foreclosure Secrets GuideDokumen146 halamanThe Foreclosure Secrets GuideAkil BeyBelum ada peringkat

- CA Foreclosure Law - Civil Code 2924Dokumen44 halamanCA Foreclosure Law - Civil Code 2924api-22112682Belum ada peringkat

- James Kucherka Signs As Vice President of Coldwell Bank October 2007Dokumen1 halamanJames Kucherka Signs As Vice President of Coldwell Bank October 2007Kerri KnoxBelum ada peringkat

- California Guide to Trust Deeds and Foreclosure RulesDokumen28 halamanCalifornia Guide to Trust Deeds and Foreclosure RulesJulio Cesar NavasBelum ada peringkat

- 11 MERS Core Legal Concepts BDokumen107 halaman11 MERS Core Legal Concepts Bneil1975100% (1)

- 2009-02-05Dokumen40 halaman2009-02-05Southern Maryland OnlineBelum ada peringkat

- Cemap 2 Revision Guide: 2010/2011 EditionDokumen20 halamanCemap 2 Revision Guide: 2010/2011 EditionSling ShotBelum ada peringkat

- DOJ Letter Re Texas Central - 4-5-24 SignedDokumen21 halamanDOJ Letter Re Texas Central - 4-5-24 SignedKBTXBelum ada peringkat

- Fraudulent Assignment of DotDokumen48 halamanFraudulent Assignment of DotSherry Hernandez100% (4)

- Response Brief of Quality Loan Service CorpDokumen24 halamanResponse Brief of Quality Loan Service CorpLee Perry100% (1)

- Max Gardner's 65 Tips FOR FAKE MORTGAGE DOCUMENTSDokumen4 halamanMax Gardner's 65 Tips FOR FAKE MORTGAGE DOCUMENTS83jjmack100% (1)

- Chattel MortgageDokumen11 halamanChattel MortgageMary Faith DaroyBelum ada peringkat

- Real Estate Transactions - OUTLINE - Fall 2010Dokumen14 halamanReal Estate Transactions - OUTLINE - Fall 2010Silvia Adaes100% (2)

- HOA Form No. 1-A ArticlesDokumen4 halamanHOA Form No. 1-A ArticlesChanChi Domocmat LaresBelum ada peringkat

- Cashflow Without RentalsDokumen17 halamanCashflow Without RentalsSadegh SimorghBelum ada peringkat

- Williamson County Real Property Records Audit - January 29, 2013Dokumen179 halamanWilliamson County Real Property Records Audit - January 29, 2013cloudedtitles100% (1)

- Deed Sets Terms Property TrustDokumen9 halamanDeed Sets Terms Property TrustKartik GuptaBelum ada peringkat

- Amending Trust Deeds in Terms of Common Law and Derived PowersDokumen3 halamanAmending Trust Deeds in Terms of Common Law and Derived PowersMohit SoniBelum ada peringkat

- SovereignDokumen151 halamanSovereignlenorescribdaccountBelum ada peringkat

- Will The Court Allow Fraudulent Documents To Prevail?? Opposition To Motion To Annul Stay - See Supporting Declaration As WellDokumen25 halamanWill The Court Allow Fraudulent Documents To Prevail?? Opposition To Motion To Annul Stay - See Supporting Declaration As WellBlaqRubiBelum ada peringkat

- LAND TRUST AGREEMENT SampleDokumen4 halamanLAND TRUST AGREEMENT SampleTiggle MadaleneBelum ada peringkat

- TWO FACES: DEMYSTIFYING THE MORTGAGE ELECTRONIC REGISTRATION SYSTEM'S LAND TITLE THEORY (MERS) SSRN-id1684729Dokumen39 halamanTWO FACES: DEMYSTIFYING THE MORTGAGE ELECTRONIC REGISTRATION SYSTEM'S LAND TITLE THEORY (MERS) SSRN-id1684729CarrieonicBelum ada peringkat

- Sample Preliminary ReportDokumen10 halamanSample Preliminary ReportAidyl Rain SimbulanBelum ada peringkat

- Assignment of Deed of Trust for 1200 Palo Alto Dr propertyDokumen13 halamanAssignment of Deed of Trust for 1200 Palo Alto Dr propertystudy sampleBelum ada peringkat