IGF Fact-Sheet December-2014 PDF

Diunggah oleh

YudhistirJJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

IGF Fact-Sheet December-2014 PDF

Diunggah oleh

YudhistirJHak Cipta:

Format Tersedia

NAV Rs. 28.

32

31 DECEMBER 2014

NAV EVOLUTION FUND OBJECTIVE

35.00

28.32 IPRO Growth Fund Ltd (“IGF”) is governed by the

30.00

laws of Mauritius and is authorised to operate as

25.00 a Collective Investment Scheme (“CIS”) by the

20.00 Financial Services Commission under the

15.00 Mauritian Securities Act 2005.

10.00

5.00 For full investment objective and policy details,

please refer to the Prospectus.

0.00

Dec-04

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Jun-05

Jun-06

Jun-07

Jun-08

Jun-09

Jun-10

Jun-11

Jun-12

Jun-13

Jun-14

INVESTMENT OPTIONS

• Systematic Investment Plan (SIP):

Allows individuals to make regular payments

in IGF.

CUMULATIVE PERFORMANCE • Lump-Sum Investment:

ANNUALISED A one-off investment into the fund suitable for

those who have accumulated capital in hand.

1 3 1 3 5 7 10 Since

month months year years years years years inception

-0.7% -3.8% 2.1% 7.6% 5.5% 2.0% 9.0% 8.8% FUND FACTS

FUND MANAGER COMMENTARY SEM class code IGF 81751

As at 31 December 2014, the Net Asset Value (“NAV”) per share of IPRO Growth Inception date 1 December 2000

Fund Ltd (“IGF”) stood at Rs. 28.32 compared to Rs. 28.52 as at 28 November

Launch price Rs. 13.87

2014, representing a loss of 0.7% for the month. The SEMTRI declined by 0.5%

over the same period. Fund size as at

Rs. 632 million

31 December 2014

IGF’s local portfolio shed 0.7% over the month. Performance was driven by Dealing frequency Weekly

positive returns from Phoenix Beverages, Cim and Omnicane, which collectively

Domicile Republic of Mauritius

contributed 0.5%. Gamma Civic, Ciel and MCB Group provided a drag on returns

for the month, with a collective negative impact of 0.6%. Custodian Mauritius Commercial Bank Ltd

Investment manager IPRO Fund Management Ltd

The foreign portfolio lost 0.7%, driven by our main investment in the African

Administrator Galileo Portfolio Services Ltd

Market Leaders Fund as market conditions remained challenging across the

continent over the month. The Johannesburg All Share Index lost 3.6%, Nigerian Auditors BDO & Co

All Share Index lost 1.0% and Nairobi All Share Index lost 0.1% (all returns in MUR Annual management fee 0.85%

terms). Annual distribution fee 0.40%

Entry fee Nil

TOTAL PORTFOLIO SECTOR ALLOCATION PORTFOLIO COMPOSITION Exit fee Nil

Equity Local Listed Equities 57.5%

Banks & Insurance & Other African Market Leaders 17.8%

36.8%

Finance

Africa Absolute Return 10.7% TOP 10 HOLDINGS

Investments 14.8%

Local Fixed Income 8.9%

Sugar & Agriculture 0.9% African Market Leaders Fund 17.8%

Consumer Goods 1.2% International Property 1.3%

Africa Absolute Return Fund 10.7%

Commerce 2.1% Liquidity 3.8% MCB Group 9.3%

Leisure & Hotels 6.3% Total 100.0% SBM Holdings 8.3%

Industry 5.6% Govt. of Mauritius Bond 7.40% Jan 2028 4.9%

Liquidity

3.8% Ciel 4.1%

Telecommunications 4.1% International

Property

Alteo 4.0%

Mining and Basic Resources 1.1% 1.3% Mauritius Union 3.2%

Local Fixed

Energy, Oil and Gas 0.5% Income Mutual Aid Fixed Deposit RR+3.1% Feb 2023 3.2%

8.9%

Transport 0.2% Lux* Island Resorts 3.1%

Unquoted 0.1% Africa Absolute

Return

10.7%

International Property 1.3% INVESTMENT PROFESSIONALS LTD

Local Listed

Ebene Skies, 3rd Floor, Rue de l’Institut

Fixed Income 19.6%

i

Equities

57.5% Ebene, Mauritius

Liquidity 5.4% African Market

Email: info@ipro.mu

Leaders

17.8% Tel: (230) 403 6700

IMPORTANT LEGAL INFORMATION:

This report is provided by IPRO Fund Management Ltd for information purposes only and is meant for investment professional use. Neither the information nor any opinion expressed

constitutes an offer or an invitation to make an offer, to buy or sell any fund. This report does not have regard to the specific investment objectives and financial situation of any specific

person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any funds recommended in this report and should understand that

statements regarding future prospects may not be realized. Investors should note that each fund's price or value may rise or fall. Past performance is not a guide to future performance.

Anda mungkin juga menyukai

- DSCR Tutorial: Understanding the Debt Service Coverage RatioDokumen2 halamanDSCR Tutorial: Understanding the Debt Service Coverage RatioArun Pasi100% (1)

- Monthly Fund Performance Update Aia International Small Cap FundDokumen1 halamanMonthly Fund Performance Update Aia International Small Cap FundLam Kah MengBelum ada peringkat

- Get The Power of Equity and Debt With Sbi Dual Advantage Fund - Series XxiiDokumen4 halamanGet The Power of Equity and Debt With Sbi Dual Advantage Fund - Series Xxiiarghya000Belum ada peringkat

- Update On IDFC Arbitrage FundDokumen6 halamanUpdate On IDFC Arbitrage FundGBelum ada peringkat

- Dolat Capital Modi Era S Century An AnalysisDokumen21 halamanDolat Capital Modi Era S Century An AnalysisRohan ShahBelum ada peringkat

- Al Ahli Bank of Kuwait - Egypt - MMF - November 2017 - English - Monthly ReportDokumen1 halamanAl Ahli Bank of Kuwait - Egypt - MMF - November 2017 - English - Monthly ReportSobolBelum ada peringkat

- "Planning Your Financial Future": Mangala Boyagoda 26 October 2010Dokumen71 halaman"Planning Your Financial Future": Mangala Boyagoda 26 October 2010Inde Pendent LkBelum ada peringkat

- 3 QTD MCO and Cumulative Outflow AnalysisDokumen1 halaman3 QTD MCO and Cumulative Outflow AnalysisAlberto EstanesBelum ada peringkat

- MMSF FS 202304Dokumen2 halamanMMSF FS 202304beddybair98Belum ada peringkat

- PvsystDokumen44 halamanPvsystSgfvv100% (1)

- Beaumont Port Arthur Labor StatisticsDokumen1 halamanBeaumont Port Arthur Labor StatisticsCharlie FoxworthBelum ada peringkat

- Accommodation Supply Analysis in Launceston Part 1Dokumen34 halamanAccommodation Supply Analysis in Launceston Part 1The ExaminerBelum ada peringkat

- Click To Edit Master Title Style: Ambit Good & Clean Midcap FundDokumen20 halamanClick To Edit Master Title Style: Ambit Good & Clean Midcap Fundksprakash1990Belum ada peringkat

- Gerald CorcoranDokumen9 halamanGerald CorcoranMarketsWikiBelum ada peringkat

- Athenian Shipbrokers S.A.: Baltic Dry IndexDokumen17 halamanAthenian Shipbrokers S.A.: Baltic Dry IndexgeorgevarsasBelum ada peringkat

- Southeast Texas Labor StatisticsDokumen1 halamanSoutheast Texas Labor StatisticsCharlie FoxworthBelum ada peringkat

- Athenian-Shipbrokers-July 2013Dokumen18 halamanAthenian-Shipbrokers-July 2013Nguyen Le Thu HaBelum ada peringkat

- List Suhu Oct 01-30-2021Dokumen3 halamanList Suhu Oct 01-30-2021upickrahmanBelum ada peringkat

- Athenian Shipbrokers Monthly Report Baltic Dry Index Prices Tankers Bulk CarriersDokumen20 halamanAthenian Shipbrokers Monthly Report Baltic Dry Index Prices Tankers Bulk Carriersgeorgevarsas0% (1)

- Athenian-Shipbrokers-April 2013Dokumen18 halamanAthenian-Shipbrokers-April 2013Nguyen Le Thu HaBelum ada peringkat

- Account Statement 2015Dokumen3 halamanAccount Statement 2015Mohd Zubair Mohd YusofBelum ada peringkat

- Research Speak - 16-04-2010Dokumen12 halamanResearch Speak - 16-04-2010A_KinshukBelum ada peringkat

- FFS Ep1aDokumen1 halamanFFS Ep1aNavin IndranBelum ada peringkat

- Introduction To M&A With Piramal Abbott DealDokumen22 halamanIntroduction To M&A With Piramal Abbott DealSachidanand Singh100% (2)

- Ideas & InsightsDokumen2 halamanIdeas & Insightsag rBelum ada peringkat

- CIMB Islamic Sukuk Fund: Fund Objective Investment VolatilityDokumen2 halamanCIMB Islamic Sukuk Fund: Fund Objective Investment VolatilityMaria haneffBelum ada peringkat

- Monthly report on shipping prices and Baltic Dry IndexDokumen17 halamanMonthly report on shipping prices and Baltic Dry IndexgeorgevarsasBelum ada peringkat

- Special Section 1Dokumen3 halamanSpecial Section 1M.A. ShaikhBelum ada peringkat

- Athenian Shipbrokers - Monthy Report - 14.07.15 PDFDokumen18 halamanAthenian Shipbrokers - Monthy Report - 14.07.15 PDFgeorgevarsasBelum ada peringkat

- Job Losses Since December 2007Dokumen1 halamanJob Losses Since December 2007EricFruitsBelum ada peringkat

- MEF Analysis UI Claims - March 2020Dokumen2 halamanMEF Analysis UI Claims - March 2020Dave AllenBelum ada peringkat

- NTDOP One Pager Jun'22Dokumen3 halamanNTDOP One Pager Jun'22Deepak GoyalBelum ada peringkat

- 34 Birla Corp Buy For A Price Target of Rs430Dokumen2 halaman34 Birla Corp Buy For A Price Target of Rs430mamtakariraBelum ada peringkat

- Indian fixed income market update and outlookDokumen2 halamanIndian fixed income market update and outlookAnubhav TripathiBelum ada peringkat

- River Stones RemainDokumen27 halamanRiver Stones Remainርቺሪሆርሁ ቹነቹᎇፓገኤጊBelum ada peringkat

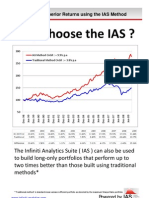

- Why Choose The IASDokumen6 halamanWhy Choose The IASPeter UrbaniBelum ada peringkat

- Long-term focused Indian equity portfolioDokumen1 halamanLong-term focused Indian equity portfoliocoureBelum ada peringkat

- JPM Global Equity Multi-FactorDokumen2 halamanJPM Global Equity Multi-FactorHari ChandanaBelum ada peringkat

- Athenian-Shipbrokers-March 2013Dokumen19 halamanAthenian-Shipbrokers-March 2013Nguyen Le Thu HaBelum ada peringkat

- Outlook For The SMSF SectorDokumen13 halamanOutlook For The SMSF SectorRomeoBelum ada peringkat

- Lanvyl TubesDokumen5 halamanLanvyl TubesIshmeet SinghBelum ada peringkat

- Mutual Fund Industry Decade of Growth 2010 2020 ReportDokumen36 halamanMutual Fund Industry Decade of Growth 2010 2020 ReportHarshit SinghBelum ada peringkat

- 2014 Comparing SARIMA and Holt Winter Model For Indian Automobile SectorDokumen4 halaman2014 Comparing SARIMA and Holt Winter Model For Indian Automobile SectorShiv PrasadBelum ada peringkat

- Pakistan Fertilizer Sector Update Highlights Valuations and Growth OutlookDokumen3 halamanPakistan Fertilizer Sector Update Highlights Valuations and Growth OutlookOnail AbbasBelum ada peringkat

- Vinall 2014 - ValuationDokumen19 halamanVinall 2014 - ValuationOmar MalikBelum ada peringkat

- Unemployment DataDokumen2 halamanUnemployment Datakettle1Belum ada peringkat

- Ambit Good and Clean India PMSDokumen22 halamanAmbit Good and Clean India PMSAnkurBelum ada peringkat

- NIT Jan'20Dokumen11 halamanNIT Jan'20afnaniqbalBelum ada peringkat

- Banking Review - Q4FY10Dokumen26 halamanBanking Review - Q4FY10vishi.segalBelum ada peringkat

- Budget 2024 ProfileDokumen1 halamanBudget 2024 ProfilemadhurmehrotraBelum ada peringkat

- Comunicado SSUINGLSDokumen1 halamanComunicado SSUINGLSMultiplan RIBelum ada peringkat

- Central Bank Monetary Policy Analysis of Sveriges RiksbankDokumen6 halamanCentral Bank Monetary Policy Analysis of Sveriges RiksbankGuillermo VarelaBelum ada peringkat

- Eclectica Absolute Macro Fund: Manager CommentDokumen3 halamanEclectica Absolute Macro Fund: Manager Commentfreemind3682Belum ada peringkat

- 094 CIMB-Principal Asia Pacific Dynamic Income Fund MYR FFSDokumen2 halaman094 CIMB-Principal Asia Pacific Dynamic Income Fund MYR FFSAbby IbnuBelum ada peringkat

- Netra Early Warnings Signals Through Charts - Dec 2022Dokumen19 halamanNetra Early Warnings Signals Through Charts - Dec 2022rashmi nandaBelum ada peringkat

- South Korean Energy Outlook 2015Dokumen13 halamanSouth Korean Energy Outlook 2015Afifa KamilaBelum ada peringkat

- Lecture 1 2019Dokumen58 halamanLecture 1 2019yitong zhangBelum ada peringkat

- Philippine Rice Trade Liberalization: Impacts On Agriculture and The Economy, and Alternative Policy ActionsDokumen12 halamanPhilippine Rice Trade Liberalization: Impacts On Agriculture and The Economy, and Alternative Policy ActionsJofred Dela VegaBelum ada peringkat

- Child ProtectionDokumen9 halamanChild ProtectionYudhistirJBelum ada peringkat

- IGF Fact Sheet January 2019Dokumen1 halamanIGF Fact Sheet January 2019YudhistirJBelum ada peringkat

- IGF Fact Sheet November 2018Dokumen1 halamanIGF Fact Sheet November 2018YudhistirJBelum ada peringkat

- IGF Fact Sheet December 2018Dokumen1 halamanIGF Fact Sheet December 2018YudhistirJBelum ada peringkat

- IGF Fact Sheet December 2017 PDFDokumen1 halamanIGF Fact Sheet December 2017 PDFYudhistirJBelum ada peringkat

- IGF Fact Sheet December 2016 PDFDokumen1 halamanIGF Fact Sheet December 2016 PDFYudhistirJBelum ada peringkat

- IGF Fact Sheet Dec 2015 PDFDokumen1 halamanIGF Fact Sheet Dec 2015 PDFYudhistirJBelum ada peringkat

- IGF Fact Sheet November 2018Dokumen1 halamanIGF Fact Sheet November 2018YudhistirJBelum ada peringkat

- 12 11 14 16 13 00 IGF Performance-Report FY-2014 15 Q1 PDFDokumen1 halaman12 11 14 16 13 00 IGF Performance-Report FY-2014 15 Q1 PDFYudhistirJBelum ada peringkat

- Public Bodies Appeal Tribunal Act 2008: 1. Short TitleDokumen4 halamanPublic Bodies Appeal Tribunal Act 2008: 1. Short TitleYudhistirJBelum ada peringkat

- Number of Units How Much It Cost Me (Invested) Term of Investment Selling PriceDokumen3 halamanNumber of Units How Much It Cost Me (Invested) Term of Investment Selling PriceYudhistirJBelum ada peringkat

- NIT Local Equity Fund: Number of Units How Much It Cost Me (Invested) Term of Investment Selling PriceDokumen2 halamanNIT Local Equity Fund: Number of Units How Much It Cost Me (Invested) Term of Investment Selling PriceYudhistirJBelum ada peringkat

- Nit RateDokumen1 halamanNit RateYudhistirJBelum ada peringkat

- Drugs: Are We Losing The BattleDokumen16 halamanDrugs: Are We Losing The BattleYudhistirJBelum ada peringkat

- Accountant / Student Resume SampleDokumen2 halamanAccountant / Student Resume Sampleresume7.com100% (6)

- Medanit Sisay Tesfaye PDF Th...Dokumen71 halamanMedanit Sisay Tesfaye PDF Th...Tesfahun GetachewBelum ada peringkat

- Sustainable Development Statement Arupv-2023Dokumen1 halamanSustainable Development Statement Arupv-2023James CubittBelum ada peringkat

- Tax Invoice Details for Mobile Phone PurchaseDokumen1 halamanTax Invoice Details for Mobile Phone PurchaseNiraj kumarBelum ada peringkat

- Marketing Plan Termite CompanyDokumen15 halamanMarketing Plan Termite CompanyJessey RiveraBelum ada peringkat

- MV Sir's Bramhastra Marathon NotesDokumen210 halamanMV Sir's Bramhastra Marathon NotesDeepanshu Gupta89% (18)

- CFAP SYLLABUS SUMMER 2023Dokumen31 halamanCFAP SYLLABUS SUMMER 2023shajar-abbasBelum ada peringkat

- VRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisDokumen5 halamanVRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisKaran VasheeBelum ada peringkat

- SECL's HR Strategies, Employee Welfare & Coal ProductionDokumen27 halamanSECL's HR Strategies, Employee Welfare & Coal ProductionRima PandeyBelum ada peringkat

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDokumen2 halaman6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettBelum ada peringkat

- ABC Brand Incense Sticks (Agarbatti)Dokumen2 halamanABC Brand Incense Sticks (Agarbatti)keethanBelum ada peringkat

- Using APV: Advantages Over WACCDokumen2 halamanUsing APV: Advantages Over WACCMortal_AqBelum ada peringkat

- PARTNERSHIP ACCOUNTING EXAM REVIEWDokumen26 halamanPARTNERSHIP ACCOUNTING EXAM REVIEWIts meh Sushi50% (2)

- M1 C2 Case Study WorkbookDokumen25 halamanM1 C2 Case Study WorkbookfenixaBelum ada peringkat

- Solution: International Inance SsignmentDokumen7 halamanSolution: International Inance SsignmentJamshidBelum ada peringkat

- Accounts Project FinalDokumen13 halamanAccounts Project FinalesheetmodiBelum ada peringkat

- Sop Finaldraft RaghavbangadDokumen3 halamanSop Finaldraft RaghavbangadraghavBelum ada peringkat

- Smu Project Synopsis Format & HelpDokumen4 halamanSmu Project Synopsis Format & HelpKautilyaTiwariBelum ada peringkat

- TLE 5 EntrepDokumen10 halamanTLE 5 EntrepFrance PilapilBelum ada peringkat

- Role of The Construction Industry in Economic Development of TurkmenistanDokumen8 halamanRole of The Construction Industry in Economic Development of TurkmenistanekakBelum ada peringkat

- Housing Delivery Process & Government AgenciesDokumen29 halamanHousing Delivery Process & Government AgenciesPsy Giel Va-ayBelum ada peringkat

- Fybcom Acc PDFDokumen441 halamanFybcom Acc PDFaayush rathi100% (1)

- Deutsche BrauereiDokumen24 halamanDeutsche Brauereiapi-371968780% (5)

- Trade Data Structure and Basics of Trade Analytics: Biswajit NagDokumen33 halamanTrade Data Structure and Basics of Trade Analytics: Biswajit Nagyashd99Belum ada peringkat

- Umw 2015 PDFDokumen253 halamanUmw 2015 PDFsuhaimiBelum ada peringkat

- Experienced Sales and Marketing Professional Seeking New OpportunitiesDokumen2 halamanExperienced Sales and Marketing Professional Seeking New OpportunitiesAshwini KumarBelum ada peringkat

- The Business Group and The IndustryDokumen10 halamanThe Business Group and The IndustryApoorva PattnaikBelum ada peringkat

- Journal entries for lamp production costs and inventoryDokumen2 halamanJournal entries for lamp production costs and inventoryLucy HeartfiliaBelum ada peringkat

- Furniture Industry in IndiaDokumen38 halamanFurniture Industry in IndiaCristiano Ronaldo100% (1)

- Specialization Project Report FinalDokumen49 halamanSpecialization Project Report FinalANCHURI NANDINIBelum ada peringkat