CH 11 Question Book - Not Reconciliation

Diunggah oleh

ahmedJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CH 11 Question Book - Not Reconciliation

Diunggah oleh

ahmedHak Cipta:

Format Tersedia

b.

The auditor should ordinarily send confirmation requests to all banks with which the

client has conducted any business during the year, regardless of the year-end balance,

because

(1) this procedure will detect kiting activities that would otherwise not be detected.

(2) the confirmation form also seeks information about indebtedness to the bank.

(3) the sending of confirmation requests to all such banks is required by auditing

standards.

(4) this procedure relieves the auditor of any responsibility with respect to non-

detection of forged checks.

c. The usefulness of the standard bank confirmation request may be limited because the

bank employee who completes the confirmation may

(1) be unaware of all the financial relationships that the bank has with the client.

(2) not believe the bank is obligated to verify confidential information to a third party.

(3) sign and return the confirmation without inspecting the accuracy of the client’s

bank reconciliation.

(4) not have access to the client’s bank statement.

23-19 (Objective 23-4) The following questions deal with discovering fraud in auditing

year-end cash. Choose the best response.

a. Which of the following is one of the better auditing techniques to detect kiting?

(1) Review composition of authenticated deposit slips.

(2) Review subsequent bank statements and cancelled checks received directly from

the banks.

(3) Prepare year-end bank reconciliations.

(4) Prepare a schedule of bank transfers from the client’s books.

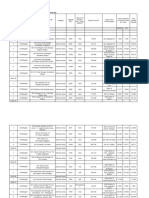

b. Which of the following cash transfers results in a misstatement of cash at December 31,

2011?

BANK TRANSFER SCHEDULE

Apago PDF Enhancer

Disbursements Receipt

Recorded Paid by Recorded Received

Transfer in books bank in books by bank

(1) 12/31/11 1/4/12 12/31/11 12/31/11

(2) 1/4/12 1/5/12 12/31/11 1/4/12

(3) 12/31/11 1/5/12 12/31/11 1/4/12

(4) 1/4/12 1/11/12 1/4/12 1/4/12

c. A cash shortage may be concealed by transporting funds from one location to another or

by converting negotiable assets to cash. Because of this, which of the following is vital?

(1) Simultaneous bank confirmations.

(2) Simultaneous bank reconciliations.

(3) Simultaneous four-column proofs of cash.

(4) Simultaneous surprise cash counts.

DISCUSSION QUESTIONS AND PROBLEMS

23-20 (Objectives 23-3, 23-4) The following are misstatements that might be found in the

client’s year-end cash balance (assume that the balance sheet date is June 30):

1. The outstanding checks on the June 30 bank reconciliation were underfooted by

$2,000.

2. A loan from the bank on June 26 was credited directly to the client’s bank account.

The loan was not entered as of June 30.

3. A check was omitted from the outstanding check list on the June 30 bank recon-

ciliation. It cleared the bank July 7.

750 Part 4 / APPLICATION OF THE AUDIT PROCESS TO OTHER CYCLES

4. A check was omitted from the outstanding check list on the bank reconciliation. It

cleared the bank September 6.

5. Cash receipts collected on accounts receivable from July 1 to July 5 were included as

June 29 and 30 cash receipts.

6. A bank transfer recorded in the accounting records on July 1 was included as a deposit

in transit on June 30.

7. A check that was dated June 26 and disbursed in June was not recorded in the cash

disbursements journal, but it was included as an outstanding check on June 30.

a. Assuming that each of these misstatements was intentional (fraud), state the most Required

likely motivation of the person responsible.

b. What control can be instituted for each fraud to reduce the likelihood of occurrence?

c. List an audit procedure that can be used to discover each fraud.

23-21 (Objectives 23-3, 23-4) The following audit procedures are concerned with tests of

details of general cash balances:

1. Obtain a standard bank confirmation from each bank with which the client does

business.

2. Compare the balance on the bank reconciliation obtained from the client with the

bank confirmation.

3. Compare the checks returned along with the cutoff bank statement with the list of

outstanding checks on the bank reconciliation.

4. List the check number, payee, and amount of all material checks not returned with

the cutoff bank statement.

5. Review minutes of the board of directors meetings, loan agreements, and bank

confirmation for interest-bearing deposits, restrictions on the withdrawal of cash,

and compensating balance agreements.

6. Prepare a four-column proof of cash.

7. Compare the bank cancellation date with the date on the cancelled check for checks

Apago PDF Enhancer

dated on or shortly before the balance sheet date.

8. Trace deposits in transit on the bank reconciliation to the cutoff bank statement and

the current year cash receipts journal.

Explain the objective of each. Required

23-22 (Objective 23-3) You are auditing general cash for the Pittsburgh Supply Company

for the fiscal year ended July 31, 2011. The client has not prepared the July 31 bank

reconciliation. After a brief discussion with the owner, you agree to prepare the recon-

ciliation, with assistance from one of Pittsburgh Supply’s clerks. You obtain the following

information:

General Ledger Bank Statement

Beginning balance 7/1/11 $ 6,400 $ 8,378

Deposits 25,474

Cash receipts journal 26,874

Checks cleared (25,307)

Cash disbursements journal (23,171)

July bank service charge (107)

Note paid directly (6,400)

NSF check ________ (516)

________

Ending balance 7/31/11 $ 10,103 $ 1,522

June 30 Bank Reconciliation

Information in General Ledger and Bank Statement

Balance per bank $8,378

Deposits in transit 600

Outstanding checks 2,578

Balance per books 6,400

Chapter 23 / AUDIT OF CASH BALANCES 751

Additional information obtained is as follows:

1. Checks clearing that were outstanding on June 30 totaled $2,411.

2. Checks clearing that were recorded in the July disbursements journal totaled $21,120.

3. A check for $1,130 cleared the bank but had not been recorded in the cash disburse-

ments journal. It was for an acquisition of inventory. Pittsburgh Supply uses the

periodic-inventory method.

4. A check for $646 was charged to Pittsburgh Supply but had been written on a

different company’s bank account.

5. Deposits included $600 from June and $24,874 for July.

6. The bank charged Pittsburgh Supply’s account for a nonsufficient check totaling

$516. The credit manager concluded that the customer intentionally closed its

account and the owner left the city. The check was turned over to a collection

agency.

7. A note for $6,000, plus interest, was paid directly to the bank under an agreement

signed 4 months ago. The note payable was recorded at $6,000 on Pittsburgh Supply’s

books.

Required a. Prepare a bank reconciliation that shows both the unadjusted and adjusted balance

per books.

b. Prepare all adjusting entries.

c. What audit procedures would you use to verify each item in the bank reconciliation?

d. What is the cash balance that should appear on the July 31, 2011, financial statements?

23-23 (Objectives 23-3, 23-4) In the audit of the Regional Transport Company, a large

branch that maintains its own bank account, cash is periodically transferred to the central

account in Cedar Rapids. On the branch account’s records, bank transfers are recorded as a

debit to the home office clearing account and a credit to the branch bank account.

Similarly, the home office account is recorded as a debit to the central bank account and a

Apago PDF Enhancer

credit to the branch office clearing account. Gordon Light is the head bookkeeper for both

the home office and the branch bank accounts. Because he also reconciles the bank

account, the senior auditor, Cindy Marintette, is concerned about the internal control

deficiency.

As a part of the year-end audit of bank transfers, Marintette asks you to schedule the trans-

fers for the last few days in 2011 and the first few days of 2012. You prepare the following list:

Date Recorded in Date Recorded in Date Deposited

the Home Office the Branch Office in the Home Date Cleared

Amount of Cash Receipts Cash Disbursements Office Bank the Branch

Transfer Journal Journal Account Bank Account

$17,000 12-27-11 12-29-11 12-26-11 12-27-11

28,000 12-28-11 01-02-12 12-28-11 12-29-11

16,000 01-02-12 12-30-11 12-28-11 12-29-11

10,000 12-26-11 12-26-11 12-28-11 01-03-12

21,000 01-02-12 01-02-12 12-28-11 12-31-11

22,000 01-07-12 01-05-12 12-28-11 01-03-12

39,000 01-04-12 01-06-12 01-03-12 01-05-12

Required a. In verifying each bank transfer, state the appropriate audit procedures you should

perform.

b. Prepare any adjusting entries required in the home office records.

c. Prepare any adjusting entries required in the branch bank records.

d. State how each bank transfer should be included in the December 31, 2011, bank

reconciliation for the home office account after your adjustments in part b.

e. State how each bank transfer should be included in the December 31, 2011, bank

reconciliation of the branch bank account after your adjustments in part c.

752 Part 4 / APPLICATION OF THE AUDIT PROCESS TO OTHER CYCLES

23-24 (Objective 23-4) The following are various potential misstatements due to errors or

fraud (1 through 7), and a list of auditing procedures (a through h) the auditor would

consider performing to gather evidence to determine whether the error or fraud is present.

Possible Misstatements Due to Errors or Fraud

1. The auditor suspects that a lapping scheme exists because an accounting department

employee who has access to cash receipts also maintains the accounts receivable

ledger and refuses to take any vacation or sick days.

2. The auditor suspects that the entity is inappropriately increasing the cash reported on its

balance sheet by drawing a check on one account and not recording it as an outstanding

check on that account and simultaneously recording it as a deposit in a second account.

3. The entity’s cash receipts of the first few days of the subsequent year were properly

deposited in its general operating account after the year-end. However, the auditor

suspects that the entity recorded the cash receipts in its books during the last week of

the year under audit.

4. The auditor noticed a significant increase in the number of times that petty cash was

reimbursed during the year and suspects that the custodian is stealing from the petty

cash fund.

5. The auditor suspects that a kiting scheme exists because an accounting department

employee who can issue and record checks seems to be leading an unusually

luxurious lifestyle.

6. During tests of the reconciliation of the payroll bank account, the auditor notices

that a check to an employee is significantly larger than other payroll checks.

7. The auditor suspects that the controller wrote several checks and recorded the cash

disbursements just before year-end but did not mail the checks until after the first

week of the subsequent year.

List of Auditing Procedures

a. Send a standard bank confirmation confirming the balance in the bank at year-end.

b. Compare the details of the cash receipts journal entries with the details of the

corresponding daily deposit slips. Apago PDF Enhancer

c. Count the balance in petty cash at year-end.

d. Agree gross amount on payroll checks to approved hours and pay rates.

e. Obtain the cutoff bank statement and compare the cleared checks to the year-end

reconciliation.

f . Examine invoices, receipts, and other documentation supporting reimbursement of

petty cash.

g. Examine payroll checks clearing after year-end with the payroll journal.

h. Prepare a bank transfer schedule.

For each possible misstatement, identify one audit procedure that would be most effective Required

in providing evidence regarding the potential misstatement. Listed auditing procedures

may be used once, more than once, or not at all.*

23-25 (Objective 23-3) In connection with an audit you are given the following worksheet:

Bank Reconciliation, December 31, 2011

Balance per ledger December 31, 2011 $27,253.85

Add:

Cash receipts received on the last day of December and

charged to “cash in bank” on books but not deposited 3,715.27

Debit memo for customer’s check returned unpaid (check

is on hand but no entry has been made on the books) 450.00

Debit memo for bank service charge for December 35.00

_________

$31,454.12

(continued on following page)

*AICPA adapted.

Chapter 23 / AUDIT OF CASH BALANCES 753

Deduct:

Checks drawn but not paid by bank (see detailed list below) $3,295.15

Credit memo for proceeds of a note receivable that had

been left at the bank for collection but which has not

been recorded as collected 1,200.00

Checks for an account payable entered on books as

$297.50 but drawn and paid by bank as $694.50 397.00

________ (4,892.15)

_________

Computed balance 26,561.97

Unlocated difference 416.44

_________

Balance per bank (checked to confirmation) $26,978.41

Checks Drawn but Not Paid by Bank

No. Amount

573 $ 267.27

724 39.92

903 454.67

907 291.80

911 648.29

913 737.52

914 529.10

916 36.00

917 117.26

__________

$ 3,295.15

Required a. Prepare a corrected reconciliation.

b. Prepare journal entries for items that should be adjusted prior to closing the books.*

23-26 (Objective 23-4) You are doing the first-year audit of Sherman School District and

have been assigned responsibility for doing a four-column proof of cash for the month of

October 2011. You obtain the following information:

Apago PDF Enhancer

1. Balance per books September 30 $ 10,725

October 31 5,836

2. Balance per bank September 30 6,915

October 31 8,276

3. Outstanding checks September 30 1,811

October 31 2,615

4. Cash receipts for October per bank 28,792

per books 20,271

5. Deposits in transit September 30 5,621

October 31 996

6. Interest on a bank loan for the month of October, charged by the bank but not

recorded, was $596.

7. Proceeds on a note of the Jones Company were collected by the bank on October 28

but were not entered on the books:

Principal $ 2,900

Interest 396

_______

$ 3,296

8. On October 26, a $1,144 check of the Billings Company was charged to Sherman

School District’s account by the bank in error.

9. Dishonored checks are not recorded on the books unless they permanently fail to clear

the bank. The bank treats them as disbursements when they are dishonored and

deposits when they are redeposited. Checks totaling $1,335 were dishonored in

October; $600 was redeposited in October and $735 in November.

Required a. Prepare a four-column proof of cash for the month ended October 31. It should show

both adjusted and unadjusted cash.

b. Prepare all adjusting entries.

*AICPA adapted.

754 Part 4 / APPLICATION OF THE AUDIT PROCESS TO OTHER CYCLES

Anda mungkin juga menyukai

- Citi Statment PDFDokumen4 halamanCiti Statment PDFBERNARD KUSIBelum ada peringkat

- RECENT AMENDMENTS TO NEGOTIABLE INSTRUMENTS ACTDokumen20 halamanRECENT AMENDMENTS TO NEGOTIABLE INSTRUMENTS ACTpooja guptaBelum ada peringkat

- 01 Cash and Cash Equivalents WITH ANSWERSDokumen5 halaman01 Cash and Cash Equivalents WITH ANSWERSRselle DiataBelum ada peringkat

- Bond Interest Revenue ReportingDokumen24 halamanBond Interest Revenue ReportingPatrick WaltersBelum ada peringkat

- Understanding Cash and Cash EquivalentsDokumen43 halamanUnderstanding Cash and Cash EquivalentsMarriel Fate CullanoBelum ada peringkat

- 2022 - 05 - Bad and Doubtful DebtsDokumen39 halaman2022 - 05 - Bad and Doubtful DebtsSafi UllahBelum ada peringkat

- TPH Day - 5 - R18Dokumen79 halamanTPH Day - 5 - R18PRAVIN JOSHUA100% (5)

- Samson Module 3 VcaDokumen6 halamanSamson Module 3 VcaEizzel SamsonBelum ada peringkat

- Audit of Cash and Cash EquivalentsDokumen9 halamanAudit of Cash and Cash Equivalentspatricia100% (1)

- Seatwork 3-Liabilities 22Aug2019JMDokumen3 halamanSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaBelum ada peringkat

- Audit of Cash and Cash Equivalents PDFDokumen4 halamanAudit of Cash and Cash Equivalents PDFRandyBelum ada peringkat

- Chapter 1-CFAS: I. AccountingDokumen6 halamanChapter 1-CFAS: I. AccountingDale Jose GarchitorenaBelum ada peringkat

- InternshipDokumen2 halamanInternshipChelsi Christine TenorioBelum ada peringkat

- Bank Reconciliation StatementsDokumen6 halamanBank Reconciliation StatementsTawanda Tatenda Herbert0% (1)

- Auditing Theory1 1Dokumen14 halamanAuditing Theory1 1JPIA MSU-IITBelum ada peringkat

- Toa - 2011Dokumen7 halamanToa - 2011EugeneDumalagBelum ada peringkat

- Fundamentals of Accounting I: Conceptual Framework (ACCT 1A&BDokumen12 halamanFundamentals of Accounting I: Conceptual Framework (ACCT 1A&BericacadagoBelum ada peringkat

- CORPORATE LIQUIDATION STATEMENTDokumen73 halamanCORPORATE LIQUIDATION STATEMENTCasper John Nanas MuñozBelum ada peringkat

- The Internet-Force For Competitive AdvantageDokumen8 halamanThe Internet-Force For Competitive Advantagechisonimtingwi100% (1)

- Capital Budgeting - NotesDokumen7 halamanCapital Budgeting - NotesnerieroseBelum ada peringkat

- Auditing of ReceivablesDokumen20 halamanAuditing of ReceivablesMary April Masbang100% (1)

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDokumen12 halamanACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaBelum ada peringkat

- Revenue Cycle - DefinitionDokumen4 halamanRevenue Cycle - DefinitionGANNLAUREN SIMANGANBelum ada peringkat

- Financial Ratio Analysis, Exercise and WorksheetDokumen4 halamanFinancial Ratio Analysis, Exercise and Worksheetatiqahrahim90Belum ada peringkat

- Financial Accounting Problems: Problem I (Current Assets)Dokumen21 halamanFinancial Accounting Problems: Problem I (Current Assets)Fery AnnBelum ada peringkat

- 3rd On-Line Quiz - Substantive Test For CashDokumen3 halaman3rd On-Line Quiz - Substantive Test For CashMJ YaconBelum ada peringkat

- Cash Flow Statement NotesDokumen8 halamanCash Flow Statement NotesAbdullahBelum ada peringkat

- Petty Cash, Part 3 - Kuya Joseph's BlogDokumen5 halamanPetty Cash, Part 3 - Kuya Joseph's BlogCM LanceBelum ada peringkat

- Completing Audit ProceduresDokumen7 halamanCompleting Audit ProceduresyebegashetBelum ada peringkat

- Cash and Cash Equivalents Multiple Choice QuestionsDokumen11 halamanCash and Cash Equivalents Multiple Choice Questionsjhela18Belum ada peringkat

- Select The Best Answer From The Choices Given.: TheoryDokumen14 halamanSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGABelum ada peringkat

- GovAcc HO No. 3 - The Government Accounting ProcessDokumen9 halamanGovAcc HO No. 3 - The Government Accounting Processbobo kaBelum ada peringkat

- Expert Q&A SolutionsDokumen3 halamanExpert Q&A SolutionsSitiNadyaSefrilyBelum ada peringkat

- Preweek Practical Accounting 1Dokumen24 halamanPreweek Practical Accounting 1alellieBelum ada peringkat

- Easy Round-APDokumen69 halamanEasy Round-APDaneen GastarBelum ada peringkat

- Chapter 8 - Receivables Lecture Notes - StudentsDokumen43 halamanChapter 8 - Receivables Lecture Notes - StudentsKy Anh NguyễnBelum ada peringkat

- Inter Company Sells Its Products in ReusableDokumen2 halamanInter Company Sells Its Products in ReusableNicole AguinaldoBelum ada peringkat

- AF304 Auditing Tutorial 4 AnswersDokumen7 halamanAF304 Auditing Tutorial 4 AnswersShivneel NaiduBelum ada peringkat

- Audit 2 - TheoriesDokumen2 halamanAudit 2 - TheoriesJoy ConsigeneBelum ada peringkat

- IFRS 3 Business Combinations GuideDeferred tax assets or liabilities arising from the initial recognition of anDokumen9 halamanIFRS 3 Business Combinations GuideDeferred tax assets or liabilities arising from the initial recognition of anKath SantosBelum ada peringkat

- Auditing Problems and SolutionsDokumen45 halamanAuditing Problems and SolutionsRonnel TagalogonBelum ada peringkat

- Audit of BPO and Shared Service Sector WebinarDokumen2 halamanAudit of BPO and Shared Service Sector WebinarDeanna GicaleBelum ada peringkat

- Auditing Exam Part IDokumen2 halamanAuditing Exam Part Ianna19 lopezBelum ada peringkat

- The Unadjusted Trial Balance of Fashion Centre LTD Contained TheDokumen2 halamanThe Unadjusted Trial Balance of Fashion Centre LTD Contained TheBube KachevskaBelum ada peringkat

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDokumen84 halamanFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiBelum ada peringkat

- Concept Map - Cooperatives & Construction CompaniesDokumen2 halamanConcept Map - Cooperatives & Construction CompaniesSherilyn BunagBelum ada peringkat

- Study Notes 4 PAPS 1013Dokumen6 halamanStudy Notes 4 PAPS 1013Francis Ysabella BalagtasBelum ada peringkat

- 8533 AnDokumen25 halaman8533 AnunsaarshadBelum ada peringkat

- Nfjpia Nmbe Far 2017 Ans-1Dokumen10 halamanNfjpia Nmbe Far 2017 Ans-1Stephen ChuaBelum ada peringkat

- PP 15 NewDokumen49 halamanPP 15 NewStevan PknBelum ada peringkat

- 01 - Audit of Cash & Cash EquivalentsDokumen4 halaman01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesBelum ada peringkat

- FINANCIAL ASSET AT FAIR VALUE (103 e-NOTES)Dokumen3 halamanFINANCIAL ASSET AT FAIR VALUE (103 e-NOTES)Soleil LeisolBelum ada peringkat

- Receivable Part 1Dokumen22 halamanReceivable Part 1Rose Marie Anne ReyesBelum ada peringkat

- Financial Reporting Conceptual FrameworkDokumen15 halamanFinancial Reporting Conceptual FrameworkMarielle Mae BurbosBelum ada peringkat

- Chap 8Dokumen13 halamanChap 8MichelleLeeBelum ada peringkat

- Course Plan - CA51024 - AY2021-2022Dokumen10 halamanCourse Plan - CA51024 - AY2021-2022Jaimell LimBelum ada peringkat

- Accounting for Income TaxesDokumen18 halamanAccounting for Income TaxesAndrea Marie CalmaBelum ada peringkat

- Data Privacy Act Notes on Key DefinitionsDokumen6 halamanData Privacy Act Notes on Key DefinitionsRad IsnaniBelum ada peringkat

- Quiz 2 - Cost AccountingDokumen4 halamanQuiz 2 - Cost AccountingDong WestBelum ada peringkat

- LG2 - Audit of Cash (S)Dokumen8 halamanLG2 - Audit of Cash (S)Moira VilogBelum ada peringkat

- CHAPTER 10 - Pre-Board ExaminationsDokumen34 halamanCHAPTER 10 - Pre-Board Examinationsmjc24Belum ada peringkat

- AP - Liabilities - Without AnswersDokumen2 halamanAP - Liabilities - Without AnswersstillwinmsBelum ada peringkat

- CH 11 Question Book Not Reconciliation PDFDokumen5 halamanCH 11 Question Book Not Reconciliation PDFRyan TamondongBelum ada peringkat

- Final Exam Preparation for Faculty of Economics and BusinessDokumen3 halamanFinal Exam Preparation for Faculty of Economics and BusinessAlvira FajriBelum ada peringkat

- Chapter 10: Cash and Financial InvestmentsDokumen13 halamanChapter 10: Cash and Financial Investmentsdes arellanoBelum ada peringkat

- Chapter 1Dokumen13 halamanChapter 1ahmedBelum ada peringkat

- Chapter 2Dokumen11 halamanChapter 2ahmedBelum ada peringkat

- Advanced Auditing Course: Dr. Nisreen AlmaleehDokumen8 halamanAdvanced Auditing Course: Dr. Nisreen AlmaleehahmedBelum ada peringkat

- Nature and types of audit evidenceDokumen13 halamanNature and types of audit evidenceahmedBelum ada peringkat

- CH 4-6-8 Economic IssuesDokumen3 halamanCH 4-6-8 Economic IssuesahmedBelum ada peringkat

- WordDokumen1 halamanWordahmedBelum ada peringkat

- AISDokumen1 halamanAISahmedBelum ada peringkat

- CH 4-6-8 Economic IssuesDokumen3 halamanCH 4-6-8 Economic IssuesahmedBelum ada peringkat

- Quiz - Model 8 Cost SystemDokumen1 halamanQuiz - Model 8 Cost SystemahmedBelum ada peringkat

- PPPDokumen1 halamanPPPahmedBelum ada peringkat

- 3rd Lecture Audit Report & Auditor Responsibilities (First)Dokumen11 halaman3rd Lecture Audit Report & Auditor Responsibilities (First)ahmedBelum ada peringkat

- Exercises For Process CostingDokumen3 halamanExercises For Process CostingahmedBelum ada peringkat

- LengthDokumen1 halamanLengthahmedBelum ada peringkat

- Introduction To Budgets and Preparing The Master Budget Coverage of Learning ObjectivesDokumen44 halamanIntroduction To Budgets and Preparing The Master Budget Coverage of Learning Objectivesahmed100% (1)

- Advanced Accounting 5eDokumen2 halamanAdvanced Accounting 5eahmedBelum ada peringkat

- TB 09Dokumen13 halamanTB 09ahmedBelum ada peringkat

- Ch. 11: Service Dept. and Joint Cost AllocationDokumen5 halamanCh. 11: Service Dept. and Joint Cost AllocationahmedBelum ada peringkat

- Introduction To Budgets and Preparing The Master Budget Coverage of Learning ObjectivesDokumen44 halamanIntroduction To Budgets and Preparing The Master Budget Coverage of Learning Objectivesahmed100% (1)

- Notes Allocation of Joint CostsDokumen3 halamanNotes Allocation of Joint CostsKimberly A AlanizBelum ada peringkat

- Request For Electronic Policy Payout: Policy Number Name of Policy Holder Aadhaar Number PAN Mobile NumberDokumen1 halamanRequest For Electronic Policy Payout: Policy Number Name of Policy Holder Aadhaar Number PAN Mobile Numberrovensingh007Belum ada peringkat

- SBI@ Your Door StepDokumen2 halamanSBI@ Your Door StepDynamic LevelsBelum ada peringkat

- Non-Performing Assets - Dissertation - Final Report PDFDokumen51 halamanNon-Performing Assets - Dissertation - Final Report PDFShubham Sakhuja100% (1)

- Your Citi Card Agreement GuideDokumen39 halamanYour Citi Card Agreement GuideReyy MereloxBelum ada peringkat

- SEO-optimized title for document IDs and customer categoriesDokumen1.612 halamanSEO-optimized title for document IDs and customer categoriesleminhbkBelum ada peringkat

- Shriram Nysa: Wing - C 2 BHK 2.5 BHKDokumen4 halamanShriram Nysa: Wing - C 2 BHK 2.5 BHKShraddha ChimurkarBelum ada peringkat

- 00000000002001133432Dokumen3 halaman00000000002001133432Luna M Al-HowidiBelum ada peringkat

- CHAP 5 - Cash & Marketable Securities MGTDokumen20 halamanCHAP 5 - Cash & Marketable Securities MGTNyra NaraBelum ada peringkat

- MBF QuestionDokumen3 halamanMBF QuestionShoaib MalikBelum ada peringkat

- Establish Foreign Currency Savings AccountsDokumen7 halamanEstablish Foreign Currency Savings AccountsAbraham TesfayBelum ada peringkat

- Analysis of Notes Receivable and Related AccountsqDokumen5 halamanAnalysis of Notes Receivable and Related AccountsqCJ alandyBelum ada peringkat

- 1222222222222222222222222222222Dokumen3 halaman1222222222222222222222222222222Jessica Anne TulaliBelum ada peringkat

- Receipt & Disbursment Cycles: Audit of Cash Balance: Auditing ProblemsDokumen6 halamanReceipt & Disbursment Cycles: Audit of Cash Balance: Auditing ProblemsJohn Lester DocaBelum ada peringkat

- Accomodation Party Case Digest MidtermDokumen3 halamanAccomodation Party Case Digest Midtermmares100% (1)

- Application To Start Family PensionDokumen4 halamanApplication To Start Family PensionSabuj SarkarBelum ada peringkat

- Compound Interes - VIIIDokumen3 halamanCompound Interes - VIIIAbhijitm7Belum ada peringkat

- Mishkin CH 15Dokumen22 halamanMishkin CH 15Ana Maria SpasovskaBelum ada peringkat

- ICICI BankDokumen32 halamanICICI Bankaditi100% (1)

- CISS For Cold Storage - Chhattisgarh State Year-Wise DataDokumen3 halamanCISS For Cold Storage - Chhattisgarh State Year-Wise DataAshokBelum ada peringkat

- Media Release: 4 October 2018Dokumen3 halamanMedia Release: 4 October 2018tajuddin8Belum ada peringkat

- Role of Prime Lending Rate in Bank Credit PricingDokumen28 halamanRole of Prime Lending Rate in Bank Credit PricingRagini VermaBelum ada peringkat

- FriDec23001442GMT05002022 PDFDokumen2 halamanFriDec23001442GMT05002022 PDFAli JanjuaBelum ada peringkat

- Payment Instruction Form (Pif) : TaclobanDokumen1 halamanPayment Instruction Form (Pif) : TaclobanEr WinBelum ada peringkat

- Cigi Membership Form 2022Dokumen1 halamanCigi Membership Form 2022Uday MongaBelum ada peringkat

- ALTRUIST FullDokumen2 halamanALTRUIST Fullganesh pandiBelum ada peringkat