Ikhtisar Keuangan

Ikhtisar Keuangan

Diunggah oleh

Marselo MHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ikhtisar Keuangan

Ikhtisar Keuangan

Diunggah oleh

Marselo MHak Cipta:

Format Tersedia

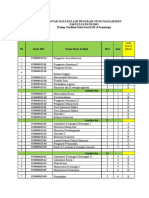

Dalam Rp Juta/In Rp Million

Keterangan/Description 2012 2011 2010 2009 ↑↓% '12-'1 ↑↓% 3Q '12-'11 ↑↓% 1H '12-'11 ↑↓% 1Q '12-'11↑↓% FY '11-'10

Laba (Rugi)/Profit (Loss)

Penjualan/Sales 717,788 648,375 566,186 516,319 10.71% 10.60% 12.17% 10.45% 14.52%

Laba Kotor/Gross Profit 376,439 346,141 301,486 268,075 8.75% 9.63% 13.31% 10.80% 14.81%

Laba Usaha/Operating Profit 54,075 47,092 51,750 27,901 14.83% 13.29% 5.04% 33.70% -9.00%

Laba

Laba Bersih/Net Profit (Rugi) 45,523 42,659 36,764 22,230 6.71% 5.97% 2.31% 9.42% 16.04%

persaham/Eraning Per

Share 43 40 51 222 6.71% 5.97% 2.31% 8.12% -22.46%

EBITDA 62,967.59 57,138 59,727 34,310 10.20% 17.08% 20.65% 24.15% -4.33%

Jumlah Saham

Beredar/Outstanding Shares 1,070,000,000 1,070,000,000 715,000,000 100,003,000

Neraca/Balance Sheet

Aset Lancar/Current Asset 510,203 459,791 263,874 211,744 10.96% 6.47% -0.94% -1.64% 74.25%

Modal Kerja Bersih/Net

Working Capital 372,690 347,126 97,803 91,636 7.36% 5.15% 4.97% 5.55% 254.92%

Jumlah Investasi 28,183 20,000 - - 40.91%

Total Aset/Total Asset 609,494 541,674 333,130 276,872 12.52% 7.81% 0.66% -0.06% 62.60%

Hutang Bank Jk Pendek 31,398 21,959 35,683 42.99%

Kewajiban Lancar/Current

Liabilities 137,513 112,665 166,071 120,108 22.05% 10.56% -16.47% -22.05% -32.16%

Jumlah Kewajiban/Total

Liabilities 174,931 141,132 216,211 186,180 23.95% 11.95% -10.31% -14.47% -34.72%

Ekuitas/Equity 434,563 400,542 116,919 90,692 8.49% 6.35% 4.98% 5.21% 242.58%

Rasio

Laba Kotor terhadap

Penjualan/Gross Margin 52.4% 53.39% 53.25% 51.92% -0.88% 1.02%

Laba Operasi terhadap

Penjualan/Operating Margin 7.53% 7.26% 9.14% 5.40% 2.42% -6.35%

EBITDA Margin 8.8% 10.5%

Laba Bersih terhadap

Penjualan/Net Margin 6.34% 6.58% 6.49% 4.31% -4.19% -8.78%

Laba Bersih terhadap

Aset/Retun on Assets 7.47% 7.88% 11.04% 8.03% -1.71% 1.64%

Laba Bersih terhadap

Ekuitas/Return on Equity 10.48% 10.65% 31.44% 24.51% -0.36% -2.54%

Rasio Lancar/Current Ratio 371.02% 408.10% 158.89% 176.29% -3.70% 18.59%

Kewajiban terhadap

Ekuitas/Debt to Equity Ratio 40.25% 35.24% 184.92% 205.29% 5.26% -14.56%

Kewajiban terhadap

Aset/Debt to Assets 28.70% 26.05% 64.90% 67.24% 3.84% -10.90%

COGS 341,350 302,234 264,700 12.94% 11.75% 10.83% 10.04% 14.18%

Non Current Asset 99,291 81,883 69,256 21.26% 15.34% 9.90% 8.76% 18.23%

Non Current Liabilities 37,418 28,467 50,140 31.44% 17.46% 20.15% 21.29% -43.22%

PBT 59,555 54,406 48,620 27,037 9.46% 8.57% 3.19% 10.23% 11.90%

PBT Margin % 8.30% 8.39% 8.59% 5.24%

Sales to Net Work Cap TO 1.93 1.87 5.79 5.63

Operating Expense 240,174

Selling & Marketing Exp 252,453 237,071 188,407 6.49% 10.73% 18.83% 15.34% 25.83%

S&M exp/ Sales 35.17% 36.56% 33.28%

Ad, Promo & Exhib 189,038 176,985 6.81%

Ad, Promo & Exhib/S&M 74.88% 74.65%

G &A 68,962 62,151 61,329 10.96% -1.60% -3.57% -1.34% 1.34%

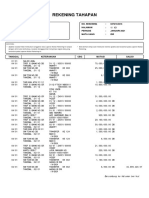

Pergerakan saham Perseroan selama tahun 2011

Bulan/Mont Harga Saham/Share Price Volume Nilai/Value

Tertinggi/H Terendah/ Penutupan/Closing

January 800 440 455 266,575,000 ###

February 510 450 485 56,495,000 27,194,452,500

March 540 460 520 59,814,500 29,431,835,000

April 610 520 590 49,041,000 28,100,280,000

May 590 520 530 26,904,500 15,128,885,000

June 560 490 530 23,113,000 12,121,405,000

July 540 490 530 52,410,500 26,885,957,500

August 530 450 500 16,412,000 8,076,010,000

September 500 370 430 14,945,000 6,667,422,500

October 425 370 410 7,074,500 2,805,207,500

November 420 390 415 10,426,000 4,304,767,500

December 420 390 410 12,280,500 5,012,085,000

0.146811

0.19

0.122879

Sales Cedef

(in Rp.000)

2010 2011 May-12

Internal ### 63,576,797 ###

Eksternal ### 27,722,676 ###

### 91,299,473 ###

Klien Air Mancur Kiddy Bear Kid Vinolia

Vinolia Kraft Food Aubeau

Aubeau Lignea Makarizo

MBK Mandom MBK

Makarizo Nouvelle Echele

Lignea Osimo Deltomed

Yvonne Yvonne Darya Varia

Rohto Myrh Pheromone

Watchout Deltomed Kraft Food

Nouvelle MBK Lignea

Softex Aubeau Koze

Pheromone Mandom

Nouvelle

± 23 Co's ± 45 Co's ± 51 Co's

Anda mungkin juga menyukai

- Draft Surat Perjanjian Kerjasama Usaha Body Repair and ReconditionDokumen5 halamanDraft Surat Perjanjian Kerjasama Usaha Body Repair and Reconditionfadlan100% (1)

- Katalog Tridaya PerkasaDokumen26 halamanKatalog Tridaya PerkasafadlanBelum ada peringkat

- Nov 2020Dokumen10 halamanNov 2020fadlanBelum ada peringkat

- Oct 2020Dokumen12 halamanOct 2020fadlanBelum ada peringkat

- Dec 2020Dokumen9 halamanDec 2020fadlanBelum ada peringkat

- Jan 2021Dokumen13 halamanJan 2021fadlanBelum ada peringkat

- Surat Penundaan Advance Inv No 1220220811 - 13290852Dokumen1 halamanSurat Penundaan Advance Inv No 1220220811 - 13290852fadlanBelum ada peringkat

- Company Profile CV Alam BaruDokumen2 halamanCompany Profile CV Alam BarufadlanBelum ada peringkat

- Ipa Besaran Dan SatuanDokumen14 halamanIpa Besaran Dan SatuanfadlanBelum ada peringkat

- Form Po KBNDokumen1 halamanForm Po KBNfadlanBelum ada peringkat

- CitilinkDokumen2 halamanCitilinkfadlanBelum ada peringkat

- Cetakan Kode Billing AGUSTUSDokumen1 halamanCetakan Kode Billing AGUSTUSfadlanBelum ada peringkat

- 015 SKet Karyawan PanjiDokumen1 halaman015 SKet Karyawan PanjifadlanBelum ada peringkat

- Transkip Nilai RezaDokumen2 halamanTranskip Nilai RezafadlanBelum ada peringkat

- Penilaian Masa Kontrak LogistikDokumen1 halamanPenilaian Masa Kontrak LogistikfadlanBelum ada peringkat

- Page 00022Dokumen1 halamanPage 00022fadlanBelum ada peringkat

- Invoice: Info Perusahaan Tagihan UntukDokumen1 halamanInvoice: Info Perusahaan Tagihan UntukfadlanBelum ada peringkat

- Hauling Unit Tronton Juli 2014Dokumen49 halamanHauling Unit Tronton Juli 2014fadlanBelum ada peringkat