Financial Ratio Analysis and DuPont Model Explained

Diunggah oleh

CPAJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Ratio Analysis and DuPont Model Explained

Diunggah oleh

CPAHak Cipta:

Format Tersedia

rl"->(! i/'"- {o,,we.+, .jJ"nnd of A".-^^7*,.

*7 MAS-12

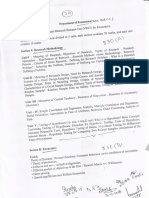

f:iNAnl(-"]l\l !i rA f E'Mf:N-l' Al\AtYSIS

" il:'.1 i t.)i: FRQ{IIA*IJI"J'ilY

l:leiLtrfi on $ttIt-:: I!!-oin,e,

Net Sales

i

Iltllr"rrrr r:n Assets .ltlcqry:q

Average Assets

lssi.ie r',1-r.ii. IIJCOMI fiqLire sirorrld be i-rs*d?

* Ii'llte rnlsrrtion is t<.: i'ntasi-rre ap,erat'ianal perfrtrmar?ce, income is expressed as,i?.9&Ig_u,t,!g{$qt*AlE-Jax;

aiterrtetiveiy, irrcr:rrrr bqfqrplAftgr;;XaXl.ilt,e_IgF[ may be used to exclude the effect of capitai structure.

. If tite inteilt.ion is lo evaluate total rnanagerial effort, income is expressed aftqf inte!'gSt and tax.

, '!

ire fJractice ol i:xrrressrrg ir)corn(l ?flig.r.ln,te-Ig1l .pq,t-b-elqrcjg; is now rarely applied in business.

n Irr{cLnre shoLrl<l irrcltrr-ir: c.livrdends and interest earned if the said investments are included in asset base"

n If useri in the contexl: of "DuPont" technique, then income must be expressed a&e-fjnle.rc_sts-taxesgnd

preier red stA!-k dlyidg[]!!,!.

--. Rerturn on Sales x Assets Turnover.x Equity Multiplierj

L'r-,y,:r,,1,::::

Irlqsryla

llr:tt.L rrt tt n t:t1 ts itt7

Average Equity

ir'drrlillqr f:'er 5lta rt: r Nqt l,r'rcqrtle_: P,relerrqd-Diyl{eld-s

I lVtct Ave. Cornmon Shares Outstanding

MARKET :f {; II:

..'l

;,i r.e p_qr

SiLare It indicates the number of pesos

:;'.-:.gS Pg: Share required to buy P 1 of earnings

i

I

-

Mejsures-tt-,u ,aie-of returl in t[J]

Dtt,tdend I teld -,, , iCe:r(i Per Share

. investor's common stock

i

i!lyes!Ug!ti:- .. . ...

;..ti.'i, (.)iii Dlvidqld pqr Share : It indicates the proportron

,r /j'.ir

i, arnings Per Share earnings distributed as dividends

OTHER MEANINGFUL RATIOS

o i.'.i: r,)-., |;SIi-) i(,\ iVALUA./-L- LONG-Tt.R!"1 f'INANCIAL POSITION OR STABILITY

ll"air."s

It"-----'--- ine propo.tion of

oixqd Ass'ets I owners', equity to fixed assets'

;

i

i:'ireri4:<;sers kt [<tt,t! [cluriy , raiJ Eq;iry I lxj::?l,,::.

of

byou":*#,

,,,j;J

i -l

i I /Ar^!\

Acca+. (Net)

tri*a; Assets lI ,--r;--+^-

r .Ai reri l1ssr,l.s rc; l.tttatlsri,rr,

! \)ta! /1r1''t:

Fixed tndicates possible

^^--ilr^ over-expansion

^..

L _ Total Asseis I of plant and equipment

I - - .i ..,....-. -.- I

| -

I -.;.,i u ,, t t) !: r t e{1A.sso' rs , saies

ruet

roughly the efficiency of

Tests

Ilff---^^,-^^r

lurnover) II |i rrrorr€gcrrrcrrl rrr l-,-^^:^^ pldlll

plant

Ksei,rrrg -.1--!

I I i-

iir - ir)iant lurrlOver'}

i{)ittrlt Fixed trnret;

[ssers (Net)

ri*eci ASSetS

I iliiffl":j -,'l -,keeping

.,ProPerti-esemPloY-e-d. -

I , I Measures recoverable amouni-_uv

I fl,','L u'..rlut.'Pt'r "$/r.:rE: I Cqnm-ql.Stiereho,LdeGl Egui-ty I common stockholders in the event

("on)tnor) $lor1<

acr,rlr;nr:n $rc.,e"( , i;;i*;";Gr*i"ffiitr;;id

Conrmon Shares Outstanding ;';;;;;;;';';;;'r.-"r.",'r"i

i of liquidation if assets are realized

:t-.----.- I at their book values

t"

'ti*tes prefr:rred !)ivirt*rri {:;ttrt:rl I

,

N*rt-I?sqiaa

preferred Dividends

jftei l1:"t i :i"'Jixff*t "?l't', o.[|:#;

ij slgc-blolqclS: - _

II ,ni.rr Acca*c Measures efficiency of the firm to

c.r1-ril;:l Inler;slry /tailrr r

Istal-4,559!$

Net $aies i generate

laleqthrough

-

i ,,,,..,", r,",r,i t h-t,t,,< r.:a.t-t,t Net lnceme bgfclre t4xes & fixed ctlarqes I Measures abillty to meet fixed

' (/( *: L(Jr I't(:u (Fixerl < harqes + sinking furrd payment)** j charges.

il,r

'Tr;rdinq nn the eqr.rity'is *noitjei name foi teGraaa:'.-

i:ixt."tl charqes i;h;r1l ir;e.lr"lde r*nt, inteiests and other relevant.fixed exFlenses; sinking fund payment

fltL.rlt lre cxl)rc-.:;seil ilrFor{i Iax^

PaqeSofSpaoes "td.r

; /&s{\ 1

Anda mungkin juga menyukai

- Samples and InstructionsDokumen479 halamanSamples and InstructionsWunmi OlaBelum ada peringkat

- Spec. Pro. ReportDokumen5 halamanSpec. Pro. ReportCharshiiBelum ada peringkat

- Partnership Deed-Compressed PDFDokumen11 halamanPartnership Deed-Compressed PDFAssistant Inspector of Labour Krishnagiri0% (1)

- Roche's Acquisition of Genentech: by Group 2 Amol Ghorpade Anurag Bhatia Basant Rajvaidhya Madhusudan SharmaDokumen18 halamanRoche's Acquisition of Genentech: by Group 2 Amol Ghorpade Anurag Bhatia Basant Rajvaidhya Madhusudan SharmaAkshay PatrikarBelum ada peringkat

- Afarq 2 Corporate LiquidationDokumen4 halamanAfarq 2 Corporate LiquidationCPABelum ada peringkat

- 1.3. Sales: Regulatory Framework For Business Transactions MadbolivarDokumen9 halaman1.3. Sales: Regulatory Framework For Business Transactions MadbolivarJims Leñar CezarBelum ada peringkat

- CPAR P2 7406 Business Combination at Date of Acquisition With Answer PDFDokumen6 halamanCPAR P2 7406 Business Combination at Date of Acquisition With Answer PDFRose Vee0% (2)

- Learning Advancement Cpa Review Center: Revenue From Contracts With CustomersDokumen4 halamanLearning Advancement Cpa Review Center: Revenue From Contracts With CustomersCPABelum ada peringkat

- Big City - 5334 - (Bert Paige-Pol Stone)Dokumen35 halamanBig City - 5334 - (Bert Paige-Pol Stone)Ralph SuttonBelum ada peringkat

- Bringing Up BebeDokumen2 halamanBringing Up Bebemvaneyck0% (4)

- Economic (Dictionar Financiar Contabil)Dokumen46 halamanEconomic (Dictionar Financiar Contabil)Readmorebooks100% (1)

- MATS20231000381Dokumen2 halamanMATS20231000381kiran rayan euBelum ada peringkat

- Acf 0 2 Tiie: Arrnex FR:RDokumen1 halamanAcf 0 2 Tiie: Arrnex FR:RCliff DaquioagBelum ada peringkat

- ,/' I Ffivnticl: I - C R: R O R C In:P,:Rta'T - Tirc Pro 1 ' PRRRT (,S: . (6) What Do - You Under:Iiancl BF S.$R"GG - F.:Egs - $3!Ult.V ? Librv Is Ihc Process Mil"Uriiill-AnDokumen4 halaman,/' I Ffivnticl: I - C R: R O R C In:P,:Rta'T - Tirc Pro 1 ' PRRRT (,S: . (6) What Do - You Under:Iiancl BF S.$R"GG - F.:Egs - $3!Ult.V ? Librv Is Ihc Process Mil"Uriiill-AnMeenu GuptaBelum ada peringkat

- The Stock Market - Cig Anul 2 Sem 1 - Comunicare in Faceri in Limba AnglezaDokumen10 halamanThe Stock Market - Cig Anul 2 Sem 1 - Comunicare in Faceri in Limba AnglezaMincu IulianBelum ada peringkat

- Img 20231101 0002Dokumen5 halamanImg 20231101 0002niranjan.nirala570Belum ada peringkat

- '' I A' S.TT: A SK Lul, Fut "A"ADokumen3 halaman'' I A' S.TT: A SK Lul, Fut "A"AVenkataraju BadanapuriBelum ada peringkat

- CS (MA) Order - HaryanaDokumen1 halamanCS (MA) Order - HaryanaPWD Subrata sir's class DA-2017 batchBelum ada peringkat

- BMS34A149Dokumen3 halamanBMS34A149Rohit Parmar (Computer Operator, Bangalore)Belum ada peringkat

- Electricity Bill Details for Customer ALA USMAN ANWARDokumen2 halamanElectricity Bill Details for Customer ALA USMAN ANWARMuhammad SõhãgBelum ada peringkat

- BMS34A141Dokumen3 halamanBMS34A141Rohit Parmar (Computer Operator, Bangalore)Belum ada peringkat

- ' Lu (:s Un'-H) : Ii, HFR"F Fi11ffi - FfiDokumen1 halaman' Lu (:s Un'-H) : Ii, HFR"F Fi11ffi - Fficely16loryBelum ada peringkat

- CURRENT ELECTRICITY PHYSICS - CompressedDokumen32 halamanCURRENT ELECTRICITY PHYSICS - CompressedShaik KhadeerBelum ada peringkat

- Rurnover: '.::::"" ':'U ' O, .-Ffhsffihr"ODokumen1 halamanRurnover: '.::::"" ':'U ' O, .-Ffhsffihr"OCPABelum ada peringkat

- 1-10 Counting of Training Period For The Purpose of Drawing Increments - No. 60-6-92-SPB-I Dt. 02.09.1993Dokumen3 halaman1-10 Counting of Training Period For The Purpose of Drawing Increments - No. 60-6-92-SPB-I Dt. 02.09.1993Pawan Kumar100% (1)

- Business Permit 1 - 2Dokumen1 halamanBusiness Permit 1 - 2Raymund BediotBelum ada peringkat

- Aprval 11Dokumen11 halamanAprval 11Moses Iyekekpolor OtaborBelum ada peringkat

- RMO - No. 32-2019 PDFDokumen3 halamanRMO - No. 32-2019 PDFTin LicoBelum ada peringkat

- GSF Financials - CompressedDokumen19 halamanGSF Financials - CompressedHari GSFBelum ada peringkat

- ""Tupper: ." 11 - R.Ii J - L L I/ LDokumen29 halaman""Tupper: ." 11 - R.Ii J - L L I/ LcylversunBelum ada peringkat

- Img 20231129 0001Dokumen1 halamanImg 20231129 0001Dhanasingh nainarBelum ada peringkat

- Government QA guidelinesDokumen1 halamanGovernment QA guidelinesEmdad HamidBelum ada peringkat

- Performance Certificate - 2023Dokumen13 halamanPerformance Certificate - 2023Brown builderBelum ada peringkat

- I'!.'.' Irr RT :,'FF:"H,:R#.L" Uj Y ( - F FFH ,,'R Ilij:'I,"Ij:.1Y,".T1"'Il' .J . TDokumen1 halamanI'!.'.' Irr RT :,'FF:"H,:R#.L" Uj Y ( - F FFH ,,'R Ilij:'I,"Ij:.1Y,".T1"'Il' .J . TRaluca SBBelum ada peringkat

- Dialysis Quotation ReceivedDokumen5 halamanDialysis Quotation Receivedmoinul shuvoBelum ada peringkat

- Sysmex - 2000i Catalogue enDokumen6 halamanSysmex - 2000i Catalogue enOo Kenx OoBelum ada peringkat

- rilr JDokumen6 halamanrilr JMuni AwasthiBelum ada peringkat

- Img 20190301 0003Dokumen2 halamanImg 20190301 0003minithemaxBelum ada peringkat

- Dpwh-Dilg JMC 001 07-04-13 & MC 2014-153Dokumen4 halamanDpwh-Dilg JMC 001 07-04-13 & MC 2014-153Arch. Steve Virgil SarabiaBelum ada peringkat

- Walters Prize SongDokumen2 halamanWalters Prize SongAntonino De Luca MusicBelum ada peringkat

- Tamgqmfl:, 3rrjer, I/Lnrila A (A' (, UjuanDokumen1 halamanTamgqmfl:, 3rrjer, I/Lnrila A (A' (, UjuanGery Bisma GentinaBelum ada peringkat

- สลิปเดือน 10Dokumen1 halamanสลิปเดือน 10กัมพล หยั่งถึงBelum ada peringkat

- 01IMG - aLFALAH (Part Ratio)Dokumen10 halaman01IMG - aLFALAH (Part Ratio)Nur AthirahBelum ada peringkat

- Analyzing project delays for extension of time requestDokumen3 halamanAnalyzing project delays for extension of time requestRakesh NayakBelum ada peringkat

- BIR OPM On TIN of Involuntary SellerDokumen3 halamanBIR OPM On TIN of Involuntary Sellerracquel dimalantaBelum ada peringkat

- India-Sri Lanka relations: Historical overview of ethnic conflictDokumen20 halamanIndia-Sri Lanka relations: Historical overview of ethnic conflictSantosh ParvatikarBelum ada peringkat

- c5 Organic Agricuture StandardsDokumen11 halamanc5 Organic Agricuture Standardschan nareinBelum ada peringkat

- Image 034Dokumen5 halamanImage 034زهراء احمد محمدBelum ada peringkat

- Chap 02Dokumen15 halamanChap 02Tanvirul AlamBelum ada peringkat

- Biotech AprilDokumen1 halamanBiotech AprilAzhan SusairiBelum ada peringkat

- Civil - 9. Railway-1-10Dokumen10 halamanCivil - 9. Railway-1-10Mohd AhmadBelum ada peringkat

- Darc!:, (,'1 "... 1 T),, t:1, Il, /LDokumen3 halamanDarc!:, (,'1 "... 1 T),, t:1, Il, /LRohit Parmar (Computer Operator, Bangalore)Belum ada peringkat

- Img 20230105 0007Dokumen8 halamanImg 20230105 0007Md monsur AhmmedBelum ada peringkat

- Scan 20240225 0001Dokumen4 halamanScan 20240225 0001kapil.kBelum ada peringkat

- PDF 20231109 0001256Dokumen2 halamanPDF 20231109 0001256lkobharat 00Belum ada peringkat

- SEO-Optimized title for document on legal case analysisDokumen1 halamanSEO-Optimized title for document on legal case analysisEmdad HamidBelum ada peringkat

- 757 RokeyaDokumen1 halaman757 RokeyaEmdad HamidBelum ada peringkat

- Capital Budgeting Analysis for Lewisville WarehouseDokumen14 halamanCapital Budgeting Analysis for Lewisville WarehouseQueen Jean MielBelum ada peringkat

- E:li, Rali: I'He OIIDokumen2 halamanE:li, Rali: I'He OIIDarlene BelosoBelum ada peringkat

- Img 0001Dokumen2 halamanImg 0001lucheria torneaBelum ada peringkat

- Ruffiffi: H (UnnrhnDokumen32 halamanRuffiffi: H (Unnrhnsanju_kishanBelum ada peringkat

- PKG-132 Rfi No.4441Dokumen59 halamanPKG-132 Rfi No.4441Zelan KocheBelum ada peringkat

- IMG_20230907_0001Dokumen1 halamanIMG_20230907_0001leatherkingbangladeshBelum ada peringkat

- Economics 21.11.23Dokumen2 halamanEconomics 21.11.23saswatimishra62Belum ada peringkat

- District Rate-RautahatDokumen31 halamanDistrict Rate-Rautahatrashmi bhailaBelum ada peringkat

- Toa 334-2Dokumen1 halamanToa 334-2CPABelum ada peringkat

- Cpar AuditingDokumen10 halamanCpar AuditingCPABelum ada peringkat

- Toa 333-2 PDFDokumen1 halamanToa 333-2 PDFCPABelum ada peringkat

- Financial Ratios and Statement AnalysisDokumen1 halamanFinancial Ratios and Statement AnalysisCPABelum ada peringkat

- J "0 A. N,", o ,: UnitDokumen1 halamanJ "0 A. N,", o ,: UnitCPABelum ada peringkat

- CamScanner Document ScansDokumen46 halamanCamScanner Document ScansCPABelum ada peringkat

- Financial Statement Analysis Key RatiosDokumen1 halamanFinancial Statement Analysis Key RatiosCPABelum ada peringkat

- Financial: " " 1" 2. 3. 4. 5. RetiosDokumen1 halamanFinancial: " " 1" 2. 3. 4. 5. RetiosCPABelum ada peringkat

- Rurnover: '.::::"" ':'U ' O, .-Ffhsffihr"ODokumen1 halamanRurnover: '.::::"" ':'U ' O, .-Ffhsffihr"OCPABelum ada peringkat

- Toa 333-1Dokumen1 halamanToa 333-1CPABelum ada peringkat

- Financial statement analysis ratiosDokumen1 halamanFinancial statement analysis ratiosCPABelum ada peringkat

- Fif, T n'1t : Q, o D.".-,". R, , 5-Il, L"!,' 2qC! 2) I Ti 2) JTDokumen1 halamanFif, T n'1t : Q, o D.".-,". R, , 5-Il, L"!,' 2qC! 2) I Ti 2) JTCPABelum ada peringkat

- Toa 334-1 PDFDokumen1 halamanToa 334-1 PDFCPABelum ada peringkat

- Toa 334-3Dokumen1 halamanToa 334-3CPABelum ada peringkat

- RFBT 34new-2Dokumen1 halamanRFBT 34new-2CPABelum ada peringkat

- Quiz 2-Contracts: Self-assessment on status of contractsDokumen2 halamanQuiz 2-Contracts: Self-assessment on status of contractsCPABelum ada peringkat

- RFBT 34new-3Dokumen1 halamanRFBT 34new-3CPABelum ada peringkat

- RFBT 34new-1Dokumen1 halamanRFBT 34new-1CPABelum ada peringkat

- Toa 333-3 PDFDokumen1 halamanToa 333-3 PDFCPABelum ada peringkat

- Financial Accounting and Reporting MsvegaDokumen2 halamanFinancial Accounting and Reporting MsvegaCPABelum ada peringkat

- RFBT Handout 4Dokumen5 halamanRFBT Handout 4CPABelum ada peringkat

- RFBT Handout 4Dokumen5 halamanRFBT Handout 4CPABelum ada peringkat

- C. D. A. B. C. It D.: Il', I:TjrDokumen1 halamanC. D. A. B. C. It D.: Il', I:TjrCPABelum ada peringkat

- Toa 34B-2Dokumen1 halamanToa 34B-2CPABelum ada peringkat

- Handouts ConsolidationIntercompany Sale of Plant AssetsDokumen3 halamanHandouts ConsolidationIntercompany Sale of Plant AssetsCPABelum ada peringkat

- Toa 34B-1Dokumen1 halamanToa 34B-1CPABelum ada peringkat

- Economies of Scale HandoutDokumen2 halamanEconomies of Scale HandoutrobtriniBelum ada peringkat

- Ezz Steel, Al Ezz Steel Com..Dokumen2 halamanEzz Steel, Al Ezz Steel Com..شادى احمدBelum ada peringkat

- HWChap 012Dokumen42 halamanHWChap 012hellooceanBelum ada peringkat

- MCQDokumen105 halamanMCQSourabh AgarwalBelum ada peringkat

- MBA Model Exam on Security Analysis and Portfolio ManagementDokumen2 halamanMBA Model Exam on Security Analysis and Portfolio ManagementSabha PathyBelum ada peringkat

- Calculating bond duration and yieldDokumen48 halamanCalculating bond duration and yieldOUSSAMA NASRBelum ada peringkat

- Types of Opinions Provided by The AuditorDokumen20 halamanTypes of Opinions Provided by The AuditorFarrukh TahirBelum ada peringkat

- 1 Republic v. HarpDokumen92 halaman1 Republic v. HarpArren RelucioBelum ada peringkat

- Current Affairs 2015Dokumen549 halamanCurrent Affairs 2015arijit17Belum ada peringkat

- Foreign Exchange SeminarDokumen4 halamanForeign Exchange Seminarbinith_krishBelum ada peringkat

- Isb540 - HiwalahDokumen16 halamanIsb540 - HiwalahMahyuddin Khalid100% (1)

- FI Warrant - Quebec - FormDokumen16 halamanFI Warrant - Quebec - FormMarkogarciamtzBelum ada peringkat

- Ce 1000 Pts - StockMockDokumen15 halamanCe 1000 Pts - StockMockRakesh CBelum ada peringkat

- CAFC Law RevisionDokumen126 halamanCAFC Law Revisionzubair khanBelum ada peringkat

- CIR Vs Anglo California National Bank - FulltextDokumen1 halamanCIR Vs Anglo California National Bank - Fulltextscartoneros_1Belum ada peringkat

- 2013 Economy PrelimsDokumen135 halaman2013 Economy PrelimsNancy DebbarmaBelum ada peringkat

- Answer Key POD Cup Jr. Final RoundDokumen6 halamanAnswer Key POD Cup Jr. Final RoundRitsBelum ada peringkat

- United States District Court Southern District of New YorkDokumen28 halamanUnited States District Court Southern District of New YorkAnn DwyerBelum ada peringkat

- Lockdrop + LBA: A Novel Token Launch MechanismDokumen16 halamanLockdrop + LBA: A Novel Token Launch MechanismGonziBelum ada peringkat

- Far 610 Group Project 1: InstructionsDokumen6 halamanFar 610 Group Project 1: InstructionsSiti Rafidah DaudBelum ada peringkat

- RBI Banking Awareness CapsuleDokumen118 halamanRBI Banking Awareness CapsuleAbhishek Choudhary100% (1)

- Icex FinalDokumen33 halamanIcex FinalAmi Parekh MehtaBelum ada peringkat

- Aldrich Magnaye BSA 1 B Problem 8 ActivityDokumen5 halamanAldrich Magnaye BSA 1 B Problem 8 ActivityAnonnBelum ada peringkat

- TUTORIAL 6 SOLUTION GUIDE (From Chapter 8) Q4Dokumen5 halamanTUTORIAL 6 SOLUTION GUIDE (From Chapter 8) Q4hien05Belum ada peringkat

- The 5 C's of BankingDokumen5 halamanThe 5 C's of BankingEman SultanBelum ada peringkat

- 8 - An Economic Analysis On Financial StructureDokumen18 halaman8 - An Economic Analysis On Financial StructurecihtanbioBelum ada peringkat