VAT Exempt Transactions (TRAIN Law)

Diunggah oleh

Pau SantosHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

VAT Exempt Transactions (TRAIN Law)

Diunggah oleh

Pau SantosHak Cipta:

Format Tersedia

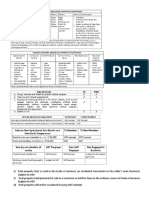

VAT-Exempt Transactions (Sec.

109-1)

AGRICULTURE

(a) Sale or importation of:

o Agriculture and marine food products in their original state;

o Livestock and poultry generally used for yielding or producing food

for human consumption; and

o Breeding stock and genetic materials.

(b) Sale or importation of:

o Fertilizers, seeds, seedlings or fingerlings;

o Fish, prawn, livestock or poultry feeds used in manufacturing of

finished feeds.

o Except: specialty feeds for race horses, fighting cocks, zoo animals

and other animals considered as pets.

(f) Services by agricultural contract growers and milling of:

o Palay into rice;

o Corn into grits; and

o Sugar cane into raw sugar.

PERSONAL EFFECTS

(c) Importation of:

o Residents returning to Philippines; and

o Non-resident Citizens resettling in the Philippines.

(d) Importations of professional materials, tools of trade, personal and

household effects, etc. not in commercial quantity of persons coming to

settling in the Philippines, or Filipinos.

Except: Vehicles, vessels, aircraft, machineries, etc. used in production

of any kind in commercial quantity.

RESIDENTIAL DWELLINGS

(p) Sale of:

o Real property not in the ordinary course of business;

o Low-cost housing

(Level 1 – PHP 450,000 to PHP 1,700,000; Level 2 – PHP 1,700,000 to PHP 3,000,000)

o Socialized Housing

(House and lot – PHP 400,000; Lot only – PHP 160,000)

o Residential Lot valued at PHP 1,500,000 and below; PHP 1,919,500 (prior to TRAIN).

o Residential House & Lot at PHP 2,500,000 and below. PHP 3,199,200 (prior to TRAIN).

(q) Lease of residential units

o Monthly rent < PHP 15,000 per unit; or PHP 12,800 per unit regardless

o If monthly rent is > PHP 15,000 per unit, aggregate rent income is < of aggregate (prior to TRAIN).

PHP 3,000,000

INSTITUTIONS

(g) Medical, dental, hospital and veterinary services except those rendered

by professionals.

(h) Educational institutions recognized by DepEd, CHED and TESDA; or

those rendered by gov’t educational institutions.

(r) Sale or importation, printing or publication of books

o at regular intervals;

o at fixed price for subscription and sale; and

o not principally for the purpose of paid advertisement.

(v) Banks, non-banks financial institutions performing quasi-banking

functions, and others (money changers and pawnshops, subject to

Percentage Tax under Sec. 121 and 122).

TRANSPORTATIONS

(s) Transport of passengers by international carriers. Transport of passengers and

cargo by international carriers

(prior to TRAIN).

(t) Sale, importation or lease of passenger or cargo vessels/aircraft

including engine and spare parts for domestic or international transport.

(u) Importation of fuel, goods and supplies by persons engaged in

international transport operations:

o from Philippines to Foreign Country, and vice versa;

o must be uninterrupted.

COOPERATIVES

(l) Sales by agricultural cooperatives

o Sale of their produce to non-members, whether in original state or

not;

o Importation solely and directly for production and processing

produce.

(m) Gross receipts from lending activities by a credit or multi-purpose

cooperative.

VAT-Exempt Transactions (Sec. 109-1)

(n) Sales by non-agricultural, non-electric and non-credit cooperatives –

capital contributions of each member < PHP 15,000, aggregate

notwithstanding.

OTHERS

(j) Services rendered by RHQ (non-operating) in the Philippines.

(e) Subject to OPT.

(i) Services of individuals under employee-employer relationship.

(k) Transactions exempt by special laws and international agreements.

Except: Petroleum Exploration Concessionaires

(o) Export sales by non-VAT registered.

TRAIN ADDITIONS (Seniors-PWD MAG-Drugs)

(w) Sale or lease of goods/properties to Senior citizens or PWD

(x) Transfer of property under Merger and consolidation

(y) Association dues, membership fees and other assessments by

Homeowners Associations and Condominium Corp.

(z) Sale of Gold to BSP. Used to be 0%-rated Sale (prior

to TRAIN).

(aa) Sale of Drugs and medicines for hypertension, high cholesterol and

diabetes (starting January 1, 2019).

CATCH-ALL PROVISION

(bb) o Those not covered by other provisions. Used to be PHP 1,919,500

o Sale of goods/services are exempt if gross annual receipts/sales is (prior to TRAIN).

> PHP 3,000,000.

o If individual with 8% tax on gross sales, exempt from VAT.

Anda mungkin juga menyukai

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDokumen12 halaman(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaBelum ada peringkat

- AFAR Notes by Dr. Ferrer PDFDokumen21 halamanAFAR Notes by Dr. Ferrer PDFjexBelum ada peringkat

- Module 2 - Bases Conversion and Development ActDokumen14 halamanModule 2 - Bases Conversion and Development ActIm NayeonBelum ada peringkat

- Chapter 8 Output Vat Zero-Rated SalesDokumen8 halamanChapter 8 Output Vat Zero-Rated SalesJamaica DavidBelum ada peringkat

- Nput Vat On Mixed TransactionsDokumen15 halamanNput Vat On Mixed TransactionsBSACCBLK1COLEEN CALUGAYBelum ada peringkat

- AFAR H01 Cost AccountingDokumen7 halamanAFAR H01 Cost AccountingPau SantosBelum ada peringkat

- Simplified Invoice: Invoice Number Date of Transaction Date of IssueDokumen2 halamanSimplified Invoice: Invoice Number Date of Transaction Date of Issue박예랑Belum ada peringkat

- Chapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSDokumen3 halamanChapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSAlyssa BerangberangBelum ada peringkat

- Midterm Exam - TaxationDokumen5 halamanMidterm Exam - TaxationGANNLAUREN SIMANGANBelum ada peringkat

- Tariff and Customs Code of The Philippines - Test BankDokumen3 halamanTariff and Customs Code of The Philippines - Test BankTyrelle CastilloBelum ada peringkat

- ERP Tax Setup OverviewDokumen59 halamanERP Tax Setup Overviewprasadv19806273100% (1)

- 04 Vat Exempt TransactionsDokumen4 halaman04 Vat Exempt TransactionsJaneLayugCabacunganBelum ada peringkat

- Philippine Competition ActDokumen31 halamanPhilippine Competition ActJam RxBelum ada peringkat

- Introduction To Donor's Tax (Presentation Slides)Dokumen22 halamanIntroduction To Donor's Tax (Presentation Slides)KezBelum ada peringkat

- Chapter 11 Excise TaxDokumen10 halamanChapter 11 Excise TaxAmzelle Diego LaspiñasBelum ada peringkat

- Lasallian Educational vs. CIRDokumen2 halamanLasallian Educational vs. CIRCherrie May OrenseBelum ada peringkat

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDokumen38 halamanBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoBelum ada peringkat

- 05 Input TaxesDokumen4 halaman05 Input TaxesJaneLayugCabacunganBelum ada peringkat

- Example Financial Due Diligence Report RedactedDokumen26 halamanExample Financial Due Diligence Report RedactedDumas Tchibozo75% (4)

- Vat Exempt SalesDokumen4 halamanVat Exempt SalesEmma Mariz GarciaBelum ada peringkat

- AFAR H02 Process CostingDokumen7 halamanAFAR H02 Process CostingPau SantosBelum ada peringkat

- Value Added TaxDokumen32 halamanValue Added Taxsei1davidBelum ada peringkat

- MCQ MidtermsRevDokumen30 halamanMCQ MidtermsRevVANESSA BANASBelum ada peringkat

- Vat-Exempt Transactions (Under TRAIN Law)Dokumen2 halamanVat-Exempt Transactions (Under TRAIN Law)Fabiano JoeyBelum ada peringkat

- Documentary Stamp TaxDokumen6 halamanDocumentary Stamp TaxchrizBelum ada peringkat

- Statement FINV05490132-2011D 15016473 20201225 4201445Dokumen1 halamanStatement FINV05490132-2011D 15016473 20201225 4201445Isha PopBelum ada peringkat

- Excise Tax WowoweeDokumen18 halamanExcise Tax WowoweeAmado Vallejo IIIBelum ada peringkat

- Excise Tax BIR FinalDokumen11 halamanExcise Tax BIR FinalmixxBelum ada peringkat

- Tax Compliance RequirementsDokumen8 halamanTax Compliance RequirementsJocelyn Verbo-AyubanBelum ada peringkat

- Building Surveys and Technical Due Diligence of Commercial PropertyDokumen41 halamanBuilding Surveys and Technical Due Diligence of Commercial PropertyernestdjuvaraBelum ada peringkat

- Allowable Deductions Part 1Dokumen3 halamanAllowable Deductions Part 1John Rich GamasBelum ada peringkat

- Chapter 12Dokumen11 halamanChapter 12Kim Patrice NavarraBelum ada peringkat

- Donors TaxDokumen34 halamanDonors TaxMikee TanBelum ada peringkat

- Quiz 2 in TaxDokumen3 halamanQuiz 2 in TaxAnne Camille AlfonsoBelum ada peringkat

- GCRO Module 120 - 07 Computation of TaxDokumen34 halamanGCRO Module 120 - 07 Computation of TaxKezia100% (1)

- Deductions From Gross Estate (Presentation Slides)Dokumen24 halamanDeductions From Gross Estate (Presentation Slides)KezBelum ada peringkat

- Remaking Singapore Group 2Dokumen5 halamanRemaking Singapore Group 2Muhamad FudolahBelum ada peringkat

- Taxation of Individuals QuizzerDokumen37 halamanTaxation of Individuals QuizzerJc QuismundoBelum ada peringkat

- Income Taxation Ind PracticeDokumen3 halamanIncome Taxation Ind PracticeJanine Tividad100% (1)

- Tax Quiz 4Dokumen61 halamanTax Quiz 4Seri CrisologoBelum ada peringkat

- Taxation Challenge - With Answer KeyDokumen9 halamanTaxation Challenge - With Answer Keyariaseg100% (1)

- Value Added Tax Quiz ReviewerDokumen2 halamanValue Added Tax Quiz ReviewerLouiseBelum ada peringkat

- Value Added Tax NotesDokumen6 halamanValue Added Tax NotesPatrickHidalgoBelum ada peringkat

- Mcq-Opt and Excise TaxesDokumen3 halamanMcq-Opt and Excise TaxesRandy ManzanoBelum ada peringkat

- Documentary Stamp Tax PDFDokumen9 halamanDocumentary Stamp Tax PDFQuinnee VallejosBelum ada peringkat

- Basic Pricing ConceptsDokumen15 halamanBasic Pricing ConceptsJoshi DrcpBelum ada peringkat

- VAT Exempt TransactionsDokumen4 halamanVAT Exempt TransactionsAndehl AguinaldoBelum ada peringkat

- Tax Consequences: No Output Tax Allowed and Seller IsDokumen12 halamanTax Consequences: No Output Tax Allowed and Seller IsXerez SingsonBelum ada peringkat

- Other Percentage TaxesDokumen9 halamanOther Percentage TaxesLeonard CañamoBelum ada peringkat

- Consumption Tax On ImportationDokumen27 halamanConsumption Tax On ImportationOwncoebdief100% (1)

- How To Compute DSTDokumen6 halamanHow To Compute DSTShayne AgustinBelum ada peringkat

- Tax Remedies (Reviewer)Dokumen2 halamanTax Remedies (Reviewer)Equi TinBelum ada peringkat

- Deductions From Gi (Part 2)Dokumen4 halamanDeductions From Gi (Part 2)Koibitz WarrenBelum ada peringkat

- Percentage Taxes NotesDokumen4 halamanPercentage Taxes Notesrajahmati_28Belum ada peringkat

- Midterm Quiz 1 Gross IncomeDokumen3 halamanMidterm Quiz 1 Gross IncomeMjhayeBelum ada peringkat

- Bouncing Check Law Bp22 PDFDokumen2 halamanBouncing Check Law Bp22 PDFCrimson PidlaoanBelum ada peringkat

- Reo Notes - TaxDokumen20 halamanReo Notes - TaxgeexellBelum ada peringkat

- Quick Notes PezaDokumen8 halamanQuick Notes PezaAlexandra GarciaBelum ada peringkat

- Module 3 - Donors TaxDokumen6 halamanModule 3 - Donors TaxMaryrose SumulongBelum ada peringkat

- Value Added TaxDokumen8 halamanValue Added TaxErica VillaruelBelum ada peringkat

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDokumen7 halamanRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaBelum ada peringkat

- Multiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionDokumen11 halamanMultiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionJinx Cyrus RodilloBelum ada peringkat

- Corporate Income Tax RateDokumen3 halamanCorporate Income Tax RateJuliana ChengBelum ada peringkat

- Module 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Dokumen10 halamanModule 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Jann Exequiel FranciscoBelum ada peringkat

- ATC HandbookDokumen15 halamanATC HandbookPrintet08Belum ada peringkat

- Fria QuizDokumen2 halamanFria QuizdavidgollaBelum ada peringkat

- Chapter 10 v2Dokumen15 halamanChapter 10 v2Sheilamae Sernadilla Gregorio0% (1)

- Section 109 Should Be Read in Relation To Section 116Dokumen5 halamanSection 109 Should Be Read in Relation To Section 116Stephanie LopezBelum ada peringkat

- VAT Exempt SalesDokumen5 halamanVAT Exempt SalesKristine CamposBelum ada peringkat

- VatDokumen13 halamanVatJohn Derek GarreroBelum ada peringkat

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDokumen32 halamanSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzBelum ada peringkat

- Transaction Cycles SummaryDokumen39 halamanTransaction Cycles SummaryPau Santos100% (1)

- RFBTDokumen22 halamanRFBTMary Ann ChoaBelum ada peringkat

- Management's Responsibilities TemplateDokumen2 halamanManagement's Responsibilities TemplatePau SantosBelum ada peringkat

- Aud Notes - Cash and Cash EquivalentsDokumen3 halamanAud Notes - Cash and Cash EquivalentsPau SantosBelum ada peringkat

- CPAR First Preboard at (May 2018)Dokumen11 halamanCPAR First Preboard at (May 2018)Pau Santos100% (4)

- AFAR - H03 - Revenue Recognition (PFRS 15)Dokumen2 halamanAFAR - H03 - Revenue Recognition (PFRS 15)Pau SantosBelum ada peringkat

- Cost Marathon Notes Session 1 Pranav PopatDokumen71 halamanCost Marathon Notes Session 1 Pranav PopatRohit bhulBelum ada peringkat

- Dog Kennel Business PlanDokumen26 halamanDog Kennel Business PlanZuzani MathiyaBelum ada peringkat

- Congress of The Philippines Metro ManilaDokumen13 halamanCongress of The Philippines Metro ManilaLyna Manlunas GayasBelum ada peringkat

- Govt. of India VAT Report-2Dokumen126 halamanGovt. of India VAT Report-2thorat82Belum ada peringkat

- StocksDokumen15 halamanStocksmayko-angeles-3102Belum ada peringkat

- AC - EZEKWE, MAGNUS IKECHUKWU - AUGUST, 2021 - 505588132 - FullStmt-1Dokumen5 halamanAC - EZEKWE, MAGNUS IKECHUKWU - AUGUST, 2021 - 505588132 - FullStmt-1Magnus Ikechukwu EzekweBelum ada peringkat

- P02619BCPU - 30 01 2024 02 04 - 65b90225c8da453b386dfb40Dokumen32 halamanP02619BCPU - 30 01 2024 02 04 - 65b90225c8da453b386dfb40Irfan ShaikBelum ada peringkat

- Ape Auto Magma CHP - RemovedDokumen1 halamanApe Auto Magma CHP - Removedsarath potnuriBelum ada peringkat

- REf 2Dokumen29 halamanREf 2yakyakxxBelum ada peringkat

- TC Start Up ModuleDokumen11 halamanTC Start Up ModuleFbsix ApBelum ada peringkat

- Ategory: Details of Possible Complaints Relating To TheaccountDokumen45 halamanAtegory: Details of Possible Complaints Relating To TheaccountKen Lati100% (1)

- Bitumen in ChinaDokumen4 halamanBitumen in ChinapigheadponceBelum ada peringkat

- PDA Europe Microbiology Conference 2017Dokumen18 halamanPDA Europe Microbiology Conference 2017Tim SandleBelum ada peringkat

- PLS Taxation QA FinalDokumen24 halamanPLS Taxation QA FinalTAU MU OFFICIALBelum ada peringkat

- Global Petroleum Tax GuideDokumen14 halamanGlobal Petroleum Tax Guidemuki10Belum ada peringkat

- V-20113 R2Dokumen1 halamanV-20113 R2Anonymous w53hOKdRoIBelum ada peringkat

- Isability Upport Ervices: Nside This IssueDokumen6 halamanIsability Upport Ervices: Nside This IssueAotearoa AutismBelum ada peringkat

- Abakada Vs Executive Secretary Case DigestDokumen2 halamanAbakada Vs Executive Secretary Case DigestEsnani MaiBelum ada peringkat

- Tanzania Mining Contractual Terms by Gilay ShamikaDokumen26 halamanTanzania Mining Contractual Terms by Gilay ShamikaEngineer Gilay Kilay Shamika100% (1)

- Ca Final VatDokumen34 halamanCa Final VatSuhag PatelBelum ada peringkat

- Train LawDokumen3 halamanTrain LawRONNEL SECADRONBelum ada peringkat

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokumen1 halamanTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)PV VimalBelum ada peringkat