Maadhavan Chandhiran 16-Mar-2018 454072340

Diunggah oleh

samaadhuHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Maadhavan Chandhiran 16-Mar-2018 454072340

Diunggah oleh

samaadhuHak Cipta:

Format Tersedia

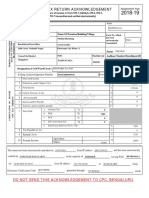

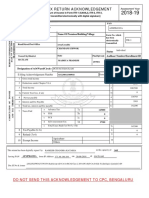

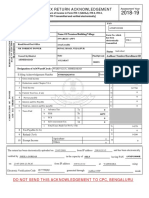

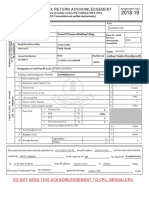

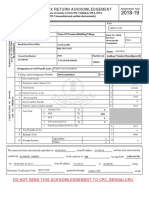

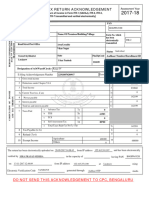

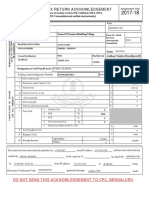

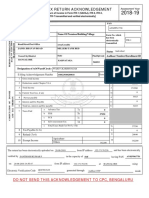

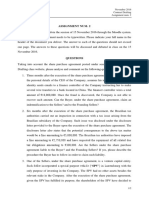

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2017-18

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

MAADHAVAN CHANDHIRAN

PERSONAL INFORMATION AND THE

ANHPC0021B

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-4

TRANSMISSION

5 SAKTHI COMPLEX

electronically

transmitted

Road/Street/Post Office Area/Locality

CUTCHERY STREET ERODE Individual

Status

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

ERODE

TAMILNADU 638006 XXXX XXXX 2018

Designation of AO (Ward / Circle) WARD 1(4), ERODE Original or Revised ORIGINAL

E-filing Acknowledgement Number 454072340160318 Date(DD-MM-YYYY) 16-03-2018

1 Gross Total Income 1 298032

2 Deductions under Chapter-VI-A 2 0

3 Total Income 3 298030

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 0

5 Interest Payable 5 0

6 Total Tax and Interest Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 0

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 0

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture

10

Others

VERIFICATION

I, MAADHAVAN CHANDHIRAN son/ daughter of MAADHAVAN , holding Permanent Account Number ANHPC0021B

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2017-18. I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Sign here Date 16-03-2018 Place ERODE

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 157.50.63.10

Date

Seal and signature of ANHPC0021B04454072340160318F9109B2168737C5D59A5A62DBC58614C4A373FF7

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address cachandhiran@gmail.com

Anda mungkin juga menyukai

- Sellakkili Ramaiah 31-Jul-2018 969570370Dokumen1 halamanSellakkili Ramaiah 31-Jul-2018 969570370samaadhuBelum ada peringkat

- Letsgettin Fraud CompanyDokumen1 halamanLetsgettin Fraud CompanyAnonymous A3CiCzvBelum ada peringkat

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDokumen1 halaman2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravBelum ada peringkat

- INDIAN INCOME TAX RETURN VERIFICATION FORMDokumen1 halamanINDIAN INCOME TAX RETURN VERIFICATION FORMramarao_pandBelum ada peringkat

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDokumen1 halaman2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiBelum ada peringkat

- Indian Income Tax Return Verification FormDokumen1 halamanIndian Income Tax Return Verification Formtax solutionsBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthBelum ada peringkat

- Itr-V Indian Income Tax Return VerificatDokumen1 halamanItr-V Indian Income Tax Return VerificatMOHD AslamBelum ada peringkat

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Dokumen1 halamanItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageGolu GuptaBelum ada peringkat

- Indian Income Tax Return AcknowledgementDokumen1 halamanIndian Income Tax Return Acknowledgementitkrishna1988Belum ada peringkat

- Itr Receipt A.Y 2018-19Dokumen1 halamanItr Receipt A.Y 2018-19Parminder SinghBelum ada peringkat

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDokumen1 halaman2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALBelum ada peringkat

- Indian Income Tax Return Verification FormDokumen1 halamanIndian Income Tax Return Verification FormUday RayapudiBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanBelum ada peringkat

- Indian Income Tax Return Acknowledgement for Rs. 9970 RefundDokumen1 halamanIndian Income Tax Return Acknowledgement for Rs. 9970 RefundsamaadhuBelum ada peringkat

- INDIAN INCOME TAX RETURN VERIFICATION FORMDokumen3 halamanINDIAN INCOME TAX RETURN VERIFICATION FORMsrinivas maguluriBelum ada peringkat

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDokumen1 halaman2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageApoorva MoonatBelum ada peringkat

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDokumen1 halaman2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagecachandhiranBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageutsavgautamBelum ada peringkat

- Sukhjeet Singh 2018-19 (Itr) PDFDokumen1 halamanSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQBelum ada peringkat

- MANI SIVASANKAR - 28-Feb-2019 - 427477180Dokumen1 halamanMANI SIVASANKAR - 28-Feb-2019 - 427477180samaadhuBelum ada peringkat

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDokumen1 halaman2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaBelum ada peringkat

- Indian Income Tax Return AcknowledgementDokumen1 halamanIndian Income Tax Return AcknowledgementhemakumarsBelum ada peringkat

- Itr 2018-19 S B Mishra PDFDokumen1 halamanItr 2018-19 S B Mishra PDFJITENDRA DUBEBYBelum ada peringkat

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Dokumen1 halamanItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriBelum ada peringkat

- Edjpb0287g Itrv PDFDokumen1 halamanEdjpb0287g Itrv PDFArun BhatnagarBelum ada peringkat

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDokumen1 halaman2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarBelum ada peringkat

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDokumen1 halaman2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahBelum ada peringkat

- Indian Income Tax Return AcknowledgementDokumen1 halamanIndian Income Tax Return AcknowledgementSamdhani StrikesBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaBelum ada peringkat

- Ack FY 17-18-Ramesh BDokumen1 halamanAck FY 17-18-Ramesh BMurthy KarumuriBelum ada peringkat

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDokumen1 halaman2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiBelum ada peringkat

- Itr-V Ajqpy0100n 2017-18 775756550170517Dokumen1 halamanItr-V Ajqpy0100n 2017-18 775756550170517Raj RajBelum ada peringkat

- ITR 18-19Dokumen1 halamanITR 18-19aarushi singhBelum ada peringkat

- 2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFDokumen1 halaman2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFvscomputersBelum ada peringkat

- Indian Income Tax Return Acknowledgement for AY 2018-19Dokumen1 halamanIndian Income Tax Return Acknowledgement for AY 2018-19Bimal Kumar MaityBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagechinna rajaBelum ada peringkat

- INDIAN INCOME TAX RETURN VERIFICATION FORMDokumen1 halamanINDIAN INCOME TAX RETURN VERIFICATION FORMsantoshkumarBelum ada peringkat

- INDIAN INCOME TAX RETURN VERIFICATIONDokumen1 halamanINDIAN INCOME TAX RETURN VERIFICATIONJayanta Sur RoyBelum ada peringkat

- 2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - ItrvDokumen1 halaman2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - Itrvdibyan dasBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSAI MOHANBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuresh raaviBelum ada peringkat

- Itr-V Bogpp6352h 2017-18 225020870280917Dokumen1 halamanItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXBelum ada peringkat

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDokumen1 halaman2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageIshani ShahBelum ada peringkat

- INDIAN INCOME TAX RETURN VERIFICATIONDokumen1 halamanINDIAN INCOME TAX RETURN VERIFICATIONShivshankar RBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuraj Dev MahatoBelum ada peringkat

- Indian Income Tax Return Verification FormDokumen1 halamanIndian Income Tax Return Verification Formdibyan dasBelum ada peringkat

- INDIAN INCOME TAX RETURN VERIFICATIONDokumen1 halamanINDIAN INCOME TAX RETURN VERIFICATIONSunil PeerojiBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKashyap SikdarBelum ada peringkat

- Electrical & Mechanical Components World Summary: Market Values & Financials by CountryDari EverandElectrical & Mechanical Components World Summary: Market Values & Financials by CountryBelum ada peringkat

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDokumen12 halamanForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuBelum ada peringkat

- ReturnDokumen41 halamanReturnsamaadhuBelum ada peringkat

- PDFDokumen4 halamanPDFsamaadhuBelum ada peringkat

- Total Income StatementDokumen1 halamanTotal Income StatementsamaadhuBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokumen1 halamanIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagesamaadhuBelum ada peringkat

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDokumen10 halamanForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuBelum ada peringkat

- Sun Mobiles and Electronics Prop S Mohamed Rafi No.19 Abs Complex Ground Floor Mettur Road Erode 638011 Profit and Loss Account 01.04.2015 TO 31.03.2016 Particulars Rs. Particulars RsDokumen6 halamanSun Mobiles and Electronics Prop S Mohamed Rafi No.19 Abs Complex Ground Floor Mettur Road Erode 638011 Profit and Loss Account 01.04.2015 TO 31.03.2016 Particulars Rs. Particulars RssamaadhuBelum ada peringkat

- 1718Dokumen2 halaman1718samaadhuBelum ada peringkat

- Part A-GENDokumen29 halamanPart A-GENsamaadhuBelum ada peringkat

- Deed of Partnership Victory Export This Deed of Partnership Executed at Erode OnDokumen7 halamanDeed of Partnership Victory Export This Deed of Partnership Executed at Erode OnsamaadhuBelum ada peringkat

- Know Your JurisdictionDokumen10 halamanKnow Your JurisdictionsamaadhuBelum ada peringkat

- Know Your JurisdictionDokumen1 halamanKnow Your JurisdictionsamaadhuBelum ada peringkat

- Duplicate MsmeDokumen4 halamanDuplicate MsmesamaadhuBelum ada peringkat

- Rental Agreement CompressedDokumen4 halamanRental Agreement CompressedsamaadhuBelum ada peringkat

- Municipal Tax CompressedDokumen1 halamanMunicipal Tax CompressedsamaadhuBelum ada peringkat

- Rental AgreementDokumen4 halamanRental AgreementsamaadhuBelum ada peringkat

- Municipal TaxDokumen1 halamanMunicipal TaxsamaadhuBelum ada peringkat

- Goods and Services Tax (//WWW - Gst.gov - In/)Dokumen2 halamanGoods and Services Tax (//WWW - Gst.gov - In/)samaadhuBelum ada peringkat

- Reference No. Debit Account Number Debit Branch Remarks Transaction Date Amount Status ReasonDokumen1 halamanReference No. Debit Account Number Debit Branch Remarks Transaction Date Amount Status ReasonsamaadhuBelum ada peringkat

- Annexure PDFDokumen1 halamanAnnexure PDFsamaadhuBelum ada peringkat

- Reference No. Debit Account Number Debit Branch Remarks Transaction Date Amount Status ReasonDokumen1 halamanReference No. Debit Account Number Debit Branch Remarks Transaction Date Amount Status ReasonsamaadhuBelum ada peringkat

- Gayathri TexDokumen1 halamanGayathri TexsamaadhuBelum ada peringkat

- Purchase GST Nagarajan GodownDokumen10 halamanPurchase GST Nagarajan GodownsamaadhuBelum ada peringkat

- Purchase GST Nagarajan GodownDokumen4 halamanPurchase GST Nagarajan GodownsamaadhuBelum ada peringkat

- Sales GST Nagarajan GodownDokumen21 halamanSales GST Nagarajan GodownsamaadhuBelum ada peringkat

- GST eligible ITC detailsDokumen2 halamanGST eligible ITC detailssamaadhuBelum ada peringkat

- Purchase GST Nagarajan GodownDokumen4 halamanPurchase GST Nagarajan GodownsamaadhuBelum ada peringkat

- Ik00Txatd9 10-Oct-2018 (08:09 AM IST) 00000031172928770 PallipalayamDokumen1 halamanIk00Txatd9 10-Oct-2018 (08:09 AM IST) 00000031172928770 PallipalayamsamaadhuBelum ada peringkat

- Serial - No Name - of - Seller Seller - TIN Commodity - Invoice - No Invoice - DateDokumen11 halamanSerial - No Name - of - Seller Seller - TIN Commodity - Invoice - No Invoice - DatecachandhiranBelum ada peringkat

- Purchase GST Nagarajan GodownDokumen10 halamanPurchase GST Nagarajan GodownsamaadhuBelum ada peringkat

- Contract Drafting - Assignment 2Dokumen2 halamanContract Drafting - Assignment 2verna_goh_shileiBelum ada peringkat

- Payment of Capital Gains TaxDokumen10 halamanPayment of Capital Gains TaxHelena Herrera100% (1)

- Corporate Hedging: What, Why and How?Dokumen48 halamanCorporate Hedging: What, Why and How?postscriptBelum ada peringkat

- Villanueva V City of IloiloDokumen1 halamanVillanueva V City of IloilorobbyBelum ada peringkat

- 2013 LAVCA ScorecardDokumen43 halaman2013 LAVCA ScorecardJonnattan MuñozBelum ada peringkat

- Zonal Values Notice for Cebu City North PropertiesDokumen199 halamanZonal Values Notice for Cebu City North PropertiesSeth Raven100% (1)

- Clickworker Payment ConformationDokumen1 halamanClickworker Payment ConformationRekha RavaliBelum ada peringkat

- Answer Key HandoutsDokumen5 halamanAnswer Key HandoutsRichard de Leon100% (1)

- Funda & BF PTDokumen10 halamanFunda & BF PTReign AlfonsoBelum ada peringkat

- Bec Su8 MCQDokumen51 halamanBec Su8 MCQyejiBelum ada peringkat

- FIN 300 Chapter 3 Analysis of Financial StatementsDokumen9 halamanFIN 300 Chapter 3 Analysis of Financial StatementsJean EliaBelum ada peringkat

- Bayag 1Dokumen41 halamanBayag 1Jan Angelo MagnoBelum ada peringkat

- Case Digest on Contex Corporation v. CIR examines VAT exemptionsDokumen3 halamanCase Digest on Contex Corporation v. CIR examines VAT exemptionsTimothy Joel CabreraBelum ada peringkat

- MGT201 BRAC Bank ReportDokumen30 halamanMGT201 BRAC Bank Report2221979Belum ada peringkat

- Bir Form 1904Dokumen2 halamanBir Form 1904Kate Brzezinska50% (4)

- Dilg Joincircular 2016815 81d0d76d7eDokumen16 halamanDilg Joincircular 2016815 81d0d76d7eRaidenAiBelum ada peringkat

- Property CasesDokumen95 halamanProperty CasesJohn Adrian MaulionBelum ada peringkat

- Mgt101 - 1 - Basics of Financial AccountingDokumen64 halamanMgt101 - 1 - Basics of Financial AccountingMT MalikBelum ada peringkat

- IAS 12 Deferred Tax Questions SolvedDokumen74 halamanIAS 12 Deferred Tax Questions Solvedrafid aliBelum ada peringkat

- Government and Citizens in A Globally Interconnected Wolrd of StatesDokumen35 halamanGovernment and Citizens in A Globally Interconnected Wolrd of Statesmaryclaire comediaBelum ada peringkat

- InvoiceDokumen1 halamanInvoicesarathBelum ada peringkat

- LESCO - Web BillDokumen1 halamanLESCO - Web BillMalik IrfanBelum ada peringkat

- Rose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Dokumen11 halamanRose Gelb, Victor Edwin Gelb, Manufacturers Trust Company, Executors, of The Estate of Harry Gelb v. Commissioner of Internal Revenue, 298 F.2d 544, 2d Cir. (1962)Scribd Government DocsBelum ada peringkat

- Transfer TaxesDokumen103 halamanTransfer TaxesRhei BarbaBelum ada peringkat

- Gaudreau v. R. Tax Residency CaseDokumen13 halamanGaudreau v. R. Tax Residency CaseCiera BriancaBelum ada peringkat

- Chemalite Cash Flow StatementDokumen2 halamanChemalite Cash Flow Statementrishika rshBelum ada peringkat

- Ratio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able ToDokumen21 halamanRatio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able TobanilbBelum ada peringkat

- McDonald's Globalization in India's MarketDokumen4 halamanMcDonald's Globalization in India's MarketNuzhat TasnimBelum ada peringkat

- Ease of Paying TaxesDokumen2 halamanEase of Paying TaxesLET ReviewerBelum ada peringkat

- 20 Rules For Markets and Investing - Compound AdvisorsDokumen27 halaman20 Rules For Markets and Investing - Compound AdvisorsEngin VarolBelum ada peringkat