Astra Financial Summary 2011

Diunggah oleh

Khaerudin RangersJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Astra Financial Summary 2011

Diunggah oleh

Khaerudin RangersHak Cipta:

Format Tersedia

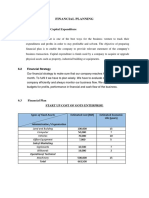

PT Astra International Tbk.

Automotive and Allied Products

Head Office AMDI Building Summary of Financial Statement

Jl. Raya Motor Raya No. 8

Sunter II, Jakarta 14330 (Million Rupiah)

Phone (021) 652-2555, 6530-4956 2009 2010 2011

Fax (021) 6530-4957, 651-2058/9 Total Assets 88,938,000 112,857,000 153,521,000

Current Assets 36,742,000 46,843,000 65,978,000

Website: www.astra.co.id of which

Business Automotive, Finance, Heavy Equipment, Cash and cash equivalents 8,732,000 7,005,000 13,111,000

Trade receivables 7,579,000 9,391,000 14,526,000

Agribusiness, Information Technology and

Inventories 7,282,000 10,842,000 11,990,000

Infrastructure Non-Current Assets 52,196,000 66,014,000 87,543,000

Company Status Limited Liability Company of which

Fixed Assets-Net 20,761,000 22,141,000 28,804,000

Financing Receivables 10,992,000 14,950,000 20,247,000

Financial Performance: In 2011, the Company Investments 14,140,000 18,502,000 21,113,000

booked net income amounted IDR 21.348 trillion, soaring from Other Assets 455,000 612,000 1,043,000

IDR 17.255 trillion recorded last year. Net sales increase from Liabilities 40,006,000 54,168,000 77,683,000

Current Liabilities 26,760,000 36,482,000 48,371,000

IDR129 trillion to IDR 162 trillion. of which

Brief History: PT Astra International Tbk (“Astra or Short-term debt 2,430,000 4,689,000 4,681,000

Trade payables 7,278,000 9,275,000 15,542,000

Company”) was founded in 1957 as a general trading company Current maturities

based in Jakarta, Indonesia and was initially involved in agricul- of long term-debt 8,824,000 13,114,000 16,359,000

Non-Current Liabilities 13,246,000 17,686,000 29,312,000

tural trade. Astra is now one of the largest conglomeration

Shareholders' Equity 48,974,000 58,689,000 75,838,000

business group in Indonesia. It diversified into the manufacture Share capital 2,024,000 2,024,000 2,024,000

and distribution of automobiles, heavy equipment and compo- Paid-up capital

1,106,000 1,106,000 1,106,000

nents in the late 1960s. It currently has six business divisions: Revaluation of fixed assets n.a n.a n.a

Automotive, Financial Services, Heavy Equipment, Agribusiness, Retained earnings (accumulated loss) 45,844,000 55,559,000 72,708,000

Information Technology, and Infrastructure. In addition to be- Net Sales and Revenue

Cost of Goods Sold

98,526,000

75,755,000

129,991,000

103,117,000

162,564,000

130,530,000

ing a holding company, through its own operations and those Gross Profit 22,771,000 26,874,000 32,034,000

Operating Expenses 10,015,000 12,149,000 14,202,000

of its Subsidiaries and Associates, Astra is an integrated auto- Operating Profit 12,756,000 14,725,000 17,832,000

motive business with operations ranging from automotive and Other Income (Expenses) 1,079,000 1,410,000 2,180,000

Equity Income 2,567,000 4,896,000 5,760,000

component manufacturing, distribution and after-sales services Profit (Loss) before Taxes 16,402,000 21,031,000 25,772,000

through out the country, car rental, used car sales, consumer Income Tax 2,567,000 4,896,000 5,760,000

Minority Interest 2,404,000 2,638,000 3,292,000

finance for automotive products, insurance and infrastructure. Net Profit 10,040,000 17,255,000 21,348,000

The Company has partnerships with some international auto- Per Share Data (Rp)

motive entities such as Toyota, Honda, Daihatsu, Isuzu, BMW, Earnings (Loss) per Share 2,480 4,263 5,274

Equity per Share 12,098 14,498 18,735

Peugeot and Nissan Diesel. Astra adds value to the joint ven- Dividend per Share n.a 600 n.a

tures it participates in by supplying valuable local marketing and Closing Price 34,700 54,550 74,000

product development advice as well as extensive experience in Financial Ratios

PER (x) 13.99 12.80 14.03

distribution. Over the course of its development, the Company PBV (x) 2.87 3.76 3.95

has formed strategic alliances with reputable international cor- Dividend Payout (%)

Dividend Yield (%)

n.a

n.a

14.08

1.10

n.a

n.a

porations in its efforts to expand business opportunities such as

Current Ratio (x) 1.37 1.28 1.36

Komatsu (heavy equipment), Fuji-Xerox (document solution), Debt to Equity (x) 0.82 0.92 1.02

General Electric (financial services) and CMG (life insurance). Leverage Ratio (x)

Gross Profit Margin (x)

0.45

0.23

0.48

0.21

0.51

0.20

As a public company, Astra implements corporate governance Operating Profit Margin (x) 0.13 0.11 0.11

Net Profit Margin (x) 0.10 0.13 0.13

practices in carrying out its business. The Company gives a pri- Inventory Turnover (x) 10.40 9.51 10.89

ority in social care activities in the areas of education, welfare, Total Assets Turnover (x) 1.11 1.15 1.06

ROA (%) 11.29 15.29 13.91

health and small and medium enterprises development and it ROE (%) 20.50 29.40 28.15

also actively supports community development. The Company PER = 12.82x ; PBV = 3.44x (June 2012)

became a publicly listed company on 4th April, 1990, when it Financial Year: December 31

Independent Auditor: Tanudiredja, Wibisana & Co.

listed its shares on the JSX and the SSX. Astra has a diversified

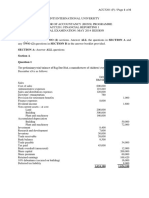

shareholder base which includes foreign shareholders with sub- (million rupiah)

stantial shareholdings. 2012 2011

Total Assets 171,481,000 136,155,000

Current Assets 75,091,000 59,994,000

Non-Current Assets 96,390,000 76,161,000

Liabilities 90,752,000 69,122,000

Shareholders' Equity 80,729,000 67,033,000

Shareholders Net Sales 95,919,000 76,264,000

Jardine Cycle & Carriage Ltd. 50.11% Profit after Taxes 11,369,000 10,084,000

Budi Setiadharma 0.02% ROI (%) 6.63 7.41

Anthony John Liddell Nightingale 0.02% ROE (%) 14.08 15.04

Public 49.85% In June

396 Indonesian Capital Market Directory 2012

PT Astra International Tbk. Automotive and Allied Products

Board of Commissioners Board of Directors

President Commissioner Budi Setiadharma President Director Prijono Sugiarto

Commissioners Djunaedi Hadisumarto, Jonathan Chang, Kyoichi Tanada, Directors Gunawan Geniusahardja, Sudirman Maman Rusdi

Soemadi Djoko Moerdjono Brotoningrat, David Alexander Newbigging, Johnny Darmawan Danusasmita, Djoko Pranoto, Simon Collier Dixon,

Anthony John Liddell Nightingale, Mark Spencer Greenberg, Widya Wiryawan, Angky Tisnadisastra, Johannes Loman

Benjamin William Keswick , Chiew Sin Cheok, Erry Firmansyah Number of Employees 178,726

No Type of Listing Listing Date Trading Date Number of Shares Total Listed

per Listing Shares

1 First Issue 04-Apr-90 04-Apr-90 30,000,000 30,000,000

2 Partial Listing 04-Apr-90 04-Oct-90 24,805,000 54,805,000

3 Company Listing 18-Dec-91 02-Jan-92 184,893,000 239,698,000

4 Cooperative 18-Dec-91 31-Dec-99 2,500,000 242,198,000

5 Right Issue 03-Jan-94 24-Jan-94 48,439,600 290,637,600

6 Bonus Shares 08-Sep-94 08-Sep-94 871,912,800 1,162,550,400

7 Convertible Bonds 1997 1997 280,837 1,162,831,237

8 Stock Split 01-Sep-97 01-Sep-97 1,162,831,237 2,325,662,474

9 Right Conversion 1999 1999 146,793,682 2,472,456,156

10 Right Conversion 2000 2000 27,826,740 2,500,282,896

11 Option Conversion 2000 2000 6,359,500 2,506,642,396

12 Right Conversion 2001 2001 24,637,387 2,531,279,783

13 Option Conversion 2001 2001 6,900,000 2,538,179,783

14 Right Conversion 2002 2002 26,798,627 2,564,978,410

15 Option Conversion 2002 2002 43,110,500 2,608,088,910

16 Right Conversion 2003 2003 16,552,875 2,624,641,785

17 Option Conversion 2003 2003 5,954,500 2,630,596,285

18 Right Issue 2003 2003 1,404,780,175 4,035,376,460

19 Option Conversion 2004 2004 2,429,500 4,037,805,960

20 Right Conversion 2004 2004 10,549,354 4,048,355,314

21 Stock Split 05-Jun-12 05-Jun-12 36,435,197,826 40,483,553,140

Underwriter PT (Persero) Danareksa (IPO)

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price Shares Traded Trading Listed Market

Month High Low Close Volume Value Frequency Day Shares Capitalization

(Rp) (Rp) (Rp) (Thousand Shares) (Rp Million) (Rp Million)

January-11 55,050 45,250 48,900 188,808.00 9,245,116.00 64,822 21 4,048,355,314 197,964,575.00

February-11 53,450 47,400 52,050 146,051.00 7,289,652.00 38,264 18 4,048,355,314 210,716,894.00

March-11 58,250 52,300 57,000 99,865.00 5,492,743.00 40,364 23 4,048,355,314 230,756,253.00

April-11 58,500 53,600 56,150 91,805.00 5,134,338.00 35,963 20 4,048,355,314 227,315,151.00

May-11 62,150 55,800 58,750 79,319.00 4,668,750.00 31,103 21 4,048,355,314 237,840,875.00

June-11 64,250 55,950 63,550 74,147.00 4,395,238.00 29,158 20 4,048,355,314 257,272,980.00

July-11 75,950 64,600 70,500 84,447.00 5,852,767.00 35,960 21 4,048,355,314 285,409,050.00

August-11 72,750 60,850 66,150 133,636.00 9,085,095.00 67,327 19 4,048,355,314 267,798,704.00

September-11 71,800 55,000 63,650 121,029.00 7,758,524.00 64,076 20 4,048,355,314 257,677,816.00

October-11 70,000 57,300 69,000 100,835.00 6,582,050.00 51,096 21 4,048,355,314 279,336,517.00

November-11 72,000 65,500 70,900 67,618.00 4,676,338.00 40,280 22 4,048,355,314 287,028,392.00

December-11 75,000 68,300 74,000 57,371.00 4,137,042.00 33,641 21 4,048,355,314 299,578,293.00

January-12 79,650 73,500 78,900 60,335.00 4,672,194.00 31,100 21 4,048,355,314 319,415,234.00

February-12 79,200 67,100 70,850 130,669.00 9,466,255.00 68,125 21 4,048,355,314 286,825,974.00

March-12 74,200 68,750 73,950 83,919.00 5,984,168.00 48,766 21 4,048,355,314 299,375,875.00

April-12 77,100 70,650 71,000 68,944.00 5,052,940.00 37,681 20 4,048,355,314 287,433,227.00

May-12 74,250 64,200 64,300 90,988.00 6,242,152.00 46,178 21 4,048,355,314 260,309,247.00

June-12 64,200 6,400 6,850 816,809.00 6,070,144.00 61,324 21 40,483,553,140 277,312,339.00

Stock Price and Traded Chart

Institute for Economic and Financial Research 397

Anda mungkin juga menyukai

- Introduction To Business Finance Feasibility Plan of Skydiving in KarachiDokumen18 halamanIntroduction To Business Finance Feasibility Plan of Skydiving in KarachiAsad HaiderBelum ada peringkat

- PDE4232 Individual Coursework - 2023-24 UpdatedDokumen5 halamanPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanBelum ada peringkat

- FAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4Dokumen6 halamanFAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4NUR NAJWA MURSYIDAH NAZRIBelum ada peringkat

- Ch.6-Tutorial 1Dokumen3 halamanCh.6-Tutorial 1NURSABRINA BINTI ROSLI (BG)Belum ada peringkat

- Book 1Dokumen6 halamanBook 1chrstncstlljBelum ada peringkat

- University of Central Punjab: Project Appraisal & Credit ManagementDokumen6 halamanUniversity of Central Punjab: Project Appraisal & Credit ManagementMisha ButtBelum ada peringkat

- Assets AmountsDokumen6 halamanAssets Amountsaashir chBelum ada peringkat

- Cash Flow Statement for K BarrettDokumen4 halamanCash Flow Statement for K BarrettRajay BramwellBelum ada peringkat

- FAR270 - FEB 2022 SolutionDokumen8 halamanFAR270 - FEB 2022 SolutionNur Fatin AmirahBelum ada peringkat

- 5.2. Unit 5 AAB AP A2 Report SunDokumen5 halaman5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuBelum ada peringkat

- Aisha Steel Mills LTDDokumen19 halamanAisha Steel Mills LTDEdnan HanBelum ada peringkat

- Colleagues-CoDokumen9 halamanColleagues-CoSVTKhsiaBelum ada peringkat

- I Fitness Venture StandaloneDokumen15 halamanI Fitness Venture StandaloneThe keyboard PlayerBelum ada peringkat

- Byco Data PDFDokumen32 halamanByco Data PDFMuiz SaddozaiBelum ada peringkat

- Sibl-Fs 30 June 2018Dokumen322 halamanSibl-Fs 30 June 2018Faizal KhanBelum ada peringkat

- Case Study FinalDokumen47 halamanCase Study FinalVan Errl Nicolai SantosBelum ada peringkat

- Fa July2023-Far210-StudentDokumen9 halamanFa July2023-Far210-Student2022613976Belum ada peringkat

- MR D.I.Y. Group's Q3 2020 financial reportDokumen15 halamanMR D.I.Y. Group's Q3 2020 financial reportMzm Zahir MzmBelum ada peringkat

- Cap II Group I RTP Dec2023Dokumen84 halamanCap II Group I RTP Dec2023pratyushmudbhari340Belum ada peringkat

- © The Institute of Chartered Accountants of IndiaDokumen24 halaman© The Institute of Chartered Accountants of IndiaAniketBelum ada peringkat

- Assignment DFA6127Dokumen3 halamanAssignment DFA6127parwez_0505Belum ada peringkat

- Class Problem: 2Dokumen7 halamanClass Problem: 2Riad FaisalBelum ada peringkat

- Camille ManufacturingDokumen4 halamanCamille ManufacturingChristina StephensonBelum ada peringkat

- Vederinus Stefanus 86220 0Dokumen9 halamanVederinus Stefanus 86220 0PdoneeverBelum ada peringkat

- Directors' Report Highlights Q1 2018 Financial ResultsDokumen24 halamanDirectors' Report Highlights Q1 2018 Financial ResultsAsma RehmanBelum ada peringkat

- ACCN 304 Revision QuestionsDokumen11 halamanACCN 304 Revision QuestionskelvinmunashenyamutumbaBelum ada peringkat

- Financial planning case study for property developerDokumen25 halamanFinancial planning case study for property developerJesse Rielle CarasBelum ada peringkat

- IRMA Financial Accounting Exam Cash Flow AnalysisDokumen5 halamanIRMA Financial Accounting Exam Cash Flow AnalysisDharampreet SinghBelum ada peringkat

- FS New - FinalDokumen14 halamanFS New - FinalDraneel SumalaBelum ada peringkat

- FUFA Question Paper_Compre_FOFA(ECON F212) 1st Sem 2018-19 (1) (1) (1)Dokumen2 halamanFUFA Question Paper_Compre_FOFA(ECON F212) 1st Sem 2018-19 (1) (1) (1)vineetchahar0210Belum ada peringkat

- ReferencesDokumen5 halamanReferencesapi-530428414Belum ada peringkat

- Question 6 Chic Homes LTD GroupDokumen5 halamanQuestion 6 Chic Homes LTD GroupsavagewolfieBelum ada peringkat

- Project 2 FAR270 SummaryDokumen6 halamanProject 2 FAR270 SummaryHaru BiruBelum ada peringkat

- Business Accounting and Analysis (Semester I) q1xAKCGPn2Dokumen3 halamanBusiness Accounting and Analysis (Semester I) q1xAKCGPn2PriyankaBelum ada peringkat

- Tutorial 4 - Consolidated Statement of Cash FlowsDokumen6 halamanTutorial 4 - Consolidated Statement of Cash FlowsFatinBelum ada peringkat

- DR Group - 2019-2020Dokumen43 halamanDR Group - 2019-2020Mohammad Rejwan UllahBelum ada peringkat

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDokumen5 halamanFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralBelum ada peringkat

- Financial Planning: 6.1 Start-Up Cost and Capital ExpenditureDokumen4 halamanFinancial Planning: 6.1 Start-Up Cost and Capital ExpenditurearefeenaBelum ada peringkat

- Colleagues CoDokumen7 halamanColleagues CoKeahlyn BoticarioBelum ada peringkat

- Laporan Keuangan PT JayatamaDokumen2 halamanLaporan Keuangan PT JayatamaKharisma Salsa Putri100% (1)

- Power Mep LLC - PRDokumen15 halamanPower Mep LLC - PRRasal PkBelum ada peringkat

- Nokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockDokumen2 halamanNokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockMohtasim Bin HabibBelum ada peringkat

- Blockchain: The Power of Distributed Ledger in Healthcare Industry I. Sources of FinancingDokumen4 halamanBlockchain: The Power of Distributed Ledger in Healthcare Industry I. Sources of Financingchatuuuu123Belum ada peringkat

- Apple Inc Financial Performance and Cash Flow AnalysisDokumen3 halamanApple Inc Financial Performance and Cash Flow AnalysisJaime Alexander PENA VILLABONABelum ada peringkat

- Revision Pack QuestionsDokumen12 halamanRevision Pack QuestionsAmmaarah PatelBelum ada peringkat

- Module 2 - Financial StatementsDokumen6 halamanModule 2 - Financial Statementskemifawole13Belum ada peringkat

- Accounts SOL 2022Dokumen12 halamanAccounts SOL 2022akshitapaul19Belum ada peringkat

- QFB Fact SheetDokumen2 halamanQFB Fact SheetRianovel MareBelum ada peringkat

- Business Combi PDF FreeDokumen13 halamanBusiness Combi PDF FreeEricka RedoñaBelum ada peringkat

- Ceylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021Dokumen14 halamanCeylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021hvalolaBelum ada peringkat

- National College of Business Administration & Economics Front Lane Campus (FLC)Dokumen7 halamanNational College of Business Administration & Economics Front Lane Campus (FLC)Abdul RehmanBelum ada peringkat

- Cherat Cement's Financial Health in 2020Dokumen4 halamanCherat Cement's Financial Health in 2020Asad RehmanBelum ada peringkat

- ACC 281 SEMINAR QUESTIONS Version 2Dokumen8 halamanACC 281 SEMINAR QUESTIONS Version 2Joel SimonBelum ada peringkat

- Tutorial SCF A192 StudentDokumen9 halamanTutorial SCF A192 StudentAina SyieraBelum ada peringkat

- Financial Statement Analysis QuestionsDokumen4 halamanFinancial Statement Analysis QuestionsAsad RehmanBelum ada peringkat

- ACC3201Dokumen6 halamanACC3201natlyhBelum ada peringkat

- BF405 May 2019 PDFDokumen5 halamanBF405 May 2019 PDFhuku memeBelum ada peringkat

- CFAB - Accounting - QB - Chapter 13Dokumen14 halamanCFAB - Accounting - QB - Chapter 13Huy NguyenBelum ada peringkat

- 5th Year Pre-Final ExamDokumen3 halaman5th Year Pre-Final ExamJoshua UmaliBelum ada peringkat

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDari EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisBelum ada peringkat

- ReadmeDokumen1 halamanReadmefellow23Belum ada peringkat

- OutputDokumen1 halamanOutputKhaerudin RangersBelum ada peringkat

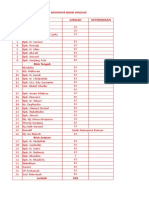

- Daftar Donatur Baesi Khusus NO Nama Jumlah Keterangan Blok UtaraDokumen1 halamanDaftar Donatur Baesi Khusus NO Nama Jumlah Keterangan Blok UtaraKhaerudin RangersBelum ada peringkat

- PT Kalbe Farma Tbk. Financial Summary 2011Dokumen2 halamanPT Kalbe Farma Tbk. Financial Summary 2011Khaerudin RangersBelum ada peringkat

- PT Semen Gresik (Persero) Tbk. Financial Summary and RatiosDokumen2 halamanPT Semen Gresik (Persero) Tbk. Financial Summary and RatiosKhaerudin RangersBelum ada peringkat

- Jurnal 1.hubungan Pengetahuan Dan Sikap Ibu Hamil Dengan Status GiziDokumen7 halamanJurnal 1.hubungan Pengetahuan Dan Sikap Ibu Hamil Dengan Status GiziToni SubarkahBelum ada peringkat

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDokumen2 halamanPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersBelum ada peringkat

- Noori Mosque Amsterdam Qasida Burda ShariefDokumen44 halamanNoori Mosque Amsterdam Qasida Burda ShariefAza JunūdīBelum ada peringkat

- Book 1Dokumen7 halamanBook 1Khaerudin RangersBelum ada peringkat

- CoverDokumen2 halamanCoverKhaerudin RangersBelum ada peringkat

- Muhammad Abduh'S Contributions To Modernity: Ahmad N. Amir, Abdi O. Shuriye, Ahmad F. IsmailDokumen13 halamanMuhammad Abduh'S Contributions To Modernity: Ahmad N. Amir, Abdi O. Shuriye, Ahmad F. IsmailAhmad YusryBelum ada peringkat

- ReadmeDokumen1 halamanReadmeHermantonoBelum ada peringkat

- ReadmeDokumen1 halamanReadmeHermantonoBelum ada peringkat

- Balance Sheet - Tata Motors Annual Report 2015-16 PDFDokumen2 halamanBalance Sheet - Tata Motors Annual Report 2015-16 PDFbijoy majumderBelum ada peringkat

- CV Resume for Quality Assurance ChemistDokumen3 halamanCV Resume for Quality Assurance Chemistnvvsganesh1984Belum ada peringkat

- Chap 001Dokumen41 halamanChap 001ms_cherriesBelum ada peringkat

- ANUNAAD - Issue XXIV, (The Quarterly In-House Publication of Resonance)Dokumen44 halamanANUNAAD - Issue XXIV, (The Quarterly In-House Publication of Resonance)Resonance Kota0% (1)

- UPS A Globally Operated OrganizationDokumen19 halamanUPS A Globally Operated OrganizationJorge Yeshayahu Gonzales-LaraBelum ada peringkat

- Marketing Report InsightsDokumen20 halamanMarketing Report Insightsmewtoki33% (3)

- Practical 10 EDPDokumen3 halamanPractical 10 EDPPogo ToonBelum ada peringkat

- OKR One PagerDokumen1 halamanOKR One Pagermyrudyku100% (1)

- Manage credit card payments and earn rewardsDokumen3 halamanManage credit card payments and earn rewardsManoranjan DashBelum ada peringkat

- PT041000 Relatedresources Trade Secret Case Law Report 2013cDokumen78 halamanPT041000 Relatedresources Trade Secret Case Law Report 2013cGulshatRaissovaBelum ada peringkat

- Fernando Shashen s3655990 Aero2410 Ind AssignmentDokumen5 halamanFernando Shashen s3655990 Aero2410 Ind AssignmentShashen FernandoBelum ada peringkat

- Perceptions of ABM Students on Becoming Young EntrepreneursDokumen8 halamanPerceptions of ABM Students on Becoming Young EntrepreneursHoward CullugBelum ada peringkat

- Felipe, Fisher. Aggregation in Production Functions. What Applied Economists Should Know - Metroeconomica - 2003 PDFDokumen55 halamanFelipe, Fisher. Aggregation in Production Functions. What Applied Economists Should Know - Metroeconomica - 2003 PDFjuancahermida3056Belum ada peringkat

- New Product Planning ProcessDokumen18 halamanNew Product Planning ProcessAqeel MuradBelum ada peringkat

- Part 3 4 SPECS CONTRACTSDokumen45 halamanPart 3 4 SPECS CONTRACTSKristin ArgosinoBelum ada peringkat

- Finance For Non FinanceDokumen56 halamanFinance For Non Financeamitiiit31100% (3)

- FDG-Droid Tech #1 - Sentry DroidDokumen10 halamanFDG-Droid Tech #1 - Sentry DroidBatzarroTorreta100% (1)

- Thomas Pynchon - Gravity's Rainbow - 1973Dokumen2 halamanThomas Pynchon - Gravity's Rainbow - 1973Coco Bungbing0% (12)

- AplDokumen4 halamanAplAmeya RegeBelum ada peringkat

- Agreements - HTML: Dassault Systemes Biovia Corp.Dokumen5 halamanAgreements - HTML: Dassault Systemes Biovia Corp.Joakin BahamondesBelum ada peringkat

- FMDokumen386 halamanFMArpan PatelBelum ada peringkat

- Macro Tut 9Dokumen7 halamanMacro Tut 9Phạm Minh NgọcBelum ada peringkat

- Greenport Parking StudyDokumen32 halamanGreenport Parking StudyRiverhead News-ReviewBelum ada peringkat

- Co-Operative HSGDokumen85 halamanCo-Operative HSGnachiket shilotriBelum ada peringkat

- Siemens Elpro AcquisitionDokumen12 halamanSiemens Elpro AcquisitionmandarBelum ada peringkat

- Great American Duck Races v. Intellectual Solutions Et. Al.Dokumen12 halamanGreat American Duck Races v. Intellectual Solutions Et. Al.PriorSmartBelum ada peringkat

- 06 100 HR Management PlanDokumen12 halaman06 100 HR Management PlanBrian Shanny100% (1)

- SALES Annotated SyllabusDokumen60 halamanSALES Annotated SyllabusRodrigo ChavezBelum ada peringkat

- Fabm Notes Lesson 005 008Dokumen13 halamanFabm Notes Lesson 005 008KyyBelum ada peringkat

- Plant Layout New 2017Dokumen78 halamanPlant Layout New 2017anuroopBelum ada peringkat