(Kotak) Tata Tea, July 29, 2008

Diunggah oleh

Chirag ShahDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

(Kotak) Tata Tea, July 29, 2008

Diunggah oleh

Chirag ShahHak Cipta:

Format Tersedia

®

TATA TEA

India Daily Summary - July 29, 2008 July 29, 2008

Consumer Products Tata Tea: Volume-led domestic growth, higher tea prices hit margins

TTTE.BO, Rs787

Aman Batra : aman.batra@kotak.com, +91-22-6634-1231

Rating BUY

Sector coverage view Attractive

Manoj Menon : manoj.menon@kotak.com, +91-22-6749-3391

Target Price (Rs) 1,100 • Domestic tea business benefiting from uptrading, cost pressures visible

52W High -Low (Rs) 1015 - 545

Market Cap (Rs bn) 48.7 • Strong growth across regions and businesses

• Expect ramp-up in mineral water business

Financials

March y/e 2008 2009E 2010E • Restructuring complete with separation of North Indian tea plantations

Sales (Rs bn) 45.3 46.7 48.7

Net Profit (Rs bn) 3.3 3.9 4.2

• Retain BUY, target price of Rs1,100/share

EPS (Rs) 54.1 63.3 67.3

Tata Tea reported 12% growth in standalone revenues at Rs3.15 bn and 3% decline in

EPS gth 3.6 17.2 6.2

EBITDA to Rs534 mn during 1QFY09. We estimate that the volume growth contributed

P/E (x) 14.6 12.4 11.7

the entire domestic sales growth. Plans to effect a modest 5-7% price increase in July/

EV/EBITDA (x) 5.6 5.1 4.5

August will mitigate the impact of higher tea prices. Consolidated sales grew 12%

Div yield (%) 1.9 2.2 2.4

(domestic +12%, Tetley +7%, Tata Coffee +40%, Eight O' Clock coffee +17%,

Mount Everest +9%), EBITDA declined by 4% (higher tea commodity prices) and PAT

growth at 72% (lower interest costs). We make nominal changes to our EPS estimates

Shareholding, March 2008

at Rs63.9 (Rs63.3 previously) for FY2009E and Rs68.6 (Rs67.3 previously) for FY2010E.

% of Over/(under)

At 12XFY09E, Tata Tea is one of the cheapest FMCG stocks on a P/E basis. The

Pattern Portfolio weight

Promoters 35.3 - -

company commanded a lower multiple earlier due to the presence in plantations

FIIs 12.9 0.1 (0.0)

business (which is cyclical) as well. With the company transforming into a branded

MFs 9.8 0.4 0.2

player in beverages business, we believe the significant discount to FMCG players is

UTI - - (0.1)

unjustified. We reiterate BUY with a target price of Rs1,100/share implying a P/E of

LIC 11.0 0.4 0.2

17X on FY2009E.

Domestic tea business benefiting from uptrading, cost pressures visible. Tata

Tea continues to be the volume market leader in Indian tea market posting about 12%

sales growth during the quarter. We estimate that volume growth has contributed the

entire domestic sales growth. We estimate the low-end offering ‘Agni’ is leading the

growth as it benefits from capturing the natural uptrading from unorganized segment.

EBITDA declined 3% due to higher tea commodity costs as the company has

maintained retail prices and has focused on market share gains. Plans to effect a

modest 5-7% price increase in July/August will likely mitigate the impact of higher tea

prices in rest of FY09E.

Strong growth across regions and businesses. Consolidated sales grew by 12%

(domestic +12%, Tetley +7%, Tata Coffee +40%, Eight O’ Clock coffee +17%,

Mount Everest Mineral Water +9%). The growth in coffee business was driven by

(1) new launches under the Eight O’ Clock umbrella (2) relaunch of ‘Good Earth’ and

(3) strong growth in freeze dried coffee in Tata Coffee. We estimate Tetley growth at

~7%; which is a positive. We believe that the company’s strategy of focusing on new

markets and new initiatives in tea (aggressive push of herbal and green tea) is paying

off well.

Kotak Institutional Equities Research

For Private Circulation Only. FOR IMPORTANT INFORMATION ABOUT KOTAK SECURITIES’ RATING

kotak.research@kotak.com SYSTEM AND OTHER DISCLOSURES, REFER TO THE END OF THIS MATERIAL, GO TO HEDGES AT

Mumbai: +91-22-6634-1100 http://www.kotaksecurities.com.

Kotak Institutional Equities Research 1

India Daily Summary - July 29, 2008

Expect ramp-up in Mount Everest. We believe growth in Tata Tea would be a

function of successful integration of operations—both for domestic as well as

international operations. The management had earlier highlighted the recent launch of

‘Himalayan’ in Mumbai with the Mount Everest (MEMW) team working together with

Tata Tea’s sales and marketing team. We believe Tata Tea can significantly scale up

the water business using its distribution reach. Market sources indicate that the launch

of ‘Himalayan’ in Mumbai market has met with reasonable success and the company

would look at expanding the footprint in India by moving to other metro cities. At

Rs1.5 bn and an estimated 10% of the overall water market, we believe the mineral

water business in India offers huge potential. The recent legal fight between MEMW

and Bisleri regarding the ownership of ‘Himalayan’ name and media reports of

Kingfisher launching their own ‘Himalayan’ version indicates active business interest in

this segment—likely helping to expand this nascent category.

Restructuring complete with separation of North Indian tea plantations. The

separation of tea plantations has now been completed and in our view the company

has now a healthier balance sheet—having reduced asset intensive businesses (and

used cash generated to retire debt) and better financial flexibility—without the burden

of a large workforce. The North India Plantations Division (NIPD) has been transferred

to Amalgamated Plantations Private Limited (APPL) with effect from April 1, 2007.

Retain BUY, target price of Rs1,100/share

We believe the strong performance by the company across markets augurs well. While

the margin pressure due to high tea commodity prices were a dampener, we believe

Tata Tea can effect modest price increases (following the grammage reduction and

effective price increase by HUL in domestic market) to manage margins in the rest of

FY09E. We make nominal changes to our EPS estimates at Rs63.9 (Rs63.3 previously)

for FY2009E and Rs68.6 (Rs67.3 previously) for FY2010E. At 12XFY09E, Tata Tea is one

of the cheapest FMCG stocks on a P/E basis. However, the company commanded a

lower multiple earlier due to the presence in the plantations business (which is cyclical)

as well. With the company transforming into a branded player in beverages business,

we believe the significant valuation discount to other FMCG players is unjustified.

Reiterate BUY with a target price of Rs1,100/share. Our valuation captures the DCF

value of the core business plus 50% value of the investment portfolio (Rs85/share).

Tata Tea has investments in group companies like Rallis, Tata Consultancy Services,

Tata Chemicals, Tata Sons. Our target price implies a P/E of 17X on FY2009E and

offers an upside of 40% over the current market price.

2 Kotak Institutional Equities Research

India Daily Summary - July 29, 2008

Tata Tea (consolidated) quarterly summary, March year-ends (Rs mn)

yoy

1QFY9 1QFY08 % chg

Net sales 11,347 10,107 12.3

Total operating expenses (9,809) (8,502)

EBITDA 1,538 1,606 (4.2)

Depreciation (222) (236)

EBIT 1,316 1,370

Other income 74 86

Net interest (109) (918)

PBT 1,280 538 138.0

Tax (440) (134)

PAT 840 404 108.1

Extraordinary Income (loss) 14 86

Minority interest & share of profit in associates (97) (50)

Net profit 757 439 72.4

EBITDA margin (%) 13.6 15.9

Effective tax rate (%) 34.4 25.0

Source: Company data, Kotak Institutional Equities

Tata Tea (unconsolidated) quarterly summary, March year-ends (Rs mn)

yoy Our est.

1QFY9 1QFY08 % chg 1QFY9 % chg

Net sales 3,150 2,806 12.2 3,231 15.1

Total operating expenses (2,615) (2,258) (2,601)

EBITDA 534 548 (2.5) 630 15.0

Depreciation (24) (26) (46)

EBIT 510 522 584

Other income 122 138 90

Net interest (64) (109) (27)

PBT 568 552 2.9 647 17.3

Tax (168) (148) (149)

Deferred tax — — —

PAT 399 404 (1.2) 498 23.4

Extraordinary income (loss) (22) 9 —

Net profit 377 412 (8.5) 498 20.8

EBITDA margin (%) 17.0 19.5 19.5

Effective tax rate (%) 29.7 26.8 23.0

Source: Company data, Kotak Institutional Equities

Kotak Institutional Equities Research 3

India Daily Summary - July 29, 2008

"I, Aman Batra, hereby certify that all of the views expressed in this report accurately reflect my personal views about

the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly

or indirectly, related to the specific recommendations or views expressed in this report."

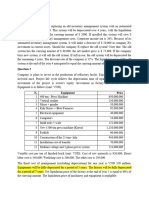

Kotak Institutional Equities Research coverage universe

Distribution of ratings/investment banking relationships

Percentage of companies covered by Kotak Institutional

70% Equities, within the specified category.

60%

Percentage of companies within each category for which

Kotak Institutional Equities and or its affiliates has provided

50%

investment banking services within the previous 12 months.

40%

33.8% 34.5%

30% * The above categories are defined as follows: Buy = OP;

Hold = IL; Sell = U. Buy, Hold and Sell are not defined

20.9% Kotak Institutional Equities ratings and should not be

20% constructed as investment opinions. Rather, these ratings

are used illustratively to comply with applicable regulations.

3.0% 8.1% As of 30/06/2008 Kotak Institutional Equities Investment

10%

5.2% Research had investment ratings on 143 equity

3.0% 0.7% securities.

0%

BUY ADD REDUCE SELL

Source: Kotak Institutional Equities. As of June 30, 2008

Ratings and other definitions/identifiers

New rating system

Definitions of ratings

BUY. We expect this stock to outperform the BSE Sensex by 10% over the next 12 months.

ADD. We expect this stock to outperform the BSE Sensex by 0-10% over the next 12 months.

REDUCE: We expect this stock to underperform the BSE Sensex by 0-10% over the next 12 months.

SELL: We expect this stock to underperform the BSE Sensexby more than 10% over the next 12 months.

Old rating system

Definitions of ratings

OP = Outperform. We expect this stock to outperform the BSE Sensex over the next 12 months.

IL = In-Line. We expect this stock to perform in line with the BSE Sensex over the next 12 months.

U = Underperform. We expect this stock to underperform the BSE Sensex over the next 12 months.

Our target price are also on 12-month horizon basis.

Other definitions

Coverage view. The coverage view represents each analyst’s overall fundamental outlook on the Sector. The coverage view will consist of one of the following designations:

Attractive (A), Neutral (N), Cautious (C).

Other ratings/identifiers

NR = Not Rated. The investment rating and target price, if any, have been suspended temporarily. Such suspension is in compliance with applicable regulation(s) and/or

Kotak Securities policies in circumstances when Kotak Securities or its affiliates is acting in an advisory capacity in a merger or strategic transaction involving this company

and in certain other circumstances.

CS = Coverage Suspended. Kotak Securities has suspended coverage of this company.

NC = Not Covered. Kotak Securities does not cover this company.

RS = Rating Suspended. Kotak Securities Research has suspended the investment rating and price target, if any, for this stock, because there is not a sufficient fundamental

basis for determining an investment rating or target. The previous investment rating and price target, if any, are no longer in effect for this stock and should not be relied

upon.

NA = Not Available or Not Applicable. The information is not available for display or is not applicable.

NM = Not Meaningful. The information is not meaningful and is therefore excluded.

4 Kotak Institutional Equities Research

India Daily Summary - July 29, 2008

Corporate Office Overseas Offices

Kotak Securities Ltd. Kotak Mahindra (UK) Ltd. Kotak Mahindra Inc.

Bakhtawar, 1st Floor 6th Floor, Portsoken House 50 Main Street, Suite No.310

229, Nariman Point 155-157 The Minories Westchester Financial Centre

Mumbai 400 021, India London EC 3N 1 LS White Plains, New York 10606

Tel: +91-22-6634-1100 Tel: +44-20-7977-6900 / 6940 Tel: +1-914-997-6120

Copyright 2008 Kotak Institutional Equities (Kotak Securities Limited). All rights reserved.

Kotak Securities Limited and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We along with our affiliates

are leading underwriter of securities and participants in virtually all securities trading markets in India. We and our affiliates have investment banking and other business

relationships with a significant percentage of the companies covered by our Investment Research Department. Our research professionals provide important input into our

investment banking and other business selection processes. Investors should assume that Kotak Securities Limited and/or its affiliates are seeking or will seek investment banking

or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may

participate in the solicitation of such business. Our research professionals are paid in part based on the profitability of Kotak Securities Limited, which include earnings from

investment banking and other business. Kotak Securities Limited generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining

a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, Kotak Securities Limited generally prohibits its analysts and persons

reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals

may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary

trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be

aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. Additionally, other important information regarding our

relationships with the company or companies that are the subject of this material is provided herein.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

We are not soliciting any action based on this material. It is for the general information of clients of Kotak Securities Limited. It does not constitute a personal recommendation

or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, clients

should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this

material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance,

future returns are not guaranteed and a loss of original capital may occur. Kotak Securities Limited does not provide tax advise to its clients, and all investors are strongly advised

to consult with their tax advisers regarding any potential investment.

Certain transactions -including those involving futures, options, and other derivatives as well as non-investment-grade securities - give rise to substantial risk and are not suitable

for all investors. The material is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such.

Opinions expressed are our current opinions as of the date appearing on this material only. We endeavor to update on a reasonable basis the information discussed in this material,

but regulatory, compliance, or other reasons may prevent us from doing so. We and our affiliates, officers, directors, and employees, including persons involved in the preparation

or issuance of this material, may from time to time have “long” or “short” positions in, act as principal in, and buy or sell the securities or derivatives thereof of companies

mentioned herein. For the purpose of calculating whether Kotak Securities Limited and its affiliates holds beneficially owns or controls, including the right to vote for directors,

1% of more of the equity shares of the subject issuer of a research report, the holdings does not include accounts managed by Kotak Mahindra Mutual Fund.Kotak Securities

Limited and its non US affiliates may, to the extent permissible under applicable laws, have acted on or used this research to the extent that it relates to non US issuers, prior

to or immediately following its publication. Foreign currency denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value

or price of or income derived from the investment. In addition , investors in securities such as ADRs, the value of which are influenced by foreign currencies affectively assume

currency risk. In addition options involve risks and are not suitable for all investors. Please ensure that you have read and understood the current derivatives risk disclosure

document before entering into any derivative transactions.

This report has not been prepared by Kotak Mahindra Inc. (KMInc). However KMInc has reviewed the report and, in so far as it includes current or historical information, it is

believed to be reliable, although its accuracy and completeness cannot be guaranteed. Any reference to Kotak Securities Limited shall also be deemed to mean and include Kotak

Mahindra Inc.

Kotak Securities Ltd.

Kotak Institutional

Bakhtawar, 1st floor, Equities Research

229 Nariman Point, Mumbai 400 021, India. Tel: +91-22-6634-1100 Fax: +91-22-2288-64535

Anda mungkin juga menyukai

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)Dari EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Belum ada peringkat

- Ang TGBL 122011 94043Dokumen17 halamanAng TGBL 122011 94043DanSteinBelum ada peringkat

- Fats & Oils Refining & Blending World Summary: Market Values & Financials by CountryDari EverandFats & Oils Refining & Blending World Summary: Market Values & Financials by CountryBelum ada peringkat

- Alkesh Dinesh Mody Institute of Finacial and Management StudiesDokumen22 halamanAlkesh Dinesh Mody Institute of Finacial and Management StudiesMAnoj ChorgeBelum ada peringkat

- Financial Accounting: Group Project, Milestone 1, Term 1, 2021 Group-11, Section-E Project Guide: Prof. Debojyoti DasDokumen5 halamanFinancial Accounting: Group Project, Milestone 1, Term 1, 2021 Group-11, Section-E Project Guide: Prof. Debojyoti DasEncore GamingBelum ada peringkat

- Toilet Preparations World Summary: Market Values & Financials by CountryDari EverandToilet Preparations World Summary: Market Values & Financials by CountryBelum ada peringkat

- THE WOLF OF WALL STREET - Dhanwate National CollegeDokumen17 halamanTHE WOLF OF WALL STREET - Dhanwate National Collegerohitshukla0543Belum ada peringkat

- Soaps & Detergents World Summary: Market Values & Financials by CountryDari EverandSoaps & Detergents World Summary: Market Values & Financials by CountryBelum ada peringkat

- Tata Global Beverages: Brewing A Heady Mix!Dokumen40 halamanTata Global Beverages: Brewing A Heady Mix!Prasoon SinhaBelum ada peringkat

- EQ Research Report - TCPLDokumen16 halamanEQ Research Report - TCPLrohitshukla0543Belum ada peringkat

- Analyst Presentation 2006 07Dokumen34 halamanAnalyst Presentation 2006 07totalpaluBelum ada peringkat

- Nestlé (Malaysia) Berhad: MaintainDokumen3 halamanNestlé (Malaysia) Berhad: MaintainZhi Ming CheahBelum ada peringkat

- Business+Analysis Working Aug+2007Dokumen200 halamanBusiness+Analysis Working Aug+2007cakartikayBelum ada peringkat

- Tata Consumer Products LTD - Initiating Coverage - 17.05.2021Dokumen21 halamanTata Consumer Products LTD - Initiating Coverage - 17.05.2021Karthik KarthikBelum ada peringkat

- Kolkata700001 Scrip Code - 10000027 (Demat) 27 (Physical) : Tata Consumer Products LimitedDokumen47 halamanKolkata700001 Scrip Code - 10000027 (Demat) 27 (Physical) : Tata Consumer Products LimitedChesterBelum ada peringkat

- Strategic Position of The Tata Tea LTDDokumen11 halamanStrategic Position of The Tata Tea LTDPrakashkrjsrBelum ada peringkat

- Tata Global Bevrages LTDDokumen6 halamanTata Global Bevrages LTDmehakBelum ada peringkat

- Market Outlook 21st December 2011Dokumen5 halamanMarket Outlook 21st December 2011Angel BrokingBelum ada peringkat

- Morning India 20231215 Mosl Mi Pg022Dokumen22 halamanMorning India 20231215 Mosl Mi Pg022Anurag PharkyaBelum ada peringkat

- Tata MotorsDokumen5 halamanTata Motorsapi-3826612Belum ada peringkat

- Tata Globalw2w Sep 13Dokumen38 halamanTata Globalw2w Sep 13darshanmaldeBelum ada peringkat

- Managerial Economics Project ReportDokumen6 halamanManagerial Economics Project ReportchandanjeeBelum ada peringkat

- Equity Research ReportDokumen7 halamanEquity Research Reportjyoti_prakash_11Belum ada peringkat

- Tata Global Beverages LTD: Key Financial IndicatorsDokumen4 halamanTata Global Beverages LTD: Key Financial IndicatorsPravesh AroraBelum ada peringkat

- Golden Midcap Portfolio: October 18, 2019Dokumen7 halamanGolden Midcap Portfolio: October 18, 2019Arvind MeenaBelum ada peringkat

- Our Key Priority Is To NurtureDokumen2 halamanOur Key Priority Is To Nurturelaloo01Belum ada peringkat

- Buy Tata ChemicalsDokumen9 halamanBuy Tata ChemicalsSovid GuptaBelum ada peringkat

- Begum Rukshani Mohamed Refai Batch 42Dokumen24 halamanBegum Rukshani Mohamed Refai Batch 42Rukshani RefaiBelum ada peringkat

- Tata Tea LTD Annual General Meeting 2003/04Dokumen14 halamanTata Tea LTD Annual General Meeting 2003/04hemal masaliaBelum ada peringkat

- Globus SpiritsDokumen17 halamanGlobus SpiritsTejesh GoudBelum ada peringkat

- Analysis of Tata Tea in Indian Tea Industry and Its Comparison With HulDokumen6 halamanAnalysis of Tata Tea in Indian Tea Industry and Its Comparison With Hulramansharma1769Belum ada peringkat

- Tata ConsumerDokumen12 halamanTata ConsumerSANDIP MISHRABelum ada peringkat

- Dabur India: Outperformance ContinuesDokumen14 halamanDabur India: Outperformance ContinuesVishakha RathodBelum ada peringkat

- Tata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, AshwaniDokumen32 halamanTata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, Ashwaniapi-3828752Belum ada peringkat

- Dabur India (DABIND) : Safe Bet On Natural' Consumer BusinessDokumen11 halamanDabur India (DABIND) : Safe Bet On Natural' Consumer Businessarun_algoBelum ada peringkat

- Thesun 2009-06-18 Page16 January-May Cpi Rises by 3Dokumen1 halamanThesun 2009-06-18 Page16 January-May Cpi Rises by 3Impulsive collectorBelum ada peringkat

- AngelTopPicks July 2018Dokumen14 halamanAngelTopPicks July 2018Sujitha RaniBelum ada peringkat

- Core Pacific - Yamaichi: China Green (904 HK)Dokumen4 halamanCore Pacific - Yamaichi: China Green (904 HK)prapasoBelum ada peringkat

- Hero Honda: Performance HighlightsDokumen6 halamanHero Honda: Performance HighlightsamitkumaraxnBelum ada peringkat

- Tata Chemicals: CMP: INR650 Acquires Residual Stake in North American Soda Ash BizDokumen8 halamanTata Chemicals: CMP: INR650 Acquires Residual Stake in North American Soda Ash BizTayyaba AnsariBelum ada peringkat

- Tata Tea's Leveraged Buyout of TetleyDokumen20 halamanTata Tea's Leveraged Buyout of TetleySahil Singla100% (1)

- Project On Tata TeaDokumen32 halamanProject On Tata TeaNirbhay Pandey71% (7)

- Tao HeungDokumen2 halamanTao Heungjeffau88Belum ada peringkat

- Marico Kaya HDFC Sec ICDokumen12 halamanMarico Kaya HDFC Sec ICJatin SoniBelum ada peringkat

- Deepak Nitrite - Initiation ReportDokumen20 halamanDeepak Nitrite - Initiation Report9avinashrBelum ada peringkat

- Geogit BNP Paribus PDFDokumen5 halamanGeogit BNP Paribus PDFBook MonkBelum ada peringkat

- CD Equisearch PVT LTD: Company BriefDokumen11 halamanCD Equisearch PVT LTD: Company BriefVishal GargBelum ada peringkat

- Dabur India LTD PDFDokumen8 halamanDabur India LTD PDFBook MonkBelum ada peringkat

- Tata Global BeveragesDokumen37 halamanTata Global BeveragesAmeerHamsaBelum ada peringkat

- CFA Institute Research Challenge: CFA Society India (IAIP) Team Code - ArtumeDokumen31 halamanCFA Institute Research Challenge: CFA Society India (IAIP) Team Code - Artumeshreyansh naharBelum ada peringkat

- DBS - Tsit Wing (2119 HK) - Initation - 20180712Dokumen40 halamanDBS - Tsit Wing (2119 HK) - Initation - 20180712Wong King Peng StephenBelum ada peringkat

- RIL Macquarie 10 July 06Dokumen50 halamanRIL Macquarie 10 July 06alokkuma05Belum ada peringkat

- CCL Products (India) LTD: Key Financial IndicatorsDokumen4 halamanCCL Products (India) LTD: Key Financial IndicatorsRk ParmarBelum ada peringkat

- TCP Research ReportDokumen6 halamanTCP Research ReportAyush GoelBelum ada peringkat

- Shoppers Stop Result Update Jul 08 EDELDokumen8 halamanShoppers Stop Result Update Jul 08 EDELPerty24Belum ada peringkat

- February Case Study IBSDokumen5 halamanFebruary Case Study IBSnerises364Belum ada peringkat

- High Five StocksDokumen7 halamanHigh Five Stockseswar414Belum ada peringkat

- TTK Prestige LTD Visit NoteDokumen7 halamanTTK Prestige LTD Visit Notehazrat1Belum ada peringkat

- Atul Sushil 250919Dokumen23 halamanAtul Sushil 250919Bhaveek OstwalBelum ada peringkat

- ContrsctDokumen23 halamanContrsctMohammed Naeem Mohammed NaeemBelum ada peringkat

- Mock Exam Paper - 28 - April - 2022Dokumen3 halamanMock Exam Paper - 28 - April - 2022dilinhtinh04Belum ada peringkat

- Classification of Housing Units in The MarketDokumen3 halamanClassification of Housing Units in The MarketAron Stephen PlanBelum ada peringkat

- PEST AnalysisDokumen8 halamanPEST AnalysisAkash AgrawalBelum ada peringkat

- Homestyle Renovation June 2008Dokumen34 halamanHomestyle Renovation June 2008Abu HanifahBelum ada peringkat

- Percentages: Multiple-Choice QuestionsDokumen4 halamanPercentages: Multiple-Choice QuestionsJason Lam LamBelum ada peringkat

- Cost of Capital Capital Structure Dividend ProblemsDokumen26 halamanCost of Capital Capital Structure Dividend ProblemsAnonymous JgyJLTqpNSBelum ada peringkat

- Occ 4 Cost ControlDokumen40 halamanOcc 4 Cost ControlEsad Taha100% (1)

- Level 3 Costing & MA Text Update June 2021pdfDokumen125 halamanLevel 3 Costing & MA Text Update June 2021pdfAmi KayBelum ada peringkat

- Marketing Strategies Term Project OutlineDokumen3 halamanMarketing Strategies Term Project OutlinesaaaruuuBelum ada peringkat

- FIN 254 A Simple Report On Virtual TradingDokumen5 halamanFIN 254 A Simple Report On Virtual Tradingsajal sazzadBelum ada peringkat

- Economics AssignmentDokumen6 halamanEconomics Assignmenturoosa vayaniBelum ada peringkat

- 15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritiesDokumen29 halaman15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritieswelcometoankitBelum ada peringkat

- Title FormDokumen2 halamanTitle FormHamza MinhasBelum ada peringkat

- Day 2 Test Trading Smarter and Winning With OFA 1Dokumen5 halamanDay 2 Test Trading Smarter and Winning With OFA 1Vishal NikamBelum ada peringkat

- Engineering Economic Analysis 11thDokumen2 halamanEngineering Economic Analysis 11thJesus DunnBelum ada peringkat

- IM Unit 1Dokumen29 halamanIM Unit 1Sahil AgrawalBelum ada peringkat

- Global Distribution SystemDokumen3 halamanGlobal Distribution SystemAnonymous gUySMcpSqBelum ada peringkat

- Forex Candlestick MagicDokumen70 halamanForex Candlestick MagicAlexsandro Souza de Lima100% (2)

- Nora JV Sakari AnalysisDokumen3 halamanNora JV Sakari AnalysisIrwan PriambodoBelum ada peringkat

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDokumen2 halamanM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현100% (1)

- Cadbury Sales PromotionDokumen47 halamanCadbury Sales PromotionVinodDubeyBelum ada peringkat

- Business Strategies of Wal - MartDokumen22 halamanBusiness Strategies of Wal - Martsanjeev67% (12)

- 03 9708 22 MS Final Scoris 10032023Dokumen21 halaman03 9708 22 MS Final Scoris 10032023Kalsoom SoniBelum ada peringkat

- The Procurement Process and Contract Types: L10: Chibwe D. MWELWADokumen29 halamanThe Procurement Process and Contract Types: L10: Chibwe D. MWELWAyeddy andriansyahBelum ada peringkat

- Fin 072 Midterm ExamDokumen10 halamanFin 072 Midterm ExamGargaritanoBelum ada peringkat

- Final Reviewer For TAX 2Dokumen45 halamanFinal Reviewer For TAX 2Mosarah AltBelum ada peringkat

- Incomplete SentencesDokumen103 halamanIncomplete Sentences0123405137067% (3)

- Keynes' Liquidity Preference Theory of Interest Rate - ppt1Dokumen17 halamanKeynes' Liquidity Preference Theory of Interest Rate - ppt1Bhagyashree Chauhan100% (1)

- (Trading Ebook) Pristine - Micro Trading For A Living Micro Trading For A Living PDFDokumen54 halaman(Trading Ebook) Pristine - Micro Trading For A Living Micro Trading For A Living PDFjairojuradoBelum ada peringkat

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDari EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (14)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDari EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthPenilaian: 4 dari 5 bintang4/5 (20)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDari EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisPenilaian: 5 dari 5 bintang5/5 (6)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDari Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDari EverandReady, Set, Growth hack:: A beginners guide to growth hacking successPenilaian: 4.5 dari 5 bintang4.5/5 (93)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDari EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaPenilaian: 3.5 dari 5 bintang3.5/5 (8)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDari EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamBelum ada peringkat

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDari EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingPenilaian: 4.5 dari 5 bintang4.5/5 (17)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDari EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPenilaian: 4.5 dari 5 bintang4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceDari EverandValue: The Four Cornerstones of Corporate FinancePenilaian: 4.5 dari 5 bintang4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDari EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursPenilaian: 4.5 dari 5 bintang4.5/5 (8)

- Creating Shareholder Value: A Guide For Managers And InvestorsDari EverandCreating Shareholder Value: A Guide For Managers And InvestorsPenilaian: 4.5 dari 5 bintang4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)Dari EverandFinance Basics (HBR 20-Minute Manager Series)Penilaian: 4.5 dari 5 bintang4.5/5 (32)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsDari EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsBelum ada peringkat

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursDari EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursPenilaian: 5 dari 5 bintang5/5 (13)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsDari EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsPenilaian: 5 dari 5 bintang5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterDari EverandMind over Money: The Psychology of Money and How to Use It BetterPenilaian: 4 dari 5 bintang4/5 (24)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDari EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorBelum ada peringkat

- Financial Risk Management: A Simple IntroductionDari EverandFinancial Risk Management: A Simple IntroductionPenilaian: 4.5 dari 5 bintang4.5/5 (7)

- Product-Led Growth: How to Build a Product That Sells ItselfDari EverandProduct-Led Growth: How to Build a Product That Sells ItselfPenilaian: 5 dari 5 bintang5/5 (1)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondDari EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondBelum ada peringkat

- The Value of a Whale: On the Illusions of Green CapitalismDari EverandThe Value of a Whale: On the Illusions of Green CapitalismPenilaian: 5 dari 5 bintang5/5 (2)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Dari EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Penilaian: 4 dari 5 bintang4/5 (5)