Final Dividend: SRN Withheld

Diunggah oleh

Martin PotterJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Final Dividend: SRN Withheld

Diunggah oleh

Martin PotterHak Cipta:

Format Tersedia

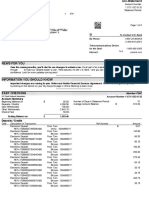

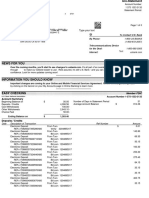

Update your information:

: Online:

www.investorcentre.com/au

* By Mail:

Computershare Investor Services Pty Limited

GPO Box 2975 Melbourne

Victoria 3001 Australia

Enquiries:

(within Australia) 1300 350 716

(international) +61 3 9415 4296

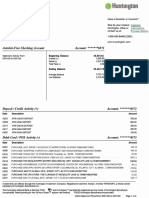

T 003318 000 ARG

1301013011211110122001331022230221213 Securityholder Reference Number (SRN)

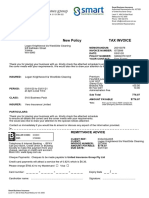

MR MARTIN GEORGE POTTER SRN WITHHELD

536C RATHDOWNE STREET

CARLTON NORTH VIC 3054 ASX Code ARG

TFN/ABN Status Quoted

Record Date 28 August 2017

Payment Date 15 September 2017

Direct Credit Reference No. 806796

Final Dividend

This payment represents the final dividend of 16 cents per share for the year ended 30 June 2017 and is paid on the shares registered in your

name and entitled to participate as at the record date of 28 August 2017. The dividend is 100% franked at the corporate tax rate of 30% and

includes a listed investment company (LIC) capital gain component of 5 cents per share.

Please register at www.investorcentre.com/au in order to update your TFN, bank account and other details online.

Class Amount per Number of Franked Unfranked Gross

Description Share Shares Amount Amount Payment

Ordinary 16 cents 20,000 $3,200.00 $0.00 $3,200.00

Net Payment $3,200.00

Franking Credit $1,371.43

Important tax information:

For income tax purposes, the attributable part of the LIC capital gain dividend is $1,428.57.

1. If you are an Australian resident when the dividend is paid and an individual, a trust (except a trust that is a complying superannuation

entity) or a partnership, you are entitled to a tax deduction of $714.29 (i.e. 50% of the attributable part) at the "dividend deductions" label

of the income tax return for individuals or retirees.

2. If you are an Australian resident when the dividend is paid and a complying superannuation entity or a life insurance company receiving

this dividend in respect of shares that are virtual PST assets, you are entitled to a tax deduction of $476.19 (i.e. 33 1/3% of the

attributable part).

3. If you are any other type of entity, you are not entitled to a tax deduction.

Note: You should retain this statement to assist you in preparing your 2018 tax return. All values are in Australian dollars.

Your Payment Instruction

Amount Deposited

COMMONWEALTH BANK OF AUSTRALIA

BSB: 065-000 Account number: XXXXXX70 $3,200.00

If payment cannot be made to the above instruction, a cheque will be forwarded to your registered address.

225915_01ZPHC

225915_EML_Payment/003318/003345/i

Anda mungkin juga menyukai

- Asterisk-Free Checking AccountDokumen2 halamanAsterisk-Free Checking AccountViktoria Denisenko100% (1)

- Earnings Statement: Non-NegotiableDokumen1 halamanEarnings Statement: Non-NegotiableMorenita ParelesBelum ada peringkat

- Us Bank Statement PDFDokumen4 halamanUs Bank Statement PDFlubia86% (7)

- Earnings Statement: Non-NegotiableDokumen1 halamanEarnings Statement: Non-NegotiableMorenita Pareles100% (1)

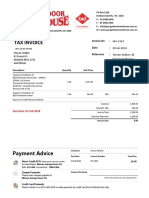

- Tax Invoice: Pay ImmediatelyDokumen76 halamanTax Invoice: Pay ImmediatelySMART DESIGNSBelum ada peringkat

- Tax Credit Certificate 2023 9553776791212Dokumen2 halamanTax Credit Certificate 2023 9553776791212Mariana SurduBelum ada peringkat

- Invoice 008102Dokumen1 halamanInvoice 008102Ded MarozBelum ada peringkat

- Citibank Client Services 000 PO Box 769013 San Antonio, TX 78245-9013Dokumen4 halamanCitibank Client Services 000 PO Box 769013 San Antonio, TX 78245-9013Steven Lee0% (1)

- Kevin Gause 9750 Old Placerville RD Sacramento, Ca 95827: 000072209 01 SP 106481000528447 E Ryan R FanningDokumen4 halamanKevin Gause 9750 Old Placerville RD Sacramento, Ca 95827: 000072209 01 SP 106481000528447 E Ryan R FanningBryan Pasqueci100% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionBelum ada peringkat

- Citibank StatementDokumen2 halamanCitibank Statementsfhui100% (2)

- TCS India Process - Separation KitDokumen25 halamanTCS India Process - Separation KitSuman Dey33% (6)

- IROWA Directory 2017Dokumen442 halamanIROWA Directory 2017kamal siddhantham75% (4)

- Josh Murray 7620 Vincent Ave Richfield, MN 55425Dokumen4 halamanJosh Murray 7620 Vincent Ave Richfield, MN 55425empower93 empower93100% (1)

- Document SOS1Dokumen2 halamanDocument SOS1James AndersonBelum ada peringkat

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDari EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineBelum ada peringkat

- PaulRand Designers WordsDokumen16 halamanPaulRand Designers Wordsoub100% (4)

- Summary of My Deposit Accounts How To Contact UsDokumen2 halamanSummary of My Deposit Accounts How To Contact UsĐào Văn CườngBelum ada peringkat

- What's Your Investing IQDokumen256 halamanWhat's Your Investing IQAmir O. OshoBelum ada peringkat

- Amara Raja Batteries LimitedDokumen1 halamanAmara Raja Batteries LimitedNani AnugaBelum ada peringkat

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDokumen2 halamanAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloBelum ada peringkat

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDokumen4 halamanNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardBelum ada peringkat

- Tax Invoice: Steven Walker 42 Francis ST Moama NSW 2731 AustraliaDokumen1 halamanTax Invoice: Steven Walker 42 Francis ST Moama NSW 2731 AustraliaStephen walker519889037Belum ada peringkat

- SA300535Dokumen1 halamanSA300535JEFF WONBelum ada peringkat

- TAX Allowable Deductions-1Dokumen35 halamanTAX Allowable Deductions-1lyza nedtranBelum ada peringkat

- Notice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6ÄDokumen4 halamanNotice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6Äjoshiepow3llBelum ada peringkat

- Lansing Complex Adaptive SystemsDokumen24 halamanLansing Complex Adaptive SystemsMartin PotterBelum ada peringkat

- Stuartbill PDFDokumen3 halamanStuartbill PDFMendez SusanBelum ada peringkat

- Account Details: Invoice/Statement DateDokumen3 halamanAccount Details: Invoice/Statement DateThanh GiangBelum ada peringkat

- The Location of CultureDokumen30 halamanThe Location of CultureMartin Potter100% (5)

- Data VisualizationDokumen47 halamanData Visualizationsid66792001100% (1)

- Tax Credit Certificate 2023 9552312947779Dokumen2 halamanTax Credit Certificate 2023 9552312947779Toni rogers CardosoBelum ada peringkat

- Notice of Assessment OriginalDokumen1 halamanNotice of Assessment OriginalWawan SaidBelum ada peringkat

- Amended Tax Credit Certificate: 2217905KA Pps NoDokumen2 halamanAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Noa-Iit Ob2320170627071310ufp PDFDokumen1 halamanNoa-Iit Ob2320170627071310ufp PDFjasper haiBelum ada peringkat

- Exam 4 February 2018, Questions and AnswersDokumen6 halamanExam 4 February 2018, Questions and AnswersjohnBelum ada peringkat

- Invoice 74902Dokumen2 halamanInvoice 74902Lisa WagstaffBelum ada peringkat

- Íæ"N %$ K# B 3çféî Ìç ! Î: Total Due R 1,999.70Dokumen4 halamanÍæ"N %$ K# B 3çféî Ìç ! Î: Total Due R 1,999.70Grenville Rusteberg40% (5)

- 747956694Dokumen2 halaman747956694andrimulyaBelum ada peringkat

- Tax Credit Certificate 2023 9753768935878Dokumen2 halamanTax Credit Certificate 2023 9753768935878Rogério LimaBelum ada peringkat

- NDQ Tax Statement 2023Dokumen2 halamanNDQ Tax Statement 2023Jonno CapaldiBelum ada peringkat

- ZARINVSSCDokumen1 halamanZARINVSSCOKAY JAROD PUGBelum ada peringkat

- Electronic Contribution Collection List SummaryDokumen2 halamanElectronic Contribution Collection List SummaryKatesicawattpad OfficialBelum ada peringkat

- VHY Issuer Annual Tax Statement 2023-08-03Dokumen1 halamanVHY Issuer Annual Tax Statement 2023-08-03Jonno CapaldiBelum ada peringkat

- Noa-Iit Ob2620150425142233zb4 PDFDokumen1 halamanNoa-Iit Ob2620150425142233zb4 PDFKanza KhanBelum ada peringkat

- Investment Account Statement RIE 62244433439 Aug2018Dokumen1 halamanInvestment Account Statement RIE 62244433439 Aug2018Zairo MosesBelum ada peringkat

- DZZF Distribution Advice 2023-07-18Dokumen1 halamanDZZF Distribution Advice 2023-07-18gigi65328Belum ada peringkat

- Electronic Contribution Collection List SummaryDokumen2 halamanElectronic Contribution Collection List SummaryKatesicawattpad OfficialBelum ada peringkat

- ZARINVSSCDokumen1 halamanZARINVSSCOKAY JAROD PUGBelum ada peringkat

- Us Bank Statement PDFDokumen4 halamanUs Bank Statement PDF45pfzfsx7bBelum ada peringkat

- Noa-Iit Ob2120200629085533331Dokumen1 halamanNoa-Iit Ob2120200629085533331Jay Maung MaungBelum ada peringkat

- Statement: Elizabeth BarryDokumen2 halamanStatement: Elizabeth BarryLiz BarryBelum ada peringkat

- Shopify PaymentDokumen4 halamanShopify PaymentchayaaliwaBelum ada peringkat

- Logan Knightwood Ta WestSide Cleaning (033LOGA005) - Tax InvoiceDokumen4 halamanLogan Knightwood Ta WestSide Cleaning (033LOGA005) - Tax InvoiceLoki KingBelum ada peringkat

- 10-10-2023 Pitney Bowes $121.26Dokumen2 halaman10-10-2023 Pitney Bowes $121.26kinyas.alexanderBelum ada peringkat

- Statement: Elizabeth BarryDokumen2 halamanStatement: Elizabeth BarryLiz BarryBelum ada peringkat

- Tax Invoice / Receipt: Total Paid: USD10.00 Date Paid: 12 May 2019Dokumen3 halamanTax Invoice / Receipt: Total Paid: USD10.00 Date Paid: 12 May 2019coBelum ada peringkat

- Tax Invoice: New ChargesDokumen3 halamanTax Invoice: New ChargesSMART DESIGNSBelum ada peringkat

- Noa-Iit Ob2320190701042209hz8Dokumen1 halamanNoa-Iit Ob2320190701042209hz8Jay Maung MaungBelum ada peringkat

- Account Statement: Call 800-574-5626 or Apply OnlineDokumen1 halamanAccount Statement: Call 800-574-5626 or Apply Onlinekunsmanbaby16Belum ada peringkat

- Social Security System: Collection List Summary For The Month of December 2018Dokumen2 halamanSocial Security System: Collection List Summary For The Month of December 2018exergyBelum ada peringkat

- Rie March2018Dokumen1 halamanRie March2018Zairo MosesBelum ada peringkat

- Account Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestDokumen1 halamanAccount Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestBakang Brian MothobiBelum ada peringkat

- Electronic Contribution Collection List SummaryDokumen2 halamanElectronic Contribution Collection List SummaryMjlc StudioBelum ada peringkat

- RCG SoaDokumen1 halamanRCG Soaraymon generBelum ada peringkat

- Ar 508863Dokumen1 halamanAr 508863JEFF WONBelum ada peringkat

- QQ PDFDokumen2 halamanQQ PDFWierd SpecieBelum ada peringkat

- Invoice INV-2291Dokumen1 halamanInvoice INV-2291Trung ThaiBelum ada peringkat

- Tax Credit Certificate 2023 9552941697409 PDFDokumen2 halamanTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeBelum ada peringkat

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineDari EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineBelum ada peringkat

- Community Archaeology BN WDokumen18 halamanCommunity Archaeology BN WMartin PotterBelum ada peringkat

- Sample Life Review Interview ScheduleDokumen1 halamanSample Life Review Interview ScheduleMartin PotterBelum ada peringkat

- MilkyWay Archernar Pleiades Norris 2013 PDFDokumen13 halamanMilkyWay Archernar Pleiades Norris 2013 PDFccg19Belum ada peringkat

- 7131-Article Text-15304-1-10-20161209Dokumen14 halaman7131-Article Text-15304-1-10-20161209Martin PotterBelum ada peringkat

- MurchDokumen8 halamanMurchMartin PotterBelum ada peringkat

- Martin Potter BioDokumen1 halamanMartin Potter BioMartin PotterBelum ada peringkat

- Mini TufteDokumen48 halamanMini TufteBrigita ElizabetaBelum ada peringkat

- La Investigación Basada en La PracticaDokumen19 halamanLa Investigación Basada en La PracticaDarkGaia100% (2)

- Miessen-Democracy Revisited Conversation W Chantal MouffeDokumen32 halamanMiessen-Democracy Revisited Conversation W Chantal MouffeMartin PotterBelum ada peringkat

- Making Data Meaningful. Part 2: A Guide To Presenting StatisticsDokumen58 halamanMaking Data Meaningful. Part 2: A Guide To Presenting StatisticsUNECE Statistical DivisionBelum ada peringkat

- Power at The Heart of The Present Except PDFDokumen18 halamanPower at The Heart of The Present Except PDFMartin PotterBelum ada peringkat

- Gender and Newsroom Cultures. 2014 in Me PDFDokumen110 halamanGender and Newsroom Cultures. 2014 in Me PDFMartin PotterBelum ada peringkat

- Film Handbook 030415Dokumen21 halamanFilm Handbook 030415Martin PotterBelum ada peringkat

- Study by IT4Change Bangalore1307.10 PDFDokumen4 halamanStudy by IT4Change Bangalore1307.10 PDFMartin PotterBelum ada peringkat

- SLQ Oral History and DST ReviewDokumen69 halamanSLQ Oral History and DST ReviewMartin PotterBelum ada peringkat

- CFP Seon Vol2no3and4Dokumen2 halamanCFP Seon Vol2no3and4Martin PotterBelum ada peringkat

- Playfair and Pie ChartsDokumen16 halamanPlayfair and Pie ChartsMartin PotterBelum ada peringkat

- Participatory Media On The Tonle Sap Lake, CambodiaDokumen14 halamanParticipatory Media On The Tonle Sap Lake, CambodiaMartin PotterBelum ada peringkat

- Why Hackers Do What They DoDokumen27 halamanWhy Hackers Do What They DoDenny GeorgeBelum ada peringkat

- Community Media For Peace-Building, Conflict Resolution and Reconciliation: A Roadmap To Develop A Bi-Community Radio Station in CyprusDokumen23 halamanCommunity Media For Peace-Building, Conflict Resolution and Reconciliation: A Roadmap To Develop A Bi-Community Radio Station in CyprusMartin PotterBelum ada peringkat

- Media and Belonging To The Nation in Sabah, East MalaysiaDokumen23 halamanMedia and Belonging To The Nation in Sabah, East Malaysiaewinze100% (1)

- Plasticity Into Power, Roberto UngerDokumen239 halamanPlasticity Into Power, Roberto UngerMartin PotterBelum ada peringkat

- PV Ethical PracticeDokumen6 halamanPV Ethical PracticeMartin PotterBelum ada peringkat

- Schaefer Bastard-Culture 2011Dokumen250 halamanSchaefer Bastard-Culture 2011Diego CardosoBelum ada peringkat

- 1972 The Pegram LecturesDokumen128 halaman1972 The Pegram LecturesMartin PotterBelum ada peringkat

- Financial Preparation and Needs of Older PeopleDokumen2 halamanFinancial Preparation and Needs of Older Peoplejasmine alayonBelum ada peringkat

- Aasara Pension Scheme PDFDokumen2 halamanAasara Pension Scheme PDFRaghava Sharma50% (2)

- Form 6744Dokumen6 halamanForm 6744api-495108136Belum ada peringkat

- MA State Tax InstructionDokumen41 halamanMA State Tax InstructionYang JeanBelum ada peringkat

- Annexure B PPO RenewalDokumen1 halamanAnnexure B PPO RenewalMela Chaar Dina DaBelum ada peringkat

- 2014 15 Tax Planning Guide - 29 01 15Dokumen252 halaman2014 15 Tax Planning Guide - 29 01 15DaneGilbertBelum ada peringkat

- Recruitment of AdvisiorDokumen66 halamanRecruitment of AdvisiorSamuel DavisBelum ada peringkat

- Insurance LawDokumen12 halamanInsurance Lawvishal agarwalBelum ada peringkat

- JEEVAN LABH 5k-10k 21-15Dokumen1 halamanJEEVAN LABH 5k-10k 21-15suku_mcaBelum ada peringkat

- Module 4 ECON AnnuityDokumen11 halamanModule 4 ECON AnnuityMIKE ARTHUR DAVIDBelum ada peringkat

- SME Bank v. de Guzman - G.R. No. 184517Dokumen2 halamanSME Bank v. de Guzman - G.R. No. 184517Nica Cielo B. LibunaoBelum ada peringkat

- Project Report BBA 4TH SEMDokumen88 halamanProject Report BBA 4TH SEMranaindia2011Belum ada peringkat

- Toaz - Info Cfas Quiz PRDokumen9 halamanToaz - Info Cfas Quiz PRASHERAH ENGKONGBelum ada peringkat

- Pay For Performance and Employee BenefitsDokumen23 halamanPay For Performance and Employee BenefitsTiya DjBelum ada peringkat

- Non Taxable IncomeDokumen35 halamanNon Taxable IncomeGayatri RaneBelum ada peringkat

- May Payslip JamesDokumen1 halamanMay Payslip JamesJames PuckeyBelum ada peringkat

- IPSF Submission Process Online 2018-19 PDFDokumen69 halamanIPSF Submission Process Online 2018-19 PDFChanakya GorlaBelum ada peringkat

- Vijaya Bank Pension Regulation 1995Dokumen78 halamanVijaya Bank Pension Regulation 1995Latest Laws Team0% (1)

- Maharashtra Pension 6th Pay MaharashtraDokumen81 halamanMaharashtra Pension 6th Pay MaharashtrakhandelwalBelum ada peringkat

- Affidavit of Undertaking: Our ConformityDokumen1 halamanAffidavit of Undertaking: Our ConformitymaebalbinBelum ada peringkat

- One Form Per Adult Member of The Household: Tenant Income Certification Questionnaire Name: Telephone NumberDokumen5 halamanOne Form Per Adult Member of The Household: Tenant Income Certification Questionnaire Name: Telephone NumbervipetetBelum ada peringkat

- 5 - Haryana Municipal Safai Mazdoor Service Rules, 1976Dokumen18 halaman5 - Haryana Municipal Safai Mazdoor Service Rules, 1976ABCBelum ada peringkat

- Manual Pension OfficersDokumen166 halamanManual Pension OfficersSourabh Singh100% (1)

- Baby BoomerDokumen18 halamanBaby BoomerBethany CrusantBelum ada peringkat