BSBFIA402 Assessment 1

Diunggah oleh

YingsriManaweep0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

214 tayangan2 halamanJudul Asli

BSBFIA402 Assessment 1.docx

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

214 tayangan2 halamanBSBFIA402 Assessment 1

Diunggah oleh

YingsriManaweepHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

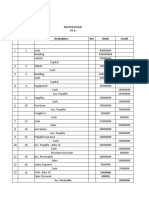

BSBFIA402 Assessment task 1

General Journal

General Journal Packett Packaging Pty Ltd

Date Account # Debit Credit

Asset acquisition

1/7/2010 1-1150 Cash in bank 88,000

1-5110 Motor vehicle 80,000

2-3030 GST 8,000

Total 88,000 88,000

General Journal Packett Packaging Pty Ltd

Date Account # Debit Credit

Depreciation entry

30/6/2011 1-5210 Accumulated 10,000

depreciation

6-0160 Depreciation 10,000

expense

Total 10,000 10,000

You notice a discrepancy. Another employee has created the following unauthorized

entry for the acquisition of the sales vehicle.

Date Account # Debit Credit

Asset acquisition

1/7/2010 1-5111 Motor vehicle 88,000

1-1150 Cash at bank 88,000

Total 88,000 88,000

BSBFIA402 Assessment task 1

Organisational asset register template

Asset register

Packett Packaging Pty Ltd

Asset description: Motor vehicle General Ledger acct: 1-5210

Value: $60,000 Person responsible: Fai

Depreciation method: Prime GST Depreciation rate: 12.5%

Estimated life: 8 years

Authorisation Asset Date Details Asset Accumulated

ID Depreciation

Debit Credit Balance Debit Credit Balance

x 1 1/7/2010 Motor vehicle 80000 80000

x 1 30/6/2011 Acc. dep. 10000

70000

30/6/2012 Accumulated

10000

depreciation

60000

30/6/2013 Accumulated 10000

depreciation 50000

30/6/2014 Accumulated

10000

depreciation

40000

30/6/2015 Accumulated 10000

depreciation 30000

30/6/2016 Accumulated 10000

depreciation 20000

30/6/2017 Accumulated 10000

depreciation 10000

30/6/2018 Accumulated 10000 0

depreciation

Authorisation Disposal Disposal method Disposal amount

date

Anda mungkin juga menyukai

- 07 Receivable Financing 2 SolvingDokumen3 halaman07 Receivable Financing 2 Solvingkyle mandaresioBelum ada peringkat

- Unit-5 Final AccountsDokumen7 halamanUnit-5 Final AccountsSanthosh Santhu0% (1)

- ACCT 1107 - Assignment #4Dokumen3 halamanACCT 1107 - Assignment #4hkarim8641Belum ada peringkat

- Class Test – Financial Statements with AdjustmentsDokumen2 halamanClass Test – Financial Statements with Adjustmentssara VermaBelum ada peringkat

- 2014 Final Exam SolutionsDokumen6 halaman2014 Final Exam SolutionsAyaan Ahaan Malik-WilliamsBelum ada peringkat

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDokumen23 halamanProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonBelum ada peringkat

- Tutorial QuestionsDokumen2 halamanTutorial QuestionsNishika KaranBelum ada peringkat

- Perpetual Bank: ReceivablesDokumen13 halamanPerpetual Bank: ReceivablesYes ChannelBelum ada peringkat

- Tutorial Question - Company AccountDokumen3 halamanTutorial Question - Company AccountmaiBelum ada peringkat

- Financial Analysis ProblemDokumen16 halamanFinancial Analysis ProblemShreyashi DasBelum ada peringkat

- Depreciation of Non-Current Assets - 11Dokumen3 halamanDepreciation of Non-Current Assets - 11Adinda Nathania Damaris SurbaktiBelum ada peringkat

- Pembahasan LabAkun 16-17Dokumen6 halamanPembahasan LabAkun 16-17sepuluh 10Belum ada peringkat

- Accountancy Answer Key - II Puc Annual Exam March 2019Dokumen8 halamanAccountancy Answer Key - II Puc Annual Exam March 2019Akash kBelum ada peringkat

- CA Foundation Accounts A MTP 2 Dec 2022Dokumen11 halamanCA Foundation Accounts A MTP 2 Dec 2022shagana212005Belum ada peringkat

- Truck 12000 Equipment 6000 Rototiller 400 Cash Register 3600 Cash 80000Dokumen8 halamanTruck 12000 Equipment 6000 Rototiller 400 Cash Register 3600 Cash 80000RishabhJainBelum ada peringkat

- Book 2Dokumen8 halamanBook 2May ManseBelum ada peringkat

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionDokumen2 halamanACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaBelum ada peringkat

- Problem 8-3Dokumen1 halamanProblem 8-3Gilbert MoralesBelum ada peringkat

- RTP Group IDokumen202 halamanRTP Group Iravi_bansal85Belum ada peringkat

- Chapter # 03 ProblemsDokumen99 halamanChapter # 03 Problemsruman mahmoodBelum ada peringkat

- FM PracticalDokumen7 halamanFM PracticalIshaan ParwandaBelum ada peringkat

- Vidya Consumer Co-op Society AccountsDokumen7 halamanVidya Consumer Co-op Society Accountsswati100% (3)

- JETJET Co Investment ScheduleDokumen2 halamanJETJET Co Investment Schedulehy googleBelum ada peringkat

- Symbiosis Law School, Pune Project Backlog on Corporate AccountingDokumen2 halamanSymbiosis Law School, Pune Project Backlog on Corporate AccountingARATFTAFTBelum ada peringkat

- Company Final Accounts: Debit Rs. Credit RsDokumen5 halamanCompany Final Accounts: Debit Rs. Credit RsDebaditya SenguptaBelum ada peringkat

- Group FinancialDokumen8 halamanGroup FinancialNever GonondoBelum ada peringkat

- 04 Extra Question Pack For Chapter 4 After Initial AcquisitionDokumen3 halaman04 Extra Question Pack For Chapter 4 After Initial AcquisitionhlisoBelum ada peringkat

- Accounting I Mar 2022Dokumen4 halamanAccounting I Mar 2022Ishmaal KhanBelum ada peringkat

- Toaz - Info Prelim Midterm PRDokumen98 halamanToaz - Info Prelim Midterm PRClandestine SoulBelum ada peringkat

- Question No 8: Cost Overhauling Depreciatoin Reducing Bal Method Sold DR Truck A/C Date Details Amount DateDokumen6 halamanQuestion No 8: Cost Overhauling Depreciatoin Reducing Bal Method Sold DR Truck A/C Date Details Amount DateEducatry FamBelum ada peringkat

- Sample Test (Extract)Dokumen6 halamanSample Test (Extract)Julie KimBelum ada peringkat

- Zoom SlidesDokumen10 halamanZoom SlidesTuấn Kiệt NguyễnBelum ada peringkat

- f200 CPF Budget ExtensionDokumen11 halamanf200 CPF Budget Extensionbranax2000Belum ada peringkat

- Q5 Vikings LimitedDokumen2 halamanQ5 Vikings Limitedamosmalusi5Belum ada peringkat

- ACC 1202 INTRODUCTION TO ACCOUNTING II Open Book PTDokumen3 halamanACC 1202 INTRODUCTION TO ACCOUNTING II Open Book PTChallieBoss100% (1)

- Acc311 2021 2Dokumen4 halamanAcc311 2021 2hoghidan1Belum ada peringkat

- CAJEGAS CHLOE WorksheetDokumen8 halamanCAJEGAS CHLOE WorksheetChloe Cataluna100% (1)

- Screenshot 2022-09-14 at 3.28.29 PMDokumen1 halamanScreenshot 2022-09-14 at 3.28.29 PMBopha PhoemBelum ada peringkat

- Financial Statements for Aleesya BhdDokumen12 halamanFinancial Statements for Aleesya Bhdanis athirahBelum ada peringkat

- Bba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Dokumen5 halamanBba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Nikkie pieBelum ada peringkat

- Classroom Exercises On Receivables AnswersDokumen4 halamanClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- Quateur Ltd Financial StatementsDokumen8 halamanQuateur Ltd Financial StatementsTASH TASHNABelum ada peringkat

- Solution To Problems - Chapter 10Dokumen14 halamanSolution To Problems - Chapter 10GFGSHSBelum ada peringkat

- Cash Flow Statement Numericals QDokumen3 halamanCash Flow Statement Numericals QDheeraj BholaBelum ada peringkat

- Basic Principles of AccountingDokumen3 halamanBasic Principles of Accounting22ba045Belum ada peringkat

- Cash flow problemsDokumen9 halamanCash flow problemsSharu BsBelum ada peringkat

- Intacc 3 Fs ProblemsDokumen25 halamanIntacc 3 Fs ProblemsUn knownBelum ada peringkat

- General Jounal PTX No Date Deskription Ref. Debit Credit: Nama: Anivah Sari Nim: 4103 3403 19 1003Dokumen17 halamanGeneral Jounal PTX No Date Deskription Ref. Debit Credit: Nama: Anivah Sari Nim: 4103 3403 19 1003Euis LatifahBelum ada peringkat

- Class Exercise Sheet FourDokumen9 halamanClass Exercise Sheet Fourcarol mohasebBelum ada peringkat

- Income Taxes - Moments LTD Rupert LTD MemoDokumen5 halamanIncome Taxes - Moments LTD Rupert LTD Memoandiswa zuluBelum ada peringkat

- SS CT DEC 2021 TITLEDokumen4 halamanSS CT DEC 2021 TITLEsharifah nurshahira sakinaBelum ada peringkat

- 72222bos58192 P1aDokumen11 halaman72222bos58192 P1aSufiyan MominBelum ada peringkat

- Tugas Latihan Chapter 10 Dan 11Dokumen2 halamanTugas Latihan Chapter 10 Dan 11Arnalistan EkaBelum ada peringkat

- Accounting concepts explainedDokumen6 halamanAccounting concepts explainedMaringanti ShobhanaBelum ada peringkat

- MOJAKOE AK1 UTS 2012 GasalDokumen15 halamanMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudBelum ada peringkat

- Name Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementDokumen9 halamanName Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementHamza IqbalBelum ada peringkat

- Problem 6-1: Interest Expense Present ValueDokumen3 halamanProblem 6-1: Interest Expense Present ValueAngieBelum ada peringkat

- Hot Qus Class 12thDokumen13 halamanHot Qus Class 12thNaveen ShahBelum ada peringkat

- Fast-Track Tax Reform: Lessons from the MaldivesDari EverandFast-Track Tax Reform: Lessons from the MaldivesBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionBelum ada peringkat

- BSBCUS301B YingDokumen13 halamanBSBCUS301B YingYingsriManaweepBelum ada peringkat

- Mobile Phone Customer ServiceDokumen17 halamanMobile Phone Customer ServiceYingsriManaweepBelum ada peringkat

- BSBCUS301B YingDokumen13 halamanBSBCUS301B YingYingsriManaweepBelum ada peringkat

- BSBMGT502 PresentationDokumen8 halamanBSBMGT502 PresentationYingsriManaweepBelum ada peringkat

- BSBMGT502 Presentation 2Dokumen6 halamanBSBMGT502 Presentation 2YingsriManaweepBelum ada peringkat

- BSBMKG515Dokumen11 halamanBSBMKG515YingsriManaweepBelum ada peringkat

- BSBADM506 - Ass2 TestingDokumen3 halamanBSBADM506 - Ass2 TestingYingsriManaweepBelum ada peringkat

- BBQfun PerformanceDokumen78 halamanBBQfun PerformanceYingsriManaweepBelum ada peringkat

- QuestioningDokumen1 halamanQuestioningYingsriManaweepBelum ada peringkat

- DA SupplyDokumen13 halamanDA SupplyYingsriManaweepBelum ada peringkat

- Trial BalanceDokumen2 halamanTrial BalanceYingsriManaweepBelum ada peringkat

- BSBMGT502 PresentationDokumen8 halamanBSBMGT502 PresentationYingsriManaweepBelum ada peringkat

- The Little Company With The Big Roar!Dokumen2 halamanThe Little Company With The Big Roar!YingsriManaweepBelum ada peringkat

- Trial Balance June 30, 2011 Account DRDokumen2 halamanTrial Balance June 30, 2011 Account DRYingsriManaweepBelum ada peringkat

- Class PowerpointDokumen8 halamanClass PowerpointYingsriManaweepBelum ada peringkat

- BSBCUS301 - Task1Dokumen3 halamanBSBCUS301 - Task1YingsriManaweep50% (2)

- BSBMGT617 Assessment 3Dokumen5 halamanBSBMGT617 Assessment 3YingsriManaweep75% (4)

- Australian Tourism Stats: Top Destinations & Visitor NumbersDokumen15 halamanAustralian Tourism Stats: Top Destinations & Visitor NumbersYingsriManaweepBelum ada peringkat

- Bsbwor 301 BDokumen18 halamanBsbwor 301 BYingsriManaweep100% (1)

- Staff: Current Date Staff ID First Name Last Name Date of Birth Age Classification Pay RateDokumen2 halamanStaff: Current Date Staff ID First Name Last Name Date of Birth Age Classification Pay RateYingsriManaweepBelum ada peringkat

- Staff Resources & Employee EngagementDokumen1 halamanStaff Resources & Employee EngagementYingsriManaweepBelum ada peringkat

- BSBWHS401 Assessment PresentationDokumen9 halamanBSBWHS401 Assessment PresentationYingsriManaweep100% (1)

- BSBADM502Dokumen6 halamanBSBADM502YingsriManaweep100% (3)

- BSBCUS301 - Task3Dokumen5 halamanBSBCUS301 - Task3YingsriManaweep100% (2)

- BSBCUS301 - Task2Dokumen7 halamanBSBCUS301 - Task2YingsriManaweep100% (4)

- Inclusion of Construction Occupational Health and SafetyDokumen8 halamanInclusion of Construction Occupational Health and SafetyTri JakBelum ada peringkat

- 412 Marketing Sales SQP T1jhjkDokumen7 halaman412 Marketing Sales SQP T1jhjkRaghavBelum ada peringkat

- Inventory Models QuestionsDokumen26 halamanInventory Models Questionskrisshawk83% (6)

- List All Eastern PG DMDokumen7 halamanList All Eastern PG DManuja awateBelum ada peringkat

- WC 2007Dokumen156 halamanWC 2007BETTY ELIZABETH JUI�A QUILACHAMINBelum ada peringkat

- Chapter 2 Brand PositioningDokumen27 halamanChapter 2 Brand PositioningRose AnnBelum ada peringkat

- Marketing Strategy Cases Text Book Midterm CasesDokumen31 halamanMarketing Strategy Cases Text Book Midterm CasesThan HuyenBelum ada peringkat

- Marketing 4Ps, Marketing Strategy and Brands 2h - 4Dokumen4 halamanMarketing 4Ps, Marketing Strategy and Brands 2h - 4Дмитрий СметанинBelum ada peringkat

- Curriculum Vitae: Christi-Lee Janse Van VuurenDokumen5 halamanCurriculum Vitae: Christi-Lee Janse Van VuurenChristi-Lee Janse van VuurenBelum ada peringkat

- Summary PirDokumen16 halamanSummary PirHerson AlvarezBelum ada peringkat

- Tugas 5Dokumen6 halamanTugas 5GILANG100% (1)

- Oracle Heterogeneous Services To Connect To MS Access On MS WindowsDokumen4 halamanOracle Heterogeneous Services To Connect To MS Access On MS WindowsAhmed Abd El LatifBelum ada peringkat

- Jsa Bitumen Heating, Lying at DahejDokumen6 halamanJsa Bitumen Heating, Lying at DahejJayavant LoharBelum ada peringkat

- Sample Cover Letter For Volunteer Teaching AssistantDokumen8 halamanSample Cover Letter For Volunteer Teaching Assistantwisaj0jat0l3100% (1)

- Priscillar Khumalo: CoppersmithDokumen2 halamanPriscillar Khumalo: CoppersmithBukhosi Ian DzavakwaBelum ada peringkat

- Us Technology TMT Outlook 2020Dokumen8 halamanUs Technology TMT Outlook 2020Brandon TanBelum ada peringkat

- Alibaba's Founding and Rapid GrowthDokumen3 halamanAlibaba's Founding and Rapid Growthtayyab malikBelum ada peringkat

- PERT/CPM Project Planning, Scheduling and ControlDokumen58 halamanPERT/CPM Project Planning, Scheduling and ControlJayson J. PagalBelum ada peringkat

- UntitledDokumen3 halamanUntitledÇağatay İşbilenBelum ada peringkat

- Restocking Final RuleDokumen13 halamanRestocking Final RuleSpit FireBelum ada peringkat

- Ebook Motherlode of Wealth PDFDokumen109 halamanEbook Motherlode of Wealth PDFNeerav PrithivirajBelum ada peringkat

- Cryptocurrency: Risk Management Overview: A Level of CautionDokumen3 halamanCryptocurrency: Risk Management Overview: A Level of Cautiondaniella maliwatBelum ada peringkat

- TOPIC 11 - Final PaymentDokumen31 halamanTOPIC 11 - Final PaymentLina KljajicBelum ada peringkat

- 2024 Becker CPA Financial (FAR) Mock Exam QuestionsDokumen19 halaman2024 Becker CPA Financial (FAR) Mock Exam QuestionscraigsappletreeBelum ada peringkat

- Arck Systems & Lux Software - Hardware and Software Companies ComparisonDokumen2 halamanArck Systems & Lux Software - Hardware and Software Companies ComparisonSurbhi SharmaBelum ada peringkat

- DEA2017 Proceedings PDFDokumen265 halamanDEA2017 Proceedings PDFBharadwaja ReddyBelum ada peringkat

- Separation of Teachers Some Legal BasesDokumen21 halamanSeparation of Teachers Some Legal BasesLen C. Anorma96% (23)

- FinancingDokumen3 halamanFinancingAbdul KhanBelum ada peringkat

- LRN Format - BRDokumen2 halamanLRN Format - BRADR LAW FIRM CHENNAIBelum ada peringkat

- Jasmine Zennia A. Iñola Performance Evaluation Jan-Mar 2021Dokumen1 halamanJasmine Zennia A. Iñola Performance Evaluation Jan-Mar 2021NaevisweloveuBelum ada peringkat