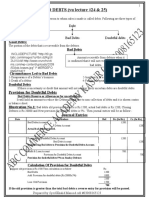

Accounting For Doubtful Debts

Diunggah oleh

ZeeShan IqbalJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting For Doubtful Debts

Diunggah oleh

ZeeShan IqbalHak Cipta:

Format Tersedia

Accounting for Doubtful Debts

Home >

Receivables >

Accounting for Doubtful Debts

Allowance for doubtful debts is created by forming a credit balance which is

netted off against the total receivables appearing in the balance sheet. A

corresponding debit entry is recorded to account for the expense of the

potential loss. Accounting entry to record the allowance for receivable is as

follows:

Debit Allowance for Doubtful Debts (Expense)

Credit Allowance for Doubtful Debts (Balance Sheet)

Once an allowance for doubtful debts has been created, only the movement in

the allowance will need to be charged to the income statement in future

accounting period. So if estimated allowance for doubtful debt is same as last

accounting period, no accounting entry will be required in the current period

as the total receivables will be reduced by the amount of allowance which has

already been created.

Example

ABC LTD has trade receivable of worth $50,000 as at 31 December 2010.

XYZ LTD, a receivable owing $10,000 to ABC LTD at the year end, has been

recently been wound up. Consequently, ABC LTD does not expect to recover

the amount due from XYZ LTD. Based on past experience, ABC LTD

estimates that 5% of its receivables will default. Allowance for doubtful debts

on 31 December 2009 was $1500.

ABC LTD must write off the $10,000 receivable from XYZ LTD as bad debt.

Accounting entry to record the bad debt will be as follows:

Debit Bad Debt Expense $10,000

Credit XYZ LTD (Receivable) $10,000

A general allowance of $2,000 [( 50,000-10,000) x 5%] must be made. As a

general allowance of $1500 has already been created, only $500 additional

allowance must be charged to the income statement:

Debit Allowance for Doubtful Debts $500

(Expense)

Allowance for Doubtful Debts

Credit $500

(Balance Sheet)

Note that $10,000 in respect of receivable from XYZ LTD has been excluded

from the calculation of the general allowance as it has already been written off

in full.

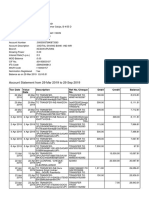

Bad Debt Expense

Debit $ Credit $

XYZ LTD

10,000 Income Statement 10,000

(Receivable)

10,000 10,000

XYZ LTD Receivable

Debit $ Credit $

Sales 10,000 Bad Debt Expense 10,000

10,000 10,000

Allowance for Doubtful Debts

Debit $ Credit $

Balance c/d 2,000 Balance c/d 1,500

Income Statement 500

2,000 2,000

Anda mungkin juga menyukai

- 11 Bad Debts & ProvisionsDokumen6 halaman11 Bad Debts & ProvisionsDayaan ABelum ada peringkat

- Bad Debt and Provision For Bad Debt HandoutDokumen10 halamanBad Debt and Provision For Bad Debt HandoutDajueBelum ada peringkat

- ACCT101 YUNLEE SOLUTIONS Ch05Dokumen19 halamanACCT101 YUNLEE SOLUTIONS Ch05KO YANG JINBelum ada peringkat

- Bad & Provision For Bad Debt HandoutDokumen10 halamanBad & Provision For Bad Debt HandoutDajueBelum ada peringkat

- Financial Reporting and Analysis 6th Edition Revsine Solutions ManualDokumen53 halamanFinancial Reporting and Analysis 6th Edition Revsine Solutions Manualretailnyas.rjah100% (24)

- BUSN7008 Week 5 Receivables and PayablesDokumen33 halamanBUSN7008 Week 5 Receivables and PayablesberfamenBelum ada peringkat

- Financial Accounting 7Th Edition Harrison Solutions Manual Full Chapter PDFDokumen53 halamanFinancial Accounting 7Th Edition Harrison Solutions Manual Full Chapter PDFMichaelMurrayewrsd100% (11)

- Financial Accounting 7th Edition Harrison Solutions ManualDokumen32 halamanFinancial Accounting 7th Edition Harrison Solutions Manualmelioraque2bd0v100% (23)

- MGT 101 SampleDokumen9 halamanMGT 101 SampleWaleed AbbasiBelum ada peringkat

- First SpetDokumen30 halamanFirst Spetteem teerutBelum ada peringkat

- Irrecoverable Debts and Allowances For ReceivablesDokumen20 halamanIrrecoverable Debts and Allowances For ReceivablesShayan KhanBelum ada peringkat

- Chapter02 AccountingDokumen36 halamanChapter02 Accountingkenshi ihsnekBelum ada peringkat

- Chapter 7 - Accounting For ReceivablesDokumen53 halamanChapter 7 - Accounting For ReceivablesJes ReelBelum ada peringkat

- Computation For Formation of PartnershipDokumen10 halamanComputation For Formation of PartnershipErille Julianne (Rielianne)Belum ada peringkat

- Ch#3 Bad Debts and The Provision For Bad DebtsDokumen7 halamanCh#3 Bad Debts and The Provision For Bad Debtseaglerealestate31Belum ada peringkat

- CH 5 Problem Session Exercise - StudentDokumen5 halamanCH 5 Problem Session Exercise - StudenthannahBelum ada peringkat

- Rac 101 - Adjusting Entries or Year End AjustmentsDokumen6 halamanRac 101 - Adjusting Entries or Year End AjustmentsMiko MananiBelum ada peringkat

- ACCT2511 Topic 1 PASS Question Answers 2023 T1Dokumen3 halamanACCT2511 Topic 1 PASS Question Answers 2023 T1KJSAdBelum ada peringkat

- HUM 121assignment 1Dokumen6 halamanHUM 121assignment 1Nayeem HossainBelum ada peringkat

- FA - Preparing A Trial BalanceDokumen19 halamanFA - Preparing A Trial BalanceOwen GradyBelum ada peringkat

- Ageing Analysis, Bad Debts - PDDDokumen3 halamanAgeing Analysis, Bad Debts - PDDRaman AgnihotriBelum ada peringkat

- Irrecoverable DebtsDokumen21 halamanIrrecoverable DebtsjsxlinaBelum ada peringkat

- Financial Reporting and Analysis 101Dokumen10 halamanFinancial Reporting and Analysis 101Samrat KanitkarBelum ada peringkat

- Chapter 2 - Recording ProcessDokumen35 halamanChapter 2 - Recording ProcessMinetteGabrielBelum ada peringkat

- Akl P4.3 & P4.4Dokumen18 halamanAkl P4.3 & P4.4Dhivena JeonBelum ada peringkat

- Answer Key Chapter 3Dokumen60 halamanAnswer Key Chapter 3HectorBelum ada peringkat

- 4.4 Bad and Doubtful DebtsDokumen14 halaman4.4 Bad and Doubtful Debtsnurainbello8Belum ada peringkat

- Three Methods of Estimating Doubtful AccountsDokumen8 halamanThree Methods of Estimating Doubtful AccountsJay Lou PayotBelum ada peringkat

- 514 50456 Fall061aanswersDokumen4 halaman514 50456 Fall061aanswersVki BffBelum ada peringkat

- Accountin Rules - Session 1 SJDokumen5 halamanAccountin Rules - Session 1 SJKrishna ChaitanyaBelum ada peringkat

- Accounting Problem 1Dokumen12 halamanAccounting Problem 1Reynaldo BurgosBelum ada peringkat

- Financial Accounting Major Assignment1Dokumen7 halamanFinancial Accounting Major Assignment1Elham JabarkhailBelum ada peringkat

- Unit 1: Introduction of Business EquationDokumen14 halamanUnit 1: Introduction of Business EquationAnees GillaniBelum ada peringkat

- Chap 12 NotesDokumen3 halamanChap 12 NotesrbarronsolutionsBelum ada peringkat

- AccounBM1 - Recording Business TransactionsDokumen41 halamanAccounBM1 - Recording Business TransactionsKathlyn LabetaBelum ada peringkat

- Acc136 Module GuideDokumen36 halamanAcc136 Module Guidemcskelta8Belum ada peringkat

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadDokumen17 halamanSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadGregory Brown100% (21)

- M4 Transaction Analysis JEDokumen7 halamanM4 Transaction Analysis JEJohn Benedict Capiral TehBelum ada peringkat

- Grace LauiDokumen8 halamanGrace LauiLovely MafiBelum ada peringkat

- Chapter 11Dokumen13 halamanChapter 11pau mejaresBelum ada peringkat

- IrrecoverablwDokumen11 halamanIrrecoverablwgunasekarasugeethaBelum ada peringkat

- Adjusting For Bad DebtsDokumen16 halamanAdjusting For Bad DebtssamahaseBelum ada peringkat

- LB301 2011 06Dokumen4 halamanLB301 2011 06Clayton MutsenekiBelum ada peringkat

- Module 3Dokumen11 halamanModule 3Its Nico & SandyBelum ada peringkat

- Module 3Dokumen11 halamanModule 3Its Nico & SandyBelum ada peringkat

- AFR Practice ProblemsDokumen10 halamanAFR Practice ProblemsHassan ElhashamBelum ada peringkat

- Preparing Financial StatementsDokumen29 halamanPreparing Financial StatementsEnlightenMEBelum ada peringkat

- Bad Debts and Provision For Bad DebtsDokumen7 halamanBad Debts and Provision For Bad DebtsSyed Ali HaiderBelum ada peringkat

- Iguana: Profit TowsonDokumen11 halamanIguana: Profit TowsonJingwen YangBelum ada peringkat

- ACCTG W09 Chapter 8Dokumen15 halamanACCTG W09 Chapter 8kayla tsoiBelum ada peringkat

- Cambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtDokumen4 halamanCambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtShannen LyeBelum ada peringkat

- Bookkeeping Case Study 1Dokumen10 halamanBookkeeping Case Study 1Manu Madaan75% (4)

- Lecture 03Dokumen108 halamanLecture 03Masood AliBelum ada peringkat

- Worksheet 26-27Dokumen8 halamanWorksheet 26-27RealGenius (Carl)Belum ada peringkat

- Accounting For Receivables Practice SolutionsDokumen3 halamanAccounting For Receivables Practice SolutionsNgân GiangBelum ada peringkat

- Accounting 571-9Dokumen6 halamanAccounting 571-9Nicolle PotvinBelum ada peringkat

- Final Grading Exam - Key AnswersDokumen35 halamanFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- Professional English For Students of Logistics PDFDokumen187 halamanProfessional English For Students of Logistics PDFbibaBelum ada peringkat

- Check Trade Service FTU EDokumen4 halamanCheck Trade Service FTU EChu Minh LanBelum ada peringkat

- 2.traffic and QoS ManagementDokumen45 halaman2.traffic and QoS ManagementEdina HadzicBelum ada peringkat

- A Report OnDokumen63 halamanA Report OnPriya SharmaBelum ada peringkat

- BitRoyal Exchange Ltd. Is Globally Launching A New Crypto Trading PlatformDokumen2 halamanBitRoyal Exchange Ltd. Is Globally Launching A New Crypto Trading PlatformPR.comBelum ada peringkat

- SniffingDokumen120 halamanSniffingWoyBelum ada peringkat

- Sailor Rt5022 VHF DSC Sailor Rt5020 VHF DSC Duplex: Operation ManualDokumen68 halamanSailor Rt5022 VHF DSC Sailor Rt5020 VHF DSC Duplex: Operation ManualAleksey BuzulukovBelum ada peringkat

- Puregas Invoice - 2021-22-COM-268 - Chaitanya ParanthasDokumen2 halamanPuregas Invoice - 2021-22-COM-268 - Chaitanya ParanthasMansi SupekarBelum ada peringkat

- CEILLI Sample Questions - Set 1 (ENG)Dokumen13 halamanCEILLI Sample Questions - Set 1 (ENG)Premkumar NadarajanBelum ada peringkat

- Shivajirao Kadam Institute of Technology and Management: An Internship Report ONDokumen11 halamanShivajirao Kadam Institute of Technology and Management: An Internship Report ONYash KhuranaBelum ada peringkat

- 1132Dokumen112 halaman1132Kevin AndersonBelum ada peringkat

- Italy Ott Proposition: Andrea PaolettiDokumen7 halamanItaly Ott Proposition: Andrea PaolettiAndrea PaolettiBelum ada peringkat

- Lesson 1Dokumen12 halamanLesson 1riyaz878100% (2)

- Chirag STDokumen18 halamanChirag STchiragBelum ada peringkat

- Plano de Estudos 2022 Comunidade Cisco HackoneDokumen21 halamanPlano de Estudos 2022 Comunidade Cisco HackonepatrickluizjBelum ada peringkat

- First ExampleDokumen11 halamanFirst ExampleJanna GunioBelum ada peringkat

- GPS - GPA Plus Patient Survey QuestionsDokumen2 halamanGPS - GPA Plus Patient Survey QuestionsTaras AaekBelum ada peringkat

- Auditing Notes 111Dokumen1 halamanAuditing Notes 111Giriraju KasturiwariBelum ada peringkat

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Dokumen2 halamanHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekBelum ada peringkat

- Hero Housing - Sanction - 09.09.2022 - MCDokumen12 halamanHero Housing - Sanction - 09.09.2022 - MCvishwesheswaran1Belum ada peringkat

- Cash Collection Systems: 2005 by Thomson Learning, IncDokumen13 halamanCash Collection Systems: 2005 by Thomson Learning, IncuuuuufffffBelum ada peringkat

- William Kristol's 1993 Memo - Defeating President Clinton's Health Care ProposalDokumen5 halamanWilliam Kristol's 1993 Memo - Defeating President Clinton's Health Care Proposaldailykos75% (4)

- Analisis Keberlanjutan Aksesibilitas Angkutan Umum Di Kota SukabumiDokumen19 halamanAnalisis Keberlanjutan Aksesibilitas Angkutan Umum Di Kota Sukabumisahidan thoybahBelum ada peringkat

- PDFDokumen4 halamanPDFJunel King VillarBelum ada peringkat

- Financial Results Quarter Ended Mar 31 2023 Recommendation Final DividendDokumen20 halamanFinancial Results Quarter Ended Mar 31 2023 Recommendation Final DividendSudipta DasBelum ada peringkat

- HDFC LifeDokumen66 halamanHDFC LifeChetan PahwaBelum ada peringkat

- Modernizing Rail Transit Networks With CBTC TechnologyDokumen18 halamanModernizing Rail Transit Networks With CBTC TechnologyJoffrey LauthierBelum ada peringkat

- Saint Louis University Health Sciences Education Union at Saint Louis University Medical CenterDokumen2 halamanSaint Louis University Health Sciences Education Union at Saint Louis University Medical CenterSlusom WebBelum ada peringkat

- Ekb OZVi JDKQ 37 Ho GDokumen7 halamanEkb OZVi JDKQ 37 Ho GSahil SalujaBelum ada peringkat

- Lista Tranzactii: Dra Telehoi Andreea RO17BRDE140SV43532111400 RON Andreea TelehoiDokumen6 halamanLista Tranzactii: Dra Telehoi Andreea RO17BRDE140SV43532111400 RON Andreea TelehoiAndreeaBelum ada peringkat