EBook - Venture Capital & PE - Demo

Diunggah oleh

Rony JamesJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

EBook - Venture Capital & PE - Demo

Diunggah oleh

Rony JamesHak Cipta:

Format Tersedia

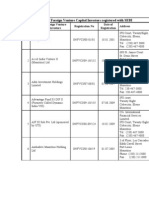

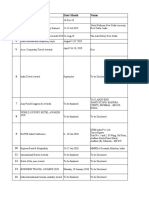

VENTURE CAPITAL and PRIVATE EQUITY Database

VC 21st Century Fund

50 East 91st Street, Suite 213

Indianapolis, IN 46240

Phone: 317-252-0258

Fax: 317-252-0255

http://www.elevateventures.com/programs/indiana-21-fund

Stage: Early, Seed

Industry: Agriculture & Agricultural Science, Communications & Networking, Defense & Homeland Security, Energy & Clean Tech, Information Technology, Life

Sciences & Healthcare, Manufacturing & Industrial, Software & Internet

The goal of the 21st Century Fund is to support the resolution of next-stage capital formation issues by co-investing with institutional investors in order to further

build innovative, high-impact, high-growth companies. As the 21 Fund's manager, Elevate works with early revenue-generating companies to solve product

demonstration and market penetration issues in order to accelerate company growth, milestone achievement, and job creation. Technical and business analysis is

conducted by Elevate Ventures staff using a structured internal venture validation process. If necessary, Elevate Ventures' Entrepreneurs-in-Residence work with

applicants to ensure that the technical and business plans are structured to make this review efficient and to provide useful feedback to the company. The 21st Century

Fund is sensitive to the acute challenges facing early-stage life science companies, especially in therapeutic verticals. They continue to be open to such opportunities

and strive to meet associated capital-intensive product development needs alongside institutional or strategic investors. The 21 Fund's maximum investment size is $2

million per company. Certain criteria for investment includes: for-profit entity headquartered in Indiana, addressable market size over $1 billion, disruptive business

models, coachable management team, and achievable growth and exit strategies.

Portfolio companies include: AIT Bioscience, App Press, bookacoach, CloudOne, haven, Husk, Sword Diagnostics, VoCare, Wolfe Diversified

Investment Team:

Alexandra Bowers, Executive Assistant, abowers@elevateventures.com

Barbara Uggen-Davis, Chief Financial Officer, buggen-davis@elevateventures.com

Chris LaMothe, Chief Executive Officer, clamothe@elevateventures.com

Erica Schweyer, Senior Analyst, eschweyer@elevateventures.com

Phil Lodato, General Counsel and Chief Compliance Officer, plodato@elevateventures.com

Ting Gootee, Chief Investment Officer, tgootee@elevateventures.com

VC 4G Ventures

14520 Quail Pointe Drive

Carmel, IN 46032

Phone: 317-816-9928

Stage: Seed

Industry: Software & Internet

4G Ventures is a venture firm focused on seed investments in software-as-a-service companies. The firm was founded by Bill Godfrey. The name, 4G, is a homage

to his four children: four Godfreys. While some of Central Indiana's angel investors take pride in high-volume investing with portfolios including up to 50

investments, Godfrey prefers to invest in fewer companies in a more concentrated way. To date, he has invested in nine companies in the range of $250,000 to $1

million, and he sits on the board of seven of them.

Portfolio companies include: DemandJump, Sigstr

Investment Team:

Bill Godfrey, Founding Partner

I 8ninths

942 Elliott Ave W

Seattle, WA 98104

Phone: 206-234-5222

www.8ninths.com

Stage: Seed

Industry: Information Technology, Software & Internet

8ninths is an R&D Lab and start-up Incubator founded in 2008 by two longtime Microsoft web veterans. The company takes its name from the concept that 8/9 of an

iceberg is hidden below the surface; the entrepreneurs look for new, emerging, hidden, and 'non-obvious' investments. The two founders have been conceiving,

building and leading product development on some of the largest and most revolutionary products Microsoft has ever produced since 1995. Until September 2008,

Co-Founder Adam Sheppard, worked in Microsoft CTO, Ray Ozzies' team as Director of Strategic Business Development for Microsoft Live Labs building external

partnerships and driving revenue through licensing programs. Co-Founder William Lai was a pioneer in the development of instant messaging, having led the

development team that was nominated as 'Legendary Development Team of Microsoft' and releasing MSN Messenger. He grew the service to become a cornerstone

of the Microsoft web offerings.

Portfolio companies include: Candence Online, Chevrolet, Fred Hutch, Great Nation Seat, Holland America Line, King, NASA, Parallels, Socrata, Sounders FC,

Toyota, Wally, XBOX

Investment Team:

Adam Sheppard, Co-Founder & CEO, ashepp@gmail.com

William Lai, Co-Founder & President, william@8ninths.com

VC Abell Foundation

111 South Calvert Street, Suite 2300

Baltimore, MD 21202-6174

Phone: 410-547-1300

Fax: 410-539-6579

www.abell.org

Stage: Early

Industry: Education & Training, Energy & Clean Tech, Life Sciences & Healthcare, Real Estate & Construction

Founded a half century ago, the Abell Foundation awards dollars to various programs, including its own venture investments. Among the Foundation's investments

are positions in companies that create jobs in Baltimore and promote various social objectives. The Foundation has seven broad program areas of interest: community

development; workforce development; education; health and human services; conservation and environment; and arts and culture. In 2013, the Abell Foundation

awarded $10,256,348 in grants ranging from $500 to $500,000.

Portfolio companies include: Breethe, Cera Tech Inc, Common Curriculum, Gliknik, Graybug, Harpoon Medical Inc., Network for Good, Noxilizer, PAICE LLC,

Perceptive Navigation, Personal Genome, Pixelligent, Pixelligent Technologies, Proper Baltimore fund, Sonavex, Sonify Biosciences, TRI, Vaccinogen, Vasoptic

Medical

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Investment Team:

Eileen O'Rourke, CFO, ​orourke@abell.org

Frances M. Keenan, Vice President of Finance, keenan@abell.org

Lynn Heller, Vice President, lheller@abell.org

Robert C. Embry, President, embry@abell.org

PE/ VC ABS Capital Partners

1700 Montgomery Street, Suite 440

San Francisco, CA 94111

Phone: 415-989-5100

Fax: 415-989-5105

400 East Pratt Street, Suite 910

Baltimore, MD 21202-3127

Phone: 410-246-5600

Fax: 410-246-5606

www.abscapital.com

Stage: Expansion, Growth, Middle Market

Industry: Business Services, Communications & Networking, Education & Training, Information Technology, Life Sciences & Healthcare, Media & Digital Media

ABS Capital Partners is a private equity firm that was founded in 1990 to invest in mid- to later-stage growth companies. The firm's investment strategy focuses on

companies in the health care, technology, business services and media & communications sectors. ABS has $2 billion under management and ten investing partners

within offices in Baltimore, San Francisco and Boston. ABS typically invests $10 to $30 million in growth companies with substantial revenues, near-term

profitability, solid customer bases and highly differentiated products or services in their focus industries. ABS provides a range of investment structures, including

expansion financings, management buyouts and recapitalizations. The firm has invested in over 60 portfolio companies. ABS typically makes investments in U.S.

based businesses. ABS has raised over $2 billion since inception, including the $420 million in ABS Capital Partners VI.

Portfolio companies include: Alarm.com, Aptegrity, Athletes' Performance, Avalere Health, Bambeco, Bravo Wellness, Brown Advisory, Commerce5, Cyveillance,

eFashion Solutions, FolioDynamix, Healthation, Ignite Media Solutions, IgnitionOne, INTTRA, InVision, ISO Group, iTok, iZotope, Modular Space, Pathology,

Payformance, PaySpan, RedZone Robotics, Rosetta Stone, Skinit, Syncapse, Tarpon Towers, Teachscape, TechMediaNetwork, Whitney International, Workscape,

Zoom Media Group

Investment Team:

Bobby Goswami, General Partner, bgoswami@abscapital.com

Cal Wheaton, General Partner, cwheaton@abscapital.com

Cass Gilmore, Principal

Deric Emry, General Partner, demry@abscapital.com

Don Hebb, Chairman & Founding Partner, dhebb@abscapital.com

James Stevenson, Chief Financial Officer, jstevenson@abscapital.com

John Stobo, Managing General Partner, jstobo@abscapital.com

Laura Witt, General Partner, lwitt@abscapital.com

Mark Anderson, General Partner, manderson@abscapital.com

Paul Mariani, General Partner, pmariani@abscapital.com

Phil Clough, Managing General Partner, pclough@abscapital.com

Ralph Terkowitz, General Partner, rterkowitz@abscapital.com

Robyn Lehman, Financial Principal, rlehman@abscapital.com

Stephanie Carter, General Partner, scarter@abscapital.com

Tim Weglicki, Founding Partner, tweglicki@abscapital.com

PE Accel-KKR

33 St. James's Square

London, SW1Y 4JS

UK

Phone: 44 (0) 20 7769 6736

2500 Sand Hill Road, Suite 300

Menlo Park, CA 94025

Phone: 650-289-2460

Fax: 650-289-2461

4300 Paces Ferry Road, Suite 610

Atlanta, GA 30339

Phone: 678-809-5989

Fax: 678-905-6809

www.accel-kkr.com

Stage: Middle Market

Industry: Business Services, Communications & Networking, Information Technology, Software & Internet, Storage & Hardware

Founded in 2000, Accel-KKR is a technology-focused private equity investment firm founded by venture firm Accel Partners and leveraged buyout firm Kohlberg

Kravis Roberts & Co. (KKR). With over $2.0 billion of capital under management, the firm's target investment size ranges from $10 to $100 million, although

Accel-KKR has the ability to take larger or smaller stakes as appropriate. The firm targets investments in companies with annual revenues ranging from $10mm to

$200mm. Accel-KKR focuses primarily on three types of transactions: buyouts of divisions, subsidiaries and business units from public companies; acquisitions and

recapitalizations of closely-held private companies; and going-private transactions of small public companies. Although Accel-KKR pursues transactions across

multiple segments, the firm is specifically active in a wide range of sub-segments, including enterprise and infrastructure software, vertical market application

software, technical software, networking software, enterprise computing and data storage, storage networking, data communications, Internet services, business

process outsourcing and professional IT services.

Portfolio companies include: Accellos, Alexander Gallo Holdings, Alias, Applied Predictive Technologies, Applied Technologies, Cendyn, CRS Retail Systems,

Endurance International Group, Infinisource, IntrinsiQ, iTradeNetwork, Kana Software, Layered Technologies, Model N, N-Able Technologies, North Plains, Opera

Solutions, PageUp People, Paymentus, PinStripe, RiseSmart, Saber, Savista, Systems & Software, The Endurance International Group, YourEncore

Investment Team:

Ben Bisconti, Managing Director, bbisconti@accel-kkr.com

Clara Yee, VP of Finance

Dean Jacobson, Principal, djacobson@accel-kkr.com

Greg Williams, Managing Director, gwilliams@accel-kkr.com

Jason Klein, Managing Director, jklein@accel-kkr.com

Joe Savig, Principal, jsavig@accel-kkr.com

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Park Durrett, Principal

Patrick Fallon, Managing Director

Rob Palumbo, Managing Director, rpalumbo@accel-kkr.com

Tom Barnds, Managing Director, tbarnds@accel-kkr.com

I Accelerator

430 East 29th Street

New York, NY 10016

Phone: 206-957-7300

Fax: 206-957-7399

1616 Eastlake Avenue East, Suite 200

Seattle, WA 98102

Phone: 206-957-7300

Fax: 206-957-7399

www.acceleratorcorp.com

Stage: Seed

Industry: Life Sciences & Healthcare

Accelerator Corporation, founded in 2003, is a privately-held biotechnology investment and development company located in Seattle and New York. Resources

provided by Accelerator and its Affiliates - MPM Capital, ARCH Venture Partners, Alexandria Real Estate Equities, Inc., Versant Ventures, Amgen Ventures, OVP

Venture Partners, and the Institute for Systems Biology - include committed investment capital, state-of-the-art facilities, world-class scientific and technical expertise

and support, and experienced start-up management. Accelerator occupies an 18,000 square foot state-of-the-art space located within a 165,000 SF facility owned and

developed by an affiliate of Alexandria Real Estate Equities, Inc. in the midst of the vibrant Eastlake life science cluster in Seattle. The facility includes a number of

laboratory/office 'suites' as well as common space (reception, conference rooms, break room, etc.) and support infrastructure (autoclave/glass wash, DI water system,

telecommunications/network, etc.). In the past nine years, twelve companies have been invested in through Accelerator. Five have emerged and raised follow on

financings of more than $164 million. Three remain under management at Accelerator. In all, Accelerator companies have raised in excess of $221 million in initial

and follow-on financings. Accelerator's investors have committed an additional $22.5 million to enable Accelerator to continue to identify, capitalize, and develop the

next-generation of exciting emerging biotechnologies. In July of 2014, the firm announced the closing of Accelerator IV with $51.1 million in capital commitments.

Portfolio companies include: Acylin Therapeutics, Allozyne, Groove BioPharma, Integrated Diagnostics, Isocket, Lodo Therapeutics, Mirina, OncoFactor,

PharmSelex, Recodagen, Theraclone Sciences, VieVax, VLST, XORI

Investment Team:

Alice Chen, Principal

David McElligott, Chief Scientific Officer

David Schubert, Venture Partner & Director of Innovation

Lindsay Rayle, CFO

Thong Q. Le, CEO

VC Access Medical Ventures

21 Habarzel Street

Tel-Aviv, 6971029

Israel

Phone: 972-77-5055645

Fax: 972-153-77-5055438

35 Windsor Road

North Haven, CT 06473

Phone: 203-281-4585

http://accessmv.com

Stage: Early, Expansion, Growth

Industry: Medical Device

Access Medical Ventures is a U.S based venture capital fund that focuses specifically on investing and advancing medical device start-ups. AMV's primary interest is

investing in interventional and therapeutic medical device start-ups, along with the variety of all the medical disciplines. AMV aims to invest both in early-stage

medical device start-ups with promising, ambitious entrepreneurs as well as later stage companies with strong management teams.

Portfolio companies include: CartiHeal

Investment Team:

Lieor Schops

Limor Sandach

Michael Tal, mtal@accessmv.com

VC Accuitive Medical Ventures

5542 First Coast Hwy., Suite 301

Fernandina Beach, FL 32034

Phone: 904-261-9690

2905 Premiere Parkway, Suite 150

Duluth, GA 30097

Phone: 678-812-1101

Fax: 678-417-7325

www.amvpartners.com

Stage: Early, Expansion, Growth

Industry: Medical Device

Accuitive Medical Ventures (AMV Partners) is a venture capital organization focused on early to expansion stage investments in highly proprietary, emerging

medical device and technology companies. The fund is committed to a risk-reduced approach to venture investing, utilizing a proprietary pipeline of potential

transactions through unique relationships with the industry's pre-eminent incubators and VC investors (including Atlanta's Innovation Factory). AMV Partners' first

investment ranges from several hundred thousand dollars to about $3 million, and generally between $4-6 million dollars over the lifetime of the investment. AMV

Partners has no geographic preferences and will invest nationwide. AMV has co-founded 20 companies, raised over $230 million of committed capital and

participated in private and public equity financings of well over $750 million while creating over billions in shareholder value. The firm maintains offices in Atlanta,

Palo Alto, CA, and Fernandina, FL.

Portfolio companies include: Acufocus, AqueSys, AxoGen, Cardiac Concepts, CardioFocus, Cellutions, Halscion, Inogen, Intuity Medical, LipoSonix, MyoScience,

NeoVista, Neuronetics, Nevro, OsteoLign, Respicardia, Sadra Medical, Sebacia, SoftScope, Torax Medical, WaveTec Vision

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Investment Team:

Charles E. Larsen, Managing Director, charlie@amvpartners.com

Cory Anderson, Principal

Gerard van Hamel Platerink, Managing Director, 678-812-1142, gerard@amvpartners.com

Gordon T. Wyatt, Chief Financial Officer

John Deedrick, Co-Founder & Venture Partner, john@amvpartners.com

Tom Weldon, Chairman and Managing Director, 678-812-1101, tom@amvpartners.com

VC Ackerley Partners

4111 East Madison St., #350

Seattle, WA 98112

Phone: 206-624-2888

Fax: 206-623-7853

www.ackerley.com

Stage: Early, Expansion, Growth

Industry: Media & Digital Media, Sports & Entertainment

Founded in June 2002, Ackerley Partners, LLC is a privately held investment company with a focus on media and entertainment investment opportunities, including

but not limited to: select investment banks, historical relationships from the media sector, entrepreneurs, institutional investors, private equity firms and venture

funds. Ackerley seldom takes a leading investment/ownership position, preferring to assume a minority ownership position or teaming with other institutional

financial backers. The firm considers development-stage companies with exceptional management teams that are targeting emerging markets in sectors in which the

partners have experience; however, the primary focus is on companies that are in a later stage of fundraising, typically B or later, and have an established product

and/or service that is generating revenue with a reasonable path to profitability.

Portfolio companies include: BuzzLogic, Cequint, CSTV, Elevation Partners, FastChannel, FlexPlay Technologies, Hidden City Games, Howcast, Jott, Judy's Book

, Labrador Mobile, LicenseStream, Mobliss, Nascar Members Club, Plum TV, Screenlife, Twelvefold Media, Withoutabox

Investment Team:

Chris Ackerley, Co-Founder

Kim Ackerley Cleworth, Co-Founder and Partner

Ted Ackerley, Co-Founder

FI Acorn

12 Gate Post Ct.

Potomac, MD 20854-1735

Phone: 301-526-0172

www.acornllc.com

Stage: Early, Seed

Industry: Communications & Networking, Information Technology, Life Sciences & Healthcare, Software & Internet

Acorn is a private equity investment company, providing angel financing to start up companies in the technology and bioscience industries. Since its establishment in

1996 and its incorporation in 1999, it has provided hands on investing to over 10 start-ups, primarily in the Washington DC and Atlanta metropolitan areas. It is also

an investment partner in Blue Water Capital Venture Fund II, a growth stage private equity fund for infotech companies, and in the Maryland Angels Council, an

organized group of angel investors providing financing and mentoring for technology and bioscience companies in the Mid-Atlantic Area. Acorn is the private equity

investment vehicle for the Oakes Family, located in the Washington DC and Atlanta, Georgia areas. The principals are William Oakes Jr., William Oakes III, and

Patricia Oakes Poulos. Acorn focuses on technology based products or services in Telecom, Software, IT, Internet, and E-Business; and in Bioscience based products

or services such as Biotech, Pharmacia, Health Care, and Bioinformatics.

Portfolio companies include: Buildtopia, InfoEther, Maryland Angels Council, Max Pitch Media, Midtown Bank and Trust, Neurostar Solutions, Optiview, Stheno,

Tosca, Universal Implant Systems, VideoNEXT Soultions

Investment Team:

Patricia Poulos Oakes, Director, patricia@acornllc.net

William Oakes, Managing Director, wroakes@acornllc.net

William Oakes, Director, bill.oakes@acornllc.net

A Acorn Ventures

PO Box 6847

Bellevue, WA 98008

Phone: 425-462-1345

Fax: 425-462-4950

www.acornventures.net

Stage: Early

Industry: Communications & Networking, Information Technology, Manufacturing & Industrial, Software & Internet, Sports & Entertainment

Acorn Ventures is a Bellevue, Washington based Angel fund founded by Rufus W. Lumry in 1991 after his retirement as EVP/CFO of McCaw Cellular

Communications (now AT&T Wireless). Acorn's mission is to find, fund and nurture early-stage companies that present extraordinary opportunities to make

industry-changing leaps in technology and applications.

Portfolio companies include: Airbiquity, BigTip, BuddyTV, Centricity Records, Cheezburger, Digital Scirocco, Gigoptix, Paksense, Perlego Systems, SimplyFun

Investment Team:

Caren Seidle, Chief Financial Officer, caren@acornventures.net

Elaine Scherba, Senior Vice President and Principal, elaine@acornventures.net

Joni Bornstead, Office Manager, joni@acornventures.net

Maryan Regan, Financial Operations Manager, maryan@acornventures.net

Rufus Lumry, Founder & President

Scott Drum, Chief Marketing Officer, scott@acornventures.net

I Advanced Technology Development Center

75 Fifth Street, N.W., Suite 202

Atlanta, GA 30308

Phone: 404-894-3575

311 Ferst Drive

Atlanta, GA 30332

Phone: 404-894-3575

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

190 Technology Circle, Suite 145

Savannah, GA 31407

Phone: 912-963-2519

www.atdc.org

Stage: Seed

Industry: Information Technology, Life Sciences & Healthcare

Formed in 1980, the Advanced Technology Development Center (ATDC) is a nationally recognized technology incubator that helps Georgia entrepreneurs launch

and build successful companies. Headquartered at the Georgia Institute of Technology, ATDC has been recognized by Inc. Magazine as one of the nation's top

non-profit incubators. ATDC provides strategic business advice and connects its member companies to the people and resources they need to succeed. More than 130

companies have emerged from ATDC, including publicly-traded firms such as MindSpring Enterprises. ATDC also manages a seed capital fund that invests in

Georgia-based businesses pursuing innovation in bioscience and advanced technology. The fund collaborates with both local and national investors, investing $1 of

its own capital for every $3 of private investment. The fund can invest up to $1 million in any one company. Launched by a multi-year grant from the Charles A.

Edison Fund, the Georgia Tech Edison provides seed funding for early-stage technology companies that have a close association with Georgia Tech. The Fund

invests in companies that may be founded by Georgia Tech faculty, students and graduates; licensing technology from Georgia Tech; sponsoring research at Georgia

Tech; or even hiring a large number of Georgia Tech alumni. Investments are generally less then $250,000.

Portfolio companies include: AccelerEyes, AptiData, Axion Biosystems, BioAutomation Systems, BLiNQ Media, BrightWhistle, Celtaxsys, Clinigence, Digital

Assent, InterCAX, KontrolFreek, LIFT Retail Marketing Technology, Lucena Research, Merlin Mobility, MessageGears, NeuroOp, OneCare, OpenStudy, Oversight

Technologies, Patientco, Physiostream, Pindrop Security, Preparis, Profounder, ProviderWeb Capital, Proximus Mobility, Quellan, RideCell, SalesLoft, Scientific

Intake, Sentrinsic, ShapeStart Measurement Systems, Sila Nanotechnologies, SimpleC, Skytree, Social Fortress, SoloHelath, Soneter, SportsCrunch, Sytheros

Communications, Toomah, TripLingo, Urjanet, Vehcon, Visioneering, VoAPPs

Investment Team:

Betsy Plattenburg, Community Catalyst, betsy@atdc.org

Blake Patton, Entrepreneur in Residence

Charlie Paparelli, Angel in Residence

Connie Casteel Connie Casteel, SBIR Catalyst

Dan Ciprari, Entrepreneur in Residence

Ivy Hughley, Client Support Manager, ivy.hughley@innovate.gatech.edu

Jennifer Bonnett, Community Catalyst

Jenny Bass, Community Catalyst

Joy Hymel, Campus Outreach Catalyst

KP Reddy, Interim General Manager

Shane Matthews, Community Catalyst

Tom Bates, Entrepreneur in Residence

VC Advantage Capital Partners

c/o Eastside Partners

207 East Side Square, Suite 200

Huntsville, AL 35801

Phone: 256-883-8711

Fax: 256-883-8558

6293 Silverado Trail

Napa, CA 94558

Phone: 707-944-2310

Fax: 707-945-0161

Wolf Asset Mgmt. Corp. c/o The Simha Group

5690 DTC Boulevard, Suite 285 West

Greenwood Village, CO 80111

Phone: 303-321-4800

Fax: 303-468-9586

c/o Ironwood Capital

45 Nod Road

Avon, CT 06001-3819

Phone: 860-409-2100

2445 M St., NW Suite 234

Washington, DC 20037

Phone: 202-457-4190

Fax: 202-457-4191

174 W. Comstock Ave., Suite 209

Winter Park, FL 32789

Phone: 407-454-6184

Fax: 407-740-8091

1911 Elmore Avenue

Downer's Grove, IL 60515

Phone: 630-241-1848

Fax: 312-577-4223

909 Poydras Street, Suite 2230

New Orleans, LA 70112

Phone: 504-522-4850

Fax: 504-522-4950

190 Carondelet Plaza, Suite 1500

St. Louis, MO 63105

Phone: 314-725-0800

Fax: 314-725-4265

208 West Georgetown Street

Crystal Springs, MS 39059

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Phone: 601-954-6636

Fax: 601-954-6636

869 Lakeshore Blvd.

Incline Village, NV 89451

Phone: 775-298-1338

5 Warren Street, Suite 204

Glens Falls, NY 12801

Phone: 518-743-0060

Fax: 518-743-1787

156 West 56th Street, Suite 801

New York, NY 10019

Phone: 646-685-8755

5000 Plaza on the Lake, Suite 195

Austin, TX 78746

Phone: 512-380-1168

Fax: 512-241-1186

c/o Venture Investors

505 S. Rosa Road, Suite 201

Madison, WI 53719

Phone: 608-441-2700

Fax: 608-441-2727

www.advantagecap.com

Stage: Early, Expansion, Growth, Middle Market

Industry: Agriculture & Agricultural Science, Business Services, Communications & Networking, Energy & Clean Tech, Financial Services, Information Technology

, Life Sciences & Healthcare, Manufacturing & Industrial, Real Estate & Construction, Retail & Restaurant, Software & Internet

Advantage Capital Partners is a group of venture capital partnerships that has raised more than $2 billion in capital. Founded in 1992, the firm has grown to include

offices in Missouri, Louisiana, New York, Texas, California, Illinois, Florida, Mississippi and Washington, D.C., with affiliated offices in Alabama, Colorado and

Wisconsin. The firm's focus is primarily in the Communication, Information Technology, Life Science and Energy sectors in markets that are underserved by other

private equity funds. Advantage makes investments in companies at all stages except seed round financings. Advantage's typical initial investment ranges from

$500,000 to $2 million. Advantage also provides small business financing through BizCapital, Advantage Capital's wholly owned non-depository financial institution

that is licensed by the Federal Government to make SBA and USDA loans. Established in 1999, BizCapital's primary mission hinges on offering small companies

competitive loan structures, which are government guaranteed in nature. BizCapital investments typically are straight debt instruments, debt with warrants, or

convertible debentures in the preferred industries of basic manufacturing, marine transportation, retail, health services, and energy. Investments range from as small

as $250,000 to as large as $5,000,000, and in most cases are secured or semi-secured by fixed asset collateral. In 2005, Advantage Capital also established a Small

Business Finance Fund of $32 million for companies and entrepreneurs in low-income communities.

Portfolio companies include: 3DR Laboratories, A.V. Smoot, Ableplanet, Adventure Central, agencyQ, AGIS Network, Agri-Source, AlfaLight, Anark, ArcMail

Technology, Artful Home, AuthenTec, Barton Nelson, Binoptics, Bizzuka, Broadpoint, Butler's Pantry, Caradax Pharmaceuticals, Cellectar, Chapman Instruments,

CheckPoint Pumps & Systems, City Carting & Recycling, Code Red Training, Computime, Contego Services Group, Crown Plastics, Crown Systems,

Digium/Asterisk, Elevate Digital, EmergingMed, Emme E2MS, Environmental Operations, Esperance Pharmaceuticals, Fire Rock, FleetCor, Floop, Fortress Risk

Management, Gleason Automation Systems, Glori Energy, Golden Goal Youth Soccer & Lacrosse Tournament Park, Greenleaf Biofuels, GridPoint, Group 360,

Hawaii Biotech, Historic Restoration, Hoku Scientific, iCardiac Technologies, Indeeco, Jahabow, Kereos, Knoa Software, Lawrence Group, Life Life Academy,

LiveClips, Manna Pro, Mason Manufacturing, Mezmeriz, Mid America Brick, Monarch Machine Tool, Motion Computing, Nanopoint, NeuWave Medical, New

England Linen Supply Company, Next Learn, Nextility, Niagara Dispensing Technologies, NovaTract Surgical, Novelos Therapeutics, OrderWithMe, Owensboro

Grain Company, Pasteuria Bioscience, PayIt, PECO Pallet, Prioria Robotics, Producers' Choice Soy Energy, QuaDPharma, Quality Wood Products, Quickoffice,

Renaissance Financial, Rucker's Wholesale & Service, Selltis, Shenandoah Growers, Skystream Markets, Soft Switching Technologies, SOMS Technologies, Stout,

Summit Broadband, Sunburst Farms, Synacor, The Green Life Guides, Traxo, Veran Medical Technologies, Waste Remedies, Xiolink, Zadspace

Investment Team:

Charles H. Booker, Principal, cbooker@advantagecap.com

Christopher C. Harris, VIce President, charris@advantagecap.com

Damon L. Rawie, Managing Director, drawie@advantagecap.com

Franchesca Lorio, SVP, florio@advantagecap.com

James O' Rourke, Managing Director, jo'rourke@advantagecap.com

Jeffrey W. Craver, Principal, jcraver@advantagecap.com

Jeremy R. Degenhart, Principal, jdegenhart@advantagecap.com

Jonathan Goldstein, Managing Director, jgoldstein@advantagecap.com

Jonathan I. Goldstein, Managing Director, jgoldstein@advantagecap.com

Justin N. Obletz, Senior Vice President, jobletz@advantagecap.com

Louis T. Dubuque, Managing Director, ldubuque@advantagecap.com

Maurice E. Doyle, Managing Director, mdoyle@advantagecap.com

Michael T. Johnson, Managing Director, COO, mjohnson@advantagecap.com

Michelle Fleher, AVP, mfleher@advantagecap.com

Philip E. Marshall, Principal, pmarshall@advantagecap.com

Reid Hutchins, Principal, rhutchins@advantagecap.com

Richard T. Hummell, Principal, rhummell@advantagecap.com

Ryan Dressler, VP, rdressler@advantagecap.com

Ryan M. Brennan, Managing Director, rbrennan@advantagecap.com

S. Talmadge Singer, Senior Vice President, tsinger@advantagecap.com

Scott Murphy, Managing Director and Chief Investment Officer, smurphy@advantagecap.com

Steven T. Stull, President, ccoleman@advantagecap.com

Thomas Bitting, VP, tbitting@advantagecap.com

Thomas W. Keaveney, Board Member and Senior Advisor, smurphy@advantagecap.com

Timothy W. Hassler, Principal, thassler@advantagecap.com

PE AEA Investors

Widenmayerstr 3

Munchen, 80538

Germany

Phone: 49 (89) 244 173 0

Fax: 49 (89) 244 173 860

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

78 Brook Street

London, W1K 5EF

UK

Phone: 44 (20) 7659 7800

Fax: 44 (20) 7491 2155

Suite 2903, 29/F Kerry Center, Tower 2

1539 Nanjing Road West, Jingan District

Shanghai, 200040

China

Phone: 86-21-2308-7888

Fax: 86-21-2308-7880

Two Stamford Plaza

281 Tresser Boulevard, 15th Floor

Stamford, CT 06901

Phone: 203-564-2660

Fax: 203-564-2661

666 Fifth Avenue, 36th Floor

New York, NY 10103

Phone: 212-644-5900

Fax: 212-888-1459

www.aeainvestors.com

Stage: Middle Market

Industry: Business Services, Consumer Products & Services, Manufacturing & Industrial

AEA is a pioneer in the private equity industry, having been founded in 1968 by the Rockefeller, Mellon, and Harriman family interests and S.G. Warburg & Co.

With almost 45 years of investing experience, AEA has established a track record of achieving returns as a leading private equity partner to middle market

companies. AEA focuses on control buyouts in four industry sectors: value-added industrial products, specialty chemicals, consumer products, and services involved

in these sectors. With offices in New York, London, and Hong Kong, the firm focuses on buying businesses headquartered in the U.S. and Europe (and selectively in

Asia). AEA's middle market private equity team currently manages over $10 billion of invested and committed capital. In 2004, AEA formed AEA Small Business

Fund as its principal investment vehicle for pursuing leveraged buyout investment opportunities in the United States small business market. The Small Business Fund

has $285 million of capital under management. In 2005, AEA formed the AEA Mezzanine Fund to pursue mezzanine debt investment opportunities in middle market

companies. The Mezzanine Fund has $600 million of capital under management. In 2007, AEA formed the AEA Middle Market Debt Fund to pursue senior secured

debt investment opportunities in middle market companies. The Middle Market Debt Fund has over $300 million of capital under management.

Portfolio companies include: 1800 Contacts, 24 Hour Fitness, Aramsco, At Home, Balboa Group, BOA Group, Brand Networks, Dayton Parts, Dematic, Evans

Network, Evoqua, Flow Control Group, Galco Industrial Electronics, Generation Brands, GMS, Inovar, Lone Star, NES Global Talent, Promach, SBP Holdings,

Sparrows Group, Suhyang Networks, Swanson Industries, Three Sixty Group, Troxell, Unifrax

Investment Team:

Alan Wilkinson, Managing Director, awilkinson@aeainvestors.com

Axel Holtrup, Partner, aholtrup@aeainvestors.com

Baron Carlson, Partner, bcarlson@aeainvestors.com

Benjamin Althaus, VP, balthaus@aeainvestors.com

Benjamin Cannon, VP, bcannon@aeainvestors.com

Brian Hoesterey, Partner, bhoesterey@aeainvestors.com

Christopher Basham, VP, pbasham@aeainvestors.com

David P. Manzano, Partner, dmanzano@gmail.com

Gary Cappeline, Operating Partner, gcappeline@aeainvestors.com

J. Louis Sharpe, Partner

James Ho, Partner, jho@aeainvestors.com

Jessica Hodgkinson, VP

John Cozzi, Partner, jcozzi@aeainvestors.com

John Garcia, CEO and Chairman, jgarcia@aeainvestors.com

Joseph D. Carrabino, Partner, jcarrabino@aeainvestors.com

Martin Eltrich, Managing Director, meltrich@aeainvestors.com

Nannette McNally, Partner, nmcnally@aeainvestors.com

Sandra Ginker, VP, sgrinker@aeainvestors.com

Scott Zoellner, Partner, szoellner@aeainvestors.com

Steven DeCillis, CFO & Partner, sdecillis@aeainvestors.com

Thomas Pryma, Partner, tprima@aeainvestors.com

Thomas W. S. Groves, Partner, tgroves@aeainvestors.com

VD Agility Ventures

101 E. Gurley St., Suite 202

Prescott, AZ 86301

Phone: 928-541-0771

Fax: 928-541-0773

www.agilityventures.com

Stage: Early

Industry: Communications & Networking, Information Technology

Agility Ventures specializes in financing and consulting for the Broadband Industry. The firm was founded by owners and managers of successful Wireless Internet

Service Providers (WISPs) and technology finance companies. Since 2004, Agility has been providing venture debt funding to several of the largest independent

broadband network operators in the United States.

Portfolio companies include: Air Canopy, Airband, Cache Broadband, Canyon Broadband, Central Oregon Wireless, CommSpeed, Compulinx, Digital Bridge, ERF

Wireless, Frontier Broadband, Home Town, KC Nap, Keyon, Metrobridge, Michiana, MStar, Neighbor Networks, New Era, Omnicity, Pixius, Road 9, Sierra

Advantage, Skyrider, SPITwSPOTS, Vaspian, Vroom Wireless

Investment Team:

Bill MacNamara, Director of Business Development

Hal Hayden, Managing Director, hhayden@agilityventures.com

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Ken Colvin, Controller, kcolvin@agilityventures.com

Rena Curtis, Lease Manager, rcurtis@agilityventures.com

PE AGS Capital

5424 W. Crenshaw St.

Tampa, FL 33634

9850 E. 30th Street

Indianapolis, IN 46229

Phone: 317-895-2701

www.ags-capital.com

Stage: Middle Market

Industry: Business Services, Manufacturing & Industrial, Transportation & Distribution

AGS Capital is an Indianapolis based company that invests, owns, and provides capital and financial resources to numerous private companies in the U.S. and

Canada. With over $200,000,000 raised through public offerings and $75,000,000 in private capital arrangements, AGS' team has refinanced multi-million dollar

companies in a variety of industries including aircraft, manufacturing, warehousing, real estate and more.

Portfolio companies include: 9850, LLC, Ace Mobility, AGS IT Services, deskPort, Destinations Press, Hoosier Trim Products, Morgan-Francis Flagpoles, Paws

Aboard, Sams Technical Publishing, SMT Transportation, Superior Employee Services, Superior Metal Technologies

Investment Team:

Alan Symons, Chairman, 317-895-2701, asymons@ags-capital.com

Cherie Smith, Corporate HR Director, 317-895-2708, csmith@ags-capital.com

Keith Siergiej, Chief Financial Officer, 317-895-2703, ksiergiej@ags-capital.com

Kyle Blue, Vice President, kblue@ags-capital.com

Steve Blackburn, President, sblackburn@ags-capital.com

Terri Symons, Vice President, tsymons@ags-capital.com

PE Aldrich Capital Partners

6430 Rockledge Dr., Suite 503

Bethesda, MD 20817

Phone: 703-376-3570

Fax: 703-376-3569

http://www.aldrichcap.com/

Stage: Middle Market

Industry: Financial Services, Information Technology, Life Sciences & Healthcare, Software & Internet

Aldrich Capital Partners (ACP) is a middle-market private equity firm investing in promising enterprises in the United States. Aldrich Capital Partners primarily

focuses on investments in technology sectors such as healthcare IT, internet, software and financial services technologies. ACP has a national presence, headquartered

in the Washington D.C. metro area, with additional offices in the San Francisco Bay Area and a research center in Hyderabad, India. The firm's Growth Equity Fund

investment mandate covers North American firms with sustainable revenues and competitive advantage, $5-50 million in annual sales and EBITDA of at least $1

million.

Portfolio companies include: Amazon, American Greetings, Anka, Decision One, Health Recovery Systems, Imaging Advantage, Kiwi Tech, Lavu, Legal

Advantage, Legal Igaming Inc, Loma Vista Medical, PhishMe, Respond, Smart Bargains, Stamps.com, Streamlined Medical Solutions, Woundtech

Investment Team:

Mirza Baig, Partner, mirza@aldrichcap.com

Raheel (Raz) Zia, Partner, raz@aldrichcap.com

PE/ VC Alerion Capital Group

7702 East Doubletree Ranch Rd., Suite 350

Scottsdale, AZ 85258

Phone: 480-367-0900

Fax: 480-367-0936

1338 South Foothill Drive, Suite 190

Salt Lake City, UT 84108

Phone: 801-415-9163

www.alerion.com

Stage: Expansion, Middle Market

Industry: Communications & Networking, Information Technology, Semiconductor, Software & Internet, Storage & Hardware

Founded in the 1990's, Alerion Capital Group is a private equity and management advisory firm investing in later stage, mid-market businesses in the Mountain West,

Southwest and Pacific areas. Alerion invests in the following technology industry sectors: hardware and devices, electronics, instrumentation, semiconductor,

software, business technology services, and technology enabled services (non-technology industry). Potential companies should have a definable market, significant

growth opportunities, demonstrated and sustainable profitability, an experienced management team, an established business model, and proprietary technology,

processes or services. Potential investments should also have a gross enterprise value between $5 million and $50 million dollars, annual revenues between $5 and

$100 million dollars, and a minimum EBITDA of $1.5 million.

Portfolio companies include: Apex Microtechnology, BioVigilant Systems, Kiosk Information Systems, LumenIQ, Steton, Tiros, VTI Instruments, VXI Technology

, Worldlink Integration Group

Investment Team:

Cindy Bloch, Business Development

Jeffrey Unruh, Managing Director, jeffunruh@alerion.com

Jerry Lindfelt, Principal

Jim Unruh, Founding Principal, jimunruh@alerion.com

Rick Deavila, Managing Director, rickdeavila@alerion.com

CVC Alexandria Real Estate Equities

4660 La Jolla Village Drive, Suite 725

San Diego, CA 92122

Phone: 858-638-2800

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

1700 Owens Street, Suite 590

San Francisco, CA 94158

Phone: 415-554-8848

400 Technology Square, Suite 101

Cambridge, MA 02139

Phone: 508-755-4249

946 Clopper Road

Gaithersburg, MD 20878

Phone: 301-947-1770

7020 Kit Creek Road, Suite 100

Research Triangle Park, NC 27709

Phone: 919-313-6645

450 East 29th Street, Suite 1500

New York, NY 10019

Phone: 646-223-03882

1600 Fairview Avenue East, Suite 100

Seattle, WA 98102

Phone: 206-408-1554

http://www.are.com/

Stage: Early, Seed

Industry: Energy & Clean Tech, Life Sciences & Healthcare, Medical Device

Alexandria Equities, LLC is the strategic investment entity of Alexandria Real Estate Equities, Inc. (ARE: NYSE). Alexandria Equities provides capital to the broad

and diverse life science sector. Since 1994, Alexandria Real Estate has created first-in-class life science clusters that foster innovative and collaborative environments

in key locations immediately proximate to leading research institutions. Alexandria's diverse tenant base includes internationally renowned academic and medical

institutions, multinational pharmaceutical companies, leading private and public biotechnology entities, non-profit institutions, government agencies, medical device

companies, biofuels companies, research tools and service companies, and venture capitalists.

Portfolio companies include: Adaptive Biotechnologies, Agrivida, Atara Biotherapeutics, Aura Biosciences, Benson Hill Biosystems, Biological Dynamics,

Calimmune, Concert Pharmaceuticals, Cydan, Flex Pharma, Lodo Therapeutics, RGenix, Seres Health, Syros Pharmaceuticals, Theraclone Sciences, Visterra, Vtesse,

WellDoc, Yumanity Therapeutics

Investment Team:

Amanda Cashin, Senior Vice President

Andres Gavinet, Chief Accounting Officer

Daniel J. Ryan, Executive VP and Regional Market Director

Dean A. Shigenaga, Chief Financial Officer & Treasurer, dshigenaga@labspace.com

Jennifer J. Banks, Executive Vice President

Joel S. Marcus, Chairman, jmarcus@labspace.com

John Cunningham, Sr. VP of Strategic Operations, jcunningham@labspace.com

John J. Cox, Senior Vice President

Larry J. Diamond, Senior Vice President

Marc E. Binda, Senior Vice President

Peter M. Moglia, Chief Investment Officer

Stephen A. Richardson, Chief Operating Officer and Regional Market Director

Thomas J. Andrews, Executive Vice President

Vincent R. Ciruzzi, Senior Vice President

PE Alinda Capital Partners

Augustine House

Austin Friars

London, EC2N 2HA

UK

Phone: 44 20 7101 2500

Fax: 44 20 7101 7721

Konigsallee 61

Dusseldorf, 40215

Germany

Phone: 49 211 42471 327

Fax: 49 211 298 9008

100 West Putnam Avenue

Greenwich, CT 06830

Phone: 203-930-3800

Fax: 203-930-3880

600 Travis Street, Suite 6290

Houston, TX 77002

Phone: 713-315-2900

Fax: 713-315-2940

www.alinda.com

Stage: Middle Market

Industry: Energy & Clean Tech, Manufacturing & Industrial, Transportation & Distribution

Alinda Capital Partners looks for infrastructure assets in North America and Europe that have a strong operating record or are under construction and can demonstrate

a potential for: steady, growing and predictable cash flow; strategic competitive advantage; or limited commodity or merchant risk. Specific sectors of interest include

transportation, energy, power, water and wastewater, and utility services for residential, commercial and industrial customers. The firm manages the Alinda

Infrastructure Fund, an unlisted institutional fund with over $7.8 billion in capital and approximately $15 billion in purchasing power. Over the past 25 years, Alinda

has been responsible for over $150 billion of infrastructure investing. Alinda owns interests in infrastructure businesses that operate in 31 states in the United States,

all 10 Canadian provinces, 6 European nations and Mexico.

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Portfolio companies include: AC Biogas Group, Binnenlandse Container Terminals Nederland, Cambridge Water, Heathrow Airport Holdings, Heathrow Express,

Houston Fuel Oil Terminal Company, Regency Intrastate Gas System, Santa Paula Water, South Staffordshire Water, SSI Services, Worsham-Steed

Investment Team:

Alex Black, Partner, 203-930-3815, alex.black@alinda.com

Andrew Bishop, Partner, 44 20 7101 2023, andrew.bishop@alinda.com

Christopher W. Beale, Managing Director, 203-930-3801, chris.beale@alinda.com

Jim Metcalfe, Partner, 203-930-3806, jim.metcalfe@alinda.com

Joe Kelleher, Partner, 203-930-3811, joe.kelleher@alinda.com

John S. Laxmi, Partner, 203-930-3802, john.laxmi@alinda.com

Philip W. Dyk, Partner, 203-930-3804, philip.dyk@alinda.com

Sanjay Khettry, Partner, 203-930-3805, sanjay.khettry@alinda.com

Simon Riggall, Partner, 44 20 7101 2501, simon.riggall@alinda.com

VC Alliance Healthcare Investment Fund

6900 East Camelback Road, Suite 860

Scottsdale, AZ 85251

Phone: 602-845-5590

Fax: 602-419-3100

http://alliancehcpartners.com

Stage: Early, Seed

Industry: Life Sciences & Healthcare

Alliance Healthcare Fund focuses its investments on innovative, high-growth companies that are already making waves in the healthcare delivery-improvement

space. Alliance Healthcare Partners are serial entrepreneurs and experienced in business development within healthcare. The fund focuses its investments on

innovative technology and service companies that help healthcare providers deliver enhanced efficiency, improved outcomes and lower cost healthcare. The primary

focus is on healthcare service companies that use new approaches and technologies to disrupt the healthcare status quo.

Portfolio companies include: Flower Orthopedics, INRange, IntelliBlast, Patient Conversation Media, Physician's Referral Network, PrivIT, Targeted Instant

Communications, Vestagen

Investment Team:

Arthur Goodrich, Partner, agoodrich@alliancehcpartners.com

Joe Mayernik, Partner, jmayernik@alliancehcpartners.com

Rick Ferreira, Partner, rferreira@alliancehcpartners.com

Tim Einwechter, Partner, teinwechter@alliancehcpartners.com

A Alliance of Angels

719 Second Avenue, Suite 1403

Seattle, WA 98104

www.allianceofangels.com

Stage: Early, Seed

Industry: Consumer Products & Services, Energy & Clean Tech, Information Technology, Life Sciences & Healthcare, Manufacturing & Industrial, Retail &

Restaurant, Software & Internet

Since 1997, the Alliance of Angels (AoA) has connected a community of over 100 investors with the most promising early-stage companies in the Northwest to

invest, mentor and enable their success. The AoA has provided over $70 million of early funding for more than 180 Northwest entrepreneurs over the last dozen years

and celebrated more than 30 exits. In 2009, the AoA launched a $4.4 million Seed Fund which it invests alongside its members. Companies become eligible for a

matching investment by the Seed Fund when the company is approved by the AoA Screening Committee and two ore more AoA members invest in the company for

at least $100,000 in aggregate. The Seed Fund invests pari passu with the AoA members (dollars are matched on exact same terms) and the maximum investment in

any single company is 10% of the Seed Fund, with a default maximum of $250,000. Each year, AoA typically invests about $10 million into 20 companies.

Portfolio companies include: 1000 Museums, Accium BioSciences, AppAttach, Apptentive, AutoGraph, Battlefly, Billing Revoltion, Buddy TV, Cadence

Biomedical, Claim-Maps, daptiv, DRY Soda Company, Earth Class Mail, Entomo, Food.ee, HomeGrocer.com, Illumigen, Impel NeuroPharma, Julep Nail Salons,

Limeade, LiquidPlanner, Livebid.com, MailChannels, Mercent, Meteor Solutions, Microgreen, MobiSante, Modumetal, mPoria, nfluence, Overcast Media,

Record360, Redfin, Zooppa

Investment Team:

Boyd Anderson, Senior Associate

Jennie Johnson, Membership and Sponsorship Manager

Michele Chaffee, Senior Associate

Yi-Jian Ngo, Managing Director, 206-389-7321, yijian@allianceofangels.com

VC Allos Ventures

11611 North Meridian Street, Suite 310

Carmel, IN 46032

Phone: 317-275-6800

312 Walnut Street, Suite 1120

Cincinnati, OH 45202

Phone: 513-456-1001

www.allosventures.com

Stage: Early

Industry: Information Technology, Media & Digital Media, Software & Internet

Founded 2010, Allos Ventures raised $20 million from investors and plans to focus on early-stage tech companies. Initial investments are expected to average $1.5

million to $2 million. The firm was formed by veterans of Blue Chip Venture.

Portfolio companies include: 7signal, Alung Technologies, AssureRx Health, Assurex Health, BidPal Network, Blue Pillar, Bluebridge, EnosiX, Lesson.ly,

PeachWorks, Revenew, Scale Computing, TinderBox, Weblink

Investment Team:

Chloe Morrical, Associate, 317-275-6805, chloe@allosventures.com

Don Aquilano, Managing Director, 317-275-6802, don@allosventures.com

Dov Rosenberg, Director, 513-549-3689, dov@allosventures.com

John McIlwraith, Managing Director, 513-723-2311, john@allosventures.com

Julie Whitehead, CFO, 513-723-2302, julie@allosventures.com

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

FOF/ PE/ SEC AlpInvest Partners

Jachthavenweg 118

Amsterdam, 1081 KJ

The Netherlands

Phone: 31 20 540 7575

Fax: 31 20 540 7500

701 Citibank Tower

3 Garden Road

Hong Kong,

China

Phone: 852 2878 7099

Fax: 852 2878 7009

201 North Illinois Street, Suite 1530

Indianapolis, IN 46204

Phone: 317-361-4436

630 Fifth Avenue, 28th Floor

New York, NY 10111

Phone: 212-332-6240

Fax: 212-332-6241

http://alpinvest.com/

Stage: Early, Late, Middle Market

Industry: Business Services, Energy & Clean Tech, Information Technology, Manufacturing & Industrial, Transportation & Distribution

With over EURO34 billion assets under management, AlpInvest Partners is a leading global private equity investor. AlpInvest Partners' only agenda is private

equity-related investing and the Firm strives to be the partner of choice for all fund, secondary, co-investment, and mezzanine opportunities. The Fund Investments

team allocates more than EURO4 billion per annum for fund commitments. the team manages an annual allocation in excess of EURO4 billion with total

commitments of over EURO27 billion. The Fund Investments team has over 100 core general partnership relationships worldwide and is a proactive partner across

the full spectrum of the private equity market, including: Large Buyouts; Middle-Market, Lower Middle-Market, and Growth Buyouts; Venture Capital; Mezzanine;

Distressed Securities; Secondary; and Sustainable Energy. Since 2000, AlpInvest Partners' dedicated Secondary Investment team has crafted innovative liquidity and

restructuring solutions representing EURO6 billion of transaction value. Since 2000, the Co-Investments team invested over EURO5 billion in equity financing and

EURO 1.2 billion in mezzanine financing in more than 170 leveraged buyouts and growth capital transactions throughout Europe, North and Latin America, Asia and

Australia.

Portfolio companies include: Abertis, AMC Entertainment, Biomet, BioXell Spa, BondDesk, Capio, Celtic House, Curacyte AG, Dollar General, Gemplus, Harrah's

Entertainment, IASIS Healthcare, IMS Health, LA Fitness, Maxeda, Nycomed, Ontex, Planet Fitness, Retail Decisions, Rosemont, Roundy's, Skylark, Soil Safe

Conduit, Springer, Takko Fashion, Tank & Rast, The Weather Channel, Univision Communications, Vetco

Investment Team:

Chris Perriello, Managing Director, 212-332-6227, chris.perriello@alpinvest.com

Christophe Nicolas, Managing Director, 31 20 540 7633, christophe.nicolas@alpinvest.com

Erik Thyssen, Managing Director, 31 20 540 7620, erik.thyssen@alpinvest.com

Ken Bloomberg, Principal, 212-332-6336, ken.bloomberg@alpinvest.com

Marek Herchel, Managing Director, 212-332-6248, marek.herchel@alpinvest.com

Nadim Barakat, Managing Director, 212-332-6260, nadim.barakat@alpinvest.com

Paul de Klerk, Managing Director, 31 20 540 7530, paul.de.klerk@alpinvest.com

Peter Cornelius, Managing Director, 212-332-6204, peter.cornelius@alpinvest.com

Reidan Cruz, Managing Director, 212-332-6395, reidan.cruz@alpinvest.com

Rob de Jong, Managing Director, 31 20 540 7618, rob.de.jong@alpinvest.com

Tatiana Chopova, Managing Director, 31 20 540 7602, tatiana.chopova@alpinvest.com

Thomas Spoto, Managing Director, 212-332-6222, thomas.spoto@alpinvest.com

Tjarko Hektor, Managing Partner, 212-332-6270, tjarko.hektor@alpinvest.com

Volkert Doeksen, Managing Director, 31 20 540 7520, volkert.doeksen@alpinvest.com

Wouter Moerel, Managing Director, 31 20 540 7623, wouter.moerel@alpinvest.com

PE Alterna Capital Partners

15 River Road, Suite 320

Wilton, CT 06897

Phone: 203-210-7333

Fax: 203-563-9210

www.alternacapital.com

Stage: Middle Market

Industry: Energy & Clean Tech, Manufacturing & Industrial, Transportation & Distribution

Alterna Capital Partners is a private investment firm focusing on core capital assets that are vital to the transportation, industrial and energy sectors. The firm is

managed by Citi's former core capital asset equity investment team and has over $400MM of committed capital. Alterna invests between $25 million and $100

million of equity capital in each transaction and will consider smaller or larger investments where appropriate. Alterna looks for income producing assets in

developed economies that are essential for expansion and maintenance of productive operations and have the following characteristics: Economically vital, Long

useful life, and Stable technology. The team has more than 100 years of aggregate investment experience having successfully invested more than $2 billion in core

capital assets.

Portfolio companies include: Alterna Aviation, AMG Graphit Kropfmül, Merom Generation Station, Mid Ocean Tanker, Midwest Energy Emissions,

Springerville Generating Station Unit 1, Sterling Ocean Shipping, Supertanker Services, Western Bulk

Investment Team:

Earle Goldin, Partner, 203-557-9024, earle.goldin@alternacapital.com

Eric Press, Managing Partner, 203-557-9023, eric.press@alternacapital.com

Harry Toll, Managing Partner, 203-557-9024, harry.toll@alternacapital.com

James Furnivall, Managing Partner, 203-557-9021, jim.furnivall@alternacapital.com

Mark S. Satran, Managing Director, mark.satran@alternacapital.com

Paul C. Schaffer, Managing Director & CFO, paul.schaffer@alternacapital.com

Richard C. Bertkau, Managing Director Emeritus, richard.bertkau@alternacapital.com

Roger Miller, Managing Partner, 203-557-9022, roger.miller@alternacapital.com

Stephen Z. Serepca, Director Emeritus, stephen.serepca@alternacapital.com

VC Altitude Life Science Ventures

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

701 5th Avenue, Suite 5400

Seattle, WA 98104

www.altitudefunds.com

Stage: Early

Industry: Consumer Products & Services, Life Sciences & Healthcare

The Southern Ute Indian Tribe has sponsored Altitude Life Science Ventures through its wholly owned private equity division, GF Private Equity Group, LLC.

Altitude acts as the seed partner and investor in such funds, partnering with experienced management teams with differentiated value-added strategies and compelling

track records in their field of expertise. Sectors of interest include: Life Sciences. Altitude's initial investment into a portfolio company is between $1 to $2.5 million

with a reserve of significant capital for later rounds. The firm's strategy is to have a balanced portfolio of 15 early stage life companies selected from a portfolio Pool

of 35 to 40 companies.

Portfolio companies include: Achaogen, Arete Therapeutics, Cambrios Technologies, Constellation Pharmaceuticals, Ikaria, Kythera, Limerick Neurosciences,

Receptos, Sienna Biopharmaceuticals, Siluria Technologies

Investment Team:

Dave Maki, Co-Founder, dmaki@altitudelsv.com

Steve Johnson, Co-Founder

PE Altus Capital Partners

10 Westport Road, Suite C204

Wilton, CT 06897

Phone: 203-429-2000

Fax: 203-429-2010

250 Parkway Drive, Suite 120

Lincolnshire, IL 60069

Phone: 847-229-0770

Fax: 847-229-9271

www.altuscapitalpartners.com

Stage: Middle Market

Industry: Defense & Homeland Security, Financial Services, Manufacturing & Industrial

Altus Capital Partners is private equity firm investing in small to middle market manufacturing companies. To date, the firm has invested in eight portfolio companies

with combined annual revenues of approximately $500 million. Ideal companies are U.S. based manufacturing companies (located east of the Rockies) with an

enterprise value between $30 million and $100 million and a minimum EBITDA of $5 million. Altus Capital Partners types of transactions include buyouts,

recapitalizations, divestitures, and consolidations.

Portfolio companies include: Aqua-Chem, Die Cast Holdings, DS Brown, Gichner Shelter Systems, Gulf Coast Machine & Supply Company, International Imaging

Materials, Magnatech International, Mistras Group, Models & Tools, Thermafiber, Thomson Plastics

Investment Team:

Elizabeth A. Burgess, Founder & Senior Partner, eburgess@altuscapitalpartners.com

Gregory L. Greenberg, Founder & Senior Partner, ggreenberg@altuscapitalpartners.com

Heidi Goldstein, Principal, hgoldstein@altuscapitalpartners.com

Kim VanCleef, Vice President, kvancleef@altuscapitalpartners.com

Mike Barry, Associate, mbarry@altuscapitalpartners.com

Peter Polimino, Chief Financial Officer, ppolimino@altuscapitalpartners.com

Russell J. Greenberg, Managing Partner, rgreenberg@altuscapitalpartners.com

Scott Johnson, Senior Associate, sjohnson@altuscapitalpartners.com

PE Ambassador Enterprises

2845 East Dupont Road

Fort Wayne, IN 46825

Phone: 260-487-4000

http://ambassador-enterprises.com/

Stage: Middle Market

Industry: Education & Training, Information Technology, Manufacturing & Industrial, Transportation & Distribution

Formed 2008, Ambassador Enterprises is an active owner or partner assisting leaders in optimizing their for-profit and nonprofit organizations. Ambassador focuses

on optimizing the performance of organizations that are culturally compatible, relationally engaged, and strategically aligned, believing that an investment in people

and teams will pay returns in the form of healthy relationships and strong communities.

Portfolio companies include: American SportWorks, Correct Craft, Diakonia, RES Polyflow, Rethink Books/ Bookshout!, The Summit, Wagner-Meinert

Investment Team:

Arlan Friesen, President

Daryle Doden, CEO

Tim Klage, CFO

PE American Capital

25 Bedford Street

London, WC2E 9ES

UK

Phone: +44 (0) 20 7539 7000

Fax: +44 (0) 20 7539 7001

37 Avenue Pierre 1er de Serbie

Paris, 75008

France

Phone: +33 (0) 1 40 68 06 66

Fax: +33 (0) 1 40 68 06 88

311 South Wacker Drive, Suite 1500

Chicago, IL 60606

Phone: 312-681-7400

Fax: 312-454-0600

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

161 Worcester Road, Suite 606

Framingham, MA 01701

Phone: 508-598-1100

Fax: 508-598-1101

2 Bethesda Metro Center, 14th Floor

Bethesda, MD 20814

Phone: 301-951-6122

Fax: 301-654-6714

180 Main Street, Second Floor

Annapolis, MD 21401

Phone: 443-214-7070

Fax: 443-214-7071

505 Fifth Avenue, 26th Floor

New York, NY 10017

Phone: 212-213-2009

Fax: 212-213-2060

2200 Ross Avenue, Suite 5000 East

Dallas, TX 75201

Phone: 214-273-6630

Fax: 214-273-6635

www.american-capital.com

Stage: Middle Market

Industry: Agriculture & Agricultural Science, Business Services, Communications & Networking, Consumer Products & Services, Defense & Homeland Security,

Education & Training, Energy & Clean Tech, Financial Services, Information Technology, Life Sciences & Healthcare, Manufacturing & Industrial, Media &

Digital Media, Medical Device, Real Estate & Construction, Retail & Restaurant, Semiconductor, Software & Internet, Sports & Entertainment, Storage &

Hardware, Transportation & Distribution

American Capital (NASDAQ:ACAS) is the largest U.S. publicly traded alternative asset manager with approximately $117 billion in assets under management. The

firm provides debt and equity to small and medium sized private and public companies and invests from $10 million to $750 million per company in North America

and EURO10 million to EURO 100 million per company in Europe. American invests in businesses which typically have enterprise values of $20 to $500 million.

American Capital typically targets new investments with at least $4 million in EBITDA. In addition to providing financing for growth, liquidity and restructuring, the

firm also participates in financing management and employee buyouts of corporations and subsidiaries, divisions and product lines of major corporations. American

has invested approximately $31 billion in more than 550 portfolio companies. The firm's portfolio includes services, transportation, construction, wholesale, retail,

health care, industrial, consumer, chemical and food products, but is typically focused on manufacturing, services and distribution companies. American has more

than 90 investment professionals in 8 offices around the world.

Portfolio companies include: Appleseed's, ASAP Industries, Avalon Laboratories, Cambridge Major Laboratories, CIBT Holdings, Consolidated Precision Products

, Core Financial Group, Dynojet Research, Explorer Pipeline Company, Fleischmann's Vinegar, Flexera Software, Gamblit Gaming, Halex, HALT Medical,

iTradeNetwork, Miron Technologies, New England Confectionary Company, Nivel Parts & Manufacturing, Qioptiq Group, Renaissance Learning, Rug Doctor,

Service Experts, Survey Sampling International, Tomkins Air Distribution, Transtar Holding Company, Vision Solutions, WIS International, York Label

Investment Team:

Adam Stern, Principal

Alvin N. Puryear, Director

Brian Graff, Senior Vice President and Senior Managing Director

Craig Moore, Managing Director

Darin Winn, Senior Managing Director

David Steinglass, Managing Director

Douglas Kelley, Principal

Dustin Smith, Managing Director

Eugene Krichevsky, Principal

Fernando Ruiz, Vice President

Gordon O'Brien, President

Ira Wagner, President

Jeffrey N. MacDowell, Managing Director, Jeff.MacDowell@AmericanCapital.com

John Erickson, President, John.Erickson@AmericanCapital.com

Jon Isaacson, Managing Director, Jon.Isaacson@AmericanCapital.com

Joseph Romic, Principal, Joseph.Romic@americancapital.com

Justin DuFour, Vice President

Kenneth D. Peterson Jr., Director

Kyle Bradford, Principal

Malon Wilkus, Chairman, Malon.Wilkus@AmericanCapital.com

Mark Opel, Senior Vice President

Mary C. (Molly) Baskin, Director

Michael Cerullo, Managing Director

Myung Yi, Managing Director

Neil M. Hahl, Director

Philip R. Harper, Director

Roland Cline, Senior Vice President and Managing Director

Ryan Brauns, Managing Director

Ryan Nagim, Vice President, ryan.nagim@americancapital.com

Samuel Flax, Executive Vice President and General Counsel, Sam.Flax@americancapital.com

Scott Kauffman, Vice President

Sean Eagle, Managing Director, Sean.Eagle@AmericanCapital.com

Stan Lundine, Director

Susan K. Nestegard, Director

Thomas Nathanson, Managing Director

Tom McHale, Senior Vice President

A Angel Investor Forum

222 Pitkin St.

East Hartford, CT 06108

Phone: 860-314-2101

www.angelinvestorforum.com

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Stage: Seed

Industry: Information Technology, Life Sciences & Healthcare

The Angel Investor Forum (AIF), founded in 2004, is an organization located in Connecticut comprised of accredited investors, who are former CEOs, VCs, serial

entrepreneurs, and active private equity investors. Due to the widening gap in the capital markets, there is a shortage of funding available at the seed stage

($250K-$5M). This funding gap represents a great opportunity for investment in companies and the group provides $100K to $2M for companies with substantial

growth potential. AIF is not a fund; Investment members collaborate on due diligence, but make individual investment decisions (under common valuation and

terms). The typical company the group looks at is raising between $750K and $1.5 Million. Members typically put in between $150K and $350K as a group. The

individual investment is typically $25,000 but ranges from $10,000 (if the deal permits) to $100,000. The group's investment criteria includes: a clearly articulated

market position, management team with a demonstrated track record, clear intellectual property strategy, defensible competitive position in an emerging or growth

market, and an exit strategy for investors within 3-5 years.

Portfolio companies include: Autotether, Device42, Hadapt, innRoad, RuMe, SchoolChapters, SocialGenius, Sustainable Real Estate Manager, TracerPix

Investment Team:

Amy Cohen Bauman

Cindy Scoville, Administrative Assistant

Ed Goodwin, President

Joe DeMartino, Deal Flow Coordinator, 860-659-5855, jdemartino@gmail.com

John Mullen

John Seiffer, 203-775-6676, john@betterceo.com

Mark Schneider

Scott Nevins, Chair, scott.nevins@bernstein.com

Susan Forshauer, Chair

VC Anthem Capital Management

1448 South Rolling Road, Suite 200

Baltimore, MD 21227

Phone: 410-625-1510

Fax: 410-625-1735

www.anthemcapital.com

Stage: Early, Expansion, Growth

Industry: Communications & Networking, Information Technology, Life Sciences & Healthcare, Medical Device, Software & Internet

Anthem invests exclusively in the Mid-Atlantic and seeks opportunities in IT/telecom and healthcare/life sciences industries including enterprise software or network

management software companies. Medical investments tend to fall into three categories: medical devices, biotechnology or healthcare. Anthem seeks to invest

between $2 million and $5 million in a company from the first private equity round through exit. Anthem invests in early to expansion stage opportunities. Anthem's

initial investment is usually made in the Series A or Series B institutional venture capital round. Typically, the firm's initial investment ranges from $1 million to $2

million.

Portfolio companies include: Corridor, Echo360, GlycoMimetics, Grab Networks, Senseonics, Sensors for Medicine and Science, Systech International, Triumfant

Investment Team:

Bill Gust, Partner, wgust@anthemcapital.com

Ed Spiva, Partner, espiva@anthemcapital.com

Gerry Schaafsma, Partner, gschaasfma@anthemcapital.com

Xander Perry, Partner, xperry@anthemcapital.com

PE Arbor Investments

5135 Riverlake Drive

Duluth, GA 30097

Phone: 312-981-3770

Fax: 312-981-3771

676 North Michigan Avenue, Suite 3410

Chicago, IL 60611

www.arborpic.com

Stage: Middle Market

Industry: Consumer Products & Services, Retail & Restaurant

Arbor is led by two partners who have worked together for more than fifteen years, Gregory Purcell and Joseph Campolo, who founded Arbor in 1999 to be the

premier investment firm for growing food and beverage companies. Arbor has $700 million of capital under management across three private equity funds, with

investors including Goldman Sachs, Babson Capital Management, and the Kentucky Retirement Systems. The firm has developed three specialized teams that

contribute to the management of each portfolio company. Arbor considers investments in companies with annual sales of up to $300MM and EBITDA between

$5MM - $50MM. The teams are comprised of experienced food and beverage professionals who have been directly involved in guiding middle market companies to

maximize productivity, grow sales and improve profitability. Arbor maintains its headquarters in Chicago, IL.

Portfolio companies include: Allied Specialty Foods, Bradshaw International, Cooler Solutions, Dale and Gage Foods, Fieldbrook Foods, Five Star Sheets, Gold

Standard Baking, Great Kitchens, ISI Commercial Refrigeration, J.L. DeGraffenreid & Sons, Mexican Accent, Midland Packaging & Display, National Deli, Nordon,

Northern Neck Coca-Cola Bottling, Oven Fresh Banking Company, Rice Garden, Sam's Wines & Liquors, Sanford Coca-Cola Bottling Company, Shawnee Quality

Snacks, Stone Gate Foods, Texas Premium Foods & Distributing, The Martin-Brower Company, Truco Enterprises, Trudeau Distributing Company, Ultra Products

Company

Investment Team:

Alan A. Weed, Vice President, weed@arborpic.com

Brody D. Lynn, Senior Associate, lynn@arborpic.com

Gregory J. Purcell, CEO, purcell@arborpic.com

Jeffrey A. Smith, Senior Analyst, smith@arborpic.com

John M. Camp, Managing Director of Business Development, camp@arborpic.com

Joseph P. Campolo, President, campolo@arborpic.com

Michael B. Eisinger, Senior Analyst, eisinger@arborpic.com

Richard N. Boos, Partner, boos@arborpic.com

Ryan R. McKenzie, Partner, mckenzie@arborpic.com

VC Arborview Capital

5425 Wisconsin Ave., Suite 704

Chevy Chase, MD 20815

Phone: 301-215-8320

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Fax: 301-215-8326

www.arborviewcapital.com

Stage: Expansion, Growth

Industry: Energy & Clean Tech

Arborview Capital was formed in 2008 to invest in established, rapidly growing energy efficiency and clean energy businesses in North America. Over the past 15

years, Arborview Capital's two founders have successfully managed nearly $500 million of invested capital spanning four private investment firms, over multiple

economic cycles, and have completed more than 20 transactions. Arborview seeks to invest in companies which: address a large market opportunity within one of

three Industry Sectors: Energy Efficiency, Resource Efficiency, and Renewable Energy; targeting companies that have $5 - $30 million in revenue with significant

market presence and customer relationships.

Portfolio companies include: Drexel Metals, Energy Automation Systems, Lighting Retrofit International, LRI Energy Solutions, Paragon Airheater Technologies

Investment Team:

Jesse S. Sanders, Vice President, jesse.sanders@arborviewcapital.com

Joseph Lipscomb, Co-Founder and Partner, joe.lipscomb@arborviewcapital.com

Karl Khoury, Co-Founder and Partner, karl.khoury@arborviewcapital.com

Raymond Fan, Vice President, raymond.fan@arborviewcapital.com

Roger S. Ballentine, Venture Partner, roger.ballentine@arborviewcapital.com

Rona Kennedy, Chief Financial Officer, rona.kennedy@arborviewcapital.com

PE/ VC Arcapita

P.O. Box 1357

Manama,

Bahrain

Phone: +973 17 218333

Fax: +973 17 217555

8 Marina Boulevard

Marina Bay Financial Centre Tower 1, Level 11

Singapore, 018981

Singapore

Phone: +65 6653 4381

15th Floor, The Shard

London, SE1 9SG

UK

Phone: +44 20 7824 5600

Fax: +44 20 7824 5601

1180 Peachtree St NE, Suite 3000

Atlanta, GA 30309

Phone: 404-920-9000

Fax: 404-920-9001

www.arcapita.com

Stage: Expansion, Growth, Middle Market

Industry: Information Technology, Life Sciences & Healthcare, Manufacturing & Industrial

Arcapita is a diversified investment firm with interests in Venture Capital, Corporate Investment and Real Estate. Arcapita Ventures is a $200 million dedicated

investment fund launched in October 2005. The firm focuses on growth stage enterprises primarily in the United States. Arcapita typically acts as the lead investor in

companies operating in the (i) healthcare, (ii) information technology and (iii) industrial technology sectors. The investment team looks for businesses that have

established technologies and customer bases, and where its investment capital, network and expertise can be applied to scale a proven business model. Typically, the

Fund invests between $4 and $8 million in an initial round of funding, with the capability to invest up to $20 million over the life of a portfolio company. In addition

to providing growth capital, the Fund selectively considers venture buyouts of companies with enterprise values of less than $40 million. Within Arcapita's targeted

sectors, the partners look for companies that have at least $2 million in revenues over the prior twelve months. Arcapita's corporate investment team operates out of

its offices in Atlanta. Arcapita acts as a principal and arranger in the acquisition of controlling interests in established companies in the United States and Europe,

focusing on growth-oriented corporate acquisitions with a total transaction value between $300 million and $1 billion. Smaller transactions are considered in certain

high-growth situations or in circumstances where opportunities exist for strategic add-on acquisitions. Arcapita maintains additional offices in Bahrain, London and

Singapore.

Portfolio companies include: Bijoux Terner, Church Street Health Management, Compagnie Europeenne de Prestations Logistiques, Jill Acquisition, Meridian

Surgical Partners, PODS Demand Storage, Saadiyat Beach Residence, Southland Log Homes, The Tensar Corporation, Varel International Energy Services

Investment Team:

Abdulhameed Juma, Director

Ahmed Al Shirawi, Director

Atif A. Abdulmalik, CEO

Elaine Zhao, Director

Essa A. Zainal, Global Head Financial Control

Hisham Abdulrahman Al Raee, COO

Martin Tan, CIO

Michael Casey, Director

Mohammed A. Muiz Chowdhury, Global Head Financial Management

Salah Al Shaikh, Director

Vivian Chan, Director

VC ARCH Venture Partners

1700 Owens St., Suite 535

San Francisco, CA 94158

Phone: 415-565-7103

Fax: 415-565-7107

8725 West Higgins Road, Suite 290

Chicago, IL 60631

Phone: 773-380-6600

Fax: 773-380-6606

5001 Plaza on the Lake Blvd., Suite 103

Massinvestor/ VC News Daily 1

VENTURE CAPITAL and PRIVATE EQUITY Database

Austin, TX 78746

Phone: 512-795-5830

Fax: 512-795-5849

999 Third Ave., Suite 3400