Jetblue Ipo Case: What Are The Advantages and Disadvantages of Going Public?

Diunggah oleh

HouDaAakDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Jetblue Ipo Case: What Are The Advantages and Disadvantages of Going Public?

Diunggah oleh

HouDaAakHak Cipta:

Format Tersedia

JetBlue IPO case

Review the institutional aspects of the equity issuance transaction.

The center of JetBlue's system was low-cost effort accomplished through a littler and more

productive ,gainful workforce and better utilization of innovation utilization of fresh out of the

box new single model planes that diminished support expenses and preparing costs in the

meantime.However, moving into the development stage, JetBlue was contemplating the

presentation of another model of planes , that are littler than the A320s that they were utilizing.

These planes were to be used for infiltrating average size urban areas and furthermore also off-

peak circumstances on existing routes.

The aircraft business is defenseless to upturns and downturns with the patterns in the economy.

A developing economy and blasting business mean more prominent interest for air travel, and a

back off in the economy implies decreased request, resulting unutilized limit and heightened

rivalry. The accessibility of funding, and other capital sources affect the quantity of new

contestants into the business. Loan fee variances affect the cost of tasks for organizations that

have elevated amounts of obligation.

What are the advantages and disadvantages of going public?

The two bases of JetBlue’s competitive advantage are ‘cost leadership’ and ‘differentiation’.

JetBlue achieves cost leadership by attaining efficient operations. New planes minimize

maintenance and fuel costs, larger planes ensure more revenue per flight, longer hauls on an

average as compared to other point-to-point services keep planes longer in air. No-meals served

helps quicker turnarounds and reduce costs. Reservation agents working from home reduce need

for physical infrastructure, and thereby reduce overhead costs.

Firms pursuing low-cost strategy generally get trapped in focusing on too few of value chain

activities, or lack parity on differentiation with competitors. The low-cost advantage also gets

eroded when the competitive pricing information becomes available more easily. The strategy

can be imitated too easily.

The other component of JetBlue’s strategy is differentiation. Differentiation is achieved through

a strong brand image, the various features such as DirectTV at each seat, more legroom . JetBlue

employed a combination of strategies that gives it a distinctive competitive advantage. It

combined low-cost services with a differentiated offering. The company invested in technology

for efficient operations right from its inception and, therefore, is able to provide high quality

services at low-cost.

What different approaches can be used to value JetBlue’s shares?

JetBlue’s culture is built around the five key values of safety, caring, integrity, fun and passion.

The chief executive reinforces those values by being closely involved in the operations. He

travels regularly on his flights and distributes snacks to his customers. This action sets an

example to his employees on the importance of customer service. The company invests in

training its employees on safety procedures. There is also an extensive orientation program in

which new employees are told about the value of customer service as well as the need to be

productive and committed to keep costs as low as possible. Employees are called

‘crewmembers’ and that reinforces the non-hierarchical and informal culture at the company.

They are offered flexible work hours, and attractive compensation plans to keep them motivated.

The friendly and motivating work environment offsets some of the monetary component of pay

and thus helps in reducing costs.

At what price would you recommend that JetBlue offer its shares?

final offering price Cost of Debt Cost of Equity: CAPM Weights of Debt and Equity =

5.00%+1.1(5.00%)=10.50% $1,842/$17,913.99= 10.28% 1-.1028 = 89.72% WACC =

10.28%(.0425)(1-.385)+89.72%(.1050) = 9.8575%

Anda mungkin juga menyukai

- Why Jetblue Is Different From Other Airlines??Dokumen2 halamanWhy Jetblue Is Different From Other Airlines??Budy s RaharjaBelum ada peringkat

- Jetblue AirwaysDokumen6 halamanJetblue AirwaysranyaismailBelum ada peringkat

- Corporate Strategy. Case Study 2 JetBlueDokumen5 halamanCorporate Strategy. Case Study 2 JetBluetiko sikharulidzeBelum ada peringkat

- Contemporary Issues in Strategic Management: Name: IDDokumen3 halamanContemporary Issues in Strategic Management: Name: IDmahBelum ada peringkat

- JetBlue Group 1Dokumen6 halamanJetBlue Group 1Mado MadoBelum ada peringkat

- JetblueDokumen18 halamanJetbluekatrina0% (1)

- Analyze The Industry Environment of JetBlueDokumen8 halamanAnalyze The Industry Environment of JetBlueshivshanker biradarBelum ada peringkat

- Jet Blue Case AnalysisDokumen21 halamanJet Blue Case Analysisjazzy12389% (9)

- How Low Cost Airlines Gain Competitive AdvantageDokumen7 halamanHow Low Cost Airlines Gain Competitive AdvantageCheapestPapers100% (1)

- Jetblue Research PaperDokumen4 halamanJetblue Research Papermgrekccnd100% (1)

- Gustavo Hernandez - JetBlue Airways PDFDokumen13 halamanGustavo Hernandez - JetBlue Airways PDFCarlos Delgado NietoBelum ada peringkat

- Southwest Airline Case StudyDokumen5 halamanSouthwest Airline Case Study1Belum ada peringkat

- Southwest Airline Case StudyDokumen5 halamanSouthwest Airline Case Study1Belum ada peringkat

- Southwest Airline Case StudyDokumen5 halamanSouthwest Airline Case Study1Belum ada peringkat

- Research Paper2Dokumen15 halamanResearch Paper2Susan WachiraBelum ada peringkat

- Jet Blue Airways - Strategic Management Case Study - Presentation TranscriptDokumen4 halamanJet Blue Airways - Strategic Management Case Study - Presentation TranscriptAngel WingsBelum ada peringkat

- Case 03 JetBlue Airways TNDokumen16 halamanCase 03 JetBlue Airways TNsabanspahic100% (1)

- Southwest's Generic Competitive StrategyDokumen4 halamanSouthwest's Generic Competitive StrategyTayyaba AyeshaBelum ada peringkat

- Southwest's Generic Competitive Strategy: Control Avoidance of Marginal CustomsDokumen6 halamanSouthwest's Generic Competitive Strategy: Control Avoidance of Marginal CustomsTayyaba AyeshaBelum ada peringkat

- Jet Blue Airways: Starting From ScratchDokumen2 halamanJet Blue Airways: Starting From ScratchNic Sarayba100% (1)

- Case Study - Uncertain Course For Jet Blue: Questions (5 Points Each)Dokumen1 halamanCase Study - Uncertain Course For Jet Blue: Questions (5 Points Each)Chiara Yzabel FerrerBelum ada peringkat

- Jetblue AirwaysDokumen8 halamanJetblue AirwaysPatrick MasseyBelum ada peringkat

- Case Study No 18 Strategic Management by Michael A Hitt: Prepared by Roll Number 10735 Fawadhussain, 2014Dokumen27 halamanCase Study No 18 Strategic Management by Michael A Hitt: Prepared by Roll Number 10735 Fawadhussain, 2014Zeeshan MunirBelum ada peringkat

- Jetblue PPDokumen30 halamanJetblue PPVilay GuptaBelum ada peringkat

- Developing Sustainable Business ModelsDokumen7 halamanDeveloping Sustainable Business ModelsDerya CevikBelum ada peringkat

- Case Study Analysis: Team #6Dokumen29 halamanCase Study Analysis: Team #6Cindy MarroquinBelum ada peringkat

- Management Case Study Tutorial Model Answers Variant 2Dokumen6 halamanManagement Case Study Tutorial Model Answers Variant 2AFTAB GAMBHIRBelum ada peringkat

- POM Internal Assessment ComponentsDokumen4 halamanPOM Internal Assessment ComponentssateeshBelum ada peringkat

- Rauf SAP ID 42701Dokumen7 halamanRauf SAP ID 42701Muzzamil JanjuaBelum ada peringkat

- Cost Accounting at Southwest AirlinesDokumen5 halamanCost Accounting at Southwest Airlinesaryav srivastavaBelum ada peringkat

- Airline IndustryDokumen8 halamanAirline IndustryKrishnaPranayBelum ada peringkat

- Company Case Notes: Jetblue: Delighting Customers Through Happy JettingDokumen3 halamanCompany Case Notes: Jetblue: Delighting Customers Through Happy JettingCatalinaSaavedraBelum ada peringkat

- CASE Southwest AirlineDokumen4 halamanCASE Southwest AirlineSubham Chakraborty100% (1)

- The Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatDokumen5 halamanThe Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatAninda DuttaBelum ada peringkat

- Jet Blue Airways 1 Running Head: CRAFTING AND EXECUTING STRATEGY - Jet Blue AirwaysDokumen8 halamanJet Blue Airways 1 Running Head: CRAFTING AND EXECUTING STRATEGY - Jet Blue AirwaysLaKessica B. Kates-CarterBelum ada peringkat

- Jetblue Airways: Deicing at Logan AirportDokumen5 halamanJetblue Airways: Deicing at Logan AirportNarinderBelum ada peringkat

- SWOT AnalysisDokumen7 halamanSWOT Analysisvaibhav rajoreBelum ada peringkat

- Jetblue's Case Study by P.rai87@gmailDokumen25 halamanJetblue's Case Study by P.rai87@gmailPRAVEEN RAI67% (3)

- Evaluation of Easyjet Cost Leadership Competitive StrategyDokumen14 halamanEvaluation of Easyjet Cost Leadership Competitive StrategyritchieBelum ada peringkat

- Group 3: Jetblue Airways Corporation-2009 Case AnalysisDokumen21 halamanGroup 3: Jetblue Airways Corporation-2009 Case Analysisfarooq ahmadBelum ada peringkat

- Southwest Airline Case StudyDokumen5 halamanSouthwest Airline Case StudyAliya ShahBelum ada peringkat

- Analysis of Jet BlueDokumen8 halamanAnalysis of Jet Blueflittle100% (2)

- Bussiness Strategy - Strategy As Choice 2 - Friday ClassDokumen6 halamanBussiness Strategy - Strategy As Choice 2 - Friday ClassTú Oanh Nguyễn ĐặngBelum ada peringkat

- IAO Final Exam Shehla 10925Dokumen7 halamanIAO Final Exam Shehla 10925Ujala ShahidBelum ada peringkat

- JetblueDokumen4 halamanJetblueFavour ChukwunonyeremBelum ada peringkat

- Indigo AirlinesDokumen18 halamanIndigo AirlinesJatin ParwaniBelum ada peringkat

- Sir Jalal Ahmed: Blue AirlineDokumen3 halamanSir Jalal Ahmed: Blue AirlinesoreksatuBelum ada peringkat

- Jetblue Airways 1Dokumen5 halamanJetblue Airways 1Tarek DandachBelum ada peringkat

- South West Airlines Case SolutionDokumen3 halamanSouth West Airlines Case SolutionK D100% (1)

- An Analysis of Delta Air Lines - Based OnDokumen5 halamanAn Analysis of Delta Air Lines - Based OnYan FengBelum ada peringkat

- Easy Jet Low Cost Air TravelDokumen4 halamanEasy Jet Low Cost Air Travelashe100% (1)

- Case Study 1Dokumen3 halamanCase Study 1ISHA AGRAWAL100% (1)

- Rethinking Airline Business Model Chapter 3-4Dokumen18 halamanRethinking Airline Business Model Chapter 3-4Orawan SangthongnirundornBelum ada peringkat

- Case01 JetBlue Airways TNDokumen16 halamanCase01 JetBlue Airways TNSajid AnothersonBelum ada peringkat

- Swot Analysis:: Law FareDokumen8 halamanSwot Analysis:: Law FareLayasharifiBelum ada peringkat

- Airlines Revenue ManagementDokumen7 halamanAirlines Revenue Managementmyalerts_npBelum ada peringkat

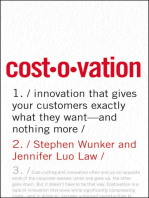

- Costovation: Innovation That Gives Your Customers Exactly What They Want--And Nothing MoreDari EverandCostovation: Innovation That Gives Your Customers Exactly What They Want--And Nothing MoreBelum ada peringkat

- Cost-Based Pricing: A Guide for Government ContractorsDari EverandCost-Based Pricing: A Guide for Government ContractorsBelum ada peringkat

- The Outsourcing Revolution (Review and Analysis of Corbett's Book)Dari EverandThe Outsourcing Revolution (Review and Analysis of Corbett's Book)Belum ada peringkat

- Tesla Analysis: By: Houda AkratDokumen11 halamanTesla Analysis: By: Houda AkratHouDaAakBelum ada peringkat

- Petrol Head School: Business ReportDokumen19 halamanPetrol Head School: Business ReportHouDaAakBelum ada peringkat

- IntroDokumen13 halamanIntroHouDaAakBelum ada peringkat

- Flash NewsDokumen11 halamanFlash NewsHouDaAakBelum ada peringkat

- Jacob Division CaseDokumen2 halamanJacob Division CaseHouDaAak100% (2)

- Boeing Case:: 1. Why Is Boeing Contemplating The Launch of The 7E7 Project? Is This A Good Time To Do So?Dokumen4 halamanBoeing Case:: 1. Why Is Boeing Contemplating The Launch of The 7E7 Project? Is This A Good Time To Do So?HouDaAakBelum ada peringkat

- IMF: International Monetary Fund.: ObjectivesDokumen1 halamanIMF: International Monetary Fund.: ObjectivesHouDaAakBelum ada peringkat

- Noncurrent Asset Held For Sale Multiple Choice: A. B. C. DDokumen5 halamanNoncurrent Asset Held For Sale Multiple Choice: A. B. C. Dlinkin soyBelum ada peringkat

- Business Model InnovationDokumen40 halamanBusiness Model InnovationinakiBelum ada peringkat

- Hul Sales and DistrubutionDokumen23 halamanHul Sales and DistrubutionKrishna Praveen PuliBelum ada peringkat

- Have Mercy On Us AutosavedDokumen11 halamanHave Mercy On Us AutosavedMyrel Cedron TucioBelum ada peringkat

- Pandora Jewelry LTD: A Brief of Marketing AnalysisDokumen4 halamanPandora Jewelry LTD: A Brief of Marketing AnalysisKomal AroraBelum ada peringkat

- Marketing Plan For Gourmet CompanyDokumen20 halamanMarketing Plan For Gourmet CompanyAfzaal AliBelum ada peringkat

- MarketingDokumen9 halamanMarketingUshed_Mlk_1204Belum ada peringkat

- ICICI Securities Ltd. Campus Placement - FY 24Dokumen15 halamanICICI Securities Ltd. Campus Placement - FY 24Ritik vermaBelum ada peringkat

- The Monks Investment Trust PLCDokumen52 halamanThe Monks Investment Trust PLCArvinLedesmaChiongBelum ada peringkat

- 7 P'sDokumen3 halaman7 P'sGlenda ValerosoBelum ada peringkat

- Report Sample SssDokumen20 halamanReport Sample Sssuser nameBelum ada peringkat

- Reflective Journal Template 1Dokumen5 halamanReflective Journal Template 1Dickson ChongBelum ada peringkat

- Asset Replacement NoteDokumen5 halamanAsset Replacement NoteAjakaiye Khooduz Ishola100% (1)

- WACC Workout FullDokumen29 halamanWACC Workout Fulldevilcaeser2010Belum ada peringkat

- BT - FBT Examiners Report Sept19-Aug20Dokumen8 halamanBT - FBT Examiners Report Sept19-Aug20Amna ZamanBelum ada peringkat

- Dishwashing LiquidDokumen13 halamanDishwashing LiquidJay ArBelum ada peringkat

- ACF Project 1Dokumen11 halamanACF Project 1Kunal DesaiBelum ada peringkat

- XXXX Lu Lin - Mobile Service Supply Coordination With Revenue Sharing ContractsDokumen10 halamanXXXX Lu Lin - Mobile Service Supply Coordination With Revenue Sharing ContractsPaaploBelum ada peringkat

- 9609 w18 QP 32Dokumen20 halaman9609 w18 QP 32Haris0% (1)

- Date: 28 April 2016 To, Amrita Salaskar, M/s Jijai Women's Hospital Sub: Proposal For Advertising On No Parking Boards Dear Ma'amDokumen2 halamanDate: 28 April 2016 To, Amrita Salaskar, M/s Jijai Women's Hospital Sub: Proposal For Advertising On No Parking Boards Dear Ma'amSachin ThemesBelum ada peringkat

- Resume Sunny TiwariDokumen4 halamanResume Sunny TiwariVIVEK SHAKYABelum ada peringkat

- dm2 PDFDokumen11 halamandm2 PDFSachin BhartiBelum ada peringkat

- Review Legal Aspects in Tourism and Hospitality 2Dokumen18 halamanReview Legal Aspects in Tourism and Hospitality 2parZeicaBelum ada peringkat

- Accounting Standard (As) 13Dokumen17 halamanAccounting Standard (As) 13shital_vyas1987Belum ada peringkat

- Fundamentals of AccountancyBusiness and Management 1Dokumen28 halamanFundamentals of AccountancyBusiness and Management 1Kimberly RaymundoBelum ada peringkat

- InfluencerDokumen73 halamanInfluencerMiruna MihăilăBelum ada peringkat

- Channel Strategy and PlanDokumen13 halamanChannel Strategy and Planapi-3831256100% (1)

- Pr1 Chapter 1Dokumen18 halamanPr1 Chapter 1アポロニオ モナBelum ada peringkat

- Unit III - Actman ModelDokumen14 halamanUnit III - Actman ModelSwathyBelum ada peringkat