Earnings Highlight - Stanbic IBTC Full Year 2017

Diunggah oleh

Law0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan1 halamanEarnings Highlight - Stanbic IBTC Full Year 2017 (1)

Judul Asli

Earnings Highlight - Stanbic IBTC Full Year 2017 (1)

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniEarnings Highlight - Stanbic IBTC Full Year 2017 (1)

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan1 halamanEarnings Highlight - Stanbic IBTC Full Year 2017

Diunggah oleh

LawEarnings Highlight - Stanbic IBTC Full Year 2017 (1)

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

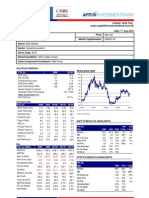

Stanbic IBTC Holdings Plc.

FY:2017 Result - Financial Highlights (NGN Billion)

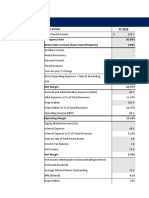

Statement of Comprehensive Income FY:2017 FY:2016 Y-o-Y Growth

Gross Earnings 212.4 156.4 35.8%

Interest Income 122.9 87.5 40.5%

Interest Expense (39.3) (29.6) 32.8%

Net Interest income 83.6 57.9 44.5%

(Credit impairment charges)/Write Back (25.6) (19.8) 29.2%

Investment and Other Operating Income 89.2 68.2 30.8%

OPEX (86.0) (69.0) 24.6%

PBT 61.2 37.2 64.4%

Taxation (12.8) (8.7) 47.1%

PAT 48.4 28.5 69.6%

Per share data STANBIC Corporate Actions

Current Price 49.15 Proposed Dividend N0.50

EPS 4.62

BVPS 18.5 Dividend Yield 1.0%

Price multiples/Ratios

Shares outstanding(bn) 10.0 Qualification Date 28-Mar-18

P/E 10.6x

P/BV 2.7x Closure Date 5-Apr-18

RoAE 29.7%

RoAA 4.0% Payment Date 28-Mar-18

Net Interest Margin 7.3%

Eko Hotel & Suites, Adetokunbo

Cost of Funds 4.7% AGM Venue

Ademola Street, Victoria Island Lagos

Cost to Income 49.8% 54.8%

Loan to Deposit Ratio 46.8% 59.9% AGM Date 19-Jun-18

Cost of Risk 6.7% 5.4%

Net Margin 22.8% 18.2%

Statement of Financial Position FY 2017 FY 2016 Y-o-Y Growth

Cash and Bank Balances 401.3 301.4 33.2%

Total Loans and advances 381.7 368.2 3.7%

Investment Securities 522.5 312.4 67.3%

Total Assets 1386.4 1053.5 31.6%

Total Equity 185.2 140.8 31.5%

Total Deposits 815.4 614.7 32.6%

Borrowings 103.9 124.0 -16.2%

Total Liabilities 1201.2 912.7 31.6%

Anda mungkin juga menyukai

- Gymboree LBO Model ComDokumen7 halamanGymboree LBO Model ComrolandsudhofBelum ada peringkat

- Earnings Highlight - Forte Oil Nigeria PLC Fy 2017Dokumen1 halamanEarnings Highlight - Forte Oil Nigeria PLC Fy 2017LawBelum ada peringkat

- FORTE OIL NIGERIA PLC. FY:2016 Result - Financial Highlights (NGN Billion)Dokumen1 halamanFORTE OIL NIGERIA PLC. FY:2016 Result - Financial Highlights (NGN Billion)LawBelum ada peringkat

- Quantamental Research - ITC LTDDokumen1 halamanQuantamental Research - ITC LTDsadaf hashmiBelum ada peringkat

- Hoàng Lê Hải Yến-Internal AuditDokumen3 halamanHoàng Lê Hải Yến-Internal AuditHoàng Lê Hải YếnBelum ada peringkat

- Banco Santander Chile 2Q18 Earnings Report: July 26, 2018Dokumen27 halamanBanco Santander Chile 2Q18 Earnings Report: July 26, 2018manuel querolBelum ada peringkat

- Earnings Highlight - DANGSUGAR PLC 9M 2016Dokumen1 halamanEarnings Highlight - DANGSUGAR PLC 9M 2016LawBelum ada peringkat

- Creative Enterprise Holdings Limited SEHK 3992 FinancialsDokumen32 halamanCreative Enterprise Holdings Limited SEHK 3992 FinancialsxunstandupBelum ada peringkat

- Corporate Accounting ExcelDokumen6 halamanCorporate Accounting ExcelshrishtiBelum ada peringkat

- Singapore Exchange Limited: Firing On All CylindersDokumen6 halamanSingapore Exchange Limited: Firing On All CylindersCalebBelum ada peringkat

- %sales Discount %yoy 18.5% 22.5% 1.8%Dokumen2 halaman%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenBelum ada peringkat

- Key Operating Financial DataDokumen1 halamanKey Operating Financial DataShbxbs dbvdhsBelum ada peringkat

- Bank of Kigali Announces AuditedDokumen10 halamanBank of Kigali Announces AuditedinjishivideoBelum ada peringkat

- Hero Motocorp LTD Quantamental EquityDokumen1 halamanHero Motocorp LTD Quantamental EquityVivek NambiarBelum ada peringkat

- AccretionDilution AnalysisDokumen14 halamanAccretionDilution AnalysisJayash KaushalBelum ada peringkat

- Βequity = Βasset (1+ (1-Tc) X B/S) : Asset Beta 0.71 0.63 0.8 Average 0.725 Tax 40%Dokumen10 halamanΒequity = Βasset (1+ (1-Tc) X B/S) : Asset Beta 0.71 0.63 0.8 Average 0.725 Tax 40%AkashNachraniBelum ada peringkat

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Dokumen21 halamanGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleBelum ada peringkat

- Union Bank - MP: Result TableDokumen4 halamanUnion Bank - MP: Result TableManjunath ManjuBelum ada peringkat

- Ganesh Textiles ExhibitsDokumen7 halamanGanesh Textiles ExhibitsPRANAV BHARARABelum ada peringkat

- Corporate Finance - DIVG - Group3Dokumen23 halamanCorporate Finance - DIVG - Group3Nisarg RupaniBelum ada peringkat

- BAJAJ AUTO LTD - Quantamental Equity Research ReportDokumen1 halamanBAJAJ AUTO LTD - Quantamental Equity Research ReportVivek NambiarBelum ada peringkat

- Breaking Events: Building MaterialsDokumen5 halamanBreaking Events: Building Materialsapi-26443191Belum ada peringkat

- Manappuram Finance Investor PresentationDokumen43 halamanManappuram Finance Investor PresentationabmahendruBelum ada peringkat

- CPRT Us Equity - Model - ZCK - Mar 15 2023Dokumen23 halamanCPRT Us Equity - Model - ZCK - Mar 15 2023Ekambaram Thirupalli TBelum ada peringkat

- M1 14-AZ2 PENROSE Part 1 (Analysis) - BlankDokumen5 halamanM1 14-AZ2 PENROSE Part 1 (Analysis) - BlankKhushi singhalBelum ada peringkat

- Purchases / Average Payables Revenue / Average Total AssetsDokumen7 halamanPurchases / Average Payables Revenue / Average Total AssetstannuBelum ada peringkat

- B D E (BDE) : LUE ART XpressDokumen18 halamanB D E (BDE) : LUE ART XpresshemantBelum ada peringkat

- Jollibee Foods Corporation PSE JFC FinancialsDokumen38 halamanJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniBelum ada peringkat

- Central Plaza Hotel Public Company Limited - CENTEL: Q3/18 Opportunity Day PresentationDokumen38 halamanCentral Plaza Hotel Public Company Limited - CENTEL: Q3/18 Opportunity Day PresentationsanyalukBelum ada peringkat

- Britannia VUDokumen37 halamanBritannia VUikamatBelum ada peringkat

- Sto Geschaeftsbericht 2018 EnglischDokumen184 halamanSto Geschaeftsbericht 2018 EnglischPremiBelum ada peringkat

- Hiap Teck RN 20100701 AffinDokumen3 halamanHiap Teck RN 20100701 Affinlimml63Belum ada peringkat

- Financial Analysis: ITC Ltd. Ticker: ITC: Prepared By: EdualphaDokumen13 halamanFinancial Analysis: ITC Ltd. Ticker: ITC: Prepared By: EdualphaParas LodayaBelum ada peringkat

- RatioDokumen11 halamanRatioAnant BothraBelum ada peringkat

- Why WACC Is Important To Consider For CompaniesDokumen8 halamanWhy WACC Is Important To Consider For Companiesfarhann JattBelum ada peringkat

- Soumya Lokhande 1353 - Manmouth CaseDokumen13 halamanSoumya Lokhande 1353 - Manmouth CasednesudhudhBelum ada peringkat

- DCF ConeDokumen37 halamanDCF Conejustinbui85Belum ada peringkat

- Is Excel Participant - Simplified v2Dokumen9 halamanIs Excel Participant - Simplified v2dikshapatil6789Belum ada peringkat

- Final Sheet DCF - With SynergiesDokumen4 halamanFinal Sheet DCF - With SynergiesAngsuman BhanjdeoBelum ada peringkat

- Investor Update For December 31, 2016 (Company Update)Dokumen17 halamanInvestor Update For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Dokumen32 halamanBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolBelum ada peringkat

- IS Excel Participant - Simplified v2Dokumen9 halamanIS Excel Participant - Simplified v2animecommunity04Belum ada peringkat

- Berger 1Dokumen8 halamanBerger 1Nikesh PandeyBelum ada peringkat

- Analisis FinancieroDokumen124 halamanAnalisis FinancieroJesús VelázquezBelum ada peringkat

- Ashok Leyland Kotak 050218Dokumen4 halamanAshok Leyland Kotak 050218suprabhattBelum ada peringkat

- Momo Operating Report 2Q20Dokumen5 halamanMomo Operating Report 2Q20Wong Kai WenBelum ada peringkat

- Selected Financial Information (Consolidate ($ Millions) )Dokumen2 halamanSelected Financial Information (Consolidate ($ Millions) )KshitishBelum ada peringkat

- Monmouth Case SolutionDokumen16 halamanMonmouth Case SolutionAjaxBelum ada peringkat

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDokumen40 halamanApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uBelum ada peringkat

- Momo Operating Report 2022 Q4Dokumen5 halamanMomo Operating Report 2022 Q4Harris ChengBelum ada peringkat

- Fundamental AnalysisDokumen4 halamanFundamental AnalysisBindu GaireBelum ada peringkat

- Is Excel Participant - Simplified v2Dokumen10 halamanIs Excel Participant - Simplified v2Aaron Pool0% (2)

- PayTM FinancialsDokumen43 halamanPayTM FinancialststBelum ada peringkat

- Hill Country Snack Foods CompanyDokumen14 halamanHill Country Snack Foods CompanyVeni GuptaBelum ada peringkat

- Earnings Presentation Q1FY22Dokumen13 halamanEarnings Presentation Q1FY22Bhav Bhagwan HaiBelum ada peringkat

- Investor PPT March 2023Dokumen42 halamanInvestor PPT March 2023Sumiran BansalBelum ada peringkat

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDokumen1 halamanDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLBelum ada peringkat

- Is Excel Participant Samarth - Simplified v2Dokumen9 halamanIs Excel Participant Samarth - Simplified v2samarth halliBelum ada peringkat

- Lonsum Highlights FY 2019Dokumen1 halamanLonsum Highlights FY 2019fahreziyuda14Belum ada peringkat

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyDari EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyPenilaian: 5 dari 5 bintang5/5 (1)

- Earnings Highlight - DANGSUGAR PLC 9M 2016Dokumen1 halamanEarnings Highlight - DANGSUGAR PLC 9M 2016LawBelum ada peringkat

- The New BicycleDokumen1 halamanThe New BicycleLawBelum ada peringkat

- Market Update For February 6, 2019Dokumen3 halamanMarket Update For February 6, 2019LawBelum ada peringkat

- LBSDecember2018 ProshareDokumen73 halamanLBSDecember2018 ProshareLawBelum ada peringkat

- Basics of Business ValuationDokumen24 halamanBasics of Business ValuationLawBelum ada peringkat

- SPE-173759-MS Scale Modeling in ReservoirsDokumen10 halamanSPE-173759-MS Scale Modeling in ReservoirsLawBelum ada peringkat

- SPE-193424-MS Chevron 2018Dokumen17 halamanSPE-193424-MS Chevron 2018LawBelum ada peringkat

- Captain Extended Well Test Program - Project Management and ExecutionDokumen12 halamanCaptain Extended Well Test Program - Project Management and ExecutionLawBelum ada peringkat

- IRP 22 Risk Register 2015Dokumen11 halamanIRP 22 Risk Register 2015LawBelum ada peringkat

- SHL Test DocumentsDokumen71 halamanSHL Test DocumentsLaw100% (4)

- Geomechanical Modeling To Assess Caprock Integrity in Oil SandsDokumen4 halamanGeomechanical Modeling To Assess Caprock Integrity in Oil SandsLawBelum ada peringkat

- Investment TrackerDokumen8 halamanInvestment TrackerLawBelum ada peringkat

- Shell TestDokumen23 halamanShell TestLawBelum ada peringkat

- 100 KPIsDokumen110 halaman100 KPIsMohammad AbdulaalBelum ada peringkat

- Intermediate Accounting CH 4 SolutionsDokumen65 halamanIntermediate Accounting CH 4 SolutionsTracy Wright100% (1)

- 13 x11 Financial Management ADokumen7 halaman13 x11 Financial Management AAG R OhcnaBelum ada peringkat

- Financial Management Case StudiesDokumen20 halamanFinancial Management Case Studiesfathima hamnaBelum ada peringkat

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokumen1 halamanIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruTed Mosby100% (1)

- Corporate Governance MCQS: 1. Property of The Company Belongs ToDokumen56 halamanCorporate Governance MCQS: 1. Property of The Company Belongs ToDairy MilkBelum ada peringkat

- The Future of Tax Research From An Accounting Professor's Perspective - Terry ShevlinDokumen7 halamanThe Future of Tax Research From An Accounting Professor's Perspective - Terry ShevlinRising PKN STANBelum ada peringkat

- Calculation of Index in FinanceDokumen6 halamanCalculation of Index in FinanceAbhiSharmaBelum ada peringkat

- Crescent All CAF Mocks With Solutions Compiled by Saboor AhmadDokumen123 halamanCrescent All CAF Mocks With Solutions Compiled by Saboor AhmadsheldonjabrazaBelum ada peringkat

- #11 Lincoln Philippines Life V CA (p16)Dokumen2 halaman#11 Lincoln Philippines Life V CA (p16)hansBelum ada peringkat

- Thermo Fisher Acquires Life Technologies Finance ModelDokumen19 halamanThermo Fisher Acquires Life Technologies Finance Modelvardhan0% (2)

- Financial Statement Analysis: Assignment Classification TableDokumen54 halamanFinancial Statement Analysis: Assignment Classification TableJ PBelum ada peringkat

- ABS-CBN v. Court of Tax Appeals, G.R. No. L - 52306, 12 October 1981Dokumen6 halamanABS-CBN v. Court of Tax Appeals, G.R. No. L - 52306, 12 October 1981MariaBelum ada peringkat

- Zacks Equity Research Report For Stanley Black & DeckerDokumen8 halamanZacks Equity Research Report For Stanley Black & DeckerAnup KelkarBelum ada peringkat

- Indroduction: Group 2 'S Types of AuditDokumen32 halamanIndroduction: Group 2 'S Types of Auditaliakhtar02Belum ada peringkat

- Direct Tax Summary Notes For IPCC JKQK1AK0Dokumen24 halamanDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaBelum ada peringkat

- Reits: Overview: Micah W. Bloomfield and Mayer Greenberg, Stroock & Stroock & Lavan LLPDokumen10 halamanReits: Overview: Micah W. Bloomfield and Mayer Greenberg, Stroock & Stroock & Lavan LLPoleetcoBelum ada peringkat

- Project Report: International School of Informatics and ManagementDokumen46 halamanProject Report: International School of Informatics and Managementdeepakpatni11Belum ada peringkat

- Final Exam Cheat Sheet ADM1340Dokumen11 halamanFinal Exam Cheat Sheet ADM1340Chaz PresserBelum ada peringkat

- RatioDokumen13 halamanRatioKaren Joyce Sinsay50% (2)

- CH 14Dokumen53 halamanCH 14muthi'ah ulfahBelum ada peringkat

- PPT-10 REITs - InvITs PresentaionDokumen24 halamanPPT-10 REITs - InvITs PresentaionVikas MaheshwariBelum ada peringkat

- BVCA Model Term Sheet For A Series A Round - Sept 2015Dokumen15 halamanBVCA Model Term Sheet For A Series A Round - Sept 2015GabrielaBelum ada peringkat

- Audit of Error Correction and Cash and AccrualsDokumen4 halamanAudit of Error Correction and Cash and AccrualsRafael BarbinBelum ada peringkat

- Financial AccountingDokumen471 halamanFinancial AccountingJasiz Philipe Ombugu80% (10)

- Book PenmanDokumen8 halamanBook PenmanL67Belum ada peringkat

- Financial Management FinalDokumen14 halamanFinancial Management FinalNeal KBelum ada peringkat

- SEC VAL AssignmentDokumen2 halamanSEC VAL Assignmentharsh7mmBelum ada peringkat

- BPI 2019 Integrated ReportDokumen336 halamanBPI 2019 Integrated ReportRegina Leona DeLos SantosBelum ada peringkat

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDokumen15 halamanAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxBelum ada peringkat