An Analysis of Indian Shipbuilding and Repair Industry PDF

Diunggah oleh

gopalptkssJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

An Analysis of Indian Shipbuilding and Repair Industry PDF

Diunggah oleh

gopalptkssHak Cipta:

Format Tersedia

International Journal of Civil Engineering and Technology (IJCIET)

Volume 9, Issue 7, July 2018, pp. 715–723, Article ID: IJCIET_09_07_074

Available online at http://www.iaeme.com/ijciet/issues.asp?JType=IJCIET&VType=9&IType=7

ISSN Print: 0976-6308 and ISSN Online: 0976-6316

© IAEME Publication Scopus Indexed

AN ANALYSIS OF INDIAN SHIPBUILDING AND

REPAIR INDUSTRY

A. Prem Anandh

Assistant Professor, Department of Naval Architecture & Offshore Engineering,

AMET University, Chennai, India

MSP Raju

Associate Professor, Department of Naval Architecture & Offshore Engineering,

AMET University, Chennai, India

ABSTRACT

In the arena of construction, Ship construction is the major and highly complex

industry market compare to other civil construction in India. India’s strong GDP

growth of about 7 percent continued to grow (2) which is supported by Government

initiative like MAKE IN INDIA and other subsidy schemes through state government

which increased the Indian ship construction and repair economy. SWOT analysis

shows India has a favorable trend for new ship construction and scrapping industry in

near future. This paper will give over all description and economic perspective analysis

of ship construction in India.

Key word: Ship construction, MAKE IN INDIA, Ship Repair, Economy, SWOT,

Scrapping industry.

Cite this Article: A. Prem Anandh and MSP Raju, An Analysis of Indian Shipbuilding

and Repair Industry, International Journal of Civil Engineering and Technology, 9(7),

2018, pp. 715–723.

http://www.iaeme.com/ijciet/issues.asp?JType=IJCIET&VType=9&IType=7

1. BACKGROUND- WORLD ECONOMIC GROWTH OF SHIP

CONSTRUCTION

International seaborne commerce continues to be predominantly decided by the growth of

global economy and trade. In spite of the fact that the interconnection over the commercial

profit & Merchandise market look like fluctuating due to a noticeable falloff in growth ratio of

trade to over GDP in latest years, but still there is a strong requirement of Maritime trade

continued to be mostly depend on performance of International economy.

While comparing the global economic growth of year 2016 there is a decrement in GDP of

2.2% from 2.6% in the year of 2015 & further more during 2001-2008 of 3.2%(2) .This declined

growth has a explicatory factors like negative trend in international trade policy and continued

conflict on low merchandise rate on both investment and exporting commodity.

http://www.iaeme.com/IJCIET/index.asp 715 editor@iaeme.com

A. Prem Anandh and MSP Raju

1.1. WORLD SEABORNE TRADE

In line with developments in the global economy, in 2016 the requirement of shipping services

is improved to a noticeable extend, comparing global trade enlarged from 1.8%(of 2015) to

2.6%, Which is lesser than average of 3% registered over past 40years.With reference to the

figure-1 the overall volume crossed 10.300 million tons, reflecting increment of 260 million

tons of cargo, in that half was to tanker oils and gas exchange (2) (Refer figure.1). Strong import

demand of China in 2016 endured to assisting world maritime seaborne exchange, even though

overall growth was offset by finite expansion in the import demand of other developing

regions(6)

Figure 1 International seaborne trade, selected years (Millions of tons loaded)

Data Sources: Review of Maritime Transport, for 2006–2016, the breakdown by cargo type

is based on data from Clarksons Research, Shipping Review and Outlook and Seaborne Trade

Monitor.

In 2016, international seaborne tanker trade for crude oil, refined petroleum and gas

products were continued to grow amid a surplus of oil market supply and lower oil prices. When

comparing growth of previous year, the Overall capacity attained 3100 million tons, which

shows a positive growth of 4.2 % (2). Need of oil for inventory building continued for crude oil

& refined oil product which impacts in high storage level.

These favorable market situation were further supported by need of crude oil imports in

India, China as well as in USA. High level of exported petroleum products from India and China

With reference to various economic reports the countries like Republic Korea, India and

Europe reported steady increase in necessity for diesel oil import mostly for transportation use.

1.2. INTRODUCTION TO ECONOMY OF INDIAN SHIPBUILDING:

The Indian shipbuilding industry has around 27 shipyards, out of which 8 shipyards are in public

and others are private. In addition to Ship repair and new constructing activities, the demand

for semi-submersibles and port auxiliary vessels is projected to develop in view of rising

shipment in coming years.

The twelfth 5 Year Plan published by Planning Commission lists “Shipbuilding and Repair”

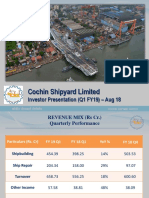

as one of the vital zones. The Indian shipbuilding overall turnover of public as well as private

http://www.iaeme.com/IJCIET/index.asp 716 editor@iaeme.com

An Analysis of Indian Shipbuilding and Repair Industry

shipyard sector crossed 3.8 crores in 2015. Government-owned Hindustan and Cochin Shipyard

Limited are the primary shipyards in India. Private shipyards are larger in the count, but are

hardly limited by size and capacity of shipbuilding and also ship repair. The Indian shipbuilding

industry is estimated to double from its 2022 revenue of Rs 20,000in the next five years (8).

2. SHIPBUILDING SUBSIDY SCHEME

2.1. Introduction to Subsidy

The Indian Government has publicized rupees 4000 Crores Shipbuilding Financial support

Policy of ten years to encourage Local shipbuilding. Financial support will be accepted to

Indian Shipyards equal to 20% of the lower of “Contract Price” or the “Fair Price” of the

individual ship built by them for a span of at most 10 years launching from 2016-17.(9)

This rate of 20% will be reduced by 3% once a year for three years. The quantum of financial

benefit of a vessel shall be the product of the appropriate rate of financial benefit prevailing on

the date of Contract and the least contract price or the fair price when changed into Indian

Rupees. Provided that, at the time of the release of financial benefit, if the actual payment

received for a vessel is lesser than the contract price, such payment shall restore the contract

price in the formulae for estimation of the financial assistance.

In the beginning, The Indian government had unfolded shipbuilding subsidy scheme for all

shipyards of India on 25th October 2002. The scheme concluded on 14th August 2007. The

Government decided in March 2009 to make a disbursement for shipbuilding subsidy for

shipbuilding agreement signed up to 14th August 2007 for which budgetary readiness was made

up to 31st March 2014 (3).Among 228 shipbuilding contracts signed in the course of 2002-2007,

subsidy amounting to Rs. 1142 Crore has been paid out for a building of 121 ships. A new

shipbuilding financial benefit policy has been publicised for orders secured during April 1,

2016, to March 31, 2026. (10)

The subsidy was focused at pitching the distortions of the domestic economic environment

which impact native shipbuilders adversely over and above aiming the impact of indirect and

also direct promotion provided to the shipyards in overseas. Refer Table: 1.

With observing the upper hand drift of world ship building, the Indian shipbuilding industry

has been able to take benefit of this Government support to stabilize its existence in world

shipbuilding.

Table 1 Shipbuilding –Total Subsidy disbursed in term of Public Vs Private sector (Rupees in crore)

Years Public shipyards Private shipyards Total

2002-03 25.36 Nil 25.36

2003-04 10 Nil 10

2004-05 15 Nil 15

2005-06 101.53 Nil 101.53

2006-07 110.52 Nil 110.52

2007-08 169.96 19.28 189.24

2008-09 131.71 Nil 131.71

2009-10 107.4 71.8 179.2

2010-11 70.91 128.19 19.1

2011-12 5.77 116.65 122.42

2012-13 Nil 220 220

2013-14 Nil 179 179

2014-15 Nil Nil Nil

2015-16 Nil Nil Nil

http://www.iaeme.com/IJCIET/index.asp 717 editor@iaeme.com

A. Prem Anandh and MSP Raju

3. INDIA ENJOYS COMPETITIVE ADVANTAGES

India appreciates considerable benefit which has boosted evolving countries such as China and

Vietnam into the leading edge of global shipbuilding. Few of the primary assets that can

influence shipbuilders in India are:

LOW LABOUR COST

Cost of Labour is a primary driving factor in shipbuilding nations, as it totalled for more than

10 per cent of the overall cost. Indian labour is relatively cheaper than Korean and Chinese

labour. More importantly, Indian labour cost is increasing at half the rate in China, which

implies that India might continue to have an edge over China in the future. Figure.2 shows the

difference in labour cost around the world in US dollar.

Figure 2

STRONG DOMESTIC DEMAND

Indian shipping trade is flourishing on the back of economic growth at the rate of close to 7 per

cent. Domestic shipping lines are multiplying their fleets and have placed orders with global

yards. There is also a strong thrust in basic zones such as power and steel companies are looking

to grab ships to control transport from international mines. The Government's new ingenuity in

Coastal and also Inland Water Transportation is likely to further raise demand for new ships.

SUPPORTING INDUSTRY INFRASTRUCTURE FOR SOME COMPONENTS:

India has domestic industries which can manufacture some of the unprocessed materials needed

in shipbuilding. Precisely, India has competitive steel manufacturing, light engineering and

IT/ITES (Information Technology/Information Technology Enabled Services) industries which

can give the necessary resource at reasonable costs. Now a day’s these industries not

manufacturing for the shipbuilding sector, due to a shortfall of sufficient scale of ship

construction in the country.

LONG COASTLINE

India owns a long coastline of exceeding 7,500 km long with a number of deepwater ports

serving as positive locations for setting up shipyards In spite of these advantages are nullified

by governing hurdles Indian yards face systemic disadvantages in several areas which turn

down their natural competitiveness and negatively impact their opportunity of achieving in a

http://www.iaeme.com/IJCIET/index.asp 718 editor@iaeme.com

An Analysis of Indian Shipbuilding and Repair Industry

worldwide shipbuilding industry. Shipbuilders of India meeting a cost drawback of around

30%-40 % of the production cost of a ship on basis of these aspects.

THE MAJOR DRAWBACKS ARE AS FOLLOWS:

Statutory Burden

Shipbuilding grabs a complex set of tax and duties. The variance in the rate of duties and taxes

between India and other nations results in further cost accountability for Indian shipyards

Financing Costs

Financing costs assume larger consequence in shipbuilding due to its special constraints.

Leading shipbuilding countries have found auxiliary methods to ease the burden of these costs.

Indian shipyards have no similar direct support, face increased costs on account of financing.

• Bank Guarantees

• Working Capital

3.1. SWOT evaluation of the Indian shipbuilding industry

Strengths

• The launch of “Make In India”

• Government allowing 30% cash subsidies to new building yards in India.

• Large coastline for ships

• Strong labour force

• Low cost

Weaknesses

• Lack of building larger capacity ship yards

• Lack of trained engineers and skilled labours

• Government support and initiative for Shipbuilding is limited.

Opportunities

• Requirements of equipment and ancillaries in Indian new building shipyards.

• Demand for offshore oil exploration and production in Indian shores and abroad through

collaborations.

• Increase in demand in India for offshore platforms and their repair facilities.

• Professionals and R&D facilities.

Threats

• Order cancellation in new ship building due to untimely delivery by ship yards.

• Lack of government recognition

• Shipbuilding industry do not have countrywide presence

http://www.iaeme.com/IJCIET/index.asp 719 editor@iaeme.com

A. Prem Anandh and MSP Raju

3.2 NEW SHIPBUILDING: New building shipyards are predominantly active in defence

and commercial shipbuilding. Commercial ships are primarily constructed for European owners

and Defence ships are for Indian Navy. Shipyards mainly build vessels for European country

owners are ABG Shipyard, Bharati Shipyard, Modest, Pipavav Shipyard, L&T Shipyard,

Cochin Shipyard, etc.

3.3 SHIPBUILDING CAPACITY: Ship building capacity of a unit is described with regard

to the number of ships built and their carrying ability measured in terms of Dead Weight

(DWT).

Figure.3.1 a &3.1 b shows the shipbuilding capacity of private and public shipyards

respectively.

400

Capacity(;000DWT)

70 50

30 20

PPV BSL SKL L&T ABG

Name Of Companies

Figure.3.1.a Shipbuilding capacity of private sector

Figure.3.1.b Shipbuilding capacity of public sector

4. INDIA’S SHIP-REPAIRING INDUSTRY

Indian ship repairing industry comprises of about 7 ship repair units (SRU's), specifically

Alcock Ashdown & Co. Limited, Chennai Port Trust, Mumbai Port Trust, Hindustan Shipyard

Limited (HSL), Cochin Shipyards Limited (CSL), Garden Reach Shipbuilders (GRSE) and

Mazagon Dock Limited(MDL) who have been approved as the permanent SRU's

http://www.iaeme.com/IJCIET/index.asp 720 editor@iaeme.com

An Analysis of Indian Shipbuilding and Repair Industry

Amongst nationalised companies, Cochin Shipyard Ltd had the maximum capacity for ship

repairing (125 thousand DWT) accompanied by Hindustan Shipyard Ltd. (80 thousand DWT)

and Garden Reach Ship Building and Engineering Ltd (26 thousand DWT) in the year 2015-

16.

Private sector category, Larsen &Turbo Ltd had the maximum capacity for ship repairing

(400 thousand DWT) accompanied by Bristol Boat (54thousand DWT) whereas ABG Shipyard

Ltd &Bharati Shipyard Ltd had 30 thousand DWT ship-repairing capacities individually.Private

sector category, Larsen &Turbo Ltd had the maximum capacity for ship repairing (400 thousand

DWT) accompanied by Bristol Boat (54thousand DWT) where as ABG shipyard Ltd &Bharati

Shipyard Ltd had 30 thousand DWT ship-repairing capacities individually.

4.1. NUMBER OF SHIPS REPAIRED

In 2015-16 total 446 ships were repaired, by private (312 ships) and government (134 ships)

sector shipyards versus 482 in 2014-15. 67 Vessels out of 446 ships repaired by Indian

shipyards were foreign vessels.Figure.4 shows the difference in the number of ships repaired in

both Government and private sectors

In 2015-16 among the government sector, CSL had repaired the utmost number of ships (89

ships with earning of Rs. 355.52 crores) accompanied by Goa Shipyard Ltd. (26 ships with

earning Rs 170.95 crore) (4).

In the private sector, Chidambaram Shipcare Ltd. had the highest number of ships repaired

(155 ships earning Rs 14.06 crore) followed by Dempo Shipbuilding &Engg. Ltd. (73 ships

earning Rs 12.19 crore), Larsen& Toubro Ltd. (31 ships with profiting Rs. 44.82 crore) and

Sembmarine Kakinada Ltd. (26 ships repaired with an profiting of Rs 71.05crore.)

Figure 4

4.2. FISCALPOSITION OF SHIPBUILDING AND SHIP REPAIRING

COMPANIES

The fiscal review of the shipbuilding/ship repair companies in terms of gross earning implies

that amongst government companies, the highest income earned during 2015-16 was Rs. 35552

Crore by Cochin Shipyard Ltd, followed by Hindustan Shipyard Ltd of Rs. 15042.89. In terms

of income, the maximum profit was earned by Goa Shipyard Ltd (17094.97) Shalimar Work

Ltd (RS127.84crore) (5)

In private sector, the highest income earned during 2015-16 was by Larsen& Toubro Ltd

(Rs 4484.8 crore) followed by ABG Shipyard Ltd (Rs. 2081 crore) and Pipavav defence (Rs700

crore)

http://www.iaeme.com/IJCIET/index.asp 721 editor@iaeme.com

A. Prem Anandh and MSP Raju

5. MAKE IN INDIA- SHIP BREAKING

Four countries particularly India, Bangladesh, Pakistan and China - altogether totalled for 94 %

of ship demolishing in the year 2016. Unified nations conference trade and development data

confirm a constant trend of industry consolidation (2), where various countries specialize in

different maritime divisions. It also validates the rise in participation of evolving countries in

several maritime sectors.

Turkey prolonged market niche for scrapping some gas carriers and also some ferries and

passenger ships. All other countries altogether totalled for 1.8 per cent of the world total.

Figure.5 shows the Reported tonnage went for scrapping, and most of vessel types and countries

where scrapped in the year 2016 (Thousands of gross tons).Key demolition figure is provided

in table 2.0.

Table 2

Reported tonnage sold for scrapping, major vessel types and countries where demolished,

2016(Thousands of gross tons).

Figure 5 Data Source: UNCTAD secretariat estimates, based on data from Clarksons Research.

CONCLUSION

The study of various aspects of the global and the Indian shipbuilding industry clearly shows

that India needs to look at multiple areas including in the areas of a Regulatory framework,

Investment policies, Trade policies, Fiscal policies, Infrastructure, R&D, Skill, Financing,

Process, Collaboration and Technology. The Indian ship breaking industry is worth Rs 5,500

crore and can raise to Rs 11,000 crore by 2022 and Rs 18,000 crore by 2026, based on the report

of shipping ministry-commissioned by management consultancy AT Kearney(11).The Indian

http://www.iaeme.com/IJCIET/index.asp 722 editor@iaeme.com

An Analysis of Indian Shipbuilding and Repair Industry

commercial shipbuilding market economy has the potential to grow five times over the next

decade.

REFERENCES

[1] Statistics Of India’s Ship Building And Ship Repairing Industry 2015-16- Government of

India Ministry of Shipping Transport Research Wing (Statistics of india's Ship building and

ship repairing Industry 2015-2016, 2017)

[2] UNCTAD (2016). Trade Facilitation and Development: Driving Trade Competitiveness,

Border Agency Effectiveness and Strengthened Governance. (United Nations publication.

Geneva.http://unctad.org/en/PublicationChapters/rmt2017ch1_en.pdf

[3] T. Subhashini, N. Kumar, V. Thanikachalam and P. Maheswari, Greener, Safer-Sustainable

Energy Efficient Shipping using Solar Power Optimizer by MPPT. International Journal of

Mechanical Engineering and Technology, 8(4), 2017, pp. 156– 164

[4] http://pib.nic.in/newsite/PrintRelease.aspx?relid=147643

[5] https://economictimes.indiatimes.com/cochin-shipyard-

ltd/infocompanyhistory/companyid-4529.cms

[6] http://www.financialexpress.com/india-news/whopping-5-individuals-in-india-have-

annual-salary-income-above-rs-100-crore/983730/

[7] http://www.germes-trans.com/chinas-debt-management-shipping-industry/

[8] http://www.stats.gov.cn/enGliSH/PressRelease/201503/t20150311_692835.html

[9] http://planningcommision.nic.in/aboutus/committe/wkgrp11/wg11_shipbild.doc

[10] https://www.marinelink.com/news/shipbuilding-looks-india419883

[11] http://taxheal.com/subsidy-for-ship-building-industry.html

[12] http://www.dailyshippingtimes.com/news-upload/upload/fullnews.php?fn_id=17049

[13] Daily shipping times dated on 16.06.2017

http://www.iaeme.com/IJCIET/index.asp 723 editor@iaeme.com

Anda mungkin juga menyukai

- Cruise Shipbuilding BusinessDokumen19 halamanCruise Shipbuilding BusinessgopalptkssBelum ada peringkat

- Scheduling of Shipyard Block Assembly ProcessDokumen44 halamanScheduling of Shipyard Block Assembly ProcessgopalptkssBelum ada peringkat

- Scheduling of Shipyard Block Assembly Process PDFDokumen20 halamanScheduling of Shipyard Block Assembly Process PDFgopalptkssBelum ada peringkat

- Safety Management SystemsDokumen125 halamanSafety Management Systemsridgell100% (2)

- Ship Doubler PlatesDokumen218 halamanShip Doubler PlateshamishjbadamsonBelum ada peringkat

- Owner's Management of Ship Construction ContractsDokumen21 halamanOwner's Management of Ship Construction ContractsgopalptkssBelum ada peringkat

- Case Studies CC 1 (Final)Dokumen12 halamanCase Studies CC 1 (Final)City Aspire50% (2)

- Ship Doubler PlatesDokumen218 halamanShip Doubler PlateshamishjbadamsonBelum ada peringkat

- L1 - 2 - Shipyard ProductivityDokumen33 halamanL1 - 2 - Shipyard ProductivityCURRITOJIMENEZBelum ada peringkat

- Safety Management SystemsDokumen125 halamanSafety Management Systemsridgell100% (2)

- CSL Investor Presentation Aug 18Dokumen21 halamanCSL Investor Presentation Aug 18gopalptkssBelum ada peringkat

- Project ManagementDokumen42 halamanProject Managementtein93Belum ada peringkat

- Shipyard Management of The Customer Nad ManagementDokumen4 halamanShipyard Management of The Customer Nad ManagementgopalptkssBelum ada peringkat

- A Manual On Planning and Production Control For Shipyard Use PDFDokumen129 halamanA Manual On Planning and Production Control For Shipyard Use PDFCURRITOJIMENEZBelum ada peringkat

- An Analysis of Indian Shipbuilding and Repair Industry PDFDokumen9 halamanAn Analysis of Indian Shipbuilding and Repair Industry PDFgopalptkssBelum ada peringkat

- 5reasons For LMSDokumen6 halaman5reasons For LMSmkondaBelum ada peringkat

- ASRY News Q2 2015Dokumen9 halamanASRY News Q2 2015gopalptkssBelum ada peringkat

- Contract Management For Ship Construction, Repair and DesignDokumen2 halamanContract Management For Ship Construction, Repair and Designgeraldo gilBelum ada peringkat

- Construction ManagementDokumen12 halamanConstruction ManagementSeble GetachewBelum ada peringkat

- MIT Shipbuilding Cost EstimationDokumen82 halamanMIT Shipbuilding Cost Estimationgopalptkss100% (1)

- HinduDokumen46 halamanHinduTripti MehrotraBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Environmental Impact AssessmentDokumen187 halamanEnvironmental Impact AssessmentVidya VenugopalBelum ada peringkat

- Personal Safety and Social Responsibilities CourseDokumen101 halamanPersonal Safety and Social Responsibilities Coursecalvin AliaBelum ada peringkat

- Fire Fighting Code PDFDokumen8 halamanFire Fighting Code PDFReuben EphraimBelum ada peringkat

- Self Checklist For Shipboard Safety Management SystemDokumen10 halamanSelf Checklist For Shipboard Safety Management SystemVeri YuliantoBelum ada peringkat

- Accident Investigation Report Solution: ST ND RDDokumen1 halamanAccident Investigation Report Solution: ST ND RDAlden CabajarBelum ada peringkat

- Briefing Paper - IceDokumen62 halamanBriefing Paper - IcePanagiotis RappasBelum ada peringkat

- Materi Tambahan - Carriage Good by SeaDokumen15 halamanMateri Tambahan - Carriage Good by Seaine fitriaBelum ada peringkat

- Brannstrom Sweden AB Operations Manual for Oil Discharge Monitoring Equipment CleanTrack 1000 BDokumen233 halamanBrannstrom Sweden AB Operations Manual for Oil Discharge Monitoring Equipment CleanTrack 1000 BIvaylo IvanovBelum ada peringkat

- Types of ShipsDokumen19 halamanTypes of ShipsDreamgirl Chrisy G100% (2)

- NTM 158 Fujairah SPM TerminalsDokumen62 halamanNTM 158 Fujairah SPM TerminalsJohn Green100% (1)

- IMO Res. Int ForceDokumen11 halamanIMO Res. Int Forceajinkyachaubal2Belum ada peringkat

- Ship-to-Ship Oil Transfer OperationsDokumen47 halamanShip-to-Ship Oil Transfer OperationsAmeyaManjrekar100% (2)

- Yanbu Commercial Port - 2013Dokumen25 halamanYanbu Commercial Port - 2013Naresh Kumar NagarajanBelum ada peringkat

- Initial Ship DesignDokumen37 halamanInitial Ship DesignlakshmiBelum ada peringkat

- Notice No.3 Rules and Regulations For The Classification of Ships JulyDokumen18 halamanNotice No.3 Rules and Regulations For The Classification of Ships JulyrickBelum ada peringkat

- SIRE QUESTION and ANSWERS PREPARATIONS LISTDokumen142 halamanSIRE QUESTION and ANSWERS PREPARATIONS LISTtroy morensBelum ada peringkat

- LNG 101 - August 11 13 SLNG PresentationDokumen17 halamanLNG 101 - August 11 13 SLNG PresentationFrank MosesBelum ada peringkat

- Fleet PDFDokumen2 halamanFleet PDFCristhian Huanqui TapiaBelum ada peringkat

- Fig. 7.2: A Tanker Voyage Cycle: A. B. C. D. Loading Rate Pumping Capacity Piping Arrangements Venting CapabilitiesDokumen43 halamanFig. 7.2: A Tanker Voyage Cycle: A. B. C. D. Loading Rate Pumping Capacity Piping Arrangements Venting CapabilitiesSunil Dayalu100% (3)

- SPMDokumen24 halamanSPMMS75% (4)

- Coast Guard Tanker Inspection GuidelinesDokumen20 halamanCoast Guard Tanker Inspection Guidelinesjohn mark manuel magalonaBelum ada peringkat

- CoC 1920s - Adventure - Whispers in The DarkDokumen82 halamanCoC 1920s - Adventure - Whispers in The DarkGabriel PereiraBelum ada peringkat

- MMIA Bulletin 037Dokumen7 halamanMMIA Bulletin 037arnoldxridleyBelum ada peringkat

- MARPOL Oily Sludge Disposal RequirementsDokumen33 halamanMARPOL Oily Sludge Disposal RequirementsRaya SBelum ada peringkat

- Advanced Oil Gas Accounting International Petroleum Accounting International Petroleum Operations MSC Postgraduate Diploma Intensive Full TimeDokumen70 halamanAdvanced Oil Gas Accounting International Petroleum Accounting International Petroleum Operations MSC Postgraduate Diploma Intensive Full TimeMoheieldeen SamehBelum ada peringkat

- Cargo Crew - 6Dokumen32 halamanCargo Crew - 6Osman Mert Atabay100% (1)

- BS 6349 1 1 2013Dokumen120 halamanBS 6349 1 1 2013foruzz100% (1)

- DNV CG 0285Dokumen156 halamanDNV CG 0285Jayasankar GopalakrishnanBelum ada peringkat

- Champion-7 Full Report PDFDokumen82 halamanChampion-7 Full Report PDFadib assoliBelum ada peringkat

- International Oil Pollution Prevention Certificate (IOPP)Dokumen18 halamanInternational Oil Pollution Prevention Certificate (IOPP)YouTube paradiseBelum ada peringkat