5OFI GST Functional P2P Flow Phase1 PDF

Diunggah oleh

lkalidas1998Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

5OFI GST Functional P2P Flow Phase1 PDF

Diunggah oleh

lkalidas1998Hak Cipta:

Format Tersedia

Pre-Release Document

Oracle Financials for India (OFI)

Goods and Services Tax (GST)

Procure to Pay Functional

Author: Vaishali and Somdeep

Creation Date: 21-Mar-2016

Last Updated: 05-Oct-2016

Document Ref:

Version: 1A

Organization: Oracle India Private Limited.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 1

Document Control

Change Record

Date Author Versio Change Reference

n

21-Mar-16 Vaishali and 1A Initial document

Somdeep

30-Sep-16 Vaishali and 1.0 Phase-I frozen document

Somdeep

Reviewers

Name Position

Rajnish Kumar Director, Financial Localizations

Development

V S Baburaj Director, Product Strategy

Audience

Name Position

12.2 Implementation team

12.2 Customers

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 2

Table of Contents

Document Control .................................................................................................................................. 2

1 – Introduction ........................................................................................................................................... 5

2 – Scope .................................................................................................................................................... 5

3 – Prerequisite Setups ............................................................................................................................. 5

4 – Functional Flow .................................................................................................................................... 6

5 – Requisition to Purchase Order (Pre-PO- PO Documents) ............................................................ 7

5.1 Flow Diagram ................................................................................................................................... 7

5.2 Create Requisition ........................................................................................................................... 7

5.3 India tax details form ..................................................................................................................... 10

5.4. Create RFQ (Request for Quotation) ........................................................................................ 11

5.5 Creating Quotation ........................................................................................................................ 14

5.6 Create Purchase Order from the approved Requisition .......................................................... 16

6 – Tax recalculation logic ...................................................................................................................... 19

7 – Tax on receipts................................................................................................................................... 19

7.1 Flow Diagram ................................................................................................................................. 19

7.2 Receipt Creation ............................................................................................................................ 19

8 – Tax Accounting on Receipts ............................................................................................................ 24

8.1 Accounting for Receipt Routing - Direct Delivery and Standard Routing ........................... 26

8.1.1 Flow Diagram .......................................................................................................................... 26

8.1.2 Direct Delivery – Recoverable Tax ...................................................................................... 28

8.1.3 Direct Delivery – Non-Recoverable Tax ............................................................................. 28

8.1.4 Standard Routing - Recoverable Tax .................................................................................. 29

8.1.5 Standard Routing - Non-Recoverable Tax ......................................................................... 29

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 3

9 – PO/Receipt Matched AP invoice ..................................................................................................... 30

9.1 Flow Diagram ................................................................................................................................. 30

9.2 Process and Accounting ............................................................................................................... 30

10 – ERS Invoice ...................................................................................................................................... 34

10.2 Process and Accounting............................................................................................................. 36

11 – Standalone AP Invoice ................................................................................................................... 39

11.1 Flow Diagram ............................................................................................................................... 39

11.2 Process and Accounting............................................................................................................. 39

12 –Tax Recovery Accounting (Interim) ............................................................................................... 41

12.1 Flow Diagram ............................................................................................................................... 41

12.2 Process and Accounting............................................................................................................. 42

13 – Third Party Invoices ........................................................................................................................ 48

13.1 Flow Diagram ............................................................................................................................... 49

13.2 Process and Accounting............................................................................................................. 49

14 – Costing Effect – Accounting Entries ............................................................................................. 54

14.1 Average Costing .............................................................................................................................. 54

14.2 Standard Costing ......................................................................................................................... 55

15 – Call to Action .................................................................................................................................... 57

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 4

1 – Introduction

The Procure to Pay cycle (P2P) is vital to an organization as in this process the organization buys and

receives goods or services from its vendors and makes necessary payments. This business process

covers the process of requesting, purchasing, receiving, paying for and accounting for goods and

services.

2 – Scope

This document provides the details of Functional flow for ‘Oracle Financials for India’ (OFI) Procure to

Pay cycle from GST point of view along with accounting entries.

Note: The current content has been compiled in reference to the frozen scope of the Phase-I

deliverables (Ref: GST Phase -1 Deliverables.docx)

3 – Prerequisite Setups

For the P2P cycle to work in the new GST architecture, the below setup needs to be defined

Regime

Tax types

Tax rates

Tax Categories

Tax Rules

Tax Defaulting basis

Item Classification

Claim term

Common Configuration

First and Third party Registration

Flow Diagram

To start with, this document facilitates with a flowchart which will allow the users to get an outline of the

setup flow for Procure to Pay Cycle. Some of the steps outlined in this flowchart are required and some

are Optional. Required step with Defaults means that the setup functionality comes with pre–seeded,

default values in the application. However, to ensure a successful setup, you need to review those

defaults and decide whether to change them to suit your business needs. If you need to change the

default values, you should perform the corresponding setup step. You need to perform Optional steps

only if you plan to use the related feature.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 5

Regime Registration Tax types (R) Tax rates (R)

(R

Tax Defaulting Document sequence

basis (R) Tax Categories (R)

(O)

Define Item Define Claim Terms

Tax Rules (R)

Classification (R) (R)

Third Party First Party

Registration Common Configuration

Registration

(R) (R)

(R)

Note: - In The above flow diagram R standard for ‘Required’ and O stands for ‘Optional’

4 – Functional Flow

The P2P cycle comprises of the following steps,

Create Requisition Create RFQ Create Quotation

(Localization taxes – (Localization taxes – (Localization taxes –

applied) Applied) Not Applied)

Receipt creation (Localization taxes Create Purchase

–Applied) Taxes are freezed Once Order (Localization

receiving is done taxes – Applied)

Create Payable Invoice-

Localization taxes from receipts Invoice Payment

are copied to Invoice

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 6

5 – Requisition to Purchase Order (Pre-PO- PO Documents)

Every organization that operates a business has to purchase material such as row materials services etc.

The procurement process of any organization consists of many steps like material requirement planning,

creation of purchase requisition, receiving quotations from various suppliers etc. Please refer to the

following section for details

5.1 Flow Diagram

Create Requisition Enter

Header/Line Info

Navigate to Tools India Tax Details. Tax category is

defaulted based on defaulting mechanism defined

Create RFQ Tax category is defaulted from requisition

Create Purchase Order

and Approve

Navigate to Tools India Tax Details. Tax category is

defaulted from requisition to Purchase order

5.2 Create Requisition

A purchase requisition is an internal request to purchase a material / service which will have details of

certain quantity of material or service on a certain date which is required by the organization. To create

requisition navigate to

Responsibility Oracle Purchasing Requisitions Requisitions

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 7

Enter Requisition Header:

The header holds the general information about the requisition that is related to all the lines. Choose the

requisition type (here it is purchase requisition). Preparer is the default person who is creating the

requisition and cannot be changed. You can give the description in the description field.

Enter Requisition Line:

In the requisition line, select the item that you wanted to purchase and enter the quantity and need by

date. In the Source details tab, you can input detailed information. You can give a specific note to the

buyer which might give particular information related to this purchase. RFQ required check box denotes

that the purchase of the item requires a request for quote.

Requisitions can be added in any currency set up in EBS by identifying the currency code and exchange

rate type on currency tab

Click on distribution button and enter the charge account

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 8

Close the form and save your work. Click the ‘Approve’ button to submit this requisition for approval.

Now navigate to Tools India tax details form. The India tax details form will show the tax category

Defaulted.

For more information on the tax defaultation logic refer the ‘OFI-GST- Tax Defaultation flow’

document.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 9

Tax

Category is

defaulted

Notes:-

Unlike earlier we will no longer have Localized forms in the new GST solution and to view the tax

details the navigation is Tools India tax details

Tax category defaulted based on tax defaultation logic can be manually Overridden at each document

level until the document is approved.

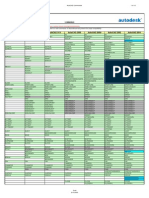

5.3 India tax details form

SL No Field Functional Description Query/Enabled

1 Organization Inventory Organization name No

2 Location Inventory Organization Location No

3 Document Number PO number No

4 Revision / release Number No

5 Currency PO currency No

6 Amount PO line amount No

7 Tax amount Total tax amount No

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 10

8 Total Amount Total PO amount No

9 Line Number Po Line number No

10 Item Item Code No

11 Item Description Descript of the item attached to PO No

12 Tax category Tax category Defaulted based on Yes

defaulting Mechanism

13 Tax rate name Tax type attached to the tax No

category

14 Tax type Tax type attached to tax category No

15 Tax point basis Determines the point in which tax No

accounting is done. Gets defaulted

from Tax type setup

16 Precedence Gets defaulted from tax category No

setup

17 Tax conversion date Date on which tax is calculated No

18 Tax rate Tax rate defined at tax rate setup No

19 Tax amount Amount calculated for each tax type No

20 Recoverable amount Tax amount which can be No

recovered. Get populated only if the

tax type is a recoverable

21 Recoverable Get populated only if the tax type is No

a recoverable

22 Inclusive Get populated only if the tax type is No

a inclusive

23 Self Assessed / reverse charge Gets defaulted from tax type No

24 Party name and Party type Gets defaulted from PO Yes

5.4. Create RFQ (Request for Quotation)

A Request for Quotation (RFQ) is a formal request sent to the suppliers to find the pricing and other

information for an item or items. Based on the information supplied, the supplier quotes a quotation

against the RFQ form.

In Oracle EBS, RFQ’s can be auto created from an existing Purchase Requisition or can be a fresh RFQ.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 11

Navigation to Auto create the RFQ is

Responsibility Oracle Purchasing (USA) Auto Create and then query the Requisition number

Your Requisition summary is shown in the next screen. Check box your Requisition line and in

the Document Type, select RFQ and click Automatic button to Auto Create RFQ.

It will navigate to a new window. Here the RFQ Type is Standard RFQ and click create button

Select the line

against which RFQ

needs to be Select

created the RFQ

type

In the next window, RFQ is auto created from an existing Purchase requisition.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 12

Click Suppliers button and enter the details of the Suppliers to whom you want to send this RFQ.

Click on Terms button and add payment terms and freight terms. Click Price Breaks button for entering

pricing information for the RFQ.

Now from the Tools India tax details form, we can see that tax category is defaulted

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 13

Tax category is

defaulted

Save the transaction.

5.5 Creating Quotation

A quotation is a supplier’s response to RFQ. Now we will create quotations based on the response from

the suppliers with relevant to RFQ which we have created in step 5.4.

To create a quotation from the RFQ, first query the RFQ. The below picture shows the completed RFQ.

Tools

Copy

Document

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 14

In the next screen, enter the details of quotation sent by the supplier. Click OK button.

Repeat the same steps if you want to create multiple quotation for multiple suppliers.

Once the quotation is created, system will show the below message

Change the status of the quotation to Active and approve the quotation.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 15

Change

status to

active

5.6 Create Purchase Order from the approved Requisition

Purchase Order (PO) is the formal request to a vendor to supply certain materials or services. A PO can

be created with reference to a requisition or RFQ or another PO.

Responsibility Oracle Purchasing Auto Create and then query the Requisition number

Select Document

type as ‘Standard

PO’

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 16

Your Requisition summary is shown in the next screen. Check box your Requisition line and in

the Document Type, select standard PO and click Automatic button to Auto Create PO. By clicking

Automatic button, a standard PO is created based on the details provided in the Purchasing requisition.

You can select Supplier either in the New Document form or in the Purchase Order form

Click on ‘Create’

Button to confirm

the PO creation

After clicking on the Create button in the above screen a Standard PO is created as follows

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 17

In the shipment form, Shipment number, Org, Ship-to, UOM, Quantity and Need-by-date are shown by

default. These fields can be edited as needed.

Even in the more tab and distribution details tab, the default values will be populated from requisition.

Now, Navigate to Tools India tax details.

The default tax category is automatically defaulted here

Tax category is

defaulted from

requisition level

Now approve the PO. No accounting entry happens when a PO is created.

Note:

Unlike earlier we will no longer have Localized forms in the new GST solution and to view the tax details

the navigation is Tools India tax details

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 18

6 – Tax recalculation logic

As per the current architecture, the tax defaultation engine should recalculate the taxes at every

document level. However if the tax is already defaulted / manually overridden at parent document level,

then the same tax category gets defaulted for further documents until unless there is some change. If the

master document does not have the tax category attached, then based on the tax defaultation logic the

tax category will get defaulted at each document level.

7 – Tax on receipts

Once the PO is sent to the supplier, the supplier sends the goods to the organization. The goods now

have to be received in Oracle.

7.1 Flow Diagram

Select the PO lineEnter

Inventory details

Navigate to Tools India Tax Details. Tax category is

defaulted from PO level

Check on ‘Confirm taxes’ Check box to freeze the tax

category and it is mandatory to check

Navigate to Receipt form

and Save the receipt

‘Receiving Transaction processor’ program will be fired and

it will process Base / Localization tax details

7.2 Receipt Creation

Navigation for creating a receipt is

Responsibility Oracle Purchasing Receiving Receipts

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 19

Enter the PO number and click Find button

Select the line

against which

receipt needs to Shows the PO

be created details against

which receipt is

created

Check the Lines you want to receive and enter the sub inventory details

In the lower part of the screen, Purchasing displays the following detail information for the current

shipment line: Order Type, Order Number, Source, Due Date, Item Description, Hazard, Destination, UN

Number, Receiver Note, and Routing.

Now if we navigate to Tools India tax details, we can see that tax category is defaulted here also.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 20

Tax category

defaulted

Now we have to click on ‘confirm taxes’ check box to freeze the tax category. Once this check box is

checked, overriding the tax category is not possible.

Note:

If a receipt is saved without checking the ‘Confirm Taxes’ check box, the Receiving Transaction

Processor program will end in error and no receipts will be created.

In GST solution ‘India Receiving Transaction’ Processor program will not be triggered and has no

relevance.

Unlike earlier we will no longer have Localized forms in the new GST solution and to view the tax

details the navigation is Tools India tax details

Once the check box is checked, below message will appear

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 21

‘Confirm Taxes’

check box

needs to be

checked to

freeze the taxes

before receipt

creation

Confirmation

message once

the taxes are

freezed

Click on Header and save the receipt to get the receipt number

Once the receipt is saved, system automatically triggers the “Receiving Transaction Processor” (RTP)

concurrent. Unlike earlier, now “India Receiving Transaction Processor program” will not be fired. The

base Receiving Transaction Processor concurrent itself will process the India localization tax details.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 22

Receiving transaction

processor program is fired

after receipt creation and it

will create / process both

base receipt detail as well

as Localization tax details

Once the RTP concurrent is completed, in the Receiving transaction Window we can see that receipt

processing has already happened

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 23

8 – Tax Accounting on Receipts

Based on the tax point basis, tax types like recoverable / non-recoverable, different routing method

adopted, different accounting entries will get generated at different stages.

The accounting entry generated after the receipt creation and this is the core accounting

Event Account Debit Credit

Receiving Inventory Line Amount

Receipt

Inventory AP Accrual Line Amount

For the India tax details, the below lines are inserted in GL_INTERFACE table after the Receiving

transaction processor program is completed.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 24

The below script can be used extract data from GL_INTERFACE

Select gcc.segment1,

gcc.segment2,gcc.segment3,gcc.segment4,gcc.segment5,gi.code_

combination_id,gi.entered_dr,gi.entered_cr,gi.user_je_category_na

me,gi.reference10

from gl_code_combinations gcc, gl_interface gi

where gi.date_created like sysdate and gi.code_Combination_id =

gcc.code_Combination_id and reference10 like '%Receipt

number%';

Below accounting entry is generated for each tax type

Event Account Debit Credit

Receiving Inventory Tax Amount

Receipt

Inventory AP Accrual Tax Amount

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 25

8.1 Accounting for Receipt Routing - Direct Delivery and Standard Routing

8.1.1 Flow Diagram

Create PO Receipt Routing set to

Direct Delivery Standard Routing

Navigate to Tools India Tax Details. Navigate to Tools India Tax Details.

Attach Category recoverable or Non- Attach Category recoverable or Non-

recoverable recoverable

Navigate to Receipt form and select Navigate to Receipt form and select

the PO line for receipt creation the PO line for receipt creation

Navigate to Tools India Tax Details. Navigate to Tools India Tax Details.

Check ‘Confirm taxes’ check box. Check ‘Confirm taxes’ check box.

‘Receiving Transaction processor’ program ‘Receiving Transaction processor’ program

will be fired and it will process Base / will be fired and it will process Base /

Localization tax details. Both Receiving and Localization tax details. Only Receiving

Delivery transaction will be created. transaction will be created.

Lines are inserted in GL_INTERFACE table Lines are inserted in GL_INTERFACE table

for tax accounting (refer query mentioned in for tax accounting (refer query mentioned in

Chapter 8 to extract the data) Chapter 8 to extract the data)

Perform the Receiving transaction by navigating to

Purchasing Receiving Receiving transactions

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 26

When a recoverable tax category is attached, in India tax details form (both at PO and receipt level) the

Recoverable check box will be checked and recoverable amount will be populated.

Recoverable check box is

checked and Recoverable

amount is calculated.

Note:

For a tax type to be recoverable, the below setup has to be in place

- Recoverable check box needs to be checked at Tax type Setup

- Recoverable option needs to be set to ‘Yes’ in item classification setup

- Claim term has to be defined for the Tax type.

If any of the above setup is missing, then the tax type will be treated as a non-recoverable tax.

When a non-recoverable tax category is attached, in India tax details form (both at PO and receipt level)

the Recoverable check box will be unchecked and recoverable amount will not be populated.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 27

Recoverable check box is

unchecked and

Recoverable amount is not

calculated.

8.1.2 Direct Delivery – Recoverable Tax

The accounting entry generated in GL_INTERFACE is

Event Account Debit Credit

Tax Interim Recovery Tax Amount

Receipt

Inventory AP Accrual A/c Tax Amount

8.1.3 Direct Delivery – Non-Recoverable Tax

The accounting entry generated in GL_INTERFACE is

Event Account Debit Credit

Receiving Inventory Tax amount

Receipt

Inventory AP Accrual Tax amount

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 28

8.1.4 Standard Routing - Recoverable Tax

The accounting entry generated in GL_INTERFACE is

Event Account Debit Credit

Tax Interim Recovery Tax Amount

Receipt

Inventory AP Accrual A/c Tax Amount

8.1.5 Standard Routing - Non-Recoverable Tax

The accounting entry generated in GL_INTERFACE is

Event Account Debit Credit

Receiving Inventory Tax Amount

Receipt

Inventory AP Accrual Tax Amount

Note:

The non–recoverable tax amounts need to be added to item cost. So after delivery transaction, lines

are inserted in MTL_MATERIAL_TRANSACTIONS (MMT) and MTL_TRANSACTION_ACCOUNTS (MTA).

For more information on queries that can be used to find out the details of the lines inserted in the

MMT and MTA tables, refer document 1065343.1.

Period End Accrual functionality which is not supported in current architecture will not be supported

even in GST solution.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 29

9 – PO/Receipt Matched AP invoice

In oracle payables an invoice can be created by using the purchase order / receipt information from

purchasing system to enable online matching with invoices. Invoiced or billed items are matched to the

original purchase orders / receipt created to ensure that invoice is created only for goods or services you

ordered and/or received.

9.1 Flow Diagram

Create Invoice Match

Action ‘Receipt’

Click on Match option Select receipt Click on Match

button

Line / distribution details are defaulted from

Receipt level to Invoice

Navigate to Tools India Tax Details. The tax

category is defaulted from Receipt to invoice

Since Tax point basis was Delivery, the taxes are freezed in

India Tax Details form

Validate and Run Create accounting

9.2 Process and Accounting

Create Payables invoice

Responsibility: Payables responsibility to create an AP invoice

Navigation: Invoice Entry Invoices

Create an Invoice for supplier against whom PO /receipt is created.

Invoice Header

In invoice header level, select the operating Unit, invoice type and enter the PO number i.e. 65 in our

example. Once you select the PO number, supplier name and Site automatically gets defaulted from the

PO.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 30

Matching Receipt to the invoice

To create a receipt matched invoice, the match type in Invoice header should be “Receipt”.

Match Action

is set to

‘Receipt’

We shall not enter the invoice line / distribution details as this will come automatically from matching the

invoice with Receipt.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 31

The next step would be to Click on Match button in Invoice work bench and query for the Receipt which

we are intending to match to the invoice and click on find.

Query the

Receipt

Select the line which needs to be matched to the invoice and click on Match button

Click on ‘Match’ button to

default distribution details

from receipt to Invoice

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 32

Now we can see that the line details and Distribution details at invoice level is automatically populated

from PO / receipt.

Tax Defaultation

Now if we navigate to Tools India tax details, we can see that Taxes which are defaulted at receipt are

defaulted at invoice level as well

Tax category

from Receipt

got defaulted to

Invoice

Tax Point basis is set

as ‘Delivery’

Now validate the invoice and run Create accounting. Accounting entry generated

The accounting class for the tax type

is set as ‘Miscellaneous’

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 33

10 – ERS Invoice

Payment on Receipt enables the user to automatically create standard, unapproved invoices for payment

of goods based on receipt transactions. Invoices are created using a combination of receipt and purchase

order information that eliminates duplicate manual data entry. It automatically creates invoices with

multiple items and distribution lines, and includes tax. Payment on Receipt is also known as Evaluated

Receipt Settlement (ERS).

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 34

10.1 Flow Diagram

Create PO for Supplier / Supplier site which has

ERS Invoice setup

Navigate to Terms Set ‘Pay on’ option to

‘Receipt

Navigate to Tools India Tax Details. Tax category is

defaulted based on defaulting mechanism defined

Create a receipt Check the ‘Confirm taxes’

check box

Three concurrent requests are triggered

Receiving Transaction Processor

ADS (Pay On Receipt AutoInvoice)

Payables Open Interface Import

. Lines are inserted in

GL_INTERFACE table for tax

ERS invoice is imported to Payables

accounting (refer query

mentioned in Chapter 8 to extract

the data)

Validate the ERS invoice and run create

accounting

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 35

10.2 Process and Accounting

Create a purchase with Pay on option set to ‘Receipt’. Once the PO is approved, create a receipt. As

soon as you save the receipt transaction, in the background the below programs will be submitted:-

Receiving Transaction Processor

ADS (Pay On Receipt

AutoInvoice)

Payables Open Interface Import

Once receiving transaction processor program is completed

The accounting entry generated in GL_INTERFACE is

Event Account Debit Credit

Receiving Inventory Tax Amount

Receipt

Inventory AP Accrual Tax Amount

The output of payable Open interface program, the ERS invoice number which got created will be

displayed

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 36

ERS invoice number

which got imported

to payables

When we query the invoice number in invoice work bench and navigate to Tools India tax details form,

the tax category has defaulted from receipt level.

Tax category is defaulted from

Receipt. Since confirm taxes

check box is checked at receipt

level, the fields are freezed at

invoice level

Once the invoice is validated and Accounted, the below accounting entry is generated by navigating to

Tools View accounting

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 37

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 38

11 – Standalone AP Invoice

Standalone AP Invoices will be raised for non-item based expense or service activities and they will not

have any reference to any purchasing documents like PO, receipt etc. These invoices are directly created

in invoice work bench by manually entering the supplier details and distribution details.

As Item information is not available for such invoices, Item-based taxes will not be applicable for

standalone invoice.

11.1 Flow Diagram

Enter the Header details like invoice

type, Supplier Name, site etc

Click on Line Items and fill the line

level and distribution details

Navigate back to Header. Tools -

India Tax details

Pick the Organization and location.

The same is required for adding

taxes/tax defaultation if any

Lines are inserted in

GL_INTERFACE table for tax

Validate and Account the invoice

accounting (refer query

mentioned in Chapter 8 to extract

the data)

Tax details can be viewed in India Tax

Details form / View accounting

(Accounting class ‘Miscellaneous

Expense’

11.2 Process and Accounting

Responsibility: Payables responsibility to create an AP invoice Navigation:

Invoice Entry Invoices

In invoice header level, select the operating Unit, invoice type, Supplier name and site details etc.

Now navigate to Line level details and enter the Line and distribution Details

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 39

Now navigate to Tools India tax details

Enter the Organization

and Location details

Tax category

defaulted

The tax point basis is

‘Invoice’

Based on the tax default rule we have setup, the ‘P2P testing 2’ tax category is defaulted automatically.

Below we can also see the Taxes attached to the ‘P2P testing 2’ category.

Once the Organization and location details are entered, save the transaction and navigate back to invoice

work bench and validate and Account the invoice. The accounting entry generated at this stage is

Tax lines are generated

with accounting class as

‘Miscellaneous Expense’

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 40

12 –Tax Recovery Accounting (Interim)

Users have the flexibility of selecting the Tax Point Basis (TPB) while defining the Tax Types

based on which the accounting will happen at differently. In the same way the recovery process

can also be done at different stages based on the Tax Point Basis. They are

12.1 Flow Diagram

Create PO Enter header /

line details

Navigate to Tools India Tax Details. Attach tax category

with Recoverable tax type and TPB as Delivery

Navigate to Receipt form and select the PO

line for receipt creation

Navigate to Tools India Tax Details. Check

‘Confirm taxes’ check box.

Lines are inserted in

GL_INTERFACE table for tax

‘Receiving Transaction processor’ program will be fired and

accounting (refer query

it will process Base / Localization tax details

mentioned in Chapter 8 to extract

the data)

Navigate to Tools India Tax Details. From Menu

select Tools Process Claims. Claim details form will

open

Enter the claim details and click on populate

values

Lines are inserted in

GL_INTERFACE table for tax

Select the lines which needs to be processed

accounting (refer query

Enter claim term details click on Process option

mentioned in Chapter 8 to extract

the data)

The processed line status is changed from

‘Pending Recovery’ to ‘Recovered’

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 41

12.2 Process and Accounting

Once the receipt accounting is done, for a receipt with recoverable taxes,

The accounting entry is generated in GL_INTERFACE is

Event Account Debit Credit

Tax Interim Recovery Tax Amount

Receipt

Inventory AP Accrual A/c Tax Amount

Once the receipt accounting is done, to process recovery amount, navigate to

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 42

Now in India tax details form navigate to

Tools Process

Claims

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 43

In the Claim details form enter the tax invoice number and tax invoice date and enter the Action as

‘Recover’

Enter the tax

information Details

Once the above details are entered click on ‘Populate Values’ button which will populate the tax invoice

number and tax invoice date to all the tax lines

Click on ‘Populate

values’ button to

default the Tax invoice

information details to

each line level. Post

that each line will have

the tax invoice number,

date information

entered at header

level.

Now select the tax line which you want to process or you can also choose Select all option if you want to

process all the tax lines. Also before processing the field ‘Intended Use’ needs to be populated.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 44

Enter Intended

use option

Manufacturing

or Non

Manufacturing

Once the above information’s are entered, click on ‘process’ button. Below confirmation message will be

shown

Confirmation

message for

Recovery

Processing

Now we can see that Status of the tax line is changed from Pending Recovery to Recovered

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 45

The line status is changed

from ‘Pending recovery’ to

‘Recovered’

In the above case, only 50% of the tax amount is recovered and other 50% is pending for recovery on

next month. That is because of the claim term ‘GST Claim Term’ Setup. As the setup of claim term GST

Claim Term’ is

Also, the once the recovery is processed,

The accounting entry is generated in GL_INTERFACE is

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 46

Event Account Debit Credit

Tax Recovery Recovered

Amount

Recovery

Tax Interim Recovery Recovered Amount

Note:

Interim recovery to recovery – currently recovery process is manually done via process recovery

option and this will be an Interim Solution. We are checking the feasibility to automate the entire

process.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 47

13 – Third Party Invoices

Third party invoice functionality provides provision to pay to the Vendor other than the PO Vendor. This

will be required for paying the services offered by other Vendors related to that PO. An approved Invoice

for the Non-PO Vendor will be created automatically when the invoice is created via payable open

interface.

For using the third party invoice functionality, the tax type attached to the PO should have the

‘Update vendor on

transaction’ check box

should be checked at

tax type definition.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 48

13.1 Flow Diagram

Create PO Enter header

and line information

Navigate to Tools India Tax Details. Attach tax category

with ‘Update vendor on transaction’ check box checked

Navigate to Receipt form and select the PO line for receipt

creation

Navigate to Tools India Tax Details. Change the

party Name and party site at tax type level Click

apply. Click on ‘Confirm taxes’ Check box

Four concurrent requests are triggered Lines are inserted in

GL_INTERFACE table for tax

Receiving Transaction Processor accounting (refer query mentioned

ADS (Pay On Receipt AutoInvoice) in Chapter 8 to extract the data)

Third party Payables Open Interface Import

Payables Open Interface Import

Payables Open Interface Import – Imports Invoice for

Item line for PO vendor and

Third party Payables Open Interface Import - Imports

Invoice for tax line for Non PO vendor

Validate and Account both Standard

Invoice and Third party Invoice

13.2 Process and Accounting

Create a purchase order with tax type which has ‘Update vendor on transaction’ check box checked at tax

type setup.

In Receipt form, before saving the receipt navigate to Tools India tax details. Change the ‘Party Name’

and ‘Party site’ to a new vendor and click apply button to save the changes

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 49

Change the Party

Name and Party Site

to a Non PO vendor

Click Apply to

save the changes

Note:

The third party vendor details can also be updated at PO level and if it is updated at PO level, the same

gets defaulted to receipt level as well.

Now click on confirm taxes check box to freeze the tax details

Now once the receipt is saved, system automatically fired the below concurrent

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 50

Below concurrent

are fired

In the above request set, the program ‘Third party Invoices - Payables open interface Import (Payables

Open Interface Import)’ creates the Third party invoice against the Non –PO vendor and ‘Payables Open

Interface Import’ program creates the invoice against the vendor in the PO. The output of the ‘Third party

Invoices - Payables open interface Import’ shows invoice for tax amount has been created against the

third party vendor.

Invoice created

against Third party

vendor

The output of ‘Payables Open Interface Import’ program shows the invoice details created against the PO

vendor.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 51

Invoice created

against PO vendor

Now in invoice work bench, when queried, the invoice created against PO vendor will show the Item + tax

amount in India tax details form even though invoice line level only item line amount is reflected.

Below accounting is created for the third party invoice

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 52

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 53

14 – Costing Effect – Accounting Entries

14.1 Average Costing

In a average costing organization, the below accounting is generated for

A. Recoverable Taxes

After receipt Accounting

Event Account Debit Credit

Interim recovery A/c Tax Amount

Receipt

Inventory AP Accrual Tax Amount

A/c

After Recovery

Event Account Debit Credit

Tax Recovery Tax Amount

Receipt

Tax Interim Recovery Tax Amount

In case of recoverable taxes, the MTL tables will not be impacted / hit with the tax amount.

B. Non Recoverable Taxes

After receipt Accounting

Event Account Debit Credit

Receiving Inventory Tax Amount

Receipt

Inventory AP Accrual Tax Amount

Once the delivery transaction is done, MTL_TRANSACTIONS_INTERFACE table gets updated with non-

recoverable tax amount and the same gets added to item cost. Accounting entry at that stage will be

Event Account Debit Credit

Receipt Material Tax Amount

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 54

Receiving inventory Tax Amount

14.2 Standard Costing

In a standard costing organization, the below accounting lines are inserted in GL_INTERFACE table once

the Receiving transaction is completed

A. Non-Recoverable taxes

Accounting entry for PO receiving

Event Account Debit Credit

Receiving Inventory Tax Amount

Receipt

Receiving Inventory Tax Amount

Accounting entry for Delivery transaction is

Event Account Debit Credit

Purchase Price Tax Amount

Variance

Receipt

Receiving Inventory Tax Amount

Note:

In case of standard costing Organization, the MTL tables will not be impacted / hit with the tax amount.

B. Recoverable taxes

After receipt accounting, the accounting entry generated in GL_INTERFACE is

Event Account Debit Credit

Interim Recovery Tax Amount

Receipt

Receiving Inventory Tax Amount

Once the recovery is done, the accounting entry generated in GL_INTERFACE is

Event Account Debit Credit

Receipt Recovery Tax Amount

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 55

Interim Recovery Tax Amount

Note:

There is no relevance of PO destination in GST architecture. Whether the destination is ‘Expense’

or ‘Inventory’ the accounting treatment will be same.

The accounting impacting on costing and OPM remains same as it is in current architecture.

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 56

15 – Call to Action

This is not the final document and further changes shall be incorporated as and when there are any

further updates from Product Management / Development teams in regards to the changed

features/functionality or pending product clarifications, if any.

For further reference, you can also refer the below Pre-Release documents released as a part of the

EBS GST Infrastructure Scope:

OFI-GST-Functional Tax Computation for O2C – Phase1

OFI-GST Configuration – Phase1

OFI-GST- Tax Defaultation flow – Phase1

OFI-GST-Functional O2C flow – Phase1

Vaishali and Somdeep OFI-GST Procure to Pay-Phase-1 57

Anda mungkin juga menyukai

- EBS GST Infrastructure ScopeDokumen15 halamanEBS GST Infrastructure ScopeRana7540Belum ada peringkat

- GST Functional OSP Flow Phase2Dokumen21 halamanGST Functional OSP Flow Phase2vishav_20003214Belum ada peringkat

- OFI GST ISupplier Functional DocumentDokumen27 halamanOFI GST ISupplier Functional Documentsubhani1211Belum ada peringkat

- OFI GST Functional TDS Configuration Phase2Dokumen26 halamanOFI GST Functional TDS Configuration Phase2rajkumarBelum ada peringkat

- GST-Fixed Asset IntegrationDokumen19 halamanGST-Fixed Asset IntegrationMadhusudhan Reddy VangaBelum ada peringkat

- OFI GST Functional Tax Computation For P2P Phase1Dokumen73 halamanOFI GST Functional Tax Computation For P2P Phase1rajkumarBelum ada peringkat

- Oracle Rest Data Services Quick Start Guide HDokumen30 halamanOracle Rest Data Services Quick Start Guide HBig Data HHBelum ada peringkat

- Consolidated SCMDokumen39 halamanConsolidated SCMNithish ReddyBelum ada peringkat

- R12 Sales Order Line Status Flow and Meaning - Oracle ERP Apps GuideDokumen4 halamanR12 Sales Order Line Status Flow and Meaning - Oracle ERP Apps Guider.n.pradeep0% (1)

- R12 Oracle Apps Overview 1 (1) .0Dokumen49 halamanR12 Oracle Apps Overview 1 (1) .0iymanbBelum ada peringkat

- COA Technical GuidelinesDokumen17 halamanCOA Technical Guidelinesvarachartered283Belum ada peringkat

- GL Drilldown For Financials For India TransactionsDokumen39 halamanGL Drilldown For Financials For India Transactionschandra_wakarBelum ada peringkat

- Eveready Ebs New Features Wipl 11012021Dokumen18 halamanEveready Ebs New Features Wipl 11012021Md MuzaffarBelum ada peringkat

- Fusion Tech ActDokumen74 halamanFusion Tech ActrahulrsinghBelum ada peringkat

- R12 - MassAllocation Across Ledgers in GLDokumen29 halamanR12 - MassAllocation Across Ledgers in GLRana Nishant SinghBelum ada peringkat

- Fusion Technical Course Content LatestDokumen4 halamanFusion Technical Course Content LatestVenu Ramgopal100% (1)

- RD011 ReceivablesDokumen7 halamanRD011 ReceivablesAnusha ReddyBelum ada peringkat

- Oracle Application Framework Troubleshooting Guide: Release 11i To Release 12.2Dokumen109 halamanOracle Application Framework Troubleshooting Guide: Release 11i To Release 12.2Rajeev KumarBelum ada peringkat

- GST List of PatchesDokumen13 halamanGST List of PatchesdurairajBelum ada peringkat

- Fusion UseBIPubli To Run SQLDokumen10 halamanFusion UseBIPubli To Run SQLnachuthan_1Belum ada peringkat

- OIC Training Material: Company ConfidentialDokumen64 halamanOIC Training Material: Company ConfidentialAnderson MedinaBelum ada peringkat

- Oracle Global Human Resources Cloud: Implementing Bene TsDokumen372 halamanOracle Global Human Resources Cloud: Implementing Bene TsThomasBelum ada peringkat

- Oracles RMCSDokumen34 halamanOracles RMCSsharas77Belum ada peringkat

- 2013 02 EBS AttachmentsDokumen58 halaman2013 02 EBS Attachmentsadroit_ramesh1436Belum ada peringkat

- OFI GST BOE Functional DocumentDokumen49 halamanOFI GST BOE Functional Documentzaheer ahamadBelum ada peringkat

- Setup Steps: This Document Explains The Basic Setup Needed To Setup TDS For Suppliers in R12Dokumen10 halamanSetup Steps: This Document Explains The Basic Setup Needed To Setup TDS For Suppliers in R12asdfBelum ada peringkat

- Interco Setup DemoDokumen18 halamanInterco Setup DemoBala RanganathBelum ada peringkat

- OCI Exam Preperation Handbook v2.0Dokumen14 halamanOCI Exam Preperation Handbook v2.0Alfredo MirandaBelum ada peringkat

- GL Drilldown For Financials For India TransactionsDokumen39 halamanGL Drilldown For Financials For India TransactionsPrem KishanBelum ada peringkat

- Extending Oracle Fusion SaaS With OCIDokumen10 halamanExtending Oracle Fusion SaaS With OCILAKSHMANANBelum ada peringkat

- Oracle eBS Bill of Materials Import ExampleDokumen3 halamanOracle eBS Bill of Materials Import ExampletracejmBelum ada peringkat

- Introducing Oracle E-Business Suite R12 SCM The Global Business ReleaseDokumen37 halamanIntroducing Oracle E-Business Suite R12 SCM The Global Business ReleaseRiz Deen100% (1)

- Allocations Recurring Journals Oracle Erp Financials CloudDokumen41 halamanAllocations Recurring Journals Oracle Erp Financials CloudMihai FildanBelum ada peringkat

- Oracle EBS - Fusion SCP Cloud Integration Automation Whitepaper FinalDokumen12 halamanOracle EBS - Fusion SCP Cloud Integration Automation Whitepaper FinalMohamed MahmoudBelum ada peringkat

- White Paper - Siebel CRM Oracle Documents Cloud Service Integration PDFDokumen23 halamanWhite Paper - Siebel CRM Oracle Documents Cloud Service Integration PDFRishi AgrawalBelum ada peringkat

- SateshDokumen2.301 halamanSateshrajaorugantiBelum ada peringkat

- Fusion Tech ActDokumen52 halamanFusion Tech Actmymle1Belum ada peringkat

- Sample EBS Technical - ResumeDokumen5 halamanSample EBS Technical - ResumejeluBelum ada peringkat

- Oracle® Trabaja Con Oracle EPM Automate para Oracle EPMCDokumen242 halamanOracle® Trabaja Con Oracle EPM Automate para Oracle EPMCAndrés RonchaquiraBelum ada peringkat

- Quick Reference Guide:: Email and Fax Delivery Options in Oracle EBS R12Dokumen14 halamanQuick Reference Guide:: Email and Fax Delivery Options in Oracle EBS R12Srinivas ReddyBelum ada peringkat

- Oracle Fusion Cloud SCM: Implementing Order ManagementDokumen2.182 halamanOracle Fusion Cloud SCM: Implementing Order ManagementKannan RamanBelum ada peringkat

- Oracle DocsDokumen12 halamanOracle Docsganesh_vijayBelum ada peringkat

- MD120 - REQ 179145 Create Accounting Error 28 SEP 22Dokumen6 halamanMD120 - REQ 179145 Create Accounting Error 28 SEP 22akhil reddyBelum ada peringkat

- Oracle MosDokumen8 halamanOracle MosjupiterBelum ada peringkat

- PO - RECV Web ADIDokumen21 halamanPO - RECV Web ADIMayur GidwaniBelum ada peringkat

- Setting Up Cost Accounting in Fusion: Source SystemsDokumen35 halamanSetting Up Cost Accounting in Fusion: Source SystemsShiva KumarBelum ada peringkat

- (INV0004) Oracle Inventory How To Setup Shortage Parameter and Notifications - Oracle Apps SCM Functional GuideDokumen5 halaman(INV0004) Oracle Inventory How To Setup Shortage Parameter and Notifications - Oracle Apps SCM Functional GuideAKSHAY PALEKARBelum ada peringkat

- Project Contracts User GuideDokumen176 halamanProject Contracts User GuideSiva KumarBelum ada peringkat

- R12 Recommended Browsers For Oracle E-Business Suite (Doc ID 389422.1)Dokumen1 halamanR12 Recommended Browsers For Oracle E-Business Suite (Doc ID 389422.1)Gopal Chandra SamantaBelum ada peringkat

- R12 Oracle Cash Management 1.0Dokumen31 halamanR12 Oracle Cash Management 1.0iymanbBelum ada peringkat

- ADI NotesDokumen5 halamanADI Notesalasbrod7Belum ada peringkat

- 10574-Oracle Support Council - Understanding and Troubleshooting GST - Functionality and New Diagnostic Tools-Presentation - 788Dokumen28 halaman10574-Oracle Support Council - Understanding and Troubleshooting GST - Functionality and New Diagnostic Tools-Presentation - 788moin786mirza100% (1)

- 01 - Lesson 1 Activities - EDAG0001Dokumen9 halaman01 - Lesson 1 Activities - EDAG0001ZNCFTCBelum ada peringkat

- Project Manufacturing TrainingDokumen36 halamanProject Manufacturing TrainingSreeharsha SBelum ada peringkat

- Jade Globals Hi Tech Industry SolutionsDokumen3 halamanJade Globals Hi Tech Industry SolutionsSapna SoniBelum ada peringkat

- Oracle WMS PICK White PaperDokumen97 halamanOracle WMS PICK White PaperjavierBelum ada peringkat

- Self LearningDokumen183 halamanSelf Learningpradeep191988Belum ada peringkat

- Oracle AIM (Old Version) PDFDokumen2 halamanOracle AIM (Old Version) PDFvishyBelum ada peringkat

- OFI GST Functional P2P FlowDokumen81 halamanOFI GST Functional P2P FlowdurairajBelum ada peringkat

- Ofi GST P2PDokumen92 halamanOfi GST P2PSamima KhatunBelum ada peringkat

- Trade Mark Copy RightDokumen1 halamanTrade Mark Copy Rightlkalidas1998Belum ada peringkat

- Board Resolution New PVT LTDDokumen3 halamanBoard Resolution New PVT LTDlkalidas1998Belum ada peringkat

- TEC Chennai - Holiday List - 2023Dokumen1 halamanTEC Chennai - Holiday List - 2023lkalidas1998Belum ada peringkat

- TEC Services and Packages Price Guide - ChennaiDokumen13 halamanTEC Services and Packages Price Guide - Chennailkalidas1998Belum ada peringkat

- KEMS Project PlanDokumen7 halamanKEMS Project Planlkalidas1998Belum ada peringkat

- Work Sheet - TenseDokumen3 halamanWork Sheet - Tenselkalidas1998Belum ada peringkat

- OFI GST Process Claim Functional DocumentDokumen22 halamanOFI GST Process Claim Functional Documentlkalidas1998Belum ada peringkat

- GST Functional TDS Configuration Phase2Dokumen26 halamanGST Functional TDS Configuration Phase2Venkata Ramana50% (4)

- Document 2407869.1Dokumen1 halamanDocument 2407869.1lkalidas1998Belum ada peringkat

- GST Functional BOE Flow Phase2Dokumen48 halamanGST Functional BOE Flow Phase2Krishanu Banerjee89% (9)

- GST RUP11 Patch Document 2342288.1Dokumen11 halamanGST RUP11 Patch Document 2342288.1lkalidas1998Belum ada peringkat

- 5OFI GST Functional P2P Flow Phase1Dokumen2 halaman5OFI GST Functional P2P Flow Phase1lkalidas1998Belum ada peringkat

- HT Service-ManualDokumen31 halamanHT Service-ManualMonete FlorinBelum ada peringkat

- Upgrading A P - SupplyDokumen7 halamanUpgrading A P - SupplyDrift GeeBelum ada peringkat

- Precooling Strategies For Efficient Natural Gas Liquefaction - Gas Processing & LNGDokumen20 halamanPrecooling Strategies For Efficient Natural Gas Liquefaction - Gas Processing & LNGMuhammad ImranBelum ada peringkat

- Summer Practice Report Format For CeDokumen8 halamanSummer Practice Report Format For CesohrabBelum ada peringkat

- M312 and M315 Excavators Electrical System: M312: 6TL1-UP M315: 7ML1-UPDokumen2 halamanM312 and M315 Excavators Electrical System: M312: 6TL1-UP M315: 7ML1-UPСергей ТаргоньBelum ada peringkat

- Python Setup and Usage: Release 2.7.8Dokumen57 halamanPython Setup and Usage: Release 2.7.8dingko_34Belum ada peringkat

- Performance Measurement. The ENAPS ApproachDokumen33 halamanPerformance Measurement. The ENAPS ApproachPavel Yandyganov100% (1)

- Observation of Defects in Cast Iron Castings by Surface AnalysisDokumen19 halamanObservation of Defects in Cast Iron Castings by Surface Analysisgonzalo gimenez100% (1)

- Alignment On Sundyne Compor PumpDokumen23 halamanAlignment On Sundyne Compor PumpBen Sijhi100% (1)

- WSO&WSP Excel Shortcuts Cheat SheetsDokumen7 halamanWSO&WSP Excel Shortcuts Cheat SheetsAndy ZouBelum ada peringkat

- Unit I Software Process and Project Management: Hindusthan College of Engineering and TechnologyDokumen1 halamanUnit I Software Process and Project Management: Hindusthan College of Engineering and TechnologyRevathimuthusamyBelum ada peringkat

- Module-I Introduction To Instructional Technology PDFDokumen15 halamanModule-I Introduction To Instructional Technology PDFcharwinsBelum ada peringkat

- Dodge Ram Truck 2015 Hitch Plate Prep Parts DiagramDokumen4 halamanDodge Ram Truck 2015 Hitch Plate Prep Parts DiagramStephen RivettBelum ada peringkat

- 12 Smart Steps To Building A New HatcheryDokumen2 halaman12 Smart Steps To Building A New HatcherytayyababBelum ada peringkat

- K9900 Series Level GaugeDokumen2 halamanK9900 Series Level GaugeBilly Isea DenaroBelum ada peringkat

- Exp 0002Dokumen28 halamanExp 0002nag_gvnrBelum ada peringkat

- Autocad R12 Autocad R13 Autocad R14 Autocad 2000 Autocad 2000I Autocad 2002 Autocad 2004Dokumen12 halamanAutocad R12 Autocad R13 Autocad R14 Autocad 2000 Autocad 2000I Autocad 2002 Autocad 2004veteranul13Belum ada peringkat

- Windpro Directory - 04.02.11Dokumen54 halamanWindpro Directory - 04.02.11Krishnan Veeraraghavan100% (1)

- J030 J032 Eu Aa V1.00Dokumen41 halamanJ030 J032 Eu Aa V1.00gkalman_2Belum ada peringkat

- Bohol HRMD Plan 2011-2015Dokumen233 halamanBohol HRMD Plan 2011-2015Don Vincent Bautista Busto100% (1)

- IA-NT-PWR-2.4-Reference GuideDokumen110 halamanIA-NT-PWR-2.4-Reference GuideSamuel LeiteBelum ada peringkat

- Catia MaualDokumen44 halamanCatia MaualSai Venkatesh.0% (1)

- Synposis FPGA Synthesis User GuideDokumen484 halamanSynposis FPGA Synthesis User GuideVijendraKumarBelum ada peringkat

- Ethics Approval Process 20150223Dokumen8 halamanEthics Approval Process 20150223MPTScribidBelum ada peringkat

- Golden Sun CNC-201R Rotary TableDokumen10 halamanGolden Sun CNC-201R Rotary TableGerald100% (2)

- 12 F 1501Dokumen278 halaman12 F 1501Marianna GulyásBelum ada peringkat

- 2018 Index of Military Strength Air Domain EssayDokumen15 halaman2018 Index of Military Strength Air Domain EssayThe Heritage FoundationBelum ada peringkat

- Automatic Railway Gate Control SystemDokumen24 halamanAutomatic Railway Gate Control SystemDIPAK VINAYAK SHIRBHATE100% (12)

- Good Clinical Practice Guidelines PDFDokumen4 halamanGood Clinical Practice Guidelines PDFJeffreyBelum ada peringkat

- Test AND Measurement: Eagle PhotonicsDokumen90 halamanTest AND Measurement: Eagle PhotonicsPankaj SharmaBelum ada peringkat