Taxes: Corporate: F F@. e 'L

Diunggah oleh

Zeyad El-sayedDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Taxes: Corporate: F F@. e 'L

Diunggah oleh

Zeyad El-sayedHak Cipta:

Format Tersedia

634 MODULE 39 TAXES: CORPORATE

24. (c) The requirement is to determine the exempt por- offset by a dividends received deduction. Therefore, both

tion of Rona Corp.' s alternative minimum taxable income personal service corporations and personal holding compa-

(AMTI). A corporation is allowed an exemption of $40,000 nies must include 100% of dividends received from unre-

'N~;t:,\- r. in computing its AMTI. However, the $40,000 exemption is lated taxable domestic corporations in gross income.

y~

<, reduced by 25% of the corporation's AMTI in excess of

30. (d) The requirement is to determine the amount of

$150,000. Here, the amount of exemption is $40,000-

bond sinking fund trust income taxable to Andi Corp. in

[($200,000 - $150,000) x 25%] = $27,500.

2009. Since the trust income will be accumulated and bene-

25. (c) The requirement is to determine which item is a fit Andi Corp. by reducing the amount of future contribu-

tax preference that must be included in the computation of a tions that Andi must make to the bond sinking fund, all of

corporation's alternative minimum tax (AMT) for 2010. the trust income, consisting of $60,000 of interest and

Tax-exempt interest on private activity bonds issued in 2009- $8,000 of long-term capital gain, is taxable to Andi Corp.

is a tax preference item. Answer (a) is incorrect because it is

the excess of income under the percentage-of-completion

Ai'. (a) The requirement is to determine the amount of

/~;pital gain recognized by Lee Corp. on the sale of its trea-

method over the amount reported using the completed-

sury stock. A corporation will never recognize gain or loss

contract method that is a positive adjustment in computing

on the receipt of money or other property in exchange for its

the AMT. Answer (b) is incorrect because a deduction for

stock; including treasury stock.

casualty losses is allowed in the computation of AMT.

Answer (d) is incorrect because capital gains are not a

preference item in computing the AMT. r;~n

~ (d) The requirement is to determine the amount of

to be recognized by Ral Corp. when it issues its stock in

26. (b) For real property that was placed in service be-

exchange for land. No gain or loss is ever recognized by a

fore January 1, 1999, an AMT adjustment is necessary be-

corporation on the receipt of money or other property in

cause for AMT purposes, real property must be depreciated

exchange for its own stock (including treasury stock).

using the straight-line method over a forty-year recovery

period, rather than the thirty-nine year or twenty-seven and 1( 3. (c) The requirement is to determine the amount of

one-half year recovery period used for regular tax purposes. dividend reportable by a corporate distributee on a property

However, note that this adjustment has been eliminated for distribution. The amount of dividend to be reported by a

real property first placed in service after December 31, 1998. corporate distributee is the ~V of the property ~ any

The dividends received deduction, charitable contributions, liability assumed. Kile's dividend would be $12,000, re-

and investment interest expense are neither adjustments nor duced by the liability of $5,000 = $7,000.

tax preference items.

C.4.b. Organizational Expenditures

r-27. (d) The requirement is to determine when a corpora-

tion will not be subject to the alternative minimum tax 34. (d) The requirement is to determine which costs are

(AMT) for 2010. A corporation is exempt from AMT for its deductible organizational expenditures. Organizational

first tax year. After the first year, a corporation is exempt expenditures include fees for accounting and legal services

from AMT for each year that it passes a gross receipts test. incident to incorporation (e.g., fees for drafting corporate

A corporation is exempt for its second year if its gross re- charter, bylaws, terms of stock certificates), expenses of

ceipts for the first year did not exceed $5 million. For all organizational meetings and of temporary directors

subsequent years, a corporation is exempt if its average an- meetings, and fees paid to the state of incorporation.

nual gross receipts for the testing period do not exceed $7.5 However, the costs incurred in issuing and selling stock and

million. Exemption.from the AMT is not based on asset size securities (e.g., professional fees to issue stock, printing

nor number of shareholders. .costs, underwriting commissions) do not qualify as

organizational expenditures and are not tax deductible.

28. (c) A corporation is exempt from the corporate 35. (a) The requirement is to determine the amount that

AMT for its first tax year. It is exempt for its second year if Brown should deduct for organizational expenditures for

its first year's gross receipts were $5 million or les . To be 2010. For organizational expenditures incurred or paid after

. exempt-for its third ye , the corporation's average gross October 22, 2004, a corporation may elect to deduct up to

receipts for the first two years must be $7.5 million or less. $5,000 for the tax year in which the corporation begins busi-

To be exempt for the fourth year(and subsequent years), the ness. The $5,000 amount must be reduced by the amount by

corporation's average gross receipts for an prior three-year which organizational expenditures exceed $50,000. Re-

-periods also must be $7.5 million or less. Here, Bradbury is maining expenditures are deducted ratably over the 180-

exempt for 2008 because its average gross receipts for 2006- month period beginning with the month in which the corpo-

2007 were $6.75 million. However, Bradbury loses its ex- ration begins business. Brown's qualifying organizational

emption for 2009 and all sub equent years because its aver- expenditures include the $40,000 of legal fees, $15,000 for

age gross receipts for 2006-2008 exceed $7.5 million ($7.67 temporary directors' meetings, and $4,400 of state incorpo-

million). ration fees, a total of $59,400. The $25,000 of underwriting

commissions and other costs of issuing stock are not de-

C.3. Gross Income ductible, and merely reduce paid-in capital. Since Brown

29. (a) The requirement is to indicate whether personal began business in July, Brown's deduction for ~01O is

/'10 f.~

service corporations and personal holding companies must (\la I

$59,400 x 6/180 = $1,980.fi';

C ~I .'1, /A

#«. ('-'I' ,/

include 100% of dividends received from unrelated taxable J 36. (a) The requirement is to determine the correct

domestic corporations in gross income in computing regular statement regarding the costs of organizing a corporation

taxable income. Since the question concerns gross income, during 2010. A corporation's organizational expenditures

not taxable income, no part of the dividend income would be (e.g., legal fees for drafting the corporate charter, bylaws, I;:

W~el!. qt1,J I t)?'/flC; ;, Ifrf@.)er'l JeI"'(I(j, I d~;' ~,( ¥,I'-.." rtfra1thl.oI"

w, ii1 d"dt"tiJ.,··" ' fI{Q,-I '0,1 ~I J. '" ~ f(J'"

Anda mungkin juga menyukai

- Approved Ein - FS Ventures IncDokumen3 halamanApproved Ein - FS Ventures IncKarthi KeyanBelum ada peringkat

- 655 Week 9 Notes PDFDokumen75 halaman655 Week 9 Notes PDFsanaha786Belum ada peringkat

- Ceasefire Industries Private Limited: Pay Slip For The Month of Oct-2020Dokumen1 halamanCeasefire Industries Private Limited: Pay Slip For The Month of Oct-2020harendra gautamBelum ada peringkat

- CIR vs. St. Luke's Medical CenterDokumen2 halamanCIR vs. St. Luke's Medical CenterTogz Mape100% (1)

- A Systematic Literature Review On Tax Amnesty in 9 Asian - Countries (#354229) - 365354Dokumen6 halamanA Systematic Literature Review On Tax Amnesty in 9 Asian - Countries (#354229) - 365354tiger4i17Belum ada peringkat

- Shriram Payslip MayDokumen2 halamanShriram Payslip MayGanesh SahuBelum ada peringkat

- Income Tax Directory - DelhiDokumen298 halamanIncome Tax Directory - DelhiVivek SehgalBelum ada peringkat

- Basilan Estates Vs CIRDokumen2 halamanBasilan Estates Vs CIRKim Lorenzo Calatrava100% (1)

- MOD L S: Corporat: U E AXE EDokumen2 halamanMOD L S: Corporat: U E AXE EAnonymous JqimV1EBelum ada peringkat

- Module 36 Taxes: Corporate: RationDokumen2 halamanModule 36 Taxes: Corporate: RationAnonymous JqimV1EBelum ada peringkat

- Taxes: Corporate: But D N LDokumen2 halamanTaxes: Corporate: But D N LZeyad El-sayedBelum ada peringkat

- Scan 0089Dokumen2 halamanScan 0089Anonymous JqimV1EBelum ada peringkat

- 622 Axes: ATE: Module 36 T CorporDokumen1 halaman622 Axes: ATE: Module 36 T CorporEl-Sayed MohammedBelum ada peringkat

- Taxes: Corporate: Sec. S OcDokumen2 halamanTaxes: Corporate: Sec. S OcAnonymous JqimV1EBelum ada peringkat

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Dokumen2 halamanTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1EBelum ada peringkat

- Module 36 Taxes: CorporateDokumen1 halamanModule 36 Taxes: CorporateAnonymous JqimV1EBelum ada peringkat

- Module 36 Taxes: Corporate: 75 Hares 5 H Res X 2 X 2 X 365 Day X 40 Days 54 750 2.000 56 750Dokumen1 halamanModule 36 Taxes: Corporate: 75 Hares 5 H Res X 2 X 2 X 365 Day X 40 Days 54 750 2.000 56 750Zeyad El-sayedBelum ada peringkat

- Tionfees Include Thecosts Connected With The Issuing And: Taxes: PartnershipsDokumen2 halamanTionfees Include Thecosts Connected With The Issuing And: Taxes: PartnershipsZeyad El-sayedBelum ada peringkat

- Scan 0022Dokumen2 halamanScan 0022El-Sayed MohammedBelum ada peringkat

- Module 36 Taxes: CorporateDokumen3 halamanModule 36 Taxes: CorporateEl-Sayed MohammedBelum ada peringkat

- Ca Final New Direct Tax Laws and International Taxation May 2018 1525Dokumen31 halamanCa Final New Direct Tax Laws and International Taxation May 2018 1525pradeep kumarBelum ada peringkat

- S I Ssa: Module 33 Taxes: IndividualDokumen1 halamanS I Ssa: Module 33 Taxes: IndividualZeyad El-sayedBelum ada peringkat

- Summer 2021 2Dokumen8 halamanSummer 2021 2shashankBelum ada peringkat

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDokumen2 halamanModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedBelum ada peringkat

- Taxes: Corporate: Sio ZSCDokumen2 halamanTaxes: Corporate: Sio ZSCAnonymous JqimV1EBelum ada peringkat

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDokumen3 halamanS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedBelum ada peringkat

- U I T U: Module 33 Taxes I Divi UALDokumen1 halamanU I T U: Module 33 Taxes I Divi UALAnonymous JqimV1EBelum ada peringkat

- M ULE Taxes: A TNE SHI S: R N L Ul L HDokumen3 halamanM ULE Taxes: A TNE SHI S: R N L Ul L HZeyad El-sayedBelum ada peringkat

- P6uk 2009 Dec AnsDokumen13 halamanP6uk 2009 Dec AnsHassan BilalBelum ada peringkat

- Chapter 09, Modern Advanced Accounting-Review Q & ExrDokumen28 halamanChapter 09, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- Scan 0093Dokumen3 halamanScan 0093Zeyad El-sayedBelum ada peringkat

- LaMitipsJDY - INCOME TAXT, DST, ESTATE TAX, VATDokumen5 halamanLaMitipsJDY - INCOME TAXT, DST, ESTATE TAX, VATJohn Dy FlautaBelum ada peringkat

- Module 35 Taxes: Partnerships:: 'S CC G C C Se e I 7 .E., o Co - Es Y. S CDokumen2 halamanModule 35 Taxes: Partnerships:: 'S CC G C C Se e I 7 .E., o Co - Es Y. S CEl Sayed AbdelgawwadBelum ada peringkat

- Corporate Reporting (International) : P2CR-MT2A-X09-A Answers & Marking SchemeDokumen11 halamanCorporate Reporting (International) : P2CR-MT2A-X09-A Answers & Marking SchemeKyaw Htin WinBelum ada peringkat

- CH 01Dokumen36 halamanCH 01Seulki Roni LeeBelum ada peringkat

- M U Taxes IND Vidual: OD LE: IDokumen1 halamanM U Taxes IND Vidual: OD LE: IZeyad El-sayedBelum ada peringkat

- SBR 2020-21 MCQ Progress Test 2 AnswersDokumen11 halamanSBR 2020-21 MCQ Progress Test 2 AnswersA JamelBelum ada peringkat

- Ssive I Vestment In-Come Exceeds of Gross Receipts,: Module 36 Taxes: Corpo ATEDokumen3 halamanSsive I Vestment In-Come Exceeds of Gross Receipts,: Module 36 Taxes: Corpo ATEEl-Sayed MohammedBelum ada peringkat

- CashFlow - A Short NoteDokumen7 halamanCashFlow - A Short NoteRamana DvBelum ada peringkat

- Scheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Dokumen8 halamanScheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Anonymous ckTjn7RCq8Belum ada peringkat

- Taxes: Individual: S S, S A - , CDokumen2 halamanTaxes: Individual: S S, S A - , CAnonymous JqimV1EBelum ada peringkat

- Chapter2 Taxable Income of A Company26Dokumen28 halamanChapter2 Taxable Income of A Company26Hashini ChamodikaBelum ada peringkat

- Scan 0090Dokumen2 halamanScan 0090Anonymous JqimV1EBelum ada peringkat

- Tax Planning Relating To Capital Structure Decision: S.G.T Collage BallariDokumen9 halamanTax Planning Relating To Capital Structure Decision: S.G.T Collage BallariVijay KumarBelum ada peringkat

- US Internal Revenue Service: I1120ric - 1994Dokumen12 halamanUS Internal Revenue Service: I1120ric - 1994IRSBelum ada peringkat

- Principles of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions ManualDokumen23 halamanPrinciples of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions Manualbosomdegerml971yf100% (19)

- Nonresident Investment in Canadian Real Estate: by Jack BernsteinDokumen6 halamanNonresident Investment in Canadian Real Estate: by Jack BernsteinAndrewBelum ada peringkat

- Final IBF (Numerical) Chapter 2, 5 & 15Dokumen13 halamanFinal IBF (Numerical) Chapter 2, 5 & 15Imtiaz SultanBelum ada peringkat

- Taxation Law 1 - Notes Co: Less: DeductionsDokumen24 halamanTaxation Law 1 - Notes Co: Less: DeductionsClint Lou Matthew EstapiaBelum ada peringkat

- Tax Aspects of M&ADokumen18 halamanTax Aspects of M&AManeet TutejaBelum ada peringkat

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDokumen31 halamanPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyBelum ada peringkat

- BPP Revision Kit Sample Answers 1Dokumen8 halamanBPP Revision Kit Sample Answers 1Kian TuckBelum ada peringkat

- Adrac Ifrs Training ProgramDokumen6 halamanAdrac Ifrs Training ProgramfrancoolBelum ada peringkat

- Taxes: Gift and Estate: S A Dard DeductioDokumen2 halamanTaxes: Gift and Estate: S A Dard DeductioZeyad El-sayedBelum ada peringkat

- Deduct From Book Income: - B - T F Dul - .Dokumen2 halamanDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedBelum ada peringkat

- CA Ipcc Taxation Suggested Answers For Nov 2016Dokumen16 halamanCA Ipcc Taxation Suggested Answers For Nov 2016Sai Kumar SandralaBelum ada peringkat

- Unit 2Dokumen23 halamanUnit 2nandan velankarBelum ada peringkat

- CA Final Direct Tax Suggested Answer Nov 2020 OldDokumen25 halamanCA Final Direct Tax Suggested Answer Nov 2020 OldBhumeeka GargBelum ada peringkat

- 75776bos61307 p7Dokumen31 halaman75776bos61307 p7wareva7754Belum ada peringkat

- US Internal Revenue Service: f8860 - 2000Dokumen2 halamanUS Internal Revenue Service: f8860 - 2000IRSBelum ada peringkat

- US Internal Revenue Service: f8860 - 1998Dokumen2 halamanUS Internal Revenue Service: f8860 - 1998IRSBelum ada peringkat

- Income From BusinessDokumen14 halamanIncome From BusinessPreeti ShresthaBelum ada peringkat

- Iaet Section 29 NIRCDokumen1 halamanIaet Section 29 NIRCregine rose bantilanBelum ada peringkat

- BIR Ruling (DA-335) 815-09Dokumen5 halamanBIR Ruling (DA-335) 815-09Ren Mar CruzBelum ada peringkat

- Planning Sales For Distributable Profits: F F M MDokumen3 halamanPlanning Sales For Distributable Profits: F F M MmeetwithsanjayBelum ada peringkat

- Fede Al Securities Acts: OvervieDokumen2 halamanFede Al Securities Acts: OvervieZeyad El-sayedBelum ada peringkat

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDokumen2 halamanI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedBelum ada peringkat

- Scan 0001Dokumen2 halamanScan 0001Zeyad El-sayedBelum ada peringkat

- Scan 0001Dokumen2 halamanScan 0001Zeyad El-sayedBelum ada peringkat

- Scan 0013Dokumen2 halamanScan 0013Zeyad El-sayedBelum ada peringkat

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDokumen2 halamanModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedBelum ada peringkat

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDokumen3 halamanS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedBelum ada peringkat

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDokumen3 halamanSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedBelum ada peringkat

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Dokumen2 halamanModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedBelum ada peringkat

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDokumen3 halamanP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedBelum ada peringkat

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Dokumen2 halamanThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedBelum ada peringkat

- Bankruptcy:: y y S e S Owed SDokumen3 halamanBankruptcy:: y y S e S Owed SZeyad El-sayedBelum ada peringkat

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDokumen2 halaman80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedBelum ada peringkat

- Scan 0010Dokumen3 halamanScan 0010Zeyad El-sayedBelum ada peringkat

- B Nkruptcy: Discharge of A BankruptDokumen2 halamanB Nkruptcy: Discharge of A BankruptZeyad El-sayedBelum ada peringkat

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDokumen3 halamanModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedBelum ada peringkat

- Scan 0012Dokumen2 halamanScan 0012Zeyad El-sayedBelum ada peringkat

- Deduct From Book Income: - B - T F Dul - .Dokumen2 halamanDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedBelum ada peringkat

- Scan 0018Dokumen1 halamanScan 0018Zeyad El-sayedBelum ada peringkat

- Scan 0010Dokumen2 halamanScan 0010Zeyad El-sayedBelum ada peringkat

- Revocation of Discharge: 2M Module27 BankruptcyDokumen2 halamanRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedBelum ada peringkat

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDokumen2 halamanProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedBelum ada peringkat

- Scan 0006Dokumen2 halamanScan 0006Zeyad El-sayedBelum ada peringkat

- Article I Responsibilities. Article Il-The Public InterestDokumen2 halamanArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedBelum ada peringkat

- Scan 0009Dokumen2 halamanScan 0009Zeyad El-sayedBelum ada peringkat

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDokumen2 halamanModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedBelum ada peringkat

- Scan 0008Dokumen2 halamanScan 0008Zeyad El-sayedBelum ada peringkat

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDokumen2 halamanET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedBelum ada peringkat

- Scan 0008Dokumen2 halamanScan 0008Zeyad El-sayedBelum ada peringkat

- Scan 0008Dokumen2 halamanScan 0008Zeyad El-sayedBelum ada peringkat

- First Tax Reform Plan: Restructuring Personal Tax Rates: Taxwise or OtherwiseDokumen3 halamanFirst Tax Reform Plan: Restructuring Personal Tax Rates: Taxwise or Otherwisegrumpybear16Belum ada peringkat

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 90,000.00 4th Quarter 53,333.33Dokumen3 halamanQuarter 1st Quarter 2nd Quarter 3rd Quarter 90,000.00 4th Quarter 53,333.33Kelvin Jay Sebastian SaplaBelum ada peringkat

- Public Finance - SyllabusDokumen6 halamanPublic Finance - SyllabusJosh RamuBelum ada peringkat

- Accounting VoucherDokumen1 halamanAccounting Vouchersuplex suryaBelum ada peringkat

- GST Under Reverse Charge On Goods Transport Agency (GTA)Dokumen2 halamanGST Under Reverse Charge On Goods Transport Agency (GTA)Deepak NimmojiBelum ada peringkat

- Salary Sheet Sathi Ko SathDokumen15 halamanSalary Sheet Sathi Ko SathyadavBelum ada peringkat

- Module 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Dokumen33 halamanModule 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Venice Marie ArroyoBelum ada peringkat

- Lease Contract Against CODDokumen2 halamanLease Contract Against CODAntonieto BBelum ada peringkat

- Residential Status Mock Test 1 IGP-CS CA Vivek GabaDokumen11 halamanResidential Status Mock Test 1 IGP-CS CA Vivek GabaRahul R SinghBelum ada peringkat

- Taxation (Malawi) : Tuesday 4 June 2013Dokumen10 halamanTaxation (Malawi) : Tuesday 4 June 2013angaBelum ada peringkat

- History of Taxation in The PhilippinesDokumen2 halamanHistory of Taxation in The PhilippinesDaniel ZuniegaBelum ada peringkat

- Public Finance: Concept, Definition and Importance For Country's DevelopmentDokumen8 halamanPublic Finance: Concept, Definition and Importance For Country's DevelopmentJoselyne Bustamante FailocBelum ada peringkat

- Nussle Jim - 5112 - A - ContributionsPt2Dokumen199 halamanNussle Jim - 5112 - A - ContributionsPt2Zach EdwardsBelum ada peringkat

- ASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&ADokumen96 halamanASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&Agir botBelum ada peringkat

- Click Here For English Version: AMAPS2671K 2021-22 439514830050921Dokumen8 halamanClick Here For English Version: AMAPS2671K 2021-22 439514830050921BabuHalderBelum ada peringkat

- Taxation Elims 1Dokumen3 halamanTaxation Elims 1Valerie Faye BadajosBelum ada peringkat

- Computation of Total IncomeDokumen18 halamanComputation of Total IncomerahulBelum ada peringkat

- Duke Energy Corporation PAC To PortmanDokumen191 halamanDuke Energy Corporation PAC To PortmanSunlight FoundationBelum ada peringkat

- GSTR3B 03alnpk4728k1zv 052021Dokumen2 halamanGSTR3B 03alnpk4728k1zv 052021Harish VermaBelum ada peringkat

- Pesco Full Bill AbuDokumen2 halamanPesco Full Bill AbuSyed Muhammad ZeeshanBelum ada peringkat

- Guide To State Incentives For Investments in TurkeyDokumen26 halamanGuide To State Incentives For Investments in TurkeyBoubacar Zakari WARGOBelum ada peringkat

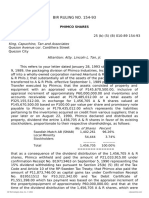

- BIR RULING NO. 154-93: King, Capuchino, Tan and AssociatesDokumen2 halamanBIR RULING NO. 154-93: King, Capuchino, Tan and Associatesrian.lee.b.tiangcoBelum ada peringkat

- Ucc Mock Board Exam 2021 Taxation 70Dokumen15 halamanUcc Mock Board Exam 2021 Taxation 70Veronika BlairBelum ada peringkat