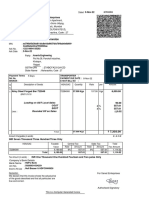

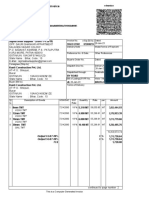

Tax Invoice: State Name: Maharashtra, Code: 27 Place of Supply: Maharashtra

Diunggah oleh

AslamShikalgarJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Tax Invoice: State Name: Maharashtra, Code: 27 Place of Supply: Maharashtra

Diunggah oleh

AslamShikalgarHak Cipta:

Format Tersedia

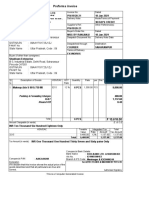

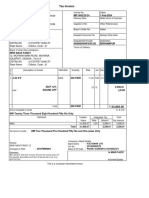

TAX INVOICE (ORIGINAL FOR RECIPIENT)

Ridhi Sidhi Computer - (From 1-Apr-2017) Invoice No. Dated

B-158, Vashi Plaza, RSC/18-19/004076 24-Sep-2018

Sector 17, Vashi

Navi Mumbai 400 703 Delivery Note Mode/Terms of Payment

CESS No;-NMMC/LBT/03/03870

022-27898834

Sales@riddhisiddhicomputer.Com Supplier’s Ref. Other Reference(s)

GSTIN/UIN: 27AXJPB0821A1Z9

State Name : Maharashtra, Code : 27

E-Mail : sales@riddhisiddhicomputer.com

Buyer’s Order No. Dated

Buyer

ASLAM Despatch Document No. Delivery Note Date

State Name : Maharashtra, Code : 27 Despatched through Destination

Place of Supply : Maharashtra

Terms of Delivery

Sl Description of Goods HSN/SAC GST Quantity Rate per Disc. % Amount

No. Rate

1 UPS 18 % 1 pc 8,000.00 pc 15.254 % 6,779.68

APC BR 1000G-IN

SN:- E21514002672

S GST(State Tax) 610.17

C GST(Central Taxes) 610.17

Less : Round Off (-)0.02

Total 1 pc I 8,000.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Eight Thousand Only

Company’s PAN : AXJPB0821A

Declaration

I/We hereby certify that my/our registration certificate under Company’s LBT No. : NMMC/LBT/03/03870

GST Act 2017 is in force on the date on which the sale of the Company’s Bank Details

goods specified in this tax invoice is made by me/us and it

shall be accounted for in the turnover of sales while filling of

Bank Name : Hdfc Bank

return and the due tax,if any payable on the sale has been A/c No. : 05402000021405

paid or shall be paid Branch & IFS Code : Vashi & HDFC0000540

Customer’s Seal and Signature for Ridhi Sidhi Computer - (From 1-Apr-2017)

Authorised Signatory

This is a Computer Generated Invoice

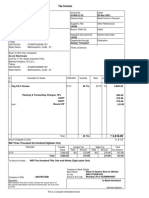

TAX INVOICE (DUPLICATE FOR TRANSPORTER)

Ridhi Sidhi Computer - (From 1-Apr-2017) Invoice No. Dated

B-158, Vashi Plaza, RSC/18-19/004076 24-Sep-2018

Sector 17, Vashi

Navi Mumbai 400 703 Delivery Note Mode/Terms of Payment

CESS No;-NMMC/LBT/03/03870

022-27898834

Sales@riddhisiddhicomputer.Com Supplier’s Ref. Other Reference(s)

GSTIN/UIN: 27AXJPB0821A1Z9

State Name : Maharashtra, Code : 27

E-Mail : sales@riddhisiddhicomputer.com

Buyer’s Order No. Dated

Buyer

ASLAM Despatch Document No. Delivery Note Date

State Name : Maharashtra, Code : 27 Despatched through Destination

Place of Supply : Maharashtra

Terms of Delivery

Sl Description of Goods HSN/SAC GST Quantity Rate per Disc. % Amount

No. Rate

1 UPS 18 % 1 pc 8,000.00 pc 15.254 % 6,779.68

APC BR 1000G-IN

SN:- E21514002672

S GST(State Tax) 610.17

C GST(Central Taxes) 610.17

Less : Round Off (-)0.02

Total 1 pc I 8,000.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Eight Thousand Only

Company’s PAN : AXJPB0821A

Declaration

I/We hereby certify that my/our registration certificate under Company’s LBT No. : NMMC/LBT/03/03870

GST Act 2017 is in force on the date on which the sale of the Company’s Bank Details

goods specified in this tax invoice is made by me/us and it

shall be accounted for in the turnover of sales while filling of

Bank Name : Hdfc Bank

return and the due tax,if any payable on the sale has been A/c No. : 05402000021405

paid or shall be paid Branch & IFS Code : Vashi & HDFC0000540

Customer’s Seal and Signature for Ridhi Sidhi Computer - (From 1-Apr-2017)

Authorised Signatory

This is a Computer Generated Invoice

Anda mungkin juga menyukai

- Tax Invoice for Leyland Radiator AssemblyDokumen3 halamanTax Invoice for Leyland Radiator Assemblydeepak vashistBelum ada peringkat

- Sudev Podder 084Dokumen1 halamanSudev Podder 084ssd dBelum ada peringkat

- Tax Invoice: Main Road, Athagarh, Cuttack 754029 Gstin/Uin: 21DGZPM0370M1ZX State Name: Odisha, Code: 21Dokumen1 halamanTax Invoice: Main Road, Athagarh, Cuttack 754029 Gstin/Uin: 21DGZPM0370M1ZX State Name: Odisha, Code: 21Ashish BhagatBelum ada peringkat

- Tax InvoiceDokumen2 halamanTax Invoiceojasprajapati6Belum ada peringkat

- Tax InvoiceDokumen2 halamanTax Invoiceojasprajapati6Belum ada peringkat

- Tax InvoiceDokumen1 halamanTax InvoiceAnil KumarBelum ada peringkat

- Asc 5033Dokumen1 halamanAsc 5033omkar sawantBelum ada peringkat

- MST 1295Dokumen1 halamanMST 1295digital lifeBelum ada peringkat

- Tax Invoice for TVsDokumen1 halamanTax Invoice for TVsAthahBelum ada peringkat

- Heart N HillsDokumen1 halamanHeart N HillsPrint Mart digitalBelum ada peringkat

- Tax Invoice: Pest Kare (India) PVT - LTDDokumen1 halamanTax Invoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3Belum ada peringkat

- 0269 (22-23) (Harshpriya)Dokumen1 halaman0269 (22-23) (Harshpriya)Ravikant MishraBelum ada peringkat

- Sss Kunti 502Dokumen2 halamanSss Kunti 502msBelum ada peringkat

- Shope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851Dokumen1 halamanShope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851cnanda89Belum ada peringkat

- RzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoiceDokumen1 halamanRzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoicePratyush kumar NayakBelum ada peringkat

- Tax Invoice: SBN Small Udhyog Machinery Private Limited Invoice1 22/03/2024Dokumen1 halamanTax Invoice: SBN Small Udhyog Machinery Private Limited Invoice1 22/03/2024Prince KumarBelum ada peringkat

- Tax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Dokumen1 halamanTax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Abhinaya JoBelum ada peringkat

- Accounting VoucherDokumen1 halamanAccounting VoucherPapia ChandaBelum ada peringkat

- Invoice No. 4439 e-Invoice summaryDokumen1 halamanInvoice No. 4439 e-Invoice summaryomkar sawantBelum ada peringkat

- SahanaDokumen1 halamanSahanaShreenath AgarwalBelum ada peringkat

- Accounting VoucherDokumen1 halamanAccounting VoucherUttam PurohitBelum ada peringkat

- Tax Invoice: United Squares PVT - Ltd. (Hyd) From 1-Apr-2017Dokumen1 halamanTax Invoice: United Squares PVT - Ltd. (Hyd) From 1-Apr-2017AthahBelum ada peringkat

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionDokumen1 halamanOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurBelum ada peringkat

- TAX INVOICEDokumen1 halamanTAX INVOICEAnjani KumariBelum ada peringkat

- Invoice: Pest Kare (India) PVT - LTDDokumen1 halamanInvoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3Belum ada peringkat

- Invoice 16Dokumen1 halamanInvoice 16kuldeep singhBelum ada peringkat

- Tax Invoice: Easymix Concrete Solution 1 1-Feb-2023Dokumen1 halamanTax Invoice: Easymix Concrete Solution 1 1-Feb-2023amit chouguleBelum ada peringkat

- Shubham PIDokumen1 halamanShubham PIVarsha JiBelum ada peringkat

- Screenshot 2022-08-24 at 8.11.05 PMDokumen2 halamanScreenshot 2022-08-24 at 8.11.05 PMutkarshBelum ada peringkat

- Tax Invoice DetailsDokumen1 halamanTax Invoice DetailsSANJAY PRAKASHBelum ada peringkat

- 13.05.23-002Dokumen1 halaman13.05.23-002Rajendra LaddaBelum ada peringkat

- Tax Invoice: Order Number Order DateDokumen2 halamanTax Invoice: Order Number Order Daterohit bondreBelum ada peringkat

- Tax Invoice for Godown FumigationDokumen1 halamanTax Invoice for Godown FumigationAnonymous rNqW9p3Belum ada peringkat

- Tax Invoice DetailsDokumen1 halamanTax Invoice DetailsmsBelum ada peringkat

- SV Roofing-13Dokumen1 halamanSV Roofing-13bikkumalla shivaprasadBelum ada peringkat

- Tax Filing InvoiceDokumen2 halamanTax Filing InvoiceashutoshBelum ada peringkat

- Accounting VoucherDokumen1 halamanAccounting VoucherHařsh Thakkar HťBelum ada peringkat

- Drill MachineDokumen1 halamanDrill Machineranjitghosh684Belum ada peringkat

- Bts 44445Dokumen1 halamanBts 44445msBelum ada peringkat

- Sobraj SinghDokumen2 halamanSobraj SinghSHEKHARBelum ada peringkat

- Amba TownshipDokumen1 halamanAmba TownshipshiviBelum ada peringkat

- Income Tax Payment Challan: PSID #: 164056997Dokumen1 halamanIncome Tax Payment Challan: PSID #: 164056997M ZubairBelum ada peringkat

- Domestic_All_GADokumen1 halamanDomestic_All_GAknpranchi111Belum ada peringkat

- 031 - StelloidDokumen1 halaman031 - Stelloidsumit chaudharyBelum ada peringkat

- Tax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08Dokumen1 halamanTax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08SHIV SHAKTI TRUCKSBelum ada peringkat

- AJPL0602Dokumen1 halamanAJPL0602shrungar.ornament1Belum ada peringkat

- Accounting VoucherDokumen1 halamanAccounting Vouchershailesh patilBelum ada peringkat

- Accounting VoucherDokumen1 halamanAccounting VoucherVinay VenugopalBelum ada peringkat

- Modular Kitchen InvoiceDokumen1 halamanModular Kitchen InvoiceShubham MishraBelum ada peringkat

- Parshwa Home AppliencesDokumen1 halamanParshwa Home AppliencesRajendra LaddaBelum ada peringkat

- 0068 NehaDokumen1 halaman0068 Nehang.neha8990Belum ada peringkat

- Ae 4197Dokumen1 halamanAe 4197omkar sawantBelum ada peringkat

- Bta s2Dokumen2 halamanBta s2msBelum ada peringkat

- Accounting Voucher 289Dokumen1 halamanAccounting Voucher 289rajesh puhanBelum ada peringkat

- 23 PFDokumen2 halaman23 PFSunil PatelBelum ada peringkat

- Bolero Bill JanuaryDokumen1 halamanBolero Bill JanuaryMAA KALI ENTERPRISESBelum ada peringkat

- Tax Invoice SummaryDokumen1 halamanTax Invoice SummaryDashing DealBelum ada peringkat

- Secured Package PDFDokumen2 halamanSecured Package PDFAman DagaBelum ada peringkat

- MP 1602 23 24Dokumen1 halamanMP 1602 23 24minarplastic200Belum ada peringkat

- List of Counties of US PDFDokumen149 halamanList of Counties of US PDFAslamShikalgarBelum ada peringkat

- PetsDokumen1 halamanPetsAslamShikalgarBelum ada peringkat

- OccupationsDokumen12 halamanOccupationsAslamShikalgarBelum ada peringkat

- Network Security: A Case StudyDokumen6 halamanNetwork Security: A Case StudyAslamShikalgarBelum ada peringkat

- The Internet Worm: - Compromising The Availability and Reliability of Systems Through Security FailureDokumen14 halamanThe Internet Worm: - Compromising The Availability and Reliability of Systems Through Security Failureapi-25884963Belum ada peringkat

- Tcs Bancs On SbiDokumen9 halamanTcs Bancs On SbiSushil GoyalBelum ada peringkat

- Software 130611073316 Phpapp02Dokumen15 halamanSoftware 130611073316 Phpapp02AslamShikalgarBelum ada peringkat

- Course Plan GST III (State) 2020Dokumen10 halamanCourse Plan GST III (State) 2020Nitish Kumar NaveenBelum ada peringkat

- 0.02 Requirements Questionnaire by Role SAMPLE NAVDokumen46 halaman0.02 Requirements Questionnaire by Role SAMPLE NAVApoorva BadolaBelum ada peringkat

- Om Singh Amrapali Institute of Hotel ManagementDokumen23 halamanOm Singh Amrapali Institute of Hotel ManagementOm SinghBelum ada peringkat

- LU1 - Value-Added TaxDokumen24 halamanLU1 - Value-Added Taxmandisanomzamo72Belum ada peringkat

- Purchase Order: This Is An Electronically Generated Document. No Signatures Are RequiredDokumen3 halamanPurchase Order: This Is An Electronically Generated Document. No Signatures Are RequiredNarendraBelum ada peringkat

- InvoiceDokumen2 halamanInvoiceRaju DharmaBelum ada peringkat

- Consolidated Invoice 2346Dokumen4 halamanConsolidated Invoice 2346Narendra NarshimamoorthyBelum ada peringkat

- Tracking Data Flow Through Receipts Tables 9-11-13Dokumen68 halamanTracking Data Flow Through Receipts Tables 9-11-13Sudheer SanagalaBelum ada peringkat

- Export DocumentationDokumen2 halamanExport DocumentationPravin NisharBelum ada peringkat

- Purchase OrderDokumen8 halamanPurchase Ordervg elumalaiBelum ada peringkat

- Impact of GST On Retail Tailors 69 PagesDokumen69 halamanImpact of GST On Retail Tailors 69 PagesTasmay EnterprisesBelum ada peringkat

- Oracle Ebusiness Financials R12 Oracle Receivables Functional OverviewDokumen37 halamanOracle Ebusiness Financials R12 Oracle Receivables Functional OverviewbksidhuBelum ada peringkat

- Import & Export DocumentationDokumen6 halamanImport & Export Documentationyasararafat12010Belum ada peringkat

- Unifi BillDokumen6 halamanUnifi BillJayalily DanielBelum ada peringkat

- Inter-Company Process in S - 4 HANA - SAP BlogsDokumen17 halamanInter-Company Process in S - 4 HANA - SAP BlogsAbilash R100% (2)

- Document Splitting Subsequent Implementation: Enter Date (Month, Year)Dokumen49 halamanDocument Splitting Subsequent Implementation: Enter Date (Month, Year)rahul_agrawal165Belum ada peringkat

- Tally - All in One (Part) - 2Dokumen3 halamanTally - All in One (Part) - 2A KumarBelum ada peringkat

- Invoice P: YALE Europe Materials HandlingDokumen2 halamanInvoice P: YALE Europe Materials HandlingNy Aritiana Miratia MahefasoaBelum ada peringkat

- 16 3732Dokumen1 halaman16 3732AlizaShaikhBelum ada peringkat

- Students Netsuite QuizDokumen1 halamanStudents Netsuite QuizVINCENT GAYRAMONBelum ada peringkat

- 26096442469Dokumen1 halaman26096442469Alaric Manen JamirBelum ada peringkat

- InvoiceDokumen2 halamanInvoicebhavesh kumarBelum ada peringkat

- Viet Hoi PhieuDokumen9 halamanViet Hoi Phieuthaiquangsang92Belum ada peringkat

- Digital Fortress LedgerDokumen60 halamanDigital Fortress Ledgerlyla_cksBelum ada peringkat

- Internal Control PoliciesDokumen30 halamanInternal Control Policiesintel4mpkBelum ada peringkat

- BP070 UcilDokumen43 halamanBP070 UcilSrikanth PeriBelum ada peringkat

- 模板:形式发票 Proforma InvoiceDokumen2 halaman模板:形式发票 Proforma InvoicezekiyamccreeBelum ada peringkat

- Merise Exercises EtudesDeCasDokumen13 halamanMerise Exercises EtudesDeCas4gen_1100% (1)

- OLFM Training5Dokumen22 halamanOLFM Training5Srinibas100% (1)

- Introduction To Value Added TaxDokumen5 halamanIntroduction To Value Added TaxNYSHAN JOFIELYN TABBAYBelum ada peringkat