59678RMC 35-2011 PDF

Diunggah oleh

Cliff Daquioag0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

19 tayangan1 halamanJudul Asli

59678RMC 35-2011.pdf

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

19 tayangan1 halaman59678RMC 35-2011 PDF

Diunggah oleh

Cliff DaquioagHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

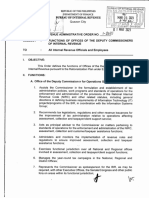

REVENUE MEMORANDUM CIRCULAR NO.

35-2011 issued on August 17, 2011

clarifies issues concerning the imposition of the ten percent (10%) Improperly Accumulated

Earnings Tax (IAET) pursuant to Section 29 of the Tax Code of 1997, as amended, as it

applies to the taxable income earned starting January 1, 1998 by closely-held domestic

corporations, except publicly held corporations, banks and other non-bank financial

intermediaries, insurance companies and those enumerated under Section 4 of Revenue

Regulations (RR) No. 2-2001.

Under Section 29 of the Tax Code, as amended, a corporation that permits the

accumulation of earnings and profits beyond the reasonable needs of the business, instead of

dividing or distributing said profits, is subject to 10% IAET on the improperly accumulated

taxable income (IATI).

For corporations using the calendar year basis, the accumulated earnings under tax

shall not apply on improperly accumulated income as of December 31, 1997. In the case of

corporations adopting the fiscal year accounting period, the improperly accumulated income

not subject to this tax shall be reckoned as of the end of the month comprising the 12-month

period of fiscal year 1997-1998.

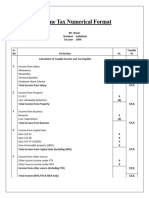

By way of illustration, IATI is computed as follows:

Taxable Income for the year (e.g., 2010) P xxxx

Add:

(a) Income subjected to Final Tax P xxx

(b) NOLCO xxx

(c) Income exempt from tax xxx

(d) Income excluded from gross income xxx xxxx

P xxxx

Less:

Income Tax paid P xxx

Dividends declared/paid xxx xxxx

Total P xxxx

Add: Retained Earnings from prior years

Accumulated Earnings as of December 31, 2010

Less: Amount that may be Retained

(100% of Paid-Up Capital as of Dec. 31, 2010) xxxx

IATI P xxxx

The resulting IATI is multiplied by 10% to arrive at the IAET.

The amount that may be retained, taking into consideration the accumulated earnings

within the “reasonable needs of the business”, as determined under Section 3 of RR No. 2-

2001, shall be 100% of the paid-up capital or the amount contributed to the corporation

representing the par value of the shares of stock. Hence, any excess capital over and above

the par shall be excluded.

Anda mungkin juga menyukai

- RMC 35-2011 DigestDokumen1 halamanRMC 35-2011 DigestA CybaBelum ada peringkat

- 59678RMC 35-2011Dokumen1 halaman59678RMC 35-2011Hannah BonillaBelum ada peringkat

- RMC 35-2011 IaetDokumen2 halamanRMC 35-2011 IaetDyan de la FuenteBelum ada peringkat

- Chapter 15 BDokumen3 halamanChapter 15 BErinBelum ada peringkat

- CorporationDokumen23 halamanCorporationLiyana Chua50% (2)

- RMC 35-2011Dokumen3 halamanRMC 35-2011Alyssa NuquiBelum ada peringkat

- Week 10 CorporationssDokumen9 halamanWeek 10 CorporationssAdrian MontemayorBelum ada peringkat

- TAX RULES FOR CORPORATIONSDokumen10 halamanTAX RULES FOR CORPORATIONSeinel dcBelum ada peringkat

- Di Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai BerikutDokumen2 halamanDi Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai Berikutnoviliaa7Belum ada peringkat

- Allowable DeductionsDokumen17 halamanAllowable DeductionsShanelle SilmaroBelum ada peringkat

- Computation of TaxesDokumen34 halamanComputation of TaxesIrish D DagmilBelum ada peringkat

- ERG TAX 7.0 CorporationDokumen22 halamanERG TAX 7.0 CorporationRiyo Mae MagnoBelum ada peringkat

- Income Tax Computation For Corporate TaxpayersDokumen79 halamanIncome Tax Computation For Corporate TaxpayersPATATASBelum ada peringkat

- Lecture 3 - Income Taxation (Corporate)Dokumen5 halamanLecture 3 - Income Taxation (Corporate)Paula MerrilesBelum ada peringkat

- Clarification On The Amendment To Section 16 of Companies Income Tax Act in Relation To Taxation of Insurance CompaniesDokumen7 halamanClarification On The Amendment To Section 16 of Companies Income Tax Act in Relation To Taxation of Insurance CompaniesOluwagbenga OgunsakinBelum ada peringkat

- Income Tax Part IIDokumen85 halamanIncome Tax Part IILeitz Camyll Ang-AwBelum ada peringkat

- As 17Dokumen6 halamanAs 17abhishekkapse654Belum ada peringkat

- REGULAR INCOME TAXATION OVERVIEWDokumen4 halamanREGULAR INCOME TAXATION OVERVIEWMary Jane Pabroa100% (1)

- Investment Decisions NotesDokumen2 halamanInvestment Decisions NotesSaumya AllapartiBelum ada peringkat

- Mat and Amt: Objective of Levying MATDokumen17 halamanMat and Amt: Objective of Levying MATSamuel AnthrayoseBelum ada peringkat

- Mat and Amt: Objective of Levying MATDokumen16 halamanMat and Amt: Objective of Levying MATaBelum ada peringkat

- Chapter 21 IAS 1Dokumen4 halamanChapter 21 IAS 1Chandan SamalBelum ada peringkat

- GCRO Module 120 - 07 Computation of TaxDokumen34 halamanGCRO Module 120 - 07 Computation of TaxKezia100% (1)

- Notes Income Taxation IndividualDokumen10 halamanNotes Income Taxation IndividualTriscia QuiñonesBelum ada peringkat

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDokumen4 halamanComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Ias 1-Presentation of Financial StatementsDokumen21 halamanIas 1-Presentation of Financial StatementsChumani GqadaBelum ada peringkat

- Notes On Value Added TaxDokumen7 halamanNotes On Value Added TaxPines MacapagalBelum ada peringkat

- Preparation of Financial Statement For A Sole TraderDokumen8 halamanPreparation of Financial Statement For A Sole TraderDebbie DebzBelum ada peringkat

- Guide to Philippine Income and Withholding TaxesDokumen8 halamanGuide to Philippine Income and Withholding TaxesEunice SerneoBelum ada peringkat

- 10.mat and AmtDokumen17 halaman10.mat and AmtShailendra SainwalBelum ada peringkat

- First City Providential College: Corporation Part 2Dokumen8 halamanFirst City Providential College: Corporation Part 2Arjhay CruzBelum ada peringkat

- To Whomsoever It May ConcernDokumen2 halamanTo Whomsoever It May ConcernrajeshBelum ada peringkat

- Cash Flow StatementDokumen16 halamanCash Flow Statementrajesh337masssBelum ada peringkat

- Statement of Profit and Loss (As Per Division I of Schedule Iii)Dokumen7 halamanStatement of Profit and Loss (As Per Division I of Schedule Iii)Yash GoyalBelum ada peringkat

- Format of Cash FlowDokumen3 halamanFormat of Cash Flowsaldanha889Belum ada peringkat

- MAT and AMT ExplainedDokumen17 halamanMAT and AMT ExplainedNitin ChoudharyBelum ada peringkat

- Introduction To Regular Income TaxDokumen44 halamanIntroduction To Regular Income TaxGabriel Trinidad Soniel0% (1)

- It Goi Note On Mat and AmtDokumen17 halamanIt Goi Note On Mat and AmtKapil AroraBelum ada peringkat

- Accounting For Income Tax FinDokumen8 halamanAccounting For Income Tax FinAmparo ReyesBelum ada peringkat

- Tax Practice Quiz QuestionsDokumen3 halamanTax Practice Quiz QuestionsDanji MisoBelum ada peringkat

- Provisional Tax - SlidesDokumen17 halamanProvisional Tax - SlidesZwivhuya MaimelaBelum ada peringkat

- Problems Accouting For Deferred Taxes Webinar ReoDokumen7 halamanProblems Accouting For Deferred Taxes Webinar ReocrookshanksBelum ada peringkat

- Accounting for Income Tax ExpenseDokumen6 halamanAccounting for Income Tax ExpenseKakay EspirituBelum ada peringkat

- IFRS Deferred Tax Calculation and ReportDokumen4 halamanIFRS Deferred Tax Calculation and ReportSandeep GyawaliBelum ada peringkat

- Fundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTDokumen15 halamanFundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTSherlock HolmesBelum ada peringkat

- Module 3 Tax On CorporationsDokumen33 halamanModule 3 Tax On Corporationscha1150% (2)

- Types of Taxable Income ExplainedDokumen18 halamanTypes of Taxable Income Explainedrav danoBelum ada peringkat

- DT Group QNDokumen2 halamanDT Group QNJohn WickBelum ada peringkat

- Vertical income statement proformaDokumen2 halamanVertical income statement proformaBheemeswar ReddyBelum ada peringkat

- Ya2022 - Format Tax Computation Trust BodyDokumen4 halamanYa2022 - Format Tax Computation Trust BodyDaniel HaziqBelum ada peringkat

- NIGERIAN TAXATION 2 LECTURE NOTEDokumen83 halamanNIGERIAN TAXATION 2 LECTURE NOTEKofo IswatBelum ada peringkat

- Summary Sheet NumericalDokumen2 halamanSummary Sheet NumericalSamina HyderBelum ada peringkat

- Accounting For Income Taxes Pt. 2: Temporary DifferencesDokumen23 halamanAccounting For Income Taxes Pt. 2: Temporary Differenceskrisha milloBelum ada peringkat

- Ias12 SN PDFDokumen15 halamanIas12 SN PDFShiza ArifBelum ada peringkat

- Tax XXXXDokumen60 halamanTax XXXXGerald Bowe ResuelloBelum ada peringkat

- 1 Accounting For Taxation: Section OverviewDokumen36 halaman1 Accounting For Taxation: Section Overviewsimran jeswaniBelum ada peringkat

- Lecture 2 Income Taxation IndividualDokumen5 halamanLecture 2 Income Taxation IndividualJohn Daryl P. DagatanBelum ada peringkat

- Part 6Dokumen8 halamanPart 6Amr YoussefBelum ada peringkat

- @urdior: DepartmatDokumen3 halaman@urdior: DepartmatCliff DaquioagBelum ada peringkat

- Gluratior: Srruilltdtdc?!Flffilr DepartmedDokumen2 halamanGluratior: Srruilltdtdc?!Flffilr DepartmedCliff DaquioagBelum ada peringkat

- JDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Dokumen1 halamanJDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Cliff DaquioagBelum ada peringkat

- Revised Administrative Code of 1987 On The Civil Service CommissionDokumen42 halamanRevised Administrative Code of 1987 On The Civil Service CommissionCSC Public Assistance and Information Office100% (1)

- #.Ciq Of: Revenue The CollectionDokumen6 halaman#.Ciq Of: Revenue The CollectionCliff DaquioagBelum ada peringkat

- Ra, XG TR-FZ: Stejgo+.R@F, EDokumen1 halamanRa, XG TR-FZ: Stejgo+.R@F, ECliff DaquioagBelum ada peringkat

- Iaecetveb: I TL:' FMDokumen1 halamanIaecetveb: I TL:' FMCliff DaquioagBelum ada peringkat

- Prilipin.r Department: GtutationDokumen4 halamanPrilipin.r Department: GtutationCliff DaquioagBelum ada peringkat

- 1889 Spanish Civil CodeDokumen225 halaman1889 Spanish Civil CodeJ DBelum ada peringkat

- The Spanish Civil Code PDFDokumen9 halamanThe Spanish Civil Code PDFTimothy YuBelum ada peringkat

- Of Of: Areas Ni/VaoDokumen1 halamanOf Of: Areas Ni/VaoCliff DaquioagBelum ada peringkat

- Subject: Bureau RevenueDokumen1 halamanSubject: Bureau RevenueCliff DaquioagBelum ada peringkat

- RAO No. 2-2018Dokumen16 halamanRAO No. 2-2018Cliff DaquioagBelum ada peringkat

- RAO No. 1-2019Dokumen22 halamanRAO No. 1-2019Cliff DaquioagBelum ada peringkat

- Inffit'Rl: ?-2oig ofDokumen1 halamanInffit'Rl: ?-2oig ofCliff DaquioagBelum ada peringkat

- RAO No. 2-2020Dokumen2 halamanRAO No. 2-2020nathalie velasquezBelum ada peringkat

- RAO No. 2-2020 - DigestDokumen1 halamanRAO No. 2-2020 - Digestnathalie velasquezBelum ada peringkat

- RAO No.1-2020Dokumen1 halamanRAO No.1-2020nathalie velasquezBelum ada peringkat

- RAO No. 1-2021Dokumen5 halamanRAO No. 1-2021Cliff DaquioagBelum ada peringkat

- 1701 January 2018 Consov4Dokumen2 halaman1701 January 2018 Consov4RAS ConsultancyBelum ada peringkat

- Bir 1701a FormDokumen2 halamanBir 1701a FormChe CacatianBelum ada peringkat

- Annual Income Tax ReturnDokumen2 halamanAnnual Income Tax ReturnRAS ConsultancyBelum ada peringkat

- RR No. 12-2018: New Consolidated RR on Estate Tax and Donor's TaxDokumen20 halamanRR No. 12-2018: New Consolidated RR on Estate Tax and Donor's Taxjune Alvarez100% (1)

- Bir 1701Dokumen4 halamanBir 1701Vanesa Calimag ClementeBelum ada peringkat

- Presentation of Financial Statements: IAS 1 (r2007) Compliance ChecklistDokumen24 halamanPresentation of Financial Statements: IAS 1 (r2007) Compliance ChecklistAnonymous 7HGskNBelum ada peringkat

- IAS Plus: IFRS 8 Operating SegmentsDokumen4 halamanIAS Plus: IFRS 8 Operating SegmentsScarlet FoxBelum ada peringkat

- Operating Segments: Ifrs 8Dokumen18 halamanOperating Segments: Ifrs 8Carmel ThereseBelum ada peringkat

- IAS 34 Interim Financial ReportingDokumen18 halamanIAS 34 Interim Financial ReportingSoleil LeisolBelum ada peringkat

- RMO No.16-2018Dokumen1 halamanRMO No.16-2018Cliff DaquioagBelum ada peringkat

- RMO No.16-2018Dokumen1 halamanRMO No.16-2018Cliff DaquioagBelum ada peringkat

- Pune Hotel PDFDokumen2 halamanPune Hotel PDFkiran parveBelum ada peringkat

- BP Singapore PTE LIMITED (CRN196600436K) : Singapore 098632 #02-01 Keppel Bay TowerDokumen1 halamanBP Singapore PTE LIMITED (CRN196600436K) : Singapore 098632 #02-01 Keppel Bay Toweralsone07Belum ada peringkat

- Chase credit card statement blueprint paymentDokumen3 halamanChase credit card statement blueprint paymentquannbui950% (1)

- CIR v. UCSFADokumen7 halamanCIR v. UCSFATheresa BuaquenBelum ada peringkat

- Bajaj RBL StatementDokumen2 halamanBajaj RBL StatementSameer SadhwaniBelum ada peringkat

- Swiggy Order 1143177130Dokumen2 halamanSwiggy Order 11431771308sam8888Belum ada peringkat

- Ce 01264659Dokumen1 halamanCe 01264659Zakhele MpofuBelum ada peringkat

- Export Procedure PDFDokumen2 halamanExport Procedure PDFMichaelBelum ada peringkat

- Donors TaxDokumen4 halamanDonors TaxRo-Anne LozadaBelum ada peringkat

- Bts 44445Dokumen1 halamanBts 44445msBelum ada peringkat

- M SamiDokumen5 halamanM SamiMah rukh M.yaqoobBelum ada peringkat

- Breakeven point analysis in 40 charactersDokumen4 halamanBreakeven point analysis in 40 charactersMelanie Daclan AntepasadoBelum ada peringkat

- Income Tax ReviewerDokumen3 halamanIncome Tax ReviewerKrizah Marie CaballeroBelum ada peringkat

- OECD Transfer-Pricing-Country-Profile-CanadaDokumen8 halamanOECD Transfer-Pricing-Country-Profile-CanadaSen JanBelum ada peringkat

- Merchant Presentation v5.0 (QR)Dokumen21 halamanMerchant Presentation v5.0 (QR)أغيلا جيليان100% (2)

- Tax Distinguished From Other FeesDokumen1 halamanTax Distinguished From Other FeesAndro Louis Malabarbas RulonaBelum ada peringkat

- Canara Bank Specialist Officers Recruitment Sept 2010 Payment ChallanDokumen1 halamanCanara Bank Specialist Officers Recruitment Sept 2010 Payment ChallanmaneeshjBelum ada peringkat

- Foreign Investments in US REDokumen25 halamanForeign Investments in US RETony ZhengBelum ada peringkat

- PAS 12 Income Taxes Conceptual Framework & Acctg StandardsDokumen9 halamanPAS 12 Income Taxes Conceptual Framework & Acctg StandardsBritnys NimBelum ada peringkat

- MnA India TaxPerspectiveDokumen36 halamanMnA India TaxPerspectiveGamer LastBelum ada peringkat

- Return Train TicketDokumen2 halamanReturn Train Ticketziyan skBelum ada peringkat

- Quizlet IIPDokumen129 halamanQuizlet IIPVũ Cẩm Tú K16Belum ada peringkat

- General Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaDokumen137 halamanGeneral Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaMarvin Marciano DiñoBelum ada peringkat

- Ajio 1706695254075Dokumen1 halamanAjio 1706695254075shaelkmr550Belum ada peringkat

- Foreign Investment Real Property Tax Act (FIRPTA)Dokumen1 halamanForeign Investment Real Property Tax Act (FIRPTA)book15wormBelum ada peringkat

- Concept Paper: (Available For Comments Up To April 15, 2016)Dokumen23 halamanConcept Paper: (Available For Comments Up To April 15, 2016)SanjeevBelum ada peringkat

- JOURNALSDokumen2 halamanJOURNALSJD AguilarBelum ada peringkat

- IT-PLANET Cash Memo DetailsDokumen1 halamanIT-PLANET Cash Memo DetailsNikk AdesaraBelum ada peringkat

- Application For Fee Waiver Exemption For Part-Time Tuition FeesDokumen2 halamanApplication For Fee Waiver Exemption For Part-Time Tuition FeesRafikiMolBelum ada peringkat

- Estate Tax DeductionsDokumen22 halamanEstate Tax DeductionsJess Guiang CasamorinBelum ada peringkat