12 Business Combination Pt2 PDF

Diunggah oleh

Riselle Ann SanchezJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

12 Business Combination Pt2 PDF

Diunggah oleh

Riselle Ann SanchezHak Cipta:

Format Tersedia

BUSINESS COMBINATIONS (Pt.

2) (AFAR)

1. On January 1, 2019, CONJUNCTION Co., and UNION, Inc. entered into a business combination effected through exchange of

equity instruments. The combination resulted to CONJUNCTION obtaining 100% interest in UNION. Both of the combining

entities are publicly listed. As of this date, CONJUNCTION’s shares have a quoted price of ₱200 per share. CONJUNCTION Co.

recognized goodwill of ₱600,000 on the business combination. No acquisition-related costs were incurred. Additional selected

information at acquisition date is shown below:

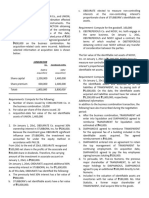

CONJUNCTION Co. Combined entity

(before acquisition) (after acquisition)

Share capital 1,200,000 1,400,000

Share premium 600,000 2,400,000

Totals 1,800,000 3,800,000

Requirements: Compute for the following:

a. Number of shares issued by CONJUNCTION Co. in the business combination.

b. Par value per share of the shares issued.

c. Acquisition-date fair value of the net identifiable assets of UNION.

2. On January 1, 2019, OBDURATE Co. acquired 30% ownership interest in STUBBORN, Inc. for ₱200,000. Because the investment

gave OBDURATE significant influence over STUBBORN, the investment was accounted for under the equity method in

accordance with PAS 28.

From 2019 to the end of 2021, OBDURATE recognized ₱100,000 net share in the profits of the associate and ₱20,000 share in

dividends. Therefore, the carrying amount of the investment in associate account on January 1, 2021, is ₱280,000.

On January 1, 2022, OBDURATE acquired additional 60% ownership interest in STUBBORN, Inc. for ₱1,600,000. As of this date,

OBDURATE has identified the following:

a. The previously held 30% interest has a fair value of ₱360,000.

b. STUBBORN’s net identifiable assets have a fair value of ₱2,000,000.

c. OBDURATE elected to measure non-controlling interests at the non-controlling interest’s proportionate share of

STUBBORN’s identifiable net assets.

Requirement: Compute for the goodwill.

3. OBSTREPEROUS Co. and NOISY, Inc. both engage in the same business. On January 1, 2019, OBSTREPEROUS and NOISY signed a

contract, the terms of which resulted in OBSTREPEROUS obtaining control over NOISY without any transfer of consideration

between the parties.

The fair value of the identifiable net assets of NOISY, Inc. on January 1, 2019 is ₱2,000,000. NOISY chose to measure non-

controlling interest at the non-controlling interest’s proportionate share of the acquiree’s identifiable net assets.

Requirement: Compute for the goodwill.

4. On January 1, 2019, DIAPHANOUS Co. acquired all of the identifiable assets and assumed all of the liabilities of TRANSPARENT,

Inc. by paying cash of ₱2,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of

₱3,200,000 and ₱1,800,000, respectively.

Additional information:

In addition to the business combination transaction, the following have also transcribed during the negotiation period:

a. After the business combination, TRANSPARENT will enter into liquidation and DIAPHANOUS agreed to reimburse

TRANSPARENT for liquidation costs estimated at ₱40,000.

b. DIAPHANOUS agreed to reimburse TRANSPARENT for the appraisal fee of a building included in the identifiable assets

acquired. The agreed reimbursement is ₱20,000.

c. DIAPHANOUS entered into an agreement to retain the top management of TRANSPARENT for continuing employment.

On acquisition date, DIAPHANOUS agreed to pay the key employees signing bonuses totaling ₱200,000.

d. To persuade, Mr. Five-six Numerix, the previous major shareholder of TRANSPARENT, to sell his major holdings to

DIAPHANOUS, DIAPHANOUS agreed to pay an additional ₱100,000 directly to Mr. Numerix.

e. Included in the valuation of identifiable assets are inventories with fair value of ₱180,000. Ms. Vital Statistix, a former

major shareholder of TRANSPARENT, shall acquire title to the goods.

Requirement: Compute for the goodwill (gain on bargain purchase).

Anda mungkin juga menyukai

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Dari EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Belum ada peringkat

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideDari EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideBelum ada peringkat

- EMPLOYEE-BENEFITS AnswerkeyDokumen6 halamanEMPLOYEE-BENEFITS AnswerkeyRiselle Ann Sanchez100% (2)

- Week 2Dokumen6 halamanWeek 2Maryane AngelaBelum ada peringkat

- 14 Consolidated FS Pt1 PDFDokumen2 halaman14 Consolidated FS Pt1 PDFRiselle Ann Sanchez53% (15)

- Business Combi and Conso FSDokumen56 halamanBusiness Combi and Conso FSlachimolaluv chim50% (12)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementDari EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementBelum ada peringkat

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDokumen5 halamanBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Business Combination ActivityDokumen5 halamanBusiness Combination ActivityAndy LaluBelum ada peringkat

- Merchant Banking & Investment Lecture 01Dokumen198 halamanMerchant Banking & Investment Lecture 01Mehedi HasanBelum ada peringkat

- Gen 010 Q1 Sy2223Dokumen5 halamanGen 010 Q1 Sy2223CLAIRE PAJOBelum ada peringkat

- Quiz Chapter 1 Business Combinations Part 1Dokumen6 halamanQuiz Chapter 1 Business Combinations Part 1Kaye L. Dela CruzBelum ada peringkat

- U TECH PetitionDokumen47 halamanU TECH PetitionAyushi Verma100% (1)

- Management Advisory Services: 1 Open Preboard Examination, Batch 3Dokumen14 halamanManagement Advisory Services: 1 Open Preboard Examination, Batch 3Merliza Jusayan100% (1)

- Ch#5 Strategy in Marketing Channels - BRMDokumen45 halamanCh#5 Strategy in Marketing Channels - BRMYazdani ShowravBelum ada peringkat

- The Advanced App Store Optimization Ebook 2022 v1.3Dokumen321 halamanThe Advanced App Store Optimization Ebook 2022 v1.3KabezasBelum ada peringkat

- Fusion Payables White Paper - Modify Proration Method in MPA V 1.0 PDFDokumen20 halamanFusion Payables White Paper - Modify Proration Method in MPA V 1.0 PDFMaqbulhusenBelum ada peringkat

- JAM For Quiz MasterDokumen10 halamanJAM For Quiz MasterJulie VelasquezBelum ada peringkat

- 12 Business Combination Pt2Dokumen1 halaman12 Business Combination Pt2Mel paloma0% (1)

- (Before Acquisition) (After Acquisition) : Conjunction Co. Combined EntityDokumen2 halaman(Before Acquisition) (After Acquisition) : Conjunction Co. Combined Entityellie100% (1)

- M ABC 5 CopiesDokumen6 halamanM ABC 5 CopiesChloe CataluñaBelum ada peringkat

- Quiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Dokumen2 halamanQuiz 1:: Case #1: As Consideration For The Business Combination, SMUTTY Co. Transferred 8,000Andrew wigginBelum ada peringkat

- ABC - Homework 02 - JaguinesDokumen5 halamanABC - Homework 02 - JaguinesHannah Mae JaguinesBelum ada peringkat

- Quiz - Chapter 2 - Business Combinations (Part 2)Dokumen4 halamanQuiz - Chapter 2 - Business Combinations (Part 2)Pearly Jean ApuradorBelum ada peringkat

- Acc AssignmentDokumen5 halamanAcc AssignmentBlen tesfayeBelum ada peringkat

- Profe03 - Chapter 2 Business Combinations Specific CasesDokumen12 halamanProfe03 - Chapter 2 Business Combinations Specific CasesSteffany RoqueBelum ada peringkat

- DMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyDokumen9 halamanDMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyMitch RegenciaBelum ada peringkat

- Memory Enhancement ProgramDokumen8 halamanMemory Enhancement ProgramLhowellaAquinoBelum ada peringkat

- Afar Quesh-R4Dokumen14 halamanAfar Quesh-R4Cheska JaplosBelum ada peringkat

- A. Technical MalversationDokumen8 halamanA. Technical MalversationDinosaur Korean100% (1)

- Mendoza, Keije Lawrence M.Dokumen10 halamanMendoza, Keije Lawrence M.21-39693Belum ada peringkat

- Quiz 1 AnswersDokumen6 halamanQuiz 1 AnswersAlyssa CasimiroBelum ada peringkat

- P1 - ReviewDokumen14 halamanP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Uloc Answer Key Let's Check: A. Contingent ConsiderationsDokumen2 halamanUloc Answer Key Let's Check: A. Contingent Considerationszee abadillaBelum ada peringkat

- PARCOR DiscussionDokumen6 halamanPARCOR DiscussionSittiBelum ada peringkat

- AFAR TestbanksDokumen165 halamanAFAR TestbanksbognadonhazelBelum ada peringkat

- LLL 14 PDF FreeDokumen34 halamanLLL 14 PDF FreeLayBelum ada peringkat

- DySAS General Review Acctg6 - AnsDokumen11 halamanDySAS General Review Acctg6 - Ansyasira0% (1)

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDokumen2 halamanAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeBelum ada peringkat

- Partnership MidtermDokumen10 halamanPartnership MidtermJoanna Caballero100% (1)

- FAR Assessment-ExamDokumen15 halamanFAR Assessment-ExamJazzy MercadoBelum ada peringkat

- Bill Signs A Contract To Buy Furniture For Official Use in The PartnershipDokumen4 halamanBill Signs A Contract To Buy Furniture For Official Use in The PartnershipVon Andrei MedinaBelum ada peringkat

- Auditing Investments 1Dokumen2 halamanAuditing Investments 1Sabel FordBelum ada peringkat

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDokumen9 halamanMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaBelum ada peringkat

- Exam 2 ReviewDokumen4 halamanExam 2 ReviewAdrienne NicoleBelum ada peringkat

- Business Combination Jan. 22 2022Dokumen2 halamanBusiness Combination Jan. 22 2022Ann SarmientoBelum ada peringkat

- Cpa Review School of The Philippines ManilaDokumen3 halamanCpa Review School of The Philippines ManilaAljur SalamedaBelum ada peringkat

- Tax-May 8Dokumen1 halamanTax-May 8Ella Apelo100% (1)

- AFAR 2nd Monthly AssessmentDokumen7 halamanAFAR 2nd Monthly AssessmentCiena Mae AsasBelum ada peringkat

- Afar 2Dokumen7 halamanAfar 2Diana Faye CaduadaBelum ada peringkat

- Accounting For Business Combinations: Adri N T. Nov LDokumen30 halamanAccounting For Business Combinations: Adri N T. Nov Ltankofdoom 4100% (1)

- Exercises 04 - Intangibles INTACC2Dokumen3 halamanExercises 04 - Intangibles INTACC2EmzBelum ada peringkat

- BusCom ExerciseDokumen12 halamanBusCom ExerciseMerel Rose FloresBelum ada peringkat

- Final Exam 10 PDF FreeDokumen12 halamanFinal Exam 10 PDF FreeMariefel OrdanezBelum ada peringkat

- Exercises 04 - Intangibles INTACC2 PDFDokumen3 halamanExercises 04 - Intangibles INTACC2 PDFKhan TanBelum ada peringkat

- FinalDokumen104 halamanFinalEZEKIELBelum ada peringkat

- AFAR Assessment October 2020Dokumen8 halamanAFAR Assessment October 2020FelixBelum ada peringkat

- ReporttDokumen7 halamanReporttaryan nicoleBelum ada peringkat

- BusCom Seatwork - 05 15 2021Dokumen4 halamanBusCom Seatwork - 05 15 2021Joshua UmaliBelum ada peringkat

- FINALS QUIZ Fin3Dokumen11 halamanFINALS QUIZ Fin3Angela MartiresBelum ada peringkat

- FINALS QUIZ Fin3Dokumen11 halamanFINALS QUIZ Fin3Erika Larinay100% (1)

- AFAR ReviewDokumen6 halamanAFAR ReviewDenise Jane RoqueBelum ada peringkat

- FAR ReviewDokumen9 halamanFAR ReviewJude Vincent VittoBelum ada peringkat

- P2Dokumen3 halamanP2Let it beBelum ada peringkat

- SEPARATE and CONSOLIDATED STATEMENTSDokumen4 halamanSEPARATE and CONSOLIDATED STATEMENTSCha EsguerraBelum ada peringkat

- TOPIC 2 - Topic 2 - Consolidated and Separate Financial StatementsDokumen6 halamanTOPIC 2 - Topic 2 - Consolidated and Separate Financial Statementsduguitjinky20.svcBelum ada peringkat

- Joint ArrangementsDokumen3 halamanJoint ArrangementsMaurice AgbayaniBelum ada peringkat

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDari EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisBelum ada peringkat

- 13 Business Combination Pt3Dokumen1 halaman13 Business Combination Pt3Riselle Ann Sanchez50% (2)

- 17 Financial Statement AnalysisDokumen3 halaman17 Financial Statement AnalysisRiselle Ann SanchezBelum ada peringkat

- BIR 2019 Income Tax DescriptionDokumen20 halamanBIR 2019 Income Tax DescriptionRiselle Ann SanchezBelum ada peringkat

- 16 Investment Centers and Transfer PricingDokumen2 halaman16 Investment Centers and Transfer PricingRiselle Ann Sanchez100% (1)

- Direct MarketingDokumen19 halamanDirect MarketingKhoirul MunaBelum ada peringkat

- Quality Manual CGPLDokumen39 halamanQuality Manual CGPLወይኩን ፍቃድከBelum ada peringkat

- Attracting The Talent - The Recruitment and Selection 1Dokumen5 halamanAttracting The Talent - The Recruitment and Selection 1Kristine JoyBelum ada peringkat

- MAS 8 FS Analysis AnswersDokumen15 halamanMAS 8 FS Analysis AnswersKatherine Cabading InocandoBelum ada peringkat

- Ed 6061Dokumen1 halamanEd 6061darknightBelum ada peringkat

- AccountsDokumen35 halamanAccounts053Mayank SharmaBelum ada peringkat

- Internship Report On Financial PerformanDokumen70 halamanInternship Report On Financial PerformanPik PokBelum ada peringkat

- TECH Meets LEADERSHIP Webinar CEO Circle February 21 2023 ADokumen6 halamanTECH Meets LEADERSHIP Webinar CEO Circle February 21 2023 ASteeve ShajiBelum ada peringkat

- Popular Cover Letter Template For Job SearchDokumen2 halamanPopular Cover Letter Template For Job SearchcelynBelum ada peringkat

- Customer Complaint Role PlayDokumen1 halamanCustomer Complaint Role PlayJewel AhmedBelum ada peringkat

- Operational Modeling (Complete) - 5Dokumen8 halamanOperational Modeling (Complete) - 5amr aboulmaatyBelum ada peringkat

- Remarks by Amb. Irwin LaRocque, ASG, Trade and Economic Integration (WTO Regional Forum On Aid For Trade For The Caribbean) (Press Release 22/2011)Dokumen4 halamanRemarks by Amb. Irwin LaRocque, ASG, Trade and Economic Integration (WTO Regional Forum On Aid For Trade For The Caribbean) (Press Release 22/2011)Economic Partnership Agreement (EPA) Implementation Unit within the CARIFORUM DirectorateBelum ada peringkat

- Taxation Final Pre Board Oct 2016Dokumen13 halamanTaxation Final Pre Board Oct 2016Maryane AngelaBelum ada peringkat

- Strategy Case: Eastern Bank: Renante Simpron JRDokumen2 halamanStrategy Case: Eastern Bank: Renante Simpron JRLuchie Ann Espina Tnmn0% (1)

- Coconut Husk PDFDokumen6 halamanCoconut Husk PDFMaxine FernandezBelum ada peringkat

- RMC No. 15-2021Dokumen1 halamanRMC No. 15-2021nathalie velasquezBelum ada peringkat

- Birmingham Smithfield MOI FinalDokumen11 halamanBirmingham Smithfield MOI Final168 - Harry SudartoBelum ada peringkat

- Functional Level Strategy: What It Is Plus 18 Examples - SlingDokumen13 halamanFunctional Level Strategy: What It Is Plus 18 Examples - SlingBhanu VermaBelum ada peringkat

- New File. FIN 302Dokumen16 halamanNew File. FIN 302iftekharBelum ada peringkat

- Module 1Dokumen75 halamanModule 1Suvhro Deep MondalBelum ada peringkat

- Specialization of ProductionDokumen3 halamanSpecialization of ProductionEphraim UhuruBelum ada peringkat

- 18191101034, Sumaiya HowladarDokumen9 halaman18191101034, Sumaiya HowladarSumaiya Howladar034Belum ada peringkat

- Fundamentals Class 12 Accountancy MCQs PDFDokumen6 halamanFundamentals Class 12 Accountancy MCQs PDFAryan RawatBelum ada peringkat

- JanSamarth Finance PortalDokumen5 halamanJanSamarth Finance PortalAkshitaBelum ada peringkat