Income Taxation

Diunggah oleh

Vidgezxc LoriaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Income Taxation

Diunggah oleh

Vidgezxc LoriaHak Cipta:

Format Tersedia

Full file at http://testbanksolution.

eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

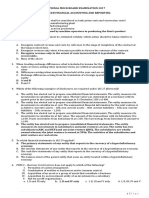

Chapter 1 Test Bank

BUSINESS COMBINATIONS

Multiple Choice Questions

LO1

1. Which of the following is a reason why a company would expand

through a combination, rather than by building new facilities?

a. A combination might provide cost advantages.

b. A combination might provide fewer operating delays.

c. A combination might provide easier access to intangible

assets.

d. All of the above are possible reasons that a company might

choose a combination.

LO2

2. A business combination in which a new corporation is created

and two or more existing corporations are combined into the

newly created corporation is called a

a. merger.

b. purchase transaction.

c. pooling-of-interests.

d. consolidation.

3. A business combination occurs when a company acquires an equity

interest in another entity and has

a. at least 20% ownership in the entity.

b. more than 50% ownership in the entity.

c. 100% ownership in the entity.

d. control over the entity, irrespective of the percentage

owned.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-1

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

4. FASB favors consolidation of two entities when

a. one acquires less than 20% equity ownership of the other.

b. one company’s ownership interest in another gives it

control of the acquired company, yet the acquiring company

does not have a majority ownership in the acquired.

Typically, this is in the 20%-50% interest range.

c. one acquires two thirds equity ownership in the other.

d. one gains control over the entity, irrespective of the

equity percentage owned.

LO3

LO4

5. Michangelo Co. paid $100,000 in fees to its accountants and

lawyers in acquiring Florence Company. Michangelo will treat

the $100,000 as

a. an expense for the current year.

b. a prior period adjustment to retained earnings.

c. additional cost to investment of Florence on the

consolidated balance sheet.

d. a reduction in paid-in capital.

6. Picasso Co. issued 10,000 shares of its $1 par common stock,

valued at $400,000, to acquire shares of Bull Company in an

all-stock transaction. Picasso paid the investment bankers

$35,000. Picasso will treat the investment banker fee as:

a. an expense for the current year.

b. a prior period adjustment to Retained Earnings.

c. additional goodwill on the consolidated balance sheet.

d. a reduction in paid-in capital.

7. Durer Inc acquired Sea Corporation in a business combination

and Sea Corp went out of existence. Sea Corp developed a patent

listed as an asset on Sea Corp’s books at the patent office

filing cost. In recording the combination

a. fair value is not assigned to the patent because the

research and development costs have been expensed by Sea

Corp.

b. Sea Corp’s prior expenses to develop the patent are

recorded as an asset by Durer at purchase.

c. the patent is recorded as an asset at fair market value.

d. the patent's market value increases goodwill.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-2

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

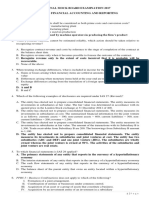

8. In a merger, which of the following will occur?

a. A merger occurs when one corporation takes over the

operations of another business entity, and the acquired

entity is dissolved.

b. None of the business entities will be dissolved.

c. The acquired assets will be recorded at book value by the

acquiring entity.

d. None of the above is correct.

9. According to FASB Statement 141, which one of the following

items may not be accounted for as an intangible asset apart

from goodwill?

a. A production backlog.

b. A talented employee workforce.

c. Noncontractual customer relationships.

d. Employment contracts.

10. Under the provisions of FASB Statement No. 141R, in a business

combination, when the fair value exceeds the investment cost,

which of the following statements is correct?

a. A gain from a bargain purchase is recognized for the amount

that the fair value of the identifiable net assets acquired

exceeds the acquisition price.

b. the value is allocated first to reduce proportionately

(according to market value) non-current assets, then to

non-monetary current assets, and any negative remainder is

classified as a deferred credit.

c. it is allocated first to reduce proportionately (according

to market value) non-current assets, and any negative

remainder is classified as an extraordinary gain.

d. It is allocated first to reduce proportionately (according

to market value) non-current, depreciable assets to zero,

and any negative remainder is classified as a deferred

credit.

11. With respect to goodwill, an impairment

a. will be amortized over the remaining useful life.

b. is a two-step process which analyzes each business unit of

the entity.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-3

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

c. is a one-step process considering the entire firm.

d. occurs when asset values are adjusted to fair value in a

purchase.

Use the following information in answering questions 12 and 13.

Manet Corporation exchanges 150,000 shares of newly issued $1 par

value common stock with a fair market value of $25 per share for all

of the outstanding $5 par value common stock of Gardner Inc and

Gardner is then dissolved. Manet paid the following costs and

expenses related to the business combination:

Costs of special shareholders’ meeting

to vote on the merger $13,000

Registering and issuing securities 14,000

Accounting and legal fees 9,000

Salaries of Manet’s employees assigned

to the implementation of the merger 15,000

Cost of closing duplicate facilities 11,000

12. In the business combination of Manet and Gardner

a. the costs of registering and issuing the securities are

included as part of the purchase price for Gardner.

b. only the salaries of Manet's employees assigned to the

merger are treated as expenses.

c. all of the costs except those of registering and issuing

the securities are included in the purchase price of

Gardner.

d. only the accounting and legal fees are included in the

purchase price of Gardner.

13. In the business combination of Manet and Gardner

a. all of the items listed above are treated as expenses.

b. all of the items listed above except the cost of

registering and issuing the securities are expensed.

c. the costs of registering and issuing the securities are

deducted from the fair market value of the common stock

used to acquire Gardner.

d. only the costs of closing duplicate facilities, the

salaries of Manet's employees assigned to the merger, and

the costs of the shareholders' meeting would be treated as

expenses.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-4

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

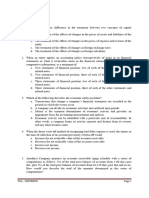

14. In Statement 142, which of the following methods does the FASB

consider the best indicators of fair values in the evaluation

of goodwill impairment?

a. Senior executive’s estimates.

b. Financial analyst forecasts.

c. Market value.

d. The present value of future cash flows discounted at the

firm’s cost of capital.

15. Raphael Company paid $2,000,000 for the net assets of Paris

Corporation and Paris was then dissolved. Paris had no

liabilities. The fair values of Paris’ assets were $2,500,000.

Paris’s only non-current assets were land and equipment with

fair values of $160,000 and $640,000, respectively. At what

value will the equipment be recorded by Raphael?

a. $640,000

b. $240,000

c. $400,000

d. $0

16. According to FASB 141, liabilities assumed in an acquisition

will be valued at the

a. estimated fair value.

b. historical book value.

c. current replacement cost.

d. present value using market interest rates.

17. In reference to the FASB disclosure requirements, which of the

following is correct?

a. Information related to several minor acquisitions may not

be combined.

b. Firms are not required to disclose the business purpose for

a combination

c. Notes to the financial statements of an acquiring

corporation must disclose that the business combination was

accounted for by the acquisition method.

d. All of the above are correct.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-5

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

18. Goodwill arising from a business combination is

a. charged to Retained Earnings after the acquisition is

completed.

b. amortized over 40 years or its useful life, whichever is

longer.

c. amortized over 40 years or its useful life, whichever is

shorter.

d. never amortized.

19. In reference to international accounting for goodwill, which of

the following statements is correct?

a. U.S. companies have complained that past accounting rules

for amortizing goodwill placed them at a disadvantage in

competing against foreign companies for merger partners.

b. Some foreign countries permitted the immediate write-off of

goodwill to stockholders’ equity.

c. The IASB and the FASB are working to eliminate differences

in accounting for business combinations.

d. All of the above are correct.

20. In recording acquisition costs, which of following procedures

is correct?

a. Registration costs are expensed, and not charged against

the fair value of the securities issued.

b. Indirect costs are charged against the fair value of the

securities issued.

c. Consulting fees are expensed.

d. None of the above procedures is correct.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-6

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Exercises

LO2

Exercise 1

On January 2, 2005 Bison Corporation issued 100,000 new shares of its

$5 par value common stock valued at $19 a share for all of Deer

Corporation’s outstanding common shares. Bison paid $15,000 to

register and issue shares. Bison also paid $10,000 for the direct

combination costs of the accountants. The fair value and book value

of Deer's identifiable assets and liabilities were the same.

Summarized balance sheet information for both companies just before

the acquisition on January 2, 2005 is as follows:

Bison Deer

Cash $ 150,000 $ 120,000

Inventories 320,000 400,000

Other current assets 500,000 500,000

Land 350,000 250,000

Plant assets-net 4,000,000 1,500,000

Total Assets $5,320,000 $2,770,000

Accounts payable $1,000,000 $ 300,000

Notes payable 1,300,000 660,000

Capital stock, $5 par 2,000,000 500,000

Paid-in capital 1,000,000 100,000

Retained Earnings 20,000 1,210,000

Total Liabilities & Equities $5,320,000 $2,770,000

Required:

1. Prepare Bison's general journal entry for the acquisition of

Deer, assuming that Deer survives as a separate legal entity.

2. Prepare Bison's general journal entry for the acquisition of

Deer, assuming that Deer will dissolve as a separate legal entity.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-7

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

LO2

Exercise 2

On January 2, 2005 Altamira Company issued 80,000 new shares of its

$2 par value common stock valued at $12 a share for all of Lascaux

Corporation’s outstanding common shares. Altamira paid $5,000 for the

direct combination costs of the accountants. Altamira paid $10,000 to

register and issue shares. The fair value and book value of Lascaux's

identifiable assets and liabilities were the same. Summarized balance

sheet information for both companies just before the acquisition on

January 2, 2005 is as follows:

Altamira Lascaux

Cash $ 75,000 $ 60,000

Inventories 160,000 200,000

Other current assets 200,000 250,000

Land 175,000 125,000

Plant assets-net 1,500,000 750,000

Total Assets $2,110,000 $1,385,000

Accounts payable $ 100,000 $ 155,000

Notes payable 700,000 330,000

Capital stock, $2 par 600,000 250,000

Paid-in capital 450,000 50,000

Retained Earnings 260,000 600,000

Total Liabilities & Equity $2,110,000 $1,385,000

Required:

1. Prepare Altamira's general journal entry for the acquisition of

Lascaux assuming that Lascaux survives as a separate legal entity.

2. Prepare Altamira's general journal entry for the acquisition of

Lascaux assuming that Lascaux will dissolve as a separate legal

entity.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-8

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Exercise 3

Dolmen Corporation purchased the net assets of Carnac Inc on January

2, 2005 for $280,000 and also paid $10,000 in direct acquisition

costs. Carnac's balance sheet on January 2, 2005 was as follows:

Accounts receivable-net $ 90,000 Current liabilities $ 35,000

Inventory 180,000 Long term debt 80,000

Land 20,000 Common stock ($1 par) 10,000

Building-net 30,000 Paid-in capital 215,000

Equipment-net 40,000 Retained earnings 20,000

Total assets $360,000 Total liab. & equity $360,000

Fair values agree with book values except for inventory, land, and

equipment, that have fair values of $200,000, $25,000 and $35,000,

respectively. Carnac has patent rights valued at $10,000.

Required:

Prepare Dolmen's general journal entry for the cash purchase of

Carnac's net assets.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-9

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Exercise 4

The balance sheets of Palisade Company and Salisbury Corporation were

as follows on December 31, 2004:

Palisade Salisbury

Current Assets $ 260,000 $ 120,000

Equipment-net 440,000 480,000

Buildings-net 600,000 200,000

Land 100,000 200,000

Total Assets $1,400,000 $1,000,000

Current Liabilities 100,000 120,000

Common Stock, $5 par 1,000,000 400,000

Paid-in Capital 100,000 280,000

Retained Earnings 200,000 200,000

Total Liabilities and $1,400,000 $1,000,000

Stockholders' equity

On January 1, 2005 Palisade issued 30,000 of its shares with a market

value of $40 per share in exchange for all of Salisbury's shares, and

Salisbury was dissolved. Palisade paid $20,000 to register and issue

the new common shares. It cost Palisade $50,000 in direct combination

costs. Book values equal market values except that Salisbury’s land is

worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on

January 1, 2005.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-10

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

LO4

Exercise 5

Paradise Inc purchased the net assets of Sublime Company on January

2, 2005 for $320,000 and also paid $5,000 in direct acquisition

costs. Sublime's balance sheet on January 2, 2005 was as follows:

Accounts receivable-net $180,000 Current liabilities $ 25,000

Inventory 180,000 Long term debt 90,000

Land 30,000 Common stock ($1 par) 10,000

Building-net 30,000 Paid-in capital 225,000

Equipment-net 30,000 Retained earnings 100,000

Total assets $450,000 Total liab. & equity $450,000

Fair values agree with book values except for inventory, land, and

equipment, that have fair values of $200,000, $25,000 and $35,000,

respectively. Solitaire has patent rights valued at $10,000.

Required:

Prepare Paradise's general journal entry for the cash purchase of

Sublime's net assets.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-11

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

LO4

Exercise 6

On January 2, 2005 Tennessee Corporation issued 100,000 new shares of

its $5 par value common stock valued at $19 a share for all of Alaska

Company’s outstanding common shares in an acquisition. Tennessee paid

$15,000 for registering and issuing securities and $10,000 for other

direct costs of the business combination. The fair value and book

value of Alaska's identifiable assets and liabilities were the same.

Summarized balance sheet information for both companies just before

the acquisition on January 2, 2005 is as follows:

Tennessee Alaska

Cash $ 150,000 $ 120,000

Inventories 320,000 400,000

Other current assets 500,000 500,000

Land 350,000 250,000

Plant assets-net 4,000,000 1,500,000

Total Assets $5,320,000 $2,770,000

Accounts payable $1,000,000 $ 300,000

Notes payable 1,300,000 660,000

Capital stock, $5 par 2,000,000 500,000

Paid-in capital 1,000,000 100,000

Retained Earnings 20,000 1,210,000

Total Liabilities & Equities $5,320,000 $2,770,000

Required:

Prepare a balance sheet for Tennessee Corporation immediately after

the business combination.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-12

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Exercise 7

Balance sheet information for Sphinx Company at January 1, 2005, is

summarized as follows:

Current assets $ 230,000 Liabilities $ 300,000

Plant assets 450,000 Capital stock $10 par 200,000

Retained earnings 180,000

$ 680,000 $ 680,000

Sphinx’s assets and liabilities are fairly valued except for plant

assets that are undervalued by $50,000. On January 2, 2005, Pyramid

Corporation issues 20,000 shares of its $10 par value common stock

for all of Sphinx’s net assets and Sphinx is dissolved. Market

quotations for the two stocks on this date are:

Pyramid common: $28.00

Sphinx common: $19.50

Butler pays the following fees and costs in connection with the

combination:

Finder’s fee $10,000

Legal and accounting fees 6,000

Required:

1. Calculate Pyramid’s investment cost of Sphinx Corporation.

2. Calculate any goodwill from the business combination.

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-13

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Solutions:

Multiple Choice Questions

1 D 2 D 3 D 4 B 5 C

6 D 7 B 8 A 9 B 10 A

11 B 12 B 13 C 14 C 15 A

16 A 17 C 18 D 19 D 20 C

Exercise 1

1. General journal entry recorded by Bison for the acquisition of

Deer (Deer survives as a separate legal entity):

Investment in Deer 1,900,000

Common stock 500,000

Paid-in capital 1,400,000

Investment in Deer 10,000

Paid-in capital 15,000

Cash 25,000

2. General journal entry recorded by Bison for the acquisition of

Deer (Deer dissolves as a separate legal entity):

Cash 120,000

Inventories 400,000

Other current assets 500,000

Land 250,000

Plant assets 1,500,000

Goodwill 75,000

Accounts payable 300,000

Notes payable 660,000

Common stock 500,000

Paid-in capital 1,385,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-14

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Exercise 2

1. General journal entry recorded by Altamira for the acquisition of

Lascaux (Lascaux survives as a separate legal entity):

Investment in Lascaux 960,000

Common stock 160,000

Paid-in capital 800,000

Investment in Lascaux 5,000

Paid-in capital 10,000

Cash 15,000

2. General journal entry recorded by Altamira for the acquisition of

Lascaux (Lascaux dissolves as a separate legal entity):

Cash 60,000

Inventories 200,000

Other current assets 250,000

Land 125,000

Plant assets 750,000

Goodwill 55,000

Accounts payable 155,000

Notes payable 330,000

Common stock 160,000

Paid-in capital 790,000

Exercise 3

General journal entry for the purchase of Carnac's net assets:

Accounts receivable 90,000

Inventory 200,000

Land 25,000

Building 30,000

Equipment 35,000

Patent 10,000

Goodwill 15,000

Current liabilities 35,000

Long-term debt 80,000

Cash 290,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-15

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Exercise 4

The stockholders' equity section for Palisade Corporation subsequent

to its acquisition of Salisbury Corporation on January 1, 2005 will

appear as follows:

Palisade Corporation

Balance Sheet

January 1, 2005

Current Assets $ 310,000

Equipment-net 920,000

Buildings-net 800,000

Land 350,000

Goodwill 320,000

Total Assets $2,270,000

Current Liabilities 220,000

Common Stock, $5 par 1,150,000

Paid-in Capital 1,130,000

Retained Earnings 200,000

Total Liabilities and $2,700,000

Stockholders' equity

Exercise 5

General journal entry for the purchase of Sublime's net assets:

Accounts receivable 180,000

Inventory 200,000

Land 25,000

Building-net 30,000

Equipment-net 35,000

Patent rights 10,000

Current liabilities 25,000

Long-term debt 90,000

Cash 325,000

Extraordinary gain 40,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-16

Full file at http://testbanksolution.eu/Test-Bank-Bank-for-Advanced-Accounting-10-E-by-Beams

Exercise 6

Tennessee Corporation

Balance Sheet

January 1, 2005

Assets: Liabilities:

Cash $ 245,000 Accounts payable $1,300,000

Inventory 720,000 Notes payable 1,960,000

Other current assets 1,000,000 Total liabilities 3,260,000

Total current assets 1,965,000

Land 600,000 Equity:

Plant assets-net 5,500,000 Common stock ($5 par) 2,500,000

Goodwill 100,000 Paid-in capital 2,385,000

Total L.T. assets 6,200,000 Retained earnings 20,000

Total equity 4,905,000

Total assets $8,165,000 Total liab.& eq. $8,165,000

Exercise 7

Requirement 1

FMV of shares issued by Pyramid: 20,000 x $28.00= $ 560,000

Finder’s fees 10,000

Legal and accounting fees 6,000

Total acquisition cost for Sphinx Corporation: $ 576,000

Requirement 2

Investment cost from above: $ 576,000

Less: Fair value of Sphinx’s net assets ($680,000 of

total assets plus $50,000 of undervalued plant assets

minus $300,000 of debt) 430,000

Equals: Goodwill from investment in Sphinx: $ 146,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

1-17

Anda mungkin juga menyukai

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Dari EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Penilaian: 5 dari 5 bintang5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Dari EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Belum ada peringkat

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkDari EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkBelum ada peringkat

- MILYONARYO TESTBANK AFAR-THEORIESDokumen21 halamanMILYONARYO TESTBANK AFAR-THEORIESVanessa Anne Acuña DavisBelum ada peringkat

- Summary of Joshua Rosenbaum & Joshua Pearl's Investment BankingDari EverandSummary of Joshua Rosenbaum & Joshua Pearl's Investment BankingBelum ada peringkat

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItDari EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItPenilaian: 5 dari 5 bintang5/5 (1)

- Accounting For Business CombinationsDokumen19 halamanAccounting For Business Combinationsvinanovia50% (2)

- 24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalDokumen14 halaman24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalJoel DiasBelum ada peringkat

- Topic 7 Impairment of Assets A122 1Dokumen36 halamanTopic 7 Impairment of Assets A122 1Mei Chien Yap50% (2)

- AFAR Theories Reviewer For CPALEDokumen25 halamanAFAR Theories Reviewer For CPALEColeen CunananBelum ada peringkat

- Acctg for Business CombosDokumen10 halamanAcctg for Business CombosFaye EnrileBelum ada peringkat

- Chapter 9Dokumen21 halamanChapter 9Vidgezxc Loria100% (1)

- Case 31Dokumen5 halamanCase 31Vidgezxc LoriaBelum ada peringkat

- Multiple Choice QuestionsDokumen25 halamanMultiple Choice QuestionsJohn Remar Lavina70% (20)

- SCIENTIFIC STORECASTING OR LARGE PROFITS ON SMALL RISKSDokumen15 halamanSCIENTIFIC STORECASTING OR LARGE PROFITS ON SMALL RISKSSirrudramahasanjeevani Dhyanparihar YagnaBelum ada peringkat

- Afar - BC-1-2018Dokumen4 halamanAfar - BC-1-2018Joanna Rose Deciar100% (2)

- FULLIFRS Vs IFRSforSMES BAGSITDokumen220 halamanFULLIFRS Vs IFRSforSMES BAGSITVidgezxc LoriaBelum ada peringkat

- Chapter 21 Accounting For Non Profit OrganizationsDokumen21 halamanChapter 21 Accounting For Non Profit OrganizationsHyewon100% (1)

- Chapter 21 Accounting For Non Profit OrganizationsDokumen21 halamanChapter 21 Accounting For Non Profit OrganizationsHyewon100% (1)

- AfarDokumen11 halamanAfarWilsonBelum ada peringkat

- Test Bank Bank For Advanced Accounting 3 e by JeterDokumen15 halamanTest Bank Bank For Advanced Accounting 3 e by Jeterjr centenoBelum ada peringkat

- Business CombinationDokumen4 halamanBusiness CombinationZoomKoolBelum ada peringkat

- Business CombinationsDokumen17 halamanBusiness CombinationsBlairEmrallaf0% (1)

- Multiple Choice Questions: Business CombinationsDokumen25 halamanMultiple Choice Questions: Business CombinationsHera AsuncionBelum ada peringkat

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterDari EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterBelum ada peringkat

- Bac 412 - Advacc2-Reviewer For Final Departmental ExamDokumen11 halamanBac 412 - Advacc2-Reviewer For Final Departmental ExamAudreyMaeBelum ada peringkat

- Tokeny Solutions ONBOARDDokumen2 halamanTokeny Solutions ONBOARDJosephine BonjourBelum ada peringkat

- Architectural Elevation and Section GuideDokumen58 halamanArchitectural Elevation and Section GuideVidgezxc LoriaBelum ada peringkat

- Architectural Elevation and Section GuideDokumen58 halamanArchitectural Elevation and Section GuideVidgezxc LoriaBelum ada peringkat

- Chapter 2 3 4 15 16Dokumen99 halamanChapter 2 3 4 15 16HayjackBelum ada peringkat

- Team PRTC Afar-Finpb - 5.21Dokumen16 halamanTeam PRTC Afar-Finpb - 5.21Nanananana100% (2)

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Dokumen14 halamanCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoBelum ada peringkat

- Internal Control of Fixed Assets: A Controller and Auditor's GuideDari EverandInternal Control of Fixed Assets: A Controller and Auditor's GuidePenilaian: 4 dari 5 bintang4/5 (1)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownDari EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownBelum ada peringkat

- ACC 221 - Second ExaminationDokumen4 halamanACC 221 - Second ExaminationCharlesBelum ada peringkat

- Afar Business CombinationDokumen16 halamanAfar Business CombinationAnnie Sta Maria TrinidadBelum ada peringkat

- Chapter 01 - Business CombinationsDokumen17 halamanChapter 01 - Business CombinationsTina LundstromBelum ada peringkat

- Ethical Issues in Advanced Accounting Chapter 1 Test Bank QuestionsDokumen20 halamanEthical Issues in Advanced Accounting Chapter 1 Test Bank Questionskgarza2011100% (1)

- Business Combinations: Solution: DDokumen17 halamanBusiness Combinations: Solution: Dbabycatine100% (1)

- Chapter 9 Ed 01Dokumen20 halamanChapter 9 Ed 01Abdullah Al-fifiBelum ada peringkat

- Advanced Accounting 4th Edition Jeter Test BankDokumen20 halamanAdvanced Accounting 4th Edition Jeter Test Bankbryanharrismpqrsfbokn100% (15)

- Mixed Accounting QuestionsDokumen10 halamanMixed Accounting QuestionsSVTKhsiaBelum ada peringkat

- Business Combination TheoriesDokumen2 halamanBusiness Combination TheoriesSchool Files100% (1)

- CH 01Dokumen14 halamanCH 01Ryan Victor MoralesBelum ada peringkat

- Full Solution Manual Advance Accounting 5th Edition by Debra Jeter SLW1016Dokumen18 halamanFull Solution Manual Advance Accounting 5th Edition by Debra Jeter SLW1016Sm Help75% (4)

- Test Bank Advanced Accounting 5th Edition Jeter PDFDokumen17 halamanTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoBelum ada peringkat

- Accounting For Business Combinations: Multiple ChoiceDokumen19 halamanAccounting For Business Combinations: Multiple Choicehassan nassereddineBelum ada peringkat

- Test Bank For Advanced Accounting 12th EditionDokumen36 halamanTest Bank For Advanced Accounting 12th Editionacetize.maleyl.hprj100% (46)

- Full Download Test Bank For Advanced Accounting 12th Edition PDF Full ChapterDokumen36 halamanFull Download Test Bank For Advanced Accounting 12th Edition PDF Full Chapterchapmangladiate.1wb1h100% (15)

- Test Bank For Advanced Accounting 5th Edition Jeter, ChaneyDokumen17 halamanTest Bank For Advanced Accounting 5th Edition Jeter, ChaneyEych Mendoza100% (2)

- Chapter 4 Multiple ChoicesDokumen11 halamanChapter 4 Multiple ChoicesAurcus JumskieBelum ada peringkat

- Junior Philippine Accounting Midterms ReviewDokumen5 halamanJunior Philippine Accounting Midterms ReviewezraelydanBelum ada peringkat

- Nfjpia Nmbe Afar 2017 AnsDokumen12 halamanNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- Multiple choice questions on business combinationsDokumen12 halamanMultiple choice questions on business combinationsHerwin Mae BoclarasBelum ada peringkat

- Business Combination MCQsDokumen6 halamanBusiness Combination MCQsJustine FloresBelum ada peringkat

- ACCTGDokumen13 halamanACCTGCabardo Maria RegilynBelum ada peringkat

- Nfjpia Nmbe Afar 2017 AnsDokumen10 halamanNfjpia Nmbe Afar 2017 AnshyosungloverBelum ada peringkat

- Advanced Accounting Jeter 5th Edition Test BankDokumen14 halamanAdvanced Accounting Jeter 5th Edition Test BankJerry Williams100% (29)

- Financial Analysis Placement TestDokumen15 halamanFinancial Analysis Placement TestAbigail SubaBelum ada peringkat

- National Mock Board Examination 2017 Advanced Financial Accounting and ReportingDokumen11 halamanNational Mock Board Examination 2017 Advanced Financial Accounting and ReportingTzaddi Ann DeluteBelum ada peringkat

- Advanced Financial Accounting ReviewDokumen11 halamanAdvanced Financial Accounting ReviewJoyce Anne GarduqueBelum ada peringkat

- This Study Resource Was: Page 1 of 5Dokumen5 halamanThis Study Resource Was: Page 1 of 5debate ddBelum ada peringkat

- TOA DRILL 3 (Practical Accounting 2)Dokumen14 halamanTOA DRILL 3 (Practical Accounting 2)ROMAR A. PIGABelum ada peringkat

- Midterms WITHOUT ANSWERSDokumen21 halamanMidterms WITHOUT ANSWERScasio3627Belum ada peringkat

- Quiz 1 Answers BUSICOMBIDokumen14 halamanQuiz 1 Answers BUSICOMBIfoxtrotBelum ada peringkat

- Ch02 Test Bank Jeter Advanced Accounting 3rd EditionDokumen19 halamanCh02 Test Bank Jeter Advanced Accounting 3rd EditionAnne Claire Agad Maghinay100% (1)

- CPA Financial Accounting and Reporting: Second EditionDari EverandCPA Financial Accounting and Reporting: Second EditionBelum ada peringkat

- Online Treasure Hunt StarsDokumen3 halamanOnline Treasure Hunt StarsVidgezxc LoriaBelum ada peringkat

- Science Written ReportDokumen1 halamanScience Written ReportVidgezxc LoriaBelum ada peringkat

- HO Roof and Its TypesDokumen21 halamanHO Roof and Its TypesVidgezxc LoriaBelum ada peringkat

- Organic Compounds in Everyday LifeDokumen2 halamanOrganic Compounds in Everyday LifeVidgezxc LoriaBelum ada peringkat

- Chapter 10Dokumen23 halamanChapter 10Vidgezxc Loria100% (1)

- Organic Compounds in Everyday LifeDokumen2 halamanOrganic Compounds in Everyday LifeVidgezxc LoriaBelum ada peringkat

- Before:: Full Tank of GasDokumen5 halamanBefore:: Full Tank of GasVidgezxc LoriaBelum ada peringkat

- HO Roof and Its TypesDokumen21 halamanHO Roof and Its TypesVidgezxc LoriaBelum ada peringkat

- August 24 ScriptDokumen4 halamanAugust 24 ScriptVidgezxc LoriaBelum ada peringkat

- Dishes CaseDokumen1 halamanDishes CaseVidgezxc Loria50% (2)

- Chap 19 PDFDokumen22 halamanChap 19 PDFAngelicBelum ada peringkat

- Advacc ForexDokumen22 halamanAdvacc ForexVidgezxc LoriaBelum ada peringkat

- Final August 24 ScriptDokumen4 halamanFinal August 24 ScriptVidgezxc LoriaBelum ada peringkat

- Income TaxationDokumen17 halamanIncome TaxationVidgezxc LoriaBelum ada peringkat

- BusCom Exercises AnswerDokumen4 halamanBusCom Exercises AnswerVidgezxc LoriaBelum ada peringkat

- BusCom Exercises AnswerDokumen4 halamanBusCom Exercises AnswerVidgezxc LoriaBelum ada peringkat

- Income TaxationDokumen59 halamanIncome TaxationVidgezxc LoriaBelum ada peringkat

- Astra Micro Wave Products - Ar - 2015-16Dokumen162 halamanAstra Micro Wave Products - Ar - 2015-16Pratap 2k21Belum ada peringkat

- Acct7104 Seminar 1 s1 2016 Pdf6Dokumen14 halamanAcct7104 Seminar 1 s1 2016 Pdf6Harnekh PuharBelum ada peringkat

- 194.kool Fun Toys (HK) Pty LTD Current and Historical Company ExtractDokumen7 halaman194.kool Fun Toys (HK) Pty LTD Current and Historical Company ExtractFlinders TrusteesBelum ada peringkat

- MMFS AGM NoticeDokumen249 halamanMMFS AGM Noticejitendra76Belum ada peringkat

- CH 7 - TAK Soal PDFDokumen9 halamanCH 7 - TAK Soal PDFDiny SulisBelum ada peringkat

- Letter From Shapley 23/07/2012Dokumen2 halamanLetter From Shapley 23/07/2012bwanamamboBelum ada peringkat

- Online Brokers UpdatedDokumen4 halamanOnline Brokers UpdatedHassan RazaBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Global CrisisDokumen21 halamanGlobal Crisishema sri mediBelum ada peringkat

- Nego Sec 1-23Dokumen4 halamanNego Sec 1-23Gracielle Falcasantos Dalaguit0% (1)

- Aspe Vs IfrsDokumen49 halamanAspe Vs IfrsafaiziBelum ada peringkat

- Certificate of Sale PNBDokumen4 halamanCertificate of Sale PNBGirish SharmaBelum ada peringkat

- NTPC 1Dokumen470 halamanNTPC 1ImsBelum ada peringkat

- Chapter 4Dokumen7 halamanChapter 4Gilang PurwoBelum ada peringkat

- 1 Hour Tunnel Method Forex StrategyDokumen7 halaman1 Hour Tunnel Method Forex StrategyhiltonengBelum ada peringkat

- VNS Finance & Capital Services Limited: Summary of Rated InstrumentsDokumen6 halamanVNS Finance & Capital Services Limited: Summary of Rated InstrumentsRakesh JainBelum ada peringkat

- BSM and BinominalDokumen72 halamanBSM and BinominalANISH NARANGBelum ada peringkat

- Case StudiesDokumen3 halamanCase StudiesjmfaleelBelum ada peringkat

- Synopsis GurpratapDokumen16 halamanSynopsis GurpratapGurpratap GillBelum ada peringkat

- CFAP 04 BFD PracticeKitDokumen441 halamanCFAP 04 BFD PracticeKitSajid Ali100% (4)

- Securities and Exchange Board of India Final Order: Noticee NoDokumen55 halamanSecurities and Exchange Board of India Final Order: Noticee NoPratim Majumder100% (1)

- Share Entitlement Ratio ReportDokumen15 halamanShare Entitlement Ratio ReportVani PattnaikBelum ada peringkat

- Advanced Corporate Finance Chapter 19Dokumen35 halamanAdvanced Corporate Finance Chapter 19laurenBelum ada peringkat

- Takeover Defense in MinnesotaDokumen48 halamanTakeover Defense in MinnesotaSteve QuinlivanBelum ada peringkat

- 12006.departmental AccountsDokumen10 halaman12006.departmental Accountsyuvraj216Belum ada peringkat