Scan 0006

Diunggah oleh

El-Sayed MohammedJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Scan 0006

Diunggah oleh

El-Sayed MohammedHak Cipta:

Format Tersedia

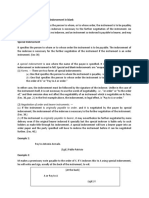

192 MODULE 25 COMMERCIAL PAPER

(1) Indicates specific person to whom endorsee wishes to negotiate instrument

EXAMPLE: On the back of a check payable to the order of M. Jordan he signs as follows: Pay to L. Smith,

. (signed) M. Jordan.

(a) Note that words "pay to the order of' are not required on back as endorsements-

instrument need be payable to order or to bearer on front only

(b) Also, note that if instrument is not payable to order or to bearer on its face, it cannot be

turned into a negotiable instrument by using these words in an endorsement on the back

EXAMPLE: A particular instrument would have been negotiable except that on the front it was payable

to A. On the back, A signed it. "Pay to the order of B, (signed) A." This does not convert it into a

negotiable instrument.

(2) Bearer paper may be converted into order paper by use of special endorsement

EXAMPLE: A check made out to cash is delivered to Carp. Carp writes on the back; Pay to Dum, (signed)

Carp. It was bearer paper until this special endorsement.

EXAM~LE: Continuing the previous example, Dum simply endorses it in blank. The check is bearer paper

again.

(3) Iflast (or only) endorsement on instrument is a blank endorsement, any holder may convert

that bearer paper into order paper bywriting "Pay to X," etc. above that

blank endorsement

c. Restrictive endorsement

(1) Requires endorsees to comply with certain conditions to be a holder

EXAMPLE: Endorsement reads "For deposit only,

(signed) A. Bell. "

EXAMPLE: Another endorsement reads "Pay to X only if X completes work to my satisfaction on my car

within three days of the date on this check, (signed) A." Neither X nor any subsequent holder can enforce

payment until: this condition has been met.

(2) Note that conditions in restrictive endorsements do not destroy negotiability even though con-

ditions placed on front of instruments do destroy negotiability because they create

conditional

promises or orders to pay

(3) Endorsements cannot prohibit subsequent negotiation

EXAMPLE: Above her endorsement, M wrote: "Pay to N only." This indicates that N is the new endorsee

but does not stop further negotiation after N when N endorses.

d. Qualified endorsement

(1) Normally, endorser, upon signing, promises automatically to pay holder or any subsequent en-

dorser amount of instrument if it is later dishonored .

(2) Qualified endorsement disclaims this liability

EXAMPLE: Ann Knolls endorses "Without recourse, (signed) Ann Knolls. "

(3) Qualified endorsements, otherwise, have same effects as other endorsements

(4) Combinations of endorsements occur

(a) Special qualified endorsement

EXAMPLE: "Pay to Pete Bell without recourse, (signed) Tom Lack." Tom Lack has limited his liability

and also Pete Bell's endorsement is needed to negotiate this instrument further.

(b) Blank qualified endorsement

EXAMPLE: "Without recourse, (signed) D. Hamilton."

(C) Endorsement that is re stricti ve, qualified, and blank

EXAMPLE: "For deposit only, without recourse, (signed) Bill Coffey."

(d) Endorsement that is restrictive, qualified, and special

EXAMPLE: "Pay to X if she completes work today, without recourse, (signed) D. Magee. "

3. If payee's name misspelled, s/he may endorse in proper spelling or misspelling or

both

a, But endorsee may require both

4, Ifan order instrument is transferred for value without endorsement, transferee may require endorse-

ment from transferor

a, Upon obtaining endorsement, will become a holder

Anda mungkin juga menyukai

- Scan 0004Dokumen2 halamanScan 0004El-Sayed MohammedBelum ada peringkat

- Business Laws: QuestionsDokumen5 halamanBusiness Laws: QuestionsLakshay GargBelum ada peringkat

- Sec 34. Special Indorsement Indorsement in BlankDokumen5 halamanSec 34. Special Indorsement Indorsement in BlankKathleen AcunaBelum ada peringkat

- NIL Notes ReviewerDokumen3 halamanNIL Notes ReviewerMichelle Ann AsuncionBelum ada peringkat

- EndorsementsDokumen16 halamanEndorsementsHarish Kapoor67% (3)

- U TC N N Un Ondi Nal P I P: M S o Tai An C Tio Rom Se or Order To AyDokumen2 halamanU TC N N Un Ondi Nal P I P: M S o Tai An C Tio Rom Se or Order To AyEl-Sayed MohammedBelum ada peringkat

- GROUP 1 Reporting - Draft - CompleteDokumen25 halamanGROUP 1 Reporting - Draft - CompleteLorenz BaguioBelum ada peringkat

- 190 Commercial Paper: PL R M in U T TH BL N A RDR B B L N. Hi D R LDokumen2 halaman190 Commercial Paper: PL R M in U T TH BL N A RDR B B L N. Hi D R LEl-Sayed MohammedBelum ada peringkat

- Scan 0004Dokumen2 halamanScan 0004El-Sayed MohammedBelum ada peringkat

- 30 Negotiable InstrumentDokumen100 halaman30 Negotiable InstrumentA100% (2)

- 11111the Law On Negotiable ContractsDokumen15 halaman11111the Law On Negotiable ContractsMary Justine GallanoBelum ada peringkat

- The Law On Negotiable ContractsDokumen4 halamanThe Law On Negotiable ContractsMary Justine GallanoBelum ada peringkat

- EndorsementsDokumen5 halamanEndorsementsMohib Ali100% (1)

- C. Accrual / Rate of Interest Specified. (Not Specified)Dokumen5 halamanC. Accrual / Rate of Interest Specified. (Not Specified)Velerie RomeroBelum ada peringkat

- Escalante NotesDokumen23 halamanEscalante NotesJULLIAN PAOLO UMALIBelum ada peringkat

- Terms ContractDokumen5 halamanTerms ContractKelly ObrienBelum ada peringkat

- NIL Reviewer de LeonDokumen3 halamanNIL Reviewer de LeonGedi RojasBelum ada peringkat

- Negotiable Instrument Law Philippines PDFDokumen51 halamanNegotiable Instrument Law Philippines PDFRSQ100% (1)

- Terms of The Contract 2Dokumen9 halamanTerms of The Contract 2bhekijabuBelum ada peringkat

- RFBT 06 - Negotiable-Instruments-Law-ACT-No.-2031Dokumen24 halamanRFBT 06 - Negotiable-Instruments-Law-ACT-No.-2031Cyn ThiaBelum ada peringkat

- Negotiable Instrument Law ReviewerDokumen8 halamanNegotiable Instrument Law ReviewerGretel Jagape TimarioBelum ada peringkat

- Negotiable InstrumentsDokumen65 halamanNegotiable InstrumentsfariaBelum ada peringkat

- BLAW ReviewerDokumen4 halamanBLAW Reviewerrhod cabritoBelum ada peringkat

- Case 2Dokumen40 halamanCase 2Howard DinumlaBelum ada peringkat

- Ucc LawDokumen177 halamanUcc LawGatorBelum ada peringkat

- Negotiable Instruments Reviewer Midterms PDFDokumen16 halamanNegotiable Instruments Reviewer Midterms PDFLyka Mae Palarca IrangBelum ada peringkat

- Nego ReviewerDokumen9 halamanNego ReviewerStacy Shara OtazaBelum ada peringkat

- Terms & Exclusion ClauseDokumen17 halamanTerms & Exclusion ClausersehelinBelum ada peringkat

- Lecture Notes, Negotiable InstrumentsDokumen10 halamanLecture Notes, Negotiable Instrumentsشوكت حياتBelum ada peringkat

- Law On Negotiable Instruments Arts. 41-50Dokumen30 halamanLaw On Negotiable Instruments Arts. 41-50BSA 1ABelum ada peringkat

- Scan 0024Dokumen2 halamanScan 0024El-Sayed MohammedBelum ada peringkat

- Bar Questions in Negotiable InstrumentDokumen13 halamanBar Questions in Negotiable InstrumentSitti Sarah SaripBelum ada peringkat

- NEGO Secs 30-69 FiNotesDokumen23 halamanNEGO Secs 30-69 FiNotesFayie De LunaBelum ada peringkat

- Banking Final ReportDokumen34 halamanBanking Final Reportrobiulhasan53bdBelum ada peringkat

- Negotiable InstrumentDokumen15 halamanNegotiable InstrumentGemsBelum ada peringkat

- Chan Wan Vs Tan Kim (109 Phil 706, 30 Sept 1960)Dokumen6 halamanChan Wan Vs Tan Kim (109 Phil 706, 30 Sept 1960)Anonymous ov2tOnBelum ada peringkat

- Negotiable Instruments Law ReviewerDokumen10 halamanNegotiable Instruments Law ReviewerLester PioquintoBelum ada peringkat

- Sales Reviewer JuradoDokumen33 halamanSales Reviewer Juradojake31100% (5)

- Y N - Negotiable Instruments Law: Asay OtesDokumen6 halamanY N - Negotiable Instruments Law: Asay OtesBrandon BeachBelum ada peringkat

- The Negotiable Instruments ActDokumen63 halamanThe Negotiable Instruments ActRavi KumarBelum ada peringkat

- Negotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Dokumen1 halamanNegotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Mark Hiro NakagawaBelum ada peringkat

- Terms 1A. The Parol Evidence RuleDokumen10 halamanTerms 1A. The Parol Evidence RuleTina AlexaBelum ada peringkat

- Scan 0001Dokumen2 halamanScan 0001El-Sayed MohammedBelum ada peringkat

- Scan 0006Dokumen2 halamanScan 0006El-Sayed MohammedBelum ada peringkat

- NIL Jokeman NotesDokumen82 halamanNIL Jokeman NotesjenesBelum ada peringkat

- Pemberton Benchlands Housing Corp. v. Sabre Transport Ltd.Dokumen1 halamanPemberton Benchlands Housing Corp. v. Sabre Transport Ltd.Alice JiangBelum ada peringkat

- The Negotiable Instruments ActDokumen38 halamanThe Negotiable Instruments ActPJr MilleteBelum ada peringkat

- Kinds and Modes of TransferDokumen21 halamanKinds and Modes of TransferGian Alexis FernandezBelum ada peringkat

- Negotiable Instruments Law ReviewerDokumen8 halamanNegotiable Instruments Law ReviewerRowbby GwynBelum ada peringkat

- Negotiable Instruments Law Reviewer Q ADokumen13 halamanNegotiable Instruments Law Reviewer Q AMD Jewel RanaBelum ada peringkat

- Negotiable Instruments Law ReviewerDokumen10 halamanNegotiable Instruments Law ReviewerEdwin VillaBelum ada peringkat

- NEGO Secs 184-189 & 119-124Dokumen20 halamanNEGO Secs 184-189 & 119-124Fayie De LunaBelum ada peringkat

- Universidad de Manila: Negotiable Instruments Law First Trimester SY 2020-2021Dokumen183 halamanUniversidad de Manila: Negotiable Instruments Law First Trimester SY 2020-2021Kyle JamiliBelum ada peringkat

- 2 - FormalitiesDokumen7 halaman2 - Formalitiesvivian cheungBelum ada peringkat

- Law On NegoDokumen5 halamanLaw On NegoCALERO CATHERINE CBelum ada peringkat

- Payment System Outline 2009 NewmanDokumen56 halamanPayment System Outline 2009 NewmanHyoun Ja Park100% (1)

- TAMBASACAN ReviewerDokumen61 halamanTAMBASACAN ReviewerIsabella SiggaoatBelum ada peringkat

- NegoDokumen3 halamanNegoAldrin Santos AntonioBelum ada peringkat

- RFBT - Law On ContractDokumen8 halamanRFBT - Law On ContractMichelle BarabadBelum ada peringkat

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyDari EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyBelum ada peringkat

- Eq o o o o Eq: ND RDDokumen8 halamanEq o o o o Eq: ND RDEl-Sayed MohammedBelum ada peringkat

- IMP BooksDokumen13 halamanIMP BooksEl-Sayed MohammedBelum ada peringkat

- M ULE Taxes Individual: Multiple CHO Ce Answers'Dokumen3 halamanM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedBelum ada peringkat

- Worksheet 5Dokumen1 halamanWorksheet 5El-Sayed Mohammed100% (1)

- MCQ PRDokumen1 halamanMCQ PREl-Sayed MohammedBelum ada peringkat

- M ULE Taxes Individual: Multiple CHO Ce Answers'Dokumen3 halamanM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedBelum ada peringkat

- Oxs CASDWE213Dokumen1 halamanOxs CASDWE213El-Sayed MohammedBelum ada peringkat

- Professional Responsibilities: Requ RedDokumen2 halamanProfessional Responsibilities: Requ RedEl-Sayed MohammedBelum ada peringkat

- 622 Axes: ATE: Module 36 T CorporDokumen1 halaman622 Axes: ATE: Module 36 T CorporEl-Sayed MohammedBelum ada peringkat

- Ghewrefgafewekqpergkafklefdbf Fdfbdsamsldfbmfdel Elrwetkgio3P (Regfb Efdgfbfndfskwl Erfgfbgjrewkl 3Retgero3EwrpgfbDokumen1 halamanGhewrefgafewekqpergkafklefdbf Fdfbdsamsldfbmfdel Elrwetkgio3P (Regfb Efdgfbfndfskwl Erfgfbgjrewkl 3Retgero3EwrpgfbEl-Sayed MohammedBelum ada peringkat

- Alexander The Great Act 2 Scenes 3 & 4Dokumen3 halamanAlexander The Great Act 2 Scenes 3 & 4El-Sayed MohammedBelum ada peringkat

- Mjds ALKDSFDEQWEWFDEQWEWEQWEFEQWEFDokumen2 halamanMjds ALKDSFDEQWEWFDEQWEWEQWEFEQWEFEl-Sayed MohammedBelum ada peringkat

- Alex Act 2 Sc1 Site 2Dokumen5 halamanAlex Act 2 Sc1 Site 2El-Sayed MohammedBelum ada peringkat

- Scan 0098Dokumen2 halamanScan 0098El-Sayed MohammedBelum ada peringkat

- Module 21 Professional ResponsibilitiesDokumen2 halamanModule 21 Professional ResponsibilitiesEl-Sayed MohammedBelum ada peringkat

- Vvdfgdhjkhgfdssdfghjkljhgfdsa DSFGHJDokumen1 halamanVvdfgdhjkhgfdssdfghjkljhgfdsa DSFGHJEl-Sayed MohammedBelum ada peringkat

- Retirement SpeechDokumen11 halamanRetirement SpeechRayan Castro100% (1)

- Travisa India ETA v5Dokumen4 halamanTravisa India ETA v5Chamith KarunadharaBelum ada peringkat

- Report WritingDokumen3 halamanReport WritingSeema SinghBelum ada peringkat

- EvaluationDokumen4 halamanEvaluationArjay Gabriel DudoBelum ada peringkat

- SiswaDokumen5 halamanSiswaNurkholis MajidBelum ada peringkat

- Objectives of Financial AnalysisDokumen3 halamanObjectives of Financial AnalysisMahaveer SinghBelum ada peringkat

- José Mourinho - Defensive Organization PDFDokumen3 halamanJosé Mourinho - Defensive Organization PDFIvo Leite100% (1)

- Ch.6 TariffsDokumen59 halamanCh.6 TariffsDina SamirBelum ada peringkat

- Design of Swimming Pool PDFDokumen21 halamanDesign of Swimming Pool PDFjanithbogahawatta67% (3)

- Section 7 4 Part IVDokumen10 halamanSection 7 4 Part IVapi-196193978Belum ada peringkat

- Chapter 11: Re-Situating ConstructionismDokumen2 halamanChapter 11: Re-Situating ConstructionismEmilio GuerreroBelum ada peringkat

- AJWS Response To July 17 NoticeDokumen3 halamanAJWS Response To July 17 NoticeInterActionBelum ada peringkat

- Aarushi VerdictDokumen273 halamanAarushi VerdictOutlookMagazine88% (8)

- List of Departed Soul For Daily PrayerDokumen12 halamanList of Departed Soul For Daily PrayermoreBelum ada peringkat

- Starmada House RulesDokumen2 halamanStarmada House Ruleshvwilson62Belum ada peringkat

- Project Driven & Non Project Driven OrganizationsDokumen19 halamanProject Driven & Non Project Driven OrganizationsEkhlas Ghani100% (2)

- MC Script For StorytellingDokumen1 halamanMC Script For StorytellingPPD LUBOK ANTU-CM15 KPMBelum ada peringkat

- Teens Intermediate 5 (4 - 6)Dokumen5 halamanTeens Intermediate 5 (4 - 6)UserMotMooBelum ada peringkat

- Loan AgreementDokumen6 halamanLoan AgreementSachin ShastriBelum ada peringkat

- EAD-533 Topic 3 - Clinical Field Experience A - Leadership AssessmentDokumen4 halamanEAD-533 Topic 3 - Clinical Field Experience A - Leadership Assessmentefrain silvaBelum ada peringkat

- NF79178240335624 ETicketDokumen2 halamanNF79178240335624 ETicketridam aroraBelum ada peringkat

- 4-Cortina-Conill - 2016-Ethics of VulnerabilityDokumen21 halaman4-Cortina-Conill - 2016-Ethics of VulnerabilityJuan ApcarianBelum ada peringkat

- 01-Cost Engineering BasicsDokumen41 halaman01-Cost Engineering BasicsAmparo Grados100% (3)

- (Bloom's Modern Critical Views) (2000)Dokumen267 halaman(Bloom's Modern Critical Views) (2000)andreea1613232100% (1)

- Contemporary World Reflection PaperDokumen8 halamanContemporary World Reflection PaperNyna Claire GangeBelum ada peringkat

- GHMC Results, 2009Dokumen149 halamanGHMC Results, 2009UrsTruly kotiBelum ada peringkat

- Adobe Scan 03-May-2021Dokumen22 halamanAdobe Scan 03-May-2021Mohit RanaBelum ada peringkat

- Variable Costing Case Part A SolutionDokumen3 halamanVariable Costing Case Part A SolutionG, BBelum ada peringkat

- Budo Hard Style WushuDokumen29 halamanBudo Hard Style Wushusabaraceifador0% (1)