Diunggah oleh

Kritarth KapoorJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Diunggah oleh

Kritarth KapoorHak Cipta:

Format Tersedia

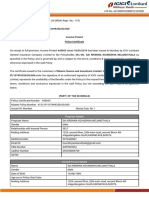

NPS Transaction Statement for Tier I Account

Statement Period: From April 01, 2018 to February 13, 2019 Statement Generation Date : February 13, 2019

PRAN 110163117639 Registration Date 17-Jan-19

Subscriber Name SHRI. RAJ KUMAR KAPOOR Tier I Status Active

PARTAP NAGAR WARD NO 3 Tier II Status Not Activated

HAMIRPUR Scheme Choice MODERATE AUTO CHOICE

HAMIRPUR HP POP-SP Registration 6008203

No

Address

DEHRA HAMIRPUR POP-SP Name STATE BANK OF INDIA, HAMIRPUR(04851)

HIMACHAL PRADESH - 177001 POP-SP Address Main Bazar, Hamirpur, 177001

INDIA POP Registration No 5000214

POP Name State Bank of India

Mobile Number +919418012039

Cross Selling Dept. SBI, Corporate Centre, Floor-

Email ID ITZ.KAPOORHMR@GMAIL.COM POP Address 10

Air India Bldg, Nariman Point, Mumbai, 400021

IRA Status IRA compliant

Tier I Nominee Name/s Percentage

UPMA RANI 100%

Summary

The total contribution to your pension account till February 13, 2019 was Rs. 36240.00.

The total value of your contributions as on February 13, 2019 was Rs. 36108.03.

Your contributions have earned a return of Rs.-131.97 till February 13, 2019.

Current Scheme Preference

Investment Option Scheme Details Percentage

Scheme 1 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME E - TIER I 26.00%

Scheme 2 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME C - TIER I 18.00%

Scheme 3 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME G - TIER I 56.00%

Investment Details Summary

Total Contribution Total Withdrawal Current Valuation Notional Gain / Loss

(Rs) No of Contribution (Rs) (Rs) (Rs)

36240.00 4 0.0000 36108.03 (131.97)

Investment Details - Scheme Wise Summary

Total Net Latest NAV Value at NAV Unrealized Return on

PFM/Scheme Contribution Total Units (Rs) Gain / Loss Investment(XIRR)

(Rs) Date (Rs)

HDFC PENSION MANAGEMENT COMPANY 20.5608

9423.36 452.2862 9299.36 (124.00)

LIMITED SCHEME E - TIER I 12-Feb-2019

HDFC PENSION MANAGEMENT COMPANY 16.8566

6523.87 387.5788 6533.26 9.39 -10.64%

LIMITED SCHEME C - TIER I 12-Feb-2019

HDFC PENSION MANAGEMENT COMPANY 16.6650

20295.64 1216.6468 20275.41 (20.23)

LIMITED SCHEME G - TIER I 12-Feb-2019

Total 36242.87 36108.03 -134.84

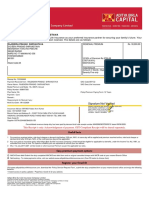

Changes made during the selected period

Date Tier Type Transaction Type

21-Jan-2019 Tier-1 Change in scheme preference

25-Jan-2019 Tier-1 On account of Rebalancing of Assets as per Regulatory Requirement

Contribution/ Redemption Details

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (Rs)

(Rs) (Rs)

01-Apr-2018 Opening balance 0.00

18-Jan- By Contribution State Bank of India (5000214), 4740.00 0.00 4740.00

2019

28-Jan- By Voluntary Contributions eNPS - Online (5000682), 500.00 0.00 500.00

2019

31-Jan- By Voluntary Contributions eNPS - Online (5000682), 16000.00 0.00 16000.00

2019

07-Feb- By Voluntary Contributions eNPS - Online (5000682), 15000.00 0.00 15000.00

2019

13-Feb-2019 Closing Balance at NSDL CRA 36,240.00

Transaction Details

SBI PENSION FUND SCHEME E - SBI PENSION FUND SCHEME C - SBI PENSION FUND SCHEME G -

TIER I TIER I TIER I

Date Particulars

Amount (Rs) Amount (Rs) Amount (Rs)

Units Units Units

NAV (Rs) NAV (Rs) NAV (Rs)

01-Apr-2018 Opening Balance 0.0000 0.0000 0.0000

18-Jan- 1327.20 900.60 2512.20

By Contribution 54.7762 34.7144 104.1706

2019 24.2295 25.9431 24.1162

21-Jan- To Withdrawal On Account of (1330.66) (899.16) (2513.86)

2019 Subscriber Initiated Scheme (54.7762) (34.7144) (104.1706)

Preference Change 24.2928 25.9019 24.1322

13-Feb-2019 Closing Balance at NSDL CRA 0.0000 0.0000 0.0000

HDFC PENSION MANAGEMENT HDFC PENSION MANAGEMENT HDFC PENSION MANAGEMENT

COMPANY LIMITED SCHEME E - COMPANY LIMITED SCHEME C - COMPANY LIMITED SCHEME G -

TIER I TIER I TIER I

Date Particulars

Amount (Rs) Amount (Rs) Amount (Rs)

Units Units Units

NAV (Rs) NAV (Rs) NAV (Rs)

01-Apr-2018 Opening Balance 0.0000 0.0000 0.0000

24-Jan- By Contribution On Account of 1328.23 901.29 2514.16

2019 Subscriber Initiated Scheme 64.0191 53.6616 151.1867

Preference Change 20.7474 16.7958 16.6295

25-Jan- On account of Rebalancing of Assets (93.96) (47.52) 141.48

(4.5731) (2.8239) 8.4951

2019 as per Regulatory Requirement 20.5464 16.8302 16.6542

28-Jan- 130.00 90.00 280.00

By Voluntary Contributions 6.4067 5.3442 16.8189

2019 20.2912 16.8406 16.6479

31-Jan- 4160.00 2880.00 8960.00

By Voluntary Contributions 201.3591 171.0996 536.3920

2019 20.6596 16.8323 16.7042

07-Feb- 3900.00 2700.00 8400.00

By Voluntary Contributions 185.0744 160.2973 503.7541

2019 21.0726 16.8437 16.6748

13-Feb-2019 Closing Balance at NSDL CRA 9423.36 452.2862 6523.87 387.5788 20295.64 1216.6468

Notes

1. The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2. 'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3. 'Total Net Contributions' indicates the cost of units currently held in the PRAN account

4. 'Unrealized Gain / Loss' indicates the gain / loss in the account for the current units balance in the account.

Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

5. calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

6.

'Changes made during the selected period' indicates all the change requests processed in PRAN account during the period for which the

statement is generated

The section 'Contribution / Redemption Details' gives the details of the contributions and redemption processed in subscribers' account during the

7.

period for which the statement is generated. While contribution amount indicates the amount invested in subscribers account, the redemption

amount indicates the cost of units redeemed from the account. The cost of units is calculated on a First-In-First-Out (FIFO) basis. The details are

sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

'Transaction Details' gives the units allotted under different schemes / asset classes for each of the contributions processed in subscribers'

8. account during the period for which the statement is generated. It also contains units debited from the account for redemption and rectification. The

details are sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

The Amount in the Closing Balance under the section 'Transaction Details' refers to the Units Balance in the books of NSDL CRA and it gives the

9. cost of investment of the balance units and not a sum total of all contributions and withdrawals. The cost of units is calculated on a First-In-First-Out

(FIFO) basis.

For transactions with the remarks "To Unit Redemption", the cost of units redeemed are adjusted against the total contribution in the Investment

10. Details section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual

redemption value corresponding to the units redeemed has been considered.

11. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

12.

The above returns are calculated based on scheme NAVs and the securities held under the scheme portfolio are valued on mark to market basis

and are subject to change on NAV fluctuations.

If you are an employee or if you are self-employed , you will be able to avail of deduction on contribution made from your taxable income to the extent

of (u/s 80 CCD (1) of income Tax Act, 1961)

- 10% of salary (Basic + DA ) - if you are salaried employee

- 10% of your gross income - if you are self-employed

However, please note that the maximum deduction from your taxable income is limited to RS.1.50 lac, as permitted under Sec 80 CCE of the

13.

Income Tax Act.

Further, an additional deduction from your taxable income to the extent of Rs. 50,000/- is available only for contribution in NPS u/s Sec. 80 CCD (1B).

To give an example, your salary is Rs.15 lac per annum. On contribution of Rs. 2 lac, you can avail:

Deduction under Sec. 80 CCD (1) - Rs. 1.50 lac

Deduction under Sec. 80 CCD (1B) - Rs. 0.50 lac

Total deduction - Rs. 2.00 lac

Also note that your employer's contribution upto 10% of your salary is fully deductible from your taxable income.

14. Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

Home | Contact Us | System Configuration | Entrust Secured | Privacy Policy | Grievance Redressal Policy

Best viewed in Internet Explorer 7.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

Anda mungkin juga menyukai

- NPS Transaction Statement For Tier I AccountDokumen4 halamanNPS Transaction Statement For Tier I AccountabhishekBelum ada peringkat

- Declaration 80D 80DDBDokumen1 halamanDeclaration 80D 80DDBShobit0% (1)

- Premium Paid CertificateDokumen1 halamanPremium Paid CertificateSenthil balasubramanianBelum ada peringkat

- Donation Detail Partner Ngo Donation Giveindia Retention TotalDokumen1 halamanDonation Detail Partner Ngo Donation Giveindia Retention TotalSelvamBelum ada peringkat

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDokumen3 halamanNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2Belum ada peringkat

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDokumen2 halamanNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarBelum ada peringkat

- Business Plan Example - Little LearnerDokumen26 halamanBusiness Plan Example - Little LearnerCourtney mcintosh100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDokumen2 halamanNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarBelum ada peringkat

- Ather Tax Invoice EVDokumen1 halamanAther Tax Invoice EVKing Ezekiel100% (1)

- Renewal of Your Optima Restore Floater Insurance PolicyDokumen4 halamanRenewal of Your Optima Restore Floater Insurance PolicyNikky KapoorBelum ada peringkat

- Education Loan 2023-24 ProvisionalDokumen1 halamanEducation Loan 2023-24 ProvisionalSandeep Dubey100% (1)

- Pooja Policy Self 80 DDokumen2 halamanPooja Policy Self 80 Dcagopalofficebackup100% (1)

- NPS Transaction Statement For Tier I AccountDokumen2 halamanNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYBelum ada peringkat

- 80G Certificate: Donation ReceiptDokumen1 halaman80G Certificate: Donation Receiptqwert0% (1)

- NPS Transaction Statement For Tier I AccountDokumen2 halamanNPS Transaction Statement For Tier I AccountthilaksafaryBelum ada peringkat

- NPS Transaction Statement For Tier I AccountDokumen4 halamanNPS Transaction Statement For Tier I AccountabhishekBelum ada peringkat

- Donation Detail Partner Ngo Program Donation Giveindia Retention TotalDokumen1 halamanDonation Detail Partner Ngo Program Donation Giveindia Retention TotalHarshit SinghBelum ada peringkat

- DyslexiaDokumen19 halamanDyslexiaKeren HapkhBelum ada peringkat

- NPS Transaction Statement For Tier I AccountDokumen3 halamanNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- Health Insurance ParentsDokumen1 halamanHealth Insurance ParentscagopalofficebackupBelum ada peringkat

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDokumen2 halamanNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavBelum ada peringkat

- Web It CertDokumen1 halamanWeb It CertGuna SeelanBelum ada peringkat

- A 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaDokumen2 halamanA 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaNilesh ChauhanBelum ada peringkat

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDokumen2 halamanStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDokumen2 halamanNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaBelum ada peringkat

- IT CertificateDokumen1 halamanIT CertificateManoj DasBelum ada peringkat

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDokumen2 halamanBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanBelum ada peringkat

- NPSPayment ReceiptDokumen1 halamanNPSPayment ReceiptSanthosh DamaBelum ada peringkat

- Branch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDokumen1 halamanBranch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRavi Kumar100% (1)

- CERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Dokumen1 halamanCERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Raman SharmaBelum ada peringkat

- Health Policy SiddharthDokumen9 halamanHealth Policy SiddharthSiddharth DasBelum ada peringkat

- Tax Certificate: R MargabandhuDokumen2 halamanTax Certificate: R MargabandhuTrollstyleBelum ada peringkat

- PPF e Receipt PDFDokumen1 halamanPPF e Receipt PDFManoj KumarBelum ada peringkat

- NPS Transaction Statement For Tier I AccountDokumen2 halamanNPS Transaction Statement For Tier I AccountAkash RahangdaleBelum ada peringkat

- Elss - Fy 2021-22Dokumen2 halamanElss - Fy 2021-22Amit SinghBelum ada peringkat

- Health Insurance Policy Certificate Section80DDokumen1 halamanHealth Insurance Policy Certificate Section80DDebosmita DasBelum ada peringkat

- Tax CertificateDokumen3 halamanTax Certificateamrita50% (2)

- PPF e ReceiptDokumen1 halamanPPF e ReceiptDhananjay RambhatlaBelum ada peringkat

- KK EV Auto Loan CertificateDokumen1 halamanKK EV Auto Loan CertificateKranthi Kumar KingBelum ada peringkat

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDokumen2 halamanNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaBelum ada peringkat

- Nps 123Dokumen3 halamanNps 123Md Sharma SharmaBelum ada peringkat

- Management of Preterm LaborDokumen2 halamanManagement of Preterm LaborpolygoneBelum ada peringkat

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDokumen1 halamanBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDokumen3 halamanNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyBelum ada peringkat

- Premium CertificateDokumen2 halamanPremium CertificateKamsiddha KhandekarBelum ada peringkat

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDokumen2 halamanCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- Shri Ram Janmbhoomi Teerth Kshetra: E-ReceiptDokumen2 halamanShri Ram Janmbhoomi Teerth Kshetra: E-ReceiptSasank KomarlaBelum ada peringkat

- Birla Premium Paid Certificate 2020Dokumen2 halamanBirla Premium Paid Certificate 2020SindhuBelum ada peringkat

- PPFDokumen1 halamanPPFArnab RoyBelum ada peringkat

- LIC Sikha PDFDokumen1 halamanLIC Sikha PDFsikha singh100% (1)

- Homeloancertificate 75543875Dokumen1 halamanHomeloancertificate 75543875Pradeep Chauhan100% (1)

- Compartment SyndromeDokumen14 halamanCompartment SyndromedokteraanBelum ada peringkat

- 1516352333813Dokumen3 halaman1516352333813gullipalli srinivasa raoBelum ada peringkat

- NPS CertificateDokumen2 halamanNPS CertificateSatish Tiwari100% (1)

- Interest Certificate: Shivam Garg and Ramkrishna GargDokumen1 halamanInterest Certificate: Shivam Garg and Ramkrishna GargShivamBelum ada peringkat

- LIC Aug 2020 PDFDokumen1 halamanLIC Aug 2020 PDFShantanu MetayBelum ada peringkat

- For HDFC ERGO General Insurance Company LTDDokumen2 halamanFor HDFC ERGO General Insurance Company LTDNAVEEN H EBelum ada peringkat

- ICICI COI IncomeProtect 445605Dokumen5 halamanICICI COI IncomeProtect 445605sree koundinyaBelum ada peringkat

- PPF Receipt Jan 2020Dokumen1 halamanPPF Receipt Jan 2020prasad_batheBelum ada peringkat

- 80D CertificateDokumen2 halaman80D CertificateSiva KadaliBelum ada peringkat

- Renewal of Your Ican Essential Advanced Insurance PolicyDokumen3 halamanRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranBelum ada peringkat

- Rajendra Prasad ShrivastavaDokumen2 halamanRajendra Prasad ShrivastavaSourabh ShrivastavaBelum ada peringkat

- 13 18 0038121 00 PDFDokumen7 halaman13 18 0038121 00 PDFRaoul JhaBelum ada peringkat

- NPS Transaction Statement For Tier I AccountDokumen4 halamanNPS Transaction Statement For Tier I AccountAnonymous HvihZxGNBelum ada peringkat

- 6 Kuliah Liver CirrhosisDokumen55 halaman6 Kuliah Liver CirrhosisAnonymous vUEDx8100% (1)

- A Comprehensive Review of Cementitious Grouts - Composition, Properties, Requirements and Advanced PerformanceDokumen16 halamanA Comprehensive Review of Cementitious Grouts - Composition, Properties, Requirements and Advanced PerformanceiporrasBelum ada peringkat

- Flame Retardant and Fire Resistant Cable - NexansDokumen2 halamanFlame Retardant and Fire Resistant Cable - NexansprseBelum ada peringkat

- Rules For State Competitions and Iabf Approved TournamentsDokumen56 halamanRules For State Competitions and Iabf Approved TournamentsQuality management systems documentsBelum ada peringkat

- ACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional InformationDokumen2 halamanACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional InformationkietBelum ada peringkat

- Uas MR1Dokumen2 halamanUas MR1IvanBelum ada peringkat

- Neuro M Summary NotesDokumen4 halamanNeuro M Summary NotesNishikaBelum ada peringkat

- Heteropolyacids FurfuralacetoneDokumen12 halamanHeteropolyacids FurfuralacetonecligcodiBelum ada peringkat

- FINAL PAPER Marketing Plan For Rainbow Air PurifierDokumen12 halamanFINAL PAPER Marketing Plan For Rainbow Air PurifierMohola Tebello Griffith100% (1)

- Ds0h Ufaa68 ProposalDokumen11 halamanDs0h Ufaa68 Proposaledward baskaraBelum ada peringkat

- NRF Nano EthicsDokumen18 halamanNRF Nano Ethicsfelipe de jesus juarez torresBelum ada peringkat

- Senior Project RiceberryDokumen76 halamanSenior Project RiceberryIttisak PrommaBelum ada peringkat

- Principles of Health Management: Mokhlis Al Adham Pharmacist, MPHDokumen26 halamanPrinciples of Health Management: Mokhlis Al Adham Pharmacist, MPHYantoBelum ada peringkat

- Acute Renal Failure in The Intensive Care Unit: Steven D. Weisbord, M.D., M.Sc. and Paul M. Palevsky, M.DDokumen12 halamanAcute Renal Failure in The Intensive Care Unit: Steven D. Weisbord, M.D., M.Sc. and Paul M. Palevsky, M.Dkerm6991Belum ada peringkat

- Mil STD 792fDokumen13 halamanMil STD 792fdoradoanBelum ada peringkat

- India Wine ReportDokumen19 halamanIndia Wine ReportRajat KatiyarBelum ada peringkat

- Feeder BrochureDokumen12 halamanFeeder BrochureThupten Gedun Kelvin OngBelum ada peringkat

- Fill The Gaps With The Correct WordsDokumen2 halamanFill The Gaps With The Correct WordsAlayza ChangBelum ada peringkat

- Comparison and Contrast Essay FormatDokumen5 halamanComparison and Contrast Essay Formattxmvblaeg100% (2)

- CONTROLTUB - Controle de Juntas - New-Flare-Piping-Joints-ControlDokumen109 halamanCONTROLTUB - Controle de Juntas - New-Flare-Piping-Joints-ControlVss SantosBelum ada peringkat

- REV Description Appr'D CHK'D Prep'D: Tolerances (Unless Otherwise Stated) - (In)Dokumen2 halamanREV Description Appr'D CHK'D Prep'D: Tolerances (Unless Otherwise Stated) - (In)Bacano CapoeiraBelum ada peringkat

- Review - Practical Accounting 1Dokumen2 halamanReview - Practical Accounting 1Kath LeynesBelum ada peringkat

- Report On Analysis of TSF Water Samples Using Cyanide PhotometerDokumen4 halamanReport On Analysis of TSF Water Samples Using Cyanide PhotometerEleazar DequiñaBelum ada peringkat

- Study Notes On Isomers and Alkyl HalidesDokumen3 halamanStudy Notes On Isomers and Alkyl HalidesChristian Josef AvelinoBelum ada peringkat

- Benzil PDFDokumen5 halamanBenzil PDFAijaz NawazBelum ada peringkat

- Covid-19 Mitigation PlanDokumen8 halamanCovid-19 Mitigation PlanEkum EdunghuBelum ada peringkat