1904 January 2018 ENCS Final

Diunggah oleh

Fatima Luna0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

523 tayangan3 halamanAdvanced Educ.Stats.

Judul Asli

1904 January 2018 ENCS Final (1)

Hak Cipta

© © All Rights Reserved

Format Tersedia

TXT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAdvanced Educ.Stats.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai TXT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

523 tayangan3 halaman1904 January 2018 ENCS Final

Diunggah oleh

Fatima LunaAdvanced Educ.Stats.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai TXT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

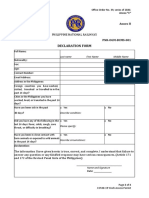

(To be filled out by BIR) DLN: _______________________

Republic of the Philippines

BIR Form No.

APPLICATION FOR REGISTRATION

Department of Finance

Enter all required information in CAPITAL LETTERS using BLACK ink. Mark all

applicable

Bureau of Internal Revenue

boxes with an “X”. One copy must be filed with the BIR and one held by the

taxpayer.

1904

For One-Time Taxpayer and Person Registering under E.O. 98

January 2018 (ENCS)

(Securing a TIN to be able to transact with any government office)

1 PhilSys Number (PSN)

3 Date of Registration

2 Taxpayer Identification Number (TIN)

4 RDO Code

(If Applicable)

(MM/DD/YYYY)

-

-

-

Part I - Taxpayer Information

5 Taxpayer Type

E.O. 98 (Filipino Citizen)

One-Time Transaction - Foreign National

Passive Income Earner Only

E.O. 98 (Foreign National)

Non-Resident Foreign Corporation

One-Time Transaction - Filipino Citizen

Non-Resident Foreign Partnership

6 Foreign TIN (if any)

7 Country of Residence

8 Taxpayer’s Name (If Individual) Last Name

First Name

Middle Name

Suffix

Nickname

9 Taxpayer’s Name (If Non-Individual, Registered Name)

10 Taxpayer’s Name [If ESTATE , ESTATE of (First Name, Middle Name, Last Name,

Suffix)]

[If TRUST, FAO: (First Name, Middle Name, Last Name, Suffix)]

11 Local/Registered Address

Unit/Room/Floor/Building No.

Building Name/Tower

Lot/Block/Phase/House No.

Street Name

Subdivision/Village/Zone

Barangay

Town/District

Municipality/City

Province

ZIP Code

12 Principal Foreign Address (indicate complete foreign address)

13 Date of Birth/Organization

14 Contact Number

15 Date of Arrival in the Philippines 16 Municipality Code

(MM/DD/YYYY)

(Phone/Mobile No.)

(MM/DD/YYYY)

(To be filled-up by BIR)

/

/

/

/

17 Mother’s Maiden Name

18 Father’s Name

19 Gender

20 Email Address

Male

Female

Part II - Transaction Details

21 Purpose of TIN Application

A

Dealings with Banks

B

Dealings with Government Agencies

C Tax Treaty Relief

Part III - Withholding Agent/Accredited Tax Agent Information

22 Taxpayer Identification Number (TIN)

-

-

- 23 RDO Code

24 Withholding Agent/Accredited Tax Agent’s Name (Last Name, First Name, Middle

Name for Individual)/(Registered Name for Non-Individual) (if different from

taxpayer)

25 Registered Address (Sub-street, Building/Street, Barangay, City/Municipality,

Province)

25A ZIP Code

26 Contact Number (Phone/Mobile No.)

27 Email Address

28 Declaration

Stamp of BIR Receiving Office

I declare, under the penalties of perjury, that this application has been made in

good faith, verified by me and to the best of my knowledge and belief, is true and

and Date of Receipt

correct, pursuant to the provisions of the National Internal Revenue Code, as

amended, and the regulations issued under authority thereof. Further, I give my

consent to

the processing of my information as contemplated under the *Data Privacy Act of

2012 (R.A. No. 10173) for legitimate and lawful purposes.

_____________________________________________

________________________

TAXPAYER/AUTHORIZED REPRESENTATIVE

Title/Position of Signatory

(Signature over Printed Name)

*Note: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph)

Required Attachments/Documents:

A. For Individual

- Any identification issued by an authorized government body (e.g. Birth

Certificate, Passport, Driver’s License) that shows the name, address and birthdate

of the applicant

- Passport (in case of Non-Resident Alien not engaged in trade or business)

B. For Non-Individual

- Any official document issued by an authorized government body (e.g. government

agency (tax authority) thereof, or a municipality) that includes the name of the

non-individual and the

address of its principal office in the jurisdiction in which the non-individual was

incorporated or organized (e.g. Articles of Incorporation, Certificate of

Residency)

Anda mungkin juga menyukai

- ICPEP 2018 National Convention Invites FINAL v4Dokumen1 halamanICPEP 2018 National Convention Invites FINAL v4roxy8marie8chanBelum ada peringkat

- Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Dokumen2 halamanMembership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Sevy D PoloyapoyBelum ada peringkat

- PRPWD ApplicationDokumen7 halamanPRPWD ApplicationGemma Abad0% (2)

- MC 2022-2309Dokumen2 halamanMC 2022-2309Ernest Mendoza100% (1)

- NeecoDokumen5 halamanNeecoMagno AnnBelum ada peringkat

- Application Form: Programming System Analysis and DesignDokumen1 halamanApplication Form: Programming System Analysis and DesignJakeAmabaJacoBoBelum ada peringkat

- Maxicare Healthcare AuthorizationDokumen1 halamanMaxicare Healthcare AuthorizationZa NiahBelum ada peringkat

- Parental Consent and Release Form For Field Study: Signature Over Printed Name of Student's Parent or Legal GuardianDokumen1 halamanParental Consent and Release Form For Field Study: Signature Over Printed Name of Student's Parent or Legal GuardianAngella MaquilingBelum ada peringkat

- CS Form No. 212 Revised Personal Data Sheet 2 - NewDokumen14 halamanCS Form No. 212 Revised Personal Data Sheet 2 - NewDonald Bose Mandac100% (5)

- Bir Form 0605Dokumen2 halamanBir Form 0605alona_245883% (6)

- YOUNG - Directory of Officers AdvisersDokumen4 halamanYOUNG - Directory of Officers AdvisersJohn Chezter V. CarlitBelum ada peringkat

- Endorsement Letter For MEQDokumen1 halamanEndorsement Letter For MEQJude Bon AlbaoBelum ada peringkat

- Letter of Intent-NTCDokumen2 halamanLetter of Intent-NTCJoel SantosBelum ada peringkat

- Department of Education PSIPOP 2022Dokumen126 halamanDepartment of Education PSIPOP 2022Joshkorro GeronimoBelum ada peringkat

- Bir Form No. 0605Dokumen2 halamanBir Form No. 0605Ronald varrie Bautista50% (2)

- Tourism Code of Siniloan, LagunaDokumen34 halamanTourism Code of Siniloan, LagunaMark Ronald ArgoteBelum ada peringkat

- PNR Health Declaration Form - 1603096877 PDFDokumen1 halamanPNR Health Declaration Form - 1603096877 PDFJohn Paul Sgst100% (1)

- Dict MC 004 2017 Prescribing The Philippines Web Accessibility Policy and Adopting For This PurposeDokumen9 halamanDict MC 004 2017 Prescribing The Philippines Web Accessibility Policy and Adopting For This PurposetatsBelum ada peringkat

- Appendix 14 - Instructions - BURSDokumen1 halamanAppendix 14 - Instructions - BURSthessa_starBelum ada peringkat

- MEMORANDUM OF AGREEMENT Template CY 2013Dokumen4 halamanMEMORANDUM OF AGREEMENT Template CY 2013jerick16Belum ada peringkat

- Faculty Monitoring Chapter 3Dokumen22 halamanFaculty Monitoring Chapter 3api-238921447Belum ada peringkat

- CPDD-03 Rev 04 Self Directed Edited ArdmDokumen2 halamanCPDD-03 Rev 04 Self Directed Edited ArdmMarinel June PalerBelum ada peringkat

- Deped Policy Framework For The Implementation of The Alternative Dispute Resolution (Adr) System-MediationDokumen11 halamanDeped Policy Framework For The Implementation of The Alternative Dispute Resolution (Adr) System-MediationDarwin AbesBelum ada peringkat

- Job Description of Branch StaffDokumen3 halamanJob Description of Branch StaffEleanor JamcoBelum ada peringkat

- Malaybalay City Requirements For Building PermitDokumen1 halamanMalaybalay City Requirements For Building PermitGenevieve GayosoBelum ada peringkat

- Goldilocks permit fee deadline extensionDokumen1 halamanGoldilocks permit fee deadline extensionPhilippe CamposanoBelum ada peringkat

- BWC Registration DetailsDokumen1 halamanBWC Registration DetailsCriss JungBelum ada peringkat

- RFID Proposal For Schools v1.0Dokumen19 halamanRFID Proposal For Schools v1.0Ravindra KumarBelum ada peringkat

- MEMBER’S CHANGE OF INFORMATION FORM (MCIF) INSTRUCTIONSDokumen2 halamanMEMBER’S CHANGE OF INFORMATION FORM (MCIF) INSTRUCTIONSlucci_1182Belum ada peringkat

- Sample Letter To Landbank Requesting For MDS AccountDokumen2 halamanSample Letter To Landbank Requesting For MDS AccountCatherine JoaquinBelum ada peringkat

- FibrBiz MSME Application FormDokumen3 halamanFibrBiz MSME Application FormBernie Cervantes100% (1)

- NTC Complaint LetterDokumen3 halamanNTC Complaint LetterClaire RoxasBelum ada peringkat

- Fine Arts Program, Up Baguio ChecklistDokumen1 halamanFine Arts Program, Up Baguio ChecklistKelsch DiamondBelum ada peringkat

- Letter Sample CommissionerDokumen2 halamanLetter Sample CommissionerGaurav ReddyBelum ada peringkat

- TVL - Ict - CSS: Quarter 2 - Module 2: Using Hand Tools (Uht)Dokumen17 halamanTVL - Ict - CSS: Quarter 2 - Module 2: Using Hand Tools (Uht)anderson villalunaBelum ada peringkat

- Background Investigation FormDokumen3 halamanBackground Investigation FormJoppet BarramedaBelum ada peringkat

- Complete List of CHED Accredited SchoolsDokumen11 halamanComplete List of CHED Accredited SchoolsKristine CruzBelum ada peringkat

- A Research Paper On San Fernando La UnionDokumen4 halamanA Research Paper On San Fernando La UnionPatty PadillaBelum ada peringkat

- Bir - Form 1903Dokumen2 halamanBir - Form 1903Jennifer Deleon86% (7)

- TIN Application ProcedureDokumen3 halamanTIN Application ProcedureJuan Dela CruzBelum ada peringkat

- Bir Form 1903 - Registration Corp (Blank)Dokumen2 halamanBir Form 1903 - Registration Corp (Blank)Dennis Tolentino100% (3)

- BIR Form 1901Dokumen2 halamanBIR Form 1901Jap Algabre40% (5)

- 3 - Instruction For Completing The Application For Registration and Entry in The Single Register of Indirect Taxpayers - 4Dokumen4 halaman3 - Instruction For Completing The Application For Registration and Entry in The Single Register of Indirect Taxpayers - 4Dead_dzBelum ada peringkat

- Bir Form 1901 BlankDokumen4 halamanBir Form 1901 BlankLecel Llamedo100% (1)

- BIR Registration Requirements for IndividualsDokumen19 halamanBIR Registration Requirements for IndividualsKristarah HernandezBelum ada peringkat

- BIR Form 1604EDokumen2 halamanBIR Form 1604Ecld_tiger100% (2)

- BIR Form No. 0901-O (Other Income) Bureau of Internal RevenueDokumen2 halamanBIR Form No. 0901-O (Other Income) Bureau of Internal RevenueChristianNicolasBetantosBelum ada peringkat

- 1604 e 99Dokumen4 halaman1604 e 99ILubo AkBelum ada peringkat

- BIR Form 1904Dokumen1 halamanBIR Form 1904keith10567% (6)

- BIR Form 1901 ApplicationDokumen4 halamanBIR Form 1901 ApplicationAlvin John Benavidez SalvadorBelum ada peringkat

- BIR Form 1901 ApplicationDokumen4 halamanBIR Form 1901 ApplicationAlvin John Benavidez Salvador50% (2)

- BIR Form 1903Dokumen2 halamanBIR Form 1903Earl LarroderBelum ada peringkat

- Annual Information Return of Creditable Income Taxes WithheldDokumen2 halamanAnnual Information Return of Creditable Income Taxes WithheldAngela ArleneBelum ada peringkat

- Bir Form 2306Dokumen3 halamanBir Form 2306Rebecca McdowellBelum ada peringkat

- Bir Form 0608Dokumen2 halamanBir Form 0608Kram Ynothna BulahanBelum ada peringkat

- 1913 Final2 03.2023434341 2Dokumen1 halaman1913 Final2 03.2023434341 2LandsBelum ada peringkat

- Tax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior YearsDokumen2 halamanTax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior YearsAngela ArleneBelum ada peringkat

- Application One-Time Taxpayer Philippine BIR Form No. 1904Dokumen1 halamanApplication One-Time Taxpayer Philippine BIR Form No. 1904Edd N Ros Adlawan100% (2)

- Application For Registration: Kawanihan NG Rentas InternasDokumen2 halamanApplication For Registration: Kawanihan NG Rentas InternasJay-r Eniel ArguellesBelum ada peringkat

- BIR Form No. 0901-S1Dokumen2 halamanBIR Form No. 0901-S1Aldrinn BenamirBelum ada peringkat

- TalisayDokumen2 halamanTalisayJet GarciaBelum ada peringkat

- TalisayDokumen2 halamanTalisayJet GarciaBelum ada peringkat

- OFFICIAL BALLOT FOR MARAWI CITY ELECTIONSDokumen2 halamanOFFICIAL BALLOT FOR MARAWI CITY ELECTIONSFatima LunaBelum ada peringkat

- Faqs PDFDokumen7 halamanFaqs PDFJudel ValdezBelum ada peringkat

- 1904 January 2018 ENCS FinalDokumen3 halaman1904 January 2018 ENCS FinalFatima LunaBelum ada peringkat

- Malaysian Cyber LawDokumen16 halamanMalaysian Cyber LawNur Syamiza Zamri100% (1)

- Unpacking The Reasonable Expectation of Privacy TestDokumen20 halamanUnpacking The Reasonable Expectation of Privacy TestFahmida M Rahman100% (1)

- ASWB Study Guide-IVDokumen8 halamanASWB Study Guide-IVsue tom100% (1)

- F-QMO-017Data Use and Protection Agreement Annex-5Dokumen3 halamanF-QMO-017Data Use and Protection Agreement Annex-5Cyan Vincent CanlasBelum ada peringkat

- REVIEW ARTICLE Security and Privacy For Augmented Reality SystemsDokumen9 halamanREVIEW ARTICLE Security and Privacy For Augmented Reality SystemsRato AhmedBelum ada peringkat

- Tracing The Master in Business Administration Graduates Towards Their Personal and Professional Growth, and Program Aspects' ContributionDokumen8 halamanTracing The Master in Business Administration Graduates Towards Their Personal and Professional Growth, and Program Aspects' ContributionPsychology and Education: A Multidisciplinary JournalBelum ada peringkat

- Cyber Crime Against Women: Right To Privacy and Other IssuesDokumen14 halamanCyber Crime Against Women: Right To Privacy and Other Issuesaditi ranaBelum ada peringkat

- Health Surveillance Affirmative and Negative - Michigan7 2015Dokumen323 halamanHealth Surveillance Affirmative and Negative - Michigan7 2015Davis HillBelum ada peringkat

- DATA SHARING AGREEMENT DrafffffttttttttttDokumen4 halamanDATA SHARING AGREEMENT DrafffffttttttttttHoward UntalanBelum ada peringkat

- Arg Essay FinalDokumen8 halamanArg Essay Finalapi-577062507Belum ada peringkat

- E-Government Ethics A Synergy of Computer Ethics, Information Ethics, and Cyber EthicsDokumen5 halamanE-Government Ethics A Synergy of Computer Ethics, Information Ethics, and Cyber EthicsEditor IJACSABelum ada peringkat

- Matthews Commission Report 10 Sept 2008Dokumen303 halamanMatthews Commission Report 10 Sept 2008Amanda WatsonBelum ada peringkat

- Privacy Policy TemplateTITLE | Privacy Policy TemplateDokumen4 halamanPrivacy Policy TemplateTITLE | Privacy Policy TemplateZafarBelum ada peringkat

- Philippine Laws - Simplified: RA 4200: The Anti-Wire Tapping LawDokumen3 halamanPhilippine Laws - Simplified: RA 4200: The Anti-Wire Tapping LawArnold Conlu JumpayBelum ada peringkat

- Polisens Blanketter 442-4 EngelskaDokumen3 halamanPolisens Blanketter 442-4 EngelskaKeller Brown JnrBelum ada peringkat

- CIPT SampleQuestions v5.1Dokumen17 halamanCIPT SampleQuestions v5.1Musa Odole SolomonBelum ada peringkat

- Biometrics and Cyber SecurityDokumen25 halamanBiometrics and Cyber SecurityanthonysuberBelum ada peringkat

- Microsoft Premium MB-220 by - VCEplus 60q-DEMODokumen35 halamanMicrosoft Premium MB-220 by - VCEplus 60q-DEMORuchi VadodariaBelum ada peringkat

- (DPC) Appointing A DPO - v1.2Dokumen25 halaman(DPC) Appointing A DPO - v1.2Kate NavarraBelum ada peringkat

- 1 IntroductionDokumen20 halaman1 IntroductionRodrigue ChuingouaBelum ada peringkat

- Certificado de NacimientoDokumen4 halamanCertificado de NacimientoOlenka_ChaponanBelum ada peringkat

- DHS/ICE (ICEPIC) Information Sharing Status: Enforcement Systems BranchDokumen22 halamanDHS/ICE (ICEPIC) Information Sharing Status: Enforcement Systems BranchImpello_TyrannisBelum ada peringkat

- 4.BSBFIA402 Assessment 1 LearnerDokumen20 halaman4.BSBFIA402 Assessment 1 LearnerFarah Adila Binti TalibBelum ada peringkat

- UNDP SDGs & Digital Public Infra 2023Dokumen47 halamanUNDP SDGs & Digital Public Infra 2023VasilisBelum ada peringkat

- Safari White Paper Nov 2019oppDokumen12 halamanSafari White Paper Nov 2019oppDavid CarlsonBelum ada peringkat

- Create A Bulleted or Numbered ListDokumen4 halamanCreate A Bulleted or Numbered ListTaryo TaryoBelum ada peringkat

- Cryptography and Network Security July 2023Dokumen4 halamanCryptography and Network Security July 2023Jramesh RameshBelum ada peringkat

- THE PRODIGY AND THE PRESS: WILLIAM JAMES SIDE$ ANTI-INTELLECTUALISM, AND STANDARDS OF SUCCESS by Stephen BatesDokumen24 halamanTHE PRODIGY AND THE PRESS: WILLIAM JAMES SIDE$ ANTI-INTELLECTUALISM, AND STANDARDS OF SUCCESS by Stephen BatesSaúl VelásquezBelum ada peringkat

- Thecodeblocks Com Pseudonymization in Programming Enhancing Data Privacy With Hashing and SaltingDokumen1 halamanThecodeblocks Com Pseudonymization in Programming Enhancing Data Privacy With Hashing and SaltingHamza JaveedBelum ada peringkat

- Priya Offer LetterDokumen1 halamanPriya Offer Letterkaran bhadauriyaBelum ada peringkat