NAV For Mutual Funds Cals

Diunggah oleh

Anonymous fbft2rTlJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

NAV For Mutual Funds Cals

Diunggah oleh

Anonymous fbft2rTlHak Cipta:

Format Tersedia

NAV for Mutual Funds

Unlike a stock whose price changes with every passing second, mutual funds

don’t trade in real time. Instead, mutual funds are priced based on end of the day

methodology based on their assets and liabilities.

The assets of mutual fund comprise of total market value of the fund's

investments, cash and cash equivalents, receivables and accrued income. The

market value of the fund is computed once per day based on the closing prices of

the securities held in the fund's portfolio. Since a fund may have a certain amount

of capital in the form of cash and liquid assets, that portion is accounted for under

the cash and cash equivalents heading. Receivables include items

like dividend or interest payments applicable on that day, while accrued

income refers to money that is earned by a fund but yet to be received. Sum of

all these items, and any of their qualifying variants, constitutes the fund’s assets.

The liabilities of a mutual fund typically include money owed to the lending banks,

pending payments and a variety of charges and fees owed to various associated

entities. Additionally, a fund may have foreign liabilities that may be the shares

issued to non-residents, income or dividend for which payments are pending to

non-residents, and sale proceeds pending repatriation. All such outflows may be

classified as long-term and short-term liabilities, depending upon the payment

horizon. The liabilities of a fund also include accrued expenses, like staff salaries,

utilities, operating expenses, management expenses, distribution and marketing

expenses, transfer agent fees, custodian and audit fees and other operational

expenses.

To compute the NAV for a particular day, all these various items falling under

assets and liabilities are taken as of the end of a particular business day.

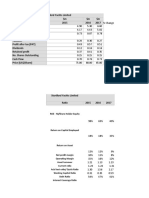

Example of Net Asset Value Calculation

Assume that a mutual fund has $100 million worth of total investments in different

securities, which is calculated based on the day's closing prices for each

individual asset. It also has $7 million of cash and cash equivalents on hand, as

well $4 million in total receivables. Accrued income for the day is $75,000. The

fund has $13 million in short-term liabilities and $2 million in long-term liabilities.

Accrued expenses for the day are $10,000. The fund has 5 million shares

outstanding. The NAV is calculated as:

NAV = (Assets - Liabilities) / Total number of outstanding shares

NAV = [($100,000,000 + $7,000,000 + $4,000,000 + $75,000) - ($13,000,000 +

$2,000,000 + $10,000)] / 5,000,000 = ($111,075,000 - $15,010,000) / 5,000,000

= $19.21 For the given day, the mutual funds shares will be traded at $19.21 per

share.

In above calculation you can see we have purchased total 355.55 units at average price of

15.i.e(10+20+15+12+18/5).

What investor want is to Buy low and Sell high. So, while investing regularly through systematic

investment plan , investor tends to average his rupee cost on investments.

Anda mungkin juga menyukai

- Saim JennyDokumen17 halamanSaim JennyJeni shahBelum ada peringkat

- Lesson 1 (Mutual Funds)Dokumen14 halamanLesson 1 (Mutual Funds)JINKY MARIELLA VERGARABelum ada peringkat

- Fund Accounting NotesDokumen33 halamanFund Accounting NotesnirbhayBelum ada peringkat

- DETAILS Net Asset ValueDokumen2 halamanDETAILS Net Asset Valuevj_for_uBelum ada peringkat

- Edit Edit: Index FundDokumen8 halamanEdit Edit: Index FundVignesh VSBelum ada peringkat

- Mutual Funds: Getting StartedDokumen48 halamanMutual Funds: Getting Startedmitesh_ojhaBelum ada peringkat

- Cash and Receivables OverviewDokumen9 halamanCash and Receivables OverviewhamidBelum ada peringkat

- Introduction To Mutual FundsDokumen34 halamanIntroduction To Mutual FundsVipin MenonBelum ada peringkat

- Mutual Fund NAVDokumen10 halamanMutual Fund NAVBrijesh SharmaBelum ada peringkat

- SEBI (Mutual Fund) Regulations, 1996 Defines MF AsaDokumen35 halamanSEBI (Mutual Fund) Regulations, 1996 Defines MF Asaoureducation.inBelum ada peringkat

- Interest Rate and Security ValuationDokumen16 halamanInterest Rate and Security ValuationMUYCO RISHELBelum ada peringkat

- Cash Equities: Share Capital Equity, Stock, Share-DefinitionDokumen12 halamanCash Equities: Share Capital Equity, Stock, Share-DefinitionSURYABelum ada peringkat

- Mutual Funds ExplainedDokumen3 halamanMutual Funds ExplainedafreenessaniBelum ada peringkat

- Is Used As A Generic Term For Various Types of Collective Investment Vehicles, Such AsDokumen10 halamanIs Used As A Generic Term For Various Types of Collective Investment Vehicles, Such AsRaghavendra ChauhanBelum ada peringkat

- Overview of Financial Management Concepts and ToolsDokumen4 halamanOverview of Financial Management Concepts and ToolsPeixuan Zhuang100% (1)

- Course Code and Title:: 12 Topic: Accounting and Valuation of Mutual Funds Professor: Prof. Romualdo Del Agua/Prof. Geric BaliaoDokumen8 halamanCourse Code and Title:: 12 Topic: Accounting and Valuation of Mutual Funds Professor: Prof. Romualdo Del Agua/Prof. Geric BaliaoI love strawberry berry berry strawberryBelum ada peringkat

- Bond Valuation: Coupon Rate: Some Bonds Have An Interest Rate, Also Known As The CouponDokumen2 halamanBond Valuation: Coupon Rate: Some Bonds Have An Interest Rate, Also Known As The CouponNikki QuilonBelum ada peringkat

- Mutual Funds 1Dokumen42 halamanMutual Funds 1Harsh ThakurBelum ada peringkat

- Corporate Finance 02Dokumen4 halamanCorporate Finance 02anupsorenBelum ada peringkat

- Pranav Kapse SIPDokumen61 halamanPranav Kapse SIPAGRIFORCE SALESBelum ada peringkat

- Stocks Bonds Money Market Securities Fund Manager TradesDokumen13 halamanStocks Bonds Money Market Securities Fund Manager TradesarobindohalderBelum ada peringkat

- Open End Fund: Buy Securities From DC Receive Return (B) Sales Share To GP Pay Dividend To GP (A)Dokumen8 halamanOpen End Fund: Buy Securities From DC Receive Return (B) Sales Share To GP Pay Dividend To GP (A)MD Abdur RahmanBelum ada peringkat

- Solution Manual For Investments An Introduction 10th Edition by MayoDokumen13 halamanSolution Manual For Investments An Introduction 10th Edition by MayoChristianLeonardqgsm100% (37)

- Financial Ratio Analysis and Investment TypesDokumen14 halamanFinancial Ratio Analysis and Investment TypesTere YpilBelum ada peringkat

- Mutual Fund Term PaperDokumen20 halamanMutual Fund Term PaperManish GuptaBelum ada peringkat

- What Is NAV ?: Net Asset Value (NAV) (Assets - Debts) / (Number of Outstanding Units)Dokumen5 halamanWhat Is NAV ?: Net Asset Value (NAV) (Assets - Debts) / (Number of Outstanding Units)rohit rakhiBelum ada peringkat

- Investment Companies and Exchange-Traded FundsDokumen11 halamanInvestment Companies and Exchange-Traded FundsJion DiazBelum ada peringkat

- Mutual Fund: A Glossary of TermsDokumen16 halamanMutual Fund: A Glossary of TermsIqbal BabaBelum ada peringkat

- Mutual FundDokumen10 halamanMutual FundmadhuBelum ada peringkat

- What Are Shares Bonds Amp SukukDokumen6 halamanWhat Are Shares Bonds Amp Sukukkhalid_ghafoor6226Belum ada peringkat

- What Is Cash FlowDokumen31 halamanWhat Is Cash FlowSumaira BilalBelum ada peringkat

- Corporate Finance Fundamentals ExplainedDokumen26 halamanCorporate Finance Fundamentals ExplainedAkhilesh PanwarBelum ada peringkat

- Finance Terms ExplainedDokumen3 halamanFinance Terms Explainedkalpaa sharmaBelum ada peringkat

- Investment Companies & Pension Funds Chapter SummaryDokumen31 halamanInvestment Companies & Pension Funds Chapter SummarySantosh BhandariBelum ada peringkat

- Lecture 11: The Mutual Fund IndustryDokumen41 halamanLecture 11: The Mutual Fund Industrycadeau01Belum ada peringkat

- Class Note Corporate FinanceDokumen15 halamanClass Note Corporate FinanceSaif UzZolBelum ada peringkat

- Different Types of Capital IssuesDokumen5 halamanDifferent Types of Capital IssuesUdhayakumar ManickamBelum ada peringkat

- A Guide To Closed-End FundsDokumen5 halamanA Guide To Closed-End FundssherBelum ada peringkat

- 1 Financial Statements Cash Flows and TaxesDokumen13 halaman1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiBelum ada peringkat

- Financial Terms GuideDokumen11 halamanFinancial Terms GuidePavithra100% (1)

- Financial ManagementDokumen50 halamanFinancial ManagementLEO FRAGGERBelum ada peringkat

- Acorn Diversified Trust: Series A, Series F and Series I UnitsDokumen40 halamanAcorn Diversified Trust: Series A, Series F and Series I Unitsac4wongBelum ada peringkat

- Course 6: The Management of CapitalDokumen26 halamanCourse 6: The Management of CapitalAlif Rachmad Haidar SabiafzahBelum ada peringkat

- Financial Statements ExplainedDokumen12 halamanFinancial Statements ExplainedRosda DhangBelum ada peringkat

- Mutual Funds and TypesDokumen4 halamanMutual Funds and TypesZain CheemaBelum ada peringkat

- MFS, Etfs, HfsDokumen25 halamanMFS, Etfs, HfsAriful Haidar MunnaBelum ada peringkat

- JKHJKDokumen22 halamanJKHJKirfanBelum ada peringkat

- Banking PresentationDokumen56 halamanBanking PresentationRabia KhanBelum ada peringkat

- Lecture # 15Dokumen14 halamanLecture # 15Zohaib Jamil WahajBelum ada peringkat

- FM MbaDokumen77 halamanFM Mbakamalyadav5907Belum ada peringkat

- Mutual Funds: An OverviewDokumen18 halamanMutual Funds: An OverviewOjas LeoBelum ada peringkat

- Finance Glossary: Study. Learn. ShareDokumen9 halamanFinance Glossary: Study. Learn. ShareAditya RatnamBelum ada peringkat

- Dimensions of Working Capital ManagementDokumen22 halamanDimensions of Working Capital ManagementRamana Rao V GuthikondaBelum ada peringkat

- InterviewDokumen24 halamanInterviewZawad Ahmed 1722219Belum ada peringkat

- Mutual FundsDokumen36 halamanMutual FundsRavindra BabuBelum ada peringkat

- Financial Statements, Cash Flow, and TaxesDokumen18 halamanFinancial Statements, Cash Flow, and TaxesPhearl Anjeyllie PilotonBelum ada peringkat

- Cost of Capital, Equity, Debt, and Preference Shares ExplainedDokumen5 halamanCost of Capital, Equity, Debt, and Preference Shares ExplainedANSHUMAN DASBelum ada peringkat

- Capital GainDokumen3 halamanCapital GainHarsh GadaBelum ada peringkat

- BGT Pricing Planner & CalculatorDokumen16 halamanBGT Pricing Planner & CalculatorTwacy Chan100% (1)

- Sap Fico - Course ContentDokumen4 halamanSap Fico - Course ContentDebabrata SahooBelum ada peringkat

- Paypal Transactions Mar 2018 To Nov 20 2019 - PDFDokumen791 halamanPaypal Transactions Mar 2018 To Nov 20 2019 - PDFkaleem rozdarBelum ada peringkat

- Advertisement Process of Pran-Rfl GroupDokumen31 halamanAdvertisement Process of Pran-Rfl GrouparpondevBelum ada peringkat

- Section 2 - Microeconomics - Table of ContentsDokumen163 halamanSection 2 - Microeconomics - Table of ContentsKevin Velasco100% (1)

- Stortford Yachts Limited ratio analysis reveals operational issuesDokumen8 halamanStortford Yachts Limited ratio analysis reveals operational issuesMuhammad Ali SamarBelum ada peringkat

- The Value of Sustainability in Real Estate A Review From A Valuation PerspectiveDokumen33 halamanThe Value of Sustainability in Real Estate A Review From A Valuation PerspectiveKarla RojasBelum ada peringkat

- Paper WISC RodriguesVieiraDokumen44 halamanPaper WISC RodriguesVieiraVinicius Guilherme Rodrigues VieiraBelum ada peringkat

- Webinar IPPC - Vendor SelectionDokumen27 halamanWebinar IPPC - Vendor Selectionadhe.priyambodo8743Belum ada peringkat

- Senior Brand Manager CPG in New York City Resume Deborah ZorbasDokumen2 halamanSenior Brand Manager CPG in New York City Resume Deborah ZorbasDeborahZorbasBelum ada peringkat

- Introductjon Jaisar Spintex PVT LTDDokumen24 halamanIntroductjon Jaisar Spintex PVT LTDRamesh Babu B100% (1)

- Walmart Case Study On Strategic ManagementDokumen4 halamanWalmart Case Study On Strategic ManagementSwati Goyal Sethi50% (4)

- The Introduction To The Effectiveness of VWAPP in TradingDokumen4 halamanThe Introduction To The Effectiveness of VWAPP in Tradingnaldspirit69Belum ada peringkat

- Chapter 5 Strategies in ActionDokumen28 halamanChapter 5 Strategies in ActionShe BayambanBelum ada peringkat

- Business Hmwk24 Vithuran Rames 9txdDokumen4 halamanBusiness Hmwk24 Vithuran Rames 9txdNWLV1 LDNBelum ada peringkat

- Nature ViewDokumen4 halamanNature ViewRituja RaneBelum ada peringkat

- Math in Finance MITDokumen22 halamanMath in Finance MITkkappaBelum ada peringkat

- HW3Dokumen2 halamanHW3Nakshatra SharmaBelum ada peringkat

- Partnering To Build Customer Engagement, Value, and RelationshipDokumen32 halamanPartnering To Build Customer Engagement, Value, and RelationshipSơn Trần BảoBelum ada peringkat

- Category Management in Purchasing and Supply ManagementDokumen9 halamanCategory Management in Purchasing and Supply Managementmihai simionescuBelum ada peringkat

- Tesco CaseDokumen17 halamanTesco CaseShaina SinghBelum ada peringkat

- Zott Et Al. - 2011 - The Business Model Recent Developments and Future Research PDFDokumen24 halamanZott Et Al. - 2011 - The Business Model Recent Developments and Future Research PDFindrabudhiBelum ada peringkat

- Sharma IndustriesDokumen5 halamanSharma IndustriesRohanBelum ada peringkat

- Nivea Case StudyDokumen25 halamanNivea Case StudyRavi Kumar67% (6)

- Eu To Rewrite Trading Rules: Xmas Gifts SpecialDokumen40 halamanEu To Rewrite Trading Rules: Xmas Gifts SpecialCity A.M.Belum ada peringkat

- Maverick Capital Q4 2016Dokumen13 halamanMaverick Capital Q4 2016superinvestorbulleti100% (2)

- Marketing CCDVTP - Create Communicate Deliver VALUE To Target at ProfitDokumen6 halamanMarketing CCDVTP - Create Communicate Deliver VALUE To Target at Profitaamolster7693Belum ada peringkat

- Beer Industry in ChinaDokumen6 halamanBeer Industry in ChinaatefzouariBelum ada peringkat

- PDFDokumen58 halamanPDFNatty Scelo ShongweBelum ada peringkat

- Introduction To Derivatives and Risk Management 9th Edition Chance Test BankDokumen26 halamanIntroduction To Derivatives and Risk Management 9th Edition Chance Test BankRobertNavarroenbk100% (43)