VAT calculations and transactions

Diunggah oleh

Kathreen Aya ExcondeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

VAT calculations and transactions

Diunggah oleh

Kathreen Aya ExcondeHak Cipta:

Format Tersedia

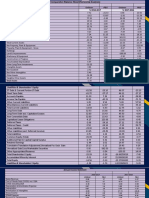

1. b.

LBJ may not register under the VAT system because his sales from

VAT taxable and zero-rated transactions did not exceed

P1,919,500.

2. c. Common carriers transporting passengers by land within the

Philippines

3. b. May be due even if the goods or properties were not actually

sold;

4. d. Sale of goods to an export oriented enterprise

5. c. VAT exempt transactions **3,199,000 each is the threshold

6. c. Transitional input tax credit

7. c. Both (a) and (b)

8. b. On collections of the month on all billings made

9. b. There is a transitional input tax from purchases of

services;

10. a. Balance, net of input taxes

11. b. P216,000

Cash sales P200,000

Open account sales 500,000

Consignment:

0 to 30 days old (on which there were

remittances from consignees of P200,000) 200,000

61 days old and above 900,000

Total VATABLE SALES 1,800,000

VAT RATE 12%

OUTPUT VAT 216,000

12. a. P2,800,000

Local sales to private entities 1,500,000

Export Sales 500,000

Local sales to government 800,000

Total VATABLE SALES 2,800,000

13. d. P63,000

Sales, gross of VAT P 784,000

Output TAX 84,000

Purchases of Corn & Coconut (330,000 x4%) (13,200)

Purchases from VAT suppliers, VAT included:

Packaging Materials 56,000

Supplies 16,800 72,800 x3/28 (7,800)

VAT PAYABLE 63,000

14. a. P20,580

Sales P200,000 Output Tax 24,000

Purchases:

Fresh Fruits 30,000

Raw sugarcane 12,000

Tin Can, gross of VAT 12,320 Input Tax (1,320)

Paper Labels, net of VAT 5,000 Input Tax ( 600)

Cardboard for boxes, net of VAT 8,000 Input Tax ( 960)

Freight, gross of VAT

(50% still unpaid) 10,080 Input Tax ( 540)

VAT PAYABLE 20,580

15. c. P249,600

**Zonal Value 5,200,000 x 12% = 624,000 x 2M/5M =

249,600 Output Tax for 2018

16. a. P0

Zero as in 0 for the sale will no longer qualify as Installment

Sales.

17. a. P414,000

Final Payment on Contracts 2,850,000

Retention 100,000

Materials 500,000

TOTAL Receipts 3,450,000

VAT Rate 12%

Output VAT 414,000

18. b. P9,000

Light Equipment 300,000/36 x 12% 1,000

Heavy Equipment 4,000,000/60 x 12% 8,000

Total Input VAT 9,000

19. b. P80,400

Materials from VAT Supplier 500,000

On contractor’s billing in June 100,000

On contractor’s billing in July 70,000

Total 670,000

VAT Rate 12%

Output Tax 80,400

20. d. P174,000

Output Tax (2,000,000 x 12%) 240,000

Input Tax on Domestic Sales (690,000 x 12%) (82,800)

Input Tax on Zero Rated (2,760,000 x 12%) (331,200)

Refundable VAT (174,000)

Anda mungkin juga menyukai

- Affidavit of Truth and FactDokumen5 halamanAffidavit of Truth and Factyahweh1192% (36)

- Taxation - Corporation - Quizzer - 2018Dokumen4 halamanTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- VAT True or False QuestionsDokumen7 halamanVAT True or False QuestionsAllen Fey De JesusBelum ada peringkat

- DocxDokumen14 halamanDocxtrisha100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDari EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionBelum ada peringkat

- 2.2 Problems - VAT PayableDokumen11 halaman2.2 Problems - VAT PayableHafi DisoBelum ada peringkat

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDokumen10 halamanJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyBelum ada peringkat

- VAT Rules for Sales, Imports, Exports, and MoreDokumen28 halamanVAT Rules for Sales, Imports, Exports, and Moremichean mabao75% (8)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionBelum ada peringkat

- CHAPTER13 Home Office and Branch - Special ProblemsDokumen21 halamanCHAPTER13 Home Office and Branch - Special ProblemsAlgifariAdityaBelum ada peringkat

- IELTS Confirmation ReceiptDokumen1 halamanIELTS Confirmation Receiptvaland sagarBelum ada peringkat

- Chapter 10 - Vat On Goods2013Dokumen8 halamanChapter 10 - Vat On Goods2013libraolrack100% (4)

- Solutions To Quiz 2 - VAT PAYABLEDokumen4 halamanSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritBelum ada peringkat

- Tax Endterm Business Taxes: ExampleDokumen4 halamanTax Endterm Business Taxes: ExampleCharmaine ChuaBelum ada peringkat

- Chapter 12 - Input Vat2013Dokumen8 halamanChapter 12 - Input Vat2013libraolrack0% (3)

- Local Media603729699590229664Dokumen3 halamanLocal Media603729699590229664Mallari, Princess Diane D.Belum ada peringkat

- Chapter 9 - Input VAT True or False 1Dokumen7 halamanChapter 9 - Input VAT True or False 1Angelo BagabaldoBelum ada peringkat

- Input VAT Credits and RefundsDokumen8 halamanInput VAT Credits and RefundskathBelum ada peringkat

- VAT Calculation and TransactionsDokumen11 halamanVAT Calculation and Transactionsishinoya keishiBelum ada peringkat

- Departmental Finals Answer KeyDokumen6 halamanDepartmental Finals Answer KeyRichard de Leon50% (4)

- Tax Lecture VATDokumen4 halamanTax Lecture VATRozzane Ann RomaBelum ada peringkat

- Rex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions ManualDokumen6 halamanRex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions ManualMaris RamiBelum ada peringkat

- Chapter 10 - Vat On Goods2013Dokumen8 halamanChapter 10 - Vat On Goods2013Eliza BethBelum ada peringkat

- VAT and OPTDokumen10 halamanVAT and OPTSharon CarilloBelum ada peringkat

- Take Home Quiz 1Dokumen9 halamanTake Home Quiz 1Akira Marantal Valdez100% (1)

- B. Transitional Input Tax: (Use This Problem For Numbers 49-52)Dokumen3 halamanB. Transitional Input Tax: (Use This Problem For Numbers 49-52)Camille HornillaBelum ada peringkat

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDokumen3 halamanAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonBelum ada peringkat

- UntitledDokumen10 halamanUntitledAccess MaterialsBelum ada peringkat

- CPA Review - VAT Quizzer - 2019Dokumen11 halamanCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- VAT Calculation and Tax PaymentsDokumen31 halamanVAT Calculation and Tax PaymentsNguyễn Ánh NgọcBelum ada peringkat

- Name: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationDokumen5 halamanName: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationJean Rose Tabagay BustamanteBelum ada peringkat

- DocxDokumen28 halamanDocxGrace Managuelod GabuyoBelum ada peringkat

- Chapter 9 - Input VAT True or False 1Dokumen55 halamanChapter 9 - Input VAT True or False 1Angelo Bagabaldo100% (1)

- L-NU AA-23-02-01-18 Finals Exam ReviewDokumen10 halamanL-NU AA-23-02-01-18 Finals Exam ReviewAmie Jane MirandaBelum ada peringkat

- Philhealth and Pag-IBIG contribution tables explainedDokumen5 halamanPhilhealth and Pag-IBIG contribution tables explainedMaraiah InciongBelum ada peringkat

- Transfer and Business Taxation HOMEWORK 006 (HW006)Dokumen3 halamanTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraBelum ada peringkat

- Solving Tax ProblemsDokumen4 halamanSolving Tax ProblemsPaupauBelum ada peringkat

- Calculate Input VAT for purchases and capital goodsDokumen15 halamanCalculate Input VAT for purchases and capital goodsA cBelum ada peringkat

- Value-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDokumen7 halamanValue-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersCha DumpyBelum ada peringkat

- Review in Business Law and TaxationDokumen4 halamanReview in Business Law and TaxationFery AnnBelum ada peringkat

- Tax 2 - Midterm Quiz 1Dokumen6 halamanTax 2 - Midterm Quiz 1Uy SamuelBelum ada peringkat

- Quiz VatDokumen1 halamanQuiz VatHeidi OpadaBelum ada peringkat

- Session 5Dokumen19 halamanSession 5youssef.oubenaliBelum ada peringkat

- Illustrative Problems Chap7-8Dokumen3 halamanIllustrative Problems Chap7-8Nikki GarciaBelum ada peringkat

- Chapt 10 - Mixed Business TransactionsDokumen6 halamanChapt 10 - Mixed Business TransactionsGemine Ailna Panganiban NuevoBelum ada peringkat

- Tax2 Seatworks-03.30.2020Dokumen4 halamanTax2 Seatworks-03.30.2020Allen Fey De JesusBelum ada peringkat

- Business TaxDokumen9 halamanBusiness TaxChristian Dela PenaBelum ada peringkat

- VAT Solving Exercise (TAX2)Dokumen3 halamanVAT Solving Exercise (TAX2)Peter Paul Enero PerezBelum ada peringkat

- Business & Transfer Taxation CH Reviewer PDFDokumen14 halamanBusiness & Transfer Taxation CH Reviewer PDFJessa FelisildaBelum ada peringkat

- Quiz 405Dokumen3 halamanQuiz 405Shaika HaceenaBelum ada peringkat

- VATDokumen5 halamanVATCyril John RamosBelum ada peringkat

- Vat 2Dokumen4 halamanVat 2Allen KateBelum ada peringkat

- Departmental Finals Answer Key PDFDokumen4 halamanDepartmental Finals Answer Key PDFJacob AcostaBelum ada peringkat

- Vat 4Dokumen4 halamanVat 4Allen KateBelum ada peringkat

- Tax 2 PDFDokumen16 halamanTax 2 PDFLeah MoscareBelum ada peringkat

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesDari EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionBelum ada peringkat

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesDari EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesBelum ada peringkat

- Wealth Management Planning: The UK Tax PrinciplesDari EverandWealth Management Planning: The UK Tax PrinciplesPenilaian: 4.5 dari 5 bintang4.5/5 (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDari EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineBelum ada peringkat

- Dalubhasaan NG Lunsod NG San Pablo Brgy. San Jose, San Pablo CityDokumen3 halamanDalubhasaan NG Lunsod NG San Pablo Brgy. San Jose, San Pablo CityKathreen Aya Exconde100% (1)

- Overview of Audit ProcessDokumen3 halamanOverview of Audit ProcessCristy Estrella0% (1)

- 5 6224131361138016410Dokumen6 halaman5 6224131361138016410Kathreen Aya ExcondeBelum ada peringkat

- CPD updates in accounting professionDokumen5 halamanCPD updates in accounting professionKathreen Aya ExcondeBelum ada peringkat

- The Revised Corporation Code of The Philippines: Changes and Developments in Corporation LawDokumen10 halamanThe Revised Corporation Code of The Philippines: Changes and Developments in Corporation LawKathreen Aya ExcondeBelum ada peringkat

- CPDDokumen2 halamanCPDKathreen Aya ExcondeBelum ada peringkat

- FINANCIAL ACCOUNTING - INVESTMENT IN EQUITYDokumen2 halamanFINANCIAL ACCOUNTING - INVESTMENT IN EQUITYKathreen Aya ExcondeBelum ada peringkat

- CPALE Syllabi 2018 PDFDokumen32 halamanCPALE Syllabi 2018 PDFLorraine TomasBelum ada peringkat

- 5 6116244325283135666Dokumen2 halaman5 6116244325283135666Kathreen Aya ExcondeBelum ada peringkat

- EquityDokumen2 halamanEquityKathreen Aya ExcondeBelum ada peringkat

- Tax Lecture Estate Tax Part 2Dokumen7 halamanTax Lecture Estate Tax Part 2Kathreen Aya ExcondeBelum ada peringkat

- OBLICON SummaryDokumen13 halamanOBLICON SummaryKathreen Aya ExcondeBelum ada peringkat

- Research Title: Merits and Demerits: Cpas' CPD Units Raised To 120 Personal InformationDokumen1 halamanResearch Title: Merits and Demerits: Cpas' CPD Units Raised To 120 Personal InformationKathreen Aya ExcondeBelum ada peringkat

- Seatwork Answer KeyDokumen6 halamanSeatwork Answer KeyKathreen Aya Exconde100% (1)

- 8MAS 08 ABC Balanced Scorecard ModuleDokumen4 halaman8MAS 08 ABC Balanced Scorecard ModuleKathreen Aya ExcondeBelum ada peringkat

- What Is Subject-Verb Agreement?Dokumen4 halamanWhat Is Subject-Verb Agreement?Venus PalmencoBelum ada peringkat

- Unilever P&G Unilever P&G Assets: Add A Footer 1Dokumen4 halamanUnilever P&G Unilever P&G Assets: Add A Footer 1Kathreen Aya ExcondeBelum ada peringkat

- Weekly Accomplishment Report: Dalubhasaan NG Lunsod NG San PabloDokumen6 halamanWeekly Accomplishment Report: Dalubhasaan NG Lunsod NG San PabloKathreen Aya ExcondeBelum ada peringkat

- Everyone Writes! Royals Never Quit!Dokumen1 halamanEveryone Writes! Royals Never Quit!Kathreen Aya ExcondeBelum ada peringkat

- CHAPTER 13 - Home Office and Branch - Special ProblemsDokumen21 halamanCHAPTER 13 - Home Office and Branch - Special ProblemsKathreen Aya ExcondeBelum ada peringkat

- Theories of Global Stratification and Globalization and Trade and PovertyDokumen2 halamanTheories of Global Stratification and Globalization and Trade and PovertyKathreen Aya ExcondeBelum ada peringkat

- CHAPTER 13 - Home Office and Branch - Special ProblemsDokumen21 halamanCHAPTER 13 - Home Office and Branch - Special ProblemsKathreen Aya ExcondeBelum ada peringkat

- Advance Accounting 2 by GuerreroDokumen23 halamanAdvance Accounting 2 by Guerreromarycayton80% (5)

- CHAPTER 16 Consolidated Financial Statements PAS 27 Subsequent ToDate of Purchase Type of BDokumen3 halamanCHAPTER 16 Consolidated Financial Statements PAS 27 Subsequent ToDate of Purchase Type of BKathreen Aya ExcondeBelum ada peringkat

- Crash Course Economics No.16: Globalization and Trade and PovertyDokumen2 halamanCrash Course Economics No.16: Globalization and Trade and PovertyKathreen Aya ExcondeBelum ada peringkat

- Screenshot To PrintDokumen6 halamanScreenshot To PrintKathreen Aya ExcondeBelum ada peringkat

- ENTREP2Dokumen14 halamanENTREP2Kathreen Aya ExcondeBelum ada peringkat

- 02 16 18 San Antonio Trump Victory LuncheonDokumen3 halaman02 16 18 San Antonio Trump Victory LuncheonPatrick SvitekBelum ada peringkat

- B.L Jain & Sons: Particulars ParticularsDokumen4 halamanB.L Jain & Sons: Particulars Particularsdeepak guptaBelum ada peringkat

- Warranty Card #BML9726Dokumen1 halamanWarranty Card #BML9726tanBelum ada peringkat

- InvoiceFMDokumen1 halamanInvoiceFMharshBelum ada peringkat

- Types: Fringe Benefit Vincent Ryan T. Esteves, Bsa-2Dokumen1 halamanTypes: Fringe Benefit Vincent Ryan T. Esteves, Bsa-2Lhorene Hope DueñasBelum ada peringkat

- Recharge Amount: Mobile ServicesDokumen2 halamanRecharge Amount: Mobile ServicesPremnath DuraichamyBelum ada peringkat

- FinalDokumen2 halamanFinalJessica FordBelum ada peringkat

- Jio Fiber Tax Invoice TemplateDokumen5 halamanJio Fiber Tax Invoice TemplatehhhhBelum ada peringkat

- Business Tax Chapter 9 ReviewerDokumen3 halamanBusiness Tax Chapter 9 ReviewerMurien LimBelum ada peringkat

- Everything you need to know about online paymentsDokumen22 halamanEverything you need to know about online paymentsshubhamnet67% (3)

- Cir Vs GoodyearDokumen19 halamanCir Vs GoodyearMary Anne Guanzon VitugBelum ada peringkat

- Robles Payroll ComputationDokumen24 halamanRobles Payroll Computationacctg2012Belum ada peringkat

- Preview 31Dokumen16 halamanPreview 31kakabadzebaiaBelum ada peringkat

- Calculate ROI, EVA, Residual Income for Company DivisionsDokumen3 halamanCalculate ROI, EVA, Residual Income for Company DivisionsDhiva Rianitha ManurungBelum ada peringkat

- Employee Pay Slip DetailsDokumen1 halamanEmployee Pay Slip Detailsk8shoebBelum ada peringkat

- Report 20230802102614Dokumen4 halamanReport 20230802102614Jerry htjlBelum ada peringkat

- Other Percentage Taxes (OPT) : By: Donna Lerma Janica A. PacoDokumen48 halamanOther Percentage Taxes (OPT) : By: Donna Lerma Janica A. PacoNiña PacoBelum ada peringkat

- Msme Global Mart: An Exclusive B2B Web Portal For Msmes ProductsDokumen1 halamanMsme Global Mart: An Exclusive B2B Web Portal For Msmes ProductsNIragBelum ada peringkat

- Sample Assumption For Strategic Management PaperDokumen2 halamanSample Assumption For Strategic Management PaperDaniela AubreyBelum ada peringkat

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokumen26 halamanDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBEPF 32 Sharma RohitBelum ada peringkat

- Bitumen Price List - 16.4.2020 PDFDokumen1 halamanBitumen Price List - 16.4.2020 PDFChakravarthy PinnamaneniBelum ada peringkat

- V. Commissioner of Internal Revenue, RespondentDokumen3 halamanV. Commissioner of Internal Revenue, RespondentJenifferRimandoBelum ada peringkat

- Einvoice 1661931542084Dokumen1 halamanEinvoice 1661931542084Jessica MathisBelum ada peringkat

- Invoice No. 398484: Endor AGDokumen1 halamanInvoice No. 398484: Endor AGLamesHunterBelum ada peringkat

- Biocon Standalone Balance Sheet and Profit & Loss SummaryDokumen5 halamanBiocon Standalone Balance Sheet and Profit & Loss SummarySweety RoyBelum ada peringkat

- Citi rent cashbackDokumen3 halamanCiti rent cashbackdwarakanath4Belum ada peringkat

- Sec 194 N - Declaration of Filing of Income Tax ReturnDokumen2 halamanSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaBelum ada peringkat

- 2021 TIMTA-ANNEX B Form (With Sample)Dokumen27 halaman2021 TIMTA-ANNEX B Form (With Sample)Mark Kevin IIIBelum ada peringkat