Analysis Risk

Diunggah oleh

sen0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

9 tayangan2 halamanrisk

Hak Cipta

© © All Rights Reserved

Format Tersedia

XLSX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inirisk

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

9 tayangan2 halamanAnalysis Risk

Diunggah oleh

senrisk

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

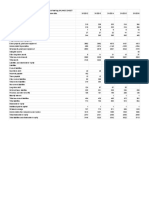

RISK ÂNLYSIS

Cash flow basis 2017 2016

1 CFO 266,839,158,028 -606,786,738,572 1

2 Current asset 2,389,547,833,365 2,057,144,267,489 2

3 CFO/current assets 0.1116693101 -0.2949655735 3

4 Total debt 1,903,267,007,614 2027254442694.00 4

5 CFO/ total debt 14.020% -29.931% 5

6 Interest payment 81,932,394,240 54723982374.00 6

7 Tax payment 18,905,614,852 0.00 7

8 Interest coverage ratio 4.487567714 -10.0881319716 8

9 Dividend 43,494,792,624 72,850,112,074 9

10 Dividend coverage ratio 6.1349679336 -8.3292492118 10

11

12

13

14

15

ÂNLYSIS

Traditional basis 2017 2016

Net operating income 43,494,792,624 72850112074.00

Total debt 1,903,267,007,614 2,027,254,442,694

Net operating income/Total debt 0.0228527 0.0359354

Current assets 2,389,547,833,365 2,057,144,267,489

current liabilities 1,903,267,007,614 2,027,254,442,694

Current ratio 1.2554980 1.0147440

Cash and cash equivalents 38,747,453,680 10,347,757,599

Current liabilities 1,903,267,007,614 2,027,254,442,694

Cash ratio 0.0203584 0.0051043

EBIT 137,047,748,855 129,845,329,281

interest expense 81,781,025,836 54,723,982,374

Interest coverage ratio ( ebit/ interest 2.6757891 3.3727317

Net operating income 43,494,792,624 72,850,112,074

Dividend to common shareholders 43,494,792,624 72,850,112,074

Dividend coverage ratio 1.0000000 1.0000000

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- NISM Series IX Merchant Banking Workbook February 2019 PDFDokumen211 halamanNISM Series IX Merchant Banking Workbook February 2019 PDFBiswajit SarmaBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- SIGTTO BookletDokumen6 halamanSIGTTO BookletbernardinodinoBelum ada peringkat

- Corporation Law Notes Under Atty Ladia RevisedDokumen78 halamanCorporation Law Notes Under Atty Ladia Revisedcarlo_tabangcuraBelum ada peringkat

- Chapter 1-Solution To ProblemsDokumen7 halamanChapter 1-Solution To ProblemsawaisjinnahBelum ada peringkat

- SlideDokumen4 halamanSlidesenBelum ada peringkat

- Balance SheetDokumen3 halamanBalance SheetsenBelum ada peringkat

- Short Term LiquidDokumen3 halamanShort Term LiquidsenBelum ada peringkat

- Current Asset Use EfficiencyDokumen6 halamanCurrent Asset Use EfficiencysenBelum ada peringkat

- Indicator Cash FlowDokumen23 halamanIndicator Cash FlowsenBelum ada peringkat

- Analyzing Business TransactionsDokumen33 halamanAnalyzing Business Transactionsabdulw_40Belum ada peringkat

- Financial Analysis and Business Valuation of Viet-Y SteelDokumen6 halamanFinancial Analysis and Business Valuation of Viet-Y SteelsenBelum ada peringkat

- Payment For Interest and Income Taxes Cash Payment For InterestDokumen5 halamanPayment For Interest and Income Taxes Cash Payment For InterestsenBelum ada peringkat

- RISK ANALYSIS (VIS Company 2017) Traditional Ratio 1 2 3 4 5 6 7 8 9Dokumen2 halamanRISK ANALYSIS (VIS Company 2017) Traditional Ratio 1 2 3 4 5 6 7 8 9senBelum ada peringkat

- B NG Đã Chính Xác Phân Rã RoaDokumen19 halamanB NG Đã Chính Xác Phân Rã RoasenBelum ada peringkat

- Payment For Interest and Income Taxes Cash Payment For InterestDokumen5 halamanPayment For Interest and Income Taxes Cash Payment For InterestsenBelum ada peringkat

- RISK ANALYSIS (VIS Company 2017) Traditional Ratio 1 2 3 4 5 6 7 8 9Dokumen2 halamanRISK ANALYSIS (VIS Company 2017) Traditional Ratio 1 2 3 4 5 6 7 8 9senBelum ada peringkat

- Contribution Margin BomDokumen23 halamanContribution Margin BomsenBelum ada peringkat

- Current Asset Use EfficiencyDokumen6 halamanCurrent Asset Use EfficiencysenBelum ada peringkat

- INDokumen4 halamanINsenBelum ada peringkat

- MTNLDokumen1 halamanMTNLa_halanBelum ada peringkat

- 2010 11 03 - 043737 - P6 16Dokumen5 halaman2010 11 03 - 043737 - P6 16Ayuu MonaLisa100% (1)

- Lowe's Stock Analysis for 35-Year-Old InvestorDokumen10 halamanLowe's Stock Analysis for 35-Year-Old InvestorDani Alvarez100% (1)

- CEU Balance SheetDokumen1 halamanCEU Balance SheetmadhuBelum ada peringkat

- The Pizza Theory of Business ValuationDokumen3 halamanThe Pizza Theory of Business ValuationBharat SahniBelum ada peringkat

- Paper 2 Corporate and Other Laws Ans Series 2 PDFDokumen8 halamanPaper 2 Corporate and Other Laws Ans Series 2 PDFMEGHANABelum ada peringkat

- BLAW4Dokumen11 halamanBLAW43333nishBelum ada peringkat

- Metrobank FoundationDokumen13 halamanMetrobank FoundationAbigail LeronBelum ada peringkat

- Investment in Equity SecuritiesDokumen11 halamanInvestment in Equity SecuritiesJANISCHAJEAN RECTOBelum ada peringkat

- RFBT 34new-2Dokumen1 halamanRFBT 34new-2CPABelum ada peringkat

- Anil AmbaniDokumen13 halamanAnil AmbaniJayaJayashBelum ada peringkat

- Internal Rate of Return: A Cautionary TaleDokumen5 halamanInternal Rate of Return: A Cautionary TaleAkansh_Khurana_8459Belum ada peringkat

- Similaires and Diferencies IFRS US GAAP 2005Dokumen92 halamanSimilaires and Diferencies IFRS US GAAP 2005Bader Akarkoune100% (1)

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDokumen7 halamanTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghBelum ada peringkat

- Presentation Topics First CaseDokumen2 halamanPresentation Topics First CaseRohit KumarBelum ada peringkat

- Sol ManDokumen144 halamanSol ManShr Bn100% (1)

- MGT 498 Chapter 10 AnswersDokumen47 halamanMGT 498 Chapter 10 Answersjewelz15overBelum ada peringkat

- Discussion QuestionsDokumen121 halamanDiscussion QuestionsDnyaneshwar KharatmalBelum ada peringkat

- Ethics, Social Responsibilty, and Stakeholders NotesDokumen7 halamanEthics, Social Responsibilty, and Stakeholders NotesMa.Edarlee RaccaBelum ada peringkat

- MAlongDokumen253 halamanMAlongerikchoisyBelum ada peringkat

- PDFDokumen109 halamanPDFAbhijeet VyasBelum ada peringkat

- Sarko Pelzer Stock Purchase AnalysisDokumen4 halamanSarko Pelzer Stock Purchase Analysisgisela gilbertaBelum ada peringkat

- Rjnth64oq - ACTIVITY - CHAPTER 16 - ACCOUNTING FOR DIVIDENDSDokumen2 halamanRjnth64oq - ACTIVITY - CHAPTER 16 - ACCOUNTING FOR DIVIDENDSJustine Marie BalderasBelum ada peringkat

- Ugovor o Zajedničkom UlaganjuDokumen28 halamanUgovor o Zajedničkom UlaganjuDalibor Kunic0% (1)

- Accounting Theory: Text and Readings: Richard G. Schroeder Myrtle Clark Jack CatheyDokumen39 halamanAccounting Theory: Text and Readings: Richard G. Schroeder Myrtle Clark Jack CatheyNur Kumala DewiBelum ada peringkat

- Understanding Preferential Allotment of Securities: Pavan Kumar VijayDokumen54 halamanUnderstanding Preferential Allotment of Securities: Pavan Kumar VijayAakash MehtaBelum ada peringkat