Bega

Diunggah oleh

syed rahman0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

31 tayangan2 halamanJudul Asli

bega.docx

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

31 tayangan2 halamanBega

Diunggah oleh

syed rahmanHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

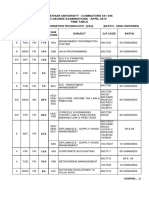

NAME of The company considered for the discussion is

Company Bega Cheese Limited

DISCUSSION

FACTOR LOW MODERATE HIG

H

Initial versus Auditor gains knowledge and experience about Moderat

repeat audits the probability of misstatement after auditing a e

company for several years. Therefore, most

auditors set a high inherent risk in the first year

of an audit and reduce it in the later years.

Based on the annual report of the company it is

noted that the audit is performed in end of the

year which was done for June 2018, the auditor

has stated that the audit approach based on

three key aspects: materiality of the financial

transactions, scope of the audit and key audit

matters. ( Bekaert, 2016). The objective of

auditor rotation is to promote auditor

independence. reasonable assurance about

whether the financial report as a whole is free

from material misstatement, whether due to

fraud or error, and to issue an auditor’s report

that includes our opinion.Reasonable assurance.

Auditor rotation requirements apply to individuals

who have played a significant role in the audit of

listed companies or listed registered schemes.

The audit has been performed based on the

standards which have been set by AASB and

IFRS, the auditor has described in detail the key

audit aspects which are related to the goodwill &

intangibles and inventory valuation. Hence, the

risk associated with the initial vs repeat audits is

moderate as the company has complied with the

necessary laws and regulations

When recording transactions that occur

infrequently, the client may not have sufficient

Quantity of and adequate experience to record them

non-routine correctly. The client is more likely to make

transactions mistake(s) due to a lack of relevant experience.

It is logical for the auditor to estimate a high

inherent risk in this situation. No –routine

transactions which are unusual for the client are

more likely to be incorrectly recorded than

Hig

routine transactions as the client lacks

experience to record them. h

One-off items in FY2018

The Group completed the purchase of Bega

Foods business on 4 July 2017, which

incurred a number of one-off transaction costs

(including stamp duty and other costs) totalling

$12.9 million before tax in FY2018.

On 17 August the Group acquired the Koroit

dairy manufacturing facility from Saputo for

$250.0 million, which incurred a number of

one-off transaction costs totalling $0.8 million

before tax prior to the end of FY2018, with

further transaction costs to be incurred

inFY2019, including transitional costs, stamp

duty, legal and advisory fees and other costs.

One-off items in FY2017

The Group incurred legal, financial and

corporate advice and transaction costs relating

to the acquisition of the Mondelēz Grocery

Business totalling $11.5 million before tax.

On 24 April 2017 the Group completed the

sale of infant nutritional assets to Mead

Johnson and formed the MJN Alliance, which

resulted in a material capital gain of $177.8

million after transaction costs and before tax.

References

Alexander, D. Britton, A., et al., (2017) International financial reporting and analysis. 7th ed. London:

Cengage. ISBN 978-1-473-72545-4

Bega. (2018). Annual report of Bega Cheese limited

Bekaert, G. J., & Hodrick, R.J., (2016), International Financial Management, 2nd Ed., Pearson,

London. ISBN-10: 129202139X (also available as e-book)

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Smith's Lawn Care General JournalDokumen2 halamanSmith's Lawn Care General JournalJacob SnyderBelum ada peringkat

- 11th Accountancy Full Study Material English Medium 2023-24Dokumen64 halaman11th Accountancy Full Study Material English Medium 2023-24osama guyzz100% (1)

- BI Business Content Overview-FIDokumen86 halamanBI Business Content Overview-FIMuralikrishna PuvvalaBelum ada peringkat

- File SPI TambahanDokumen76 halamanFile SPI Tambahansyarifah SPBelum ada peringkat

- FICO Real Time ProjectDokumen105 halamanFICO Real Time ProjectsowmyanavalBelum ada peringkat

- Reynaldo Gulane Cleaners Trial Balance and Financial StatementsDokumen4 halamanReynaldo Gulane Cleaners Trial Balance and Financial StatementsNicole Sarmiento83% (6)

- Full DisclosureDokumen22 halamanFull DisclosurepanjiBelum ada peringkat

- Goo F: Date of Acquisition .:., G 110Dokumen11 halamanGoo F: Date of Acquisition .:., G 110Lee TeukBelum ada peringkat

- Audit Program - Breeding StockDokumen4 halamanAudit Program - Breeding StockNanette Rose HaguilingBelum ada peringkat

- By Phase - PlanningDokumen60 halamanBy Phase - Planningsyed rahmanBelum ada peringkat

- Introduction and Overview of Audit AssuranceDokumen54 halamanIntroduction and Overview of Audit Assurancesyed rahmanBelum ada peringkat

- 01 - Sajibur CG - 060419Dokumen6 halaman01 - Sajibur CG - 060419syed rahmanBelum ada peringkat

- Sustainability and Corporate Social Responsibility ReportingDokumen39 halamanSustainability and Corporate Social Responsibility Reportingsyed rahmanBelum ada peringkat

- Group 16, Assignment - 3Dokumen6 halamanGroup 16, Assignment - 3syed rahmanBelum ada peringkat

- Mail Advertising and Addressing Co Pty LTD (1975) 133 CLR 72. C. Reliance: The Outsider Must Have Been Induced byDokumen23 halamanMail Advertising and Addressing Co Pty LTD (1975) 133 CLR 72. C. Reliance: The Outsider Must Have Been Induced bysyed rahmanBelum ada peringkat

- Accounting Information System Assignment 2Dokumen1 halamanAccounting Information System Assignment 2syed rahmanBelum ada peringkat

- Introduction and Overview of Audit AssuranceDokumen54 halamanIntroduction and Overview of Audit Assurancesyed rahmanBelum ada peringkat

- Assignment 3 - Implementation PlanDokumen1 halamanAssignment 3 - Implementation Plansyed rahmanBelum ada peringkat

- 01 - Group - 120519Dokumen2 halaman01 - Group - 120519syed rahmanBelum ada peringkat

- Accounting Information System Assignment 2Dokumen2 halamanAccounting Information System Assignment 2syed rahmanBelum ada peringkat

- Accounting Information System Assignment 2Dokumen1 halamanAccounting Information System Assignment 2syed rahmanBelum ada peringkat

- Exam Preparation QuestionsDokumen2 halamanExam Preparation Questionssyed rahmanBelum ada peringkat

- Auditing and Assurance Defined An Assurance EngagementDokumen2 halamanAuditing and Assurance Defined An Assurance Engagementsyed rahmanBelum ada peringkat

- 2015 Sem2 PACC6009Dokumen5 halaman2015 Sem2 PACC6009syed rahmanBelum ada peringkat

- Auditing A4 Sheet (Mid Term)Dokumen7 halamanAuditing A4 Sheet (Mid Term)syed rahmanBelum ada peringkat

- S1A2J3Dokumen1 halamanS1A2J3syed rahmanBelum ada peringkat

- My Name Is sAJIBDokumen1 halamanMy Name Is sAJIBsyed rahmanBelum ada peringkat

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDokumen8 halamanChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanBelum ada peringkat

- Initial vs Repeat Audit RisksDokumen3 halamanInitial vs Repeat Audit Riskssyed rahmanBelum ada peringkat

- Initial vs Repeat Audit RisksDokumen3 halamanInitial vs Repeat Audit Riskssyed rahmanBelum ada peringkat

- ASA 200 Compiled 2015Dokumen31 halamanASA 200 Compiled 2015syed rahmanBelum ada peringkat

- PPPPPPPPPPPPPPPPPPPPDokumen1 halamanPPPPPPPPPPPPPPPPPPPPsyed rahmanBelum ada peringkat

- Initial vs Repeat Audit RisksDokumen3 halamanInitial vs Repeat Audit Riskssyed rahmanBelum ada peringkat

- SE10210Dokumen3 halamanSE10210syed rahmanBelum ada peringkat

- Assignment/Assessment Item Cover Sheet: Student NameDokumen1 halamanAssignment/Assessment Item Cover Sheet: Student Namesyed rahmanBelum ada peringkat

- Practice Question 1 For Problem 1 Test in Week 4 - BBDokumen8 halamanPractice Question 1 For Problem 1 Test in Week 4 - BBsyed rahmanBelum ada peringkat

- QweDokumen1 halamanQwesyed rahmanBelum ada peringkat

- LKT09Dokumen1 halamanLKT09syed rahmanBelum ada peringkat

- Mock BoardsDokumen11 halamanMock BoardsRaenessa FranciscoBelum ada peringkat

- Full Download Fundamentals of Corporate Finance Canadian 2nd Edition Berk Solutions ManualDokumen36 halamanFull Download Fundamentals of Corporate Finance Canadian 2nd Edition Berk Solutions Manualhone.kyanize.gnjijj100% (34)

- Sagar Cement - Financial STMT AnalysisDokumen79 halamanSagar Cement - Financial STMT AnalysisRamesh AnkathiBelum ada peringkat

- Accounting For InventoriesDokumen65 halamanAccounting For InventoriesRalph Ernest HulguinBelum ada peringkat

- CIE ANNUAL REPORT HIGHLIGHTSDokumen8 halamanCIE ANNUAL REPORT HIGHLIGHTSSana ZargarBelum ada peringkat

- Solutions - Chapter 5Dokumen21 halamanSolutions - Chapter 5Dre ThathipBelum ada peringkat

- Summary, Conclusions and RecommendationsDokumen6 halamanSummary, Conclusions and RecommendationsJustine BartolomeBelum ada peringkat

- Bharathiar University UG Exam Time Table April 2019 B.Com ITDokumen26 halamanBharathiar University UG Exam Time Table April 2019 B.Com ITപേരില്ലോക്കെ എന്തിരിക്കുന്നുBelum ada peringkat

- Overall NSA - ICANDokumen33 halamanOverall NSA - ICANDristi SaudBelum ada peringkat

- Government Auditing Lesson 1 1Dokumen8 halamanGovernment Auditing Lesson 1 1Aubrey Jean ZantuaBelum ada peringkat

- Chapter 2 - Cost AccountingDokumen41 halamanChapter 2 - Cost AccountingCarina Carollo Malinao100% (2)

- Horizontal&Vertical Analysis Sample ProblemDokumen3 halamanHorizontal&Vertical Analysis Sample ProblemGenner RazBelum ada peringkat

- Sample Practice Exam 29 March 2019 Answers - CompressDokumen7 halamanSample Practice Exam 29 March 2019 Answers - CompressShevina Maghari shsnohsBelum ada peringkat

- Division of Corporation Finance: Financial Reporting ManualDokumen358 halamanDivision of Corporation Finance: Financial Reporting ManualankushbindwalBelum ada peringkat

- Accounting Theory ReviewerDokumen4 halamanAccounting Theory ReviewerAlbert Sean LocsinBelum ada peringkat

- Indofood CBP: Navigating WellDokumen11 halamanIndofood CBP: Navigating WellAbimanyu LearingBelum ada peringkat

- Impact of IT on Accounting ProfessionDokumen11 halamanImpact of IT on Accounting ProfessionNBA EPICBelum ada peringkat

- MSO Chapter 8 & 9 ObjDokumen22 halamanMSO Chapter 8 & 9 ObjsantaBelum ada peringkat

- Transmittal Letter CoaDokumen1 halamanTransmittal Letter CoaJanine PigaoBelum ada peringkat

- Intermediate Accounting Kieso 15th Edition Test BankDokumen13 halamanIntermediate Accounting Kieso 15th Edition Test BankWillis Sanchez100% (35)

- CAF 1 IA ModelPaperDokumen7 halamanCAF 1 IA ModelPaperAli RehanBelum ada peringkat