Attributes of The Patnership

Diunggah oleh

Ezekiel Japhet Cedillo EsguerraJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Attributes of The Patnership

Diunggah oleh

Ezekiel Japhet Cedillo EsguerraHak Cipta:

Format Tersedia

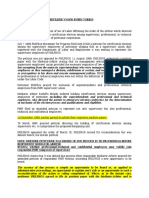

ATTRIBUTES OF THE PATNERSHIP Memorandum was entered into for the

operation of the quarry with spouses Cruz.

YU VS NLRC Operations continued just like the same, and all

(old partnership to new partnership) of the employees of the partners continued

working in the business.

FACTS:

Due to the transfer of office, petitioner

Petitioner Benjamin Yu was formerly the reported in Mandaluyong, met Co for the first

Assistant General Manager of the marble time.

quarrying and export business operated by a

registered partnership with the firm name of

Petitioner was in fact not allowed to work

"Jade Mountain Products Company Limited" anymore in the Jade Mountain business

("Jade Mountain"). enterprise. His unpaid salaries remained

unpaid.3

The partnership was originally organized on 28

June 1984 with Lea Bendal and Rhodora Bendal Petitioner then filed a complaint for illegal

as general partners and Chin Shian Jeng,

dismissal and recovery of unpaid salaries from

Chen Ho-Fu and Yu Chang, all citizens of the

Republic of China (Taiwan), as limited Nov 1984-Oct 1988, moral and exemplary

partners. damages against Jade Mountain, Co, and other

PR.

The partnership business consisted of

exploiting a marble deposit found on land owned PR CONTENTION: The partnership and Willy Co

by the Sps. Ricardo and Guillerma Cruz, denied petitioner's charges, contending in the

situated in Bulacan Province, under a main that Benjamin Yu was never hired as an

Memorandum Agreement dated 26 June 1984 employee by the present or new partnership.

with the Cruz spouses. 1 The partnership had its

main office in Makati, Metropolitan Manila. LA decided petitioner was illegally dismissed,

ordered reinstatement and damages.

Petitioner was hired as Asst General Manager,

monthly salary of 4K. however, accg to him, he NLRC reversed the decision. The NLRC held

that a new partnership consisting of Mr. Willy Co

only receives half of his salary, as partners

and Mr. Emmanuel Zapanta had bought the

promised the balance when they got the Jade Mountain business, that the new

operating funds from abroad. He managaed the partnership had not retained petitioner Yu in

operations and finances of the business; had his original position as Assistant General

overall supervision of the workers in marble Manager, and that there was no law requiring

quarry in Bulacan. the new partnership to absorb the employees of

the old partnership. Benjamin Yu, therefore, had

1988, without petitioner knowledge, general not been illegally dismissed by the new

partners transferred their interests in the partnership which had simply declined to retain

him in his former managerial position or any

partnership to PR Willy CO and Zapanta.

other position.

One limited partner also sold his interest to Co. NLRC held that petitioner should assert his

action against the original members of the

PR continued to use the old firm name Jade partnership.

Mountain, transferred the principal office from

Manila to MAndaluyong.

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 1

Petitioner contention: Such independent legal (1) without violation of the agreement between

personality subsists, petitioner claims, the partners;

notwithstanding changes in the identities of the

partners. Consequently, the employment (b) by the express will of any partner, who must

contract between Benjamin Yu and the act in good faith, when no definite term or

partnership Jade Mountain could not have particular undertaking is specified;

been affected by changes in the latter's

membership.

The acquisition of 82% of the partnership

interest by new partners, coupled with the

ISSUE: retirement or withdrawal of the partners who

had originally owned such 82% interest, was

(1) whether the partnership which had hired enough to constitute a new partnership.

petitioner Yu as Assistant General Manager had

been extinguished and replaced by a new The occurrence of events which precipitate the

legal consequence of dissolution of a

partnerships composed of Willy Co and

partnership do not, however, automatically

Emmanuel Zapanta; and result in the termination of the legal

personality of the old partnership. Article

(2) if indeed a new partnership had come into 1829 of the Civil Code states that:

existence, whether petitioner Yu could

nonetheless assert his rights under his [o]n dissolution the partnership

employment contract as against the new is not terminated, but continues

partnership. until the winding up of

partnership affairs is completed.

HELD:

In the ordinary course of events, the legal

FIRST ISSUE personality of the expiring partnership

persists for the limited purpose of winding

We agree with the result reached by the NLRC, up and closing of the affairs of the

that is, that the legal effect of the changes in the partnership.

membership of the partnership was the

dissolution of the old partnership which had What is important for present purposes is that,

hired petitioner in 1984 and the emergence of a under the above described situation, not only the

new firm composed of Willy Co and Emmanuel retiring partners (Rhodora Bendal, et al.)

Zapanta in 1987. but also the new partnership itself which

continued the business of the old, dissolved,

The applicable law in this connection — of which one, are liable for the debts of the preceding

the NLRC seemed quite unaware — is found in partnership.

the Civil Code provisions relating to

partnerships. Article 1828 of the Civil Code The liability of the new partnership, upon the

provides as follows: other hand, in the set of circumstances obtaining

in the case at bar, is established in Article 1840

Art. 1828. The dissolution of a partnership is the of the Civil Code.

change in the relation of the partners caused by

any partner ceasing to be associated in the (3) When any Partner retires or dies and the

carrying on as distinguished from the winding business of the dissolved partnership is

up of the business. continued as set forth in Nos. 1 and 2 of this

Article, with the consent of the retired partners or

Art. 1830. Dissolution is caused: the representative of the deceased partner, but

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 2

without any assignment of his right in

partnership property;

LYONS vs ROSENSTOCK (1932)

(4) When all the partners or their representatives

assign their rights in partnership property to one FACTS:

or more third persons who promise to pay the

debts and who continue the business of the Prior to his death, Henry Welser is a resident of

dissolved partnership; city of Manila where he was engaged in buy and

sell and administer real estate.

The liability of a third person becoming a partner

in the partnership continuing the business, under In several ventures, plaintiff Lyons joined him,

this article, to the creditors of the dissolved the profits being shared by the two equally.

partnership shall be satisfied out of the Plaintiff’s regular vocation was as a missionary

partnership property only, unless there is a of Methodist Episcopal Church, went to US for

stipulation to the contrary. nearly a year and a half. Eve of his departure,

ELSER made a writtern statements showing that

Under Article 1840 above, creditors of the old Lyons was half owner with him of three parcels

Jade Mountain are also creditors of the new of real property.

Jade Mountain which continued the business of

the old one without liquidation of the partnership Concurrently with this act Lyons execute in favor

affairs. Indeed, a creditor of the old Jade of Elser a general power of attorney

Mountain, like petitioner Benjamin Yu in empowering him to manage and dispose of said

respect of his claim for unpaid wages, is entitled properties at will and to represent Lyons fully

to priority vis-a-vis any claim of any retired or and amply, to the mutual advantage of both.

previous partner insofar as such retired partner's

interest in the dissolved partnership is

concerned. While Lyons was away, 2 of the properties were

sold, leaving one property in Carriedo St,

The non-retention of Benjamin Yu as Assistant

Manila, with 282 sq m with improvements (SAN

General Manager did not therefore constitute

JUAN ESTATE).

unlawful termination, or termination without just

or authorized cause. We think that the precise 1920, Elser drawn his attention to a piece of

authorized cause for termination in the case at land, 1,500,000 sq m, discerned opportunity for

bar was redundancy. 10 The new partnership the promotion and development of a suburban

had its own new General Manager, apparently development. The owner offered that land for

Mr. Willy Co, the principal new owner himself, P570,000

who personally ran the business of Jade

Mountain. To afford a little time for maturing his plans,

Elser purchased an option on this property for

The treatment (including the refusal to honor his P5,000, and when this option was about to

claim for unpaid wages) accorded to Assistant expire without his having been able to raise the

General Manager Benjamin Yu was so summary necessary funds, he paid P15,000 more for an

and cavalier as to amount to arbitrary, bad faith extension of the option, with the understanding

treatment, for which the new Jade Mountain may in both cases that, in case the option should be

legitimately be required to respond by paying exercised, the amounts thus paid should be

moral damages. credited as part of the first payment.

Benjamin Yu is entitled to unpaid wages, Later on, he was able to acquire the said estate.

separation and atty’s fees. First payment was P150k, he has 120K plus the

previous 20K, and obtained a loan for 50K.

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 3

Loan was obtained from a Chinese merchant of been criticizing his independent commercial

the city named Uy Siuliong. Lon was secured activities.

through son of the lender and in order to get the

money it was necessary for Elser not only to Accg to the books, E was indebted to Lyons of

give a personal note signed by himself and his 11,669, accrued to L from profits and earnings

two associates in the projected enterprise, but derived from profits.

also by the Fidelity & Surety Company

and when the J. K. Pickering & Company was

organized and stock issued, Elser indorsed to

Lyons 200 of the shares allocated to himself, as

June 28, 1920, he was able to purchase the he then believed that Lyons would be one of his

San Juan property. associates in the deal. It will be noted that the

par value of these 200 shares was more than

For the purpose of the further development of P8,000 in excess of the amount which Elser

the property a limited partnership had, about this in fact owed to Lyons.

time, been organized by Elser and three

associates, under the name of J. K. Pickering & L then sold the shares for his own benefit.

Company; and when the transfer of the property We should perhaps add that after Lyons' return

was effected the deed was made directly to to the Philippine Islands he acted for a time as

this company. As Elser was the principal one of the members of the board of directors of

capitalist in the enterprise he received by far the the J. K. Pickering & Company, his qualification

greater number of the shares issued, his portion for this office being derived precisely from the

ownership of these shares.

amount in the beginning to 3,290 shares.

We now turn to the incident which supplies the

main basis of this action. It will be remembered

While negotiations are going, Elser hoped Lyons that, when Elser obtained the loan of P50,000 to

might be induced to come in with him and supply complete the amount needed for the first

part of the means necessary. payment on the San Juan Estate, the lender, Uy

Siuliong, insisted that he should procure the

May 1920, Elser made a letter to Lyons for an signature of the Fidelity & Surety Co. on the note

offer for a big subdivision to be given for said loan. But before signing the

note with Elser and his associates, the Fidelity &

June 3, 1920, 8 days before the first option to

Surety Co. insisted upon having security for the

buy expires, E cabled L to leave his work in New

liability thus assumed by it. To meet this

York.

requirements Elser mortgaged to the Fidelity &

Surety Co. the equity of redemption in the

property owned by himself and Lyons on

Summer of 1920, Lyons went back to Manila, Carriedo Street. This mortgage was executed on

resumed to his position as managing teasurer June 30, 1920, at which time Elser expected that

and one of its trustees. Lyons would come in on the purchase of the

San Juan Estate. But when he learned from the

One source of embarrassment which had letter from Lyons of July 21, 1920, that the latter

operated on Lyson to bring him to the had determined not to come into this deal, Elser

resolution to stay out of this venture, was began to cast around for means to relieve the

that the board of mission was averse to his Carriedo property of the encumbrance which he

engaging in business activities other than those had placed upon it. For this purpose, on

in which the church was concerned; and some September 9, 1920, he addressed a letter to the

of Lyons' missionary associates had apparently Fidelity & Surety Co., asking it to permit him to

substitute a property owned by himself at 644 M.

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 4

H. del Pilar Street, Manila, and 1,000 shares of Lyons tells us that he did not know until after

the J. K. Pickering & Company, in lieu of the Elser's death that the money obtained from Uy

Carriedo property, as security. The Fidelity & Siuliong in the manner already explained had

Surety Co. agreed to the proposition; and on been used to held finance the purchase of the

September 15, 1920, Elser executed in favor San Juan Estate.

of the Fidelity & Surety Co. a new mortgage

on the M. H. del Pillar property and delivered the ISSUE:

same, with 1,000 shares of J. K. Pickering &

WON LYONS CAN BE CONSIDERED AS A

Company, to said company. The latter

PARTNER BEING HALF OWNER OF THE

thereupon in turn executed a cancellation of the

MORTGAGED PROPERTY CARRIEDO

mortgage on the Carriedo property and

delivered it to Elser.

NO. Of course, if an actual relation of

But notwithstanding the fact that these partnership had existed in the money used, the

case might be difference; and much emphasis is

documents were executed and delivered, the

laid in the appellant's brief upon the relation of

new mortgage and the release of the old partnership which, it is claimed, existed. But

were never registered; and on September 25, there was clearly no general relation of

1920, thereafter, Elser returned the cancellation partnership, under article 1678 of the Civil Code.

of the mortgage on the Carriedo property and It is clear that Elser, in buying the San Juan

took back from the Fidelity & Surety Co. the new Estate, was not acting for any partnership

mortgage on the M. H. del Pilar property, composed of himself and Lyons, and the law

cannot be distorted into a proposition which

together with the 1,000 shares of the J. K. would make Lyons a participant in this deal

Pickering & Company which he had delivered to contrary to his express determination.

it.

It seems to be supposed that the doctrines of

It is also plain that no money actually deriving

equity worked out in the jurisprudence of

from this mortgage was ever applied to the

England and the United States with reference to

purchase of the San Juan Estate. What really

trust supply a basis for this action. The doctrines

happened was the Elser merely subjected the

referred to operate, however, only where money

property to a contingent liability, and no actual

belonging to one person is used by another for

liability ever resulted therefrom. The financing of

the acquisition of property which should belong

the purchase of the San Juan Estate, apart from

to both; and it takes but little discernment to see

the modest financial participation of his three

that the situation here involved is not one for the

associates in the San Juan deal, was the work

application of that doctrine, for no money

of Elser accomplished entirely upon his own

belonging to Lyons or any partnership

account.

composed of Elser and Lyons was in fact used

by Elser in the purchase of the San Juan Estate.

The case for the plaintiff supposes that, when

Elser placed a mortgage for P50,000 upon the

equity of redemption in the Carriedo property,

Lyons, as half owner of said property,

became, as it were, involuntarily the owner of

an undivided interest in the property

acquired partly by that money; and it is

insisted for him that, in consideration of this

fact, he is entitled to the four hundred forty-

six and two-thirds shares of J. K. Pickering &

Company, with the earnings thereon, as

claimed in his complaint.

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 5

CONTRACT OF PARTNERSHIP June 1946, executed a contract extending the

partnership for three years. Benefits are to be

YULO VS YANG CHIAO SENG divided 50-50; after the contract, showhouse

building shall belong exclusively to Mrs. Yulo.

FACTS:

Land was leased by Mrs. Yulo from the owners

Defendant Seng wrote a letter to plaintiff Mrs.

Emilia Carrion Santa Marina and Maria Carrion

Rosario Yulo, proposing the formation of a

Santa Marina for an indefinite time, but may be

partnership between them to run and operate a

cancelled after one year by written notice 90

theatre on the premises occupied by former

days before the date of cancellation.

Cine Oro at Plaza Sta. Cruz, Manila.

April 5, 1949 – attorney notified Mrs. Yulo of the

Principal conditions:

owner’s desire to cancel the contract of lease on

1. Seng guaranteers Mrs. Yulo monthly July 31, 1949.

participation of 3000 payable quarterly

MTC ordered ejectment of Mrs Yulo and Mr

2. Partnership for a period of 2 years and

Yang.

six months, July 1945-Dece,ber 31,

1947 On October 27, 1950, Mrs. Yulo demanded

3. With condition if the land s expropriated from Yang Chiao Seng her share in the

or if owner constructs a permanent profits of the business. Yang answered the

building, or lease is terminated, letter saying that upon the advice of his counsel

partnership shall be terminated early. he had to suspend the payment (of the rentals)

4. that Mrs. Yulo is authorized personally because of the pendency of the ejectment suit

to conduct such business in the lobby of by the owners of the land against Mrs. Yulo.

the building as is ordinarily carried on in

lobbies of theatres in operation In this letter Yang alleges that inasmuch as he is

5. that after December 31, 1947, all a sublessee and inasmuch as Mrs. Yulo has not

improvements placed by the partnership paid to the lessors the rentals from August,

shall belong to Mrs. Yulo, but if the 1949, he was retaining the rentals to make good

partnership agreement is terminated to the landowners the rentals due from Mrs. Yulo

before the lapse of one and a half in arrears.

years period under any of the causes

mentioned in paragraph (2), then Yang On refusal of Mr. Yang to pay for the amount

Chiao Seng shall have the right to agreed upon, Mrs. Yulo filed an action alleging

remove and take away all improvements the existence of the partnership between them

that the partnership may place in the and that defendant has refused to pay her

premises. share.

Parties then executed partnership agreement, And by the termination in 1950, plaintiff became

“Yang Company, Ltd”. the absolute owner of the building; that the

defendant has acted maliciously and refuses to

The capital is fixed at P100,000, P80,000 of pay the participation of the plaintiff in the profits

which is to be furnished by Yang Chiao Seng of the business amounting to P35,000 from

and P20,000, by Mrs. Yulo. All gains and November, 1949 to October, 1950, and that as a

profits are to be distributed among the partners result of such bad faith and malice on the part of

in the same proportion as their capital the defendant, Mrs. Yulo has suffered damages.

contribution and the liability of Mrs. Yulo, in case

of loss, shall be limited to her capital DEFENDANT CONTETION: defendant alleges

contribution. that the real agreement between the plaintiff and

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 6

the defendant was one of lease and not of

partnership.

ELIGIO ESTANISLAO vs COURT OF

That the partnership was adopted as a APPEALS, REMEDIOS ESTANISLAO, EMILIO

subterfuge to get around the prohibition AND LEOCADIO SANTIAGO

contained in the contract of lease between the

owners and the plaintiff against the sublease of

the said property.

FACTS:

ISSUE: WON THERE IS CONTRACT OF

Petitioner and PRs are brothers and sisters

PARTNERSHIP BETWEEN THE PARTIES

who are co-owners of certain lots in Quezon

HELD: City, being leased in Shell Philippines Ltd.

They agreed to open and operate a gas station

We have gone over the evidence and we fully

thereat to be known as Estanislao Shell Service

agree with the conclusion of the trial court that

the agreement was a sublease, not a Station with an initial investment of P 15,000.00

partnership. to be taken from the advance rentals due to

them from SHELL for the occupancy of the said

The following are the requisites of partnership: lots owned in common by them.

(1) two or more persons who bind themselves to

contribute money, property, or industry to a A joint affidavit was made. Petitioner was

common fund; allowed to operate and manage the gasoline

service station for the family.

(2) intention on the part of the partners to divide

the profits among themselves. (Art. 1767, Civil *T*hey negotiated with SHELL. For practical

Code.). purposes and in order not to run counter to the

company's policy of appointing only one dealer,

In the first place, plaintiff did not furnish the it was agreed that petitioner would apply for the

supposed P20,000 capital. In the second dealership. Respondent Remedios helped in

place, she did not furnish any help or

intervention in the management of the theatre. managing the business with petitioner from May

In the third place, it does not appear that she 3, 1966 up to February 16, 1967.

has ever demanded from defendant any

accounting of the expenses and earnings of the **On May 26, 1966, the parties herein entered

business. Were she really a partner, her first into an Additional Cash Pledge Agreement with

concern should have been to find out how the SHELL wherein it was reiterated that the P

business was progressing, whether the 15,000.00 advance rental shall be deposited

expenses were legitimate, whether the earnings with SHELL to cover advances of fuel to

were correct, etc. She was absolutely silent

petitioner as dealer with a proviso that said

with respect to any of the acts that a partner

should have done; all that she did was to agreement "cancels and supersedes the Joint

receive her share of P3,000 a month, which Affidavit dated 11 April 1966 executed by the co-

can not be interpreted in any manner than a owners."

payment for the use of the premises which

she had leased from the owners. Clearly, Petitioner submitted financial statements

plaintiff had always acted in accordance with the regarding the operation of the business to PR,

original letter of defendant of June 17, 1945 but petitioner failed to render accounting, so Atty

(Exh. "A"), which shows that both parties Angeles demanded to render accounting on

considered this offer as the real contract

profits.

between them.

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 7

Dec 31, 1968, shows that business was able to OWNERS, collectively, under the above

make profit of P87, 293, and end of 1969, P150k describe two Lease Agreements,

was realized.

The above stated monthly rentals accumulated

1970, PR filed a complaint against petitioner that shall be treated as additional cash deposit by

latter be ordered: 1) to execute public instrument DEALER to SHELL, thereby in increasing his

embodying all provisions of the partnership credit limit from P 10,000 to P 25,000. This

agreement between parties; 2) render formal agreement, therefore, cancels and supersedes

accounting of business operation; 3) to pay the Joint affidavit dated 11 April 1966 executed

private respondents proper shares and by the CO-OWNERS.

participation.

In the aforesaid Joint Affidavit of April 11, 1966

Hon. Lino Anover rendered judgment dismissing (Exhibit A), it is clearly stipulated by the

the complaint and counterclaim and ordering PR parties that the P 15,000.00 advance rental

to pay 3000 attys fees. due to them from SHELL shall augment their

"capital investment" in the operation of the

PR filed an appeal, Hon. Tensuan set aside gasoline station, which advance rentals shall

decision, rendered another in favor of PR. be credited as rentals from May 25, 1966 up to

four and one-half months or until 10 October

Until it reached the SC. 1966, more or less covering said P 15,000.00.

PETITIONER CONTENTION: relied heavily in In the subsequent document entitled "Additional

the Joint Affidavit. Cash Pledge Agreement" above reproduced

(Exhibit 6), the private respondents and

petitioners assigned to SHELL the monthly

(1) That we are the Lessors of two parcels of rentals due them commencing the 24th of May

land fully describe in Transfer Certificates of 1966 until such time that the monthly rentals

Title Nos. 45071 and 71244 of the Register of accumulated equal P 15,000.00 which private

Deeds of Quezon City, in favor of the LESSEE - respondents agree to be a cash deposit of

SHELL COMPANY OF THE PHILIPPINES petitioner in favor of SHELL to increase his

LIMITED a corporation duly licensed to do credit limit as dealer. As above-stated it provided

business in the Philippines; therein that "This agreement, therefore,

cancels and supersedes the Joint Affidavit

(the facts above) dated 11 April 1966 executed by the CO-

OWNERS."

In the Additional Cash Pledge Agreement:

PETITIONER CONTENTION: because of the

WHEREAS, CO-OWNER Eligio Estanislao Jr. is cancellation, partnership agreement has been

the Dealer of the Shell Station constructed on abrogated.

the leased land, and as Dealer under the Cash

Pledge Agreement dated llth May 1966, he NO MERIT.

deposited to SHELL in cash the amount of

PESOS TEN THOUSAND (P 10,000), Philippine

Currency, to secure his purchase on credit of Said cancelling provision was necessary for the

Shell petroleum products; . . . Joint Affidavit speaks of P 15,000.00 advance

rentals starting May 25, 1966 while the latter

agreement also refers to advance rentals of the

The CO-OWNERS dohere by waive in favor of

same amount starting May 24, 1966. There is,

DEALER the monthly rentals due to all CO- therefore, a duplication of reference to the P

15,000.00 hence the need to provide in the

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 8

subsequent document that it "cancels and

supersedes" the previous one. True it is that

in the latter document, it is silent as to the EVANGELISTA vs COLLECTOR OF

statement in the Joint Affidavit that the P INTERNAL REVENUE, CTA

15,000.00 represents the "capital investment"

of the parties in the gasoline station business

and it speaks of petitioner as the sole dealer,

but this is as it should be for in the latter FACTS:

document SHELL was a signatory and it

would be against its policy if in the

That petitioners borrowed from their father with

agreement it should be stated that the

business is a partnership with private sum of P59,140, which amount with their

respondents and not a sole proprietorship of personal money, for purpose of buying real

petitioner. properties.

As to the issue of Partnership That on February 2, 1943, they bought from Mrs.

Josefina Florentino a lot with an area of

3,713.40 sq. m. including improvements thereon

Petitioner gave a written authority to

from the sum of P100,000.00; this property has

private respondent Remedies

Estanislao, his sister, to examine and an assessed value of P57,517.00 as of 1948

audit the books of their "common

business' aming negosyo). That on April 3, 1944 they purchased from Mrs.

Respondent Remedios assisted in the Josefa Oppus 21 parcels of land with an

running of the business. There is no aggregate area of 3,718.40 sq. m. including

doubt that the parties hereto formed a improvements thereon for P130,000.00; this

partnership when they bound property has an assessed value of P82,255.00

themselves to contribute money to a as of 1948;

common fund with the intention of

dividing the profits among themselves. That on April 28, 1944 they purchased from the

The sole dealership by the petitioner

Insular Investments Inc., a lot of 4,353 sq. m.

and the issuance of all government

permits and licenses in the name of including improvements thereon for

petitioner was in compliance with the P108,825.00. This property has an assessed

afore-stated policy of SHELL and the value of P4,983.00 as of 1948;

understanding of the parties of

having only one dealer of the SHELL That on April 28, 1944 they bought form Mrs.

products. Valentina Afable a lot of 8,371 sq. m. including

improvements thereon for P237,234.34. This

property has an assessed value of P59,140.00

as of 1948;

1945, they appointed their brother Simeon to

manage their properties with full power to lease,

collect and receive rents, issue receipts, in

default, to bring suits.

After being brought all properties, had the same

rented or leased to various tenants.

1945: net rental was 5, 948.

1946: net rental 7, 498

1948: net rental 12, 615

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 9

1954, Collector of Internal Revenue demanded 1. they jointly borrowed a substantial

payment of income tax on corporations, real portion in order to establish said

estate dealer’s fixed tax and corporation common fund.

residence tax. 2. They invested the same, not merely not

merely in one transaction, but in

a series of transactions

3. The aforesaid lots were not devoted to

Said letter of assessments were delivered to

residential purposes, or to other

petitioners, whereupon they instituted the presnt

personal uses, of petitioners herein. The

case, decision be reversed and that they be

properties were leased separately to

absolved from payment of the taxes in question.

several persons, who, from 1945 to

ISSUE: 1948 inclusive, paid the total sum of

P70,068.30 by way of rentals.

whether petitioners are subject to the tax on 4. Since August, 1945, the properties have

corporations provided for in section 24 of been under the management of one

Commonwealth Act. No. 466, otherwise person, namely Simeon Evangelista,

known as the National Internal Revenue with full power to lease, to collect rents,

Code, as well as to the residence tax for to issue receipts, to bring suits, to sign

corporations and the real estate dealers fixed letters and contracts, and to indorse and

tax. deposit notes and checks. Thus, the

affairs relative to said properties have

been handled as if the same belonged

to a corporation or business and

HELD:

enterprise operated for profit.

Tax on corporation includes the terms 5. Conditions have existed for more

“corporation” and “partnership”. than 10 years, to be exact 15 yrs, and

12 years under the management of

The essential elements of a partnership are two, Simeon.

namely:

(a) an agreement to contribute money, property Petitioners insist, however, that they are mere

or industry to a common fund; and co-owners, not copartners, for, in consequence

of the acts performed by them, a legal entity,

(b) intent to divide the profits among the with a personality independent of that of its

contracting parties. The first element is members, did not come into existence, and

undoubtedly present in the case at bar, for, some of the characteristics of partnerships are

admittedly, petitioners have agreed to, and did, lacking in the case at bar. This pretense was

correctly rejected by the Court of Tax

contribute money and property to a common

Appeals.

fund.

Hence, the issue narrows down to their Likewise, as defined in section 84(b) of said

Code, "the term corporation includes

intent in acting as they did. YES. partnerships, no matter how created or

organized." This qualifying expression clearly

We (SC) are fully satisfied that their purpose indicates that a joint venture need not be

was to engage in real estate transactions for undertaken in any of the standard forms, or in

monetary gain and then divide the same among conformity with the usual requirements of the

themselves. law on partnerships, in order that one could be

deemed constituted for purposes of the tax on

corporations. Again, pursuant to said section

84(b), the term "corporation" includes, among

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 10

other, joint accounts, (cuentas en participation)"

and "associations," none of which has a legal

personality of its own, independent of that of its LORENZO ONA AND HEIRS OF BUNALES vs

members. COMMISSIONER OF INTERNAL REVENUE

For purposes of the tax on corporations, our FACTS

National Internal Revenue Code, includes

these partnerships — with the exception only

of duly registered general copartnerships — Lorenzo Ona and 5 children were the heirs of

within the purview of the term Julia Bunales. A case was instituted for the

"corporation." It is, therefore, clear to our

settlement of her estate, Lorenzo as

mind that petitioners herein constitute a

partnership, insofar as said Code is administrator.

concerned and are subject to the income tax

for corporations.

The project of partition shows that heirs have ½

Lastly, the records show that petitioners have

habitually engaged in leasing the properties interest in ten parcels of land with total assessed

above mentioned for a period of over twelve value of P17,590 and undetermined amount to

years, and that the yearly gross rentals of said be collected from War Damage Commission.

properties from June 1945 to 1948 ranged from They then received 50,000, but was not divided

P9,599 to P17,453. Thus, they are subject to the among them., but used for rehabilitation of

tax provided in section 193 (q) of our National properties owned by them in common.

Internal Revenue Code, for "real estate dealers.”

2 out of 10 parcels were acquired after the death

'Real estate dealer' includes any person of decedent with money borrowed from the Phil

engaged in the business of buying, selling, Trust Company amount of P72,173.

exchanging, leasing, or renting property or

his own account as principal and holding

The project of partition also shows that the

himself out as a full or part time dealer in real

estate or as an owner of rental property or estate shares equally with Lorenzo T. Oña, the

properties rented or offered to rent for an administrator thereof, in the obligation of

aggregate amount of three thousand pesos or P94,973.00, consisting of loans contracted by

more a year. . . (emphasis supplied.) the latter with the approval of the Court.

Although project of partition was approved, no

attempt was made to divide the properties

therein listed.

Instead, the properties remained under the

management of Lorenzo T. Oña who used

said properties in business by leasing or selling

them and investing the income derived

therefrom and the proceeds from the sales

thereof in real properties and securities.

Petitioners’ properties and investment gradually

increased from 105K to 480K.

Books of account kept by Ona where

corresponding shares of the petitioners in

the net income are known.

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 11

Petitioners returned income tax purposes their Indeed, it is admitted that during the material

share in net income every year. years herein involved, some of the said

properties were sold at considerable profit, and

However, petitioners did not actually receive that with said profit, petitioners engaged, thru

their shares in the yearly income. Lorenzo T. Oña, in the purchase and sale of

corporate securities. It is likewise admitted that

Income was left in the hands of Lorenzo Ona, all the profits from these ventures were divided

among petitioners proportionately in accordance

as heretofore pointed out, invested them in

with their respective shares in the inheritance. In

real properties and securities. these circumstances, it is Our considered view

that from the moment petitioners allowed not

only the incomes from their respective

shares of the inheritance but even the

Based on the facts, respondent CIR decided that inherited properties themselves to be used

petitioners formed an unregistered partnership, by Lorenzo T. Oña as a common fund in

therefore, subject to corporate income tax. undertaking several transactions or in

Respondent assessed against petitioners 8K business, with the intention of deriving profit to

and 13, 889 as corporate income tax. be shared by them proportionally, such act was

tantamount to actually contributing such

Petitioners then protested against the incomes to a common fund and, in effect, they

thereby formed an unregistered partnership

assessment and asked for reconsideration of the

within the purview of the above-mentioned

ruling of the respondent. provisions of the Tax Code.

Before the partition and distribution of the estate

of the deceased, all the income thereof does

belong commonly to all the heirs, obviously,

without them becoming thereby unregistered co-

ISSUE: WON THERE IS AN UNREGISTERED

partners, but it does not necessarily follow that

PARTNESHIP FORMED AMONG THE HEIRS such status as co-owners continues until the

OF JULIA BUNALES inheritance is actually and physically distributed

among the heirs, for it is easily conceivable that

after knowing their respective shares in the

partition, they might decide to continue holding

HELD: said shares under the common management of

the administrator or executor or of anyone

petitioners' predecessor in interest died way chosen by them and engage in business on that

back on March 23, 1944 and the project of basis. Withal, if this were to be allowed, it would

partition of her estate was judicially approved as be the easiest thing for heirs in any inheritance

early as May 16, 1949, and presumably to circumvent and render meaningless Sections

petitioners have been holding their respective 24 and 84(b) of the National Internal Revenue

Code.

shares in their inheritance since those dates

admittedly under the administration or

management of the head of the family, the

widower and father Lorenzo T. Oña, the As already indicated, for tax purposes, the co-

assessment in question refers to the later ownership of inherited properties is

years 1955 and 1956. automatically converted into an unregistered

partnership the moment the said common

IN 1944-1954, respondent treated petitioners as properties and/or the incomes derived

co-owners, not liable to corporate tax, and it was therefrom are used as a common fund with

only in 1955 he considered petitioners formed intent to produce profits for the heirs in

partnership. proportion to their respective shares in the

inheritance as determined in a project

partition either duly executed in an

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 12

extrajudicial settlement or approved by the Even if we were to yield to the decision of this

court in the corresponding testate or Honorable Court that the herein petitioners have

intestate proceeding. formed an unregistered partnership and,

therefore, have to be taxed as such, it might be

From the moment of such partition, the heirs recalled that the petitioners in their individual

are entitled already to their respective income tax returns reported their shares of the

definite shares of the estate and the incomes profits of the unregistered partnership. We think

thereof, for each of them to manage and it only fair and equitable that the various

dispose of as exclusively his own without the amounts paid by the individual petitioners as

intervention of the other heirs, and, accordingly income tax on their respective shares of the

he becomes liable individually for all taxes in unregistered partnership should be deducted

connection therewith. If after such partition, he from the deficiency income tax found by this

allows his share to be held in common with Honorable Court against the unregistered

his co-heirs under a single management to partnership.

be used with the intent of making profit

thereby in proportion to his share, there can And since the period for the recovery of the

be no doubt that, even if no document or excess income taxes in the case of herein

instrument were executed for the purpose, for petitioners has already lapsed, it would not

tax purposes, at least, an unregistered seem right to virtually disregard prescription

partnership is formed. This is exactly what merely upon the ground that the reason for the

happened to petitioners in this case. delay is precisely because the taxpayers failed

to make the proper return and payment of the

(Evanglista was cited in this case) corporate taxes legally due from them. In

principle, it is but proper not to allow any

In connection with the second ground, it is relaxation of the tax laws in favor of persons

alleged that, if there was an unregistered who are not exactly above suspicion in their

conduct vis-a-vis their tax obligation to the State.

partnership, the holding should be limited to the

business engaged in apart from the properties

inherited by petitioners. In other words, the

taxable income of the partnership should be

limited to the income derived from the

acquisition and sale of real properties and

corporate securities and should not include

the income derived from the inherited

properties.

Besides, as already observed earlier, the

income derived from inherited properties may be

considered as individual income of the

respective heirs only so long as the inheritance

or estate is not distributed or, at least,

partitioned, but the moment their respective

known shares are used as part of the common

assets of the heirs to be used in making profits,

it is but proper that the income of such

shares should be considered as the part of

the taxable income of an unregistered

partnership. This, We hold, is the clear intent of

the law.

IN THE THIRD GROUND

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 13

were required to pay the deficiency income tax

assessed.

MARIANO PASCUAL, RENATO DRAGON VS

CIR In the present case, there is no evidence that

petitioners entered into an agreement to

FACTS: contribute money, property or industry to a

common fund, and that they intended to

The distinction between co-ownership and divide the profits among themselves.

an unregistered partnership or joint venture Respondent commissioner and/ or his

for income tax purposes is the issue in this representative just assumed these conditions to

petition. be present on the basis of the fact that

petitioners purchased certain parcels of land and

became co-owners thereof.

1965, petitioners bought two parcels of land

from Santiago Bernardino, and 1966 bought

In Evangelista, there was a series of

another 3 parcels of land from Juan Roque. transactions where petitioners purchased

twenty-four (24) lots showing that the purpose

The first two parcels of land were sold by was not limited to the conservation or

petitioners in 1968 to Marenir Development preservation of the common fund or even the

Corporation, while the three parcels of land properties acquired by them. The character of

were sold by petitioners to Erlinda Reyes and habituality peculiar to business transactions

Maria Samson on March 19,1970. engaged in for the purpose of gain was

present.

They realized profit 1968 – P165k, while 1970

60,000. The corresponding capital gains taxes In the instant case, petitioners bought two (2)

were paid by petitioners in 1973 and 1974 by parcels of land in 1965. They did not sell the

availing of the tax amnesties granted in the said same nor make any improvements thereon. In

years. 1966, they bought another three (3) parcels of

land from one seller. It was only 1968 when they

sold the two (2) parcels of land after which they

Then acting BIR Commissioner, petitioners were did not make any additional or new purchase.

assessed and required to pay to a total amount The remaining three (3) parcels were sold by

P107K, and alleged deficiency corporate income them in 1970. The transactions were isolated.

taxes for the years 68 and 70. The character of habituality peculiar to

business transactions for the purpose of

Petitioners protested, asserting that they had gain was not present.

availed tax amenities way back 1974.

In Evangelista, the properties were leased out

Respondent Commissioner contention: to tenants for several years. The business was

petitioners as co-owners in the real estate under the management of one of the partners.

transactions formed an unregistered Such condition existed for over fifteen (15)

partnership or joint venture taxable as a years.

corporation under Section 20(b) and its income

was subject to the taxes prescribed under None of the circumstances are present in the

Section 24, both of the National Internal case at bar. The co-ownership started only in

Revenue Code 1 that the unregistered 1965 and ended in 1970.

partnership was subject to corporate income tax

as distinguished from profits derived from the

partnership by them which is subject to It is evident that an isolated transaction whereby

individual income tax; and that the availment of two or more persons contribute funds to buy

tax amnesty under P.D. No. 23, as amended, certain real estate for profit in the absence of

by petitioners relieved petitioners of their other circumstances showing a contrary

individual income tax liabilities but did not intention cannot be considered a partnership.

relieve them from the tax liability of the

unregistered partnership. Hence, the petitioners

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 14

Persons who contribute property or funds for a However, as petitioners have availed of the

common enterprise and agree to share the benefits of tax amnesty as individual taxpayers

gross returns of that enterprise in proportion to in these transactions, they are thereby relieved

their contribution, but who severally retain the of any further tax liability arising therefrom.

title to their respective contribution, are not

thereby rendered partners. They have no

common stock or capital, and no community

of interest as principal proprietors in the JOSE MIGUEL ANTON VS SPSERNESTO

business itself which the proceeds derived. OLIVA AND CORAAZON OLIVA

A joint purchase of land, by two, does not

constitute a co-partnership in respect

thereto; nor does an agreement to share the This case is about the obligation to continue

profits and losses on the sale of land create complying with the terms of the agreement

a partnership; the parties are only tenants in

despite the court's declaration that no

common

partnership exist between the parties.

In order to constitute a partnership inter sese

there must be:

Respondents Ernesto and Corazon

Oliva[1] (the Olivas) filed an action for

(a) An intent to form the same;

accounting and specific performance with

(b) generally participating in both profits and damages against petitioner spouses Jose

losses; Miguel and Gladys Miriam Anton (the Antons)

before the Regional Trial Court (RTC) of Quezon

(c) and such a community of interest, as far as City.[2] The Olivas alleged that they entered into

third persons are concerned as enables each three Memoranda of Agreement (MOA)[3] with

party to make contract, manage the business, Gladys Miriam, their daughter, and Jose Miguel,

and dispose of the whole property. their son-in-law, setting up a business

partnership covering three fast food stores,

The sharing of returns does not in itself establish known as "Pinoy Toppings" that were to be

a partnership whether or not the persons sharing

established at SM Megamall, SM Cubao, and

therein have a joint or common right or interest

in the property. There must be a clear intent to SM Southmall. Under the MOAs, the Olivas

form a partnership, the existence of a juridical were entitled to 30% share of the net profits of

personality different from the individual partners, the SM Megamall store and 20% in the cases of

and the freedom of each party to transfer or SM Cubao and SM Southmall stores.

assign the whole property.

In the present case, there is clear evidence of Under the MOA covering SM Megamall:

co-ownership between the petitioners. There

is no adequate basis to support the

1. That the net profits, if any, after

proposition that they thereby formed an

deducting the expenses and

unregistered partnership. The two isolated

payments of the principal and

transactions whereby they purchased properties

interest shall be divided in a seventy

and sold the same a few years thereafter did not

percent (70%) for the SECOND

thereby make them partners. They shared in the

PARTY and thirty percent (30%) to

gross profits as co- owners and paid their capital

the FIRST PARTY;

gains taxes on their net profits and availed of the

tax amnesty thereby. Under the circumstances,

2. That the SECOND PARTY,

they cannot be considered to have formed an

particularly JOSE MIGUEL ANTON,

unregistered partnership which is thereby liable

shall have a free hand in running the

for corporate income tax, as the respondent

above-described business without

commissioner proposes.

any interference from his partners,

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 15

their agents, representatives, or stores. Gladys, wife of JM, remitted to the

assigns and should such interference Olivas amount due even after loans had been

happens, the SECOND PARTY has paid. Accounting should have been only for

the right to buy back the share of the

ascertaining correctness of money paid.

FIRST PARTY less the amounts

already paid on the principal and to

They paid the Olivas in checks, representing

dissolve the partnership agreement.

In case the above amount together their share in the profits of the business. Gladys

with its corresponding interest had Miriam filed a case for legal separation against

been fully paid and said interference her husband, Jose Miguel, prompting the latter

shall take place, the SECOND PARTY to terminate their business partnership with

shall also be entitled to dissolve the her parents.

partnership agreement;

3. That the parties agree to strictly

comply with the terms and conditions RTC: no partnership relation existed between

of this agreement Olivas and Antons. But Jm had an obligation

to render accounting from the start of the

SECOND MOA covering SM Cubao:

business.

a. That the First Party shall be considered CA affirmed the RTC decision that no

a partner with a 20% share in the partnership existed. But the CA modified the

above-mentioned outlet to be set up by

RTC decision and

the Second Party;

a) deleted the RTC order that directed the

Antons to get an independent accountant,

THIRD MOA covering the SM Southmall.

approved by the Olivas, to do an accounting of

the operations of the three stores

The Olivas alleged that while the Antons gave b) directed the Antons to pay the Olivas the

them a total of P2,547,000.00 representing P240,000.00 loan in connection with the third

their monthly shares of the net profits from the MOA and net profits.

operations of the SM Megamall and SM

C) ordered to furnish copy of monthly sales

Southmall stores, the Antons did not give them

reports.

their shares of the net profits from the store at

SM Cubao. Further, Jose Miguel did not render ISSUE:

to them an account of the operations of the three

stores. And, beginning November 1997, the Whether or not the CA erred in holding that,

Antons altogether stopped giving the Olivas their notwithstanding the absence of a partnership

share in the net profits of the three stores. The between the Olivas and the Antons, the latter

Olivas demanded an accounting of have the obligation to pay the former their

partnership funds but, in response, Jose shares of the net profits of the three stores plus

Miguel terminated their partnership legal interest on those shares until they have

agreements. been paid.

HELD:

Jose Miguel contention: that they never RTC and CA, that based the terms of MOA,

partnered with the Olivas in the operations of the relationship was a debtor-credito relationship.

three stores. Antons merely borrowed from the

Olivas to finance the opening of those The finding is sound since, although the MOA

denominated the Olivas as "partners." the

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 16

amounts they gave did not appear to be Toppings" stores at SM Southmall, SM

capital contributions to the establishment of Cubao, and SM Megamall from

the stores. Indeed, the stores had to pay the November 1997 until the proper

termination of their Memoranda of

amounts back with interests.

Agreement dated May 2, 1992, May 6,

1993, and April 20, 1995.

Moreover, the MOAs forbade the Olivas from

interfering with the running of the stores.

It did not matter that the Antons had already

paid for two of the loans and their interests.

Their obligation to share net profits with the

Olivas was not extinguished by such

payment. Indeed, the Antons paid the Olivas

their share of the profits from two stores

although the loans corresponding to them had in

the meantime been paid. Only after Jose

Miguel's marital relation with Gladys Miriam

turned sour in November 1997 did he cease

to pay the Olivas their shares of the profits.

The CA also correctly ruled that, since the

Olivas were mere creditors, not partners, they

had no right to demand that the Antons make an

accounting of the money loaned out to them.

Still, the Olivas were entitled to know from

the Antons how much net profits the three

stores were making annually since the Olivas

were entitled to certain percentages of those

profits. Indeed, the third and second MO A

directed the Antons to provide the Olivas with

copies of the monthly sales reports from the

operations of the stores involved, apparently to

enable them to know how much were due them.

1. The legal interest that petitioner Jose

Miguel Anton shall pay respondent

Ernesto Oliva and the substituted heirs

of respondent Corazon Oliva on their

unpaid shares in the net profits of the

"Pinoy Toppings" stores at SM

Southmall, SM Megamall, and SM

Cubao shall be computed at the rate of

6% per annum; and

2. Petitioner Jose Miguel Anton is to

furnish respondent Ernesto Oliva and

the substituted legal heirs of respondent

Corazon Oliva copies of the monthly

sales reports of all three "Pinoy

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 17

FORMAL REQUIREMENTS FOR these demands for complete

PARTNERSHIP accounting and liquidation

were not heeded

- [Aurelio] has reasonable cause

to believe that Eduardo and/or

AURELIO K LITONJUA JR vs EDUARDO

the corporate defendants as

LITONJUA SR

well as Bobby [Yang], are

FACTS: transferring . . . various real

properties of the corporations

Petitioner and respondent are brothers. belonging to the joint

Dispute started when Aurelio filed a suit against venture/partnership to other

his brother and respondent Yang and several parties in fraud of [Aurelio].

corporations for specific performance and

accounting. On December 20, 2002, Eduardo and the

corporate respondents, as defendants a

Aurelio alleged that, since June 1973, he and quo, filed a joint ANSWER With Compulsory

Eduardo are into a joint venture/partnership Counterclaim denying under oath the material

arrangement in the Odeon Theater business allegations of the complaint, more particularly

which had expanded thru investment in some that portion thereof depicting petitioner and

enterprises. Eduardo as having entered into a contract of

partnership.

Yang is described in the complaint as

petitioner's and Eduardo's partner in their Odeon

Theater investment. Some material averments: For his part, Yang - who was served with

summons long after the other defendants

- Aurelio and Eduardo entered

into joint venture/partnership for submitted their answer ' moved to dismiss on the

continuation of family business ground, inter alia, that, as to him, petitioner has

- Contained in the memorandum

no cause of action and the complaint does not

- Agreed that in consideration of

retaining A’s share in the state any. [8] Petitioner opposed this motion to

remaining family businesses, dismiss.

and contributing his industry to

the continued operation of these 2003, Eduardo, et al., filed a Motion to Resolve

businesses, A will be given Affirmative Defenses. [9] To this motion,

P1Million or 10% equity in all petitioner interposed an Opposition with ex-

these businesses, and those Parte Motion to Set the Case for Pre-trial.

acquired, whatever is higher.

- Acquired assets for 28 years

- The substantial assets of most

Trial court denied affirmative defenses, except

of the corporate defendants

consist of real properties for Yang , set the case for pre-trial. Same court

- Sometime in 1992, the denied mortion of Eduardo for reconsideration

and Yang’s motion to dismiss.

relations between [Aurelio]

and Eduardo became sour so

that [Aurelio] requested for an Following the submission by the parties of their

accounting and liquidation of

respective Memoranda of Authorities, the

his share in the joint

venture/partnership [but appellate court came out with the herein

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 18

A partnership exists when two or more persons

assailed Decision dated March 31, 2004,

agree to place their money, effects, labor, and

finding for Eduardo and Yang, as lead skill in lawful commerce or business, with the

petitioners therein, disposing as follows: understanding that there shall be a proportionate

sharing of the profits and losses between

complaint filed by private respondent [now

them. [20] A contract of partnership is defined

petitioner Aurelio] against all the petitioners [now by the Civil Code as one where two or more

herein respondents Eduardo, et al.] with the persons bound themselves to contribute money,

property, or industry to a common fund with the

court a quo is hereby dismissed . intention of dividing the profits among

themselves. [21] A joint venture, on the other

hand, is hardly distinguishable from, and may be

likened to, a partnership since their elements are

similar,i.e., community of interests in the

Explaining its case disposition, the appellate

business and sharing of profits and losses.

court stated, inter alia, that the alleged Being a form of partnership, a joint venture is

partnership, as evidenced by the actionable generally governed by the law on partnership.

documents, Annex ' A and ' A-1 attached to the

complaint, and upon which petitioner solely

ISSUE:

predicates his right/s allegedly violated by

whether or not petitioner and respondent

Eduardo, Yang and the corporate defendants a

Eduardo are partners in the theatre, shipping

quo is 'void or legally inexistent. and realty business, as one claims but which

the other denies.

In time, petitioner moved for reconsideration but HELD:

his motion was denied by the CA in its equally Annex ' A-1 ', on its face, contains typewritten

assailed Resolution of December 7, entries, personal in tone, but is unsigned and

undated. As an unsigned document, there

2004. [18] .

can be no quibbling that Annex ' A-1 does

not meet the public instrumentation

requirements exacted under Article 1771 of

the Civil Code. Moreover, being unsigned and

Hence, petitioner's present recourse, on the doubtless referring to a partnership involving

more than P3,000.00 in money or property,

contention that the CA erred:

Annex ' A-1 cannot be presented for

notarization, let alone registered with the

A. When it ruled that there was no

Securities and Exchange Commission (SEC), as

partnership created by the actionable

called for under the Article 1772 of the Code.

document because this was not a public

And inasmuch as the inventory requirement

instrument and immovable properties

under the succeeding Article 1773 goes into the

were contributed to the partnership.

matter of validity when immovable property is

contributed to the partnership, the next logical

point of inquiry turns on the nature of petitioner's

contribution, if any, to the supposed partnership.

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 19

Lest it be overlooked, the contract-validating

But even assuming in gratia argumenti that

inventory requirement under Article 1773 of the

Civil Code applies as long real property or Annex ' A-1 partakes of a perfected innominate

real rights are initially brought into the contract, petitioner's complaint would still be

partnership. In short, it is really of no moment

dismissible as against Eduardo and, more so,

which of the partners, or, in this case, who

between petitioner and his brother Eduardo, against Yang. It cannot be over-emphasized that

contributed immovables. In context, the more petitioner points to Eduardo as the author of

important consideration is that real property was

contributed, in which case an inventory of the Annex ' A-1 . Withal, even on this consideration

contributed property duly signed by the parties alone, petitioner's claim against Yang is doomed

should be attached to the public instrument, else from the very start.

there is legally no partnership to speak of.

'As it were, the only portion of Annex ' A-1 which

Petitioner contention: immovables are not could perhaps be remotely regarded as vesting

petitioner with a right to demand from

contributed , but acquired after the formation of

respondent Eduardo the observance of a

supposed partnership. For, as earlier stated, determinate conduct.

petitioner himself admitted contributing his share

Lest it be overlooked, petitioner is the

in the supposed shipping, movie theatres and intended beneficiary of the P1 Million or 10%

realty development family businesses which equity of the family businesses supposedly

promised by Eduardo to give in the near future.

already owned immovables even before Annex Any suggestion that the stated amount or the

' A-1 was allegedly executed. equity component of the promise was intended

to go to a common fund would be to read

A partnership may be constituted in any form, something not written in Annex ' A-1.

save when immovable property or real rights are

contributed thereto or when the partnership has In sum then, the Court rules, as did the CA, that

a capital of at least P3,000.00, in which case a petitioner's complaint for specific performance

public instrument shall be necessary. [25]And if anchored on an actionable document of

only to stress what has repeatedly been partnership which is legally inexistent or void or,

articulated, an inventory to be signed by the at best, unenforceable does not state a cause of

parties and attached to the public instrument action as against respondent Eduardo and the

is also indispensable to the validity of the corporate defendants.

partnership whenever immovable property is

contributed to it. Surely, Yang could not have become a

partner in, or could not have had any form of

business relationship with, an inexistent

Indeed, because of the failure to comply with

the essential formalities of a valid contract, partnership.

the purported 'partnership/joint venture is

legally inexistent and it produces no effect - Petitioner asserted in his

whatsoever. Necessarily, a void or legally complaint that his so-called joint

venture/partnership with

inexistent contract cannot be the source of

Eduardo was 'for the

any contractual or legal right. continuation of their family

business and common family

funds which were theretofore

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 20

being mainly managed by

Eduardo. [33] But Yang denies term 'partner four (4) times. He made reference

kinship with the Litonjua family to the 'law of joint venture/partnership [being

and petitioner has not disputed

the disclaimer. applicable] to the business relationship '

- How, indeed, could a person be between [him], Eduardo and Bobby [Yang] and

considered a partner when the

document purporting to to his 'rights in all specific properties' of their

establish the partnership joint venture/partnership. Given this

contract did not even mention

his name. consideration, petitioner's right of action

- To establish a valid cause of

against respondents Eduardo and Yang

action, the complaint should

have a statement of fact upon doubtless pivots on the existence of the

which to connect [respondent]

Yang to the alleged partnership partnership between the three of them, as

between [petitioner] and purportedly evidenced by the undated and

respondent [Eduardo], including

their alleged investment in the unsigned Annex 'A-1 . A void Annex 'A-1', as' an

Odeon Theater. A statement of actionable document of partnership, would strip

facts on those matters is pivotal

to the complaint as they would petitioner of a cause of action under the

constitute the ultimate facts

premises. A complaint for delivery and

necessary to establish the

elements of a cause of action accounting of partnership property based on

against ' Yang. NOTHING was

established that would such void or legally non-existent actionable

contractually connect document is dismissible for failure to state of

respondent Yang to the alleged

partenship. action.

ANOTHER ISSUE RAISED: Thus, from a joint

venture/partnership theory which he adopted

and consistently pursued in his complaint,

petitioner embraced the innominate contract

theory.

- whether the actionable

document bears out an

actionable contract ' be

it a partnership, a joint

venture or whatever or

some innominate

contract ' It may be

noted that one kind of

innominate contract is

what is known as du ut

facias (I give that you

may do). [37]

Per the Court's own count, petitioner used in his

complaint the mixed words 'joint

venture/partnership nineteen (19) times and the

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 21

EUFRACIO D. ROJAS vs CONSTANCIO B. partnership is fixed to thirty (30) years,

MAGLANA everything else is the same.

An income was derived from the proceeds of the

FACTS:

logs in the sum of P643,633.07.

1955, Maglana and Rojas executed their

1956, Pahamotang, Maglana and Rojas

Articles of Co-Partnership (Exhibit "A") called

executed a document entitled "CONDITIONAL

Eastcoast Development Enterprises (EDE) with

SALE OF INTEREST IN THE PARTNERSHIP,

only the two of them as partners. The

EASTCOAST DEVELOPMENT ENTERPRISE"

partnership EDE with an indefinite term of

(Exhibits "C" and "D") agreeing among

existence was duly registered on January 21,

themselves that Maglana and Rojas shall

1955 with the Securities and Exchange

purchase the interest, share and

Commission.

participation in the Partnership of

One of the purposes of the duly-registered Pahamotang assessed in the amount of

partnership was to "apply or secure timber P31,501.12. It was also agreed in the said

and/or minor forests products licenses and instrument that after payment of the sum of

concessions over public and/or private forest P31,501.12 to Pahamotang including the

lands and to operate, develop and promote such amount of loan secured by Pahamotang in favor

forests rights and concessions." of the partnership, the two (Maglana and

Rojas) shall become the owners of all

A duly registered Articles of Co-Partnership was equipment contributed by Pahamotang and

filed together with an application for a timber the EASTCOAST DEVELOPMENT

concession in Davao, which was approved and ENTERPRISES, the name also given to the

timber license was duly issued and became second partnership, be dissolved.

basis of renewals. Pahamotang was paid in fun on August 31,

1957. No other rights and obligations

Maglana shall manage business affairs of accrued in the name of the second

partnership, marketing handling of cash and is partnership

authorized to sign all papers and instruments,

while appellant Rojas shall be the logging After the withdrawal of Pahamotang, the

superintendent and shall manage logging partnership was continued by Maglana and

operations of the partnership. They will also Rojas without the benefit of any written

agreement or reconstitution of their written

share profit and losses.

Articles of Partnership (Decision, R.A. 948).

During the period from January 14, 1955 to April On January 28, 1957, Rojas entered into a

30, 1956, there was no operation of said management contract with another logging

partnership (Record on Appeal [R.A.] p. 946). enterprise, the CMS Estate, Inc. He left and

Because of the difficulties encountered, Rojas abandoned the partnership.

and Maglana decided to avail of the services

of Pahamotang as industrial partner. Rojas withdrew his equipment from the

partnership, was ttransferred to CMS Estate Inc

1956, Maglana, Rojas and Agustin Pahamotang

executed their Articles of Co-Partnership (Exhibit by way of chattel mortgage.

"B" and Exhibit "C") under the firm name

EASTCOAST DEVELOPMENT ENTERPRISES 1957, Maglana wrote Rojas reminding the latter

(EDE). Aside from the slight difference in the of his obligation to contribute, either in cash or in

purpose of the second partnership which is to equipment, to the capital investments of the

hold and secure renewal of timber license partnership as well as his obligation to perform

instead of to secure the license as in the first his duties as logging superintendent.

partnership and the term of the second

ESGUERRA DOCTRINES| PARTNERSHIP CASES| 22

Rojas then told Maglana he will not be able to - That letter of Maglana did not

comply with the promised contributions and will legally dissolve the registered

not work as logging superintendent. partnership between them

- That appellant Rojas is entitled

Maglana then told Rojas that the latter's share to the rights enumerated in Art

will just be 20% of the net profits. Such was the 1837

sharing from 1957 to 1959 without complaint or - and to the sharing profits

dispute. between them of "share and

share alike" as stipulated in the

Rojas took funds from the partnership more

registered Articles of Co-

than his contribtuon. Then Maglana notified

Partnership

Rojas that he dissolved the partnership.

after careful study, it was not the intention of

Rojas filed an action before the Court of First

the parties to dissolve the first partnership,

Instance of Davao against Maglana for the

upon the constitution of the second one.

recovery of properties, accounting,

Except, for those slight differences.

receivership and damages

To all intents and purposes therefore, the First

Articles of Partnership were only amended, in

ISSUE: the form of Supplementary Articles of Co-

Partnership (Exhibit "C") which was never

The main issue in this case is the nature of

registered (Brief for Plaintiff-Appellant, p. 5).

the partnership and legal relationship of the

Maglana-Rojas after Pahamotang retired Otherwise stated, even during the existence of

from the second partnership. the second partnership, all business

transactions were carried out under the duly

registered articles. As found by the trial court, it

HELD: is an admitted fact that even up to now, there

are still subsisting obligations and contracts

Rojas CONTENTION: insists that the registered of the latter.

partnership under the firm name of Eastcoast

Development Enterprises (EDE) evidenced by No rights and obligations accrued in the

the Articles of Co-Partnership dated January 14, name of the second partnership except in

1955 (Exhibit "A") has not been novated, favor of Pahamotang which was fully paid by

superseded and/or dissolved by the the duly registered partnership.

unregistered articles of co-partnership among

Dissolution of the second partnership did

appellant Rojas, appellee Maglana and Agustin

not affect the first partnership which

Pahamotang, dated March 4, 1956 (Exhibit "C")

continued to exist.

and accordingly, the terms and stipulations of

said registered Articles of Co-Partnership (Maglana wrote Rojas to contribute) This

(Exhibit "A") should govern the relations reminder cannot refer to any other but to the