Assignment 1

Diunggah oleh

Acha BachaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Assignment 1

Diunggah oleh

Acha BachaHak Cipta:

Format Tersedia

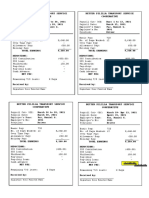

Assignment No.

1

FM

1. Nestle is contemplating replacing its old machinery with a new one. The old

machine has been completely depreciated but has a current market value of Rs.

2000. The new machine will cost Rs.50,000, having a life of 5 years. The new

machine will be depreciated using the Double declining method and will have a

Rs.5,000 salvage value. The new machine will generate revenues of Rs.100,000

while old machine was generating revenues of Rs.80,000 and annual non-

depreciation expenses increases by Rs.10,000. What are the relevant cashflows if

the company pays a 43% tax for the first 3 years and 40% tax for the last 2 years?

2. XYZ Company is considering replacement of its existing machine by a new

machine which is expected to cost Rs 160,000. The new machine will have a life

of 5 years and will yield annual cash revenues of Rs 250,000 and incur annual

cash expenses of Rs 150,000. The existing machine has a book value of Rs

40,000, and can be sold for Rs 20,000 today. It is good for the next 5 years and is

estimated to generate annual cash revenues of Rs 200,000 and to involve annual

cash expenses of Rs 140,000. If sold after five years, the salvage value of the

existing machine can be expected to be Rs.2,000.

XYZ Company pay tax at 35 per cent, and can write off depreciation at 30 per

cent on the written-down value of the asset. The company’s opportunity cost of

capital is 20 per cent. Compute the relevant cash flows.

3. Fecto cement is contemplating replacing its old machinery with a new one. The

old machine has been completely depreciated but has a current market value of

Rs.2000. The new machine will cost Rs.25,000, having a life of 6 years, and have

no value after this time. The new machine will be depreciated using MACRS 5

year property class(i.e 20%,32%,19.2%,11.52%,11.52%,5.76%) basis and will

have a Rs.5,000 salvage value. The new machine will generate revenues of

Rs.50,000 while old machine was generating revenues of Rs.40,000 and annual

non-depreciation expenses increases by Rs.3,000. What are the relevant cashflows

if the company pays a 43% tax?

4. Bittech Corporation is considering buying a plant for Rs.1, 600,000 with SV

100,000 for producing a ram. Installation charges are Rs.100,000 and you require

Rs.10,000 for your N.W.C which will be available at the end of the life of the

plant. The plant has an expected life of 5 years and will be depreciated using the

SOYD method. Sales are expected to be Rs.2,100,000. Operating cost excluding

depreciation of the plant are Rs.1,000,000 per year. The corporation pays income

tax at the rate of 35%. Find the relevant cashflows for the project.

Anda mungkin juga menyukai

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- General journal entries for consulting businessDokumen22 halamanGeneral journal entries for consulting businessPauline Bianca70% (10)

- Maf 630 Chapter 1Dokumen3 halamanMaf 630 Chapter 1Pablo EkskobaBelum ada peringkat

- CapgeminiOfferLetter 29122011 PDFDokumen23 halamanCapgeminiOfferLetter 29122011 PDFsreeharivaleti100% (1)

- Taxation Law Question Bank BALLBDokumen49 halamanTaxation Law Question Bank BALLBaazamrazamaqsoodiBelum ada peringkat

- Corporate Finance: Topic: Company Analysis "Infosys"Dokumen6 halamanCorporate Finance: Topic: Company Analysis "Infosys"Anuradha SinghBelum ada peringkat

- M and MDokumen478 halamanM and MAnoop KularBelum ada peringkat

- Asset AccountingDokumen19 halamanAsset AccountingAniruddha SonpatkiBelum ada peringkat

- Brand ValuationDokumen37 halamanBrand Valuationmohit.almal100% (2)

- Module 1, Chapter 1 Handout Introduction To Financial StatementsDokumen5 halamanModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbBelum ada peringkat

- Lone Pine Cafe-CaseDokumen28 halamanLone Pine Cafe-CaseNadya Rizkita100% (2)

- The Entering EsDokumen95 halamanThe Entering Esthomas100% (1)

- Revision Questions - CH 17 - QuestionsDokumen3 halamanRevision Questions - CH 17 - QuestionsMinh ThưBelum ada peringkat

- Shinepukur Ceramics Limited: Balance Sheet StatementDokumen9 halamanShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- TOCAO Vs CADokumen3 halamanTOCAO Vs CAJane Sudario100% (3)

- Ocbc Ar2016 Full Report English PDFDokumen236 halamanOcbc Ar2016 Full Report English PDFMr TanBelum ada peringkat

- Circular Flow of EconomyDokumen19 halamanCircular Flow of EconomyAbhijeet GuptaBelum ada peringkat

- Maruti Suzuki Financial StatementDokumen5 halamanMaruti Suzuki Financial StatementMasoud AfzaliBelum ada peringkat

- Acc101 Mini Exam Review For StudentsDokumen11 halamanAcc101 Mini Exam Review For Studentsjan petosilBelum ada peringkat

- Withholding Tax Guide - Japan PDFDokumen45 halamanWithholding Tax Guide - Japan PDFSteven OhBelum ada peringkat

- November 21, 2014 Strathmore TimesDokumen28 halamanNovember 21, 2014 Strathmore TimesStrathmore TimesBelum ada peringkat

- Kalbe Farma TBK 31 Des 2020Dokumen173 halamanKalbe Farma TBK 31 Des 2020A. A Gede Wimanta Wari Bawantu32 DarmaBelum ada peringkat

- P.R. Cements LTD Fixed Assets ManagementDokumen71 halamanP.R. Cements LTD Fixed Assets ManagementPochender vajrojBelum ada peringkat

- The Economics of Upstream Petroleum ProjectDokumen18 halamanThe Economics of Upstream Petroleum ProjectLulav BarwaryBelum ada peringkat

- Depriciation and AccountingDokumen3 halamanDepriciation and AccountingGurkirat TiwanaBelum ada peringkat

- Sample Trust DeedDokumen12 halamanSample Trust Deedfaizysyed100% (2)

- Iqta SystemDokumen10 halamanIqta SystemAnurag Sindhal75% (4)

- Internship Report ON F.E.S.C.O of PakistanDokumen54 halamanInternship Report ON F.E.S.C.O of PakistanBILALBelum ada peringkat

- Toby Crabel - Opening Range Breakout (Part1-8)Dokumen39 halamanToby Crabel - Opening Range Breakout (Part1-8)saisonia75% (8)

- Better Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeDokumen1 halamanBetter Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeHellen DeaBelum ada peringkat

- Triveni TurbineDokumen14 halamanTriveni Turbinecanaryhill100% (1)