The HMO Act of 1973 Health Maintenance Organization Act of 1973

Diunggah oleh

Sai PrabhuDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

The HMO Act of 1973 Health Maintenance Organization Act of 1973

Diunggah oleh

Sai PrabhuHak Cipta:

Format Tersedia

The HMO Act of 1973

One of the most important causes of the expansion of health plans was the federal

Health Maintenance Organization Act of 1973

. This legislation was designed toreduce the cost of healthcare by increasing competition in the health

coverage marketand to increase access to health coverage for individuals without insurance or with

onlylimited benefits. The main features of the HMO Act are:

Federal qualification.

HMOs were given the option of becoming federallyqualified. To do so, they had to meet a number of

standards related to minimumbenefit packages, provider network adequacy, enrollee grievance

systems,financial stability, and quality assurance.

Dual choice.

Employers that offered indemnity health insurance to more than 25employees had to also offer a

federally qualified HMO (if an HMO requested it).

Federal funding.

To encourage their development, grants and loans were madeavailable to federally qualified HMOs.

Funding could be used to expand theservice area of an existing HMO or establish a new HMO.

State law exemption.

Federally qualified HMOs were exempted from state lawsthat restricted their development.

The Evolution of Health Plans

Page 4 of 9

Although federal qualification was optional, many HMOs sought it because of theadvantages mentioned

above and because it could be cited as

a “stamp of approval” in

marketing. But on the other hand, in some ways it weakened the competitive position ofqualified HMOs,

since they had to meet the federal standards and traditional indemnityinsurance or other health plans did

not.From 1976 to 1996, the HMO Act was modified by a series of amendments. These gavehealth plans

more flexibility in designing and marketing products and increased theemphasis on quality. Many of the

standards for federally qualified HMOs were reducedor eliminated, and the dual choice mandate was

repealed in 1995.The HMO Act played a major role in the early establishment and growth of HMOs,

andalthough federally qualified status no longer carries the weight it had previously, someHMOs still

maintain it.

Consumer and Employer Demand

HMOs had significant success in containing healthcare costs and holding down premiumincreases, and

by the early 1990s consumers and employers sponsoring healthcoverage had come to embrace them.

But a traditional HMO required members toreceive healthcare only from providers affiliated with the plan

(that is, in

the plan’s

network), and consumers became dissatisfied with this restriction. They wanted thelower cost of an HMO

but more leeway in choosing providers. New health plan typeswere developed to address this demand.

Two of the most important were PPOs andPOS products.

Preferred provider organizations (PPOs)

like HMOs, have a network ofproviders. But unlike traditional HMOs, they cover services delivered by

non-network providers, although the member pays a greater share of costs than fornetwork care (typically

higher copayments or coinsurance). And while traditionalHMOs require members to obtain a referral from

their primary care physician tosee a specialist, PPOs generally do not.

Point-of-service (POS) products

combine elements of traditional indemnityinsurance with elements of health plans. Members do not have

to choose howthey receive services until they use them and may obtain care from networkproviders

and/or non-network providers. However, as with a PPO, members paymore for out-of-network care. Visits

to specialists may require a referral from aprimary care physician.Consumers also wanted coverage of

specialty healthcare, such as dental care, visioncare, behavioral health, and prescription drugs, and

employers wanted more cost-effective ways of providing such benefits. In response, health plans

developed

specialty

“carve

-

out”

plans and products with specialized provider networks. Specialty coveragemay be integrated into a

comprehensive health plan or offered as stand-alone product. Around the beginning of the new century,

health premiums began to go up again, andconsumers and employers looked for new solutions. One

approach is

consumer-directed health plans (CDHPs)

. CDHPs are based on employer funding of a core set ofbenefits, employee financial responsibility, and

increased accountability of the healthplan and providers. Under a CDHP, the individual has both a health

insurance plan with

The Evolution of Health Plans

Page 5 of 9

a high annual deductible and a tax-advantaged health savings account. He or she usesmoney from the

account to pay for healthcare expenses before the high deductible of thehealth plan is satisfied, as well

as other out-of-pocket healthcare costs, generally on atax-free basis. This approach both makes possible

a low premium and gives consumersan incentive to make prudent healthcare choices, as they pay much

of the costthemselves.These and other health plan types and products will be discussed in the modules

thatfollow.

Government Involvement

Government has long been involved in health insurance, at both the state and federallevels. For over a

century, states have regulated insurance companies, including healthinsurers. They mandate or prohibit

certain policy provisions, impose financialrequirements, oversee sales and marketing, and enforce many

other rules. The federalgovernment has historically taken a secondary role, but it does enact legislation

thataffects insurers and health plans. As we saw, in 1973 Congress enacted the HMO Act.In 1996 it

passed the Health Insurance Portability and Accountability Act (HIPAA), whichincluded a wide variety of

requirements for health plans. And most recently, in March2010, the Affordable Care Act (ACA),

commonly referred to as healthcare reform, wasenacted. This legislation will have a major impact on

healthcare and health plans in theyears to come.The government plays another important role in health

plans

—

it is a major purchaser ofhealth coverage, financing healthcare for millions of Americans through

severalprograms. In 1965 the Medicare program for the elderly and disabled and Medicaid forthe poor

were established, followed in 1997 by the

Children’s Health Insurance Program

(CHIP). And the federal and state governments have long sponsored health coverage formillions of

government employees and members of the military and their families.Government health coverage

programs have helped drive the growth of health plans byincreasingly turning to them as alternatives to

traditional indemnity insurance. By 2010approximately 11.1 million Medicare beneficiaries (24 percent)

were enrolled in aMedicare Advantage health plan,

1

and about 70 percent of Medicaid enrollees receivedsome or all of their healthcare through managed

care.

2

Current Factors in the Evolution of Health Plans

Now

let’s

turn our attention to current trends. The most important is the steady rise inhealthcare costs. This has

made it necessary for health insurance premiums to beincreased, and that in turn has made it harder for

employers and consumers to affordcoverage. Health plans have responded to these problems with a

number of solutions.

Rising Healthcare Costs

Spending on healthcare in the United States has been rising for many years, surpassing$2.3 trillion in

2008. This is more than three times the $714 billion spent in 1990 andabout nine times the $253 billion

spent in 1980. In 2008 U.S. healthcare spending wasabout $7,681 per resident and accounted for 16.2

percent

of the nation’s Gross

Domestic Product.

3

What is driving this increase?

Let’s look at some

key factors

Anda mungkin juga menyukai

- AHM 250 Chapter 1Dokumen9 halamanAHM 250 Chapter 1Paromita MukhopadhyayBelum ada peringkat

- AHM 250 Course MaterialDokumen285 halamanAHM 250 Course MaterialAnitha Viji73% (15)

- 1.evolution of Heath PlansDokumen9 halaman1.evolution of Heath PlansUtpal Kumar PalBelum ada peringkat

- AHM 250 1 The Evolution of Health PlansDokumen7 halamanAHM 250 1 The Evolution of Health Plansdeepakraj610Belum ada peringkat

- International Social Welfare ProgramsDokumen10 halamanInternational Social Welfare ProgramsZaira Edna JoseBelum ada peringkat

- This Time Get It Right: Good-Bye ObamaCare: Health Savings Accounts Open the Door to Universal Coverage and Lower CostsDari EverandThis Time Get It Right: Good-Bye ObamaCare: Health Savings Accounts Open the Door to Universal Coverage and Lower CostsBelum ada peringkat

- New Solvency Advocate Walker 17Dokumen4 halamanNew Solvency Advocate Walker 17saifbajwa9038Belum ada peringkat

- Massachusetts' Plan: A Failed Model For Health Care Reform: February 18, 2009Dokumen19 halamanMassachusetts' Plan: A Failed Model For Health Care Reform: February 18, 2009raj2closeBelum ada peringkat

- Social Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionDari EverandSocial Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionBelum ada peringkat

- Social Security Redefined: Adding Health Care Reform While Giving the Consumer Choice and ControlDari EverandSocial Security Redefined: Adding Health Care Reform While Giving the Consumer Choice and ControlBelum ada peringkat

- Medicare Revolution: Profiting from Quality, Not QuantityDari EverandMedicare Revolution: Profiting from Quality, Not QuantityBelum ada peringkat

- Chapter 5 Health EconDokumen7 halamanChapter 5 Health EconDoffCruzBelum ada peringkat

- Focus: Health ReformDokumen7 halamanFocus: Health ReformBrian ShawBelum ada peringkat

- US Health Policy and Market Reforms: An IntroductionDari EverandUS Health Policy and Market Reforms: An IntroductionBelum ada peringkat

- Ahm 250 5 HmoDokumen10 halamanAhm 250 5 Hmodeepakraj610Belum ada peringkat

- A New Definition' For Health Care Reform: James C. Capretta Tom MillerDokumen57 halamanA New Definition' For Health Care Reform: James C. Capretta Tom MillerFirhiwot DemisseBelum ada peringkat

- Privatizing Medicaid in ColoradoDokumen7 halamanPrivatizing Medicaid in ColoradoIndependence InstituteBelum ada peringkat

- Policy Memo 1 1Dokumen6 halamanPolicy Memo 1 1api-488942224Belum ada peringkat

- Glossary of Health TermsDokumen4 halamanGlossary of Health Termshijaz93Belum ada peringkat

- The Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperDokumen7 halamanThe Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperCato InstituteBelum ada peringkat

- The Costs of Regulation and Centralization in Health Care by Scott AtlasDokumen22 halamanThe Costs of Regulation and Centralization in Health Care by Scott AtlasHoover InstitutionBelum ada peringkat

- The Fiscal Challenges Facing Medicare: Entitlement Spending and MedicareDokumen20 halamanThe Fiscal Challenges Facing Medicare: Entitlement Spending and MedicarelosangelesBelum ada peringkat

- 9.4 Ethical Issues in The Provision of Health CareDokumen7 halaman9.4 Ethical Issues in The Provision of Health CareAngelica NatanBelum ada peringkat

- Affordable Care Act ThesisDokumen5 halamanAffordable Care Act Thesisgbtrjrap100% (1)

- The Affordable Care ActDokumen7 halamanThe Affordable Care ActalexBelum ada peringkat

- Basics L10 U.S.Healthcaresystem PDFDokumen7 halamanBasics L10 U.S.Healthcaresystem PDFNanyiLidiaMateoLucianoBelum ada peringkat

- Healthy, Wealthy, and Wise: 5 Steps to a Better Health Care System, Second EditionDari EverandHealthy, Wealthy, and Wise: 5 Steps to a Better Health Care System, Second EditionPenilaian: 5 dari 5 bintang5/5 (1)

- Ten Steps For A Market-Oriented Health Care SystemDokumen2 halamanTen Steps For A Market-Oriented Health Care SystemahmedBelum ada peringkat

- Health Economics Health System Reform: Tianxu ChenDokumen32 halamanHealth Economics Health System Reform: Tianxu ChenRobert MariasiBelum ada peringkat

- Managed CareDokumen7 halamanManaged Carearun901Belum ada peringkat

- VRRFDokumen18 halamanVRRFDan NgugiBelum ada peringkat

- The Situation: President-Elect Obama Henry J. Aaron, The Brookings Institution January 16, 2009 Reform Health CareDokumen3 halamanThe Situation: President-Elect Obama Henry J. Aaron, The Brookings Institution January 16, 2009 Reform Health CareHim LokBelum ada peringkat

- Impact of ACA On The Safety NetDokumen6 halamanImpact of ACA On The Safety NetiggybauBelum ada peringkat

- Hillary Clinton's Plan For Health CareDokumen10 halamanHillary Clinton's Plan For Health CareHashim Warren100% (2)

- 50 Vetoes: How States Can Stop the Obama Health Care LawDari Everand50 Vetoes: How States Can Stop the Obama Health Care LawBelum ada peringkat

- Healthcare Reform: Enhancing Services On A Sustainable BasisDokumen18 halamanHealthcare Reform: Enhancing Services On A Sustainable BasisextravaganzarBelum ada peringkat

- Running Head: Benchmark-Analysis of U.S. Health Care Policy 1Dokumen7 halamanRunning Head: Benchmark-Analysis of U.S. Health Care Policy 1api-520843051Belum ada peringkat

- Managed Healthcare: Industry OverviewDokumen11 halamanManaged Healthcare: Industry Overviewt6166asBelum ada peringkat

- What Is Congress Considering?Dokumen3 halamanWhat Is Congress Considering?brendawilliamsBelum ada peringkat

- Thinking of Introducing Social Health Insurance? Ten QuestionsDokumen10 halamanThinking of Introducing Social Health Insurance? Ten QuestionsIraaBelum ada peringkat

- Health Insurance in IndiaDokumen6 halamanHealth Insurance in IndiasupriyaBelum ada peringkat

- Health Reform without Side Effects: Making Markets Work for Individual Health InsuranceDari EverandHealth Reform without Side Effects: Making Markets Work for Individual Health InsuranceBelum ada peringkat

- EHIADokumen6 halamanEHIAmuhammedseid2946Belum ada peringkat

- Textbook of Urgent Care Management: Chapter 36, Virtual CareDari EverandTextbook of Urgent Care Management: Chapter 36, Virtual CareBelum ada peringkat

- Report On Health Insurance 2Dokumen23 halamanReport On Health Insurance 2DrJaideep KumarBelum ada peringkat

- Hr3200 SummaryDokumen4 halamanHr3200 Summarygregoryf09Belum ada peringkat

- Health Care USA Chapter 8Dokumen76 halamanHealth Care USA Chapter 8David TurnerBelum ada peringkat

- KFF Primer On MedicareDokumen45 halamanKFF Primer On Medicarethanks maBelum ada peringkat

- Healthpolicybrief 8 PDFDokumen5 halamanHealthpolicybrief 8 PDFfriska anjaBelum ada peringkat

- Health Financing FunctionsDokumen4 halamanHealth Financing FunctionsFredy GunawanBelum ada peringkat

- Healthy California Act AnalysisDokumen8 halamanHealthy California Act AnalysisDylan MatthewsBelum ada peringkat

- LWV RecentHealthCareChangesDokumen4 halamanLWV RecentHealthCareChangesjrfh50Belum ada peringkat

- At.2502 Auditing An OverviewDokumen28 halamanAt.2502 Auditing An Overviewawesome bloggersBelum ada peringkat

- Thesis On Wormhole Attack in ManetDokumen8 halamanThesis On Wormhole Attack in Manetaprilwbndsouthbend100% (2)

- Nayatel BillDokumen1 halamanNayatel Billnr pakiBelum ada peringkat

- China Banking CorporationDokumen8 halamanChina Banking CorporationdaphnereezeBelum ada peringkat

- Ssoar 2015 3 Kolekar Ebanking - in - IndiaDokumen8 halamanSsoar 2015 3 Kolekar Ebanking - in - IndiaSuny PaswanBelum ada peringkat

- DUMSSBDDDDokumen3 halamanDUMSSBDDDUBCREATIONZ 2019Belum ada peringkat

- Lecture 5 - Dissolution of A Partnership FirmDokumen18 halamanLecture 5 - Dissolution of A Partnership Firmdonkhalif13Belum ada peringkat

- Impact of Credit Rating On MsmeDokumen11 halamanImpact of Credit Rating On MsmeGaurav KumarBelum ada peringkat

- Case Creation The Bob Evans Way - TrainingDokumen27 halamanCase Creation The Bob Evans Way - TrainingMaalvika SinghBelum ada peringkat

- STATEMENT 08-12-2018 To 08-12-2019 PDFDokumen20 halamanSTATEMENT 08-12-2018 To 08-12-2019 PDFRinku ChauhanBelum ada peringkat

- 88937409Dokumen1 halaman88937409fariborzBelum ada peringkat

- CCS336 Cloud Services Management Lecture Notes 2Dokumen118 halamanCCS336 Cloud Services Management Lecture Notes 2Gokul MBelum ada peringkat

- Beijing Mayor SpeechDokumen1 halamanBeijing Mayor SpeechRong FangBelum ada peringkat

- Welcome To Our Presentation: Wireless CommunicationDokumen20 halamanWelcome To Our Presentation: Wireless CommunicationMD. FARHAN AFSARBelum ada peringkat

- An Investment Opportunity: Triumph's CryptocurrencyDokumen25 halamanAn Investment Opportunity: Triumph's Cryptocurrency- hermanBelum ada peringkat

- Winter Internship Project ON: A Study On Awareness About Mutual Fund Among InvestorsDokumen24 halamanWinter Internship Project ON: A Study On Awareness About Mutual Fund Among InvestorsNikita SharmaBelum ada peringkat

- Practice Final PB AuditingDokumen14 halamanPractice Final PB AuditingBenedict BoacBelum ada peringkat

- Clinical Practice Guidelines: BY: Ma. Sylvia Emilie B. BeñalesDokumen17 halamanClinical Practice Guidelines: BY: Ma. Sylvia Emilie B. Beñalespaulyn ramosBelum ada peringkat

- Pengertian, Jenis Ungkapan Dan Contoh Dialog Percakapan Asking and Giving Directions Dalam Bahasa Inggris & Artinya Dilengkapi SoalDokumen4 halamanPengertian, Jenis Ungkapan Dan Contoh Dialog Percakapan Asking and Giving Directions Dalam Bahasa Inggris & Artinya Dilengkapi SoalPrastyo Hari YadiBelum ada peringkat

- Ebay, Inc. SWOT Analysis.Dokumen10 halamanEbay, Inc. SWOT Analysis.vesperousBelum ada peringkat

- AgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportDokumen3 halamanAgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportsureshBelum ada peringkat

- Neoway N11V2 AT Command Manual V1 6 PDFDokumen217 halamanNeoway N11V2 AT Command Manual V1 6 PDFAnilyn AniBelum ada peringkat

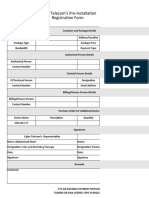

- Pre-Installation Registration FormDokumen5 halamanPre-Installation Registration FormMustafa NazariBelum ada peringkat

- E Commerce and e BusinessDokumen6 halamanE Commerce and e BusinessDilawar NafeesBelum ada peringkat

- InsuranceDokumen7 halamanInsurancesarvesh.bhartiBelum ada peringkat

- Via Callalta, 1 31046 Oderzo TV ItalyDokumen2 halamanVia Callalta, 1 31046 Oderzo TV ItalySupuran RichardoBelum ada peringkat

- National Health Insurance Scheme: Career Opportunities For Health WorkersDokumen3 halamanNational Health Insurance Scheme: Career Opportunities For Health Workersyusuf hamidBelum ada peringkat

- 1653938915403w30o7t5THrl3ZTr5 (1) (1) (1) - 1Dokumen8 halaman1653938915403w30o7t5THrl3ZTr5 (1) (1) (1) - 1Rohit raagBelum ada peringkat

- Dup Caf In30267932020369Dokumen9 halamanDup Caf In30267932020369barnana jeevanraoBelum ada peringkat

- Current Growth of Internet Subscribers in Bangladesh and Its Benefit Towards Our Economy: A Study On Premium Connectivity Ltd. (PCL)Dokumen50 halamanCurrent Growth of Internet Subscribers in Bangladesh and Its Benefit Towards Our Economy: A Study On Premium Connectivity Ltd. (PCL)Selim KhanBelum ada peringkat