Accelerated Depreciation Benefit - A Major Incentive For Solar Power

Diunggah oleh

shekhar sarodeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accelerated Depreciation Benefit - A Major Incentive For Solar Power

Diunggah oleh

shekhar sarodeHak Cipta:

Format Tersedia

solar power

MR. ROUNAK MUTHIYAN

AND MS. SHREYA PAREKH

KALPA POWER [UNIT OF SPAN PUMPS PVT LTD]

Accelerated Depreciation Benefit

– A major incentive for solar power

Due to a proposed cap on the rate of depreciation in the budget 2016-17, the benefit that was

available to the solar project investor till date will now be halved in the first year and spread over

the subsequent years.

S olar power is largely associated with

two primary incentives:

1. Savings associated with the cost of so-

From these two benefits, the accelerated

depreciation accounts for major relief in

the upfront cost of solar by providing a tax

early life of the asset. By increasing the de-

ductions taken during the first few years,

one can lower the overall tax burden.

lar power vs. grid electricity break in the first year of operation. Ideally, The normal depreciation rate for plant

2. Tax relief due to availing higher rate of there isn’t such term as accelerated depre- and machinery is 15%. As per section-32 of

depreciation more often termed as ac- ciation. It is only a method of depreciation Income Tax Act 1961, schedule entry 8(xiii),

celerated depreciation, under section used for accounting or income tax purpos- the Government of India (GoI) had till date

32 of Income Tax act es that enable greater deductions in the allowed to claim maximum up to 80% de-

energetica india · SEP | OCT16 39

solar power

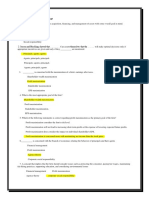

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

At present rate of depreciation, till 31st March 2017

Scenario 1

In this case, the investor can claim 100% depreciation, in F.Y. 2016-17.

Tax benefit 40.79 - - - - - - -

Payback period 4 years 1 month

Internal rate of return 25.2%

Scenario 2

In this case, the investor can claim depreciation for half year of operation in F.Y. 2016-17. Thereafter, he can claim tax benefit at a depreciation rate

of 80% on the remaining cost of the asset in the subsequent years.

Tax benefit 20.39 16.32 3.26 0.65 0.13 0.03 0.01 -

Payback period 4 years 1 month

Internal rate of return 24.4%

At proposed rate of depreciation, w.e.f 1 April 2017

st

Scenario 3

In this case, the investor can claim 60% i.e (40+20)% depreciation benefit in F.Y. 2017-18. Thereafter, he can claim tax benefit at a depreciation

rate of 40% on the remaining cost of the asset in the subsequent years

Tax benefit 24.47 6.53 3.92 2.35 1.41 0.85 0.51 0.31

Payback period 4 Years 3 months

Internal rate of return 24.2%

Scenario 4

In this case, the investor can claim depreciation for half year of operation in F.Y. 2017-18. Thereafter, he can claim tax benefit at a depreciation rate

of 40% on the remaining cost of the asset in the subsequent years

Tax benefit 12.24 11.42 6.85 4.11 2.47 1.48 0.89 0.53

Payback period 4 years 4 months

Internal rate of return 23.4%

preciation in year one of commissioning of Let’s understand the same with the help 3. Project commissioned for more than

solar power plant. Also as per Section 32 (1) of an example: 180 days, during H1 (March – Septem-

(ii A)of Income Tax Act 1961, an additional Assumptions: ber) of 2017-18

depreciation of 20% (max.) of actual cost 1. Cost of solar power project: Rs. 120 4. Project commissioned for less than 180

can be claimed if new plant and machinery lacs. days, during H2 (September – March)

is installed for purpose of manufacturing. 2. Tax rate: 33.06% of 2017-18

Hence, one can claim 100% depreciation 3. Depreciation rate till 31st March 2017 As observed in the table above, due to

for a solar power project, if the asset is in : 80% a proposed cap on the rate of depreci-

use for more than 180 days of the fiscal 4. Depreciation rate w.e.f 1st April 2017: ation, the benefit that was available to

year. If the solar power plant is commis- 40% the investor till date will now be halved

sioned for a period of less than 180 days, 5. Additional depreciation rate as per in the first year and spread over the sub-

then the depreciation benefit is split over section 32(1)(iiA) of Income Tax Act of sequent years. Though, this has been

two financial years. This applies to projects 1961: 20% considered as a setback to the renew-

commissioned in fiscal year 2016-17. We will observe four scenarios as men- able sector, it has not affected much the

tioned below (see table). viability of the solar power systems. The

Post Union Budget 2016-17 1. Project commissioned for more than investor can still expect a payback of 4-5

As per Union Budget 2016-17, GoI has 180 days, during H1 (March – Septem- years for an investment in solar power

proposed to cap the higher rate of depre- ber) of 2016-17 generation systems. Hence, we can safe-

ciation at 40% which is 50% of the exist- 2. Project commissioned for less than 180 ly say that solar power will still remain as

ing depreciation rate. It will be with effect days, during H2 (September – March) an attractive investment in the coming

from April 1, 2017. of 2016-17 financial year

40 energetica india · SEP | OCT16

Anda mungkin juga menyukai

- Tax Credit CarryoverDokumen34 halamanTax Credit CarryoverMarivicTalomaBelum ada peringkat

- 2011 Consolidated Tax CasesDokumen35 halaman2011 Consolidated Tax CasesFritzie BayauaBelum ada peringkat

- All India Tariff for Boiler and Pressure Plant InsuranceDokumen30 halamanAll India Tariff for Boiler and Pressure Plant Insurancenk2k10Belum ada peringkat

- Capiii Advtax June13Dokumen13 halamanCapiii Advtax June13Narendra KumarBelum ada peringkat

- 2011 - Consolidated Tax CasesDokumen15 halaman2011 - Consolidated Tax CasesZairah Nichole PascacioBelum ada peringkat

- Tax-Alert - October 2022 - Key Income Tax Changes Proposed in The Inland Revenue (Amendment) Bill 2022Dokumen6 halamanTax-Alert - October 2022 - Key Income Tax Changes Proposed in The Inland Revenue (Amendment) Bill 2022jdBelum ada peringkat

- Khushi (038), 5 - A, GST PresentationDokumen29 halamanKhushi (038), 5 - A, GST PresentationAnnu KashyapBelum ada peringkat

- Assignment 1Dokumen15 halamanAssignment 1Jiaxi WBelum ada peringkat

- Guideline Answers: Professional ProgrammeDokumen115 halamanGuideline Answers: Professional ProgrammeArham SoganiBelum ada peringkat

- CUP VI - Financial Accounting and ReportingDokumen17 halamanCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)

- IFRS 16 - Lease Under IFRS 16 During CovidDokumen4 halamanIFRS 16 - Lease Under IFRS 16 During CovidMuhammad Moin khanBelum ada peringkat

- 2018 Tax Reform ChartDokumen24 halaman2018 Tax Reform ChartThomist AquinasBelum ada peringkat

- US Internal Revenue Service: f8860 - 1999Dokumen2 halamanUS Internal Revenue Service: f8860 - 1999IRSBelum ada peringkat

- Tax On ReservesDokumen13 halamanTax On ReservesAyan NoorBelum ada peringkat

- PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionDokumen4 halamanPRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionEnrique Hills RiveraBelum ada peringkat

- Acctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxDokumen12 halamanAcctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxMichale JacomillaBelum ada peringkat

- RSM South Africa Tax Guide 2023-24Dokumen10 halamanRSM South Africa Tax Guide 2023-24mkhize.christian.21Belum ada peringkat

- State Claim Form Solar 2006Dokumen2 halamanState Claim Form Solar 2006sandyolkowskiBelum ada peringkat

- MODULE 1 Midterm FAR 3 LeasesDokumen31 halamanMODULE 1 Midterm FAR 3 LeasesKezBelum ada peringkat

- Module 9-DIRECT FINANCING LEASE - LESSORDokumen10 halamanModule 9-DIRECT FINANCING LEASE - LESSORJeanivyle CarmonaBelum ada peringkat

- US Internal Revenue Service: f8860 - 1998Dokumen2 halamanUS Internal Revenue Service: f8860 - 1998IRSBelum ada peringkat

- Tax Holiday vs Accelerated Depreciation AnalysisDokumen8 halamanTax Holiday vs Accelerated Depreciation Analysisjakia yasminBelum ada peringkat

- US Internal Revenue Service: f8860 - 2000Dokumen2 halamanUS Internal Revenue Service: f8860 - 2000IRSBelum ada peringkat

- Postemployment Benefits: Employee's Employee Employee Obligation DecemberDokumen25 halamanPostemployment Benefits: Employee's Employee Employee Obligation DecemberGabriel PanganBelum ada peringkat

- ACCT203 LeaseDokumen4 halamanACCT203 LeaseSweet Emme100% (1)

- Audit of Long-Term Lease LiabilitiesDokumen20 halamanAudit of Long-Term Lease LiabilitiesRUFFA SANCHEZBelum ada peringkat

- 8 - June 2018 Module 3.04 (Suggested Solutions)Dokumen16 halaman8 - June 2018 Module 3.04 (Suggested Solutions)Faisal MehmoodBelum ada peringkat

- US Internal Revenue Service: I5500sb - 1992Dokumen4 halamanUS Internal Revenue Service: I5500sb - 1992IRSBelum ada peringkat

- 5rd Sessiom - Audit of LeaseDokumen21 halaman5rd Sessiom - Audit of LeaseRyan Victor Morales100% (1)

- US Internal Revenue Service: I8697Dokumen6 halamanUS Internal Revenue Service: I8697IRSBelum ada peringkat

- Calamba Steel Center Inc Vs CIR GR151857Dokumen17 halamanCalamba Steel Center Inc Vs CIR GR151857AnonymousBelum ada peringkat

- Restricted Options AgreementDokumen18 halamanRestricted Options AgreementAnonymous sIy4b6Belum ada peringkat

- Module 8-OPERATING LESSEE-LESSORDokumen5 halamanModule 8-OPERATING LESSEE-LESSORJeanivyle CarmonaBelum ada peringkat

- Tax Planning & Compliance GuideDokumen10 halamanTax Planning & Compliance GuideMohammad Rakibul IslamBelum ada peringkat

- 10 Alternative Recording of DeferralsDokumen3 halaman10 Alternative Recording of DeferralsTrisha Mae BrazaBelum ada peringkat

- SYSTRA PHILIPPINES vs. CIR tax credit carryover rulingDokumen2 halamanSYSTRA PHILIPPINES vs. CIR tax credit carryover rulingArmstrong BosantogBelum ada peringkat

- Depreciation Rate Chart As Per Companies Act 2013 With Related LawDokumen23 halamanDepreciation Rate Chart As Per Companies Act 2013 With Related Lawfintech ConsultancyBelum ada peringkat

- Chapter 17 Intacc Post Employment BenefitDokumen16 halamanChapter 17 Intacc Post Employment BenefitKyle MariéBelum ada peringkat

- State Land Investment Corporation v. Cir DigestDokumen2 halamanState Land Investment Corporation v. Cir DigestAlan Gultia100% (1)

- Macrs TableDokumen4 halamanMacrs TableLvarsha NihanthBelum ada peringkat

- Problem 28 30Dokumen14 halamanProblem 28 30anneliban499Belum ada peringkat

- ICDS - 4 Revenue RecognitionDokumen15 halamanICDS - 4 Revenue Recognitionkavita.m.yadavBelum ada peringkat

- All India Tariff ON Civil Engineering Completed Risks InsuranceDokumen22 halamanAll India Tariff ON Civil Engineering Completed Risks Insuranceharshit kumarBelum ada peringkat

- Pinnacle Brochure 21oct09Dokumen8 halamanPinnacle Brochure 21oct09neha-bothra-1107Belum ada peringkat

- Tax RateDokumen4 halamanTax Rateamila krishanthaBelum ada peringkat

- Right of Use Asset AccountingDokumen22 halamanRight of Use Asset AccountingQueen ValleBelum ada peringkat

- JPS Supplemental ReportDokumen5 halamanJPS Supplemental ReportfulmooneyBelum ada peringkat

- Paper 5: Advanced AccountingDokumen31 halamanPaper 5: Advanced AccountingDipen AdhikariBelum ada peringkat

- Indian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaDokumen7 halamanIndian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaRITZ BROWNBelum ada peringkat

- RR 13-00Dokumen2 halamanRR 13-00saintkarri100% (2)

- Operating-Lease Bafacr4x OnlineglimpsenujpiaDokumen3 halamanOperating-Lease Bafacr4x OnlineglimpsenujpiaAga Mathew MayugaBelum ada peringkat

- PA2 X IE HW7 G2 Radja Chendykia Ifanka LubisDokumen8 halamanPA2 X IE HW7 G2 Radja Chendykia Ifanka LubischendyradjaBelum ada peringkat

- 04.how To Determine Optimum Split Percentage For Contractors, A Scenario Analysis Based On Current ConditionDokumen10 halaman04.how To Determine Optimum Split Percentage For Contractors, A Scenario Analysis Based On Current ConditionHerry SuhartomoBelum ada peringkat

- Business Transferor'S Notice To Transferee of Unemployment Tax Liability and RateDokumen2 halamanBusiness Transferor'S Notice To Transferee of Unemployment Tax Liability and RateEmmanuel GodsonBelum ada peringkat

- TXHKG 2022 Dec ADokumen8 halamanTXHKG 2022 Dec AmyheartfallsinnewyorkBelum ada peringkat

- HHLHYD00208643 ProvisionalDokumen1 halamanHHLHYD00208643 ProvisionalPranab PaulBelum ada peringkat

- INP - 2211 - Account - SUGGESTED ANSWERSDokumen15 halamanINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaBelum ada peringkat

- Commission Fees StructureDokumen2 halamanCommission Fees StructureManoj KumarBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionBelum ada peringkat

- Management Guide: BrownDokumen40 halamanManagement Guide: Brownshekhar sarodeBelum ada peringkat

- Accelerated Depreciation Benefit - A Major Incentive For Solar PowerDokumen2 halamanAccelerated Depreciation Benefit - A Major Incentive For Solar Powershekhar sarodeBelum ada peringkat

- User Guide Ver10Dokumen35 halamanUser Guide Ver10Girish R RaoBelum ada peringkat

- Environmental Guideline on Poultry RearingDokumen5 halamanEnvironmental Guideline on Poultry Rearingshekhar sarodeBelum ada peringkat

- Mahampsc - Mahaonline.gov - In: User ManualDokumen47 halamanMahampsc - Mahaonline.gov - In: User Manualswapnil jawaleBelum ada peringkat

- Environmental Guideline on Poultry RearingDokumen5 halamanEnvironmental Guideline on Poultry Rearingshekhar sarodeBelum ada peringkat

- User Guide Ver10Dokumen35 halamanUser Guide Ver10Girish R RaoBelum ada peringkat

- Environmental Guide LineDokumen7 halamanEnvironmental Guide Lineshekhar sarodeBelum ada peringkat

- Accelerated Depreciation Benefit - A Major Incentive For Solar PowerDokumen2 halamanAccelerated Depreciation Benefit - A Major Incentive For Solar Powershekhar sarodeBelum ada peringkat

- Environmental Guideline on Poultry RearingDokumen5 halamanEnvironmental Guideline on Poultry Rearingshekhar sarodeBelum ada peringkat

- K SeriesDokumen2 halamanK Seriesshekhar sarodeBelum ada peringkat

- Environmental Guideline on Poultry RearingDokumen5 halamanEnvironmental Guideline on Poultry Rearingshekhar sarodeBelum ada peringkat

- PMEGP GuidelinesDokumen23 halamanPMEGP Guidelinesshreeshlko100% (1)

- Environmental Guideline on Poultry RearingDokumen5 halamanEnvironmental Guideline on Poultry Rearingshekhar sarodeBelum ada peringkat

- Nabard Poultry FarmingDokumen9 halamanNabard Poultry Farmingtaurus_vadivelBelum ada peringkat

- Manufacturing A/c For The Year Ended .31.03.2016: XXX XXXDokumen2 halamanManufacturing A/c For The Year Ended .31.03.2016: XXX XXXsubhash dalviBelum ada peringkat

- Acctg 2 quiz covers depreciation, depletionDokumen3 halamanAcctg 2 quiz covers depreciation, depletionArjay CarolinoBelum ada peringkat

- P.R. Cements LTD Fixed Assets ManagementDokumen71 halamanP.R. Cements LTD Fixed Assets ManagementPochender vajrojBelum ada peringkat

- Annual Report Appropriation Accounts 2004Dokumen380 halamanAnnual Report Appropriation Accounts 2004thestorydotieBelum ada peringkat

- Accounting Information Systems, 6: Edition James A. HallDokumen36 halamanAccounting Information Systems, 6: Edition James A. HallArman CatacutanBelum ada peringkat

- Types of Decisions and Decision-Making MethodsDokumen16 halamanTypes of Decisions and Decision-Making MethodsRyan Malanum AbrioBelum ada peringkat

- Chilli PowderDokumen59 halamanChilli PowderAlpeshBelum ada peringkat

- ch01 (Online Module)Dokumen91 halamanch01 (Online Module)Nazmul Ahshan SawonBelum ada peringkat

- PPE - Lecture3Dokumen37 halamanPPE - Lecture317027 A. F. M. Al MukitBelum ada peringkat

- Lecture 1 SlidesDokumen63 halamanLecture 1 Slidesnatasha carmichaelBelum ada peringkat

- Math IPADokumen62 halamanMath IPARavi Surya ChallagundlaBelum ada peringkat

- 25 Question PaperDokumen4 halaman25 Question PaperPacific Tiger0% (1)

- CIR v. PAL Rules on MCITDokumen5 halamanCIR v. PAL Rules on MCITPeter Joshua OrtegaBelum ada peringkat

- Percentage and algebra questionsDokumen9 halamanPercentage and algebra questionsDaniella WilliBelum ada peringkat

- Financial Statement AnalysisDokumen19 halamanFinancial Statement AnalysisMohammad Ajmal AnsariBelum ada peringkat

- FFR 2Dokumen9 halamanFFR 2Jai KishanBelum ada peringkat

- Tutorial 3 QDokumen8 halamanTutorial 3 Q杰小Belum ada peringkat

- ACCT 504 Week 5 Homework (E7-15A, E7-19A, E8-20A, E9-23A, E9-29A)Dokumen4 halamanACCT 504 Week 5 Homework (E7-15A, E7-19A, E8-20A, E9-23A, E9-29A)leonardjonh1670% (2)

- Managing book journal entries for PT. Kharisma DigitalDokumen32 halamanManaging book journal entries for PT. Kharisma DigitalNirdila KrismawatiBelum ada peringkat

- Business Plan Group 1Dokumen23 halamanBusiness Plan Group 1bellalit100% (6)

- 57498bos46599cp6 PDFDokumen212 halaman57498bos46599cp6 PDFManoj GBelum ada peringkat

- Fixed Assets ProceduresDokumen9 halamanFixed Assets ProceduresAlif KhanBelum ada peringkat

- DepriciationDokumen3 halamanDepriciationIram RiazBelum ada peringkat

- Differences between IFRS for SMEs and full IFRS standardsDokumen18 halamanDifferences between IFRS for SMEs and full IFRS standardsJean StephanyBelum ada peringkat

- The role of financial management decisionsDokumen17 halamanThe role of financial management decisionsKofi AsaaseBelum ada peringkat

- Test Bank For Taxation of Individuals and Business Entities 2012 3rd Edition SpilkerDokumen65 halamanTest Bank For Taxation of Individuals and Business Entities 2012 3rd Edition SpilkerLindaEvansizgo100% (36)

- Shivendra CFA Sample QuestionDokumen215 halamanShivendra CFA Sample QuestionKishore Ravichandran0% (1)

- Tax Accounting Acc 3400 Chapter ExamsDokumen188 halamanTax Accounting Acc 3400 Chapter Examshmgheidi100% (2)

- Torres Ma. Deidre Yciar L - Chapter 13 ADokumen5 halamanTorres Ma. Deidre Yciar L - Chapter 13 AAriana Marie ArandiaBelum ada peringkat

- Profits and Gains Tax CalculationDokumen18 halamanProfits and Gains Tax CalculationSurya MuruganBelum ada peringkat