The Zurich Axioms 2

Diunggah oleh

ethernalx0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

139 tayangan1 halamanThe document introduces the Zurich Axioms, principles for betting to win that contradict common investment advice. Major Axiom 1 states that worry is healthy when risking money, as not worrying means not risking enough. It encourages meaningful stakes that cause worry and hurt if lost. Minor Axiom 1 also advocates for meaningful stakes rather than amounts that won't make a difference if won or lost. Minor Axiom 2 rejects diversification, arguing it reduces the chance of large gains and that investors should focus on a single investment of strong interest.

Deskripsi Asli:

The Zurich Axioms part 2

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe document introduces the Zurich Axioms, principles for betting to win that contradict common investment advice. Major Axiom 1 states that worry is healthy when risking money, as not worrying means not risking enough. It encourages meaningful stakes that cause worry and hurt if lost. Minor Axiom 1 also advocates for meaningful stakes rather than amounts that won't make a difference if won or lost. Minor Axiom 2 rejects diversification, arguing it reduces the chance of large gains and that investors should focus on a single investment of strong interest.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

139 tayangan1 halamanThe Zurich Axioms 2

Diunggah oleh

ethernalxThe document introduces the Zurich Axioms, principles for betting to win that contradict common investment advice. Major Axiom 1 states that worry is healthy when risking money, as not worrying means not risking enough. It encourages meaningful stakes that cause worry and hurt if lost. Minor Axiom 1 also advocates for meaningful stakes rather than amounts that won't make a difference if won or lost. Minor Axiom 2 rejects diversification, arguing it reduces the chance of large gains and that investors should focus on a single investment of strong interest.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

The Zurich Axioms - Page 2 -

An Introduction To The Axioms Minor Axiom 1.

These principles are about betting to win. Everyone wants Always play for meaningful stakes.

to win, but not everyone wants to bet. Therein is the very If you only bet what you can afford to lose, you can only win

key to success. Everyone wants to win without betting. The what won’t help very much. The only way to beat the

axioms discussed here apply in any situation where you put system is to play for meaningful stakes. You need to bet

your money at risk to make more money. amounts that worry you a little and that hurt if you lost.

To make any kind of gain in life, you have to put something Choose your own level according to the degree of worry

at risk. You must make a commitment of time, money, love you can tolerate - 25%, 50% or 100% of your wealth.

or something of value. The sensible approach is to not

shun risk but to learn to manage risk to your own advantage Minor Axiom 2.

with care and thought. Resist the allure of diversification.

The Zurich Axioms were developed by those with the most The investment community preaches the wisdom of having

experience of any in managing risk and winning - the Swiss a number of investments, in the hope that one good one

financial community. They contradict some of the most will make up for numerous failures or mediocre

cherished investment advice. And best of all, they work. investments. The actual fact is that diversification, by

reducing your risks, reduces by the same degree any hope

you may have of getting rich.

Major Axiom 1 - Risk

This philosophy has three major flaws;

Main Idea

1. It reduces your chances of playing for meaningful

Worry is not a sickness but a sign of health. If you are not

stakes.

worried, you are not risking enough.

2. You are creating a situation where your gains and

Supporting Ideas

losses stand to balance themselves out leaving you

If your main goal in life is to escape worry, you are going to where you started.

stay poor and be bored silly in the process. Life ought to be

3. You become like a juggler, trying to keep four balls in

an adventure, not a yawn. An adventure requires some

the air at once. You won’t be watching your investment

risk.

with the proper degree of care.

Worry is an integral part of life’s grandest enjoyments, and

In speculation, only put your money into those investments

not just the financial challenges. If you are afraid of risk, you

that really interest you. Never buy simply to have a

will never fall in love. You’ll never participate in a sports

diversified portfolio. Put all your eggs into one basket, and

event because you might lose. In these things, it’s the

watch that basket.

defeat of imminent failure that gives a spirit of adventure.

It’s the same for a financial strategy. Adventure is what

makes life worth living, and that means taking risk.

You can’t get rich working for someone else. The economic

structure of the world is rigged against you.

Try this for a rule of thumb - devote one half of your

energies to job income. The other half ought to go into

investment and speculation. The only way you can ever lift

yourself above the masses is to take a risk with your

money. There’s farther to go upward than you can go down

with this strategy, and you’ll have an adventure to boot.

"All investment is speculation. The only difference is that

some people admit it and some don’t."

- Gerald Loeb.

There’s no such thing as a risk free speculation. Calling it

an investment doesn’t change the facts - a gamble is still a

gamble. Put your money at risk. Don’t be afraid of getting

hurt a little.

Anda mungkin juga menyukai

- The Zurich Axioms 6Dokumen1 halamanThe Zurich Axioms 6ethernalxBelum ada peringkat

- The Zurich Axioms Notes and Summary - NovelinvestorDokumen8 halamanThe Zurich Axioms Notes and Summary - NovelinvestorDoğa KandemirBelum ada peringkat

- Psychology of Risk Taking: ContentsDokumen6 halamanPsychology of Risk Taking: ContentsMuhammet Fatih CantepeBelum ada peringkat

- The Zurich Axioms 7Dokumen1 halamanThe Zurich Axioms 7ethernalxBelum ada peringkat

- The Zurich Axioms 4Dokumen1 halamanThe Zurich Axioms 4ethernalxBelum ada peringkat

- Unit 3 Technical Analysis: The Visual ClueDokumen32 halamanUnit 3 Technical Analysis: The Visual ClueHarshk JainBelum ada peringkat

- The Zurich Axioms 5Dokumen1 halamanThe Zurich Axioms 5ethernalxBelum ada peringkat

- State Immunity, Human Rights, and Jus Cogens: A Critique of The Normative Hierarchy TheoryDokumen42 halamanState Immunity, Human Rights, and Jus Cogens: A Critique of The Normative Hierarchy TheoryUmberto TramontanoBelum ada peringkat

- Exercises For The Master Key: by Charles F. HaanelDokumen9 halamanExercises For The Master Key: by Charles F. HaanelPradeep Uday K UBelum ada peringkat

- High Frequency Trading Evolution and The FutureDokumen24 halamanHigh Frequency Trading Evolution and The FutureJoe ChungBelum ada peringkat

- Stock Trading: The New Gambling Addiction: How the Covid 19 pandemic aroused an addiction with dangerous consequences for the worldDari EverandStock Trading: The New Gambling Addiction: How the Covid 19 pandemic aroused an addiction with dangerous consequences for the worldBelum ada peringkat

- How to Trade ETF's Forex Futures and Stocks as a BeginnerDari EverandHow to Trade ETF's Forex Futures and Stocks as a BeginnerBelum ada peringkat

- PassarelliAdvancedTime Spreads - Webinar PDFDokumen19 halamanPassarelliAdvancedTime Spreads - Webinar PDFaasdadBelum ada peringkat

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningDari EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningBelum ada peringkat

- The Zurich Axioms 1Dokumen1 halamanThe Zurich Axioms 1ethernalxBelum ada peringkat

- Jesse Livermore 01Dokumen5 halamanJesse Livermore 01ehemBelum ada peringkat

- Pert Math Practice Test: Do NotDokumen5 halamanPert Math Practice Test: Do NotClifton JamisonBelum ada peringkat

- TGASDokumen107 halamanTGASznhtogexBelum ada peringkat

- CME - Option Box Spreads As A Financing ToolDokumen6 halamanCME - Option Box Spreads As A Financing ToolDavid TaylorBelum ada peringkat

- Permanence: 17th June 2013Dokumen5 halamanPermanence: 17th June 2013tony caputi100% (1)

- TurtleDokumen12 halamanTurtleanon-373190Belum ada peringkat

- Faber ReportDokumen43 halamanFaber ReportgrneBelum ada peringkat

- Casey ResearchDokumen3 halamanCasey ResearchsirjsslutBelum ada peringkat

- Bollinger Band Keltner Cheat SheetDokumen2 halamanBollinger Band Keltner Cheat SheetMian Umar RafiqBelum ada peringkat

- Fibonacci Sequence, Golden Section, Kalman Filter and Optimal ControlDokumen21 halamanFibonacci Sequence, Golden Section, Kalman Filter and Optimal ControlMun- KeshBelum ada peringkat

- Fibonacci FinalisedDokumen3 halamanFibonacci FinalisedNanditaBelum ada peringkat

- George Soros: How He Knows What He Knows: Part 2: Combining Theory and InstinctDokumen5 halamanGeorge Soros: How He Knows What He Knows: Part 2: Combining Theory and InstinctLavanya RamakrishnanBelum ada peringkat

- Science of GamblingDokumen21 halamanScience of GamblingZia Ul BasithBelum ada peringkat

- Velez PristineDokumen68 halamanVelez PristineMickBelum ada peringkat

- Trinity System - Theta Engine (Formerly 45+ DTE)Dokumen404 halamanTrinity System - Theta Engine (Formerly 45+ DTE)trungBelum ada peringkat

- Wiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Dokumen2 halamanWiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Rushikesh Inamdar100% (1)

- Commodity Trading CourseDokumen6 halamanCommodity Trading CourseApBelum ada peringkat

- Poker Without Cards by Ben MackDokumen357 halamanPoker Without Cards by Ben Mackjorgeblotta3489100% (1)

- Dan Zanger Trading MethodDokumen6 halamanDan Zanger Trading MethodNeeluBelum ada peringkat

- Heuristic Trading MelissaDokumen127 halamanHeuristic Trading Melissaapi-178368846100% (2)

- Straightforward To Gain Cash On The Internet Right Away!Dokumen7 halamanStraightforward To Gain Cash On The Internet Right Away!ster0514daBelum ada peringkat

- Down The Rabbit Hole - The Eurodollar Market Is The Matrix Behind It AllDokumen14 halamanDown The Rabbit Hole - The Eurodollar Market Is The Matrix Behind It AllAndyBelum ada peringkat

- Puerto Rico SRDokumen50 halamanPuerto Rico SREdmund Sullivan100% (1)

- Ssoc Manifest r3Dokumen481 halamanSsoc Manifest r3juanBelum ada peringkat

- An Anatomy of Trading Strategies: Jennifer ConradDokumen31 halamanAn Anatomy of Trading Strategies: Jennifer ConradRicardo NuñezBelum ada peringkat

- Dow TheoryDokumen5 halamanDow Theorysathishm85Belum ada peringkat

- Building A BankrollDokumen2 halamanBuilding A BankrollIvan IvanovBelum ada peringkat

- Crowded Trades and Short SellingDokumen40 halamanCrowded Trades and Short Sellinghenrychow14Belum ada peringkat

- A Profitable Hybrid Strategy For Binary Options: Luigi - Rosa@tiscali - ItDokumen11 halamanA Profitable Hybrid Strategy For Binary Options: Luigi - Rosa@tiscali - Ityogesh85100% (1)

- The 5 Basic Plays of Trading Options VS2Dokumen18 halamanThe 5 Basic Plays of Trading Options VS2Piet AardseBelum ada peringkat

- TheWireTop100 2011Dokumen2 halamanTheWireTop100 2011B_U_C_KBelum ada peringkat

- Money and EducationDokumen4 halamanMoney and EducationtamirisaarBelum ada peringkat

- It's in The CardsDokumen2 halamanIt's in The CardsJohn HernandezBelum ada peringkat

- Caleb Shooter PRO: Technical GuideDokumen18 halamanCaleb Shooter PRO: Technical GuideShivam G100% (1)

- Rich Dad Poor DAD: Interpretation by Monil NisarDokumen20 halamanRich Dad Poor DAD: Interpretation by Monil Nisarshethiren8832Belum ada peringkat

- A Theory of Inefficient Markets 2Dokumen7 halamanA Theory of Inefficient Markets 2TraderCat SolarisBelum ada peringkat

- Who Gambles in The Stock MarketDokumen45 halamanWho Gambles in The Stock MarketDebBelum ada peringkat

- Book ListDokumen10 halamanBook Listdj1284Belum ada peringkat

- Elliott Wave Simplified Making Stock Market Profits With RN Elliotts Simple Theory1Dokumen10 halamanElliott Wave Simplified Making Stock Market Profits With RN Elliotts Simple Theory1satish sBelum ada peringkat

- Suspect Trends by L.A. Little - Sacred TradersDokumen6 halamanSuspect Trends by L.A. Little - Sacred TradersDave Wain100% (1)

- Merrill Oster - 76 Rules of Millionaire Traders (2002)Dokumen78 halamanMerrill Oster - 76 Rules of Millionaire Traders (2002)Carlos Galvan100% (1)

- The Zurich AxiomsDokumen3 halamanThe Zurich AxiomsABUBAKARBelum ada peringkat

- The Zurich Axioms (Review and Analysis of Gunther's Book)Dari EverandThe Zurich Axioms (Review and Analysis of Gunther's Book)Belum ada peringkat

- The Zurich AxiomsDokumen8 halamanThe Zurich Axiomsethernalx100% (1)

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDokumen6 halamanManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoBelum ada peringkat

- Licensing of Credit Reference BureauDokumen4 halamanLicensing of Credit Reference BureauKofikoduahBelum ada peringkat

- Lecture 9 TVM (Practical Applications)Dokumen22 halamanLecture 9 TVM (Practical Applications)Devyansh GuptaBelum ada peringkat

- RFQ - M40 Milton Tactical Boots PDFDokumen19 halamanRFQ - M40 Milton Tactical Boots PDFSkhumbuzo Macinga0% (1)

- Winding Up of A CompanyDokumen126 halamanWinding Up of A CompanyYogesh Mehta0% (1)

- EPASSDokumen5 halamanEPASSHariPonnanaBelum ada peringkat

- Consignment Tutorial and Review Questions Question OneDokumen6 halamanConsignment Tutorial and Review Questions Question OneCristian RenatusBelum ada peringkat

- S3 The PTH of A Finaal MoDokumen18 halamanS3 The PTH of A Finaal Mosuhasshinde88Belum ada peringkat

- A Study On The Financial Awareness Among Women Entrepreneurs in Kottayam DistrictDokumen6 halamanA Study On The Financial Awareness Among Women Entrepreneurs in Kottayam Districtprashanthi EBelum ada peringkat

- Solution Manual For Business Ethics 013142792xDokumen10 halamanSolution Manual For Business Ethics 013142792xJamesNewmanjxag100% (38)

- Keenan V Eshleman (Pagcaliwagan)Dokumen2 halamanKeenan V Eshleman (Pagcaliwagan)AlexandraSoledadBelum ada peringkat

- SBR NoteDokumen27 halamanSBR Notejeewen thienBelum ada peringkat

- 12 Economic Lyp 2016 Delhi Set2 PDFDokumen20 halaman12 Economic Lyp 2016 Delhi Set2 PDFAshish GangwalBelum ada peringkat

- Business Mathematics: For LearnersDokumen13 halamanBusiness Mathematics: For LearnersJet Rollorata BacangBelum ada peringkat

- AFN0005Dokumen4 halamanAFN0005AiDLoBelum ada peringkat

- Budget Circular 2011-12: Government of IndiaDokumen87 halamanBudget Circular 2011-12: Government of IndiaShravan KondapakaBelum ada peringkat

- Primary Objective (RA 11211) : Salient AmendmentsDokumen25 halamanPrimary Objective (RA 11211) : Salient AmendmentsSam OneBelum ada peringkat

- Confirmation PDFDokumen4 halamanConfirmation PDFAnonymous Oe0eyXyWEBelum ada peringkat

- Mergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureDokumen24 halamanMergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureImran AliBelum ada peringkat

- BER310 Practice Sem Test MemorandumDokumen3 halamanBER310 Practice Sem Test MemorandumCailin Van RoooyenBelum ada peringkat

- SK Order SkitDokumen4 halamanSK Order SkitML.TumagayBelum ada peringkat

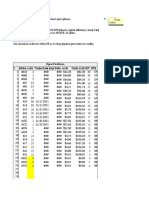

- Company XYZ: Order ID Order Date City Delivery Mode Order ValueDokumen45 halamanCompany XYZ: Order ID Order Date City Delivery Mode Order ValueEyad Ibtisam JarifBelum ada peringkat

- HQ - Sat - 13.03.21 - QuizDokumen2 halamanHQ - Sat - 13.03.21 - QuizArthasBelum ada peringkat

- Sirisha 1234 PDFDokumen54 halamanSirisha 1234 PDFAMAR NATHBelum ada peringkat

- Initiating Coverage On JP Associates LTDDokumen23 halamanInitiating Coverage On JP Associates LTDVarun YadavBelum ada peringkat

- Fundamental & Technical Analysis of 5 Companies of Oil & Gas SectorDokumen69 halamanFundamental & Technical Analysis of 5 Companies of Oil & Gas SectorAtul Barekar100% (2)

- Spouses Charito M. Reyes and Roberto Reyes vs. Heirs of Benjamin Malance GR No. 219071 August 24, 2016 FactsDokumen4 halamanSpouses Charito M. Reyes and Roberto Reyes vs. Heirs of Benjamin Malance GR No. 219071 August 24, 2016 FactsdenBelum ada peringkat

- A Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDokumen72 halamanA Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDiva U SBelum ada peringkat

- Agreed Motion For Extension of Time, 02-21-13Dokumen3 halamanAgreed Motion For Extension of Time, 02-21-13Neil GillespieBelum ada peringkat

- ACFM - Outline - Semester 7 - 2020-21Dokumen6 halamanACFM - Outline - Semester 7 - 2020-21Nishit KalawadiaBelum ada peringkat