2019 ATAF Tax Audit Exam

Diunggah oleh

Wilson CostaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2019 ATAF Tax Audit Exam

Diunggah oleh

Wilson CostaHak Cipta:

Format Tersedia

The African Tax Administration Forum (ATAF)

Online Course on Introduction to Tax Audit

2019 Written Exam

Part 1: Multiple Choice – 40 marks (compulsory)

Part 2: discussive and computational – 60 mark(compulsory)

The final assessment for this course consists of two parts, Multiple choice, discussion and computation

questions.All questions are therefore compulsory:

A final result of 50% or more for the combined result of multiple choice and the written assignment is

required in order to obtain a certificate of completion.

The final assignment will require students to apply the knowledge they have acquired throughout the

course. A final result of 50% or more for the final exam is required in order to obtain a certificate of

completion.

Please make use of the Online Course Portal to submit the Assignment,

Please refer to the exam guide for instructions.

Instructions: Please read carefully and answer all Questions

2019 TAO EXAM

Section B – (3) discussion and (1) computational questions (15 marks each)

Question 1 – 15 marks

State and briefly discuss at least five challenges that an auditor may come across in the

course of auditing Small Medium Enterprises.

Question 2 – 15 marks

Before the audit begins, the auditor should notify the taxpayer about the planned audit and

make an appointment for an entry meeting which comprise various members. Identify whom

and explain why the entry meeting should so constitute.

Question 3 – 15 marks

Briefly discuss the importance of pre-audit analysis in relation to Auditor’s planning process

Question 4 – 15 marks

Following the start of the audit cycle at the Kenya Revenue Authority, You have been selected

to conduct a tax audit on Strong fabrics limited. The company owned by Mr. Paul Owino a rich

business man with the business located in the prime area of Westlands in Nairobi, Kenya. Mr.

Paul started business on 1st June 2012, and registered for taxes with the Kenya Revenue

Authority. At the start of 2015, Paul acquired and registered with the tax body, a state of the

art pickup to use equally for both personal and business work from operational cash flows

worthy 6 million Kshs.

Through a risk based computer aided analysis, his company has been recently selected for

audit. As the team leader, your audit supervisor has assigned you the case responsibility.

Strong fabrics mainly deals in purchase, colouring and tailoring of cotton fabric into high end

African design clothing dressing from Dubai. He has had a stable supplier at 2600ksh per

meter.

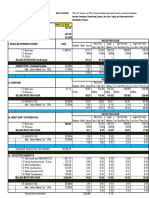

Below are Strong Fabrics Limited’s extracts of Profit and Loss Account for 2 years 2014 and

2015:

2014 2015

Revenue from Garments sale 5,500,000.00 6,900,000.00

Material utilized (COS) 3,900,000.00 5,970,000.00

Gross Profit 1,600,000.00 930,000.00

Expenses

utilities (500,000.00) (600,000.00)

staff costs (250,000.00) (180,000.00)

rent (100,000.00) (150,000.00)

2019 TAO EXAM

Stock wastes cost (850,000.00) (100,000.00)

Depreciation on Pick up (1,500,000.00)

Net profit/(loss) (100,000)

Part A: Identify the six likely risks detected by the system

- Changes in gross profit not consistent

- Staff costs drop when materials and revenue is increasing

- Percentage of stock costs in 2014

- Reduction in stock wastage

- Consistent losses when acquiring assets

- Change in materials utilised not similar to changes in revenue

- Depreciation of motor vehicle

(Max 6 points)

At the Start of 2016, January, Paul got a loan of 40 million Kenya Shillings, Using 15 million

for his home and 25m for the purchase of textile dying and colour toning equipment. He started

making loan repayments that month.

Below is an extract of his Income statement for the year ending December 2016

2016

Revenue from Garments sale 10,500,000.00

Material utilized (COS) (7,900,000.00)

Gross Profit 2,600,000.00

Expenses

utilities (600,000.00)

staff costs (180,000.00)

rent (150,000.00)

Depreciation on Pick up (1,500,000.00)

Interest on loan (2,500,000.00)

Net profit/(loss) (2,330,000.00)

Notes:

During audit you discover the following:

1. Paul imported 3500 metres of fabric at his consistent price. Of each metre, he requires 1.5

metres to make a dress and 0.9 metres to make a shirt. He made 1200 dresses and 1800

shirts on order. During the year each shirt sold for 3000 kshs while dresses were sold at 6500

kshs each. All dresses and shirts are made on order and payment is made fully before work

starts. Some clients have paid in advance worth 1.45 million kshs.

2019 TAO EXAM

2. No material losses of material is made. Paul has declared an opening stock of 100 metres

and a closing stock of 600 metres which was verified by the customs officials during a post

importation audit.

Part B: Was Mr. Paul's declaration correct? If not, recalculate his taxable income for 2016.

No (1 mark)

2016

Revenue from Garments sale 13,200,000.00

Material utilized (7,800,000.00)

Gross Profit 5,402,016

Expenses

utilities (600,000.00)

staff costs (180,000.00)

rent (150,000.00)

Depreciation on Pick up (750,000.00)

(1500,000/2

Interest on loan (1,562,500.00)

(2.5/4)* 2,500,000

Net profit/(loss) (1,409,516.00)

(7 marks max)

2019 TAO EXAM

Anda mungkin juga menyukai

- Concise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewDokumen659 halamanConcise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewPhương TạBelum ada peringkat

- Sneaker 2013Dokumen6 halamanSneaker 2013Shivam Bose67% (3)

- Day 1Dokumen11 halamanDay 1Abdullah EjazBelum ada peringkat

- The Finance Director of Stenigot Is Concerned About The LaxDokumen1 halamanThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyBelum ada peringkat

- Mock f6 Dec19Dokumen11 halamanMock f6 Dec19Abdul Waheed100% (1)

- Assignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Dokumen8 halamanAssignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Chris NdlovuBelum ada peringkat

- Outsourcing and Competition LawDokumen6 halamanOutsourcing and Competition LawAlvin Rejano TanBelum ada peringkat

- Financial Ratio Analysis ReportDokumen8 halamanFinancial Ratio Analysis ReportJeff AtuaBelum ada peringkat

- Income Statement SimDokumen5 halamanIncome Statement Simjustwon100% (1)

- Government Regulation 24/2012Dokumen14 halamanGovernment Regulation 24/2012Adria SaputeroBelum ada peringkat

- DebitCreditAnalysisComparesAccountsYear"TITLE "CashflowStatementAnalyzesPrimeSportsGearCashFlows2013" TITLE "RatioAnalysisComparesGlobalTechFinancialsSalesProfit201213Dokumen7 halamanDebitCreditAnalysisComparesAccountsYear"TITLE "CashflowStatementAnalyzesPrimeSportsGearCashFlows2013" TITLE "RatioAnalysisComparesGlobalTechFinancialsSalesProfit201213shineneigh00Belum ada peringkat

- A Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified PersonsDokumen26 halamanA Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified Personstere1330Belum ada peringkat

- Unit 2: Accounting Concepts and Trial BalanceDokumen12 halamanUnit 2: Accounting Concepts and Trial Balanceyaivna gopeeBelum ada peringkat

- Gilgit Baltistan System of Financial Control 2009Dokumen55 halamanGilgit Baltistan System of Financial Control 2009Muhammad ShakirBelum ada peringkat

- Municipal AccountingDokumen46 halamanMunicipal AccountingMarius BuysBelum ada peringkat

- AIM Business School - GSB013 Economics for Managers Report on the Australian Tourism IndustryDokumen15 halamanAIM Business School - GSB013 Economics for Managers Report on the Australian Tourism IndustryIsabel WoodsBelum ada peringkat

- ASSIGNMENT LAW 2 (TASK 1) (2) BBBDokumen4 halamanASSIGNMENT LAW 2 (TASK 1) (2) BBBChong Kai MingBelum ada peringkat

- FMV of Equity Shares As On 31st January 2018Dokumen57 halamanFMV of Equity Shares As On 31st January 2018Manish Maheshwari100% (2)

- Air BNB Business AnalysisDokumen40 halamanAir BNB Business AnalysisAdolf NAibaho100% (1)

- Grade 7 Examiner Recruitment FormDokumen2 halamanGrade 7 Examiner Recruitment FormaddyBelum ada peringkat

- Auditing and Investigations R.K 05-05-2006 DR MaunguDokumen347 halamanAuditing and Investigations R.K 05-05-2006 DR MaunguWinny Shiru Machira100% (2)

- Taxation 2 - 100 Marks ModuleDokumen3 halamanTaxation 2 - 100 Marks ModulenurulaminBelum ada peringkat

- Sched - Charge Meezan BankDokumen14 halamanSched - Charge Meezan BanksalllllBelum ada peringkat

- Microfinance's Impact on Agricultural ProductionDokumen19 halamanMicrofinance's Impact on Agricultural ProductionRisman SudarmajiBelum ada peringkat

- Administration Problems of VAT in Assela TownDokumen39 halamanAdministration Problems of VAT in Assela Townmubarek oumerBelum ada peringkat

- TAXATION MOCKDokumen12 halamanTAXATION MOCKPhán Tiêu Tiền100% (1)

- ch03 Part10Dokumen6 halamanch03 Part10Sergio HoffmanBelum ada peringkat

- Tax Group Report FinalDokumen45 halamanTax Group Report Finalapi-287792579Belum ada peringkat

- History of Taxation in EthiopiaDokumen6 halamanHistory of Taxation in EthiopiaEdlamu Alemie100% (1)

- Ali Yusuf 201201237 Report 1Dokumen21 halamanAli Yusuf 201201237 Report 1api-287792579Belum ada peringkat

- 02 QuestionsDokumen3 halaman02 QuestionsLt Gabriel100% (1)

- An Empirical Analysis of The Effect of FDokumen21 halamanAn Empirical Analysis of The Effect of FDavidBelum ada peringkat

- Sol 3 CH 6Dokumen46 halamanSol 3 CH 6Aditya KrishnaBelum ada peringkat

- Marime Chiedza Financial ReportingDokumen15 halamanMarime Chiedza Financial Reportingchiedza MarimeBelum ada peringkat

- CHAPTER 2 Joint VentureDokumen5 halamanCHAPTER 2 Joint VentureAkkamaBelum ada peringkat

- What A Marketing Assistant Is Offered at Lureen: (Using TRM)Dokumen12 halamanWhat A Marketing Assistant Is Offered at Lureen: (Using TRM)api-287792579Belum ada peringkat

- Fees StructureDokumen1 halamanFees StructureEvans Kipyego100% (1)

- DRC VAT Training CAs Day 1-2Dokumen40 halamanDRC VAT Training CAs Day 1-2iftekharul alam100% (1)

- Genene Tadesse D. HundeDokumen65 halamanGenene Tadesse D. HundeGadaa TDhBelum ada peringkat

- FinanceDokumen20 halamanFinancedua100% (1)

- From Crisis To Financial Stability Turkey Experience 3rd EdDokumen98 halamanFrom Crisis To Financial Stability Turkey Experience 3rd Edsuhail.rizwanBelum ada peringkat

- Tanzania Tax Guide 2016/2017Dokumen22 halamanTanzania Tax Guide 2016/2017Timothy Rogatus67% (3)

- Unit 1 EntrepreneurshipDokumen30 halamanUnit 1 EntrepreneurshipASHISH ABelum ada peringkat

- Assignment 1Dokumen7 halamanAssignment 1Dat DoanBelum ada peringkat

- NATIONAL INCOME ACCOUNTING - Lecture 1Dokumen4 halamanNATIONAL INCOME ACCOUNTING - Lecture 1ERICK MLINGWABelum ada peringkat

- International Investment AppraisalDokumen6 halamanInternational Investment AppraisalZeeshan Jafri100% (1)

- Implicit Taxes Arbitrage Restrictions and FrictionsDokumen33 halamanImplicit Taxes Arbitrage Restrictions and FrictionsDownloadBelum ada peringkat

- Financial Forecasting: Pro Forma Statements Using Percent-of-SalesDokumen3 halamanFinancial Forecasting: Pro Forma Statements Using Percent-of-SalesMikie AbrigoBelum ada peringkat

- Income Tax (B.com Ii)Dokumen9 halamanIncome Tax (B.com Ii)iramanwarBelum ada peringkat

- Task 8Dokumen23 halamanTask 8Anooja SajeevBelum ada peringkat

- Life Cycle CostingDokumen8 halamanLife Cycle CostingAmit GuptaBelum ada peringkat

- Apt CWDokumen10 halamanApt CWFAIZ muhammadBelum ada peringkat

- An Introductory Guide To The Bribery Act: A Growing FirmDokumen12 halamanAn Introductory Guide To The Bribery Act: A Growing Firmapi-86979083Belum ada peringkat

- Fainal Paper - MekashuDokumen54 halamanFainal Paper - Mekashubereket nigussieBelum ada peringkat

- Zica Accountancy Programme: Macro Economics (Zica) AccountingDokumen163 halamanZica Accountancy Programme: Macro Economics (Zica) AccountingAmir MirBelum ada peringkat

- Performance Prism 200302 - 14Dokumen4 halamanPerformance Prism 200302 - 14rajad2010Belum ada peringkat

- Solution Manual For Government and Not For Profit Accounting Concepts and Practices 5th Edition by GranofDokumen13 halamanSolution Manual For Government and Not For Profit Accounting Concepts and Practices 5th Edition by Granofa658506100Belum ada peringkat

- Summit Alliance Port Limited is the largest Off-dock service company in BangladeshDokumen15 halamanSummit Alliance Port Limited is the largest Off-dock service company in BangladeshAnik DeyBelum ada peringkat

- ITS-UK Organisational ReviewDokumen10 halamanITS-UK Organisational ReviewNamita Goburdhan0% (1)

- IAS 21 Foreign Currency Translation for Tanzanian Company with Zambian BranchDokumen12 halamanIAS 21 Foreign Currency Translation for Tanzanian Company with Zambian BranchNicole TaylorBelum ada peringkat

- Acc 451 (Accounting Systems & Controls)Dokumen20 halamanAcc 451 (Accounting Systems & Controls)Naveed Karim Baksh100% (1)

- Petron Corporation Vertical Analysis of Balance Sheet RatiosDokumen2 halamanPetron Corporation Vertical Analysis of Balance Sheet RatiosMeyBelum ada peringkat

- Intro To Macroeconomics and GDP Problem Set Answer KeyDokumen5 halamanIntro To Macroeconomics and GDP Problem Set Answer KeySid JhaBelum ada peringkat

- Afar (2018-2022)Dokumen49 halamanAfar (2018-2022)Princess KeithBelum ada peringkat

- 07 Bim PXP Guide-V2.0Dokumen126 halaman07 Bim PXP Guide-V2.0Felix Maurelio Canchari MallquiBelum ada peringkat

- MCI BrochureDokumen7 halamanMCI BrochureAndrzej M KotasBelum ada peringkat

- Oxford Said MBA Brochure 2017 18 PDFDokumen13 halamanOxford Said MBA Brochure 2017 18 PDFEducación ContinuaBelum ada peringkat

- Model Trading Standard ExplainedDokumen12 halamanModel Trading Standard ExplainedVinca Grace SihombingBelum ada peringkat

- Union BankDokumen7 halamanUnion BankChoice MyBelum ada peringkat

- Ofada Rice ProductionDokumen97 halamanOfada Rice ProductionPrince Oludare AkintolaBelum ada peringkat

- Commercial Lease AgreementDokumen4 halamanCommercial Lease AgreementRajesh KhetanBelum ada peringkat

- North America Equity ResearchDokumen8 halamanNorth America Equity ResearchshamashmBelum ada peringkat

- Marketing Management Chapter on Introducing New Market OfferingsDokumen24 halamanMarketing Management Chapter on Introducing New Market OfferingslokioBelum ada peringkat

- Hotels 2020 - Responding To Tomorrow's Customer and The Evolution of TechnologyDokumen12 halamanHotels 2020 - Responding To Tomorrow's Customer and The Evolution of TechnologyHetalMehtaBelum ada peringkat

- BLGF Opinion March 17 2011Dokumen7 halamanBLGF Opinion March 17 2011mynet_peterBelum ada peringkat

- My Dream Company: Why Join ITC Limited (Under 40 charsDokumen9 halamanMy Dream Company: Why Join ITC Limited (Under 40 charsamandeep152Belum ada peringkat

- Ikea 6Dokumen39 halamanIkea 6My PhamBelum ada peringkat

- QuestionsDokumen3 halamanQuestionsLayla RamirezBelum ada peringkat

- Sarah Williams CVDokumen2 halamanSarah Williams CVsarahcwilliamsBelum ada peringkat

- 1.1 Introduction To PartnershipDokumen5 halaman1.1 Introduction To PartnershipXyril MañagoBelum ada peringkat

- Average Due Date and Account CurrentDokumen80 halamanAverage Due Date and Account CurrentShynaBelum ada peringkat

- ENY MRGN 016388 31012024 NSE DERV REM SignDokumen1 halamanENY MRGN 016388 31012024 NSE DERV REM Signycharansai0Belum ada peringkat

- Security agency cost report for NCRDokumen25 halamanSecurity agency cost report for NCRRicardo DelacruzBelum ada peringkat

- Project Profile On Automobile WiresDokumen8 halamanProject Profile On Automobile WiresGirishBelum ada peringkat

- Recent Development of Digital Oil FieldDokumen23 halamanRecent Development of Digital Oil FieldMohit AgarwalBelum ada peringkat

- Big Football ManiaDokumen7 halamanBig Football ManiaSobhanBelum ada peringkat

- SSS Mandate and CoverageDokumen113 halamanSSS Mandate and CoverageYildrim Tulawie AmarajaBelum ada peringkat

- Agreement Form Undertaking Govt of IndiaDokumen9 halamanAgreement Form Undertaking Govt of IndiaPratik KulkarniBelum ada peringkat

- RAM Guide 080305Dokumen266 halamanRAM Guide 080305Ned H. CriscimagnaBelum ada peringkat

- Purchase Order: Pt. Prastiwahyu Tunas EngineeringDokumen1 halamanPurchase Order: Pt. Prastiwahyu Tunas EngineeringBowoBelum ada peringkat