Cotton Marketing News

Diunggah oleh

Brittany EtheridgeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cotton Marketing News

Diunggah oleh

Brittany EtheridgeHak Cipta:

Format Tersedia

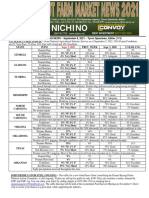

REPRESENTING COTTON GROWERS THROUGHOUT ALABAMA, FLORIDA, GEORGIA, NORTH CAROLINA, SOUTH CAROLINA, AND VIRGINIA

COTTON MARKETING NEWS

Volume 17, No. 8 June 18, 2019

201919

at 17 million bales. This compares to 14.75 million bales

Sponsored by projected for the 2018 marketing year.

World beginning stocks for the 2019 crop year were increased

due to supply and demand revisions for 2018.

Prices Rally From Recent New Low— 2019 World production was lowered slightly

But Show No Signs Yet of a Major Push Higher World Use was lowered 660,000 bales; 500,000 of that for China

Chinese imports for the 2019 crop year were lowered 500,000

New crop December futures have rallied from the recent new low bales

below 65 cents. December is currently at 66+ and likely to track Imports for Vietnam and Bangladesh were lowered 100,000

in the 65 to 68-69 cents range in the near term unless a major bales for each

unforeseen factor arises.

It seems to me that the current market (Dec19 futures in the mid-

60’s neighborhood) is based on a rather optimistic combination of

scenarios for the degree of uncertainty out there. But, I’ve been

wrong before. In addition to uncertainties about the US crop, the

USDA projection of 17 million in exports is a question mark given

the on-going US-China trade situation. Use must also stay strong.

US cotton export sales and shipments have been good. Shipments

as of June 6 totaled 11.5 million bales. To reach USDA’s projection

of 14.75 million bales for the 2018 marketing year ending July 31,

export shipments must average approximately 400,000 bales per

week. Shipments for the last 4 weeks reported have averaged

approximately 388,000 bales.

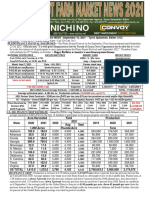

SOURCE: DTN, 06/18/2019 The 2019 crop has gotten off to a rough start for many producers.

Prices have tumbled and the planting and early season has been

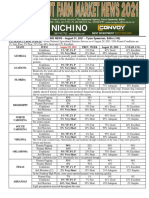

very challenging. We still wait on a resolution to the US-China

Prices previously had “support” at 66 cents and had rallied back to trade and tariff situation but we are starting to get information

over 68 cents before losing ground and eventually moving below and some details on disaster assistance (WHIP payments) and

65 cents last week. trade assistance (MFP payments). We also wait on ratification of

the USMCA (US-Mexico-Canada) trade agreement.

There are many production uncertainties as we look ahead:

The first USDA estimate of actual acres planted will be published All this causes uncertainty in cash flow for farm businesses.

on June 29. Given all the rain and delayed planting in the Mid- Questions still exist on how disaster assistance (WHIP) payments

South and the drought in the Southeast, will the June number will be determined. Likewise, there are questions on how MFP

capture the extent of prevented planting acres and shift to payments will be determined (on a per acre amount by county)

other crops? compared to last year when payments were made on a fixed per

The Southeast has finally received much needed rainfall. Has unit of production basis.

this rescued that portion of the crop that was at risk and will

conditions continue more favorable for the remainder of the The seed cotton PLC and ARC payments for the 2018 crop will be

season? received in October. Based on the final 2018 production estimates

Texas is an even bigger than normal wildcard. There are late and the currently projected 2018 market average prices, the seed

plantings, prevented planting acres, acres switched to other cotton PLC payment rate is currently projected to be 2.38 cents

crops, etc.—a mix of everything. per lb (36.7 reference price – 34.32 MYA price = 2.38 PLC rate).

USDA released its June crop production and supply/demand

estimates last week. I consider the numbers neutral to bearish. A

quick summary includes: Cotton Economist- Retired

US production for 2019 is unchanged from the May estimate at Professor Emeritus of Cotton Economics

22 million bales. This will very likely change with next month’s

report. Higher or lower is the big question.

Projected US exports for the 2019 crop marketing year remain

Anda mungkin juga menyukai

- Ground Investigation ReportDokumen49 halamanGround Investigation Reportjoemacx6624Belum ada peringkat

- Physioex Ex 7 AnswersDokumen5 halamanPhysioex Ex 7 AnswersTin-tinBelum ada peringkat

- Food Outlook: Biannual Report on Global Food Markets May 2019Dari EverandFood Outlook: Biannual Report on Global Food Markets May 2019Belum ada peringkat

- MR - Samaksh Jhalani Machinery-FinalDokumen45 halamanMR - Samaksh Jhalani Machinery-FinalSamaksh JhalaniBelum ada peringkat

- Cosmetic-Regulations, Research & Marketing Challenges and Global Compliance: An OverviewDokumen19 halamanCosmetic-Regulations, Research & Marketing Challenges and Global Compliance: An Overviewmaria sepulvedaBelum ada peringkat

- Roger Ghanem, David Higdon, Houman Owhadi (Eds.) - Handbook of Uncertainty Quantification-Springer International Publishing (2017)Dokumen2.035 halamanRoger Ghanem, David Higdon, Houman Owhadi (Eds.) - Handbook of Uncertainty Quantification-Springer International Publishing (2017)Jaime Andres Cerda Garrido100% (1)

- The Ayurvedic Vegan Kitchen PDFDokumen203 halamanThe Ayurvedic Vegan Kitchen PDFRuvaly MzBelum ada peringkat

- Interference Measurement SOP v1.2 Sum PDFDokumen26 halamanInterference Measurement SOP v1.2 Sum PDFTeofilo FloresBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- South America To Dominate SoybeansDokumen2 halamanSouth America To Dominate SoybeansSamyakBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen2 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDokumen1 halaman2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsMorgan IngramBelum ada peringkat

- Focus On Ag (3-18-19)Dokumen2 halamanFocus On Ag (3-18-19)FluenceMediaBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- All Nuts Market Report - May 2023 - FNL3Dokumen10 halamanAll Nuts Market Report - May 2023 - FNL3bonnetBelum ada peringkat

- Focus On Ag (6-18-18)Dokumen2 halamanFocus On Ag (6-18-18)FluenceMediaBelum ada peringkat

- Focus On Ag (7-16-18)Dokumen2 halamanFocus On Ag (7-16-18)FluenceMediaBelum ada peringkat

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankDokumen2 halamanFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankFluenceMediaBelum ada peringkat

- Oil Crops OutlookDokumen13 halamanOil Crops OutlookGrowing AmericaBelum ada peringkat

- 2 CMN12142020Dokumen1 halaman2 CMN12142020Morgan IngramBelum ada peringkat

- Commodities - MARKETS OUTLOOKDokumen8 halamanCommodities - MARKETS OUTLOOKMilling and Grain magazineBelum ada peringkat

- Cotton Marketing NewsDokumen2 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Focus v16 n8 FNLDokumen6 halamanFocus v16 n8 FNLrichardck61Belum ada peringkat

- Crop 1019Dokumen50 halamanCrop 1019Brittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Payments Update-FINAL-0311Dokumen6 halamanCotton Payments Update-FINAL-0311Brittany EtheridgeBelum ada peringkat

- Focus On Ag (8-19-19)Dokumen2 halamanFocus On Ag (8-19-19)FluenceMediaBelum ada peringkat

- Focus On Ag (5-18-20)Dokumen2 halamanFocus On Ag (5-18-20)FluenceMediaBelum ada peringkat

- World Agricultural Supply and Demand EstimatesDokumen40 halamanWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeBelum ada peringkat

- Focus On Ag (6-15-20)Dokumen2 halamanFocus On Ag (6-15-20)FluenceMediaBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsMorgan IngramBelum ada peringkat

- Second Wave Fears June 2020Dokumen14 halamanSecond Wave Fears June 2020Milena PasquinoBelum ada peringkat

- Cotton Marketing NewsDokumen2 halamanCotton Marketing NewsMorgan IngramBelum ada peringkat

- Focus On Ag (12-12-22)Dokumen3 halamanFocus On Ag (12-12-22)FluenceMediaBelum ada peringkat

- World Agricultural Supply and Demand EstimatesDokumen40 halamanWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeBelum ada peringkat

- PEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorDokumen1 halamanPEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorBrittany EtheridgeBelum ada peringkat

- PEANUT MARKETING NEWS - June 17, 2019 - Tyron Spearman, EditorDokumen1 halamanPEANUT MARKETING NEWS - June 17, 2019 - Tyron Spearman, EditorBrittany EtheridgeBelum ada peringkat

- Focus On Ag (11-18-19)Dokumen2 halamanFocus On Ag (11-18-19)FluenceMediaBelum ada peringkat

- Focus On Ag (3-12-18)Dokumen2 halamanFocus On Ag (3-12-18)FluenceMediaBelum ada peringkat

- Commodities - MARKETS OUTLOOKDokumen6 halamanCommodities - MARKETS OUTLOOKMilling and Grain magazineBelum ada peringkat

- Focus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionDokumen2 halamanFocus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionFluenceMediaBelum ada peringkat

- USDA Agricultural Demands ReportDokumen40 halamanUSDA Agricultural Demands ReportAustin DeneanBelum ada peringkat

- Feed Outlook: Corn Production Projections Raised, Barley and Oats Lowered For 2021/22Dokumen20 halamanFeed Outlook: Corn Production Projections Raised, Barley and Oats Lowered For 2021/22Brittany EtheridgeBelum ada peringkat

- Global Feed Markets: November - December 2013Dokumen8 halamanGlobal Feed Markets: November - December 2013Milling and Grain magazineBelum ada peringkat

- LatestDokumen40 halamanLatestPetrus Slamet Putra WijayaBelum ada peringkat

- PEANUT MARKETING NEWS - July 19, 2019 - Tyron Spearman, EditorDokumen1 halamanPEANUT MARKETING NEWS - July 19, 2019 - Tyron Spearman, EditorBrittany EtheridgeBelum ada peringkat

- Coffee: World Markets and Trade: 2020/21 Forecast OverviewDokumen9 halamanCoffee: World Markets and Trade: 2020/21 Forecast OverviewJauhar ArtBelum ada peringkat

- USGC Market Perspectives ReportDokumen14 halamanUSGC Market Perspectives Reportajdcavalcante78Belum ada peringkat

- World Agricultural Supply and Demand EstimatesDokumen40 halamanWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeBelum ada peringkat

- Focus On Ag (7-15-19)Dokumen2 halamanFocus On Ag (7-15-19)FluenceMediaBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsMorgan IngramBelum ada peringkat

- Market ReportDokumen3 halamanMarket Reportapi-311090769Belum ada peringkat

- Wheat Follow Up Sept 23Dokumen9 halamanWheat Follow Up Sept 23Leonardo IntriagoBelum ada peringkat

- Focus On Ag (1-18-21)Dokumen3 halamanFocus On Ag (1-18-21)FluenceMediaBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Short-Term Fertilizer Outlook 2019 - 2020: IFA Strategic ForumDokumen8 halamanShort-Term Fertilizer Outlook 2019 - 2020: IFA Strategic ForumccckakakBelum ada peringkat

- Food Outlook: Biannual Report on Global Food Markets July 2018Dari EverandFood Outlook: Biannual Report on Global Food Markets July 2018Belum ada peringkat

- Said Jeremy Mayes, General Manager For American Peanut Growers IngredientsDokumen1 halamanSaid Jeremy Mayes, General Manager For American Peanut Growers IngredientsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen2 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- October 17, 2021Dokumen1 halamanOctober 17, 2021Brittany EtheridgeBelum ada peringkat

- October 24, 2021Dokumen1 halamanOctober 24, 2021Brittany Etheridge100% (1)

- October 10, 2021Dokumen1 halamanOctober 10, 2021Brittany EtheridgeBelum ada peringkat

- Cotton Marketing NewsDokumen1 halamanCotton Marketing NewsBrittany EtheridgeBelum ada peringkat

- Dairy Market Report - September 2021Dokumen5 halamanDairy Market Report - September 2021Brittany EtheridgeBelum ada peringkat

- World Agricultural Supply and Demand EstimatesDokumen40 halamanWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeBelum ada peringkat

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Dokumen1 halamanU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeBelum ada peringkat

- 1,000 Acres Pounds/Acre TonsDokumen1 halaman1,000 Acres Pounds/Acre TonsBrittany EtheridgeBelum ada peringkat

- October 3, 2021Dokumen1 halamanOctober 3, 2021Brittany EtheridgeBelum ada peringkat

- Sept. 5, 2021Dokumen1 halamanSept. 5, 2021Brittany EtheridgeBelum ada peringkat

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDokumen1 halamanShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeBelum ada peringkat

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDokumen1 halaman2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeBelum ada peringkat

- Sept. 26, 2021Dokumen1 halamanSept. 26, 2021Brittany EtheridgeBelum ada peringkat

- Shelled MKT Price Weekly Prices: Same As Last WeekDokumen1 halamanShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeBelum ada peringkat

- NicholasDokumen1 halamanNicholasBrittany EtheridgeBelum ada peringkat

- Sept. 19, 2021Dokumen1 halamanSept. 19, 2021Brittany EtheridgeBelum ada peringkat

- YieldDokumen1 halamanYieldBrittany EtheridgeBelum ada peringkat

- Sept. 12, 2021Dokumen1 halamanSept. 12, 2021Brittany EtheridgeBelum ada peringkat

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Dokumen1 halamanExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeBelum ada peringkat

- World Agricultural Supply and Demand EstimatesDokumen40 halamanWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeBelum ada peringkat

- FPAC Honeybee Brochure August2021Dokumen4 halamanFPAC Honeybee Brochure August2021Brittany EtheridgeBelum ada peringkat

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDokumen1 halamanShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeBelum ada peringkat

- August 29, 2021Dokumen1 halamanAugust 29, 2021Brittany EtheridgeBelum ada peringkat

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDokumen1 halamanShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeBelum ada peringkat

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Dokumen1 halamanExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Brittany EtheridgeBelum ada peringkat

- August 22, 2021Dokumen1 halamanAugust 22, 2021Brittany EtheridgeBelum ada peringkat

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDokumen1 halamanShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeBelum ada peringkat

- As You Face Life: Pray To God and Ask His GuidanceDokumen11 halamanAs You Face Life: Pray To God and Ask His GuidancesophiegarciaBelum ada peringkat

- Class VII Half Yearly Maths, M.junaidDokumen4 halamanClass VII Half Yearly Maths, M.junaidmohd junaidBelum ada peringkat

- Elementary Graph Theory: Robin Truax March 2020Dokumen15 halamanElementary Graph Theory: Robin Truax March 2020Jefferson WidodoBelum ada peringkat

- The Book of JonahDokumen2 halamanThe Book of JonahJames Hampton BeltonBelum ada peringkat

- HVT DS HAEFELY RIC 422 Reference Impulse Calibrator V2004Dokumen4 halamanHVT DS HAEFELY RIC 422 Reference Impulse Calibrator V2004leivajBelum ada peringkat

- What Is MetaphysicsDokumen24 halamanWhat Is MetaphysicsDiane EnopiaBelum ada peringkat

- Module I: Introduction To Environmental PollutionDokumen14 halamanModule I: Introduction To Environmental PollutionAman John TuduBelum ada peringkat

- High Risk Neonatal Nursing CareDokumen40 halamanHigh Risk Neonatal Nursing Carecarol_cezar100% (2)

- Lesson 3.1 Algebraic TermsDokumen4 halamanLesson 3.1 Algebraic TermsCresencia Juliana DaluzBelum ada peringkat

- Broadway CafeDokumen13 halamanBroadway CafeIoana Taon100% (1)

- Our School Broke Up For The Winter VacationsDokumen7 halamanOur School Broke Up For The Winter VacationsprinceBelum ada peringkat

- Derivation of Gravity Loads PDFDokumen4 halamanDerivation of Gravity Loads PDFHenry TuganoBelum ada peringkat

- Subject: Using Emergency Power With DSD Elevator DrivesDokumen4 halamanSubject: Using Emergency Power With DSD Elevator DrivesmehariiBelum ada peringkat

- Interpretation of Results ReportingDokumen7 halamanInterpretation of Results ReportingMerill Harrelson LibanBelum ada peringkat

- Bhsa Inggris'Dokumen5 halamanBhsa Inggris'Dwi NovianaBelum ada peringkat

- CO3053 - Lecture 1 - What Is Embedded SystemDokumen21 halamanCO3053 - Lecture 1 - What Is Embedded SystemKhánh Tôn Thất PhúcBelum ada peringkat

- Criteria For Decorative Cosmetics PDFDokumen3 halamanCriteria For Decorative Cosmetics PDFsamudra540Belum ada peringkat

- Jeppview For Windows: List of Pages in This Trip KitDokumen12 halamanJeppview For Windows: List of Pages in This Trip KitNguyen MinhBelum ada peringkat

- Squad3.fire NSD GPMDokumen7 halamanSquad3.fire NSD GPMMac CorpuzBelum ada peringkat

- Physics Assessment 1 - Lab Report: Jessica Yam Year 10 Peace MR - SlosbergDokumen19 halamanPhysics Assessment 1 - Lab Report: Jessica Yam Year 10 Peace MR - Slosbergapi-36149866550% (2)

- Origami - Playing CardsDokumen6 halamanOrigami - Playing Cardsapi-3709851Belum ada peringkat

- Animal Cells PDFDokumen4 halamanAnimal Cells PDFFalah HabibBelum ada peringkat