Fiscal Policy 2018/2019

Diunggah oleh

Ashim Acharya0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

7 tayangan3 halamanFiscal Policy of Nepal Review 2018/19

Judul Asli

Fiscal Policy

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniFiscal Policy of Nepal Review 2018/19

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

7 tayangan3 halamanFiscal Policy 2018/2019

Diunggah oleh

Ashim AcharyaFiscal Policy of Nepal Review 2018/19

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

Fiscal Policy 2018/2019

• Have enhanced access to finance.

Amendment of Nepal Rastra Bank Act, Insurance Act, Securities Act

• Launch a campaign to open bank accounts.

• Connection of Micro Finance Institutions and Cooperatives with Credit Information Centre.

Loans without collateral like foreign employment loan, loan for educated but unemployed,

education loan will be covered.

Defaulters will be prevented from receiving any citizenry facilities

• Government had planned to collaborate with cooperatives and the private sector to make effective

utilization of available capital, skills and capacity

• Loan (on collective guarantee) of up to Rs. 1 million at 5 percent interest subsidy will be provided

for each Dalit community.

By integrating to run business through cooperatives.

Provisioned budget for modernizing and promoting traditional skills and occupation.

• Specified grants will be provided to those industries that rely on agricultural raw materials to

produce raw material they need.

• Allocated the budget for agriculture research centers, agriculture cooperatives and agriculture

campuses

To encourage research and study focused on development of agriculture and animal husbandry.

• Allocated budget for 25 percent subsidy for the acquisition of necessary equipment for milk,

meat, fruit and vegetable processing industries operating through cooperatives.

• Arranged production-based grants to sugarcane farmers, production grants for silk, cotton and

wool farming through cooperatives and 25 percent capital grant for the establishment of

processing industries.

• Factories producing organic fertilizers, chemical fertilizers, pesticides and agriculture equipment

will be established in order to facilitate supply of agricultural inputs in collaboration with

cooperatives and the private sector.

• Seed companies will be enhanced to certify the seed quality and manage the supply system.

• Agriculture cooperatives will be encouraged to produce seeds.

• Herbal and forest-based industries will be established in partnership with public, private,

cooperative and communities.

• Provisioned grant for the purchase of equipment and establishment of export-oriented industries

using forest-based raw materials.

• Arrangements will be made to operate closed and sick industries in the collaboration with the

private sector and cooperatives on the basis of their respective potentialities.

• Arrangements will be made to establish low-price-shops through cooperative organizations in the

local level.

• Wholesale shops will be established for consumable items to be purchased by cooperative shops.

• Arranged subsidies for getting basic food grains at lower price for the citizens holding national

security identity card.

Monetary Policy 2018/2019

• In order to ensure easy access of all citizens to financial services, priority will be given to

financial inclusion and financial literacy and the use of technology in payment system will be

encouraged

• A provision will be made to widen the scope of the deprived sector credit by including the loan

under the mortgage of educational certificates, loans extended to the deprived and marginalized

sections of the society and students of target group for higher as well as technical and

professional education, and loans provided to Dalit communities for operating businesses under

group guarantee. GoN has provisioned 5 percent interest subsidy on such loans.

• The existing policy for opening branches of the BFIs will be revised to make the banking

services further simplified and accessible. Provision will be made for the BFIs to open branches

without pre-approval of this bank in areas outside the metropolitan and sub-metropolitan cities.

• In order to ensure easy access of all citizens to financial services, priority will be given to

financial inclusion and financial literacy and the use of technology in payment system will be

encouraged

• A provision will be made to widen the scope of the deprived sector credit by including the loan

under the mortgage of educational certificates, loans extended to the deprived and marginalized

sections of the society and students of target group for higher as well as technical and

professional education, and loans provided to Dalit communities for operating businesses under

group guarantee. GoN has provisioned 5 percent interest subsidy on such loans.

• The existing policy for opening branches of the BFIs will be revised to make the banking

services further simplified and accessible. Provision will be made for the BFIs to open branches

without pre-approval of this bank in areas outside the metropolitan and sub-metropolitan cities.

• In the context of supporting the implementation of federalism through financial access and

inclusion, a provision will be made for financial institutions, except operating at the national

level, to adjust their area of operations in line with provincial structure. This is expected to

expand financial access and inclusion.

• A directive was issued requiring commercial banks to open branches in 243 local levels by mid-

May 2018 and additional 116 local levels by mid-July 2018. A relaxation has been made whereby

banks are not required to maintain the CRR and SLR ratios based on the deposit liabilities of

those branches for the next three years.

Provisions for Micro-finance institutions

• Microfinance institutions will also be allowed to mobilize external borrowing up to 25 percent of

their core capital. This is expected to facilitate these institutions in resource mobilization and cost

management

• A policy provision will be made to provide license of payment service provider to the

microfinance institutions. Organizational capacity, number of customers, branch network, capital

and physical infrastructure will be taken as a basis for providing such license.

• Microfinance institutions will be required to compulsorily register in the network of Credit

Information Bureau (CIB). An additional loan loss provision of 2 percentage points will be made

on the loans that are not reported to the CIB.

• Necessary provision will be made to avoid the duplicity regarding the use of credit and other

services from Poverty Alleviation Fund, Rural Self Reliance Fund and Youth Self-Employment

Fund.

• Provision regarding the single obligor limit will be made for the loans extended on the basis of

group guarantee from micro finance institutions.

• The policy of deferring the license to the microfinance institutions has been kept unchanged.

• Necessary policy will be formulated regarding the merger and acquisition of the microfinance

institutions among themselves.

• Provision will be made for offices of the micro finance institutions operating at the village

councils for extending loans up to Rs. 1 million to the persons on group or individual guarantee

for operating micro enterprises by taking acceptable mortgages.

• Provision will be made to record the transaction between the parent company and the micro

finance institution established as a subsidiary of the parent company under related party

transactions.

• Provision will be made for the microfinance institutions allowing them to determine the lending

rate by adding 6 percentage points to their cost of funds in addition to their administrative cost.

Anda mungkin juga menyukai

- Budget Analysis 2023Dokumen27 halamanBudget Analysis 2023Vivek SinghBelum ada peringkat

- A Presentation On: Micro Finance InstitutionsDokumen23 halamanA Presentation On: Micro Finance InstitutionsrhythmivBelum ada peringkat

- KCC ProjectDokumen75 halamanKCC ProjectRoopes Rs40% (5)

- Credit Facilities Offered by NABARDDokumen4 halamanCredit Facilities Offered by NABARDsparsh yadavBelum ada peringkat

- Rural Finance Reform ProposalsDokumen41 halamanRural Finance Reform ProposalsAshma kayaniBelum ada peringkat

- Concepts Bike and CarDokumen4 halamanConcepts Bike and CarVinay SheelBelum ada peringkat

- Kisan Credit CardDokumen9 halamanKisan Credit CardVikas ChinnappaBelum ada peringkat

- CommitteeDokumen6 halamanCommitteeSwagatika RathBelum ada peringkat

- Agriculture Credit OverviewDokumen6 halamanAgriculture Credit OverviewSoumalya ChakrabartiBelum ada peringkat

- Scheme Guidelines - As Per New Modified Guidelines OM. Dt. 18th May 2022Dokumen7 halamanScheme Guidelines - As Per New Modified Guidelines OM. Dt. 18th May 2022Prakriti Environment SocietyBelum ada peringkat

- Gramin Bhandaran Yojana/Rural Godown SchemeDokumen22 halamanGramin Bhandaran Yojana/Rural Godown SchememadhusudhansBelum ada peringkat

- ZTBL case study analysisDokumen55 halamanZTBL case study analysism_abubakrBelum ada peringkat

- MicrofinanceDokumen9 halamanMicrofinancesmartwebs100% (1)

- Financing and Developing PACSDokumen3 halamanFinancing and Developing PACSSadaf KushBelum ada peringkat

- Ebook Schemes Ministry of Social Justice and Empowerment Lyst4427Dokumen6 halamanEbook Schemes Ministry of Social Justice and Empowerment Lyst4427exp expoBelum ada peringkat

- scheme govtDokumen64 halamanscheme govtharshitaBelum ada peringkat

- NABARDDokumen40 halamanNABARDJesse LarsenBelum ada peringkat

- Term PaperDokumen8 halamanTerm PaperAce Hulsey TevesBelum ada peringkat

- SHG, Dairy HorticultureDokumen52 halamanSHG, Dairy HorticulturedsdfBelum ada peringkat

- Microfinanc E: Iobm PakistanDokumen44 halamanMicrofinanc E: Iobm Pakistanfujimukazu100% (1)

- Financial SchemesDokumen29 halamanFinancial SchemesVamsi KrishnaBelum ada peringkat

- Need For MicrofinanceDokumen52 halamanNeed For MicrofinancePrasad KumarBelum ada peringkat

- Microfinanc E: By: Fariha & ArsalanDokumen44 halamanMicrofinanc E: By: Fariha & ArsalanSushil KarnaBelum ada peringkat

- Nabard Rural GodownDokumen33 halamanNabard Rural Godownvenkatesh996667% (3)

- 13 - Conclusion and SuggestionsDokumen4 halaman13 - Conclusion and SuggestionsjothiBelum ada peringkat

- SHG Linkage: A) B) C) D)Dokumen2 halamanSHG Linkage: A) B) C) D)Ankit SinghBelum ada peringkat

- Agri Fishery Credit Programs PDFDokumen24 halamanAgri Fishery Credit Programs PDFMark Jerome Belarmino100% (1)

- Micro FinanceDokumen36 halamanMicro FinanceWan NieBelum ada peringkat

- Introduction To Rural Credit: LendersDokumen55 halamanIntroduction To Rural Credit: LendersJimit ShahBelum ada peringkat

- Jan Dhan Yojana Article Full PDFDokumen4 halamanJan Dhan Yojana Article Full PDFAmit KumarBelum ada peringkat

- Promotional Efforts by NabardDokumen9 halamanPromotional Efforts by NabardJimmy Vohera100% (1)

- Banking Products & Operations: Session 7Dokumen34 halamanBanking Products & Operations: Session 7Vaidyanathan RavichandranBelum ada peringkat

- Bank of AgricultureDokumen15 halamanBank of AgricultureHaidee BellaBelum ada peringkat

- Rural Banking: India's Developing Economy Offers PotentialDokumen25 halamanRural Banking: India's Developing Economy Offers PotentialAamit KumarBelum ada peringkat

- Lecture # 18 Role of Commercial BanksDokumen45 halamanLecture # 18 Role of Commercial Bankskhatri5152Belum ada peringkat

- BH 1Dokumen14 halamanBH 1krishnabapda999Belum ada peringkat

- Project Finance SchemeDokumen7 halamanProject Finance SchemeLeilani JohnsonBelum ada peringkat

- Oracle News Bulletin Edition 1Dokumen5 halamanOracle News Bulletin Edition 1Ashesh SharmaBelum ada peringkat

- Microfinance & Pandyan Grama Bank ModelDokumen20 halamanMicrofinance & Pandyan Grama Bank ModelParitosh AnandBelum ada peringkat

- BANKINGDokumen4 halamanBANKINGBles SunshineBelum ada peringkat

- Agricultural Sector Development: Problems and IssuesDokumen7 halamanAgricultural Sector Development: Problems and IssuesUmair AzamBelum ada peringkat

- Working Capital Financing PDFDokumen55 halamanWorking Capital Financing PDFgaurav112011Belum ada peringkat

- PDICDokumen19 halamanPDICYukiiBelum ada peringkat

- Unit 5 Andhra Pradesh.Dokumen18 halamanUnit 5 Andhra Pradesh.Charu ModiBelum ada peringkat

- Policy Analysis AssignmentDokumen6 halamanPolicy Analysis AssignmentAsmitha NBelum ada peringkat

- Objectives of NABARDDokumen5 halamanObjectives of NABARDAbhinav Ashok ChandelBelum ada peringkat

- Half Monk-Half Warrior: Rural Nirmaan - Iimk Backwaters, 2011Dokumen14 halamanHalf Monk-Half Warrior: Rural Nirmaan - Iimk Backwaters, 2011Preethi Ramachandra SBelum ada peringkat

- India Budget Highlights - D N Sharma & Associates - FY14-15Dokumen29 halamanIndia Budget Highlights - D N Sharma & Associates - FY14-15Deepak SharmaBelum ada peringkat

- Women Entrepreneurship Development ProgrammeDokumen51 halamanWomen Entrepreneurship Development ProgrammeThenmozhi ArunBelum ada peringkat

- Schemes For Rural Entrepreneurs in India Schemes For Women Entrepreneurs in IndiaDokumen20 halamanSchemes For Rural Entrepreneurs in India Schemes For Women Entrepreneurs in IndiaPrasadBelum ada peringkat

- February 2021 37Dokumen1 halamanFebruary 2021 37Raghav SharmaBelum ada peringkat

- Banking Sector ReformsDokumen10 halamanBanking Sector ReformsTouqeer AhmadBelum ada peringkat

- Ebook Schemes Ministry of Micro Small and Medium Enterprises Lyst9386Dokumen7 halamanEbook Schemes Ministry of Micro Small and Medium Enterprises Lyst9386exp expoBelum ada peringkat

- Microfinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsDokumen8 halamanMicrofinance: Microfinance Refers To The Provision of Financial Services To Low-Income ClientsRohan_Kapoor_4806Belum ada peringkat

- Success Story of Fino A Role Model For Development of Financial InclusionDokumen23 halamanSuccess Story of Fino A Role Model For Development of Financial InclusionSujith PillaiBelum ada peringkat

- Strategic Objectives: Group 3: Shivani Singh Vatsal Upadhyay Shreya Maheshwari Pujabhat Shaji Namrata HarshDokumen18 halamanStrategic Objectives: Group 3: Shivani Singh Vatsal Upadhyay Shreya Maheshwari Pujabhat Shaji Namrata Harshpuja bhatBelum ada peringkat

- Banking India: Accepting Deposits for the Purpose of LendingDari EverandBanking India: Accepting Deposits for the Purpose of LendingBelum ada peringkat

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Dari EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Belum ada peringkat

- Micro or Small Goat Entrepreneurship Development in IndiaDari EverandMicro or Small Goat Entrepreneurship Development in IndiaBelum ada peringkat

- Syllabus For Agribusiness Management (COQP01)Dokumen80 halamanSyllabus For Agribusiness Management (COQP01)Sachin PalBelum ada peringkat

- Renaissance PowerPoint 1Dokumen11 halamanRenaissance PowerPoint 1missseesBelum ada peringkat

- Chapter 7-10Dokumen8 halamanChapter 7-10Jolina T. OrongBelum ada peringkat

- General Insurance-Big Benefit But OverburdenedDokumen59 halamanGeneral Insurance-Big Benefit But OverburdenedChandra UddhatayudhaBelum ada peringkat

- Data Lake and Advanced AnalyticsDokumen29 halamanData Lake and Advanced AnalyticsAlap JoshiBelum ada peringkat

- Maphar Constructions Private LimitedDokumen2 halamanMaphar Constructions Private LimitedSWARUPABelum ada peringkat

- BECIL Registration Portal: How To ApplyDokumen2 halamanBECIL Registration Portal: How To ApplySoul BeatsBelum ada peringkat

- Press Release - Dec 2019Dokumen2 halamanPress Release - Dec 2019RISHI KESHBelum ada peringkat

- Integrated Payments APIDokumen41 halamanIntegrated Payments APIsebichondoBelum ada peringkat

- NON COMPETE CLAUSE PLJ Volume 83 Number 2 - 04 - Charito R. Villena PDFDokumen28 halamanNON COMPETE CLAUSE PLJ Volume 83 Number 2 - 04 - Charito R. Villena PDFHeart Lero100% (1)

- 2016 - Book - NewPerspectives OnThe Bank-Firm RelationshipDokumen189 halaman2016 - Book - NewPerspectives OnThe Bank-Firm RelationshipYash MadhogariaBelum ada peringkat

- Chapter 14 - Control AccountDokumen12 halamanChapter 14 - Control AccountFalila Banu ShaikhBelum ada peringkat

- The Future of Commerce Payme 441515Dokumen12 halamanThe Future of Commerce Payme 441515HungBelum ada peringkat

- Corporate Books and Records Chapter 11Dokumen17 halamanCorporate Books and Records Chapter 11NingClaudioBelum ada peringkat

- Cash Transaction Charges For Savings Account HoldersDokumen6 halamanCash Transaction Charges For Savings Account HoldersMaheshkumar AmulaBelum ada peringkat

- Fees Structure 2024Dokumen7 halamanFees Structure 2024smdamu2221Belum ada peringkat

- Open Letter To Mr. Anand Gopal Mahindra, Ex-Director of Kotak Mahindra Bank LimitedDokumen12 halamanOpen Letter To Mr. Anand Gopal Mahindra, Ex-Director of Kotak Mahindra Bank LimitedLaw WhizBelum ada peringkat

- Banking Sector ReformsDokumen15 halamanBanking Sector ReformsKIRANMAI CHENNURUBelum ada peringkat

- Pre ClosestatementDokumen2 halamanPre Closestatementkhurafaat inBelum ada peringkat

- ICT Applications NotesDokumen15 halamanICT Applications NotesJasmine Ho0% (1)

- 01 CashandCashEquivalentsNotesDokumen7 halaman01 CashandCashEquivalentsNotesVeroBelum ada peringkat

- Auditing Problems Mock Board ReviewDokumen9 halamanAuditing Problems Mock Board ReviewTHRISHIA ANN SOLIVABelum ada peringkat

- KGSGDokumen7 halamanKGSGAnonymous V9E1ZJtwoEBelum ada peringkat

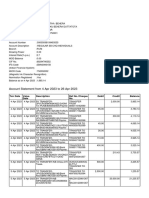

- Account statement from 4 Apr 2023 to 26 Apr 2023Dokumen7 halamanAccount statement from 4 Apr 2023 to 26 Apr 2023BIKRAM KUMAR BEHERABelum ada peringkat

- Module - 3 PDFDokumen7 halamanModule - 3 PDFKeyur PopatBelum ada peringkat

- Introduction to Financial Institutions: An OverviewDokumen16 halamanIntroduction to Financial Institutions: An OverviewsleshiBelum ada peringkat

- Management Accountant May 2020Dokumen124 halamanManagement Accountant May 2020ABC 123Belum ada peringkat

- CRM in Icici BankDokumen21 halamanCRM in Icici BankSudil Reddy100% (5)

- Sample MoaDokumen7 halamanSample MoaKool GuyBelum ada peringkat

- Credit RiskDokumen32 halamanCredit RiskDrNisa SBelum ada peringkat