FAR 3MC The Conceptual Framework of Financial Reporting

Diunggah oleh

Joy Dhemple LambacoJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

FAR 3MC The Conceptual Framework of Financial Reporting

Diunggah oleh

Joy Dhemple LambacoHak Cipta:

Format Tersedia

1. The joint FASB and IASB conceptual framework project is a. Comply with the need for conservatism.

intended to establish: b. Comply with generally accepted accounting principles.

a. A common set of objectives and concepts for use in c. Report on how effectively and efficiently management has

developing standards of financial accounting and reporting. used the entity’s resources.

b. A common set of generally accepted accounting principles. d. Provide financial information that is useful to primary users.

c. A comprehensive set of financial statement disclosures.

d. The structure of the FASB Codification. 9. According to the FASB and IASB conceptual frameworks, the

primary users of financial reports include all of the following,

2. The Conceptual Framework (choose the incorrect statement) except:

a. Is not a PFRS a. Lenders.

b. In the absence of a standard, shall be considered by b. Investors.

management when making its judgment in developing and c. Regulators.

applying accounting policy that result in information that is d. Creditors.

relevant and reliable.

c. Is concerned with general-purpose financial statements 10. According to the Conceptual Framework, the needs of primary

only. users that are met by financial statements are

d. Prevails over the PFRSs in cases of conflicts. a. All of their needs

b. All of their common needs only

3. Which of the following statements regarding the conceptual c. Majority of their common needs only

framework is incorrect? d. Substantially a majority of their common and specific needs

a. The framework is concerned with general-purpose financial only

statements

b. The framework applies to financial statements of business 11. According to the FASB and IASB conceptual frameworks, useful

reporting enterprises both in the private sector and in the information must exhibit the fundamental qualitative

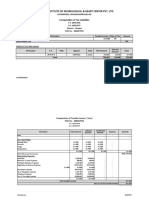

public sector characteristics of:

c. In cases where there is conflict between the framework and a. Neutrality and verifiability

an PFRS, the requirement of the framework will prevail

b. Understandability and timeliness.

d. The framework deals with concepts of capital

c. Comparability and materiality.

d. Faithful representation and relevance.

4. Financial information provided in general purpose financial

reports does not include information about:

12. Users of financial statements frequently rely upon the data

a. How effectively and efficiently the entity’s governing board

has discharged its responsibility to use the entity’s displayed in the financial statements to predict future financial

resources. outcomes. Financial accounting concepts refer to the

b. How effectively and efficiently the entity’s shareholders’ characteristic of accounting information that provides predictive

have discharged their responsibility to use the entity’s value to users as the quality of:

resources. a. Comparability

c. The resources of the entity. b. Relevance.

d. The claims against the entity. c. Faithful representation.

d. Understandability.

5. The following are the components of the conceptual framework

of accounting except 13. According to the IASB Framework for the Preparation and

a. The objective of financial statements Presentation of Financial Statements, the fundamental

b. The definition of the elements of financial statements qualitative characteristics of relevance includes

c. The form of presentation of financial statements a. Predictive value and feedback value.

d. The qualitative characteristics of financial statements b. Verifiability, neutrality, and representational faithfulness.

c. Predictive value and confirmatory value.

6. The objective of general purpose financial reporting is d. Comparability and timeliness.

a. To provide information regarding the economic resources

of an entity. 14. According to the FASB and IASB conceptual frameworks, the

b. To provide users with relevant and reliable information quality of information that helps users forecast future outcomes

needed to oversee the day-to-day operations of an entity. is:

c. To provide financial information about the reporting entity a. Neutrality.

that is useful to existing and potential investors, lenders b. Representational faithfulness.

and other creditors in making decisions about providing c. Confirming value

resources to the entity. d. Predictive value.

d. All of these.

15. According to the FASB and IASB conceptual frameworks, to be

7. A secondary objective of financial statements relevant, information should have which of the following?

a. Is to show information regarding assets and liabilities of an a. Completeness.

entity. b. Neutrality.

b. Is to show information regarding an entity’s financial c. Verifiability

position, performance, and changes in financial position. d. Predictive value

c. Is to show the results of the stewardship of management.

d. b and c 16. According to the FASB and IASB conceptual frameworks, one of

the fundamental qualitative characteristics of useful financial

8. According to the FASB and IASB conceptual frameworks, the information is:

objective of general purpose financial reporting is to: a. Timeliness.

FAR 3MC – THE CONCEPTUAL FRAMEWORK OF FINANCIAL REPORTING Page 1 of 4

b. Relevance. d. It meets the requirements of comparability and consistency.

c. Verifiability.

d. Comparability. 25. What is the underlying concept governing the recording of gain

contingencies?

17. Which of the following characteristics of accounting information a. Conservatism.

primarily allows users of financial statements to generate b. Reliability.

predictions about an organization? c. Relevance.

a. Reliability. d. Consistency.

b. Relevance.

c. Neutrality. 26. Accounting to the FASB conceptual framework, which of the

d. Timeliness. following attributes would not be used to measure inventory?

a. Replacement cost.

18. According to the FASB and IASB conceptual frameworks, b. Net realizable value.

completeness is an ingredient of: c. Historical cost.

a. Relevance. d. Present value of future cash flows.

b. Faithful Representation.

c. Both a and b. 27. What is the underlying concept that supports the immediate

d. Neither a nor b. recognition of a contingent loss?

a. Substance over form.

19. According to the FASB and IASB conceptual frameworks, b. Conservatism.

neutrality is an ingredient of: c. Matching.

a. Comparability. d. Consistency.

b. Relevance.

c. Timeliness. 28. According to the FASB conceptual framework, the process of

d. Faithful representation. reporting an item in the financial statements of an entity is:

a. Matching.

20. According to the FASB and IASB conceptual frameworks, which b. Realization.

of the following correctly pairs a fundamental qualitative c. Recognition.

characteristic of useful information with one of its components? d. Allocation.

a. Faithful representation and predictive value.

b. Faithful representation and verifiability. 29. According to the FASB conceptual framework, which of the

c. Relevance and timeliness. following statements conforms to the realization concept?

d. Relevance and materiality. a. Equipment depreciation was assigned to a production

department and then to product unit costs.

21. According to the FASB and IASB conceptual frameworks, which b. Product unit costs were assigned to cost of goods sold when

of the following is an enhancing qualitative characteristic? the units were sold.

a. Materiality. c. Depreciated equipment was sold in exchange for a note

b. Timeliness. receivable.

c. Neutrality. d. Cash was collected on accounts receivable.

d. Completeness.

30. Which of the following assumptions means that money is the

22. Which of the following characteristics enhances relevance and common denominator of economic activity and provides an

faithful representation? appropriate basis for accounting measurement and analysis?

a. Materiality. a. Periodicity.

b. Timeliness. b. Monetary unit.

c. Predictive value. c. Going concern.

d. Neutrality. d. Economic entity.

23. According to the IASB Framework, the financial statement 31. Which of the following is a generally accepted accounting

element that is defined as increases in economic benefits during principle that illustrate the practice of conservatism during a

the accounting period in the form of inflows or enhancements of particular reporting period?

assets or decreases of liabilities that result in increase in equity, a. Reporting investments with appreciated market values at

other than those relating to contributions from equity market value.

b. Capitalization of research and development costs.

participants, is

c. Reporting inventory at the lower of cost or net realizable

a. Revenue.

value.

b. Income. d. Accrual of a contingency deemed to be reasonably possible.

c. Profits.

d. Gains. 32. According to the FASB conceptual framework, certain assets

are reported in financial statements at the amount of cash or its

24. According to the IASB Framework, the two criteria required for equivalent that would have to be paid if the same or equivalent

incorporating items into income statement or statement of assets were acquired currently. What is the name of the

financial position are that reporting concept?

a. It meets the definition of relevance and faithful a. Historical cost.

representation. b. Replacement cost.

b. It meets the definition of an element and can be measured

c. Current market value.

reliably.

d. Net realizable value.

c. It satisfies the criteria of capital maintenance.

FAR 3MC – THE CONCEPTUAL FRAMEWORK OF FINANCIAL REPORTING Page 2 of 4

33. According to the IASB conceptual framework, which of the Investment in associate 900,000

following is an underlying assumption of financial statement Buildings and equipment 1,200,000

preparation and presentation? Accumulated depreciation 300,000

a. Monetary unit. Accounts payable 800,000

b. Historical cost. Bonds payable (520,000)

c. Going concern. Discount on bonds payable (120,000)

Common stock 600,000

d. Periodicity.

Additional paid-in capital 100,000

Revaluation surplus 300,000

34. Under this concept, a profit is earned only if the financial (or Dividends declared during 2017 were ₱800,000. No other

money) amount of the net assets at the end of the period transactions affected retained earnings during the year.

exceeds the financial (or money) amount of net assets at the Calculate the amount of net income to be reported in 2017.

beginning of the period, after excluding any distributions to, and a. ₱2,460,000

contributions from, owners during the period. It can be b. ₱3,100,000

measured in either nominal monetary units or units of constant c. ₱3,500,000

purchasing power. d. ₱4,460,000

a. Concept of capital

b. Concept of capital maintenance 39. For a given year, beginning and ending total liabilities were

c. Financial capital maintenance concept ₱8,400 and ₱10,000, respectively. At year-end, owners’ equity

d. Physical capital maintenance concept was ₱26,000 and total assets were ₱2,000 larger than at the

beginning of the year. If new capital stock issued exceeded

35. The following information was obtained from a review of ABC dividends by ₱2,400, profit (loss) for the year was apparently

Co.’s accounting records: a. ₱2,000

Net Assets, Jan. 1, 2017 ₱500,500 b. ₱2,400

Net Assets, Dec. 31, 2017 480,600

c. ₱(2,000)

Share capital issued in 2017 80,000

d. ₱(2,400)

Dividends declared in 2017 160,000

Using the capital maintenance approach, the amount of net

income or loss for 2017 is 40. Changes in the account balances of Victor Wooten Corp. during

a. ₱60,010 the current year are shown below:

b. (₱60,010) Increase/(Decrease)

Cash ₱270,000

c. ₱2,100

Accounts receivable, net 760,000

d. ₱60,100

Financial assets at FVPL 65,000

Inventory 1,780,000

36. The following information was obtained from a review of ABC Investment in associate (50,000)

Co.’s accounting records: Accounts payable (360,000)

Net Assets, Jan. 1, 2017 ₱503,500 Bonds payable 1,200,000

Net Assets, Dec. 31, 2017 508,600 Premium on bonds payable (25,000)

Share capital issued in 2017 69,300

Dividends declared in 2017 61,350 Additional information:

Using the capital maintenance approach, the amount of net The company issued 10,000 shares with par value of ₱100 per

income or loss for 2017 is share for ₱160 per share. Stock issuance costs incurred

a. ₱(13,050) amounted to ₱15,000. Cash dividends declared and paid

b. ₱(2,850) amounted to ₱230,000. Unrealized gains recognized in profit or

c. ₱2,850 loss amounted to ₱10,000. Using the net assets approach,

d. ₱13,050 Victor Wooten’s profit for the year is

a. ₱630,000

37. The following are the changes in Cliff Burton Co.’s account b. ₱590,000

balances during 2017: c. ₱640,000

Increase/(Decrease) d. ₱655,000

Assets ₱560,000

Liabilities 390,000

41. The following information shows the changes in the account

Capital stock 160,000

balances of Jaco Pastorious Co. during 2017:

Additional paid-in capital 8,000

There were no changes in retained earnings for 2017 other than Increase/(Decrease)

Cash ₱100,000

for a cash dividend payment of ₱34,000. Using the capital

Accounts receivable (880,000)

maintenance approach, compute for the profit of Burton in 2017.

Allowance for bad debts (120,000)

a. ₱360,000 Inventory 800,000

b. ₱816,000 Investment in associate 700,000

c. ₱304,000 Buildings and equipment 1,100,000

d. ₱36,000 Accumulated depreciation 400,000

Accounts payable (900,000)

38. Changes in the account balances of ABC Co. during 2017 are Bonds payable 700,000

shown below: Discount on bonds payable 150,000

Increase/(Decrease) Capital stock 900,000

Cash ₱1,200,000 Additional paid-in capital 100,000

Accounts receivable (640,000) Revaluation surplus 900,000

Allowance for bad debts (100,000) Dividends declared during 2017 were ₱100,000 and

Inventory 600,000 appropriations for the retirement of bonds amounted to

FAR 3MC – THE CONCEPTUAL FRAMEWORK OF FINANCIAL REPORTING Page 3 of 4

₱50,000. Calculate the amount of net income to be reported in

2017.

a. ₱40,000

b. ₱90,000

c. ₱170,000

d. ₱140,000

42. Changes in the Ytse Jam Co.’s account balances are shown

below:

Assets ₱1,870,000 Increase

Liabilities 370,000 Increase

Common stock 470,000 Decrease

Share premium 60,000 Increase

Revaluation surplus 40,000 Decrease

Unrealized gain-FVPL 60,000 Increase

Treasury stock 30,000 decrease

No other changes in the retained earnings account other than

for a cash dividend declaration of ₱35,000 and an appropriation

of ₱360,000. Ytse Jam Co.’s profit amounted to

a. ₱2,000,000

b. ₱1,960,000

c. ₱1,840,000

d. ₱1,955,000

43. The following information was obtained from a review of ABC

Co.’s accounting records:

Increase in Net assets during the period ₱120,000

Share capital issued during the period 80,000

Profit for the year 75,000

How much are the dividends declared during the period?

a. ₱65,000

b. ₱15,000

c. ₱21,000

d. ₱35,000

FAR 3MC – THE CONCEPTUAL FRAMEWORK OF FINANCIAL REPORTING Page 4 of 4

Anda mungkin juga menyukai

- PCP IiDokumen12 halamanPCP IiJoy Dhemple Lambaco75% (4)

- Conceptual Framework and Acctg Standards 1.3Dokumen3 halamanConceptual Framework and Acctg Standards 1.3Gabriel JacaBelum ada peringkat

- Compound Financial Intruments PDFDokumen2 halamanCompound Financial Intruments PDFCeline Marie Libatique AntonioBelum ada peringkat

- Change in Accounting Policy and EstimatesDokumen6 halamanChange in Accounting Policy and EstimatesMark IlanoBelum ada peringkat

- MS Corporation financial data analysis 2018-2019Dokumen2 halamanMS Corporation financial data analysis 2018-2019Princess Edelyn CastorBelum ada peringkat

- ACTIVITY 5 Interim Reporting PDFDokumen2 halamanACTIVITY 5 Interim Reporting PDFHaidee Flavier SabidoBelum ada peringkat

- Biological Assets HandoutsDokumen5 halamanBiological Assets HandoutsMichael BongalontaBelum ada peringkat

- PAS 16 Property, Plant and EquipmentDokumen13 halamanPAS 16 Property, Plant and EquipmentAseya CaloBelum ada peringkat

- Business Combinations Notes Ch 1-3Dokumen4 halamanBusiness Combinations Notes Ch 1-3Mary Jescho Vidal AmpilBelum ada peringkat

- Retrospectively in The First Set of Financial Statements Authorized For Issue AfterDokumen7 halamanRetrospectively in The First Set of Financial Statements Authorized For Issue Aftermax pBelum ada peringkat

- CASH FLOW STATEMENTS - Quiz 3Dokumen2 halamanCASH FLOW STATEMENTS - Quiz 3JyBelum ada peringkat

- IA3 Chapter 14 Problem 31Dokumen3 halamanIA3 Chapter 14 Problem 31Bea TumulakBelum ada peringkat

- Cash Surrender Value: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncDokumen8 halamanCash Surrender Value: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncJoris YapBelum ada peringkat

- Illustrative Problem Basic RecordingDokumen36 halamanIllustrative Problem Basic RecordingLeila OuanoBelum ada peringkat

- CPALE FAR STATEMENT OF FINANCIAL POSITIONDokumen12 halamanCPALE FAR STATEMENT OF FINANCIAL POSITIONEnrique Hills RiveraBelum ada peringkat

- 8 Wasting Assets PDFDokumen2 halaman8 Wasting Assets PDFGayle LalloBelum ada peringkat

- Quiz On Debt InvestmentDokumen2 halamanQuiz On Debt InvestmentYa NaBelum ada peringkat

- Calculating Impairment Loss and Discontinued OperationsDokumen7 halamanCalculating Impairment Loss and Discontinued OperationsRUNEL J. PACOTBelum ada peringkat

- Assignment - Module 2 - Stock and Their Valuation - QuestionDokumen4 halamanAssignment - Module 2 - Stock and Their Valuation - QuestionMary Justine PaquibotBelum ada peringkat

- Audit of ReceivablesDokumen20 halamanAudit of ReceivablesDethzaida AsebuqueBelum ada peringkat

- LTCC AnswerDokumen4 halamanLTCC AnswerRhina MagnawaBelum ada peringkat

- TAX 1 2020 SolMan Chapters 1 To 4Dokumen13 halamanTAX 1 2020 SolMan Chapters 1 To 4KRISTEL JOYCEBelum ada peringkat

- Financial Accounting and Reporting PartDokumen6 halamanFinancial Accounting and Reporting PartLalaine De JesusBelum ada peringkat

- Error Correction MethodsDokumen2 halamanError Correction MethodsValentina Tan DuBelum ada peringkat

- Intacc 3Dokumen102 halamanIntacc 3sofiaBelum ada peringkat

- Principles of Taxation and Financial AccountingDokumen12 halamanPrinciples of Taxation and Financial Accountingnikol sanchezBelum ada peringkat

- AFAR-07 (Home-Office & Branch Accounting)Dokumen7 halamanAFAR-07 (Home-Office & Branch Accounting)mysweet surrenderBelum ada peringkat

- Problem 1Dokumen13 halamanProblem 1Ghaill CruzBelum ada peringkat

- Estate Tax Guide for PhilippinesDokumen50 halamanEstate Tax Guide for PhilippinesLea JoaquinBelum ada peringkat

- Auditing Problems Internal Control Measures and Substantive Audit Procedures for CashDokumen8 halamanAuditing Problems Internal Control Measures and Substantive Audit Procedures for CashMa Yra YmataBelum ada peringkat

- Accounting for Government and Not-for-Profit OrganizationsDokumen24 halamanAccounting for Government and Not-for-Profit Organizationshehehedontmind me100% (1)

- Toa 4 Cash FlowsDokumen3 halamanToa 4 Cash Flowsmae tuazonBelum ada peringkat

- Conceptual Framework and Accounting StandardsDokumen4 halamanConceptual Framework and Accounting StandardsKrestyl Ann GabaldaBelum ada peringkat

- Retirement and Replacement Depreciation Methods ExplainedDokumen1 halamanRetirement and Replacement Depreciation Methods ExplainedQueenie ValleBelum ada peringkat

- PUP Accounting for Special Transactions Review Session HandoutDokumen3 halamanPUP Accounting for Special Transactions Review Session HandoutDonalyn CalipusBelum ada peringkat

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Dokumen1 halaman(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoBelum ada peringkat

- Theory of Accounts Test Reviewfinals 3 SMEs With AnswersDokumen9 halamanTheory of Accounts Test Reviewfinals 3 SMEs With Answersaziel caith florentinBelum ada peringkat

- Deductions On Gross Estate Part 1Dokumen19 halamanDeductions On Gross Estate Part 1Angel Clarisse JariolBelum ada peringkat

- 2 Inventory Cost Flow Intermediate Accounting ReviewerDokumen3 halaman2 Inventory Cost Flow Intermediate Accounting ReviewerDalia ElarabyBelum ada peringkat

- PAS 36 Impairment Asset GuideDokumen20 halamanPAS 36 Impairment Asset GuideCyril Grace Alburo BoocBelum ada peringkat

- Ventura, Mary Mickaella R - Comprehensive Income p.85 - Group3Dokumen2 halamanVentura, Mary Mickaella R - Comprehensive Income p.85 - Group3Mary VenturaBelum ada peringkat

- Audit Review Quiz Bowl 2013Dokumen52 halamanAudit Review Quiz Bowl 2013Hecel OlitaBelum ada peringkat

- Elimination Round: NCR Cup 4: TaxationDokumen16 halamanElimination Round: NCR Cup 4: TaxationKenneth RobledoBelum ada peringkat

- Tfa CompiledDokumen109 halamanTfa CompiledAsi Cas JavBelum ada peringkat

- FAR Test BankDokumen24 halamanFAR Test BankMaryjel17Belum ada peringkat

- Naqdown - Final QuestionsDokumen41 halamanNaqdown - Final QuestionssarahbeeBelum ada peringkat

- Chapt 25 Bonds PayableDokumen124 halamanChapt 25 Bonds PayablelcBelum ada peringkat

- Reviewer 1st PB P1 1920Dokumen7 halamanReviewer 1st PB P1 1920Therese AcostaBelum ada peringkat

- Financial Reporting Objectives and ConceptsDokumen14 halamanFinancial Reporting Objectives and ConceptsDarlyn Dalida San PedroBelum ada peringkat

- Working Capital ManagementDokumen5 halamanWorking Capital ManagementellaBelum ada peringkat

- Valix Financial Accounting Vol 3 AnswersDokumen1 halamanValix Financial Accounting Vol 3 AnswersJobby JaranillaBelum ada peringkat

- Chapter 3Dokumen7 halamanChapter 3Coursehero PremiumBelum ada peringkat

- Cfas Notes (Pas and PFRS)Dokumen3 halamanCfas Notes (Pas and PFRS)Gio BurburanBelum ada peringkat

- Pointers in Obligation & Contracts by Suarez (Scanned by Nicole Sulapas) .PDF Version 1 PDFDokumen205 halamanPointers in Obligation & Contracts by Suarez (Scanned by Nicole Sulapas) .PDF Version 1 PDFMark Emil PerezBelum ada peringkat

- Lecture Note-Cash and Cash EquivalentDokumen14 halamanLecture Note-Cash and Cash EquivalentLeneBelum ada peringkat

- FAR 3MC The Conceptual Framework of Financial ReportingDokumen4 halamanFAR 3MC The Conceptual Framework of Financial ReportingHassanhor Guro Bacolod100% (1)

- CFASDokumen7 halamanCFASSherica VirayBelum ada peringkat

- FAR.2943 - Conceptual-framework-for-FR - ACC-103 NotesDokumen5 halamanFAR.2943 - Conceptual-framework-for-FR - ACC-103 NotesmarielleBelum ada peringkat

- Cfas Actvity 1-2Dokumen5 halamanCfas Actvity 1-2Sherica VirayBelum ada peringkat

- Answers Post Test 01 Conceptual Framework 1Dokumen3 halamanAnswers Post Test 01 Conceptual Framework 1Faith CastroBelum ada peringkat

- Financial Accounting and Reporting-Theoretical The Conceptual FrameworkDokumen2 halamanFinancial Accounting and Reporting-Theoretical The Conceptual FrameworkROB101512Belum ada peringkat

- General Knowledge QuestionsDokumen33 halamanGeneral Knowledge QuestionsJoy Dhemple LambacoBelum ada peringkat

- Intrade NteDokumen9 halamanIntrade NteJoy Dhemple LambacoBelum ada peringkat

- Accounting Information System Chapter SummariesDokumen22 halamanAccounting Information System Chapter SummariesJoy Dhemple LambacoBelum ada peringkat

- Exchange ControlsDokumen22 halamanExchange ControlsJoy Dhemple LambacoBelum ada peringkat

- Process CostingDokumen2 halamanProcess CostingJoy Dhemple LambacoBelum ada peringkat

- Anti Vawc Ra 9262 Swu March 10 2007Dokumen44 halamanAnti Vawc Ra 9262 Swu March 10 2007Ching ApostolBelum ada peringkat

- Classification of QuotaDokumen7 halamanClassification of QuotaJoy Dhemple LambacoBelum ada peringkat

- Financial Statement Analysis Drill TheoryDokumen3 halamanFinancial Statement Analysis Drill TheoryJoy Dhemple LambacoBelum ada peringkat

- FAR 1MC Overview of AccountingDokumen7 halamanFAR 1MC Overview of AccountingJoy Dhemple LambacoBelum ada peringkat

- ManagementDokumen8 halamanManagementJoy Dhemple LambacoBelum ada peringkat

- COSO McNallyTransition Article-Final COSO Version Proof - 5!31!13Dokumen9 halamanCOSO McNallyTransition Article-Final COSO Version Proof - 5!31!13Tatiana PopiaBelum ada peringkat

- Revenue Recognition and Accounting ProcessDokumen5 halamanRevenue Recognition and Accounting ProcessJoy Dhemple LambacoBelum ada peringkat

- Brigham Test Bank Stocks PDFDokumen82 halamanBrigham Test Bank Stocks PDFBryant Lee Yurag100% (1)

- UntitledDokumen18 halamanUntitledjeralyn juditBelum ada peringkat

- Amity Global Business School Amity Global Business School: Valuation ConceptsDokumen36 halamanAmity Global Business School Amity Global Business School: Valuation ConceptssachinremaBelum ada peringkat

- Advanced Accounting Test Bank Questions Chapter 8Dokumen19 halamanAdvanced Accounting Test Bank Questions Chapter 8Ahmed Al EkamBelum ada peringkat

- Trend AnalysisDokumen5 halamanTrend AnalysisRachel VillotesBelum ada peringkat

- Financial Statement Analysis Lecture 5 - Cash FlowDokumen17 halamanFinancial Statement Analysis Lecture 5 - Cash FlowKenan AbishovBelum ada peringkat

- Depreciation Accounting: Key Concepts and MethodsDokumen81 halamanDepreciation Accounting: Key Concepts and Methodsgoel76vishalBelum ada peringkat

- Accounting Policies, Changes in Accounting Estimates and Errors - Ias 8Dokumen27 halamanAccounting Policies, Changes in Accounting Estimates and Errors - Ias 8Manuel MagadatuBelum ada peringkat

- P5 Acca - 11 Divisional Performance Evaluation BeckerDokumen30 halamanP5 Acca - 11 Divisional Performance Evaluation BeckerDanesh Kumar Rughani100% (1)

- Kathmandu Hospital UpdatedDokumen7 halamanKathmandu Hospital Updatedone twoBelum ada peringkat

- Paper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Dokumen16 halamanPaper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Aleena Clare ThomasBelum ada peringkat

- Tata Steel Ir 2022 23Dokumen109 halamanTata Steel Ir 2022 23harshita girdharBelum ada peringkat

- Accounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụDokumen45 halamanAccounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụHiep Nguyen TuanBelum ada peringkat

- Marginal CostingDokumen10 halamanMarginal CostingJoydip DasguptaBelum ada peringkat

- CMA Question August-2013Dokumen58 halamanCMA Question August-2013zafar71Belum ada peringkat

- Transcom Annual Report 2022Dokumen56 halamanTranscom Annual Report 2022John ProticBelum ada peringkat

- Bad Debts Structured 2019 PDFDokumen16 halamanBad Debts Structured 2019 PDFArshad ChaudharyBelum ada peringkat

- ACCTG 215 Quiz 1 TitleDokumen5 halamanACCTG 215 Quiz 1 TitleJenny HuynhBelum ada peringkat

- Audit Reports Part 2Dokumen70 halamanAudit Reports Part 2Nhi LâmBelum ada peringkat

- Cheat Sheet BATDokumen4 halamanCheat Sheet BATUmar PatelBelum ada peringkat

- Working Capital ManagementDokumen13 halamanWorking Capital ManagementMichael Paul GabrielBelum ada peringkat

- Beams11 ppt09Dokumen19 halamanBeams11 ppt09Mario RosaBelum ada peringkat

- BOD REPORT HIGHLIGHTS CY 2014Dokumen42 halamanBOD REPORT HIGHLIGHTS CY 2014Abdu MohammedBelum ada peringkat

- AFAR H01 Cost Accounting PDFDokumen7 halamanAFAR H01 Cost Accounting PDFhellokittysaranghaeBelum ada peringkat

- Entreprenerial Finance Master DocumentDokumen65 halamanEntreprenerial Finance Master DocumentemilspureBelum ada peringkat

- Laporan Tahunan DIVA 2022-2021Dokumen136 halamanLaporan Tahunan DIVA 2022-2021Nurjaya Ni'mah JalilBelum ada peringkat

- First Resources Annual Report 2021 HighlightsDokumen153 halamanFirst Resources Annual Report 2021 Highlightsarisnal marajoBelum ada peringkat

- Accounting Cycle QuizDokumen4 halamanAccounting Cycle QuizLucille Gacutan AramburoBelum ada peringkat

- Case 8 - Diamond DCF ModelDokumen2 halamanCase 8 - Diamond DCF ModelAudrey AngBelum ada peringkat

- Accounting For Business: Chapter 4: The Statement of Cash FlowsDokumen40 halamanAccounting For Business: Chapter 4: The Statement of Cash FlowsegBelum ada peringkat