The Effect of Fee Audit and Audit Tenure On The Quality of Audits With Asymmetry Information As Intervening Variables (At The Manufacturing Companies Listed On The Indonesia Stock Exchange)

Diunggah oleh

Anonymous izrFWiQJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

The Effect of Fee Audit and Audit Tenure On The Quality of Audits With Asymmetry Information As Intervening Variables (At The Manufacturing Companies Listed On The Indonesia Stock Exchange)

Diunggah oleh

Anonymous izrFWiQHak Cipta:

Format Tersedia

Volume 4, Issue 6, June – 2019 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The Effect of Fee Audit and Audit Tenure on the Quality of

Audits with Asymmetry Information as Intervening Variables

(At the Manufacturing Companies Listed on the Indonesia Stock Exchange)

Zelly Denofriza,SE, DR.Suhairi,SE,M.Si,Ak,CA, Nini Syofriyeni,SE,M.Si,Ak,CA

Master of Accounting Study Program

Andalas University

Padang, West Sumatra

Abstract:- The purpose of this study to examine the is different from the result of research conducted by Cahan

effect of audit fees, audit tenure of audit quality and and Jerry (2015) and Yuniarti (2011) stating that fees audit

information assymetry as intervening variable. Audit has negatively affect on audit quality. This study explain

quality variables are measured using the KAP size that audit quality is not determined by the amount of fees

included big four and non big four group of auditor. paid, when high fees are paid, it result in low audit quality.

Audit fee measured by log n, tenure measured by

calculate how long the auditor cooperation relationship Beside that, audit quality can also be effect by audit

with the auditee and information assymetry measured tenure, namely the length of tme the auditor conducts an

by altman z score. The population used in this study is a examination of the financial statement of a company

manufacturing company listed on Indonesia Stock (Rahmina et al,2014). According to Junaidi, Harun and Eko

Exchange with the 2013-3017 research year. The results (2014) the long term relationship between client and

of the tests carried out in this study show that audit fee auditors can reduce auditor independence, if both parties

and audit tenure have significant influenced of audit are intensively involved, the auditor shoul be able to detect

quality while audit fee do not affect on information the cause of the low quality of financial statement without

assymmetry, audit tenure have significant influenced of being influenced by other parties.

information assymmetry and information assymmetry

also have significant influenced on audit quality. Research on the effect of fees audit and audit tenure

on the quality has been previously investigated, but the

Keyword:- Audit Quality, Audit Fee, Audit Tenure, research has a different result, so that information on the

Information Assymmetry. audit quality produced will also be different. This reason is

reinforcing to try again to examine audit quality. In

I. INTRODUCTION addition, in this study added information asymmetry

variable.

Business development is increasingly fast and varied.

Various types of businesses that can continue to be carried This study aims to obtain empirical evidence about the

out by the management or company management. One of effect of audit fees and audit tenure on audit quality and

the effort made by management was to increase public trust effect of audit fees and audit tenure on information

in the company. Public trust can be obtained by conducting asymmetry, also to examine the effect of information

an audit of financial statements. In other words the audit asymmetry on audit quality. Other than that, this research

can be used to increase public confidence in the financial has a purpose to give a benefit in the form of guidelines for

statements of a company. conducting next research and make the other people know

about audit quality.

According to Rahmina and Agus (2014) financial

reports need to be checked by an independent auditor so II. THEORETICAL FRAMEWORK AND

that it is known whether there is any discrepancy in the HYPOTHESIS

financial statement and financial statement user’s can use

the information to make decision. According to Al- Agency Theory

thuneibat, Ream and Rana (2011) audits are designed to Jensen and Meckling (1976) defines theory agency as

check whether the financial statements in the company are a theory that explains the relationship between the owner of

presented fairly. In addition, the financial statement audit the company or shareholder and the management. The

is also useful to facilitate management and investor in management as an agent appointed by shareholder to

making decision. For this reason, management need a manage the company. In reality there is always a difference

public accountant to audit its financial statements. of interest between the shareholder and management.

Research conducted by Hoitash (2007), Asthana and The main purpose of agency theory is to explain how

Jeff (2012, Hartadi (2012) states that fees audit have a contracting parties can design contract whose purpose is to

positif effect on audit quality. The above studies explain minimize cost as a result of asymmetry information and

that audit quality is determined by fees audit. When fees uncertainty condition. In financial reporting, manager who

audit are paid high, the audit quality will also be high. This

IJISRT19JU573 www.ijisrt.com 763

Volume 4, Issue 6, June – 2019 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

act as agent and have an obligation to present information a different result that is audit tenure has a positive effect on

that is useful for users of financial statement. audit quality. Hypothesis as follow :

Signaling Theory H2 : Audit tenure has an affect on audit quality

Signal theory explain the reason a company has an

encouragement to give information of financial report to Audit Fee and Information Asymmetry

external user. Signal theory also indicates that the company According to DeAngelo (1981) audit fees are income

was trying to show the signal in the form of positive whome magnitude varies depending on the nature of the

information (goodnews) to potential investor through audit assignment. Hoitash (2007) argues that when the

disclosure in the financial statement (Suwardjono, 2008). auditor negotiates with management regarding the amount

Information provided by management will make it easier of fee that must be paid by management for audit services

for creditors to make decisions. performed, then reciprocal concessions are likely to occur

which will clearly reduce the quality of audit reports. This

When information has been diclosed, market action is an action that no longer reflects the professional

participant will analyze the information as a signal that is attitude, so this will have an impact on the provision of

good or bad. Dislosure of these information is one way to information on the users of financial statement, in other

eliminate information asymmetry that occurs between words asymmetry information on the company will

shareholder and management. Managers from well- increase. This study have a hypothesis :

performing companies will be encouraged to sign up for

that expectation and managers from companies that have H3 : Fee audit has an affect on information

neutral news will also give the good news. asymmetry

Manager from poorly performing companies choose Audit Tenure and Information Asymmetry

not to report anything. Nonetheless, manager from poorly According to Hartadi (2012) the long engagement

performing companies may be want to give information to relationship between auditor and auditee will cause the

maintain their credibility at capital market. By assuming established professional standards. This of course interferes

that these things encourage the delivery of information on with the auditor’s objectivity in conducing an audit of a

the capital market. company.

Hypothesis Previous research has shown that the influence of

audit tenure on information asymmetry still has different

Audit Fee and Audit Quality result. The research conducted by Almutairi, Kimberly and

According to hoitash (2007) fees paid by auditee to Terrace (2009) revealed a positif relationship between audit

auditor can have an effect to audit quality. The high cost of tenure and information asymmetry, where market

audit service carried out by public accountant can increase participant realize that the longer auditor relationship with a

the effort carried out by the auditor, thereby improving company, the auditor’s objectivity level will decrease so

audit quality. The research by Kurniasih anf Abdul (2014) that information gaps in a company occur. This research

have the result that fee audit have a positive effect on audit have a hypothesis :

quality, that means high fees audit will result in high audit

quality. So the company prefers to pay a large audit fee H4 : Audit tenure has an affect on information

because with a large fee the public accountant can produce asymmetry

quality report and will make trust in financial statement

increase. Asymmetry Information and Audit Quality

Asymmetry information is an information gap that

This is consistent with theory put forward, namely the occurs between one party and another. Good quality is

theory signaling. Research by Rahmina, et al (2014) that expected to be able to provide good information on each

fees audit have a positive effect on audit quality. High fees use. Research conducted by Varici (2013) show that result

audit will result in high audit quality. The explanation has a relationship between aymmetry information and audit

above produces the following hypothesis : quality which means that, if there is an increase in the level

of information asymmetry, there will be an increase in audit

H1 : Fee audit has an effect on audit quality quality, because auditor continue to work well so that

information asymmetry is not an obstacle in conduct audits,

Audit Tenure and Audit Quality based on the above framework, the authors propose the

Audit tenure is the length of the relationship between following hypothesis :

auditor and the auditee in auditing financial statement. The

longer relationship will reduce independence of the auditor. H5 : Asymmetry information has an affect on audit

The previous research related to audit tenure is a study quality

conducted by Al-thuneibat et al (2011) and the result of

their study show audit tenure has negative effect on audit

quality. Research conducted by Jackson et al, (2008) have

IJISRT19JU573 www.ijisrt.com 764

Volume 4, Issue 6, June – 2019 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

III. RESEARCH METHODE uses financial statement for 2013-2017. The population of

this research will be carried out to company going public

This research is a quantitative descriptive study that is on Indonesia Stock Exchange during 2013-2017, so that

intended to test models that explain the about fees audit, companies that have been delisted from the stock exchange

audit tenure and information asymmetry on audit quality. are not included.

The approach in the purpose of this study is to test the

hypothesis. According to Sekaran (2003) study examined in The method used for sampling is purposive sampling,

testing hypothesis it is usually related to certain traits or the population used in this study is population that meets

form differences between groups or the independence of certain criteria. These criteria are as follow :

two or more factor in one situation.

All manufactur company listed on the indonesia stock

The type of research data relates to data sources and exchange during 2013-2017, so that company have been

the selection of methods used to obtain a data in the study. delisted are not included.

The data used in this study are secondary data, namely data Companies that are sampled are companies that publish

in the form of audited financial report and published on complete financial reports during 2013-2017

Indonesia Stock Exchange. Data on research variables that will be examined must

be available in full.

The data resources in this study are financial

statement obatined from websites company. This research

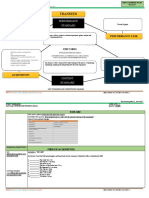

No Variables Indicators Measurement

1. Fee Audit Fee received by the auditor Natural logarithm of fees audit

2. Audit Tenure Number of engagements Calculating the number of years of engagement

between auditors and between companies and auditors

companies

3. Audit Quality KAP big 4 / non Big 4 1: big 4

(dummy) 0: non big 4

4. Information onAsymmetry AltmanZ-score Z = 1,2 (WCTA) + 1.4 (RETA) + 3.3(EBITTA)

+ 0.6 (MVEBVL) + 1 (STA)

WCTA : Working capital to total assets

or working capital divided by total assets.

RETA : Retained earnings to total

assets divided by total assets

EBITTA :Earning before interest and taxes to

total assets divided by total assets

MVEBVL : Market value of equity to

book value of liability or securities market value

divided by book value of debt).

STA : Sales to total assets or sales

divided by total assets.

Table 1:- Measurement of Variables

This study uses data analysis methods using smart Abdillah and Jogiyanto (2015) explained that PLS

software PLS version 3.0 which is run on computer. analysis is a multivariate statistical technique that make

According to Abdillah and Jogiyanto (2015) we can used comparisons between multiple dependent variable and

PLS to examines measurement models and structural multiple independent variables. PLS is designed to solve

model. multiple regression when specific problem occur in the

data.

IJISRT19JU573 www.ijisrt.com 765

Volume 4, Issue 6, June – 2019 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

IV. RESULTS AND DISCUSSION

StandardStandard T Statistics (| O /

Original Sample (O) Mean (M)

Deviation (STDEV) STERR |)

Tenure Audit -> Asymmetry

0.162494 0.162932 0.034452 4,716516

Information

Tenure Audit -> Audit Quality 0, 274886 0.274137 0.034826 7.893171

Audit Fee -> Asymmetry

0.032008 0.034039 0.033955 0.942640

Information

Audit Fee -> Audit Quality 0.341786 0.345019 0.023353 14,635492

Asymmetry Information ->

0.066527 0.067506 0.035856 1.855375

Audit Quality

Table 2:- Path Coefficients (Mean, STDEV, T-Values)

Hypothesis testing is intended to test the effect of an The effect of audit tenure on information asymmetry

exogenous variable or the effect of endogenous variables

on other endogenous variable. In other word, you want to H4 : audit tenure has a significant effect on

test the significance of the influence of a variable that information asymmetry

affects another variable that isi affected.

Based on the result of hypothesis using PLS obtained t

The basis of decision making from the hypothesis test statistik of 4,716516 > t table (1,645). This mean that audit

is that if the value of t statistic < t table then the hypothesis is tenure has a effect on information asymmetry. The value

accepted. The hypothesis that can be described based on the means sample of 0,162932 indicate that audit tenure has a

result in the table above are: direct positive relationship to information asymmetry. Thus

the hypothesis of this study was accepted.

The effect of audit fees on audit quality

The effect of information asymmetry on audit quality

H1 : fee audit has a significant effect on audit quality

H5 : information asymmetry has a significant effect on

Based on testing of hypothesis using PLS obtained t audit quality

statistik of 14,635 > t table (1,654). This mean that audit fee has

a effect on audit quality. The value means sample of Based on the result of hypothesis using PLS obtained t

0,345019 indicates that fee audit have a direct positive statistik of 1,855375 > t table (1,645). This mean that

relationship to audit quality. Thus the first hypothesis of information asymmetry has a effect on audit quality. The

this study was accepted. value means sample of 0,067506 indicate that information

asymmetry has a direct positive relationship to audit

The effect of audit tenure on audit quality quality. Thus the hypothesis of this study was accepted.

H2 : audit tenure has a significant effect on audit V. CONCLUSION

quality

This study aims to empirically examine the effect of

Based on the result of hypothesis using PLS obtained t fee audit and audit tenure on audit quality with information

statistik of 7,893171 > t table (1,645).this mean that audit asymmetry as an intervening variable. In this study the

tenure has a effect on audit quality. The value means author uses partial least square (PLS) version 3.0 in

sample of 0,274137 indicate that audit tenure has a direct analyzing relationship between variables.

positive relationship to audit quality. Thus the hypothesis of

this study was accepted. SUGGESTION

The effect of audit fees on information asymmetry The suggestion from this research are that the next

researcher can conduct research in other industries because

H3 : audit fees has significant effect on information this research only uses manufacturing comopanies, so that

asymmetry it can be better generalized. In addition, the next researcher

can add other variable that can make this study more

Based on the result of hypothesis using PLS obtained t perfect, such as adding audit committe variables and

statistik of 0,942 > t table (1,645).this mean that audit fee extendingthe research period and using different measuring

has no effect on information asymmetry. In other word, instruments.

between fee audit and information asymmetry do not have a

relationship. Thus the hypothesis of this study was rejected.

IJISRT19JU573 www.ijisrt.com 766

Volume 4, Issue 6, June – 2019 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

REFERENCES [17]. Elen, Trimayarni and Sekar Mayangsari et al. 2013.

The Influence of Public Accountants' Accountability,

[1]. Abdillah, Willy and Jogiyanto Hartono.2015.Partial Competence, Professionalism, Integrity, and

Least Square-Alternative Structural Equation Objectivity on Audit Quality with Indendency as a

Modeling (SEM) in Business Research.Publisher Moderating Variable. Journal of Accounting and

Andi. Yogyakarta. Auditing.Vol. 10 No. 1

[2]. Agoes, Sukrisn. 2004.Auditing (Examination of [18]. Ghosh, Aloke and Doochel Moon.2005. Tenure and

Accountants) by the accountant Office Public.Third Perception Auditors of Audit Quality.The Accounting

edition. Institution Publisher of the Faculty of Review. Vol. 80 (2) (585-612).

Economics, University of Indonesia [19]. Godfrey, et al., 2010.Accounting theory 7th Edition.

[3]. Agoes, Sukrisn. 2012.Auditing (examination of Australia: Jhon Willey and Sons Australia Ltd.

accountants) by theAccounting [20]. Hartadi, Bambang.2012. Effect of Audit Fee, KAP

PublicFirm.Fourth edition. Institution Publisher of Rotation, and Auditor's Reputation on Audit

the Faculty of Economics, University of Indonesia Quality.Economic and FinancialJournal. Vol. 16 No.1

[4]. Al-Thuneibat, Ali Abedalqader, Ream Tawfiq Ibrahim (84-103).

Al issa and Rana Ahmad Ata Baker.2011. Do Audit [21]. Hoitash, Rani. 2007. Auditor Fee and Audit

Tenure and Firm Size Contribute to Audit Quality: Quality.Managerial Auditing Journal. Vol.22 No.8

Empirical Evidance from Jordan.Managerial (761-786)

AuditingJournal. Vol. 25 No.4 (317-334) [22]. Jackson, Andrew.B, Michael Moldrich and Peter

[5]. Almutairi, Ali R, Kimberly A. Dunn and Terrace Roebuck.2008.Mandatory Audit Firm Rotation and

Skant. 2009.Auditor Tenure, Auditor Specialization Audit Quality.Managerial Auditing Journal.Vol 23

and Information Asymmetry Managerial Auditing issue 5 (1-27).

Journal. 24 No.7 (600-623) [23]. Jensen, MC and WH Meckling. 1976. Theory of the

[6]. Arens, Alvin.A, RandelJ.Eider and Beasley Firm: Management Behavior Agency Cost and

Marks.2012 Auditing and Assurance Services-AN Ownership Structure. Journal of Finance

Integrated Approach. Twelfth Edition. Office Hall. Economic.Vol 3 No. 4 (305-360)

[7]. Arisinta, Octaviana.2013. Effect of Competence, [24]. Junaidi, Jogiyanto Hartono.2010. Non-Financial

Independence, Time Budget, and Audit Fee on Audit Factors at Opinion Going Concern.Paper presented at

Quality at KAP in Surabaya.Journal of Economics the National Symposium on Accounting XIII.

and Business.No. 3 (226-278). Purwokerto.

[8]. Asthana, Sharad C and Jeff. P Boone.2012.Abnormal [25]. Junaidi, Harun Pamungkas A and Eko

Audit Fee and Audit Quality.A.JournalPractice and Suwardi.2014.The Effect of Audit Firm Tenure in

Theory. Vol 31 No.3 (1-22) Artificial Rotation on Audit Quality.Journal of

[9]. Banklei, Alan.I, David N.Hurt and Jason E. Mac Economic, Business and Venture Accountancy. Vol.4

Gregor. 2012.Annormal Audit Fee and Restatement.A. No.3 (439-448)

Journal of Practice and Theory.Vol. 31 No.1 (79-96). [26]. Johnson.V. IK and Reynold JK2002's security.Tenure

[10]. Bayaz, Mahmud Lari Dash and Shaban and Quality of Financial Report Audit

Mohammad.2016.The Relationship Between Quality Firm.Contemporary Accounting Research. 19 (4)

and Investment Efficiency Audit.Journalof Economic, (637-660)

MarketingManagement.Vol. 4 No.2 (20-32). [27]. JO, Odia. 2015. Tenure Auditor, Rotation Auditor,

[11]. Bradshaw, MT, Ricahrdson SA, And Sloan RG 2001. and Quality A Review Audit. European Journal of

Do Analyst and Auditors Use Information In Accrual Accounting, Auditing, and Finance Research.Vol. 3

?.Journal of Accounting Research. Vol.39 No.1 (46- No. 10 (76-96)

73). [28]. Kurniasih, Margi and Abdul Rohman. 2014. Effect of

[12]. Cahan, Steven F and Jerry Sun.2015.The Effect of Audit Fee, Tenure Audit and Audit Rotation on Audit

Experience Audit on fee Audit and Audit Quality. Diponegoro Journal of Accounting. Vol.3 No

Quality.Journal of Accounting, Auditing and 3 (1-10)

Finance.Vol. 13 (1) (78-100). [29]. Mgbame, Chijoke Oscar.2012. Audit Partner Tenure

[13]. Htourou, Sonda Marrakchi. 2001. Des Science and Audit Quality: an EuropeanEmpirical Analysis

Compatables Corporate Governance and Earning Journal of Business and Management. Vol 4 No.7

Management Department. Laval University. Canada. (154-162).

[14]. De Angelo, Linda Elizabeth. 1981. Auditor Size and [30]. Mulyadi. 2002. Auditing. Sixth Edition. First print.

Audit Quality. Journal of Accounting and economics Jakarta. Salemba Empat.

3 (183-199) [31]. Ng, Terence Bu Peow and Hun-Tong Tan.2003.Effect

[15]. Diaz, Belen Gonzalez, Roberto Garcia F and Antonio of Authoritative Guidance Availability and Audit

Lopez Diaz.2015. Auditors of Quality and Audit Committee Effectiveness on Auditor's Judgment in

Quality in Spanish State Owned Foundations.Spanish Client Negotiation context auditor. The Accounting

Accounting Review.18 (2) (115-126). Review Vol 78 (801-818).

[16]. Eisenhardt, KM. 1989. Agency Theory. Assessment

and Review.Academy of Management Review.Vol. 14

(57-74).

IJISRT19JU573 www.ijisrt.com 767

Volume 4, Issue 6, June – 2019 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[32]. Okolie, Augustine, O. 2014. Audit Quality and

Earning Reponses of the Joefficients of Quoted

Companies in Nigeria. Journal of Applied Finance

and Banking. Vol. 4 No.2 (139-161).

[33]. Praptorini, MirnaDyah and Indra Januarti. 2007.

Analysis of the Effect of Debt Default and Opinion

Shopping Audit Quality on the Acceptance of Opinion

Going Concern. Presented at the National Accounting

Symposium (SNA) X. Makassar.

[34]. Rahmina, ListyaYuniastuti and Sukrisno Agus. 2014.

Influence Auditor Independence, Tenure and Audit

Fee Audit on Quality of Members of Capital Market

Accountant Audit Forum in Indonesia. Social and

Behavioral Science 164 (324-331).

[35]. Scott, William R.2000.Financial Accounting

Theory.USA .rentice Hall

[36]. Sekaran, Uma. 2003. Research Methods for Business:

A Skill Building Approach. New York-USA. John

Wiley and Sons Inc.

[37]. Sugiono. 2013. Quantitative, Qualitative and R &

DResearch Methods. Contents Alfabeta.

[38]. Suwardjono.2008.Accounting Theory: Financial

Reporting Engineering.Third Edition. Yogyakarta:

BPFE Yogyakarta.

[39]. Tarigan, Malem Ukur and Primsa Bangun

Susanti.2013. Effects of Competence, Ethics and

Audit Fees on Audit Quality.Accounting Journal.Vol

13 No.1 (803-832).

[40]. Tuanakotta, TheodoreM. 2011. Critical Thinking in

Auditing. Jakarta. Salemba Empat.

[41]. Varici, Idiris. 2013. The Relationship Between

Information Asymmetry and the Quality of Audit.An

Empirical Business Research Vol. 6 No.10 (132-140)

[42]. Wakum, AlexanderAjisuseno, I Gede Suparta

Wisadha.2014. Effects of the Tenure Audit on

Asymmetry Information with the Audit Committee

Moderation. Accounting E-Journal of Udayana

University.Vol.6 No.3 (499-513)

[43]. Wiryadi, Arri and Nurzi Sebrina.2013. Effects of

Information Asymmetry, Audit Quality, and

Ownership Structure on Profit Management. WRA

Vol 1 No.2.

[44]. Yaghoobnezad, Ahmad, Ramazanali Royaee and

Mehdi Safari Gerayli.2014.The Effect of Quality

Audit on Information Asymmetry: Emperical

Evidence from Iran. Asian Journal of Research In

Banking and Finance.Vol. 4 No.1 (128-139).

IJISRT19JU573 www.ijisrt.com 768

Anda mungkin juga menyukai

- The Correlation of Audit Fee, Audit Quality and Integrity of Financial Statement Vanica Serly, Nayang HelmayunitaDokumen6 halamanThe Correlation of Audit Fee, Audit Quality and Integrity of Financial Statement Vanica Serly, Nayang Helmayunitaiwan prasetyaBelum ada peringkat

- 9725 Juliana 2019 E R1Dokumen25 halaman9725 Juliana 2019 E R1Aryo BimoBelum ada peringkat

- Jurnal Akuntansi Dan Auditing Indonesia: Neni Meidawati, Arden AssidiqiDokumen12 halamanJurnal Akuntansi Dan Auditing Indonesia: Neni Meidawati, Arden AssidiqiMay Yesti TrivitaBelum ada peringkat

- Audit Tenure and Investor's Perception On Audit Quality Before and After Implementation of The SA 240Dokumen11 halamanAudit Tenure and Investor's Perception On Audit Quality Before and After Implementation of The SA 240mariyha PalangganaBelum ada peringkat

- Bai Nghien Cuu 4Dokumen15 halamanBai Nghien Cuu 4Ưng Nguyễn Thị KimBelum ada peringkat

- MTA & Fadhillah. Published in JAATDokumen8 halamanMTA & Fadhillah. Published in JAATMuhammad TaufikBelum ada peringkat

- Audit ResearchDokumen10 halamanAudit ResearchChamunorwa MunemoBelum ada peringkat

- Factors Affecting Audit Firms Rotation Jordanian CaseDokumen20 halamanFactors Affecting Audit Firms Rotation Jordanian CaseSarah FawazBelum ada peringkat

- 6874 27228 2 PBDokumen14 halaman6874 27228 2 PBiwan prasetyaBelum ada peringkat

- Ilechukwu, Felix UbakaDokumen8 halamanIlechukwu, Felix UbakaMariaa IvannaBelum ada peringkat

- The Effects of Ethical Factors in Financial Statement Examination Ethical Framework of The Input Process Output IPO Model in Auditing System BasisDokumen10 halamanThe Effects of Ethical Factors in Financial Statement Examination Ethical Framework of The Input Process Output IPO Model in Auditing System BasisRoyBelum ada peringkat

- The Impact of Competency, Independency and Professional Scepticism Toward Audit Fee DeterminationDokumen9 halamanThe Impact of Competency, Independency and Professional Scepticism Toward Audit Fee DeterminationaijbmBelum ada peringkat

- An Analysis of Factors Affecting Reliability of Financial ReportDokumen18 halamanAn Analysis of Factors Affecting Reliability of Financial ReportPhượng ViBelum ada peringkat

- Integration of Audit Quality Practices and The Determinants of Strategic Decision-Making Ability To Enhance Business PerformanceDokumen7 halamanIntegration of Audit Quality Practices and The Determinants of Strategic Decision-Making Ability To Enhance Business PerformanceInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- D. I. PurnamasariDokumen5 halamanD. I. PurnamasariBella TansilBelum ada peringkat

- The Effect of Audit Quality On Firm Performance: A Panel Data ApproachDokumen16 halamanThe Effect of Audit Quality On Firm Performance: A Panel Data ApproachFaraz Khoso BalochBelum ada peringkat

- Investigating The Relationship Between ADokumen7 halamanInvestigating The Relationship Between AsmartlordartBelum ada peringkat

- Do Audit Tenure and Firm Size Contribute To Audit Quality Empirical Evidence From Jordan PDFDokumen18 halamanDo Audit Tenure and Firm Size Contribute To Audit Quality Empirical Evidence From Jordan PDFMuhammad AkbarBelum ada peringkat

- Hidayawiya, Erlina, Isfenti SadaliaDokumen12 halamanHidayawiya, Erlina, Isfenti SadaliaADELIA FILDZAH NADHILAHBelum ada peringkat

- Accuracy of Audit Opinion: Factors That Influence It: Www/http/jurnal - Unsyiah.ac - id/JAROEDokumen14 halamanAccuracy of Audit Opinion: Factors That Influence It: Www/http/jurnal - Unsyiah.ac - id/JAROEichwanBelum ada peringkat

- Audit Quality Impact of Engagement Partners' Client LoadsDokumen13 halamanAudit Quality Impact of Engagement Partners' Client LoadsHEMALA A/P VEERASINGAM MoeBelum ada peringkat

- Impact of Auditor Professionalism, Ethics and Independence on Materiality JudgmentDokumen83 halamanImpact of Auditor Professionalism, Ethics and Independence on Materiality JudgmentAlfina Fittrinnisak100% (1)

- 2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesDokumen22 halaman2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesasmeldiBelum ada peringkat

- Jurnal PendukungDokumen79 halamanJurnal PendukungAndika SuryaBelum ada peringkat

- Effect of Audit Tenure, Rotation, Firm Size on QualityDokumen14 halamanEffect of Audit Tenure, Rotation, Firm Size on Qualitylina chuaBelum ada peringkat

- Does Audit Fees and Non-Audit Fees Matters in Audit Quality?Dokumen11 halamanDoes Audit Fees and Non-Audit Fees Matters in Audit Quality?Addoula TOUNSIBelum ada peringkat

- Yu 2020Dokumen7 halamanYu 2020Rusli RusliBelum ada peringkat

- J R A K: Voluntary Disclosure, Earnings Response Coefficient, and Earnings PersistenceDokumen15 halamanJ R A K: Voluntary Disclosure, Earnings Response Coefficient, and Earnings PersistenceHadi BaziarBelum ada peringkat

- Pengaruh Profit Likuid Solva Terhdap Opini GC Persh ManufakturDokumen10 halamanPengaruh Profit Likuid Solva Terhdap Opini GC Persh ManufakturHanny FadhillahBelum ada peringkat

- CA 1 PutuagusardianaDokumen15 halamanCA 1 PutuagusardianabhupaliBelum ada peringkat

- The Effect of Financial Secrecy and IFRS Adoption On Earnings Quality: A Comparative Study Between Indonesia, Malaysia and SingaporeDokumen24 halamanThe Effect of Financial Secrecy and IFRS Adoption On Earnings Quality: A Comparative Study Between Indonesia, Malaysia and SingaporeMarwiyahBelum ada peringkat

- Ijsar 6048 PDFDokumen10 halamanIjsar 6048 PDFInsyiraah Oxaichiko ArissintaBelum ada peringkat

- The Effects of Audit LagDokumen16 halamanThe Effects of Audit LagAfrizar PaneBelum ada peringkat

- The Effect of Financial Distress, Company Growth Rate and Company Complexity On Auditor Switching in Manufacturing CompaniesDokumen7 halamanThe Effect of Financial Distress, Company Growth Rate and Company Complexity On Auditor Switching in Manufacturing CompaniesAJHSSR JournalBelum ada peringkat

- Jurnal Akuntansi Dan BisnisDokumen16 halamanJurnal Akuntansi Dan BisnisAnnisa ZabrinaBelum ada peringkat

- Stepha 1Dokumen13 halamanStepha 1yaiyalahBelum ada peringkat

- Pengaruh Audit Tenure, Komite Audit Dan Audit Capacity: Stress Terhadap Kualitas AuditDokumen13 halamanPengaruh Audit Tenure, Komite Audit Dan Audit Capacity: Stress Terhadap Kualitas AuditVany OktarinaBelum ada peringkat

- Thesis Auditor IndependenceDokumen5 halamanThesis Auditor IndependenceYasmine Anino100% (2)

- GCG - 3Dokumen6 halamanGCG - 3Amelia Wahyuni DewiBelum ada peringkat

- Impact of Audit Quality On Earnings Mana PDFDokumen8 halamanImpact of Audit Quality On Earnings Mana PDFDicky AfrizalBelum ada peringkat

- An Empirical Analysis of Auditor Independence and Audit Fees On Audit QualityDokumen7 halamanAn Empirical Analysis of Auditor Independence and Audit Fees On Audit QualityTrang HuynhBelum ada peringkat

- Mandatory Auditor Rotation and Earnings QualityDokumen25 halamanMandatory Auditor Rotation and Earnings QualityAhmad KurniawanBelum ada peringkat

- The Impact of Audit Quality On The Financial Performance of Listed Companies NigeriaDokumen6 halamanThe Impact of Audit Quality On The Financial Performance of Listed Companies NigeriaKathlyn BrawleyBelum ada peringkat

- Audit Pricing, Stat-Up Cost and Opinion Shopping - Tijani Et Al 2014 PDFDokumen33 halamanAudit Pricing, Stat-Up Cost and Opinion Shopping - Tijani Et Al 2014 PDFwaewdao7Belum ada peringkat

- Accounting Analysis Journal: Dimas Dwi Oktavianto and Dhini SuryandariDokumen8 halamanAccounting Analysis Journal: Dimas Dwi Oktavianto and Dhini SuryandariHimawan SutantoBelum ada peringkat

- The Effect of Audit Firm Size and Age On The Quality of Audit WorkDokumen9 halamanThe Effect of Audit Firm Size and Age On The Quality of Audit WorkajBelum ada peringkat

- Audit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaDokumen15 halamanAudit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaIdorenyin Okon100% (1)

- Audit Quality 4Dokumen22 halamanAudit Quality 4vera charmilaBelum ada peringkat

- 8 Akper AuditingDokumen24 halaman8 Akper AuditingArif RamdaniBelum ada peringkat

- 1 s2.0 S1877042814059035 Main PDFDokumen8 halaman1 s2.0 S1877042814059035 Main PDFwulandariBelum ada peringkat

- Determinants of Auditors Work PerformanceDokumen9 halamanDeterminants of Auditors Work PerformanceLizzy MondiaBelum ada peringkat

- Auditor Switching Pada Perusahaan Perbankan: Faktor - Faktor Yang Berpengaruh Terhadap Di IndonesiaDokumen17 halamanAuditor Switching Pada Perusahaan Perbankan: Faktor - Faktor Yang Berpengaruh Terhadap Di IndonesiasutamaBelum ada peringkat

- 10 +Dema+Octamia+AnggrainiDokumen12 halaman10 +Dema+Octamia+AnggrainiMelianaWanda041 aristaBelum ada peringkat

- Audit Summary Marjan 1Dokumen5 halamanAudit Summary Marjan 1Kogie VanieBelum ada peringkat

- Independent and Joint Effects of Audit Partner Tenure and Non-Audit Fees On Audit QualityDokumen21 halamanIndependent and Joint Effects of Audit Partner Tenure and Non-Audit Fees On Audit QualityGilang PratamaBelum ada peringkat

- Affecting The Audit Quality of Pandemic Era Public AccountantsDokumen11 halamanAffecting The Audit Quality of Pandemic Era Public AccountantsOctavia Putri WigiyanBelum ada peringkat

- AbstractDokumen18 halamanAbstractMoh. Haldy PratamaBelum ada peringkat

- 007 SSRN-id2442253Dokumen18 halaman007 SSRN-id2442253PhatLeBelum ada peringkat

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveDari EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveBelum ada peringkat

- Analysis of Ancol Beach Object Development Using Business Model Canvas ApproachDokumen8 halamanAnalysis of Ancol Beach Object Development Using Business Model Canvas ApproachAnonymous izrFWiQBelum ada peringkat

- Teacher Leaders' Experience in The Shared Leadership ModelDokumen4 halamanTeacher Leaders' Experience in The Shared Leadership ModelAnonymous izrFWiQBelum ada peringkat

- Design and Analysis of Humanitarian Aid Delivery RC AircraftDokumen6 halamanDesign and Analysis of Humanitarian Aid Delivery RC AircraftAnonymous izrFWiQBelum ada peringkat

- Knowledge and Utilisation of Various Schemes of RCH Program Among Antenatal Women and Mothers Having Less Than Five Child in A Semi-Urban Township of ChennaiDokumen5 halamanKnowledge and Utilisation of Various Schemes of RCH Program Among Antenatal Women and Mothers Having Less Than Five Child in A Semi-Urban Township of ChennaiAnonymous izrFWiQBelum ada peringkat

- Bioadhesive Inserts of Prednisolone Acetate For Postoperative Management of Cataract - Development and EvaluationDokumen8 halamanBioadhesive Inserts of Prednisolone Acetate For Postoperative Management of Cataract - Development and EvaluationAnonymous izrFWiQBelum ada peringkat

- Women in The Civil Service: Performance, Leadership and EqualityDokumen4 halamanWomen in The Civil Service: Performance, Leadership and EqualityAnonymous izrFWiQBelum ada peringkat

- Incidence of Temporary Threshold Shift After MRI (Head and Neck) in Tertiary Care CentreDokumen4 halamanIncidence of Temporary Threshold Shift After MRI (Head and Neck) in Tertiary Care CentreAnonymous izrFWiQBelum ada peringkat

- Evaluation of Assessing The Purity of Sesame Oil Available in Markets of India Using Bellier Turbidity Temperature Test (BTTT)Dokumen4 halamanEvaluation of Assessing The Purity of Sesame Oil Available in Markets of India Using Bellier Turbidity Temperature Test (BTTT)Anonymous izrFWiQBelum ada peringkat

- Investigations On BTTT As Qualitative Tool For Identification of Different Brands of Groundnut Oils Available in Markets of IndiaDokumen5 halamanInvestigations On BTTT As Qualitative Tool For Identification of Different Brands of Groundnut Oils Available in Markets of IndiaAnonymous izrFWiQBelum ada peringkat

- Securitization of Government School Building by PPP ModelDokumen8 halamanSecuritization of Government School Building by PPP ModelAnonymous izrFWiQBelum ada peringkat

- Platelet-Rich Plasma in Orthodontics - A ReviewDokumen6 halamanPlatelet-Rich Plasma in Orthodontics - A ReviewAnonymous izrFWiQBelum ada peringkat

- Closure of Midline Diastema by Multidisciplinary Approach - A Case ReportDokumen5 halamanClosure of Midline Diastema by Multidisciplinary Approach - A Case ReportAnonymous izrFWiQBelum ada peringkat

- Child Rights Violation and Mechanism For Protection of Children Rights in Southern Africa: A Perspective of Central, Eastern and Luapula Provinces of ZambiaDokumen13 halamanChild Rights Violation and Mechanism For Protection of Children Rights in Southern Africa: A Perspective of Central, Eastern and Luapula Provinces of ZambiaAnonymous izrFWiQBelum ada peringkat

- Experimental Investigation On Performance of Pre-Mixed Charge Compression Ignition EngineDokumen5 halamanExperimental Investigation On Performance of Pre-Mixed Charge Compression Ignition EngineAnonymous izrFWiQBelum ada peringkat

- A Wave Energy Generation Device Using Impact Force of A Breaking Wave Based Purely On Gear CompoundingDokumen8 halamanA Wave Energy Generation Device Using Impact Force of A Breaking Wave Based Purely On Gear CompoundingAnonymous izrFWiQBelum ada peringkat

- IJISRT19AUG928Dokumen6 halamanIJISRT19AUG928Anonymous izrFWiQBelum ada peringkat

- Enhanced Opinion Mining Approach For Product ReviewsDokumen4 halamanEnhanced Opinion Mining Approach For Product ReviewsAnonymous izrFWiQBelum ada peringkat

- IJISRT19AUG928Dokumen6 halamanIJISRT19AUG928Anonymous izrFWiQBelum ada peringkat

- Application of Analytical Hierarchy Process Method On The Selection Process of Fresh Fruit Bunch Palm Oil SupplierDokumen12 halamanApplication of Analytical Hierarchy Process Method On The Selection Process of Fresh Fruit Bunch Palm Oil SupplierAnonymous izrFWiQBelum ada peringkat

- Risk Assessment: A Mandatory Evaluation and Analysis of Periodontal Tissue in General Population - A SurveyDokumen7 halamanRisk Assessment: A Mandatory Evaluation and Analysis of Periodontal Tissue in General Population - A SurveyAnonymous izrFWiQBelum ada peringkat

- Assessment of Health-Care Expenditure For Health Insurance Among Teaching Faculty of A Private UniversityDokumen7 halamanAssessment of Health-Care Expenditure For Health Insurance Among Teaching Faculty of A Private UniversityAnonymous izrFWiQBelum ada peringkat

- Comparison of Continuum Constitutive Hyperelastic Models Based On Exponential FormsDokumen8 halamanComparison of Continuum Constitutive Hyperelastic Models Based On Exponential FormsAnonymous izrFWiQBelum ada peringkat

- Effect Commitment, Motivation, Work Environment On Performance EmployeesDokumen8 halamanEffect Commitment, Motivation, Work Environment On Performance EmployeesAnonymous izrFWiQBelum ada peringkat

- SWOT Analysis and Development of Culture-Based Accounting Curriculum ModelDokumen11 halamanSWOT Analysis and Development of Culture-Based Accounting Curriculum ModelAnonymous izrFWiQBelum ada peringkat

- Trade Liberalization and Total Factor Productivity of Indian Capital Goods IndustriesDokumen4 halamanTrade Liberalization and Total Factor Productivity of Indian Capital Goods IndustriesAnonymous izrFWiQBelum ada peringkat

- Revived Article On Alternative Therapy For CancerDokumen3 halamanRevived Article On Alternative Therapy For CancerAnonymous izrFWiQBelum ada peringkat

- Exam Anxiety in Professional Medical StudentsDokumen5 halamanExam Anxiety in Professional Medical StudentsAnonymous izrFWiQ100% (1)

- Pharmaceutical Waste Management in Private Pharmacies of Kaski District, NepalDokumen23 halamanPharmaceutical Waste Management in Private Pharmacies of Kaski District, NepalAnonymous izrFWiQBelum ada peringkat

- The Influence of Benefits of Coastal Tourism Destination On Community Participation With Transformational Leadership ModerationDokumen9 halamanThe Influence of Benefits of Coastal Tourism Destination On Community Participation With Transformational Leadership ModerationAnonymous izrFWiQBelum ada peringkat

- To Estimate The Prevalence of Sleep Deprivation and To Assess The Awareness & Attitude Towards Related Health Problems Among Medical Students in Saveetha Medical CollegeDokumen4 halamanTo Estimate The Prevalence of Sleep Deprivation and To Assess The Awareness & Attitude Towards Related Health Problems Among Medical Students in Saveetha Medical CollegeAnonymous izrFWiQBelum ada peringkat

- Poster Apsr 2019 Dr. SonyaDokumen1 halamanPoster Apsr 2019 Dr. SonyaSonya NovianaBelum ada peringkat

- ANSYS ManualDokumen62 halamanANSYS ManualPratheesh JpBelum ada peringkat

- Cost Behavior Analysis-CostAcctDokumen18 halamanCost Behavior Analysis-CostAcctindahmuliasari100% (1)

- (1996) Anthropometry and BiomechanicsDokumen59 halaman(1996) Anthropometry and BiomechanicsOscar Aviles100% (2)

- Disaster Preparedness: Key Concepts, Metrics, and PrinciplesDokumen44 halamanDisaster Preparedness: Key Concepts, Metrics, and Principlestanarman100% (3)

- Statistics MCQs and Practice QuestionsDokumen38 halamanStatistics MCQs and Practice Questionsarjunmba119624Belum ada peringkat

- Biostatistics and Research Methodology (Thakur Publication)Dokumen353 halamanBiostatistics and Research Methodology (Thakur Publication)Riya Nandu100% (2)

- Project ReportDokumen51 halamanProject ReportFarooqui AimanBelum ada peringkat

- CH 01Dokumen3 halamanCH 01Tibet Boğazköy AkyürekBelum ada peringkat

- Area Measuring InstrumentDokumen3 halamanArea Measuring InstrumentSHERWIN MOSOMOSBelum ada peringkat

- Building High Frequency Trading ModelDokumen19 halamanBuilding High Frequency Trading ModelMaxBelum ada peringkat

- KAWASHIMA. Comparing Cultural PolicyDokumen20 halamanKAWASHIMA. Comparing Cultural PolicyRocío López100% (1)

- Chapter 1 - Stats Starts HereDokumen24 halamanChapter 1 - Stats Starts HereAdam Glassner100% (1)

- HR Management CH 12 Review QuestionsDokumen4 halamanHR Management CH 12 Review QuestionsSalman KhalidBelum ada peringkat

- Lankamo Love-2Dokumen32 halamanLankamo Love-2unknown name100% (2)

- Action Verbs ListDokumen4 halamanAction Verbs ListGabriel Gómez RojoBelum ada peringkat

- STATISTICS FOR BUSINESS - CHAP05 - Sampling and Sampling Distribution PDFDokumen3 halamanSTATISTICS FOR BUSINESS - CHAP05 - Sampling and Sampling Distribution PDFHoang NguyenBelum ada peringkat

- Effect of Advertisement On Coca ColaDokumen10 halamanEffect of Advertisement On Coca ColaAnkur SheelBelum ada peringkat

- 2-AWWA Manual Od Water Audit and Leak DetectionDokumen55 halaman2-AWWA Manual Od Water Audit and Leak Detectionmuhammad.civilBelum ada peringkat

- Sparks and The 40 Developmental AssetsDokumen2 halamanSparks and The 40 Developmental AssetsMartin GonzalezBelum ada peringkat

- (OG) Characterizing Chinese Consumers Intention To Use Live Ecommerce ShoppingDokumen13 halaman(OG) Characterizing Chinese Consumers Intention To Use Live Ecommerce ShoppingMuhammad YusufaBelum ada peringkat

- Research Methodology and IPRDokumen2 halamanResearch Methodology and IPRHaran HariBelum ada peringkat

- Literature Review on Marketing Strategies and Consumer Behaviour of FMCG Companies in Rural IndiaDokumen18 halamanLiterature Review on Marketing Strategies and Consumer Behaviour of FMCG Companies in Rural IndiaFuzail asad ,76,BBelum ada peringkat

- Lab Report Bochem 1 PipettorsDokumen4 halamanLab Report Bochem 1 PipettorsMuhamad Syazwan Bin MisranBelum ada peringkat

- How Absence of Father Figures Impacts YouthDokumen29 halamanHow Absence of Father Figures Impacts YouthSamantha CampbellBelum ada peringkat

- Corbetta, P. (2003) - From Theory To Empirical Research en Social Research - Theory, Methods and Techniques PDFDokumen31 halamanCorbetta, P. (2003) - From Theory To Empirical Research en Social Research - Theory, Methods and Techniques PDF11-2 Ramírez cárdenas valentinaBelum ada peringkat

- Developing and Validating a Cyber-bullying Awareness ToolDokumen7 halamanDeveloping and Validating a Cyber-bullying Awareness ToolSHi E NaBelum ada peringkat

- Elements of Demand EstimationDokumen2 halamanElements of Demand EstimationAnggi Saputra TanjungBelum ada peringkat

- ISTQB TestAnalystDokumen2 halamanISTQB TestAnalystReshma RanganBelum ada peringkat

- Research LP (3RD Quarter)Dokumen7 halamanResearch LP (3RD Quarter)Jaidee BiluganBelum ada peringkat