Mba 2 Ba7202 May 2017 PDF

Diunggah oleh

Anonymous uHT7dD0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

1 tayangan4 halamanJudul Asli

MBA-2-BA7202-MAY-2017.pdf

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

1 tayangan4 halamanMba 2 Ba7202 May 2017 PDF

Diunggah oleh

Anonymous uHT7dDHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 4

Reg. No. : [

eel hola

Question Paper Code : 63149

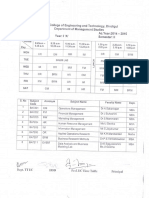

M.B.A. DEGREE EXAMINATION, APRIL/MAY 2017.

Second Semester

BA 7202 - FINANCIAL MANAGEMENT.

(Regulations 2013)

‘Time : Three hours Maximum : 100 marks

Answer ALL questions.

PART A — (10 x 2= 20 marks)

‘1. What is Risk Premium?

2. Why does money have time value?

8. What is profitability index?

4. What do you mean by Capital Rationing?

5. State the significance of financial leverage.

6. Defines stock split.

7. List out the motives for holding cash.

8 Write short note on economic Order Quantity.

9. What is private equit

10. What are the companies represented in the sensex?

PART B —(5 x 13 = 65 marks)

11. (a) Define, what is return? Write the various of total return. Whether

unrealised capital gain or loss be included in the calculations of returns?

Or

(b) ABC company currently paying a divided of € 2 per share. The dividend

is expected to grow at a 15% annual rate for the three years, then at 10%

rate of the next three years, after which it is expected to grow at a 5%

rate forever.

(@ What is the present value of the share if the capitalisation rate is

9%?

(i) If the share is held for three years, what shall be its present value?

Year: 1 2 3

4 5 6

PYF @9%: 0.917 0.842 0.772 0.708 0.650 0.596

12, (a) How is accounting rate of return calculated? Explain its merits and

demerits.

Or

(b) Machine X has a cost of € 75,000 and net cash flow of € 20,000 per year,

for six years. A substitute machine Y would cost € 50,000 and generate

net cash flow of % 14,000 per year for six years. The required rate of

return of both machines i

11%. Caleulate the IRR and NPV for the

machines. Which machine should be accepted and why?

11% «12% 18% 14%

4.231 4.111 3,998 3.889) 3.784 3.685 3.589 3.498

PVF 6° Ye:

15% 16% 17% 18%

13. (a) Discusé the procedure for determining the weighted average cost of

capital. What’ are the factors affecting the weighted average cost of

capital?

Or

() Calculate financialand operating leverages under situations when

fixed costs are (i) € 5,000 (i) € 10,000 and financial plans 1 and 2

respectively, from the following information pertaining to the operation _

and capital structure of ABC Co.

__ [Teta Assets

Total. asscts tumover based on sales

Variable costs as percentage of sales

Capital structure :

Equity

10% debenture

= 30,000

2

60

Financial plans

1 2

30,000 10,000

10,000 30,000

63149

4.

(a)

Discuss tho various opportunities available to the companies to park

their surplus funds for a short term,

Or

From the following information, prepare a cash budget for three months

from June to August :

Month Sales Purchases Wages Overheads Expenses

June 72,000 25,000 10,000 6,000 —«5,500

July 97,000 81,000 12,100 6300 _—6,700

August 86,000 25,500 10,600 6,000, 7,500

@) Cash balance in hand as on 1 June € 72,500

(i) 50%, of sales are cash sales

(ii) - A fixed assets has to he purchased for € 8,000in July

Gy) Debtors are allowed one month's credit

(¥) Creditors for materials grant one month's eredit

(vi) Sales commission at 3% on sales is paid to the salesman each

month,

Discuss the various procedure involved in obtaining a term loan.

Or

Explain in detail legal aspects of leasing. What are the contents of a lease

agreement?

PART C— (1 ¢15= 15 marks)

You are required to calculate the overall cost of capital, from the

following capital structure of a company.

x

1,000 12% Preference shares of € 100 each issued at par —_1,00,000

10,000 Equity shares of € 10 each issued at par 1,00,000

5,000 10% Debentures of € 100 each issued at par 5,00,000

12% Term loan 2,00,000

Retained earnings 1,50,000,

‘The market price of an equity share is € 30. The next expected dividend

is © 9-per share and the dividend per share is expected to grow at 10%.

The preference shares are redoomable after 7 years at par and are

currently quoted at € 75 per share. The debentures are redeemable at

par after 5 years and are quoted at € 90 per debenture. The tax rate

applicable to the company is 40%.

Or

a

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- 1 PDFDokumen5 halaman1 PDFAnonymous uHT7dDBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Notification For The Post of Computer Operator DT 02 05 2019Dokumen12 halamanNotification For The Post of Computer Operator DT 02 05 2019karthickrajaBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- TQM StudyMaterial Unit I v2.0Dokumen21 halamanTQM StudyMaterial Unit I v2.0VinishBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Tamil Books and Authors PDFDokumen8 halamanTamil Books and Authors PDFsivaram88871% (14)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Sapm QBDokumen13 halamanSapm QBAnonymous uHT7dDBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Controlling Techniques For Quality PDFDokumen25 halamanControlling Techniques For Quality PDFAnonymous uHT7dDBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- 3 Page-CV - ENGLISH Feb 15 2015 PDFDokumen3 halaman3 Page-CV - ENGLISH Feb 15 2015 PDFAnonymous uHT7dDBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- DBA 1724 Merchant Banking and Financial ServicesDokumen264 halamanDBA 1724 Merchant Banking and Financial Servicesaruna2707Belum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- TQM StudyMaterial Unit II v1.0 PDFDokumen28 halamanTQM StudyMaterial Unit II v1.0 PDFAnonymous uHT7dDBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- TQM StudyMaterial Unit I v2.0Dokumen21 halamanTQM StudyMaterial Unit I v2.0VinishBelum ada peringkat

- 12 - Chapter 8Dokumen17 halaman12 - Chapter 8Anonymous uHT7dDBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- TQM StudyMaterial Unit V v1.0 Part 2 of 2 PDFDokumen7 halamanTQM StudyMaterial Unit V v1.0 Part 2 of 2 PDFAnonymous uHT7dDBelum ada peringkat

- FLO Learning Solution Placement DriveDokumen1 halamanFLO Learning Solution Placement DriveAnonymous uHT7dDBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- MatSci PDFDokumen2 halamanMatSci PDFAnonymous uHT7dDBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- 2 2015 Not Eng ChemistDokumen27 halaman2 2015 Not Eng Chemistsatking24Belum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- TNPSC Ilakanam Periyasamy WWW Tnspctamil in PDFDokumen44 halamanTNPSC Ilakanam Periyasamy WWW Tnspctamil in PDFMalkish Rajkumar100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Competitor AnalysisDokumen11 halamanCompetitor AnalysisAnonymous uHT7dDBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- 221 Tet Tips How To Study English SubjectDokumen1 halaman221 Tet Tips How To Study English SubjectSiva2sankarBelum ada peringkat

- Sjhahhsha HHDokumen1 halamanSjhahhsha HHAnonymous uHT7dDBelum ada peringkat

- ChildDokumen1 halamanChildHari HaranBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- 223 How To Study School Books PDFDokumen3 halaman223 How To Study School Books PDFAnonymous uHT7dDBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Apparel or Fashion MarketingDokumen9 halamanApparel or Fashion MarketingAnonymous uHT7dDBelum ada peringkat

- Rural MarketingDokumen304 halamanRural Marketingmanjiree9Belum ada peringkat

- Professional Ethics PDFDokumen20 halamanProfessional Ethics PDFjothimanicseBelum ada peringkat

- Unit 2Dokumen42 halamanUnit 2Anonymous uHT7dDBelum ada peringkat

- Notes On Supply Chain ManagementDokumen20 halamanNotes On Supply Chain Managementhgopalkrishnan84% (31)

- Services On DL PDFDokumen4 halamanServices On DL PDFAnonymous uHT7dDBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Tntet - TNPSC - Social - 2019 - Test 1 - Kalam Academy (Uploaded) PDFDokumen19 halamanTntet - TNPSC - Social - 2019 - Test 1 - Kalam Academy (Uploaded) PDFAnonymous uHT7dDBelum ada peringkat

- Unit 1Dokumen37 halamanUnit 1Anonymous uHT7dDBelum ada peringkat

- Unit-Iii Retailing Decisons: PlaceDokumen16 halamanUnit-Iii Retailing Decisons: PlaceAnonymous uHT7dDBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)