05 Impact of Declining

Diunggah oleh

Murtaza HashimJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

05 Impact of Declining

Diunggah oleh

Murtaza HashimHak Cipta:

Format Tersedia

56

IMPACT OF DECLINING MACRO-ECONOMIC

INDICATORS ON THE

NATIONAL SECURITY OF PAKISTAN

*

Zaib Maroof and Obaid ur Rehman

Abstract

National Security is one of the prime concerns of every nation, as its performance

level dictates the sovereignty of the state. National Security is significantly dependent on

economic sovereignty; hence promoting economic development becomes the core priorities

for every government. In this article, a relationship between National Security and

macroeconomic indicators of Pakistan has been discussed. In case of Pakistan, these

indicators are in declining state due to expanding trade deficit, volatile exchange rate,

appreciating inflation, declining remittances, decreasing forex reserves, escalating external

debt from international lending agencies, International Monetary Fund (IMF) and World

Bank (WB) supported by poor governance parameter. These all have resulted in weak

budgetary statistics, which poses a serious concern to the National Security of Pakistan. This

paper identifies salient forthcoming looming threats to Pakistan’s National Security like

becoming prone to the sanctions of Financial Action Task Force (FATF), non-availability of

desired funding to our nuclear and defense program etc. Lastly, the article suggests way

forward to ward-off these likely coercions as a result of declining macroeconomic indicators.

Keywords: Macroeconomic Indicators, National Security, Economic Security,

External Debt and Financial Action Task Force (FATF).

Introduction

N ational Security is the safety of a nation against threats such as terrorism, war, or

espionage1. It is a concept that a government along-with its parliament should

protect the state and its citizens, against all kinds of national crises through a variety

of power projections such as political power, diplomacy, economic power, military

might, and so on2. Hence, in order to achieve comprehensive National Security, a

nation needs to possess other type of securities like economic security, energy

security, environmental security etc. Economic Security, in broader sense includes

probable continued wealth to support country’s developmental projects conceived for

increasing society's production levels, predictability of the future cash flow in a

country to ensure monetary support for non-working citizens and job security for the

*

Zaib Maroof is a Ph.D scholar and Obaid ur Rehman is former MPhil Scholar National Defence University,

Islamabad.

NDU Journal 2018

Impact of Declining Macro-Economic Indicators 57

employed one3. Economic growth is the custodian of economic security and hence

considered as a 'holy grail' of economic sovereignty of any country 4. Economic growth

of a country can be defined as quantitative changes in macroeconomic variables,

which increase the overall production or output over a certain period of time,

compared to the previous period5. Various predominant macroeconomic factors that

contribute towards the process of economic growth include Gross Domestic Product

(GDP), national income and resources, population, unemployment rate, Consumer

Price Index (CPI - Inflation), exchange rate, balance of trade, Foreign Direct

Investment (FDI), public and private investment, remittances, foreign exchange

reserves, government spending and expenditures, etc.6 Macro-economic turmoil can

lead to low level of economic freedom, thereby posing a serious threat to economic

sovereignty and security of a nation7.

Apropos in view, the present article describes the current status of macro-

economic indicators of Pakistan contributing towards one of the most essential

element of national power i.e. economy and consequential threats towards the

National Security of Pakistan due to their declining levels.

National Security

For a common person, National Security is perceived to be the protection of a

nation against alien invaders, however, if we take concept of comprehensive national

security for Pakistan, then we have to take in to account external, internal and non-

traditional securities, fully conceived, structured and implemented. These all heads

and their sub-elements are inter-linked8. External security or security against external

aggression is both a civil and military affair. It is military in execution but civil in

design. For instance, defense policy is derived from the foreign policy; however,

military action is the extreme end of failed diplomacy. On the other hand, internal

Security is the act of keeping peace within the borders of a sovereign state or other

self-governing territories, generally by upholding the national law and defending

against internal security threats. Responsibility for internal security may range from

police to paramilitary forces and in exceptional circumstances, the military itself 9.

Lastly, non-traditional security is that type, which focuses on security challenges that

are not considered main stream security threats and may be defined as challenges to

the survival of states10. They are generally non-military in nature, transnational in

scope i.e. neither totally domestic nor purely inter-state; but now-a-days they are

transmitted rapidly due to globalization and communication revolution. This implies

that these non-traditional threats are much intimidating then the traditional ones, as

they require the national leadership to look not only outwards to cultivate

international cooperation but also inwards, with an open outlook, to execute internal

socioeconomic and political reforms. Various types of non-traditional securities are

economic, energy, natural resources, border, demographic, disaster, geostrategic,

NDU Journal 2018

58 Zaib Maroof and Obaid ur Rehman

information, ethnic, cyber, genomic and human securities11. Human security further

comprises economic, food, health, environmental, personal, community and political

securities.

Notwithstanding above, interdependency is the essential hallmark of all

elements of national security, as change in one induces a change in another, resulting

in an incremental or declining effect in the overall national security environment. In

this article, out of all, only economic security has been discussed, as it is the product

of macro-economic indicators of any country and has strong association with all other

elements in national security paradigm. To some authors, health of economic security

is the performance indicator of national security itself12.

Economic Security

Economic security, in the context of politics and international relations, is the

ability of a nation-state to follow its choice of policies to develop the national

economy in the manner desired13. In today's complex system of international trade,

characterized by multi-national agreements, mutual interdependence and availability

of natural resources etc. today economic security forms, unarguably, as the most

important ingredient of national security. In view of its significance, American foreign

policy after 9/11 considers economic security as a key determinant of international

relations14 even in Canada, threat to economic security is considered as economic

espionage15.

Nexus between Economy, Economic Growth and National

Security

According to Robert McNamara, “security means development and without

development there is no security” 16 and Paul Kennedy said that nation’s military

strength rests on its economic strength 17. Studies evidenced that weak economic

growth negatively influence the national security of a country, as same fails to create

enough jobs, especially for new entrants, higher unemployment, rising poverty,

growing civil unrest, social chaos and breakdown of law and order which ultimately

creates serious threats to the national security of a country. The economy enters into

the debate on national security through three overlapping roles 18 . Initially the

economy acts as a source of funds, material, and personnel for the military; secondly it

provides economic security and well-being to citizens and lastly mode of interaction

among countries for sharing competing interests. This includes the flow of wealth

generated by trade that allows countries to build their military and financial power.

Few think tanks believe that the economy entered into the national security debate

through four modes i.e. defense industrial base, program cuts, international economic

sanctions and export controls19. Economic sanctions compliment military actions to

NDU Journal 2018

Impact of Declining Macro-Economic Indicators 59

make it successful20 and lie between diplomacy and open warfare. Often, the first

response to national security and foreign policy problems has been economic: trade

restriction, embargoes, freezing of financial assets and so on 21 . Hence, national

security of an economically declining country like Pakistan is prone to economic

sanctions and a matter of concern for policy makers. To understand the Pakistan’s

declining economy and its likely impacts, one need to understand the declining

macroeconomic indicators.

Declining Macro-Economic Indicators of Pakistan

Insignificant GDP Growths

World development indicator (WDI) reported a very negligible GDP growth

of 4.3% to 4.7% from Financial Year (FY) 2013 to FY2015 and reached to 5.28% in FY

201622. At present, GDP of Pakistan is approximately US $ 278 billion with per capita

income of US $ 1429; whereas that of India is US $ 2263 billion (8 times more)23, which

generates an alarming situation for Pakistan in the paradigm of national security.

Increase in External Debt: Statistics from the SBP reported an increase external debt

from US $ 73 billion in January 2015 to US $ 88.1 billion in January 2018. On other

hand, already deprived economy having significant defense budget requirement to

combat war on terror has to pay US $ 10 billion approximately by June 2018.

Increase in Debt to GDP Ratio: Statistics from State Bank of Pakistan (SBP)

reported an increase in Debt to GDP ratio during the last decade. Findings showed

that in FY 2008, it was 60.7% but sore to almost 70% from FY 2014 to FY 2017,

ultimately paving the way for poor economic sovereignty and a peril to national

security of country.

Inclining Revenue based on External Debt: Statistics collected from Ministry of

Finance showed that there is substantial increase in external debts from 7.4% to

24.30% from FY 2012 to FY 2017 further aggravated the economic condition as total

resources comprises of external debt, instead revenues generated from exports,

industrial production or high investment return.

Nominal Increase in Developmental but Substantial Increase in Non-

Development Expenditures: Although development expenditure has been

continuously on increase from 3,865 billion in FY 2012-13 to 4,841 billion in FY 2016-17,

but in the presence of non-developmental current expenditures i.e. almost four times

in FY 2016 – 2017 and rising external debts, it appears that acquired loans and

developmental expenditures have not been utilized correctly.

Deteriorating Industrial Growth: Despite trade being custodian of industrial

development, statistics from economic survey of Pakistan for FY 2017 marked a

NDU Journal 2018

60 Zaib Maroof and Obaid ur Rehman

decrease in industrial growth of 5.02%, as compared to 5.80% in FY 2016 evidencing

lower exports and more imports for consumption.

Increase in Imports: Pakistan Bureau of Statistics reported that in last five years the

total imports of the country increased from Rs 4,350 billion to Rs 5,540.22

Decline in Exports: According to Pakistan Bureau of Statistics, total exports of a

country decreased from Rs 2,366 billion to Rs 2,138 billion.22

Inclining Exchange Rate (US $): Statistics of World Development Indicator (WDI)

showed that the Pakistani Rupee continuously showed depreciated trend with respect

to dollar since 201023.

Escalating Inflation: Statistics shows that the FY 2008 started with per capita income

of US $ 1039 and reached to US $ 1444 in FY 2016 23, however inflation inclined to 234 %

during the same period, hence threatening the economic security and making increase

in per capita income meaningless.23

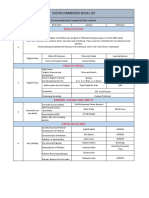

Declining Private and Public Investments in 2017: According to World Bank

indicator, investment summary is as under24:

Table-1: Investment summary (FY 2011 - 2017)

Private Public Total

Investment Investment Investments % of GDP

Year

(US $) (US $) (US $)

billion billion billion

2012 20.78 3.16 23.94 11.21

2013 22.07 2.37 24.45 10.89

2014 22.81 2.66 25.48 11.02

2015 24.82 5.40 30.22 12.37

2016 23.23 3.48 26.72 11.45

Source: Economic Survey of Pakistan24

Foreign Direct Investment (FDI): Economic survey FY2016 - 2017 showed a growth

of 12.75% in FDI from US $ 1.537 billion in FY 2016 to US $ 1.733 billion in FY 2017.

However, statistics showed that these investments were mainly in service sectors like

food, power, construction, electronics, financial business, communication, oil and gas

exploration24, hence does not tantamount to any increase in GDP or increase in

exports, mainly due to FDI (In flow) in service sector rather than industrial sector23.

Decrease in Remittances from Overseas Employees: Workers remittance reached

to US $ 14.1 billion during FY 2017 as compared to US $ 14.4 billion last year 24.

NDU Journal 2018

Impact of Declining Macro-Economic Indicators 61

Major Contributing Factor towards Deteriorating

Macroeconomic Indicators – Poor Governance

Continuous poor Governance indicators from the last five years, poses serious

threat to our national economic development. Estimate ranges from approximately -

2.5 (weak) to 2.5 (strong) governance performance, are as under:

Voice and Political Government Regulatory Rule of Control of Overall

Year Account Stability Effective Quality Law Corruption Govern

ability VA (PS) ness (GE) (RQ) (RL) (CC) ance

2011 -0.87 -2.81 -0.81 -0.63 -0.91 -1.05 -1.18

2012 -0.88 -2.69 -0.78 -0.71 -0.90 -1.06 -1.17

2013 -0.83 -2.60 -0.79 -0.70 -0.87 -0.93 -1.12

2014 -0.76 -2.40 -0.75 -0.69 -0.78 -0.81 -1.03

2015 -0.76 -2.54 -0.66 -0.62 -0.79 -0.76 -1.02

Source: World Governance Indicators (WGI) – Pakistan

Deteriorating Pakistan’s Budgetary Statistics – A Pull on the

Procurement of Modern Defense Procurement

Continuous budget deficit and four times current expenditure vis-à-vis

development one for the last five years as shown below, are already posing threat to

national security, as there will be less procurement power of defense equipment:

Table-2: Five Years Budget Summary of Pakistan

Classification 2013/ 2014/ 2015/ 2016/ 2017/

No

(Rs in Billions) 2014 2015 2016 2017 2018

A. Resources

a. Internal Resources 2,967 3,122 3,406 3,086 3,826

b. External (Loans + Grants) 714 693 860 996 838

c. Privatization Proceeds - 17.7 13.6 17.7 50

Gross Resources (a+b+c) 3681 3833 4280 4099.7 4713

B. Expenditure

Current Expenditure

a. (Pension, allowances, Re- 3199 3481 3599 3905 3764

payment of loans etc)

b. Development Expenditure 859 754 879 936 1340

Total Expenditure(a + b) 4057 4235 4479 4841 5104

Bank Borrowing for Deficient

C. 376 402 199 741 390

Amount (A - B)

Source: Federal Budget Reports, Ministry of Finance

NDU Journal 2018

62 Zaib Maroof and Obaid ur Rehman

Threat of becoming a Victim of Financial Action Task Force

(FATF) Sanctions

By observing a weak economic stature in FY 2018, on the behest of US 25, FATF

meeting held in Paris placed Pakistan in its grey list in June 2018 for the reason that

Pakistan is taking selective actions against terrorist groups in Pakistan, which has

failed the US policies in Afghanistan 26. Now, on one hand Pakistan is looking towards

any global financer as one of the option to pay off its external debt installment and on

the other, motherland is trying to avoid implications of its placement on a global

terror-financing watch list to avoid a very strong check on cash in and cash out flow 27.

Pakistan is now squeezed with only two options, first one to take a stand and let the

West do whatever it feels like on the pretext that Pakistan is doing enough and the

second one is to convince the global stake holders with a serious dialog in order to

waive off this threat.

Threat of becoming a Victim of EU Black List

After FATF, punitive action by the EU is also imminent. This all will have

serious repercussion on the fragile economy of Pakistan and in turn our National

Security.

Survival of our Nuclear Program for Minimum Credible

Deterrence against India

Although it seems to be an impossible scenario from Pakistan’s perspective,

but deteriorating economic indicators may dictate this nightmare someday, as it

happened to Ukraine 28, which had to remove its nuclear weapons in 1994 vide

Budapest Memorandum due to weak economic stature. Later, Russian absorption of

Crimea became an eye opener, despite the first clause of this Memorandum, which

clearly stated that the Russian Federation, UK and the US reaffirm their commitment

to Ukraine to respect the independence, sovereignty and the existing borders of

Ukraine. Many Ukrainians still argue that if Ukraine had not removed its nuclear

weapons, Russia would have been deterred from entering Ukraine. Pakistan needs to

improve its economic stature to preserve this strategic asset in face of large Indian

Army29.

Threat from Eastern Border

Major external threat to Pakistan has always been perceived to be emanating

from India, which is having eight times more GDP with hardly any external debt in

comparison to Pakistan30. Nevertheless, Pakistan has to maintain its large standing

Army, keep its nuclear program going for deterrence purpose, improving the law and

order situation of the country etc, which are all costly affairs. Any further

NDU Journal 2018

Impact of Declining Macro-Economic Indicators 63

deterioration in economy will make our annual budget questionable to even sustain

our armed forces as well as keeping our national security and nuclear program going.

Threat from Local Militants

Pakistan’s Government has launched different operations like Operation

Zarb-e-Azb, Radd-ul-Fasaad etc against the terrorists inside the country, which needs

a constant flow of cash, without which these cost exuberant operations can become

counter-productive31.

Security of China-Pakistan Economic Corridor (CPEC)

Security of multibillion dollar infrastructure investment plan, regarded as a

‘game changer’ for Pakistan is a cost exuberant affair in terms of its security

requirement. It needs a constant flow of cash; otherwise same project will invite

physical intrusions through terrorist, as a threat to national security32 .

Maintaining a quantum flow of Intelligence Operations to

Thwart Internal and External Threats

Pakistan needs to keep a quality force to perform the national security task in

a befitting manner, however same requires a sizeable budget to sustain their activities.

Sound financial flow is the thrust line of success of any operation done by intelligence

agencies33.

Recommendations

Quality of governance matters to macroeconomic performance because it

provides a key foundation for the equitable and efficient allocation of resources,

including capital34. Pakistan needs to improve its governance 35. Good governance

requires smart organizational promoting transparency and accountability at all tiers.

Following steps may be taken to improve economic security and in turn national

security of Pakistan:

Application of "FinTech or Financial Technology Model” i.e. use of IT to make

the financial activities transparent36 i.e. by automating all trading, insurance,

risk management etc activities to assist in improving the governance issues of

Pakistan37.

In 90’s, numerous countries like Australia, South Korea, Malaysia, Turkey,

Uganda etc have implemented Result based Monitoring and Evaluation

(RBM&E) System in their country based on accountability and transparency

to effectively overcome economic crisis. Therefore Pakistan should needs to

implement the same for collecting and analyzing information on its

macroeconomic indicators38.

NDU Journal 2018

64 Zaib Maroof and Obaid ur Rehman

A road map be made, with timeline and priority by taking all stakeholders on

board to seek improvement in all macroeconomic indicators of a country.

Pakistan’s national security division needs to have an economic security

section comprising of professionals to monitor the progress of roadmap of

each indicator, for their further discussion in all national security conferences

as agenda points.

Pakistan needs to establish a transparent, broad and effective enabling policy

environment for investment.

Comprehensive stabilization program, successfully implemented by Turkey

in 80’s may be followed to overcome trade deficit crisis, by having an

‘Outward Oriented Development Strategy’ aimed at financial openness and

increased international trade by removing trade barriers and improving

production of low cost products 39.

Making free trade zones like UAE, and to build the human and institutional

capacities to implement them; however keeping local industry and

employment of own human resource in view. This in turn will improve our

ranking in the list of business friendly countries, which is currently ranked at

102 out of total 153 as published by Forbes 2017 40.

There is a need to develop knowledge based economy to utilize more than

207 million human capital of Pakistan to a skillful human resource 41. Pakistan

Government should launch different skill development and vocational

training programs in consonance with international accreditation to develop

own HR, which will be available for their employment in developed

countries. This in turn will increase remittances from overseas employees.

Fiscal policy should be revised and government should cut its public

spending to reduce its fiscal budget deficit. Moreover, a strict policy should

be made so that amount acquired from external debt and privatization etc

should be spent on profitable development projects.

Pakistan needs to implement formal inflation-targeting program model

followed successfully by Turkey to combat economic crisis of FY 2001 42.

State Bank reserves should be increased by reforming the tax structure to

boost economic condition of country 43 . It is recommended that tax

intelligence outfit may be made with legal powers to monitor financial data of

individuals in Pakistan.

FATF issue may be handled at priority with sound planning instead of leaving

it for the last moment. All stakeholders of national security need to take the

situation seriously, as the cost of being isolated internationally cannot be

wished away by claiming that we have China’s support.

While keeping the minimum possible nuclear deterrence, we need to convert

our nuclear program to fill the gap of our energy needs. In case, global

pressure of denuclearization is built due to our high external debts, we may

NDU Journal 2018

Impact of Declining Macro-Economic Indicators 65

quote them the case of Ukraine to save our peaceful program in which

Ukraine was made non-nuclear in 1994, and resulted in its division.

Conclusion

Economic sovereignty and national security are the most important

dimension for the policy makers, in order to develop and implement the productive

strategies, and finally a grand policy. On the contrary, our above discussed prevalent

macroeconomic indicators prove that Pakistan is an economically starved nation;

hence, struggling hard to meet the bare minimum economic security needs for

survival. Instead of leaving the future of our generation on others, we need to think

and act now to improve our economic stature, otherwise our geographical layout at

cross roads Central Asia will make us prone to global economic invaders and making

us subservient to their dictates

NDU Journal 2018

66 Zaib Maroof and Obaid ur Rehman

NOTES

1

Obama, Barack. National security strategy of the United States (2010). Diane Publishing, 2010.

2

Harold Brown, Thinking about national security: defense and foreign policy in a dangerous world. Westview Press,

1983.

3

Poirson, Miss Hélène. Economic security, private investment, and growth in developing countries. International

Monetary Fund, 1998.

4

Koo, Richard C. The Holy Grail of Macroeconomics: Lessons from Japan as Great Recession. John Wiley & Sons,

2011.

5

Alush Kryeziu, "The Impact of Macroeconomic Factors In Economic Growth." European Scientific Journal, ESJ 12,

no. 7 (2016).

6

Smith, K. “List of 16 Major Leading & Lagging Economic Indicators.” (2015)

7

Cohen, Maurie J., Halina Szejnwald Brown, and Philip Vergragt, eds. Innovations in sustainable consumption: New

economics, socio-technical transitions and social practices. Edward Elgar Publishing, 2013.

8

Nanto, Dick Kazuyuki. Economics and national security: Issues and implications for US policy. DIANE Publishing,

2011.

9

Cheema, Parvaiz Iqbal. “Security Threats Confronting Pakistan." Security Outlook of the Asia Pacific Countries and

Its Implications for the Defense Sector

10

Caballero-Anthony, Mely. "Non-traditional security challenges, regional governance, and the ASEAN political-

security community (APSC)." ASEAN and the Institutionalization of East Asia (2010): 27-42.

11

Paleri, Prabhakaran. National Security: Imperatives and Challenges. Tata McGraw-Hill, 2008.

12

Lysenko, Yuliya, and Janna Zelenskaya."System Performance Indicators of Regional Economic Security."In SHS

Web of Conferences, vol. 35, p. 01043.EDP Sciences, 2017.

13

Milner, Helen V. Interests, institutions, and information: Domestic politics and international relations. Princeton

University Press, 1997.

14

Collina, Tom Z. "Oil dependence and US foreign policy: Real dangers, realistic solutions." Testimony presented to

Committee on Foreign Relations Subcommittee on Near Eastern and South Asian Affairs, Washington, DC (2005).

15

Wright, Phillip C., and Géraldine Roy. "Industrial espionage and competitive intelligence: one you do; one you do

not." Journal of Workplace Learning 11, no. 2 (1999): 53-59.

16

McDowell, Mark. "Public Diplomacy at the Crossroads: Definitions and Challenges in an Open Source Era."

Fletcher F. World Aff. 32 (2008): 7.

17

Khan, Brigadier Muhammad Khurshid."A Stable Pakistan: Proposed Model Of National Security."

18

Nanto, Dick Kazuyuki. Economics and National Security: Issues and Implications for US policy. DIANE Publishing,

2011.

19

Posen, Adam, and Daniel K. Tarullo."Report of the Working Group on Economics and National Security." The

Princeton Project on National Security. Working Group Co-Chairs. Washington, DC: Georgetown University

(2005).

20

Neu, Carl Richard, and Charles Wolf Jr. The Economic Dimensions of National Security. No. RAND/MR-466-OSD.

Office of the Secretary of Defense Washington DC, 1994.

21

Masters, Jonathan. "What Are Economic Sanctions?." Council for Foreign Relations (2015).

22

Pakistan Bureau of Statistics, “Pakistan Statistical Year Book 2012 - 2017.” pbs.gov.pk. http://www.pbs.gov.pk/

content/pakistan-statistical-year-book-2012 (accessed February 1, 2018).

23

The World Bank, “World Development Indicator (WDI) Database.” databank.worldbank.org.http://

databank.worldbank.org/data/reports.aspx?source=world-development-indicators/ (accessed February 1, 2018).

24

Pakistan Ministry of Finance, “Economic Survey 2017”, finance.gov.pk http://www.finance.gov.pk/fb_2017_18.html/

(accessed February 5, 2018)

25

Masood, Salman. "At US Urging, Pakistan to Be Placed on Terrorism-Financing List." The New York Times 23

(2018).

26

Siddiqui, Naveed. “Govt confirms Pakistan will be placed on FATF terror financing watchlist in June”.DAWN,

https://www.dawn.com/news/1392285 (accessed February 28, 2018).

27

Reuters. “Pakistan likely to face economic consequences if it returns to FATF's global terrorist financing 'grey list',

say experts” ,Firstpost,16 feb 2018.

28

Wikipedia.“Budget”. wikipedia.org https://en.wikipedia.org/wiki/Budget (accessed February 7, 2018).

29

Martel, William C. "Why Ukraine Gave Up Nuclear Weapons: Nonproliferation Incentives and Disincentives."

Pulling Back from the Nuclear Brink: Reducing and Countering Nuclear Threats, edited by Barry R. Schneider and

William L. Dowdy (1998): 88-104.

30

Singh, Hemant. “India vs. Pakistan: Economic Comparison 2017.”Jagran Josh. https://www.jagranjosh.com/general-

knowledge/india-vs-pakistan-economic-comparision-1497247847-1. (accessed February 7, 2018).

31

Iqbal, Khalid. “Pakistan’s Counter Terrorism Efforts: Expectations and Accomplishments.”Criterion

Quarterly.http://www.criterion-quarterly.com/pakistans-counter-terrorism-efforts-expectations-

accomplishments/ (accessed February 10, 2018).

32

Sial, Safdar. "The China-Pakistan Economic Corridor: an assessment of potential threats and constraints." Conflict

and Peace Studies 6, no. 2 (2014): 24.

33

Hanauer, Larry, and Peter Chalk. India's and Pakistan's Strategies in Afghanistan. RAND corporation, 2012.

NDU Journal 2018

Impact of Declining Macro-Economic Indicators 67

34

deBrouwer, Gordon. "Macroeconomics and governance." Commonwealth of Australia, Treasury Working

Paper (2003).

35

Edeh, Herbert C., and Michael I. Ugwueze. "Good Governance, National Security and Economic Development in

Nigeria: A Political Diagnosis of Boko Haram Insurgence." Mediterranean Journal of Social Sciences 5, no. 17 (2014):

31.

36

Schueffel, Patrick. "Taming the Beast: A Scientific Definition of Fintech." Journal of Innovation Management 4, no.

4 (2016): 32.

37

Aldridge, Irene, and Steven Krawciw. Real-Time Risk: What Investors Should Know About FinTech, High-Frequency

Trading, and Flash Crashes. John Wiley & Sons, 2017.

38

Binnendijk, Annette. Results Based Management in the Development Co-operation Agencies: A Review of

Experience: Executive Summary. Development Assistance Committee (DAC), 2001.

39

Rittenberg, Libby, Faruk Selçuk, and Aykut Kibritçioğlu, eds. Inflation and disinflation in Turkey. Ashgate, 2002.

40

Fombrun, Charles J. "List of lists: A compilation of international corporate reputation ratings." Corporate

Reputation Review 10, no. 2 (2007): 144-153.

41

Khan, Muhammad Aslam. "Role of human capital in attracting foreign direct investment: A South Asian

perspective." SAARC Journal of Human Resource Development 3, no. 1 (2007): 5-25.

42

Chen, Megan, Ming Li Chew, Sanya Goyal, Muzoon Matar, and Zeynep Yavuz. "The Turkish Economy, Post-2001

Crisis: Why Timing, Faith, and Expectations Matter." Chicago Undergraduate Business Journal, Spring (2014): 1-34.

43

Chen, Megan, Ming Li Chew, Sanya Goyal, Muzoon Matar, and Zeynep Yavuz. "The Turkish Economy, Post-2001

Crisis: Why Timing, Faith, and Expectations Matter." Chicago Undergraduate Business Journal, Spring (2014): 1-34.

NDU Journal 2018

Anda mungkin juga menyukai

- Financial Dimension of Economic Security of The State in Conditions of Globalization As A Prerequisite For Economic GrowthDokumen7 halamanFinancial Dimension of Economic Security of The State in Conditions of Globalization As A Prerequisite For Economic GrowthUrsu AlexBelum ada peringkat

- Deteriorating Economic Conditions and Their Impact On National SecurityDokumen16 halamanDeteriorating Economic Conditions and Their Impact On National Securitysyed shoaibBelum ada peringkat

- National Security PolicyDokumen10 halamanNational Security PolicySagar SantwaniBelum ada peringkat

- Economy and Security Are Two Sides of The Same CoinDokumen3 halamanEconomy and Security Are Two Sides of The Same CoinFarah KhanBelum ada peringkat

- 02 A National Security Policy Dr. Nazir HussainDokumen13 halaman02 A National Security Policy Dr. Nazir HussainharoonBelum ada peringkat

- Security Issues Caused by Pakistan Strategic Position: AssignmentDokumen8 halamanSecurity Issues Caused by Pakistan Strategic Position: AssignmentAdil MujtabaBelum ada peringkat

- Issue of National Security Is Not Easy For Any Country: National Law University, JodhpurDokumen20 halamanIssue of National Security Is Not Easy For Any Country: National Law University, JodhpurkrnBelum ada peringkat

- NSP 2023-2028Dokumen44 halamanNSP 2023-2028chasecastano.phBelum ada peringkat

- Poverty and Internal Security Threats in NigeriaDokumen11 halamanPoverty and Internal Security Threats in NigeriaAliyu Mukhtar Katsina, PhD100% (2)

- "Health Security" in The New National Security Paradigm: DR Nadeem JanDokumen4 halaman"Health Security" in The New National Security Paradigm: DR Nadeem JanWaqas AzizBelum ada peringkat

- Evaluation of Bangladesh'S National Security System (Subject To Change As Per The Development of The Paper)Dokumen12 halamanEvaluation of Bangladesh'S National Security System (Subject To Change As Per The Development of The Paper)Neeraj GosainBelum ada peringkat

- National Security ConcernsDokumen4 halamanNational Security ConcernsDom Christian Last100% (1)

- Chapter IIDokumen10 halamanChapter IIpragmatic.desiBelum ada peringkat

- The Contribution of Energy Diplomacy To International Security With Special Emphasis On IranDokumen39 halamanThe Contribution of Energy Diplomacy To International Security With Special Emphasis On IranmuaBelum ada peringkat

- Internal SecurityDokumen142 halamanInternal SecurityNarmathaBelum ada peringkat

- Inbound 4287381456728163276Dokumen3 halamanInbound 4287381456728163276Jhay-ar Villas PerezBelum ada peringkat

- Individual Turn in GSCDokumen3 halamanIndividual Turn in GSCMarlon MejiaBelum ada peringkat

- Effect of Terrorism On Economic Growth in Pakistan An Empirical AnalysisDokumen20 halamanEffect of Terrorism On Economic Growth in Pakistan An Empirical Analysisnadeemali303Belum ada peringkat

- National Security ThreatsDokumen26 halamanNational Security ThreatsNetflix OneBelum ada peringkat

- Conflict Resolution and Peace ProcessDokumen4 halamanConflict Resolution and Peace ProcessMissy OrgelaBelum ada peringkat

- The Effect of Financial Crisis On International Security: December 2016Dokumen14 halamanThe Effect of Financial Crisis On International Security: December 2016AliAwaisBelum ada peringkat

- Security Spending and Growth A Study of Nigeria's Fourth Republic by Falade Solomon AdeyemiDokumen24 halamanSecurity Spending and Growth A Study of Nigeria's Fourth Republic by Falade Solomon AdeyemiFalade Solomon AdeyemiBelum ada peringkat

- Nss 1998Dokumen60 halamanNss 1998carlaBelum ada peringkat

- National Security StrategyDokumen4 halamanNational Security StrategyNadeem SindhiBelum ada peringkat

- Security by N. ManoharanDokumen24 halamanSecurity by N. Manoharanrosesarahp204Belum ada peringkat

- Globalization and National Security Unraveling The Multifaceted NexusDokumen4 halamanGlobalization and National Security Unraveling The Multifaceted NexusKIU PUBLICATION AND EXTENSIONBelum ada peringkat

- Cost AnalysisDokumen1 halamanCost Analysisejandres02Belum ada peringkat

- Current Affair 2020 123Dokumen10 halamanCurrent Affair 2020 123Samina HaiderBelum ada peringkat

- Lesson 18 - National Security Concerns: Learning ObjectivesDokumen12 halamanLesson 18 - National Security Concerns: Learning ObjectivesMary Joy CuetoBelum ada peringkat

- National-Security NSTPDokumen29 halamanNational-Security NSTPstephanieroqueeBelum ada peringkat

- A Whole of Nation Approach by Sabbah UddinDokumen3 halamanA Whole of Nation Approach by Sabbah UddinHakim AliBelum ada peringkat

- National Internal Security Policy 2014Dokumen94 halamanNational Internal Security Policy 2014Hassan BalochBelum ada peringkat

- Onsa 2016Dokumen80 halamanOnsa 2016Mu'az ObadakiBelum ada peringkat

- The Economics of TerrorrismDokumen4 halamanThe Economics of TerrorrismVARNIKA GUPTA PGP 2021-23 BatchBelum ada peringkat

- Occasional Paper: AcdisDokumen49 halamanOccasional Paper: AcdisSohail BalochBelum ada peringkat

- The Impact of National Security On Foreign Direct Investment (FDI) in NigeriaDokumen6 halamanThe Impact of National Security On Foreign Direct Investment (FDI) in NigeriaIOSRjournalBelum ada peringkat

- The Country Risks and Foreign Direct Investment (FDI) : Iranian Economic Review July 2019Dokumen27 halamanThe Country Risks and Foreign Direct Investment (FDI) : Iranian Economic Review July 2019Tharindu PereraBelum ada peringkat

- TVET & Youth Empowerment For National Security in NigeriaDokumen17 halamanTVET & Youth Empowerment For National Security in NigeriaOssynthoBelum ada peringkat

- INSECURITYDokumen24 halamanINSECURITYchekwas patrickBelum ada peringkat

- Impact of Insecurity On Investment in Nigeria: Gylych Jelilov Kemal Ozden Sotonye Orinaemi BriggsDokumen21 halamanImpact of Insecurity On Investment in Nigeria: Gylych Jelilov Kemal Ozden Sotonye Orinaemi BriggsOladele ToyeebBelum ada peringkat

- Internalsecurity An International PerspectiveDokumen14 halamanInternalsecurity An International Perspectivemohd naveedBelum ada peringkat

- Module 6 National Security ConcernsDokumen8 halamanModule 6 National Security ConcernsChen HaoBelum ada peringkat

- SS Khurshid Khan and Fouzia Amin No-4 2016Dokumen21 halamanSS Khurshid Khan and Fouzia Amin No-4 2016chichponkli24Belum ada peringkat

- 5-Nstp-I Common Module 5Dokumen4 halaman5-Nstp-I Common Module 5Michelle EsternonBelum ada peringkat

- Globalization SeminarDokumen61 halamanGlobalization SeminarFareeha KhanBelum ada peringkat

- The Impact of Political Risk On Foreign Direct Inv PDFDokumen20 halamanThe Impact of Political Risk On Foreign Direct Inv PDFGeovani Hernandez MartinezBelum ada peringkat

- Impact of Terrorism On Worlds EconomyDokumen8 halamanImpact of Terrorism On Worlds EconomyEsun ToranBelum ada peringkat

- Country Risk AnalysisDokumen6 halamanCountry Risk AnalysisRavinder KaurBelum ada peringkat

- JWB SI ON RISK Final Acceptd Version 2020Dokumen25 halamanJWB SI ON RISK Final Acceptd Version 2020Yongye ChenBelum ada peringkat

- Public Finance, Security, and Development: P R W P 4806Dokumen43 halamanPublic Finance, Security, and Development: P R W P 4806Abhishek BhageriaBelum ada peringkat

- 4 Synergizing Foreing DR Zulfqar KhanDokumen12 halaman4 Synergizing Foreing DR Zulfqar KhanAsaad AreebBelum ada peringkat

- PoliRiskFDI Baek&QianDokumen35 halamanPoliRiskFDI Baek&QianAnay RajBelum ada peringkat

- National Security ConcernsDokumen11 halamanNational Security ConcernsLeandra Lei CañalitaBelum ada peringkat

- How Safe Is Our Investment: Rethinking a Pathway for a Dynamic Economic EnvironmentDari EverandHow Safe Is Our Investment: Rethinking a Pathway for a Dynamic Economic EnvironmentBelum ada peringkat

- Financial Contracts and The Political Economy of Investor ProtectionDokumen36 halamanFinancial Contracts and The Political Economy of Investor ProtectionYUDIBelum ada peringkat

- Security ChallengesDokumen20 halamanSecurity ChallengesEhsanMemonBelum ada peringkat

- The Material Risks of Gender Based Violence in Emergency Settings 2020 PDFDokumen9 halamanThe Material Risks of Gender Based Violence in Emergency Settings 2020 PDFmiriamuzBelum ada peringkat

- Security and DefenseDokumen2 halamanSecurity and DefenseCruxzelle BajoBelum ada peringkat

- Security Edu - Dick - Collins - Co - 2021Dokumen14 halamanSecurity Edu - Dick - Collins - Co - 2021Dick CollinsBelum ada peringkat

- China's National Defense in 2010Dari EverandChina's National Defense in 2010Belum ada peringkat

- Notification The Punjab Population Welfare Department Service Rules, 2009Dokumen1 halamanNotification The Punjab Population Welfare Department Service Rules, 2009Murtaza HashimBelum ada peringkat

- DeligationfpowerDokumen2 halamanDeligationfpowerMurtaza HashimBelum ada peringkat

- PFM Act 2019 30june2023Dokumen27 halamanPFM Act 2019 30june2023Murtaza HashimBelum ada peringkat

- PBPND RR 1985 Amend 20120322Dokumen2 halamanPBPND RR 1985 Amend 20120322Murtaza HashimBelum ada peringkat

- PSF JobApplicationForm PDFDokumen2 halamanPSF JobApplicationForm PDFanon_627643010Belum ada peringkat

- Audit Note Issued and Realized RegisterDokumen1 halamanAudit Note Issued and Realized RegisterMurtaza HashimBelum ada peringkat

- Cement 16 12 2020Dokumen59 halamanCement 16 12 2020Murtaza HashimBelum ada peringkat

- 4 BCD 50802Dokumen70 halaman4 BCD 50802Murtaza HashimBelum ada peringkat

- 739 PDFDokumen2 halaman739 PDFMurtaza HashimBelum ada peringkat

- 739 PDFDokumen2 halaman739 PDFMurtaza HashimBelum ada peringkat

- C.M.A.4918of2012 DT 26 4 2013Dokumen8 halamanC.M.A.4918of2012 DT 26 4 2013Murtaza HashimBelum ada peringkat

- CSS Recommended Book List by 45th Common PDFDokumen8 halamanCSS Recommended Book List by 45th Common PDFShahid KamalBelum ada peringkat

- The Cooperative Societies Act, 1925Dokumen18 halamanThe Cooperative Societies Act, 1925Muzaffar IqbalBelum ada peringkat

- Finance Act, 2019Dokumen258 halamanFinance Act, 2019Sajjad SarwarBelum ada peringkat

- 03.the Accountability Conundrum of NgosDokumen16 halaman03.the Accountability Conundrum of NgosMurtaza HashimBelum ada peringkat

- Test Composition - Ad Audit Ad at ErDokumen2 halamanTest Composition - Ad Audit Ad at ErMurtaza HashimBelum ada peringkat

- 03.the Accountability Conundrum of NgosDokumen16 halaman03.the Accountability Conundrum of NgosMurtaza HashimBelum ada peringkat

- Applications Are Invited From Pakistani Nationals Having MasterDokumen1 halamanApplications Are Invited From Pakistani Nationals Having MasterMurtaza HashimBelum ada peringkat

- (ROB Amended Upto 23rd April, 2019Dokumen83 halaman(ROB Amended Upto 23rd April, 2019AshrafBelum ada peringkat

- Finance Act, 2019Dokumen258 halamanFinance Act, 2019Sajjad SarwarBelum ada peringkat

- SHOs in Punjab Regain News ArticleDokumen1 halamanSHOs in Punjab Regain News ArticleMurtaza HashimBelum ada peringkat

- Application Form - ADUDokumen2 halamanApplication Form - ADUMurtaza HashimBelum ada peringkat

- Extension JobsDokumen8 halamanExtension JobsMurtaza HashimBelum ada peringkat

- FMMA Vol 1 8th EditionDokumen117 halamanFMMA Vol 1 8th EditionMurtaza HashimBelum ada peringkat

- CLDokumen1 halamanCLMurtaza Hashim100% (1)

- Islamabad Electric Supply Company Request For ProposalDokumen1 halamanIslamabad Electric Supply Company Request For ProposalMurtaza HashimBelum ada peringkat

- Punjab Public Service Commission: SubjectDokumen1 halamanPunjab Public Service Commission: SubjectMurtaza HashimBelum ada peringkat

- Mercantile LawDokumen47 halamanMercantile LawMurtaza Hashim100% (2)

- Mercantile LawDokumen47 halamanMercantile LawMurtaza Hashim100% (2)

- Final-Fall-2009 Mock SolutionDokumen16 halamanFinal-Fall-2009 Mock SolutionmehdiBelum ada peringkat

- Master Thesis Maarten VD WaterDokumen92 halamanMaster Thesis Maarten VD WaterkennemerBelum ada peringkat

- Ar 2019 # Samindo-4 PDFDokumen271 halamanAr 2019 # Samindo-4 PDFpradityo88100% (1)

- Amity Business School: MBA Legal Aspects of Business Ms. Shinu VigDokumen20 halamanAmity Business School: MBA Legal Aspects of Business Ms. Shinu VigAamir MalikBelum ada peringkat

- CASO Pantry ShopperDokumen2 halamanCASO Pantry ShopperDiana0% (1)

- Modelo Proof of Claim MaestroDokumen8 halamanModelo Proof of Claim MaestroMetro Puerto RicoBelum ada peringkat

- Letter-SB-Request For Special Session-11 October 2023Dokumen5 halamanLetter-SB-Request For Special Session-11 October 2023cj.pulga.palBelum ada peringkat

- Cause List Court-2 17.10.2023Dokumen6 halamanCause List Court-2 17.10.2023divyanshu31Belum ada peringkat

- Hedging QuestionsDokumen6 halamanHedging QuestionsAmeya LonkarBelum ada peringkat

- P5 FAC RTP June2013Dokumen105 halamanP5 FAC RTP June2013AlankritaBelum ada peringkat

- Set Off and Carry Forward of LossesDokumen3 halamanSet Off and Carry Forward of LossesBilal AwanBelum ada peringkat

- Twitter10 2 18 1Dokumen74 halamanTwitter10 2 18 1karen hudesBelum ada peringkat

- Seelam VinayDokumen12 halamanSeelam VinayNithya RajBelum ada peringkat

- Partnership Agreement - Sample - Taxguru - inDokumen7 halamanPartnership Agreement - Sample - Taxguru - inAbhinav BharadwajBelum ada peringkat

- Credit Transaction Codes Description Debit Transaction Codes Description Current AccountDokumen1 halamanCredit Transaction Codes Description Debit Transaction Codes Description Current AccountHakuna MatataBelum ada peringkat

- Polaroid Corporation Case Solution Final PDFDokumen8 halamanPolaroid Corporation Case Solution Final PDFShirazeBelum ada peringkat

- 31.economic Contributions of Indian Film IndustryDokumen3 halaman31.economic Contributions of Indian Film IndustrymercatuzBelum ada peringkat

- Model Residential Construction Contract Cost Plus Version 910Dokumen30 halamanModel Residential Construction Contract Cost Plus Version 910Hadi Prakoso100% (2)

- Kausar AlamDokumen1 halamanKausar AlamVenu Gopal RaoBelum ada peringkat

- Bond Capital Mezzanine FinanceDokumen9 halamanBond Capital Mezzanine FinanceVisakan Kandaswamy100% (1)

- PQ - Prequalification Document PDFDokumen56 halamanPQ - Prequalification Document PDFHema Chandra IndlaBelum ada peringkat

- Monetary PolicyDokumen23 halamanMonetary PolicyManjunath ShettigarBelum ada peringkat

- Steps of Loan ProcessDokumen16 halamanSteps of Loan ProcessShraddha TiwariBelum ada peringkat

- Practice Questions Chapter 10Dokumen5 halamanPractice Questions Chapter 10Nguyễn Bảo NgọcBelum ada peringkat

- Internal Control Reviewer3Dokumen12 halamanInternal Control Reviewer3Lon DiazBelum ada peringkat

- Franchising: Introduction ToDokumen30 halamanFranchising: Introduction Tohemant mohiteBelum ada peringkat

- Audit of SheDokumen3 halamanAudit of ShePrince PierreBelum ada peringkat

- Chapter 2Dokumen8 halamanChapter 2Pradeep RajBelum ada peringkat

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDokumen2 halamanAccount Statement: Date Value Date Description Cheque Deposit Withdrawal BalancesadhanaBelum ada peringkat

- Declaration by Salaried Persons To Be Submitted To The Employer by The EmployeeDokumen4 halamanDeclaration by Salaried Persons To Be Submitted To The Employer by The EmployeeM. AamirBelum ada peringkat