Income From House Property Income From Business or Profession Capital Gains Income From Other Sources

Diunggah oleh

Pooja Taneja0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

9 tayangan4 halamanJudul Asli

TAX PLANNING.docx

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

9 tayangan4 halamanIncome From House Property Income From Business or Profession Capital Gains Income From Other Sources

Diunggah oleh

Pooja TanejaHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

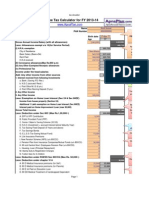

Tax Planning Measures for Government Employees for the Assessment Year

2020-2021 (Financial Year 2019-2020).

1. If your Gross Total Income is less than 5 lakhs, no special tax planning is

needed from yourself. You may claim Rebate under Section 87A which

amounts to a maximum of Rs.12500 in the Assessment Year 2020-

2021.Gross Total Income means total of the following Income

a. Income from Salaries

b. Income from House Property

c. Income from Business or Profession

d. Income from Capital Gains

e. Income from Other Sources

2. As far as Salaried persons are concerned , Standard Deduction of

Rs.50,000 is available in the Assessment Year 2020-2021.

3. You may claim Second House as Second Self –Occupied Property .But

Total Deduction under Interest on loan taken for the House Property will be

Rs.200,000. You may take Joint Housing loan with your Spouse. Then you

and your spouse can claim maximum deduction of Rs.200,000 each.

4. If your Gross Total Income (Including Interest) is less than Rs.500,000 ,You

may deposit in banks /Post-Offices (Term /Fixed/Recurring) as such:-

a. Total annual Interest on such accounts is less than Rs.40,000.

Banks and Post Offices did not deduct TDS upto Rs.40,000. Banks and Co-

operative Societies will deduct TDS when Interest more than 40,000.other

Cases 5000.

5. Closure or Opting out of the NPS did not attract tax up to 60% of the total

amount payable.

6. Please Contribute upto14% of your Salary to NPS(If you are Covered under

NPS scheme)

7.Use maximum Electronic mode of payments

8. Maximum compliance of newly introduced Sections in Chapter VIA of

Income Tax Act.

a. Sec 80EEA-Interest Up to 150,000 on loan taken for Residential House

Property (Loan should be taken from 01/4/2019 to 31/03/2020)

Subject to conditions

b. Section 80EEB –Tax Incentives for Electric Vehicles

Maximum deduction on Interest on loan taken for purchase of an electric

vehicle –Rs.150,000

(Loan Should be taken from 01/04/2019 to 31/03/2023 )

Subject to Conditions

9. Easy Application of Sec.89 is possible in the Assessment Year if you have

received arrears of Salary (Easy Procedure).

10. Use PAN Card. Avoidance of PAN CARD attract TDS@20%.

Aadhaar Card can be used as PAN CARD for certain transactions.

11. Link PAN with Aadhaar .It is most urgent

12. You cannot hide your transactions from 2020-2021 on words . CBDT will

introduce Pre-filled Tax Returns in the Assessment Year 2020-2021 on words.

13. Contribute to NPS even if you are not coming under NPS Scheme. You

may take NPS in Banks or Post offices. Besides, You may deduct the

following deductions from your Gross Total Income (Chapter VIA)

A.SEC 80 C

LIC premium paid by the You in respect of self ,spouse and son and daughter

can be deducted up to Rs. 150,000. In case of an individual, deduction is

available in respect of policy taken in the name of taxpayer or his/her spouse

or his/her children. No deduction is available in respect of premium paid in

respect of policy taken in the name of any person, other than given above.

Other deductions under Sec 80C are as follows

i. Tuition fees

ii.Contribution to SLI

iii.Contribution to GIS

iv. Contribution to Government Providenf Fund

B. An additional deduction of Rs. 50,000/- under Section 80CCD(1B) is

available to assesse over and above the benefit of Rs. 1.50 Lakhs available

as a deduction under Sec 80CCD(1). Thereby, raising the maximum limit of

exemption to Rs. 2.00 Lakhs

C. Sec 80 D

a.. Health Insurance Premium

Following are the important points

i. Self and family (Including Senior Citizen)-Maximum Rs.50,000

ii. Parents –Maximum Rs. 25,000

iii. Parents (Senior) –Maximum-50,000

iv.Self and Family including Parents –Maximum Rs. 50,000

v. Self and Family including Senior citizen Parents –Maximum Rs. 75,000

vi. Self (Senior Citizen ) and including Senior Citizen Parents –Maximum Rs.

100,000

b.. Medical Expenditure

Following are the important points

i. Self and family (Senior Citizen)-Maximum Rs.50,000

ii. Parents (Senior) –Maximum Rs.50,000

iii. Self and Family including Parents –Maximum Rs. 50,000

Payment through cash mode is not allowed for Sec 80 D Payments except the

following preventive medical checkup

c..Preventive Medical checkup

Maximum Rs. 50,00 deduction is allowed for Preventive Medical checkup

D. Sec 80DD Maintenance including medical treatment of a dependant No

Change

E. Sec 80DDB Medical treatment of Specified diseases-No Change

F. Sec 80E Interest on loan taken for Higher Education-No Change

G. Sec80 Donations to certain funds and charitable Institutions

Following points are important in this respect

a. Pay any mode other than cash

b. Visit Income Tax Department Website and check eligibility of

Institution Donations are as follows

a. Without qualifying Limit -100%

b. Without qualifying Limit- 50%

c. With qualifying Limit -100%

d. With qualifying Limit-50%

Donation to Kerala Chief Minister Draught Relief Fund can be included in

Donation as 100% without limit menu.

H.Deduction in respect of Contributions Given by any Person to Political

Parties or an Electoral Trust(Section 80GGC)

Any amount of contribution made by an assessee being any person to a a

political party or an electoral trust except local authority and every artificial

juridical person wholly or partly funded by the Government shall be allowed as

deduction while computing the total income of such person .

Note :Sum contributed by way of cash shall not be allowed as deduction

I SEC 80TTA Income from interest on Saving bank Accounts

Maximum amount of Rs. 10,000 can be deducted income from interest on

savings bank accounts of Banks and Post Offices included in the above

Income from other sources

J. SEC 80TTB Interest on deposit in case of senior citizens.

Maximum interest of Rs,50,000 can be deducted by a senior citizen from

interest on deposit income included in the above Income from other sources

L. SEC 80U In case of person with disability

Following are the important points

a. Self with disability –Maximum-Rs.75,000

b. Self with severe Disability –Maximum -125,000

Anda mungkin juga menyukai

- Income Tax NitDokumen6 halamanIncome Tax NitrensisamBelum ada peringkat

- Indian Institute of Technology Madras: CircularDokumen5 halamanIndian Institute of Technology Madras: CircularAravinthram R am18m002Belum ada peringkat

- National Institute of Technology CalicutDokumen7 halamanNational Institute of Technology CalicutraghuramaBelum ada peringkat

- ITR-1, ITR-2, ITR-3: Key points for filing Income Tax returnsDokumen4 halamanITR-1, ITR-2, ITR-3: Key points for filing Income Tax returnsSANDEEP SAHUBelum ada peringkat

- Maulana Azad National Urdu University: CircularDokumen4 halamanMaulana Azad National Urdu University: CircularDebasish BiswalBelum ada peringkat

- 1 .Income Tax On Salaries - (01.06.2015)Dokumen57 halaman1 .Income Tax On Salaries - (01.06.2015)yvBelum ada peringkat

- A Guide To Income Tax Benefits For Senior CitizensDokumen18 halamanA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalBelum ada peringkat

- Income Tax Deductions FY 2016Dokumen13 halamanIncome Tax Deductions FY 2016Nishant JhaBelum ada peringkat

- ItfjfygjDokumen3 halamanItfjfygjKrishna GBelum ada peringkat

- Taxation Law ProjectDokumen15 halamanTaxation Law Projectraj vardhan agarwalBelum ada peringkat

- Shreha Shah (Ba LLB Vii)Dokumen7 halamanShreha Shah (Ba LLB Vii)Shreha VlogsBelum ada peringkat

- Tax Deductions under Sections 80C to 80U from Gross Total IncomeDokumen19 halamanTax Deductions under Sections 80C to 80U from Gross Total IncomeShamrao GhodakeBelum ada peringkat

- Deductions On Section 80CDokumen12 halamanDeductions On Section 80CViraja GuruBelum ada peringkat

- MockDokumen18 halamanMockSmarty ShivamBelum ada peringkat

- IT Assignment 2Dokumen7 halamanIT Assignment 2Srinivasulu Reddy PBelum ada peringkat

- 5 Tax-Planning Tips For Salaried People: Share ThisDokumen3 halaman5 Tax-Planning Tips For Salaried People: Share ThisPriya DubeyBelum ada peringkat

- Exemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Dokumen5 halamanExemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Ramakoteswar NampalliBelum ada peringkat

- Tax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreDokumen5 halamanTax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreAjay MagarBelum ada peringkat

- ITR SectionsDokumen6 halamanITR SectionsRohan SharmaBelum ada peringkat

- Chapter 12 TaxdeductionsDokumen16 halamanChapter 12 TaxdeductionsRiya SharmaBelum ada peringkat

- HRA, 80C, 80D, 80CCD deductions and landlord detailsDokumen9 halamanHRA, 80C, 80D, 80CCD deductions and landlord detailsfaiyaz432Belum ada peringkat

- Direct Tax Code: Capital Gains Tax On Sale of Residential PropertyDokumen5 halamanDirect Tax Code: Capital Gains Tax On Sale of Residential Propertykarthikeyan.mohandossBelum ada peringkat

- New Section Introduced in Income Tax Act 2011Dokumen5 halamanNew Section Introduced in Income Tax Act 2011Sandy AgrawalBelum ada peringkat

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Dokumen6 halamanLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenBelum ada peringkat

- Tax Planning For Year 2010Dokumen24 halamanTax Planning For Year 2010Mehak BhargavaBelum ada peringkat

- Income Tax Calculator FY 2013 14Dokumen4 halamanIncome Tax Calculator FY 2013 14faiza17Belum ada peringkat

- Calculate your income tax with this online tax calculatorDokumen4 halamanCalculate your income tax with this online tax calculatorraattaiBelum ada peringkat

- Deduction & ITRDokumen4 halamanDeduction & ITRkomil bogharaBelum ada peringkat

- Income tax filing deadline reminderDokumen2 halamanIncome tax filing deadline remindermakamkkumarBelum ada peringkat

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDokumen8 halamanInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaBelum ada peringkat

- Session 23-25 Permissible Deduction From Gross Total IncomeDokumen14 halamanSession 23-25 Permissible Deduction From Gross Total Incomeomar zohorianBelum ada peringkat

- Investment Declaration Form For The Financial Year 2014 - 15Dokumen7 halamanInvestment Declaration Form For The Financial Year 2014 - 15devanyaBelum ada peringkat

- Presented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDokumen22 halamanPresented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDhruv singhBelum ada peringkat

- Notes To Investment Proof SubmissionDokumen10 halamanNotes To Investment Proof SubmissionVinayak DhotreBelum ada peringkat

- Individual-Txation-FY-2018-19-with - JJDokumen64 halamanIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYBelum ada peringkat

- Everything You Need to Know About Income TaxDokumen11 halamanEverything You Need to Know About Income TaxLAKSHMANARAO PBelum ada peringkat

- Understanding Income TaxDokumen31 halamanUnderstanding Income TaxRajesh RoatBelum ada peringkat

- Amity Global Business School, PuneDokumen15 halamanAmity Global Business School, PuneChand KalraBelum ada peringkat

- Portal Investment Proof Verification Guidelines 2022 23Dokumen11 halamanPortal Investment Proof Verification Guidelines 2022 23yfiamataimBelum ada peringkat

- Income Tax Exemptions For The Year 2010Dokumen4 halamanIncome Tax Exemptions For The Year 2010Homework PingBelum ada peringkat

- Guideline On ITDokumen19 halamanGuideline On ITmikekikBelum ada peringkat

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDokumen6 halamanASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201Belum ada peringkat

- Save Income Tax on Salary of Rs. 1 MillionDokumen7 halamanSave Income Tax on Salary of Rs. 1 MillionMohit SahniBelum ada peringkat

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDokumen4 halamanFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiBelum ada peringkat

- Deductions U/S 80C TO 80U: By: Sumit BediDokumen69 halamanDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniBelum ada peringkat

- Income Tax Law & PracticeDokumen29 halamanIncome Tax Law & PracticeMohanBelum ada peringkat

- Notes To Investment Proof SubmissionDokumen10 halamanNotes To Investment Proof SubmissionnikunjrnanavatiBelum ada peringkat

- The List of Components Which You Can Use For Salary BreakupDokumen8 halamanThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXBelum ada peringkat

- TDS (Tax Deducted at Source) : ST STDokumen6 halamanTDS (Tax Deducted at Source) : ST STRuchiRangariBelum ada peringkat

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Dokumen5 halamanTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgBelum ada peringkat

- As Per New Budget Technosys - Investment - Declaration Form Fy 2014-15Dokumen4 halamanAs Per New Budget Technosys - Investment - Declaration Form Fy 2014-15sandip_chauhan5862Belum ada peringkat

- Declaration Form 12BB 2022 23Dokumen4 halamanDeclaration Form 12BB 2022 23S S PradheepanBelum ada peringkat

- Income TaxDokumen8 halamanIncome Taxved prakash raoBelum ada peringkat

- The Financial Kaleidoscope - July 19 PDFDokumen8 halamanThe Financial Kaleidoscope - July 19 PDFhemanth1128Belum ada peringkat

- Budget 2015Dokumen16 halamanBudget 2015Sachin SharmaBelum ada peringkat

- Tax Declaration Form 2021 22Dokumen4 halamanTax Declaration Form 2021 22Kasiviswanathan ChinnathambiBelum ada peringkat

- Indian Income Tax deductions explained: Sections 80C, 80D, 80DD, 80E, 80GG and 80GDokumen4 halamanIndian Income Tax deductions explained: Sections 80C, 80D, 80DD, 80E, 80GG and 80GDivyanshu ShekharBelum ada peringkat

- Complete Tax DetailsDokumen23 halamanComplete Tax DetailsAnish GuptaBelum ada peringkat

- Income TaxDokumen11 halamanIncome Taxvikas_thBelum ada peringkat

- 1040 Exam Prep: Module I: The Form 1040 FormulaDari Everand1040 Exam Prep: Module I: The Form 1040 FormulaPenilaian: 1 dari 5 bintang1/5 (3)

- CIR V Solidbank CorporationDokumen1 halamanCIR V Solidbank CorporationFrancis Ray Arbon FilipinasBelum ada peringkat

- 83 (B) Elections - The Holloway Guide To Equity CompensationDokumen4 halaman83 (B) Elections - The Holloway Guide To Equity CompensationAlan PetzoldBelum ada peringkat

- HDFCDokumen1 halamanHDFCKulish JoshiBelum ada peringkat

- ROI Battery Price List Sep 2011Dokumen3 halamanROI Battery Price List Sep 2011Anurag ChaudharyBelum ada peringkat

- Estimate Quotation Medical Paracetamol APIDokumen1 halamanEstimate Quotation Medical Paracetamol APIChetan dhadhlaBelum ada peringkat

- Annex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Dokumen4 halamanAnnex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Kristel Anne Liwag100% (2)

- W8 Ben Default - 2021 12 27 - Preview - DocDokumen1 halamanW8 Ben Default - 2021 12 27 - Preview - DocJavielito RamirezbriosoBelum ada peringkat

- Problems - Income TaxationDokumen4 halamanProblems - Income Taxationpedrosagucio44% (9)

- RR 3-2015 (Other Benefits 82000)Dokumen2 halamanRR 3-2015 (Other Benefits 82000)Judith De los ReyesBelum ada peringkat

- UP vs. City Treasurer of Quezon City, GR No. 214044, 19 Jun 2019Dokumen2 halamanUP vs. City Treasurer of Quezon City, GR No. 214044, 19 Jun 2019Bernalyn Domingo AlcanarBelum ada peringkat

- Invoice Dmart 6811264Dokumen1 halamanInvoice Dmart 6811264Siva MahanthyBelum ada peringkat

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Dokumen1 halamanW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)AnesBelum ada peringkat

- Tax Invoice: Cariot Auto Private LimitedDokumen2 halamanTax Invoice: Cariot Auto Private LimitedRaggy TannaBelum ada peringkat

- Gcpl-Vendor Decl FormDokumen2 halamanGcpl-Vendor Decl FormprintBelum ada peringkat

- BIR Form 1601 RemittanceDokumen1 halamanBIR Form 1601 RemittanceAnimeMusicCollectionBacolod0% (1)

- Taxation Law Final Exam ReviewDokumen45 halamanTaxation Law Final Exam Reviewfrance marie annBelum ada peringkat

- Emfuleni Statement 11029909Dokumen1 halamanEmfuleni Statement 11029909mengelbrecht732Belum ada peringkat

- SIP Detail CalculatornewDokumen6 halamanSIP Detail CalculatornewKr PrajapatBelum ada peringkat

- RMC No. 44-2021 RevisedDokumen2 halamanRMC No. 44-2021 RevisedDessere Ann AnchetaBelum ada peringkat

- Appointment Letter ImranDokumen2 halamanAppointment Letter ImranSaadat AliBelum ada peringkat

- Gacer, Ann Mariellene L. (Assignment No.2) TaxDokumen6 halamanGacer, Ann Mariellene L. (Assignment No.2) TaxAnn Mariellene Gacer50% (2)

- WA Payroll Tax 22-23Dokumen1 halamanWA Payroll Tax 22-23JMLBelum ada peringkat

- Gifts To Reduce Illinois Estate TaxesDokumen5 halamanGifts To Reduce Illinois Estate Taxesrobertkolasa100% (1)

- Dinsha C001 200905 2023057263210824609387135Dokumen1 halamanDinsha C001 200905 2023057263210824609387135pradeepppatil12Belum ada peringkat

- Modvat & Cenvat: by Bhuvnesh Kumar 19BCOM04Dokumen12 halamanModvat & Cenvat: by Bhuvnesh Kumar 19BCOM04Bhuvnesh Kumar ManglaBelum ada peringkat

- Inter Tax FinalDokumen4 halamanInter Tax FinalJil Macasaet0% (1)

- RENTAL INVOICESDokumen9 halamanRENTAL INVOICESMadupalli Shankar VijayawadaBelum ada peringkat

- Note 1-Estate Under AdministrationDokumen8 halamanNote 1-Estate Under AdministrationNur Dina AbsbBelum ada peringkat

- 13th Month Pay and 14th Month PayDokumen7 halaman13th Month Pay and 14th Month PayInquiry PVM100% (1)

- General Principles of Estate TaxationDokumen2 halamanGeneral Principles of Estate TaxationCarlos PobladorBelum ada peringkat