Islamic Finance

Diunggah oleh

LAMOUCHI RIMJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Islamic Finance

Diunggah oleh

LAMOUCHI RIMHak Cipta:

Format Tersedia

Introduction to Islamic Banking & Finance

This introductory text provides students with a conceptual framework for understanding Introduction to Islamic

Banking & Finance

the key concepts, theories and principles associated with Islamic banking and finance.

Important elements of the discipline are explained over ten chapters, providing

students with a thorough understanding of the central products and services the

Islamic banking and finance industry offers. Current issues and concerns pertinent

to Islamic banking and finance are also considered, giving readers insight into the

possible future directions of this rapidly growing industry. Students are encouraged Principles and Practice

to connect with the subject matter through the inclusion of case studies and practice

M. Kabir Hassan

problems based on current industry trends and practices. With an emphasis on

engaging readers through the use of relevant and applicable material and activities, Rasem N. Kayed

this book gives students an excellent grounding in Islamic banking and finance. Umar A. Oseni

Supplementary Resources

The Pearson commitment goes further than just providing excellent texts—books like this are also

accompanied by a host of supplementary materials designed to enhance the teaching and learning

experience. Introduction to Islamic Banking and Finance is supported by a detailed, easy to use Instructor

Manual, powerful Test Bank Generator and dynamic PowerPoint Slides. It’s all part of the Pearson service.

Hassan Kayed Oseni

CVR_IIBF_SB_ARW_7315_CVR.indd 1 06/02/2013 12:25

al-aqidan contracting parties mukallaf legally accountable person

al-ma’qud alaih subject matter of contract muqaradah trust financing contract

al-rida consent muqasah offset contract

‘aqd contract murabahah cost-plus financing

‘aqd infiradi unilateral contract musharakah joint venture partnership

‘aqd thuna’i bilateral contract musharakah mutanaqisah diminishing

arbun down payment partnership

Bait al-mal state treasury muwa’adah bilateral promise

bay’ sale transaction muzakki zakat payer

bay al-dayn sale of debt nikah marriage

bay al-inah sale and repurchase back nisab threshold amount for zakat

bay al-muajjal deferred sale qard hasan benevolent loan

bay al-sarf contract of exchange of qimar game of chance

currencies rabb al-mal capital provider

bay al-tawrid mutual forward contract rahn collateral or mortgage

bay’ bithaman ajil deferred payment sale riba interest or usury

dhimmah juristic personality riba al-buyu’u interest in trade

fatwa legal ruling riba al-duyun interest on loans

fiqh Islamic jurisprudence riba al-fadl interest of exchange surplus

fiqh al-mu‘amalat jurisprudence of riba al-jali obvious interest

commercial transactions riba al-khafi hidden interest

gharar speculative risk-taking riba al-nasi’ah interest on money lent

hadith Prophetic tradition riba al-mubashir direct interest

hajj pilgrimage to Mecca riba ghayr al-mubashir indirect interest

hawalah contract of debt assignment ribawi interest-bearing

hibah gift Sa’a volume measurement (3 kg)

hilah legal artifice sadaqah charity or voluntary alms

hisbah guarding against infringements Sadd al-dhari’ah preventive measures

ibra’ rebate salam forward sale contract

ijarah lease contract sanadat commercial papers

ijarah mawsufah fi dhimmah forward lease sarf exchange

ijarah muntahia bittamlik lease ending with Sharī‘ah Islamic law

ownership shibh al-‘aqd quasi contract

ijarah thumma al-bay’ Islamic shirkah partnership

hire-purchase shura consultation

ijma consensus of opinion sighah form

ijtihad independent legal reasoning sukuk Islamic bonds or certificates

istihsan juristic preference Sunnah traditions of Prophet

istisna’ manufacturing contract Muhammad

ju‘alah contract of commission tabarru’ donation

kafalah contract of guarantee tabarru‘at gratuitous contracts

majlis al-‘aqd session of contract takaful Islamic insurance

maslahah mursalah unregulated public interest takaful ta’awuni cooperative insurance scheme

maysir gambling talaq divorce

mu‘allaq contingent contract tawarruq cash procurement

mu‘amalat commercial transactions tawriq securitization

mudarabah trust investment ujrah fee or commission

partnership wa’ad unilateral promise

mudarabah al-muqayyadah restricted trust wadi’ah contract of bailment

financing contract wadiah yad damanah guaranteed bank

mudarabah al-mutlaqah unrestricted trust deposit

financing contract wakalah contract of agency

mudarabah sukuk trust investment waqf charitable endowment

certificates wasiyyah bequest

mudarib entrepreneur zakat obligatory wealth levy

muhtasib ombudsman

text for flap.indd 1 09/01/2013 08:47

Preface

Introduction to

Islamic Banking

& Finance

Principles and Practice

M. Kabir Hassan, Ph.D.

University of New Orleans,

United States of America

Rasem N. Kayed, Ph.D.

Arab American University Jenin,

Palestine

Umar A. Oseni, Ph.D.

International Islamic University,

Malaysia

A01_HIBF_SB_ARW_7315_PRE.indd 1 18/02/2013 09:35

Acquisitions Editor: Rasheed Roussan Indexer: Indexing Specialists (UK) Ltd

Senior Development Editor: Sophie Bulbrook Marketing Manager: Sue Mainey

Project Editor: Jeanette Hewitt Production Controller: Christopher Crow

Copy-editor: Louise Bolotin Cover Designer: Sarah Fach

Proofreaders: Paul Stirner, Stephen York Typesetter: Tech-Set Ltd, Gateshead

Design Manager: Sarah Fach Typeface: 9/14pt The Serif HP3 Light

Permissions Editor: Rachel Thorne

Picture Researchers: Iman Naciri, Zohir Naciri

Printed in China

Pearson Education Limited

Edinburgh Gate

Harlow

Essex CM20 2JE

England

and Associated Companies throughout the world

© Pearson Education Limited 2013

The rights of M. Kabir Hassan, Rasem N. Kayed and Umar A. Oseni to be identified as authors of this

work have been asserted by them in accordance with the Copyright, Designs and Patents Act 1988.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or

transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise,

without either the prior written permission of the publisher or a licence permitting restricted copying

in the United Kingdom issued by the Copyright Licensing Agency Ltd, Saffron House, 6–10 Kirby Street,

London EC1N 8TS.

All trademarks used herein are the property of their respective owners. The use of any trademark in this

text does not vest in the author or publisher any trademark ownership rights in such trademarks, nor

does the use of such trademarks imply any affiliation with or endorsement of this book by such owners.

Pearson Education is not responsible for the content of third party internet sites.

First published 2013

21 20 19 18 17 16 15 14 13

IMP 10 9 8 7 6 5 4 3 2 1

ISBN: 978-0-2737-3731-5

A01_HIBF_SB_ARW_7315_PRE.indd 2 18/02/2013 09:35

This textbook is dedicated to our respective families who have stood behind us during the

course of writing this pioneering work. They have been a constant source of inspiration.

With renewed zeal, we have pursued the goal of producing a textbook for the global Islamic

finance industry that will enhance the Islamic finance pedagogy.

A01_HIBF_SB_ARW_7315_PRE.indd 3 18/02/2013 09:35

About the Authors

About the Authors

M. Kabir Hassan

Dr. M. Kabir Hassan is a financial economist with consulting, research, and teaching

experience in development finance, money and capital markets, Islamic finance, corporate

finance, investments, monetary economics, macroeconomics, and international trade and

finance. He has provided consulting services to the World Bank (WB), International Monetary

Fund (IMF), Islamic Development Bank (IDB), African Development Bank (AfDB), USAID,

Government of Bangladesh, Organization of Islamic Conferences (OIC), Federal Reserve

Bank, USA, and many corporations, private organizations, and universities around the

world. Dr. Hassan received his BA in Economics and Mathematics from Gustavus Adolphus

College, Minnesota, USA, and MA in Economics and PhD in Finance from the University of

Nebraska-Lincoln, USA, respectively. He is now a tenured Full Professor in the Department of

Economics and Finance at the University of New Orleans, Louisiana, USA. He has 135 papers

published in refereed academic journals to his credit. Dr. Hassan has published in the Journal

of Banking and Finance, Pacific Basin Finance Journal, Journal of Financial Services Research,

Financial Review, Quarterly Review of Economics and Finance, Journal of Business, Finance and

Accounting, Journal of Economics and Finance, Global Finance Journal, World Development,

Thunderbird International Business Review, African Development Review, Islamic Economic

Studies, Review of Islamic Economics, Journal of King Abdul Aziz University and Journal of

Developmental Entrepreneurship. Dr. Hassan supervised 27 doctoral theses, and many of his

students are now well placed in the academia, government and private sectors. He is editor

of The Global Journal of Finance and Economics and Journal of Islamic Economics, Banking and

Finance, International Journal of Islamic and Middle Eastern Finance and Management, and

co-editor of Journal of Economic Cooperation and Development. Dr. Hassan has edited and

published many books along with articles in refereed academic journals. He is co-editor (with

M. K. Lewis) of Handbook of Islamic Banking and Islamic Finance, The International Library of

Critical Writings in Economics (Edward Elgar, 2007), and co-editor (with Michael Mahlknecht)

of Islamic Capital Market: Products and Strategies (John Wiley and Sons, 2011). He is co-author

of Islamic Entrepreneurship (Routledge UK, 2010). A frequent traveler, Dr. Hassan gives lectures

and workshops in the USA and abroad, and has presented more than 257 research papers at

professional conferences and has delivered 91 invited papers/seminars.

Rasem N. Kayed

Dr. Rasem N. Kayed is currently the Head of Business Administration and Marketing

Departments and Deputy Dean of the Faculty of Administrative and Financial Sciences

at the Arab American University-Jenin (AAUJ) in Palestine. Prior to his appointment

at the AAUJ, he was a lecturer in international business at the College of Business at

Massey University, New Zealand, and an adjunct senior lecturer at the New Zealand

School of Export. Dr. Kayed received both his undergraduate degrees as well as his MBA

degree from Jacksonville State University, USA, and his PhD in Development Studies from

Massey University. His doctoral thesis explored the entrepreneurial phenomenon from

an Islamic perspective and argued for profit and loss sharing (PLS) contracts as viable

iv

A01_HIBF_SB_ARW_7315_PRE.indd 4 18/02/2013 09:35

About the Authors

alternatives to conventional interest-based financing instruments. Dr. Kayed is co-author

(with Kabir Hassan) of Islamic Entrepreneurship (UK: Routledge, Durham Modern Middle

East and Islamic World Series, 2011). He has published a number of peer-reviewed papers in

preferred academic international journals and chapters in books. He has also participated

in a variety of seminars, forums and workshops, and presented various empirical and

analytical research papers at several high-profile international conferences. Dr. Kayed

sits on the editorial advisory board of a number of internationally renowned journals of

Islamic banking and finance. His research activities are currently twofold: his first research

activity explores the developmental role that entrepreneurship could play in advancing the

wellbeing of the Muslim ummah; his second major research theme focuses on the global

financial crisis and the resilience of the Islamic financial services industry, and its ability to

present itself as a more reliable alternative to the conventional financial system. Dr. Kayed

has more than 25 years’ experience in both the commercial and academic worlds in the USA,

Saudi Arabia, New Zealand, and Palestine.

Umar A. Oseni

Umar Oseni is currently an Assistant Professor at the Ahmad Ibrahim Kulliyyah (Faculty)

of Laws, International Islamic University Malaysia. Prior to this, he was a visiting fellow at

the Islamic Legal Studies Program of Harvard Law School, USA. He received his LLB (Hons)

in Common and Islamic Law from the University of Ilorin, Nigeria; Master of Comparative

Laws (with Distinction), and PhD from the International Islamic University Malaysia. His

doctoral research was on the legal framework for alternative dispute resolution in courts

with Sharī‘ah jurisdiction in Nigeria, Malaysia, and Singapore, where he proposed a new

framework for dispute resolution in the Islamic finance industry. He was a resource person

on Islamic microfinance at the UN-Habitat Workshop on Land Development in Islam,

jointly organized by the UN-Habitat, International Islamic University Malaysia and the

University of East London in 2009. His areas of interest include the law and regulation of

Islamic finance, contemporary issues in Islamic law, alternative dispute resolution, and

international commercial arbitration. He is a member of the following professional bodies:

the Chartered Institute of Arbitrators UK; the International Centre for Dispute Resolution

Young & International (ICDR Y&I); the Young International Arbitration Group (YIAG); the

London Court of International Arbitration; the Nigerian Bar Association; and the Association

of Professional Negotiators and Mediators. Umar Oseni has written widely on current legal

and regulatory issues in Islamic finance. He is a co-editor (with Engku Rabiah Adawiah

Engku Ali) of Essential Readings in Legal and Regulatory Issues in Islamic Finance (Kuala

Lumpur: CERT Publications, 2012).

A01_HIBF_SB_ARW_7315_PRE.indd 5 18/02/2013 09:35

Brief Contents

Preface xi

Acknowledgments xix

Chapter 1 An Introduction to Islamic Banking and Finance 2

Chapter 2 Islamic Contract Law 40

Chapter 3 Financial Instruments of Islamic Banking and Finance 76

Chapter 4 Financial Accounting for Islamic Banking Products 126

Chapter 5 Corporate Governance for Islamic Financial Institutions 166

Chapter 6 Islamic Asset and Fund Management 214

Chapter 7 Islamic Bonds 252

Chapter 8 Islamic Insurance (Takaful) 290

Chapter 9 Islamic Microfinance 326

Chapter 10 Risk Management in Islamic Finance 366

Endnotes 404

Glossary 414

Index 425

Credits 435

A01_HIBF_SB_ARW_7315_PRE.indd 6 18/02/2013 09:35

Expanded Contents

Preface xi Classifications of Contract in Islamic Law 52

Acknowledgments xix Classifications of Contract According to Its Nature 52

GLOBAL ISLAMIC FINANCE 54

1 Classification of a Contract According to its

An Introduction to Islamic Banking and Circumstances 56

Finance 2 Classification of a Contract According to its Legal

Consequences 56

Professional Perspectives 3

Pillars of Shar ‘ah Contracts 58

Basis of Islamic Banking and Finance 4

Contract of Sale 59

The Shar ‘ah 4

Legal Capacity (Ahliyyah) 61

Origins and Historical Overview of Islamic The Main Forbidden Contracts in Islamic

Banking and Finance 9

Commercial Transactions 63

Early Days Transactions in the Era of the Prophet 9

Riba 64

Modern-Day Experiments in Islamic Finance 15

Bay’ al-Gharar 68

Conceptual Arguments for Islamic Banking and

ISLAMIC FINANCE IN THE NEWS: Islamic banks

Finance 19

caught between two worlds 70

The Development of Islamic Banking and Finance

Maysir or Qimar (Gambling or Games of Chance) 71

Industry 20

Components of the Islamic Banking and Review 73

Finance Industry 22 Key Terms and Concepts 73

The Four Major Components 22 Summary 73

ISLAMIC FINANCE IN THE NEWS: Islamic directive Practice Questions and Activities 74

shocks Qatari banks 23 Further Reading 74

ISLAMIC FINANCE IN PRACTICE: American

International Group Ventures into Takaful 26 3

Islamic Financial Architecture and Infrastructure 27 Financial Instruments of Islamic Banking

Operating Structures of the Islamic Banking and and Finance 76

Finance Industry 28 Professional Perspectives 77

The Development of Islamic Banking Products 29

Sources and Uses of Funds by Islamic Banks 79

The Growth of Islamic Banking and Finance 31 Sources of Funds 79

Islamic Banking Today: the Size of the Industry 31 Application of Funds 80

The Worldwide Spread of Islamic Banking 32 ISLAMIC FINANCE IN THE NEWS: Qatar Banks Prepare

GLOBAL ISLAMIC FINANCE 34 for Islamic Assets Split 81

The Future of the Islamic Finance Industry 34

Concept of Exchange-Based Contracts 82

Review 37 Murabahah (Cost-Plus or Mark-up Sale) 82

Key Terms and Concepts 37 Istisna‘ (Manufacturing Contract) 85

Summary 37 Salam or Bay al-Salam (Forward Sale) 88

Practice Questions and Activities 38 Bay al-Dayn (Sale of Debt) 89

Further Reading 38 Bay al-Inah (Sale with Immediate Repurchase) 90

GLOBAL ISLAMIC FINANCE 92

2 Tawriq (Securitization)

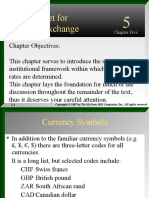

Sarf (Sale of Currency)

92

95

Islamic Contract Law 40 Tawarruq (Cash Financing or Reverse Murabahah) 96

Professional Perspectives 41 ISLAMIC FINANCE IN PRACTICE: Question on Tawarruq

Business Transactions in Islam 43 Brought Before the International Islamic Fiqh

Lawful Earning Under the Shar ‘ah 44 Academy 98

Islamic Contract Law 47 The Concept of Service-Based Contracts 99

Definition of Contract in Islamic Law 47 Ijarah (Leasing) 99

ISLAMIC FINANCE IN PRACTICE 48 Ujrah (Fees) 102

Nature of Contract and Related Terms—Wa’ad, Ju’alah (Reward) 103

Muwa’adah, and ‘Aqd 49 Partnership Contracts in Islamic Finance 104

Affirmative Evidence on Contract 51 The Concept of Equity-Based Contracts 104

vii

A01_HIBF_SB_ARW_7315_PRE.indd 7 18/02/2013 09:35

Expanded Contents

Supporting Contracts 109 AAOIFI Proposed Set of Financial Statements for

Hawalah (Transfer of Debt) 109 Islamic Banks 160

Rahn (Collateral/Pledge) 111 GLOBAL ISLAMIC FINANCE: Bringing AAOIFI Accounting

Muqasah (Offsetting) 113 Standards into the Mainstream Global Framework 161

Kafalah (Guarantee) 115

Review 163

Wakalah (Agency) 116

Key Terms and Concepts 163

Wadi’ah (Safekeeping) 118

Summary 163

Concept of Unilateral Supporting Contract 119

Practice Questions and Activities 164

Review 122 Further Reading 165

Key Terms and Concepts 122

Summary 122 5

Practice Questions and Activities 123 Corporate Governance for Islamic

Further Reading 124 Financial Institutions 166

4 Professional Perspectives

The Meaning of Corporate Governance

167

170

Financial Accounting for Islamic

Defining Corporate Governance 170

Banking Products 126

Corporate Governance in Islam 171

Professional Perspectives 127

Models of Corporate Governance:

Definition of Islamic Financial Accounting 129 Stakeholder versus Shareholder 172

What is Accounting? 129 The Role of Corporate Governance in Islamic

What is Islamic Accounting? 129 Financial Institutions 173

The Importance of Accountability in Islam 130

Mechanisms of Corporate Governance

International Financial Reporting Standards 131 and Control 174

IFRS and Islamic Banks and Financial Institutions 132 Principles of Corporate Governance in Islam 175

ISLAMIC FINANCE IN THE NEWS: IFRS to Converge with Shar ‘ah Governance 177

Islamic Accounting Standards 134 ISLAMIC FINANCE IN PRACTICE: The Corporate

Basic Principles of Accounting 135 Governance Structure of Meezan Bank 178

Recording Financial Information 135 ISLAMIC FINANCE IN THE NEWS: Islamic banking

The Three Branches of Accounting 137 seeks global standards 185

Basic Principles of Islamic Accounting 138 A Different Approach for Islamic Financial

Consumers of Accounting Information on Institutions 190

Islamic Banks 139 Models of Shar ‘ah Governance from Selected

An Islamic Perspective on Accounting Concepts 140 Countries 190

The Accounting and Auditing Organization for GLOBAL ISLAMIC FINANCE 191

Islamic Financial Institutions 141 Corporate Governance for Islamic Insurance 203

AAOIFI Accounting Standards 143 IFSB Guiding Principles on Governance for Takaful

Accrual and Cash Flow Accounting Methods 145 Undertakings 204

Cash Flow Method of Accounting 146

Accrual Method of Accounting 146

Review 210

Key Terms and Concepts 210

Financial Statements in Islamic Banks and

Summary 210

Financial Institutions 146

Practice Questions and Activities 211

Comparative Financial Statements of Islamic

Further Reading 212

Financial Products 147

The Four Basic Financial Statements

Balance Sheet

148

148

6

Income Statement 151 Islamic Asset and Fund Management 214

ISLAMIC FINANCE IN PRACTICE: Qatar Islamic Bank’s Professional Perspectives 215

Income Statement 155 Review and Fundamentals of Islamic

Cash Flow Statements 156 Investing 217

Statement of Retained Earnings or Shareholders’ Non-interest-bearing Products 219

Equity 156 Avoiding Speculative Investments 220

viii

A01_HIBF_SB_ARW_7315_PRE.indd 8 18/02/2013 09:35

Expanded Contents

Social Responsibility 220 Types and Structure of Islamic Bonds 263

Contractual Terms and Certification by Shar ‘ah ISLAMIC FINANCE IN PRACTICE: International Innovative

Experts 221 Technologies Sukuk 271

Selection of Islamic Stocks for Investment 221 AAOIFI Standards for Islamic Bonds 274

Islamic Stock Market Indices 221 Characteristics of Investment Sukuk 274

The Process of Selecting Stocks 222 Shar ‘ah Rulings and Requirements 275

ISLAMIC FINANCE IN THE NEWS: Going global from Significant AAOIFI Rulings on Sukuk in 2008 278

Iowa to Kuala Lumpur 227 Rating of Islamic Bonds 279

Addressing Issues of Non-compliant Stocks 228 Types of Ratings 279

Structure, Marketing, and Distribution of GLOBAL ISLAMIC FINANCE: Moody’s Rating of Sukuk 280

Islamic Investment Funds 229 Rating Products and Methodology 283

What is an Islamic Investment Fund? 229

Review 287

Structure of Islamic Investment Funds 229

Key Terms and Concepts 287

ISLAMIC FINANCE IN PRACTICE: Ijarah Real Estate Fund,

Summary 287

Global Investment House, Kuwait 232

Practice Questions and Activities 288

Distribution and Marketing of Islamic Funds 238

Further Reading 289

Distribution and Marketing Strategies for Islamic

Investment Funds

Challenges in the Marketing and Distribution of

239

8

Islamic Funds 240 Islamic Insurance (Takaful) 290

Shar ‘ah Governance of Islamic Funds 241 Professional Perspectives 291

Composition of the Shar ‘ah Supervisory Board 242 Basic Concepts of Takaful 293

Functions of the Shar ‘ah Supervisory Board 242 Definition of Takaful 293

Independence of the Shar ‘ah Committee and The Main Features of Takaful 295

Islamic Fund Infrastructure 242 Major Differences Between Takaful and

GLOBAL ISLAMIC FINANCE: Islamic Fund Management Conventional Insurance 296

in the Global Finance Industry 243 Historical Development of Takaful 298

Compensation and Monitoring Fees 244 GLOBAL ISLAMIC FINANCE: Current Position of

Disclosure Issues 244 Takaful in the World 301

Risk Management for Islamic Investment Models of Takaful 302

Funds 245 The Mudarabah Model 302

Risk-Reward Profiles of Islamic Investment Products 245 The Wakalah Model 303

Risk Management Strategies for Islamic Funds 246 Hybrid Wakalah-Mudarabah Model 305

Waqf-Wakalah-Mudarabah (Ultra-Hybrid) Model 306

Review 248

Main Takaful Products 310

Key Terms and Concepts 248

General Takaful 310

Summary 248

Family Takaful 310

Practice Questions and Activities 249

ISLAMIC FINANCE IN PRACTICE: HSBC Amanah

Further Reading 250

Homeowner Takaful 311

ISLAMIC FINANCE IN THE NEWS: Islamic Insurance:

7 A global market ripe for growth 313

Islamic Bonds 252 Underwriting Surplus and Technical

Provisions 314

Professional Perspectives 253

Underwriting Surplus 314

What are Sukuk? 257

Right of Policyholders to Surplus 314

Meaning of Sukuk 257

Allocating the Insurance Surplus 315

A Brief History of Sukuk 258

Covering the Takaful Deficit 316

Benefits of Sukuk 259

Reinsurance and Retakaful 317

Differences Between Sukuk and Conventional Bonds 260

ISLAMIC FINANCE IN PRACTICE: Swiss Re Retakaful 321

ISLAMIC FINANCE IN THE NEWS: Saudi sukuk success

boosts bond hopes 261 Review 323

Structuring Islamic Bonds 262 Key Terms and Concepts 323

ix

A01_HIBF_SB_ARW_7315_PRE.indd 9 18/02/2013 09:35

Expanded Contents

Summary 323 Practice Questions and Activities 363

Practice Questions and Activities 324 Further Reading 364

Further Reading 325

10

9 Risk Management in Islamic Finance 366

Islamic Microfinance 326 Professional Perspectives 367

Professional Perspectives 327 Risk Management from an Islamic

Islamic Microfinance: Providing Credit to Perspective 369

the Entrepreneurial Poor 330 The Meaning of Risk and its Underlying Principles 369

The History of Islamic Microfinance Institutions 330 Affirmative Evidence on Risk Management in Islam 369

Components of Islamic Microfinance 332 Risk Management in Islamic Commercial

Prohibition of Riba in Islamic Microfinance 333 Transactions 371

Islamic Microfinance Products 336 Types of Risk Exposure 373

Salam as an Islamic Financial Product for Credit Risk 374

Microfinancing Agriculture 336 GLOBAL ISLAMIC FINANCE: Risk Management:

Mudarabah Financing for Combating IFSB Guidelines and Basel II Framework 375

Unemployment 338 Equity Investment Risk 377

Bay al-Muajjal-Murabahah Model of Providing Market Risk 379

Working Capital 339 Liquidity Risk 381

Diminishing Partnership for Housing Microfinance 341 Rate of Return Risk 384

Not-for-Profit Modes of Islamic Microfinance 341 Operational Risk 386

Islamic Microfinance Institutions versus Risk Management Mechanisms in Islamic

Conventional Microfinance Institutions 343 Banks 387

Sources of Funds 343 Risk Avoidance 388

GLOBAL ISLAMIC FINANCE: Poverty Alleviation through Risk Absorption 389

Islamic Microfinance Programs 344 Risk Transfer 390

Modes of Financing 345 Risk Mitigation Techniques in Islamic

Financing the Poorest 346 Finance 390

Funds Transferred to Beneficiaries 346 The Basics: Defining Derivatives 391

Guarantee and Group Dynamics 346 Forwards, Futures, Options, Swaps and Other

Objective of Targeting Women 346 Derivatives from the Islamic Perspective 396

Work Incentives of Staff Members 347 Islamic Promissory Forward Contract 396

Social Development Programs 347 Islamic Swap 396

Dealing with Default 347 ISLAMIC FINANCE IN THE NEWS: Islamic finance

Notable Islamic Microfinance Institutions 348 embraces derivatives 397

Hodeidah Microfinance Program, Yemen 348 ISLAMIC FINANCE IN PRACTICE: CIMB Islamic Profit

Akhuwat, Pakistan 350 Rate Swap 399

Islami Bank Bangladesh Limited—Rural Islamic Options 400

Development Scheme 353

Review 401

Financing Micro-enterprises by Islamic

Key Terms and Concepts 401

Banks: Rationale 355

Summary 401

Role of Islamic Banks in Financing Micro-enterprises 356

Practice Questions and Activities 402

Financing Micro-enterprises: Microfinance

Further Reading 403

Institutions versus Islamic Banks 357

ISLAMIC FINANCE IN PRACTICE: Family Bank

in Bahrain 358 Endnotes 404

ISLAMIC FINANCE IN THE NEWS: Microfinance:

Industry urged to refocus on poverty 360 Glossary 414

Review 362 Index 425

Key Terms and Concepts 362

Summary 362 Credits 425

A01_HIBF_SB_ARW_7315_PRE.indd 10 18/02/2013 09:35

Preface

Preface

Islamic banking and finance is becoming one of the most significant aspects of the modern

global financial system. Why? Because it is a fast-growing industry that has developed

rapidly within a few years from a niche industry to a global force to be reckoned with in the

international arena. However, with the worldwide spread of Islamic financial products and

the growing interest of students and financial experts in Islamic finance, numerous books,

monographs, and academic articles are being produced to explain the significance of this

new industry to the global financial system. Nevertheless, there has not been much focus

on a professional textbook on Islamic banking and finance for students of higher education

who require case studies and practical examples in their programs. This seemingly

neglected aspect of Islamic financial literature is the gap that this book seeks to fill, focusing

on the principles and practice of Islamic banking and finance in the modern world. In this

dynamic industry, there is a need to present a textbook for the ever-increasing academic and

professional institutions offering Islamic finance as a course.

Approach

We have tried to simplify the discussion through practical case studies and other helpful

pedagogical features. Underpinning this are three major principles that have guided our

approach to the presentation of the book.

• Practice-oriented approach. The pedagogical features embedded in the book—ranging

from Professional Perspectives, Islamic Finance in Practice, Global Islamic Finance

and Islamic Finance in the News, to problems and activities, marginal challenges, and

marginal definitions—are meant to facilitate the understanding of the underlying

principles. These practice-oriented features provide a hands-on experience for the

students in understanding the dynamics of the Islamic finance industry.

• The need for more sustainable practices. We believe that in order to sustain the tremendous

growth recorded in the Islamic finance industry, a dedicated textbook that addresses key

issues should be made readily available for the students and practitioners alike. While

there are numerous monographs on Islamic banking and finance, this textbook provides

both the theory and practice, which is necessary to prepare the future professionals in the

industry for the rewards and challenges they are bound to face in their careers.

• Towards the standardization of Islamic finance. As the pioneering textbook on Islamic

banking and finance that seeks to fulfill the academic and professional needs of both

students and practitioners, it also seeks to standardize the principles and practices of

Islamic finance, bearing in mind the notable differences in the use of some products

between jurisdictions in South-East Asia, the Middle East, and North African countries.

We have tried to present complex Islamic financial transactions in a manner that is

easy to grasp, particularly for students who are new to the field of Islamic finance. Our

goal in writing this book is to help students understand the underlying principles of

xi

A01_HIBF_SB_ARW_7315_PRE.indd 11 18/02/2013 09:35

Anda mungkin juga menyukai

- Islamic Banking & FinanceDokumen266 halamanIslamic Banking & FinanceAhmed Lalaoui100% (2)

- Islamic Finance Book FINALDokumen129 halamanIslamic Finance Book FINALph.alvin100% (3)

- Islamic Banking 101Dokumen7 halamanIslamic Banking 101Murad KhanBelum ada peringkat

- Islamic Banking and Finance Recent Empirical LiterDokumen30 halamanIslamic Banking and Finance Recent Empirical LiterAli ShamsherBelum ada peringkat

- Textbook Islamic Finance. - Perasonpdf PDFDokumen64 halamanTextbook Islamic Finance. - Perasonpdf PDFfaizu21100% (1)

- Modes of Deployment of Fund by Islamic BanksDokumen30 halamanModes of Deployment of Fund by Islamic Banksvivekananda Roy100% (1)

- The Islamic Banking and Finance Workbook: Step-by-Step Exercises to help you Master the Fundamentals of Islamic Banking and FinanceDari EverandThe Islamic Banking and Finance Workbook: Step-by-Step Exercises to help you Master the Fundamentals of Islamic Banking and FinanceBelum ada peringkat

- Islamic BankingDokumen50 halamanIslamic Bankingmusbri mohamed100% (2)

- Steps in Accounting CycleDokumen34 halamanSteps in Accounting Cycleahmad100% (4)

- 1.overview and Concept of Islamic FinanceDokumen13 halaman1.overview and Concept of Islamic Financecikita67Belum ada peringkat

- Islamic vs. Conventional BankingDokumen32 halamanIslamic vs. Conventional BankingNuwan Tharanga LiyanageBelum ada peringkat

- Ltcma Full ReportDokumen130 halamanLtcma Full ReportclaytonBelum ada peringkat

- Sale of Goods Vs Sale of DebtDokumen36 halamanSale of Goods Vs Sale of Debtmughees100% (1)

- (Islamic Business and Finance) Yasushi Suzuki, Mohammad Dulal Miah - Dilemmas and Challenges in Islamic Finance - Looking at Equity and Microfinance-Routledge (2018)Dokumen235 halaman(Islamic Business and Finance) Yasushi Suzuki, Mohammad Dulal Miah - Dilemmas and Challenges in Islamic Finance - Looking at Equity and Microfinance-Routledge (2018)irwan hermawanBelum ada peringkat

- The Dev of Islamic Fin SystemDokumen13 halamanThe Dev of Islamic Fin SystemNadiah GhazaliBelum ada peringkat

- Islamic Banking And Finance for Beginners!Dari EverandIslamic Banking And Finance for Beginners!Penilaian: 2 dari 5 bintang2/5 (1)

- Islamic Finance in BruneiDokumen20 halamanIslamic Finance in BruneiTJPRC PublicationsBelum ada peringkat

- MT 199 Maribel Gonzalez 27 06 22Dokumen2 halamanMT 199 Maribel Gonzalez 27 06 22ULRICH VOLLERBelum ada peringkat

- Theoretical Studies in Islamic Banking and FinanceDari EverandTheoretical Studies in Islamic Banking and FinancePenilaian: 5 dari 5 bintang5/5 (1)

- Contracts and Deals in Islamic Finance: A User�s Guide to Cash Flows, Balance Sheets, and Capital StructuresDari EverandContracts and Deals in Islamic Finance: A User�s Guide to Cash Flows, Balance Sheets, and Capital StructuresBelum ada peringkat

- Essays In Islamic Finance III: Essays In Islamic Finance, #3Dari EverandEssays In Islamic Finance III: Essays In Islamic Finance, #3Belum ada peringkat

- The Foundations of Islamic Economics and BankingDari EverandThe Foundations of Islamic Economics and BankingBelum ada peringkat

- T24 System Build Credit V1.0Dokumen30 halamanT24 System Build Credit V1.0Quoc Dat Tran50% (2)

- Sukuk An Inside Study of Its Background Structures Challenges and CasesDokumen61 halamanSukuk An Inside Study of Its Background Structures Challenges and CasesTawheed Hussain50% (2)

- Monetization TawarruqDokumen4 halamanMonetization Tawarruqbilal khanBelum ada peringkat

- Dissertation Islamic FinanceDokumen129 halamanDissertation Islamic Financeleopantra100% (1)

- Essays In Islamic Finance II: Essays In Islamic Finance, #2Dari EverandEssays In Islamic Finance II: Essays In Islamic Finance, #2Belum ada peringkat

- Islamic Finance in a Nutshell: A Guide for Non-SpecialistsDari EverandIslamic Finance in a Nutshell: A Guide for Non-SpecialistsPenilaian: 5 dari 5 bintang5/5 (1)

- Takaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaDari EverandTakaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaBelum ada peringkat

- Financial Engineering in Islamic Finance the Way Forward: A Case for Shariah Compliant DerivativesDari EverandFinancial Engineering in Islamic Finance the Way Forward: A Case for Shariah Compliant DerivativesBelum ada peringkat

- Principles of Islamic Finance: New Issues and Steps ForwardDari EverandPrinciples of Islamic Finance: New Issues and Steps ForwardBelum ada peringkat

- Overview of Islamic Financial SystemDokumen11 halamanOverview of Islamic Financial SystemRyuzanna JubaidiBelum ada peringkat

- Essays In Islamic Finance I: Essays In Islamic Finance, #1Dari EverandEssays In Islamic Finance I: Essays In Islamic Finance, #1Belum ada peringkat

- Modern Islamic Banking: Products and Processes in PracticeDari EverandModern Islamic Banking: Products and Processes in PracticeBelum ada peringkat

- Islamic Finance: Issues in Sukuk and Proposals for ReformDari EverandIslamic Finance: Issues in Sukuk and Proposals for ReformBelum ada peringkat

- Islamic BankingDokumen57 halamanIslamic BankingMalik Yousaf AkramBelum ada peringkat

- Islamic Banking - Consumer PerspectivesDokumen78 halamanIslamic Banking - Consumer PerspectivesQazim Ali SumarBelum ada peringkat

- Islamic Mutual Funds Presentation Part IDokumen20 halamanIslamic Mutual Funds Presentation Part Itobyas.pearlBelum ada peringkat

- Shariah Advisory Council (SAC)Dokumen31 halamanShariah Advisory Council (SAC)Mahyuddin KhalidBelum ada peringkat

- The Implementation of Sukuk Ijarah in MalaysiaDokumen67 halamanThe Implementation of Sukuk Ijarah in Malaysiaetty100% (6)

- Islamic Finance Project On TawarruqDokumen23 halamanIslamic Finance Project On Tawarruqmahakanwal.96100% (1)

- Ethicas Handbook of Islamic Finance (Preview)Dokumen19 halamanEthicas Handbook of Islamic Finance (Preview)Ethica Institute of Islamic Finance™Belum ada peringkat

- E-PAPER - NON-BANKING ISLAMIC FINANCIAL INSTITUTIONS - Research Center For Islamic Economics (IKAM)Dokumen50 halamanE-PAPER - NON-BANKING ISLAMIC FINANCIAL INSTITUTIONS - Research Center For Islamic Economics (IKAM)Muhammad QuraisyBelum ada peringkat

- SAMPLE Islamic FinanceDokumen64 halamanSAMPLE Islamic FinanceAngelaLingBelum ada peringkat

- Islamic Banking and Conventional BankingDokumen4 halamanIslamic Banking and Conventional BankingSajjad AliBelum ada peringkat

- Certified Islamic Professional Accountant (Cipa) ProgramDokumen13 halamanCertified Islamic Professional Accountant (Cipa) ProgramTijjani Ridwanulah AdewaleBelum ada peringkat

- Shariah Sales vs. Riba LoanDokumen29 halamanShariah Sales vs. Riba LoanNorul Hazwani ZainudinBelum ada peringkat

- Assignment of Islamic FinanceDokumen20 halamanAssignment of Islamic FinanceHeena Ch100% (1)

- Islamic Banking in Pakistan A Literature Review Finance EssayDokumen7 halamanIslamic Banking in Pakistan A Literature Review Finance EssayMahmood KhanBelum ada peringkat

- Market Power, Stability, and Performance in Islamic Banks of Pakistan Research ProposalDokumen7 halamanMarket Power, Stability, and Performance in Islamic Banks of Pakistan Research ProposalIrfan AliBelum ada peringkat

- Principles of Islamic Capital MarketDokumen6 halamanPrinciples of Islamic Capital MarketSyahrul EffendeeBelum ada peringkat

- Islamic FinanceDokumen31 halamanIslamic FinanceSALEEMBelum ada peringkat

- Shariah AdvisoryDokumen8 halamanShariah AdvisoryAbeerAlgebaliBelum ada peringkat

- List of Currency in World by CountryDokumen12 halamanList of Currency in World by CountryLAMOUCHI RIMBelum ada peringkat

- Financial ModelingDokumen21 halamanFinancial ModelingLAMOUCHI RIMBelum ada peringkat

- Tasi Return (1) 3Dokumen7 halamanTasi Return (1) 3LAMOUCHI RIMBelum ada peringkat

- Project Training: Discounted Cash FlowDokumen46 halamanProject Training: Discounted Cash FlowLAMOUCHI RIMBelum ada peringkat

- Golden Rules of Financial ModelingDokumen51 halamanGolden Rules of Financial ModelingLAMOUCHI RIMBelum ada peringkat

- MSBC 5060: Financial Statement Analysis and Financial ModelsDokumen51 halamanMSBC 5060: Financial Statement Analysis and Financial ModelsLAMOUCHI RIMBelum ada peringkat

- Financial Modeling By: CA Tapan Kumar DasDokumen16 halamanFinancial Modeling By: CA Tapan Kumar DasLAMOUCHI RIMBelum ada peringkat

- If Chapter 4 StudentDokumen42 halamanIf Chapter 4 StudentLAMOUCHI RIMBelum ada peringkat

- Valuation Method: Precedent Transaction Analysis-: Selecting Comparable Transaction, Spreading Comparable TransactionDokumen18 halamanValuation Method: Precedent Transaction Analysis-: Selecting Comparable Transaction, Spreading Comparable TransactionLAMOUCHI RIMBelum ada peringkat

- Chapter 6 Comparable Companies AnalysisDokumen46 halamanChapter 6 Comparable Companies AnalysisLAMOUCHI RIMBelum ada peringkat

- © Pearson Education Limited 2015Dokumen41 halaman© Pearson Education Limited 2015LAMOUCHI RIMBelum ada peringkat

- 5 Deposit ProductsDokumen19 halaman5 Deposit ProductsLAMOUCHI RIMBelum ada peringkat

- Transaction Exposure ManagementDokumen28 halamanTransaction Exposure ManagementLAMOUCHI RIMBelum ada peringkat

- Online Financial Modeling and ValuationDokumen6 halamanOnline Financial Modeling and ValuationLAMOUCHI RIMBelum ada peringkat

- Financial Models (Applications) : Prof. Silvia MuzzioliDokumen23 halamanFinancial Models (Applications) : Prof. Silvia MuzzioliLAMOUCHI RIMBelum ada peringkat

- Statistical Techniques in Business & Economics: Douglas Lind, William Marchal & Samuel WathenDokumen16 halamanStatistical Techniques in Business & Economics: Douglas Lind, William Marchal & Samuel WathenLAMOUCHI RIMBelum ada peringkat

- Commercial Bank OperationsDokumen8 halamanCommercial Bank OperationsLAMOUCHI RIMBelum ada peringkat

- Conventional and Islamic Indices: A Comparison On PerformanceDokumen16 halamanConventional and Islamic Indices: A Comparison On PerformanceLAMOUCHI RIMBelum ada peringkat

- Financial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDokumen87 halamanFinancial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDaniel YebraBelum ada peringkat

- Unifi Capital PresentationDokumen40 halamanUnifi Capital PresentationAnkurBelum ada peringkat

- Role of Financial Market and Securities Market in Economic GrowthDokumen2 halamanRole of Financial Market and Securities Market in Economic GrowthAparna Rajasekharan100% (1)

- STCM 04 Ge CVPDokumen2 halamanSTCM 04 Ge CVPdin matanguihanBelum ada peringkat

- Control of Administrative, Selling and Distribution OverheadDokumen17 halamanControl of Administrative, Selling and Distribution OverheadBhavik AmbaniBelum ada peringkat

- Ch17 - Analysis of Bonds W Embedded Options.ADokumen25 halamanCh17 - Analysis of Bonds W Embedded Options.Akerenkang100% (1)

- Full Download Corporate Financial Accounting 13th Edition Warren Solutions ManualDokumen35 halamanFull Download Corporate Financial Accounting 13th Edition Warren Solutions Manualmasonh7dswebb100% (37)

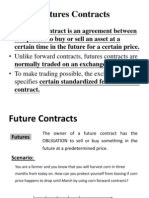

- Futures ContractsDokumen14 halamanFutures ContractsSantosh More0% (1)

- Andres Pou: Miami - Dade Community CollegeDokumen2 halamanAndres Pou: Miami - Dade Community CollegeChandra SimsBelum ada peringkat

- New Zealand 2009 Financial Knowledge SurveyDokumen11 halamanNew Zealand 2009 Financial Knowledge SurveywmhuthnanceBelum ada peringkat

- Banco CompartamosDokumen4 halamanBanco Compartamosarnulfo.perez.pBelum ada peringkat

- Project On Partnership Accounting PDFDokumen17 halamanProject On Partnership Accounting PDFManish ChouhanBelum ada peringkat

- XEROXDokumen25 halamanXEROXSALONY METHIBelum ada peringkat

- Dissolution of Partnership FirmDokumen5 halamanDissolution of Partnership FirmDark SoulBelum ada peringkat

- Banking Industry - Cygnus 1 June 09Dokumen18 halamanBanking Industry - Cygnus 1 June 09Asad khanBelum ada peringkat

- ACCO320Midterm Fall2013FNDokumen14 halamanACCO320Midterm Fall2013FNzzBelum ada peringkat

- QSRSAI Q1 2023 - DARPO Davao OrientalDokumen33 halamanQSRSAI Q1 2023 - DARPO Davao OrientalLouie Mark lligan (COA - Louie Mark Iligan)Belum ada peringkat

- Chapter 1 Cost Accounting 2020Dokumen21 halamanChapter 1 Cost Accounting 2020magdy kamelBelum ada peringkat

- Bankin and Fin Law Relationship Between Bank and Its CustomersDokumen6 halamanBankin and Fin Law Relationship Between Bank and Its CustomersPersephone WestBelum ada peringkat

- Contract of LeaseDokumen2 halamanContract of LeaseElain OrtizBelum ada peringkat

- Computer Literacy Test 3Dokumen9 halamanComputer Literacy Test 3Xavier MundattilBelum ada peringkat

- Sample Resume, Mem/Mba: Current Address Permanent Address (Optional) Current Home /cell Phone Jane - Smith@yale - EduDokumen1 halamanSample Resume, Mem/Mba: Current Address Permanent Address (Optional) Current Home /cell Phone Jane - Smith@yale - EduGurpreetBelum ada peringkat

- Exercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1Dokumen30 halamanExercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1JefferyBelum ada peringkat

- Cooperative ManualDokumen35 halamanCooperative ManualPratik MogheBelum ada peringkat

- LP Modeling For Asset-Liability Management: A Survey of Choices and SimplificationsDokumen17 halamanLP Modeling For Asset-Liability Management: A Survey of Choices and SimplificationsRidwan GunawanBelum ada peringkat

- White County Lilly Endowment Scholarship ApplicationDokumen11 halamanWhite County Lilly Endowment Scholarship ApplicationVoodooPandasBelum ada peringkat