Transaction Statement1563132579

Diunggah oleh

Vincent VDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Transaction Statement1563132579

Diunggah oleh

Vincent VHak Cipta:

Format Tersedia

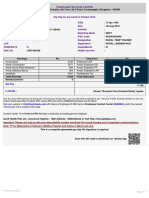

CENTRAL RECORDKEEPING AGENCY

Transaction Statement-ATAL PENSION YOJANA (APY) for the period of:01-Apr-2019 to 15-Jul-2019

Subscriber Details

PRAN : 500154951387 Statement Date : Jul 15, 2019 12:43 AM

Name : MR SANGEETH S PRAN Generation

: Nov 26, 2018

Date

: S/O SURESH A S NO107 GANESHA TEMPLE STREET

Date Of Birth : Dec 29, 1995

KOLAR

KARNATAKA563122 Saving Bank A/C No. : 4191375831

INDIA

APY-SP Bank Reg. APY-SP Bank Branch

IRA Status : IRA compliant : 7004141 : NPS237557C

no. Reg. No.

Mobile Number : 9901633381 APY-SP Bank Name : DEPARTMENT OF POSTS APY-SP Bank Branch : DOP-Robertsonpet-56312201

MINISTRY OF COMM AND IT Name

Email ID : Pension Amount

: 5000

Selected

Periodicity of

: Monthly

Contribution

Spouse Name

:

AADHAAR : null

Nominee Name ROJA A Percentage 100%

The total contribution to your pension account till July 15,2019 was Rs.1752.00

The details of your Transaction are as under

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Govt. Co-

Date Particulars Uploaded By Subscriber

Contribution/Overdue Total

Contribution

Charges (Rs)

(Rs)

(Rs)

01-Apr-2019 Opening balance 1168.00

12-Apr-2019 By APY Contribution for MARCH 2019 DEPARTMENT OF POSTS MINISTRY OF COMM AND IT (7004141), 292.00 0.00 292.00

16-May-2019 By APY Contribution for APRIL 2019 DEPARTMENT OF POSTS MINISTRY OF COMM AND IT (7004141), 292.00 0.00 292.00

15-Jul-2019 Closing Balance 1,752.00

Billing Summary

Perticulars Amount

Summary of Billing during the statement period (14.72)

Government Co-contribution Details

No records found for the selected period

Notes for Transaction Statement::

1. The section 'Contribution Details' gives the details of the contributions processed in subscriber's account during the period.

The Central Government would co-contribute 50% of the total contribution or Rs.1000 per annum, whichever is lower, to each eligible subscriber for

a period of 5 years, i.e., from Financial Year 2015-16 to 2019-20, who joins APY before March 31, 2016 and who are not members of any statutory

2.

social security scheme & who are not income tax payers. This Government co-contribution is payable into subscriber's savings bank account half

yearly basis in a Financial Year once subscriber has made the entire contribution for six months.

3. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your APY bank

4. branch. In case there is no/less/excess contribution for any month or no clarity in the narration, please contact your APY Bank Branch. In case of any

discrepancy, you must contact your APY bank branch immediately.

Contribution amount is invested as per the guidelines of Government of India (upto 85% of the money will be invested in debt and government

5.

securities and upto 15% will be invested in equity).

Legends

Term Description

Under APY, the individual subscribers shall have an option to make the contribution on a monthly, quarterly, half yearly basis. Banks are required to collect additional amount for delayed

payments. The overdue interest for delayed contributions would be as shown below: Overdue interest for delayed contribution:Rs. 1 per month for contribution for every Rs. 100, or part

Overdue interest

thereof, for each delayed monthly payment. Overdue interest for delayed contribution for quarterly / half yearly mode of contribution shall be recovered accordingly. The overdue interest

amount collected will remain as part of the pension corpus of the subscriber.

Anda mungkin juga menyukai

- Alex Eubank GGIIDokumen40 halamanAlex Eubank GGIIOliver Sleiman94% (16)

- "Next Friend" and "Guardian Ad Litem" - Difference BetweenDokumen1 halaman"Next Friend" and "Guardian Ad Litem" - Difference BetweenTeh Hong Xhe100% (2)

- Guideline On Smacna Through Penetration Fire StoppingDokumen48 halamanGuideline On Smacna Through Penetration Fire Stoppingwguindy70Belum ada peringkat

- Nta855 C400 D6 PDFDokumen110 halamanNta855 C400 D6 PDFIsmael Grünhäuser100% (4)

- Iomm VFD-3 030112Dokumen100 halamanIomm VFD-3 030112Alexander100% (1)

- Indian Standard (First Revision) : Method of Chemical Analysis of Hydraulic CementDokumen44 halamanIndian Standard (First Revision) : Method of Chemical Analysis of Hydraulic CementArijit dasguptaBelum ada peringkat

- Sbi PDFDokumen5 halamanSbi PDFshweta pundirBelum ada peringkat

- Payslip ModelDokumen1 halamanPayslip ModelKarthikeyan KarthikeyanBelum ada peringkat

- Cover Letter UchDokumen1 halamanCover Letter UchNakia nakia100% (1)

- Pay Advice: Payment SummaryDokumen1 halamanPay Advice: Payment SummaryankurbbhattBelum ada peringkat

- EXP 2 - Plug Flow Tubular ReactorDokumen18 halamanEXP 2 - Plug Flow Tubular ReactorOng Jia YeeBelum ada peringkat

- Transaction Statement1676126669Dokumen1 halamanTransaction Statement1676126669Vasanth EllendulaBelum ada peringkat

- Transaction Statement1673011931Dokumen1 halamanTransaction Statement1673011931SAMIR KUMARBelum ada peringkat

- Transaction Statement1656568636Dokumen2 halamanTransaction Statement1656568636Gulzar Ali QadriBelum ada peringkat

- Welcome To Central Record Keeping Agency PDFDokumen2 halamanWelcome To Central Record Keeping Agency PDFparthi janaBelum ada peringkat

- Transaction Statement1627022355Dokumen1 halamanTransaction Statement1627022355RamakantaSahooBelum ada peringkat

- Transaction Statement1624372022Dokumen1 halamanTransaction Statement1624372022RamakantaSahooBelum ada peringkat

- Transaction Statement1676376886Dokumen2 halamanTransaction Statement1676376886mukeshpradhan675Belum ada peringkat

- Transaction Statement1626153268Dokumen2 halamanTransaction Statement1626153268Rohit PalBelum ada peringkat

- Transaction Statement1704420433Dokumen2 halamanTransaction Statement1704420433palakaamresh46Belum ada peringkat

- Welcome To Central Record Keeping Agency 22-23Dokumen2 halamanWelcome To Central Record Keeping Agency 22-23tsvvpkumarBelum ada peringkat

- Wa0007Dokumen2 halamanWa0007sandhya.iyyanar1992Belum ada peringkat

- Account Statement 2019-2020Dokumen2 halamanAccount Statement 2019-2020suhasBelum ada peringkat

- Transaction Statement1700677173Dokumen2 halamanTransaction Statement1700677173Madhav LungareBelum ada peringkat

- Transaction Statement1698469666Dokumen2 halamanTransaction Statement1698469666rk370666Belum ada peringkat

- Welcome To Central Record Keeping Agency - PRDokumen2 halamanWelcome To Central Record Keeping Agency - PRAbhishek SenguptaBelum ada peringkat

- Transaction Statement1705415418Dokumen1 halamanTransaction Statement1705415418bhavanakatakam0Belum ada peringkat

- Transaction Statement1705397004Dokumen2 halamanTransaction Statement1705397004sureshpatil25Belum ada peringkat

- WHRBG 1224421 Payslip 02 2019 PDFDokumen1 halamanWHRBG 1224421 Payslip 02 2019 PDFAmit RamaniBelum ada peringkat

- Epf Ecr Nov-19 PDFDokumen2 halamanEpf Ecr Nov-19 PDFSOMIL DHOKEBelum ada peringkat

- Welcome To Central Record Keeping Agency 2023Dokumen2 halamanWelcome To Central Record Keeping Agency 2023pratik patilBelum ada peringkat

- Epf Ecr Oct-19 PDFDokumen2 halamanEpf Ecr Oct-19 PDFSOMIL DHOKEBelum ada peringkat

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Dokumen2 halamanEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)SOMIL DHOKEBelum ada peringkat

- Rebate: Due DateDokumen2 halamanRebate: Due DateMd IrfanBelum ada peringkat

- Form Claim VoucherDokumen1 halamanForm Claim Voucherwong warasBelum ada peringkat

- Welcome To Central Record Keeping Agency 2019Dokumen2 halamanWelcome To Central Record Keeping Agency 2019pratik patilBelum ada peringkat

- Welcome To Central Record Keeping AgencyDokumen2 halamanWelcome To Central Record Keeping AgencyAbhishek SenguptaBelum ada peringkat

- 06-2023 Bill DR Office, NRTDokumen12 halaman06-2023 Bill DR Office, NRTHird High SchoolBelum ada peringkat

- EPF ECR Sep 19Dokumen119 halamanEPF ECR Sep 19kushalthareja7777Belum ada peringkat

- + Zero Fee: RewardsDokumen2 halaman+ Zero Fee: RewardsSuraj personalBelum ada peringkat

- Folio 477167965764 AllMonthsDokumen2 halamanFolio 477167965764 AllMonthsPravin AwalkondeBelum ada peringkat

- Payment Voucher 7039515Dokumen1 halamanPayment Voucher 7039515pikapikaBelum ada peringkat

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Dokumen3 halamanEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Sivam SundaramBelum ada peringkat

- Annexure KDokumen1 halamanAnnexure KHeet ShahBelum ada peringkat

- Date:13-10-2015 Accounts OfficerDokumen1 halamanDate:13-10-2015 Accounts OfficerchozhaganBelum ada peringkat

- Sufyan Yahya PayBillDokumen2 halamanSufyan Yahya PayBillSuvLeviBelum ada peringkat

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Dokumen3 halamanEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Chandan Kumar YadavBelum ada peringkat

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Dokumen3 halamanEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Naveen GaneshBelum ada peringkat

- 120 Led Anuj JiDokumen1 halaman120 Led Anuj Jiamit testBelum ada peringkat

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Dokumen3 halamanEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)ciknomisponedoz.comBelum ada peringkat

- Portfolio 1680405795614Dokumen5 halamanPortfolio 1680405795614shravanvk35Belum ada peringkat

- Ediga Paramesh GoudDokumen10 halamanEdiga Paramesh GoudgopalBelum ada peringkat

- Sudip DasDokumen1 halamanSudip DasSurajit SarkarBelum ada peringkat

- Crystal Reports ActiveX Designer - Kartu Piutang-1Dokumen5 halamanCrystal Reports ActiveX Designer - Kartu Piutang-1Kaisar OlahragaBelum ada peringkat

- FORM47Dokumen2 halamanFORM47sspuram.vsBelum ada peringkat

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Dokumen3 halamanEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Venkatesh HaBelum ada peringkat

- Office of The Divisional Fire Officer, Purba Medinipur Pay Slip Government of West BengalDokumen1 halamanOffice of The Divisional Fire Officer, Purba Medinipur Pay Slip Government of West BengalDebnath DebnathBelum ada peringkat

- National Insurance Company Ltd. Policy No: 20350031236760012417 1 Year Liability Only From 08:53:07 Hours On 15-Feb-2024 To Midnight of 14/02/2025Dokumen2 halamanNational Insurance Company Ltd. Policy No: 20350031236760012417 1 Year Liability Only From 08:53:07 Hours On 15-Feb-2024 To Midnight of 14/02/2025Alex LalduhawmaBelum ada peringkat

- Vglades: Attested byDokumen1 halamanVglades: Attested byEmran miahBelum ada peringkat

- Mediclaim Policy Parents - H1096407Dokumen3 halamanMediclaim Policy Parents - H1096407Lokesh AnandBelum ada peringkat

- Account Statement: Folio Number: 1038047310Dokumen2 halamanAccount Statement: Folio Number: 1038047310Rajat RK KumarBelum ada peringkat

- Mahatma Gandhi National Rural Employment Guarantee Act Muster Roll (For Unskilled Labourer)Dokumen3 halamanMahatma Gandhi National Rural Employment Guarantee Act Muster Roll (For Unskilled Labourer)deepak dashBelum ada peringkat

- RCG SoaDokumen1 halamanRCG Soaraymon generBelum ada peringkat

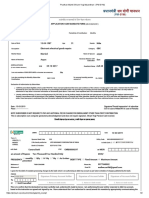

- Pradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Dokumen2 halamanPradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Honey Ali33% (3)

- FORM47Dokumen2 halamanFORM47Kotyada Srinu RaoBelum ada peringkat

- Form 47Dokumen2 halamanForm 47Madhan MohanBelum ada peringkat

- Eastern Power Distribution Company of A.P Ltd. Receipt For Online Payment (Regular Payment)Dokumen1 halamanEastern Power Distribution Company of A.P Ltd. Receipt For Online Payment (Regular Payment)pradeepkalali kBelum ada peringkat

- Kyocera Fleet Services White Paper: SecurityDokumen20 halamanKyocera Fleet Services White Paper: SecurityHoratiu OanaBelum ada peringkat

- What Is A VolcanoDokumen2 halamanWhat Is A VolcanonatachaBelum ada peringkat

- Funding HR2 Coalition LetterDokumen3 halamanFunding HR2 Coalition LetterFox NewsBelum ada peringkat

- University of Puerto Rico at PonceDokumen16 halamanUniversity of Puerto Rico at Ponceapi-583167359Belum ada peringkat

- AtelectasisDokumen37 halamanAtelectasisSandara ParkBelum ada peringkat

- Women and ViolenceDokumen8 halamanWomen and ViolenceStyrich Nyl AbayonBelum ada peringkat

- 107 2021 High Speed Rail Corridor RegDokumen3 halaman107 2021 High Speed Rail Corridor Rega siva sankarBelum ada peringkat

- DOWSIL™ 2-9034 Emulsion: Features & BenefitsDokumen5 halamanDOWSIL™ 2-9034 Emulsion: Features & BenefitsLaban KantorBelum ada peringkat

- Comprehensive Safe Hospital FrameworkDokumen12 halamanComprehensive Safe Hospital FrameworkEbby OktaviaBelum ada peringkat

- 41 Assignment Worksheets For SchoolDokumen26 halaman41 Assignment Worksheets For Schoolsoinarana456Belum ada peringkat

- Village Survey Form For Project Gaon-Setu (Village Questionnaire)Dokumen4 halamanVillage Survey Form For Project Gaon-Setu (Village Questionnaire)Yash Kotadiya100% (2)

- Pip-Elsmt01 P66 Midstream Projects 0 1/02/18: Document Number S & B Job Number Rev Date SheetDokumen11 halamanPip-Elsmt01 P66 Midstream Projects 0 1/02/18: Document Number S & B Job Number Rev Date SheetAjay BaggaBelum ada peringkat

- 5SDD 71B0210Dokumen4 halaman5SDD 71B0210Merter TolunBelum ada peringkat

- Rooftop Rain Water Harvesting in An Educational CampusDokumen9 halamanRooftop Rain Water Harvesting in An Educational CampusAkshay BoratiBelum ada peringkat

- K EtaDokumen14 halamanK EtaJosue Teni BeltetonBelum ada peringkat

- PPR Soft Copy Ayurvedic OkDokumen168 halamanPPR Soft Copy Ayurvedic OkKetan KathaneBelum ada peringkat

- Chemical Reaction Engineering-II - R2015 - 10-04-2018Dokumen2 halamanChemical Reaction Engineering-II - R2015 - 10-04-201818135A0806 MAKKUVA BHAVYABelum ada peringkat

- HVAC (Heating, Ventilation and Air Conditioning) : SRS PrecautionsDokumen1 halamanHVAC (Heating, Ventilation and Air Conditioning) : SRS PrecautionssoftallBelum ada peringkat

- Guides To The Freshwater Invertebrates of Southern Africa Volume 2 - Crustacea IDokumen136 halamanGuides To The Freshwater Invertebrates of Southern Africa Volume 2 - Crustacea IdaggaboomBelum ada peringkat

- Heat Transfer ExampleDokumen4 halamanHeat Transfer Examplekero_the_heroBelum ada peringkat

- Making Creams With Olive M 1000Dokumen28 halamanMaking Creams With Olive M 1000Nicoleta Chiric0% (1)

- Medical Records in Family PracticeDokumen22 halamanMedical Records in Family PracticenurfadillahBelum ada peringkat