Caltex V CBAA

Diunggah oleh

KIMMYJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Caltex V CBAA

Diunggah oleh

KIMMYHak Cipta:

Format Tersedia

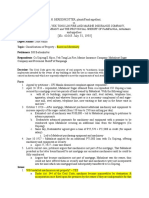

CALTEX INC.

v CENTRAL BOARD OF ASSESSMENT APPEALS and CITY ASSESSOR OF PASAY

FACTS:

● Caltex Inc installed underground tanks, elevated tanks/water tanks, gasoline and computing pumps

water pumps, car washer, car hoists, truck hoists, air compressors and tireflators in its gasoline

stations located on a leased land.

● Caltex loaned the said machinery and equipment to gas station operators under lease contracts, to be

returned to Caltex upon demand.

● The City Assessor of Pasay characterized the gas station machinery as taxable realty.

● The City Board of Tax Appeals ruled that they are personality; thus City Assessor of Pasay appealed

to the Central Board of Assessment Appeals (CBAA)

● CBAA said that the machines are real property within the meaning of Section 3(k) &(m) and 38 of the

Real Property Tax Code, and that Articles 415 and 416 defining real and personal property are not

applicable in this case

● Caltex then filed a special civil action of certiorari wherein it prayed for a declaration that the machines

and equipment are personal property not subject to realty tax.

ISSUE: WN the pieces of gas station equipment and machinery are subject to realty tax

HELD: Yes. CBAA decision is affirmed. Petition for certiorari is dismissed for lack of merit.

● The Court resolved the issue under the provisions of the Assessment Law and the Real Property Tax

Code.

● Sec 2 of the Assessment Law provides that “Realty tax is due on real property including land

buildings, machinery, and other improvements”

● Sec 38 of the Real Property Tax Code provides that “There shall be levied, assessed and collected

in all provinces, cities and municipalities an annual ad valorem tax on real property, such as land,

buildings, machinery and other improvements affixed or attached to real property not hereinafter

specifically exempted."

o k) Improvements — is a valuable addition made to property or an amelioration in its condition,

amounting to more than mere repairs or replacement of waste, costing labor or capital and

intended to enhance its value, beauty or utility or to adapt it for new or further purposes."

o m) Machinery — shall embrace machines, mechanical contrivances, instruments, appliances

and apparatus attached to the real estate. It includes the physical facilities available for

production, as well as the installations and appurtenant service facilities, together with all other

equipment designed for or essential to its manufacturing, industrial or agricultural purposes."

● The said machines and equipment are taxable improvement and machinery within the meaning of the

Assessment Law and the Real Property Tax Code, because the same are necessary to the operation

of the gas station and have been attached/affixed/embedded permanently to the gas station site.

● The Court further ruled that improvements on land are commonly taxed as realty even though for

some purposes the might be considered personality

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Agpalo Legal Ethics Reviewer PDFDokumen87 halamanAgpalo Legal Ethics Reviewer PDFGerald Hernandez100% (56)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Mercado V Municipal President of MacabebeDokumen2 halamanMercado V Municipal President of MacabebeKIMMY100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- G.R. No. 100709Dokumen8 halamanG.R. No. 100709Czarina UmilinBelum ada peringkat

- Sy v. Secretary of JusticeDokumen3 halamanSy v. Secretary of JusticeKIMMYBelum ada peringkat

- 2015report of The Special Rapporteur On The Right To Food On Her Mission To Philippines PDFDokumen20 halaman2015report of The Special Rapporteur On The Right To Food On Her Mission To Philippines PDFTrinca DiplomaBelum ada peringkat

- Davao - Training June 2019Dokumen1 halamanDavao - Training June 2019KIMMYBelum ada peringkat

- Sideco V SarenasDokumen3 halamanSideco V SarenasKIMMYBelum ada peringkat

- Modification of JudgmentDokumen35 halamanModification of JudgmentKIMMYBelum ada peringkat

- Heirs of Reyes V ReyesDokumen3 halamanHeirs of Reyes V ReyesKIMMYBelum ada peringkat

- Facts:: RULING: Yes. Redemption by Co-OwnerDokumen3 halamanFacts:: RULING: Yes. Redemption by Co-OwnerKIMMYBelum ada peringkat

- 58 Carandang V Heirs of de GuzmanDokumen2 halaman58 Carandang V Heirs of de GuzmanKIMMYBelum ada peringkat

- Sumário Da Decisão (Caso Alemanha Vs Italia)Dokumen24 halamanSumário Da Decisão (Caso Alemanha Vs Italia)Victor Bello AcciolyBelum ada peringkat

- Republic V MijaresDokumen2 halamanRepublic V MijaresKIMMYBelum ada peringkat

- North Sea Continental Case PDFDokumen4 halamanNorth Sea Continental Case PDFMaria Cherrylen Castor QuijadaBelum ada peringkat

- Caltex V CBAADokumen1 halamanCaltex V CBAAKIMMYBelum ada peringkat

- Power: Case Concerning The Barcelona Traction, Light and Company, Limited (Second Phase)Dokumen3 halamanPower: Case Concerning The Barcelona Traction, Light and Company, Limited (Second Phase)KIMMYBelum ada peringkat

- Yuba RIver Power V Nevada IrrDokumen4 halamanYuba RIver Power V Nevada IrrKIMMYBelum ada peringkat

- Star-Two v. Paper City Party Involved Yes. Machineries and Equipment Are Included in The Mortgage and ForeclosureDokumen2 halamanStar-Two v. Paper City Party Involved Yes. Machineries and Equipment Are Included in The Mortgage and ForeclosureRalph Deric EspirituBelum ada peringkat

- US v. Ignacio DigestDokumen1 halamanUS v. Ignacio DigestKIMMYBelum ada peringkat

- Favis Vs City of BaguioDokumen1 halamanFavis Vs City of BaguioKIMMYBelum ada peringkat

- Mindanao Bus Co. V City AssessorDokumen1 halamanMindanao Bus Co. V City AssessorKIMMYBelum ada peringkat

- Yee V Strong MachineryDokumen2 halamanYee V Strong MachineryKIMMYBelum ada peringkat

- Mindanao Bus Co. V City AssessorDokumen1 halamanMindanao Bus Co. V City AssessorKIMMYBelum ada peringkat

- Yuba RIver Power V Nevada IrrDokumen4 halamanYuba RIver Power V Nevada IrrKIMMYBelum ada peringkat

- Savellano V DiazDokumen1 halamanSavellano V Diazangelo prietoBelum ada peringkat

- San Lorenzo Vs CA - PropertyDokumen2 halamanSan Lorenzo Vs CA - PropertyKIMMYBelum ada peringkat

- Filipinas Investment Vs Sps. Ridad DigestDokumen1 halamanFilipinas Investment Vs Sps. Ridad DigestKIMMYBelum ada peringkat

- 08 Meralco Vs City Assessor of LucenaDokumen1 halaman08 Meralco Vs City Assessor of LucenaKIMMYBelum ada peringkat

- Cosol CaseDokumen2 halamanCosol CaseKIMMYBelum ada peringkat

- Case Analysis Shantabai V State of BombDokumen8 halamanCase Analysis Shantabai V State of BombAnanya BhatnagarBelum ada peringkat

- Pons Realty V CADokumen2 halamanPons Realty V CAJoshua PielagoBelum ada peringkat

- Residential Subdivisions GuideDokumen104 halamanResidential Subdivisions Guidethanh_nguyen760Belum ada peringkat

- Evid PG 5 To 7Dokumen339 halamanEvid PG 5 To 7Rolly AcunaBelum ada peringkat

- Valuation of Immovable Property: Professional Practice - IIDokumen18 halamanValuation of Immovable Property: Professional Practice - IIMayur KotechaBelum ada peringkat

- CHAPTER 5,6, and 7Dokumen32 halamanCHAPTER 5,6, and 7Justine PaulinoBelum ada peringkat

- Republic Vs T.a.N. Properties Inc.Dokumen5 halamanRepublic Vs T.a.N. Properties Inc.Michelle Marie TablizoBelum ada peringkat

- Presbitero vs. FernandezDokumen9 halamanPresbitero vs. FernandezButch MaatBelum ada peringkat

- Property DigestsDokumen7 halamanProperty DigestsJude FanilaBelum ada peringkat

- (F) Philippine Ports Authority vs. City of IloiloDokumen2 halaman(F) Philippine Ports Authority vs. City of IloilojakezhanBelum ada peringkat

- V.2 Fabian v. FabianDokumen3 halamanV.2 Fabian v. FabianBeltran KathBelum ada peringkat

- Forcible Entry CasesDokumen22 halamanForcible Entry CasesBeverlyn JamisonBelum ada peringkat

- Sibal Vs Valdez DigestDokumen5 halamanSibal Vs Valdez DigestJoel G. AyonBelum ada peringkat

- 46-Quezon City Vs BayantelDokumen3 halaman46-Quezon City Vs BayantelIshBelum ada peringkat

- 08 City-Lite Realty Corp. vs. CADokumen10 halaman08 City-Lite Realty Corp. vs. CARaiya AngelaBelum ada peringkat

- Civil Questions AnswersDokumen16 halamanCivil Questions AnswersI'm a Smart CatBelum ada peringkat

- Valuation Module 1Dokumen40 halamanValuation Module 1VAISHNAVI GHARGEBelum ada peringkat

- Real Property Tax HandoutDokumen6 halamanReal Property Tax HandoutPatrick TanBelum ada peringkat

- Aznar Bros Vs Aying LTD Case DigestDokumen3 halamanAznar Bros Vs Aying LTD Case Digestgielitz67% (3)

- Blanco vs. QuashaDokumen1 halamanBlanco vs. QuashaSeffirion69Belum ada peringkat

- Recovery of Possession of Immovable Property Under Specific Relief ActDokumen3 halamanRecovery of Possession of Immovable Property Under Specific Relief ActAnonymous DEEsf3tnBelum ada peringkat

- Action To Quiet Title Sample CaseDokumen21 halamanAction To Quiet Title Sample CaseAraveug InnavoigBelum ada peringkat

- Rizalino Vs Paraiso Development Corporation - G.R. No. 157493Dokumen9 halamanRizalino Vs Paraiso Development Corporation - G.R. No. 157493Ivy VillalobosBelum ada peringkat

- Legal Forms Midterms PDFDokumen18 halamanLegal Forms Midterms PDFGuiller MagsumbolBelum ada peringkat

- Fort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDokumen1 halamanFort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDeus DulayBelum ada peringkat

- City of Baguio VsDokumen13 halamanCity of Baguio VsJilyn LedesmaBelum ada peringkat

- Deed of Absolute Sale - Pro FormaDokumen4 halamanDeed of Absolute Sale - Pro FormaOgie FermoBelum ada peringkat

- Conveyancing Law 2015Dokumen159 halamanConveyancing Law 2015Samuel Ngathe100% (1)

- 4 Equatorial Realty Development, Inc. vs. Mayfair Theater, Inc.Dokumen2 halaman4 Equatorial Realty Development, Inc. vs. Mayfair Theater, Inc.JemBelum ada peringkat