La Suerte V Court of Appeals

Diunggah oleh

ojhosaka0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

17 tayangan4 halamanLa Suerte v Court of Appeals

Judul Asli

La Suerte v Court of Appeals

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniLa Suerte v Court of Appeals

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

17 tayangan4 halamanLa Suerte V Court of Appeals

Diunggah oleh

ojhosakaLa Suerte v Court of Appeals

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

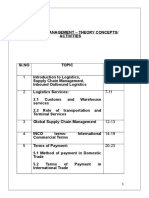

CONSTITUTION I

A.Y. 1819– DEAN CANDELARIA

TOPIC Art 6 § 1 Filling in the details drying and curing

CASE NO. G.R. No. 125346. November 11, 2014 o tobacco prepared or partially prepared with or without the

CASE NAME LA SUERTE CIGAR & CIGARETTE use of any machine or instruments or without being pressed

FACTORY vs . COURT OF or sweetened

APPEALS o fine-cut shorts and refuse, scraps, clippings, cuttings, stems

PONENTE Leonen J and sweepings of tobacco

PETITIONER LA SUERTE CIGAR & CIGARETTE - RR No. 17-67 (Gives the definition of Manufacturer of

FACTORY Tobacco, Stemmed Leaf Tobacco and L-7 Permitees)

RESPONDENT COURT OF "Manufacturer of tobacco" — Includes every person whose business it is to

APPEALS

manufacture tobacco or snuff or who employs others to manufacture tobacco

TYPE OF A consolidation of six petitions for review of or snuff, whether such manufacture be by cutting, pressing (not baling),

CASE several decisions of the Court of Appeals grinding, or rubbing (grating) any raw or leaf tobacco, or otherwise

MEMBER Enrique Hosaka preparing raw or leaf tobacco, or manufactured or partially manufactured

The following is a consolidation of multiple cases that question the excise tobacco and snuff, or putting up for consumption scraps, refuse, or stems of

tax of stemmed leaf tobacco. La Suerte, Fortune, and Sterling are the three tobacco resulting from any process of handling tobacco stems, scraps,

main manufacturers that are affected by the 1986 Tax Code, Revenue clippings, or waste by sifting, twisting, screening or by any other process

Regulations No. V-39 (RR No. V-39), and Revenue Regulations No. 17-67

(RR No. 17-67). "Partially manufactured tobacco" — Includes:

RELEVANT LAWS (1) "Stemmed leaf" — handstripped tobacco, clean, good, partially

broken leaf only, free from mold and dust.

- SEC 137 TAX CODE: L-7 — Manufacturers of tobacco products. [L-7 1/2 designates an auxiliary

Removal of tobacco products without prepayment of tax. — Products of registered book (bale books), for manufacturers of tobacco products.]

tobacco entirely unfit for chewing or smoking may be removed free of tax

for agricultural or industrial use, under such conditions as may be prescribed - RR No. V-39 The Tobacco Products Regulations

in the regulations of the Ministry of Finance. Stemmed leaf tobacco, fine-cut SECTION 20. Exemption from tax of tobacco products intended for

shorts, the refuse of fine-cut chewing tobacco, scraps, cuttings, clippings, agricultural or industrial purposes. — (a) Sale of stemmed leaf tobacco, etc.,

stems or midribs, and sweepings of tobacco may be sold in bulk as raw by one factory to another. — Subject to the limitations herein established,

material by one manufacturer directly to another, without payment of the tax products of tobacco entirely unfit for chewing or smoking may be removed

under such conditions as may be prescribed in the regulations of the Ministry free of tax for agricultural or industrial use; and stemmed leaf tobacco, fine-

of Finance cut shorts, the refuse of fine-cut chewing tobacco, refuse, scraps, cuttings,

- SEC 141 TAX CODE: clippings, and sweepings of tobacco may be sold in bulk as raw materials by

Tobacco Products. — There shall be collected a tax of seventy-five centavos one manufacturer directly to another without the prepayment of specific tax.

on each kilogram of the following products of tobacco: Stemmed leaf tobacco, fine-cut shorts, the refuse of fine-cut

o tobacco twisted by hand or reduced into a condition to be chewing tobacco, scraps, cuttings, clippings, and sweeping of leaf tobacco or

consumed in any manner other than the ordinary mode of partially manufactured tobacco or other refuse of tobacco may be transferred

1

CONSTITUTION I

A.Y. 1819– DEAN CANDELARIA

from one factory to another under an official L-7 invoice on which shall be • "leaf tobacco which has had the stem or midrib removed”

entered the exact weight of the tobacco at the time of its removal, and entry • “may be sold in bulk as raw material by one manufacturer directly to

shall be made in the L-7 register in the place provided on the page of another without payment of the tax, under such conditions as may be

removals. Corresponding debit entry will be made in the L-7 register book of prescribed in the rules and regulations prescribed by the Secretary of

the factory receiving the tobacco under heading "Refuse, etc., received from Finance”

other factory," showing the date of receipt, assessment and invoice numbers, This is the subject in question and it is important to point out that this is

name and address of the consignor, form in which received, and the weight not the final product (cigarettes) but is merely one of the materials that are

of the tobacco. This paragraph should not, however, be construed to permit used in manufacturing it.

the transfer of materials unsuitable for the manufacture of tobacco products

from one factory to another Now the transactions of the mentioned cigarette manufacturers pertinent

to these consolidated cases are the following:

• La Suerte's local purchases, importations, and sale of stemmed leaf

ISSUE tobacco from January 1, 1986 to June 30, 1989, and from June 1989

The Court cites 7 issues in this case. Though the first 4 are actually the to November 1990, and importations in March 1995 and April 1995

main ones. • Fortune's importation of tobacco strips from January 1, 1986 to June

1. W/N stemmed leaf tobacco is subject to excise (specific) tax under 30, 1989, and from July 1, 1989 to November 30, 1990

Section 141 of the 1986 Tax Code (YES) • Sterling's importations and local purchases of stemmed leaf tobacco

2. W/N Section 137 of the 1986 Tax Code exempting from the from November 1986 to June 24, 1989

payment of specific tax the sale of stemmed leaf tobacco by one The three manufacturers are being charged deficiency excise tax for

manufacturer to another is not subject to any qualification and, their importation and local purchase (importation only for Fortune) by the

therefore, exempts an L-7 manufacturer from paying said tax on its Internal Revenue Commissioner. The specific amounts being:

purchase of stemmed leaf tobacco from other manufacturers who are La Suerte: P34,934,827.67, P11,757,275.25, P325,410.0 & P175,909.50

not classified as L-7 permittees (the last two amounts were already paid but La Suerte filed a claim for

3. W/N stemmed leaf tobacco imported by La Suerte, Fortune, and refund)

Sterling is exempt from specific tax under Section 137 of the 1986 Fortune: P28,938,446.25 & P1,989,821.86

Tax Code Sterling: P5,187,432.00

4. Section 20 (a) of RR No. V-39, in relation to RR No. 17-67, which

limits the exemption from payment of specific tax on stemmed leaf The manufacturers then argue that that since Section 137 of the 1986

tobacco to sales transactions between manufacturers classified as L- Tax Code and Section 20 (a) of RR No. V-39 do not distinguish "as to the

7 permittees is a valid exercise by the Department of Finance of its type of manufacturer that may sell stemmed-leaf tobacco without the

rulemaking power under Section 338 of the 1939 Tax Code prepayment of specific tax, the logical conclusion is that any kind of tobacco

manufacturer is entitled to this treatment. The cigarette manufacturers add

that the reference to an L-7 invoice and L-7 register book in the second

RELEVANT FACTS paragraph of Section 20 (a) cannot limit the application of the tax exemption

It is first important to define what stemmed leaf tobacco is: provision only to transfers between L-7 permittees because:

2

CONSTITUTION I

A.Y. 1819– DEAN CANDELARIA

(1) it does not so provide; The conditions under which stemmed leaf tobacco may be transferred

(2) under the terms of RR No. V-39, L-7 referred to manufacturers from one factory to another without prepayment of specific tax are as

of any class of tobacco products, including manufacturers of follows:

stemmed leaf tobacco (a) The transfer shall be under an official L-7 invoice on which shall be

They further argue that, going by the theory of the Commissioner, entered the exact weight of the tobacco at the time of its removal

RR No. 17-67 would have unduly restricted the meaning of "manufacturers" (b) Entry shall be made in the L-7 register in the place provided on the

by limiting it to a few manufacturers such as manufacturers of cigars and page for removals

cigarettes. Moreover, the cigarette manufacturers contend "that Section 132 (c) Corresponding debit entry shall be made in the L-7 register book of

does not operate as a tax exemption" because "prepayment means payment the factory receiving the tobacco under the heading, "Refuse, etc.,

of obligation in advance or before it is received from the other factory," showing the date of receipt, assessment

due." and invoice numbers, name and address of the consignor, form in which

Fortune, for its part, claims that stemmed leaf tobacco is not subject received, and the weight of the tobacco.

to excise tax. It argues that stemmed leaf tobacco cannot be considered There is no new product when stemmed leaf tobacco is transferred

prepared or partially prepared tobacco because it does not fall within the between two L-7 permit holders. Thus, there can be no excise tax that will

definition of a "processed tobacco" under Section 1-b of Republic Act No. attach. The regulation, therefore, is reasonable and does not create a new

698, as amended statutory right.

3. W/N stemmed leaf tobacco imported by La Suerte, Fortune, and

Sterling is exempt from specific tax under Section 137 of the 1986

RATIO DECIDENDI Tax Code (YES)

1. W/N stemmed leaf tobacco is subject to excise (specific) tax under The transaction contemplated in Section 137 does not include

Section 141 of the 1986 Tax Code (YES) importation of stemmed leaf tobacco for the reason that the law uses the

It is evident that when tobacco is harvested and processed either by hand word "sold" to describe the transaction of transferring the raw materials from

or by machine, all its products become subject to specific tax. Section 141 one manufacturer to another. D

reveals the legislative policy to tax all forms of manufactured tobacco — in 4. W/N Section 20 (a) of RR No. V-39, in relation to RR No. 17-67,

contrast to raw tobacco leaves — including tobacco refuse or all other which limits the exemption from payment of specific tax on

tobacco which has been cut, split, twisted, or pressed and is capable of being stemmed leaf tobacco to sales transactions between manufacturers

smoked without further industrial processing. Stemmed leaf tobacco is classified as L-7 permittees is a valid exercise by the Department of

subject to the specific tax under Section 141 (b). It is a partially prepared Finance of its rulemaking power under Section 338 of the 1939 Tax

tobacco. Code (NO)

2. W/N Section 137 of the 1986 Tax Code exempting from the RR No. V-39 must be applied and read together with RR No. 17-67. The

payment of specific tax the sale of stemmed leaf tobacco by one cigarette manufacturers' argument is misplaced, stating that RR No. 17-67

manufacturer to another is not subject to any qualification and, could not modify RR No. V-39 because it was promulgated to enforce Act

therefore, exempts an L-7 manufacturer from paying said tax on its No. 2613, as amended (entitled "An Act to Improve the Methods of

purchase of stemmed leaf tobacco from other manufacturers who are Production and the Quality of Tobacco in the Philippines and to Develop the

not classified as L-7 permittees (YES) Export Trade Therein"), which allegedly had nothing whatsoever to do with

3

CONSTITUTION I

A.Y. 1819– DEAN CANDELARIA

the Tax Code or with the imposition of taxes. and

6. DENIES the petition for review filed by La Suerte Cigar &

DISPOSITIVE POSITION Cigarette Factory in G.R. No. 165499 and AFFIRMS the questioned

The court in the end granted the petition of the Commissioner of Internal decision and resolution of the Court of Appeals in CA-G.R. SP. No.

Revenue and denied the petitions of the manufacturers. This lead to the 50241.

manufacturers paying the excise tax without receiving any refund (La

Suerte). The Decision of the court can be found bellow

WHEREFORE, this court:

1. DENIES the petition for review filed by La Suerte Cigar &

Cigarette Factory in G.R. No. 125346 and AFFIRMS the questioned

decision and resolution of the Court of Appeals in CA-G.R. SP. No.

38107;

2. GRANTS the petition for review filed by the Commissioner of

Internal Revenue in G.R. Nos. 136328-29 and REVERSES and

SETS ASIDE the challenged decision and resolution of the Court of

Appeals in CA-G.R. SP. Nos. 38219 and 40313. Fortune Tobacco

Corporation is ORDERED to pay the following taxes:

a. P28,938,446.25 as deficiency excise tax for the period covering

January 1, 1986 to June 30, 1989, plus 20% interest per annum

from November 24, 1989 until fully paid; and

b. P1,989,821.26 as deficiency excise tax for the period covering

July 1, 1989 to November 30, 1990, plus 20% interest per annum

from March 1, 1991 until fully paid.

3. GRANTS the petition for review filed by the Commissioner of

Internal Revenue in G.R. No. 144942 and REVERSES and SETS

ASIDE the challenged decision of the Court of Appeals in CA-G.R.

SP. No. 51902. La Suerte Cigar & Cigarette Factory's claim for

refund of the amount of P175,909.50 is DENIED.

4. DENIES the petition for review filed by Sterling Tobacco

Corporation in G.R. No. 148605 and AFFIRMS the questioned

decision and resolution of the Court of Appeals in CA-G.R. SP. No.

38159;

5. DENIES the petition for review filed by La Suerte Cigar Cigarette

Factory in G.R. No. 158197 and AFFIRMS the questioned decision

and resolution of the Court of Appeals in CA-G.R. SP. No. 37124;

4

Anda mungkin juga menyukai

- Constitutional Law Ii Quick NotesDokumen10 halamanConstitutional Law Ii Quick NotesojhosakaBelum ada peringkat

- Guerrero v. COMELECDokumen2 halamanGuerrero v. COMELECojhosakaBelum ada peringkat

- Crim Special LawsDokumen7 halamanCrim Special LawsojhosakaBelum ada peringkat

- Vera V AvelinoDokumen3 halamanVera V Avelinoojhosaka100% (1)

- Hosaka Demand Letter 1CDokumen1 halamanHosaka Demand Letter 1CojhosakaBelum ada peringkat

- Crim Special LawsDokumen7 halamanCrim Special LawsojhosakaBelum ada peringkat

- 153024-1940-Ang Tibay v. Court of Industrial RelationsDokumen7 halaman153024-1940-Ang Tibay v. Court of Industrial RelationsjrBelum ada peringkat

- 4 Arigo v. SwiftDokumen7 halaman4 Arigo v. SwiftApa MendozaBelum ada peringkat

- Hosaka Leg Writ MemoDokumen4 halamanHosaka Leg Writ MemoojhosakaBelum ada peringkat

- PENN CENTRAL TRANSPORTATION CO. v. NYCDokumen3 halamanPENN CENTRAL TRANSPORTATION CO. v. NYCojhosakaBelum ada peringkat

- GSIS V MontesclarosDokumen2 halamanGSIS V MontesclarosojhosakaBelum ada peringkat

- Constitution I: A.Y. 1819 - Dean CandelariaDokumen1 halamanConstitution I: A.Y. 1819 - Dean CandelariaojhosakaBelum ada peringkat

- Capitol Square Review and Advisory Bd. v. PinetteDokumen2 halamanCapitol Square Review and Advisory Bd. v. PinetteojhosakaBelum ada peringkat

- 5 - El-Banco-Espanol-Filipino-vs-Palanca-37-Phil-921Dokumen14 halaman5 - El-Banco-Espanol-Filipino-vs-Palanca-37-Phil-921ojhosakaBelum ada peringkat

- HeinonlineDokumen35 halamanHeinonlineTasmeem Alejo AminBelum ada peringkat

- HOSAKA Netflix-WhenTheySeeUsDokumen1 halamanHOSAKA Netflix-WhenTheySeeUsojhosakaBelum ada peringkat

- Hosaka FieldtripDokumen1 halamanHosaka FieldtripojhosakaBelum ada peringkat

- Oblicon Cases1Dokumen65 halamanOblicon Cases1ojhosakaBelum ada peringkat

- Oblicon Cases1Dokumen65 halamanOblicon Cases1ojhosakaBelum ada peringkat

- Climate Change NegotiationsDokumen5 halamanClimate Change NegotiationsojhosakaBelum ada peringkat

- Oposa v. Factoran PDFDokumen9 halamanOposa v. Factoran PDFojhosakaBelum ada peringkat

- Resident Mammals v. ReyesDokumen23 halamanResident Mammals v. ReyesojhosakaBelum ada peringkat

- Disini V Secretary of JusticeDokumen7 halamanDisini V Secretary of JusticeojhosakaBelum ada peringkat

- Oblicon Cases1Dokumen65 halamanOblicon Cases1ojhosakaBelum ada peringkat

- On Intellectual Property RightsDokumen22 halamanOn Intellectual Property RightsojhosakaBelum ada peringkat

- Constitution I: A.Y. 1819 - Dean CandelariaDokumen1 halamanConstitution I: A.Y. 1819 - Dean CandelariaojhosakaBelum ada peringkat

- Concerned Citizens v. MMDADokumen10 halamanConcerned Citizens v. MMDAojhosakaBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Fco Gmo Soybeans (Depcon 22Dokumen4 halamanFco Gmo Soybeans (Depcon 22ABS CONSULTORIA75% (4)

- Sample DeckDokumen10 halamanSample DeckKomal ArawatBelum ada peringkat

- ACC Plus - Ch.10 - Intro To Merchandising BusinessDokumen15 halamanACC Plus - Ch.10 - Intro To Merchandising BusinessJeffrey Jazz BugashBelum ada peringkat

- Purchase Order Details Report (01.10.19-14.09.20)Dokumen82 halamanPurchase Order Details Report (01.10.19-14.09.20)Majed Hossain MasumBelum ada peringkat

- Secret Files For TXDokumen118 halamanSecret Files For TXGrace EnriquezBelum ada peringkat

- eTOM V9.0 WebDokumen1 halamaneTOM V9.0 WebvinitkhandkaBelum ada peringkat

- Preventive Health Check UpDokumen1 halamanPreventive Health Check Uprishabh.gBelum ada peringkat

- Philippine Christian University: Midterm Examination inDokumen5 halamanPhilippine Christian University: Midterm Examination inleo pigafetaBelum ada peringkat

- Virtual Certificate Course On GST: GST & Indirect Taxes Committee of Icai, New DelhiDokumen41 halamanVirtual Certificate Course On GST: GST & Indirect Taxes Committee of Icai, New DelhiNikhil JainBelum ada peringkat

- 05 Output DeterminationDokumen11 halaman05 Output Determinationmad13boy100% (1)

- A 1 FormDokumen3 halamanA 1 FormRajeev Kumar100% (1)

- Grasim NLC OrderDokumen6 halamanGrasim NLC OrderS BiswasBelum ada peringkat

- Nu Ear Price ListDokumen4 halamanNu Ear Price ListAashishh Patil0% (1)

- TERMView User Manual - ImportDokumen20 halamanTERMView User Manual - ImportSa3ma4naBelum ada peringkat

- Accounting Information SystemsDokumen39 halamanAccounting Information SystemsCBSE UGC NET EXAMBelum ada peringkat

- BP OP ENTPR S4HANA1909 06 Forms List EN USDokumen9 halamanBP OP ENTPR S4HANA1909 06 Forms List EN UStrishqBelum ada peringkat

- Tax Invoice: Page 1 of 2Dokumen2 halamanTax Invoice: Page 1 of 2nirooBelum ada peringkat

- NCCG Oa1Dokumen9 halamanNCCG Oa1Chidochiri vivianBelum ada peringkat

- Contract: Organisation Details Buyer DetailsDokumen3 halamanContract: Organisation Details Buyer DetailsTender 247Belum ada peringkat

- 1 SAP ModulesDokumen8 halaman1 SAP ModulesApuroop MummaneniBelum ada peringkat

- Shiva and Bannari Gap StudyDokumen21 halamanShiva and Bannari Gap StudyRaj KumarBelum ada peringkat

- Dyemanager User GuideDokumen177 halamanDyemanager User GuideMuhammad Kamal HossainBelum ada peringkat

- Proforma Invoice For Roma ServicesDokumen1 halamanProforma Invoice For Roma ServicesAhimbisibwe BakerBelum ada peringkat

- 7B. General Terms & Conditions of Contract For SupplyDokumen17 halaman7B. General Terms & Conditions of Contract For SupplyTHANGARAJA CBelum ada peringkat

- 102 SAP Project Addendum2Dokumen28 halaman102 SAP Project Addendum2Kiran PBelum ada peringkat

- Worksheet Theory ConceptsDokumen32 halamanWorksheet Theory ConceptslathikaBelum ada peringkat

- ISTQB Partner Program Application-Renewal Form - v2.1.4Dokumen8 halamanISTQB Partner Program Application-Renewal Form - v2.1.4Aryan KapoorBelum ada peringkat

- SAP Business Process Improvement Series - Transfer Pricing and Material Ledger in SAPDokumen40 halamanSAP Business Process Improvement Series - Transfer Pricing and Material Ledger in SAPRamakrishnan Rishi90% (10)

- Short Form Subconsultant AgreementDokumen2 halamanShort Form Subconsultant AgreementMaribi Supan Opolentisima100% (1)

- Nov - Latest Bills PDFDokumen55 halamanNov - Latest Bills PDFJanardhan KBelum ada peringkat