1 - 433 - 1 - Cash Flow Statement 2016 2017

Diunggah oleh

Avnit kumarDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

1 - 433 - 1 - Cash Flow Statement 2016 2017

Diunggah oleh

Avnit kumarHak Cipta:

Format Tersedia

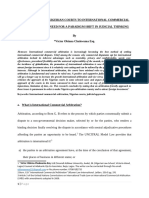

AIR INDIA

CASH FLOW STATEMENT FOR THE YEAR ENDED 31ST MARCH 2017

(Rupees in Million)

Particulars 2016-17 2015-16

A. CASH FLOW FROM OPERATING ACTIVITIES

(Loss) before Exceptional and Extraordinary Items and Tax (36,197.8) (37,510.0)

Adjustment for :

Exceptional & Extraordinary Items (Net) (21,454.0) (857.8)

Unrealised Foreign Exchange (Gain)/Loss (2,334.2) 366.7

Depreciation and amortisation (incl reserve & surplus and prior period items) 16,065.9 18,699.1

Provision for Obsolescence / Inventory Reconciliation * 1,491.3 (842.1)

Provision for Bad & Doubtful Receivables and Advances * 2,224.5 843.9

Provision for Employee Benets * 330.5 (524.0)

Provision for Wealth Tax - (0.5)

Provision for Frequent Flyer Programme (57.0) (22.3)

(Prot)/Loss on sale of xed assets 391.4 (705.1)

Dividend income (75.2) (97.6)

Interest income (on Bank Deposits, advances to subsidiary companies & others) (2,687.1) (2,567.6)

Interest and Finance Charges 42,358.7 44,740.0

36,254.8 59,032.8

Operating (Loss) / Profit Before Working Capital Changes 57.0 21,522.8

Adjustments for :

(Increase) / Decrease in Inventories 752.7 (1,913.7)

(Increase) / Decrease in Trade and Other Receivables (14,181.6) (8,714.9)

Increase / (Decrease) in Trade and Other Payables 28,262.4 15,993.5

14,833.5 5,364.9

Cash Generated from Operations 14,890.5 26,887.7

Direct Taxes paid (208.9) (572.7)

Net Cash Flow (used in)/ from Operating Activities 14,681.6 26,315.0

B. CASH FLOW FROM INVESTING ACTIVITIES

Acquisition of xed assets (23,851.3) (33,034.8)

Proceeds from sale of xed assets 63,116.6 7,874.3

(Increase) / Decrease in Investments (net) 0.1 (4,825.0)

(Increase) / Decrease in Bank Deposits (Maturity of more than 3 months) (1,002.2) (572.7)

Interest received (on Bank Deposits, advances to subsidiary companies & others) 2,652.6 2,948.1

Dividend Received 75.2 97.6

Net Cash Flow used in Investing Activities 40,991.0 (27,512.5)

C. CASH FLOW FROM FINANCING ACTIVITIES

Issue of Shares / Share application money received 24,652.1 33,000.0

Proceeds from Long Term Borrowings (1,479.6) 31,052.2

Repayment of Long Term Borrowings (21,225.2) (18,494.6)

Proceeds from ShortTerm Borrowings 50,059.7 18,135.7

Repayment of Short Term Borrowings (67,647.2) (18,161.6)

Addition to Capital Reserve 825.2 494.1

Interest Paid (42,541.4) (44,596.9)

Net Cash Flow from/(used in) Financing Activities (57,356.4) 1,428.9

Net increase/ (Decrease) in Cash and Cash equivalents (1,683.8) 231.4

Unrealised Foreign Exchange Gain/(Loss) in Cash & Bank Balances (21.9) 1,019.7

Cash and Cash equivalents (Opening balance) 5,365.1 4,114.0

Cash and Cash equivalents (Closing balance) 3,659.4 5,365.1

Notes :

*These gures have been taken from Balance Sheet movements.

1 The Cash Flow Statement has been prepared under the "Indirect Method" as set out in the Accounting Standard 3 (AS-3) on "Cash Flow

Statements", and present cash ows by operating, investing and nancing actvities.

2 For details of components of Cash and Cash equivalents, see Note No. 14.

For and on Behalf of For and on Behalf of For and on Behalf of For and on behalf of the Board

Thakur, Vaidyanath Aiyar & Co. Sarda and Pareek Varma and Varma

Chartered Accountants Chartered Accountants Chartered Accountants Sd/-

FRN : 000038N FRN : 109262W FRN : 004532S (Pardeep Singh Kharola)

Chairman & Managing Director

Sd/- Sd/- Sd/- Sd/-

(V. Rajaraman) (Sitaram Pareek) (P. R. Prasanna Varma) (V.S. Hejmadi)

Partner Partner Partner Director-Finance

M.No. 02705 M.No. 016617 M.No. 025854

Sd/-

Place : New Delhi (Kalpana Rao)

Date : 29 December 2017 Company Secretary

116

Anda mungkin juga menyukai

- Cash Flow Statement: For The Year Ended December 31, 2015Dokumen2 halamanCash Flow Statement: For The Year Ended December 31, 2015Sahrish KhanBelum ada peringkat

- Ai CF 14-15Dokumen1 halamanAi CF 14-15subhash dalviBelum ada peringkat

- Cash Flow StatementDokumen2 halamanCash Flow StatementVora JeetBelum ada peringkat

- Standalone Cash Flow 2Dokumen2 halamanStandalone Cash Flow 2rahulBelum ada peringkat

- Cash Flow Statement ConsolidatedDokumen2 halamanCash Flow Statement Consolidatedsamarth rajvaidBelum ada peringkat

- Statement of Cash Flow: A. Cash Flows From Operating ActivitiesDokumen2 halamanStatement of Cash Flow: A. Cash Flows From Operating ActivitiesRtr. Jai NandhikaBelum ada peringkat

- DPL Annual Report 2022 23 PagesDokumen1 halamanDPL Annual Report 2022 23 Pagesworkf17hoursformeBelum ada peringkat

- Cash Flow StatementDokumen3 halamanCash Flow StatementCreativity life with SmritiBelum ada peringkat

- Cashflow ConsolidatedDokumen2 halamanCashflow Consolidatedshubhramavat1322Belum ada peringkat

- Cash Flow Statement For The Year Ended March 31 2008Dokumen12 halamanCash Flow Statement For The Year Ended March 31 2008rockhillsBelum ada peringkat

- Cash Flow 2009-10Dokumen3 halamanCash Flow 2009-10deepakdsonawaneBelum ada peringkat

- UBL Annual Report 2018-79Dokumen1 halamanUBL Annual Report 2018-79IFRS LabBelum ada peringkat

- Condensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Dokumen10 halamanCondensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Annemiek BlezerBelum ada peringkat

- Standalone Cash Flow Statement: For The Year Ended March 31, 2019Dokumen2 halamanStandalone Cash Flow Statement: For The Year Ended March 31, 2019deepzBelum ada peringkat

- Consolidated Statement of Cash Flows: For The Year Ended March 31, 2018Dokumen2 halamanConsolidated Statement of Cash Flows: For The Year Ended March 31, 2018amitBelum ada peringkat

- Annual Financial ResultDokumen21 halamanAnnual Financial ResultBTS ARMY FOR LIFEBelum ada peringkat

- TML Ir Ar 2018 19Dokumen1 halamanTML Ir Ar 2018 19SRINIDHI PEESAPATIBelum ada peringkat

- Asian Paints Annual Report 2016-17Dokumen2 halamanAsian Paints Annual Report 2016-17Amit Pandey0% (1)

- Cash Flow Statement: Profit/ (Loss) For The Year (7,289.63) 2,020.60Dokumen2 halamanCash Flow Statement: Profit/ (Loss) For The Year (7,289.63) 2,020.60Prabha VishnuBelum ada peringkat

- Ford 18Dokumen6 halamanFord 18Bhavdeep singh sidhuBelum ada peringkat

- (In Millions) : Consolidated Statements of Cash FlowsDokumen1 halaman(In Millions) : Consolidated Statements of Cash FlowsrocíoBelum ada peringkat

- Gacl Ar-21 CFDokumen7 halamanGacl Ar-21 CFNikhil KuraBelum ada peringkat

- TML Annual Report Fy 2020 21 Pages 182 183Dokumen2 halamanTML Annual Report Fy 2020 21 Pages 182 183Atul PandeyBelum ada peringkat

- Consolidated Cash Flow Statement: For The Year Ended 31 March 2020Dokumen3 halamanConsolidated Cash Flow Statement: For The Year Ended 31 March 2020Ashish GuptaBelum ada peringkat

- Ratio Analysis of Lanka Ashok Leyland PLCDokumen6 halamanRatio Analysis of Lanka Ashok Leyland PLCThe MutantzBelum ada peringkat

- Final 2021 CBG Summary Fs 2021 SignedDokumen2 halamanFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooBelum ada peringkat

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDokumen2 halamanConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooBelum ada peringkat

- ONGC Cash FlowDokumen4 halamanONGC Cash FlowSreehari K.SBelum ada peringkat

- Cash Flow StatementsitcDokumen1 halamanCash Flow StatementsitcVijayBelum ada peringkat

- 2021 Full Year FinancialsDokumen2 halaman2021 Full Year FinancialsFuaad DodooBelum ada peringkat

- RCOM 4thconsoliated 09-10Dokumen3 halamanRCOM 4thconsoliated 09-10Goutam YenupuriBelum ada peringkat

- Consolidated Cash Flow StatementDokumen5 halamanConsolidated Cash Flow Statementlal kapdaBelum ada peringkat

- Cash Flow StatementsDokumen1 halamanCash Flow StatementssayeedkhanBelum ada peringkat

- Cash Flow StatementDokumen1 halamanCash Flow StatementYagika JagnaniBelum ada peringkat

- Cashflow StatementDokumen1 halamanCashflow Statementarslan.ahmed8179Belum ada peringkat

- Cash Flow Statement: (' in Crores)Dokumen1 halamanCash Flow Statement: (' in Crores)vinay saiBelum ada peringkat

- Accountancy ProjectDokumen25 halamanAccountancy ProjectkannabiranBelum ada peringkat

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Dokumen13 halamanTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdBelum ada peringkat

- Consolidated Financial Statements Mar 11Dokumen17 halamanConsolidated Financial Statements Mar 11praynamazBelum ada peringkat

- Cash FlowDokumen1 halamanCash Flowpawan_019Belum ada peringkat

- Financial Statements: For The Year Ended 31 December 2019Dokumen11 halamanFinancial Statements: For The Year Ended 31 December 2019RajithWNBelum ada peringkat

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDokumen1 halamanThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05Belum ada peringkat

- Annual Report 2021Dokumen3 halamanAnnual Report 2021hxBelum ada peringkat

- Unitech Consolidated 31-03-10Dokumen3 halamanUnitech Consolidated 31-03-10sriramrangaBelum ada peringkat

- Q3 Financial Statement q3 For Period 30 September 2021Dokumen2 halamanQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooBelum ada peringkat

- Cash Flow Analysis Col Pal 13-07-2023Dokumen17 halamanCash Flow Analysis Col Pal 13-07-2023RohitBelum ada peringkat

- Massmart 2017 - RemovedDokumen1 halamanMassmart 2017 - RemovedtmBelum ada peringkat

- Industry Segment of Bajaj CompanyDokumen4 halamanIndustry Segment of Bajaj CompanysantunusorenBelum ada peringkat

- Awasr Oman and Partners SAOC - FS 2020 EnglishDokumen42 halamanAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91Belum ada peringkat

- Accounts AssignmentDokumen17 halamanAccounts AssignmentApoorvBelum ada peringkat

- Cash Flow Statement Examples2Dokumen8 halamanCash Flow Statement Examples2ReactorAkkharBelum ada peringkat

- Yahoo Annual Report 2006Dokumen2 halamanYahoo Annual Report 2006domini809Belum ada peringkat

- Fund Flow Statement Company (Standalone) : Sources of FundsDokumen1 halamanFund Flow Statement Company (Standalone) : Sources of FundsGayatri BeheraBelum ada peringkat

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Dokumen2 halamanReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariBelum ada peringkat

- Increase in Long Term Loans and AdvancesDokumen2 halamanIncrease in Long Term Loans and Advancesusama siddiquiBelum ada peringkat

- Standalone Cash Flow Statement: For The Year Ended 31 March 2020Dokumen2 halamanStandalone Cash Flow Statement: For The Year Ended 31 March 2020Ashish GuptaBelum ada peringkat

- GT BankDokumen1 halamanGT BankFuaad DodooBelum ada peringkat

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDokumen2 halamanConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooBelum ada peringkat

- Q4 FY2007 Financial ReconciliationDokumen4 halamanQ4 FY2007 Financial ReconciliationЂорђе МалешевићBelum ada peringkat

- Discounted Cash Flow: A Theory of the Valuation of FirmsDari EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsBelum ada peringkat

- Structural Analysis of Investment Banking Industry: Meaning and Importance of Financial EngineeringDokumen18 halamanStructural Analysis of Investment Banking Industry: Meaning and Importance of Financial EngineeringAvnit kumarBelum ada peringkat

- Real Estate: March 2019Dokumen32 halamanReal Estate: March 2019Avnit kumarBelum ada peringkat

- Final Eco Live ProjectDokumen13 halamanFinal Eco Live ProjectAvnit kumarBelum ada peringkat

- Impact of GST On Travel and Tourism Industry: Sahil Gupta, Akhil SwamiDokumen4 halamanImpact of GST On Travel and Tourism Industry: Sahil Gupta, Akhil SwamiAvnit kumarBelum ada peringkat

- Time ValueDokumen18 halamanTime ValueAvnit kumarBelum ada peringkat

- Challenge For Electronic IndustryDokumen2 halamanChallenge For Electronic IndustryAvnit kumarBelum ada peringkat

- Unilever's Digital Media Strategy: Trends of Advertising Media and Changing Consumer PreferencesDokumen5 halamanUnilever's Digital Media Strategy: Trends of Advertising Media and Changing Consumer PreferencesAvnit kumarBelum ada peringkat

- Failed Product: Pond's ToothpasteDokumen2 halamanFailed Product: Pond's ToothpasteAvnit kumarBelum ada peringkat

- Maruti Suzuki India LTD (MSIL) : Presented byDokumen22 halamanMaruti Suzuki India LTD (MSIL) : Presented byAvnit kumarBelum ada peringkat

- Market Startegies of Maruti Udyog: Presented byDokumen51 halamanMarket Startegies of Maruti Udyog: Presented byAvnit kumarBelum ada peringkat

- 4.buyer BehaviorDokumen21 halaman4.buyer BehaviorAvnit kumarBelum ada peringkat

- Mizoram 04092012Dokumen44 halamanMizoram 04092012Avnit kumarBelum ada peringkat

- Pond's Relaunch StrategyDokumen15 halamanPond's Relaunch StrategyAvnit kumarBelum ada peringkat

- Er DiagramDokumen4 halamanEr DiagramAvnit kumarBelum ada peringkat

- ISM Toyota With Work FlowDokumen9 halamanISM Toyota With Work FlowAvnit kumarBelum ada peringkat

- 8.PLC StrategiesDokumen20 halaman8.PLC StrategiesAvnit kumarBelum ada peringkat

- Procurement Raw Materials - DocxDokumen12 halamanProcurement Raw Materials - DocxAvnit kumarBelum ada peringkat

- Unit Test 11 PDFDokumen1 halamanUnit Test 11 PDFYOBelum ada peringkat

- Letter To Singaravelu by M N Roy 1925Dokumen1 halamanLetter To Singaravelu by M N Roy 1925Avinash BhaleBelum ada peringkat

- 4-Cortina-Conill - 2016-Ethics of VulnerabilityDokumen21 halaman4-Cortina-Conill - 2016-Ethics of VulnerabilityJuan ApcarianBelum ada peringkat

- (Bloom's Modern Critical Views) (2000)Dokumen267 halaman(Bloom's Modern Critical Views) (2000)andreea1613232100% (1)

- An Introduction: by Rajiv SrivastavaDokumen17 halamanAn Introduction: by Rajiv SrivastavaM M PanditBelum ada peringkat

- (BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeDokumen5 halaman(BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeMiklós GrécziBelum ada peringkat

- Garrido Vs TuasonDokumen1 halamanGarrido Vs Tuasoncmv mendozaBelum ada peringkat

- "A Study On Services Offered by State Bank of India": Final ProjectDokumen59 halaman"A Study On Services Offered by State Bank of India": Final ProjectShabana KarimBelum ada peringkat

- The Approach of Nigerian Courts To InterDokumen19 halamanThe Approach of Nigerian Courts To InterMak YabuBelum ada peringkat

- WFP AF Project Proposal The Gambia REV 04sept20 CleanDokumen184 halamanWFP AF Project Proposal The Gambia REV 04sept20 CleanMahima DixitBelum ada peringkat

- Vayigash BookletDokumen35 halamanVayigash BookletSalvador Orihuela ReyesBelum ada peringkat

- MAKAUT CIVIL Syllabus SEM 8Dokumen9 halamanMAKAUT CIVIL Syllabus SEM 8u9830120786Belum ada peringkat

- Civil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Dokumen6 halamanCivil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Ronald MedinaBelum ada peringkat

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Dokumen2 halamanRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYBelum ada peringkat

- You Are The Light of The WorldDokumen2 halamanYou Are The Light of The WorldKathleen Lantry100% (1)

- CKA CKAD Candidate Handbook v1.10Dokumen28 halamanCKA CKAD Candidate Handbook v1.10Chiran RavaniBelum ada peringkat

- Prince Baruri Offer Letter-1Dokumen3 halamanPrince Baruri Offer Letter-1Sukharanjan RoyBelum ada peringkat

- The Lure of The Exotic Gauguin in New York CollectionsDokumen258 halamanThe Lure of The Exotic Gauguin in New York CollectionsFábia Pereira100% (1)

- Pulse of The Profession 2013Dokumen14 halamanPulse of The Profession 2013Andy UgohBelum ada peringkat

- UAS English For Acc - Ira MisrawatiDokumen3 halamanUAS English For Acc - Ira MisrawatiIra MisraBelum ada peringkat

- Financial Amendment Form: 1 General InformationDokumen3 halamanFinancial Amendment Form: 1 General InformationRandolph QuilingBelum ada peringkat

- 2 Quiz of mgt111 of bc090400798: Question # 1 of 20 Total Marks: 1Dokumen14 halaman2 Quiz of mgt111 of bc090400798: Question # 1 of 20 Total Marks: 1Muhammad ZeeshanBelum ada peringkat

- Final WorksheetDokumen13 halamanFinal WorksheetAgung Prasetyo WibowoBelum ada peringkat

- Chapter 12Dokumen72 halamanChapter 12Samaaraa NorBelum ada peringkat

- 1-Introduction - Defender (ISFJ) Personality - 16personalitiesDokumen6 halaman1-Introduction - Defender (ISFJ) Personality - 16personalitiesTiamat Nurvin100% (1)

- Christian Biography ResourcesDokumen7 halamanChristian Biography ResourcesAzhar QureshiBelum ada peringkat

- EIB Pan-European Guarantee Fund - Methodological NoteDokumen6 halamanEIB Pan-European Guarantee Fund - Methodological NoteJimmy SisaBelum ada peringkat

- Challenges in Leadership Development 2023Dokumen26 halamanChallenges in Leadership Development 2023Girma KusaBelum ada peringkat

- Relative Clauses: A. I Didn't Know You Only Had OnecousinDokumen3 halamanRelative Clauses: A. I Didn't Know You Only Had OnecousinShanti AyudianaBelum ada peringkat