MA - Wrap Up

Diunggah oleh

Latifa Aulia KhadijahHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

MA - Wrap Up

Diunggah oleh

Latifa Aulia KhadijahHak Cipta:

Format Tersedia

WRAP UP SESSION

(TOPICS AFTER THE MID-TERM SESSION)

QUESTION 1 – RELEVANT COSTING

Zebra Drug Corporation buys three chemicals that are processed to produce two

types of analgesics used as ingredients for popular over-the-counter drugs. The

purchased chemicals are blended for two to three hours and then heated for 15

minutes. The results of the process are two separate analgesics, depryl and

pencol, which are sent to a drying room until their moisture content is reduced

to 6 to 8%. For every 1,300 pounds of chemical used, 600 pounds of depryl and

600 pounds of pencol are produced. After drying, depryl and pencol are sold to

companies that process into their final forms. The selling price are $12 per

pound for depryl and $30 per pound for pencol.

The cost to produce 600 pound of each analgesic are as follows :

Chemical $8,500

Direct labor $6,375

Overhead $9,900

The analgesics are packaged in 20-pound bag and shipped. The cost for each bag

is $1.30; shipping cost is $0.10 per pound.

Zebra could process depryl further by grinding it into a fine powder and then

molding the powder into tablet. The tablets can be sold directly to retail drug

stores as a generic brand. If this route were taken, the revenue received per

bottle of tablets would be $4.00 with 10 bottled produced by every pound of

depryl. The costs of grinding and tableting total $2.50 per pound of depryl.

Bottles cost $0.40 each. Bottles are shipped in boxes that hold 25 bottles at a

shipping cost of $1.60 per box.

Required :

1. Should Zebra sell depryl at split-off, or should depryl be processed and sold

as a tablet?

2. If Zebra normally sells 265,000 pound of depryl per year, what will be the

difference in profits if depryil is processed further?

QUESTION 2 – CAPITAL INVESTMENT DECISION

Each of the following scenarios is independent. Assume that all cash flow are

after-tax cash flow

a. Southward manufacturing is considering the purchase of a new welding

system. The cash benefits will be $400,000 per year. The system costs

$2,250,000 and will last 10 years

b. Rahn booth invested $1,300,000 in a project that pays him an even amount

per year for 5 years. The payback period is 2.5 years

c. Kylee Sorensen has just invested $1,400,000 in a new biomedical technology.

She expects to receive the following cash flow over the next 5 years :

$350,000, $490,000, $700,000, $420,000, and $280,000

d. Skiba Company is thinking about two different modifications to its current

manufacturing process. Skiba cost of capital is 10%. The after-tax cash flow

associated with the two investments are follow :

Year Project I (in US $) Project II (in US $)

0 (100,000) (100.000)

1 - 63,857

2 134,560 63,857

Required :

1. Compute the NPV for Soutward manufacturing, assuming a discount rate

of 12%. Should the company buy the new welding system?

2. How much cash does Rahn received each year?

3. What is the payback period for Kylee?

4. Compute the NPV and IRR for each project of Skiba

QUESTION 3 – QUALITY COST AND PRODUCTIVITY

At the end of 2013, Emery manufacturing began to focus on its quality costs. As a

first step, it identified the following costs in its accounting records a being

quality related :

2013

Sales (50,000 units @ $60) 3,000,000

Scrap 90,000

Rework 120,000

Training program 36,000

Consumer complaints 60,000

Warranty 120,000

Test labor 90,000

Inspection labor 75,000

Supplier evaluation 9.000

Required :

1. Prepare a quality cost report by quality cost category

2. Calculate the relative distribution percentage of each quality cost category.

Comment on the distribution

3. Using the Taguchi quality loss function, an average loss per unit is computed

at $5. What are the hidden cost of external failure? How does this affect the

relative distribution? What effect will the hidden-cost information have on a

quality improvement program?

QUESTION 4 – LEAN ACCOUNTING, TARGET COSTING AND BSC

At the end of 2010, Everett Company implemented a low-cost strategy to

improve its competitive position. Its objective was to become the low-cost

producer in its industry and enhance its profitability. To lower costs, Everett

undertook a number od lean improvement activities. Everett also adopted a

balanced score-card approach for its strategic performance management system.

Now, after two years of operation, the president of Everett wants some

assessment of the system’s achievements. To help provide this assessment, the

following information on one product has been gathered.

2010 2011

Theoretical annual capacity a 192,000 192,000

Actual production and sales b 152,000 176,000

Production hours available (40 workers) 80,000 80,000

Postpurchase cost per unit (in US $) 20 10

Scrap (pounds) 20,000 16,000

Materials used (pounds) 200,000 200,000

Actual cost per unit (in US $) 250 200

Days of inventory 6 3

Number of defective units 9,000 4,000

Suggestions per employee 2 6

Hours of training 200 800

Selling price per unit (in US $) 300 280

Number of new customers c 4,000 16,000

Market share (in percentage) d 20% ?

a Amount that could be produced given the available production hours

b Amount that was produced given the available production hours

c The increase of total sales from 2008 and 2009 all came as a result of new

customers. In 2008, the new customers were responsible for sales of 4,000

units

d The total market increased by 20,000 units from 2008 to 2009

Required :

1. Compute the following measures for 2010 and 2011

i) Theoretical velocity and cycle time

ii) Actual velocity and cycle time

iii) Percentage change in postpurchase cost (for 2011 only)

iv) Labor productivity (outputs/hours)

v) Scrap as a percentage of total material issues

vi) Percentage change in actual product cost (for 2011 only)

vii) Percentage change in days of inventory (for 2011 only)

viii) Defective units as a percentage of total units produced

ix) New customers per unit of output

x) Hours of training

xi) Selling price per unit (as given)

xii) Total employee suggestion

xiii) Market share

xiv) Percentage change in sales revenue

2. For the measure listed in Requirement 1, list likely strategic objective and

their associated measured, classified according to four Balanced Scorecard

perspectives. Evaluate the success of the strategy

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

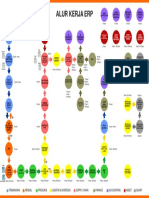

- Alur Kerja Erp: Pemasaran Rendal Produksi Logistik & Ekspedisi Supply Chain Finance Accounting Asset QuaryDokumen1 halamanAlur Kerja Erp: Pemasaran Rendal Produksi Logistik & Ekspedisi Supply Chain Finance Accounting Asset QuaryMuhammad FairusBelum ada peringkat

- Tax Invoice SummaryDokumen1 halamanTax Invoice SummaryRam Kishor SinghBelum ada peringkat

- BHArathiar BBA VI Sem Service Marketing Model PapersDokumen7 halamanBHArathiar BBA VI Sem Service Marketing Model Papersazam49100% (1)

- CH 19Dokumen46 halamanCH 19indahmuliasariBelum ada peringkat

- Chapter 4 Procurement Supply MGMTDokumen79 halamanChapter 4 Procurement Supply MGMTisang100% (1)

- CH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDokumen10 halamanCH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionssamahBelum ada peringkat

- Odoo 10 ImplementationDokumen974 halamanOdoo 10 ImplementationVu Van Than100% (1)

- Visionspring in India: Enabling Affordable Eyeglasses For The PoorDokumen11 halamanVisionspring in India: Enabling Affordable Eyeglasses For The PoorNicolasBelum ada peringkat

- Corporate ValuationDokumen16 halamanCorporate ValuationJuBeeBelum ada peringkat

- Criteria For Singing ContestDokumen302 halamanCriteria For Singing ContestTJ RosalesBelum ada peringkat

- Factors Influencing Pricing Methods and Price and NonDokumen17 halamanFactors Influencing Pricing Methods and Price and NonRutujaBelum ada peringkat

- The Perspective of Vat Concessions Regime in Tanzania PDFDokumen32 halamanThe Perspective of Vat Concessions Regime in Tanzania PDFHandley Mafwenga SimbaBelum ada peringkat

- Strategic Sourcing FrameworkDokumen19 halamanStrategic Sourcing Frameworkdipeshdutta86649Belum ada peringkat

- Harnischfeger Corporation ResearchDokumen2 halamanHarnischfeger Corporation Researchkynang0% (1)

- Monopoly: Prepared By: Jamal HuseinDokumen26 halamanMonopoly: Prepared By: Jamal Huseinsaad_hjBelum ada peringkat

- Managing International Business: Porcelain Producer Ltd. Case StudyDokumen9 halamanManaging International Business: Porcelain Producer Ltd. Case Studyritika guptaBelum ada peringkat

- 6e ch19Dokumen38 halaman6e ch19Yuswadi MulyaBelum ada peringkat

- How Do Brands Exploit Impulsive Buying?Dokumen42 halamanHow Do Brands Exploit Impulsive Buying?Rishav Saha100% (1)

- Regional Director District Manager in Dallas FT Worth TX Resume Holly LindenDokumen2 halamanRegional Director District Manager in Dallas FT Worth TX Resume Holly LindenHollyLindenBelum ada peringkat

- Buying and DisposingDokumen36 halamanBuying and DisposingYadav KrishnaBelum ada peringkat

- Abdul Rahman Dalupang Romuros: ObjectivesDokumen2 halamanAbdul Rahman Dalupang Romuros: ObjectivesSarip Sharief SaripadaBelum ada peringkat

- Barges - Ocean Going Workhorse PDFDokumen12 halamanBarges - Ocean Going Workhorse PDFKelvin Xu100% (1)

- B.Com Structure and Courses at Kuvempu UniversityDokumen79 halamanB.Com Structure and Courses at Kuvempu UniversityPragathi PraBelum ada peringkat

- Grade 7 Topic 9 Percentage and Its Application (50 Questions)Dokumen6 halamanGrade 7 Topic 9 Percentage and Its Application (50 Questions)Michelle HsiehBelum ada peringkat

- ch05 SM Carlon 5eDokumen68 halamanch05 SM Carlon 5eKyleBelum ada peringkat

- 14 ReferencesDokumen21 halaman14 ReferencespreethiBelum ada peringkat

- Cost Concepts and Classifications ExplainedDokumen34 halamanCost Concepts and Classifications Explaineddhruvesh999100% (4)

- Epicor Enterprise Resource Planning Catalog BR ENS - 2018 PDFDokumen81 halamanEpicor Enterprise Resource Planning Catalog BR ENS - 2018 PDFjoeindBelum ada peringkat

- BorisChernin ResumeDokumen1 halamanBorisChernin Resumenogudnik100% (2)

- Finals StratCostDokumen7 halamanFinals StratCostMarie AzaresBelum ada peringkat