Colgate-Palmolive Phil. Inc. v. Pedro Jimenez - G.R. No. L-14787 (2/28/61)

Diunggah oleh

christian alerJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Colgate-Palmolive Phil. Inc. v. Pedro Jimenez - G.R. No. L-14787 (2/28/61)

Diunggah oleh

christian alerHak Cipta:

Format Tersedia

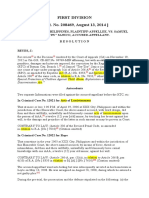

2. Colgate-Palmolive Phil. Inc. v.

Pedro

Jimenez – G.R. No. L-14787 (2/28/61)

FACTS:

The petitioner Colgate-Palmolive Philippines Inc.

is a corporation duly organized and existing under

Philippine laws engaged in the manufacture of

toilet preparations and household remedies. On

several occasions, it imported various materials

such as Irish moss extract, sodium benzoate, and

sodium saccharinate, for use as stabilizers and

flavoring of the dental cream it manufactures. For

every importation made of these materials, the

petitioner paid to the CBP the 17% special excise

tax on the foreign exchange used for the payment

of the cost, transportation and other charges

incident thereto, pursuant to RA 601, OWKAT

“Exchange Tax Law”, as amended by RA 814.

Subsequently, the petitioner filed with the CB 3

applications for refund of the 17% SET based on

Sec. 2 of RA 601 which provides that “foreign

exchange used for the payment of the cost,

transportation and/or charges incident to the

importation into the Phil. of stabilizers and flavor

shall be refunded to any importer making the

application therefor upon satisfactory proof of

actual importation”. The OIC of Exchange Tax

Admin. CBP approved the application for refund

in reduced amount. However, the Auditor of CBP

refused to the same on the theory that toothpaste

stabilizers and flavors are not exempt from

Section 2, which was affirmed by the Auditor G.

ISSUE: W/N the foreign exchange used by

petitioner for the importation of dental cream

stabilizers and flavors is exempt from the 17%

SET imposed by RA 601, Sec. 2

HELD:

YES. The decision under review was reversed.

The ruling of AG is based on the principle

“general terms may be restricted by specific

words, with the result that the general language

will be limited by the specific language which

indicates the statute’s object and purpose”. The

rule however is applicable only to cases where,

except for 1 general term, all the items in an

enumeration belong to or fall under 1 special

class. On the basis of the grouping of the articles

alone, it cannot validly be maintained that the

term stabilizer and flavors refer only to those used

in the manufacture of food and food products.

The view is supported by the principle "Ubi lex

non distinguish nec nos distinguire

debemos", or "where the law does not

distinguish, neither do we distinguish". Since the

law does not distinguish between “stabilizer and

flavors” used in the preparation of food and those

used in the manufacture of toothpaste or dental

cream, SC is not authorized to make any

distinction and must construe the words in their

general sence.

Anda mungkin juga menyukai

- Admin Exam AnswerDokumen15 halamanAdmin Exam Answeralexsarah123100% (11)

- People Vs AgustinDokumen2 halamanPeople Vs AgustinKristine GarciaBelum ada peringkat

- #Best Bar Outline Reviewer EverDokumen387 halaman#Best Bar Outline Reviewer Everruth sab-itBelum ada peringkat

- An Ideal Law Professor - Dean Pineda PDFDokumen14 halamanAn Ideal Law Professor - Dean Pineda PDFSakuraCardCaptorBelum ada peringkat

- Colgate Palmolive Philippines, Inc. v. GimenezDokumen2 halamanColgate Palmolive Philippines, Inc. v. GimenezsablcsBelum ada peringkat

- VIllafuerte Vs CortezDokumen1 halamanVIllafuerte Vs CortezClarisse Ann MirandaBelum ada peringkat

- CTA has exclusive jurisdiction over tax disputesDokumen3 halamanCTA has exclusive jurisdiction over tax disputesTherese VilogBelum ada peringkat

- 10 BOC vs. DevanaderaDokumen3 halaman10 BOC vs. Devanaderaaspiringlawyer1234Belum ada peringkat

- Reyes vs. Bagatsing, G.R. No. L-65366, November 8, 1983Dokumen2 halamanReyes vs. Bagatsing, G.R. No. L-65366, November 8, 1983christian alerBelum ada peringkat

- Reyes vs. Bagatsing, G.R. No. L-65366, November 8, 1983Dokumen2 halamanReyes vs. Bagatsing, G.R. No. L-65366, November 8, 1983christian alerBelum ada peringkat

- Construction Development Corp. v. EstrellaDokumen7 halamanConstruction Development Corp. v. Estrellajetzon2022Belum ada peringkat

- G.R. No. L-14787Dokumen2 halamanG.R. No. L-14787Vijanes BeltransBelum ada peringkat

- ONG CHIA, Petitioner, vs. REPUBLIC OF THE Philippines and The Court of Appeals, RespondentsDokumen10 halamanONG CHIA, Petitioner, vs. REPUBLIC OF THE Philippines and The Court of Appeals, RespondentsMaku PascualBelum ada peringkat

- Nolasco v. Commission on Elections: Supreme Court Affirms COMELEC Ruling but Declares Nolasco Mayor of MeycauayanDokumen92 halamanNolasco v. Commission on Elections: Supreme Court Affirms COMELEC Ruling but Declares Nolasco Mayor of MeycauayanEditha RoxasBelum ada peringkat

- Sps. Cristino & Edna Carbonell vs. Metropolitan Bank and Trust Company April 26, 2017 G.R. No. 178467 Bersamin, J.: FactsDokumen1 halamanSps. Cristino & Edna Carbonell vs. Metropolitan Bank and Trust Company April 26, 2017 G.R. No. 178467 Bersamin, J.: FactsMalolosFire BulacanBelum ada peringkat

- (Liability of Local Recruitment Agency and Foreign Employer - Solidary Liability) Princess Talent Center Prod. Inc v. Desiree Masagca PDFDokumen3 halaman(Liability of Local Recruitment Agency and Foreign Employer - Solidary Liability) Princess Talent Center Prod. Inc v. Desiree Masagca PDFRuth Angelica TeoxonBelum ada peringkat

- Republic of The Philippines, Petitioner, vs. Chule Y. LIM, RespondentDokumen5 halamanRepublic of The Philippines, Petitioner, vs. Chule Y. LIM, RespondentRogelio Rubellano IIIBelum ada peringkat

- Notarial DigestsDokumen2 halamanNotarial Digestschristian alerBelum ada peringkat

- Labor Digests Art 106-109Dokumen45 halamanLabor Digests Art 106-109Izo BellosilloBelum ada peringkat

- B45 Marvex Commercial Co. Inc. v. Petra Hawpia and Co., GR L-19297, 22 December 1966, en Banc, Castro (J) - CARINANDokumen2 halamanB45 Marvex Commercial Co. Inc. v. Petra Hawpia and Co., GR L-19297, 22 December 1966, en Banc, Castro (J) - CARINANloschudentBelum ada peringkat

- People vs Lapis Supreme Court upholds guilty verdictDokumen1 halamanPeople vs Lapis Supreme Court upholds guilty verdictchristian alerBelum ada peringkat

- Sex Reassignment Case DigestDokumen7 halamanSex Reassignment Case DigestShiela Al-agBelum ada peringkat

- MAGUAN V COURT OF APPEALSDokumen2 halamanMAGUAN V COURT OF APPEALSCedricBelum ada peringkat

- Republic of The Philippines vs. Hon. Migrinio and Troadio Tecson (G.R. No. 89483. August 30, 1990)Dokumen1 halamanRepublic of The Philippines vs. Hon. Migrinio and Troadio Tecson (G.R. No. 89483. August 30, 1990)Benitez GheroldBelum ada peringkat

- G.R. No. 112127 July 17, 1995Dokumen10 halamanG.R. No. 112127 July 17, 1995Reuben EscarlanBelum ada peringkat

- Tio Khe Chio vs. CA (G.R. No. 76101-02 September 30, 1991) - 2Dokumen2 halamanTio Khe Chio vs. CA (G.R. No. 76101-02 September 30, 1991) - 2eunice demaclidBelum ada peringkat

- Lupo Atienza v. Judge Brilliantes PDFDokumen6 halamanLupo Atienza v. Judge Brilliantes PDFchescasenBelum ada peringkat

- Pedro Abad Santos, W. H. Booram, Solicitor-General Harvey,: 150 Philippine Reports AnnotatedDokumen6 halamanPedro Abad Santos, W. H. Booram, Solicitor-General Harvey,: 150 Philippine Reports AnnotatedReyna RemultaBelum ada peringkat

- Commonwealth Code Inspection Service Inc Vs Clem Malot and Pennsylvania Municipal Code AllianceDokumen144 halamanCommonwealth Code Inspection Service Inc Vs Clem Malot and Pennsylvania Municipal Code AllianceCitizens for a Better New OxfordBelum ada peringkat

- Aguilar-Dyquiangco V Arellano - AC NoDokumen2 halamanAguilar-Dyquiangco V Arellano - AC NoLarrylaine Anne EvangelistaBelum ada peringkat

- Domondon vs Lopez Student Expulsion Case RulingDokumen1 halamanDomondon vs Lopez Student Expulsion Case Rulingabdullah mauteBelum ada peringkat

- Heirs of Loreto C. Maramag V MaramagDokumen3 halamanHeirs of Loreto C. Maramag V MaramagHannamae BayganBelum ada peringkat

- Kilosbayan V ErmitaDokumen16 halamanKilosbayan V Ermitaalexis_beaBelum ada peringkat

- PRF For October 19, 2020Dokumen13 halamanPRF For October 19, 2020Kersie GalangBelum ada peringkat

- ATTY. RAYMUND PALAD v. LOLIT SOLIS, SALVE ASIS, AL PEDROCHE AND RICARDO LODokumen1 halamanATTY. RAYMUND PALAD v. LOLIT SOLIS, SALVE ASIS, AL PEDROCHE AND RICARDO LOLara CacalBelum ada peringkat

- People v. Montierro, G.R. No. 254654, July 26, 2022Dokumen2 halamanPeople v. Montierro, G.R. No. 254654, July 26, 2022darleneirishcandontolBelum ada peringkat

- Statutory Construction 1 - MojicaDokumen7 halamanStatutory Construction 1 - MojicaRobinson MojicaBelum ada peringkat

- Counterclaim Nature of Villanueva-Ong v. Enrile, G.R. No. 212904, November 22, 2017Dokumen3 halamanCounterclaim Nature of Villanueva-Ong v. Enrile, G.R. No. 212904, November 22, 2017CHRISTY NGALOYBelum ada peringkat

- Philippine National Bank Vs CADokumen6 halamanPhilippine National Bank Vs CAHamitaf LatipBelum ada peringkat

- Yapyuco v. Sandiganbayan Case DigestDokumen3 halamanYapyuco v. Sandiganbayan Case Digestchristian aler75% (8)

- Dental cream stabilizer tax refund caseDokumen1 halamanDental cream stabilizer tax refund caseJustin ManaogBelum ada peringkat

- Colgate Vs Hon. JimenezDokumen1 halamanColgate Vs Hon. JimeneznunoBelum ada peringkat

- Gonzales vs. Abaya, G.R. No. 164007, 10 August 2006Dokumen3 halamanGonzales vs. Abaya, G.R. No. 164007, 10 August 2006JOHN CYANIDEBelum ada peringkat

- Pimentel v. Pimentel, G. R. No. 172060Dokumen1 halamanPimentel v. Pimentel, G. R. No. 172060DAblue ReyBelum ada peringkat

- 10 Spouses Sy Et Al Vs Wesmont Bank DIGESTDokumen3 halaman10 Spouses Sy Et Al Vs Wesmont Bank DIGESTAlexa Neri ValderamaBelum ada peringkat

- 7 Peltan Development VS CaDokumen2 halaman7 Peltan Development VS CaRonnie Garcia Del RosarioBelum ada peringkat

- Manuel Luis C. Gonzales vs. GJH Land, Inc., Gr. No. 202664, November 10, 2015Dokumen50 halamanManuel Luis C. Gonzales vs. GJH Land, Inc., Gr. No. 202664, November 10, 2015Jerry SerapionBelum ada peringkat

- Pagcor vs. PejiDokumen2 halamanPagcor vs. PejiRealKD30100% (3)

- 14 SANICO vs. COLIPANODokumen9 halaman14 SANICO vs. COLIPANORonnie Garcia Del RosarioBelum ada peringkat

- Case Digest People Vs RegalaDokumen2 halamanCase Digest People Vs RegalaJP De La PeñaBelum ada peringkat

- Mutuality of ContractsDokumen19 halamanMutuality of ContractsChris InocencioBelum ada peringkat

- Pinoycasedigest - MORENO vs. COMELEC Case DigestDokumen1 halamanPinoycasedigest - MORENO vs. COMELEC Case Digestchristian alerBelum ada peringkat

- Pinoycasedigest - MORENO vs. COMELEC Case DigestDokumen1 halamanPinoycasedigest - MORENO vs. COMELEC Case Digestchristian alerBelum ada peringkat

- Gonzales Vs Office of The PresidentDokumen2 halamanGonzales Vs Office of The PresidentNormita SechicoBelum ada peringkat

- Law 107 - Tan Cong V StewartDokumen2 halamanLaw 107 - Tan Cong V StewartDanielle AbuelBelum ada peringkat

- Lopez Realty Inc V Sps Tanjangco (2014)Dokumen3 halamanLopez Realty Inc V Sps Tanjangco (2014)AnnKhoLugasanBelum ada peringkat

- Leung Ben v. O'BrienDokumen2 halamanLeung Ben v. O'BrienWendell MirabelBelum ada peringkat

- M1S2 SK History and Salient Features 2023.09.25Dokumen67 halamanM1S2 SK History and Salient Features 2023.09.25Binson GibbBelum ada peringkat

- Illustrative Case: Federation of Free Farmers vs. CA, GR 41161. September 10, 1981 - Intent Prevails The Text of The LawDokumen6 halamanIllustrative Case: Federation of Free Farmers vs. CA, GR 41161. September 10, 1981 - Intent Prevails The Text of The LawAlrezaJanBelum ada peringkat

- People of The Philippines vs. Hon. Judge Antonio C. Evangelista and Huildo S. TugononDokumen2 halamanPeople of The Philippines vs. Hon. Judge Antonio C. Evangelista and Huildo S. TugononDesiree Joy LagrimasBelum ada peringkat

- Vitangcol vs. New Vista PropertiesDokumen2 halamanVitangcol vs. New Vista PropertiesLance MorilloBelum ada peringkat

- Digest #1 Legal EthicsDokumen1 halamanDigest #1 Legal EthicsJennifer Peng NavarreteBelum ada peringkat

- Spouses Villanueva Vs CADokumen2 halamanSpouses Villanueva Vs CAjoel_milan_1Belum ada peringkat

- Ascencion DigestDokumen25 halamanAscencion Digestjohn vidadBelum ada peringkat

- Chavez Vs JBC en Banc G.R. No. 202242 April 16, 2013Dokumen29 halamanChavez Vs JBC en Banc G.R. No. 202242 April 16, 2013herbs22225847Belum ada peringkat

- People Vs FormigonesDokumen6 halamanPeople Vs Formigonesnigel alinsugBelum ada peringkat

- Gonzales III Vs Office of The PresidentDokumen11 halamanGonzales III Vs Office of The PresidentDumaganBelum ada peringkat

- Disbarment of Lawyer for Gross Immorality and Scandalous ConductDokumen32 halamanDisbarment of Lawyer for Gross Immorality and Scandalous ConductMa. Fiona Stephanie DegamoBelum ada peringkat

- PFR ReportDokumen7 halamanPFR ReportRener OrtegaBelum ada peringkat

- Tolentino v. CatoyDokumen2 halamanTolentino v. CatoyCarissa CruzBelum ada peringkat

- De La Pena v. Hidalgo, 20 Phil. 323 1911Dokumen4 halamanDe La Pena v. Hidalgo, 20 Phil. 323 1911BlastBelum ada peringkat

- Legal Ethics Case DigestDokumen3 halamanLegal Ethics Case DigestGen GrajoBelum ada peringkat

- People of The Philippines v. Rustico Bartolini GR 179498, August 3, 2010Dokumen2 halamanPeople of The Philippines v. Rustico Bartolini GR 179498, August 3, 2010Hemsley Battikin Gup-ayBelum ada peringkat

- Mindex Resources Development VDokumen2 halamanMindex Resources Development VKidMonkey2299Belum ada peringkat

- Campugan vs. Tolentino, JR., 752 SCRA 254, March 11, 2015Dokumen14 halamanCampugan vs. Tolentino, JR., 752 SCRA 254, March 11, 2015Jane BandojaBelum ada peringkat

- 13 Sibayan Vs AldaDokumen6 halaman13 Sibayan Vs AldaAngelica Joyce BelenBelum ada peringkat

- Colgate-Palmolive Philippines, Inc. vs. Gimenez STATCON1B OCT.17, 2017Dokumen1 halamanColgate-Palmolive Philippines, Inc. vs. Gimenez STATCON1B OCT.17, 2017Yui RecintoBelum ada peringkat

- Colgate Palmolive v. JimenezDokumen2 halamanColgate Palmolive v. JimenezbrownboomerangBelum ada peringkat

- People vs. Lapis Et. AlDokumen1 halamanPeople vs. Lapis Et. Alchristian alerBelum ada peringkat

- IN RE - IBP January 9, 1973 PDFDokumen6 halamanIN RE - IBP January 9, 1973 PDFchristian alerBelum ada peringkat

- Relationship, Intoxication and Degree of Instruction and Education of The OffenderDokumen12 halamanRelationship, Intoxication and Degree of Instruction and Education of The Offenderchristian alerBelum ada peringkat

- People v. JabinalDokumen6 halamanPeople v. JabinalJulian Paul CachoBelum ada peringkat

- Valenzuela VallartaDokumen2 halamanValenzuela Vallartachristian alerBelum ada peringkat

- Midterm Review on Persons and Family RelationsDokumen58 halamanMidterm Review on Persons and Family Relationschristian alerBelum ada peringkat

- People Vs Mapa y MapulongDokumen3 halamanPeople Vs Mapa y MapulongAnonymous 96BXHnSziBelum ada peringkat

- Vera V AvelinoDokumen2 halamanVera V Avelinochristian alerBelum ada peringkat

- DigestDokumen1 halamanDigestchristian alerBelum ada peringkat

- Midterm Review on Persons and Family RelationsDokumen58 halamanMidterm Review on Persons and Family Relationschristian alerBelum ada peringkat

- SURPLASAGEDokumen123 halamanSURPLASAGEchristian alerBelum ada peringkat

- In Re Cunanan Part 2 PDFDokumen10 halamanIn Re Cunanan Part 2 PDFchristian alerBelum ada peringkat

- Mistake of Fact PDFDokumen2 halamanMistake of Fact PDFchristian alerBelum ada peringkat

- In Re Cunanan Part 2 PDFDokumen10 halamanIn Re Cunanan Part 2 PDFchristian alerBelum ada peringkat

- US Vsah Chong PDFDokumen2 halamanUS Vsah Chong PDFchristian alerBelum ada peringkat

- In Re: IbpDokumen6 halamanIn Re: Ibpchristian alerBelum ada peringkat

- In Re CunananDokumen17 halamanIn Re CunananJerome ArañezBelum ada peringkat

- Consumer Protection ActDokumen7 halamanConsumer Protection ActAkash PandeyBelum ada peringkat

- United States v. Ellerbe, 4th Cir. (2008)Dokumen3 halamanUnited States v. Ellerbe, 4th Cir. (2008)Scribd Government DocsBelum ada peringkat

- XII - Legal Studies - SQPDokumen14 halamanXII - Legal Studies - SQPDrishti Kaur KhuranaBelum ada peringkat

- People Vs SanicoDokumen14 halamanPeople Vs SanicoJm ReyesBelum ada peringkat

- Civil Procedure CaseDokumen2 halamanCivil Procedure Caseiaprodu000Belum ada peringkat

- Memo Starting PetitionerDokumen29 halamanMemo Starting PetitionervishnuameyaBelum ada peringkat

- FontShop pricing information for Celtic Nova Std Bold fontDokumen2 halamanFontShop pricing information for Celtic Nova Std Bold fontRHYCKS DANIELBelum ada peringkat

- Module No.4Dokumen22 halamanModule No.4Anna Joy BautistaBelum ada peringkat

- Fighting Mob Justice: Guatemalan Activists Organize Against Rural VigilantesDokumen2 halamanFighting Mob Justice: Guatemalan Activists Organize Against Rural VigilantesMeganFeldmanBelum ada peringkat

- Seguisabal v. Cabrera, 193 Phil. 809 (1981)Dokumen3 halamanSeguisabal v. Cabrera, 193 Phil. 809 (1981)Jose IbarraBelum ada peringkat

- Dacasin v. Dacasin PDFDokumen2 halamanDacasin v. Dacasin PDFJona CalibusoBelum ada peringkat

- G.R. No. 93026-27 December 17, 1996 The People of The Philippines, Plaintiff, CONRADO PAJARO Alias "DADI", DefendantDokumen7 halamanG.R. No. 93026-27 December 17, 1996 The People of The Philippines, Plaintiff, CONRADO PAJARO Alias "DADI", DefendantJosef elvin CamposBelum ada peringkat

- TORTS 2 Mejo FinalDokumen490 halamanTORTS 2 Mejo FinalJon SnowBelum ada peringkat

- CLJ3 Lesson 9Dokumen41 halamanCLJ3 Lesson 9Claire Marianne De VeraBelum ada peringkat

- Life Without The Billof Rights StoryDokumen1 halamanLife Without The Billof Rights Storyapi-236043687Belum ada peringkat

- Labor Cases 1st (Aug 13, 2014)Dokumen86 halamanLabor Cases 1st (Aug 13, 2014)MteopeBelum ada peringkat

- 24 July 2020 LETTER OF BARANGAY CAPTAIN VENANCIO SANTIDAD TO PATEROS BUILDING OFFICIALDokumen2 halaman24 July 2020 LETTER OF BARANGAY CAPTAIN VENANCIO SANTIDAD TO PATEROS BUILDING OFFICIALHaroldRamosBelum ada peringkat

- People Vs ArrojadoDokumen4 halamanPeople Vs ArrojadoRichard D. ArboBelum ada peringkat

- United States v. Juan Joel Melendez, 11th Cir. (2016)Dokumen4 halamanUnited States v. Juan Joel Melendez, 11th Cir. (2016)Scribd Government DocsBelum ada peringkat

- Pretrial Plea FormDokumen5 halamanPretrial Plea FormChristian BreadWinner ClarkBelum ada peringkat

- James Cameron Clark, JR., Executors v. United States, 267 F.2d 501, 1st Cir. (1959)Dokumen8 halamanJames Cameron Clark, JR., Executors v. United States, 267 F.2d 501, 1st Cir. (1959)Scribd Government DocsBelum ada peringkat